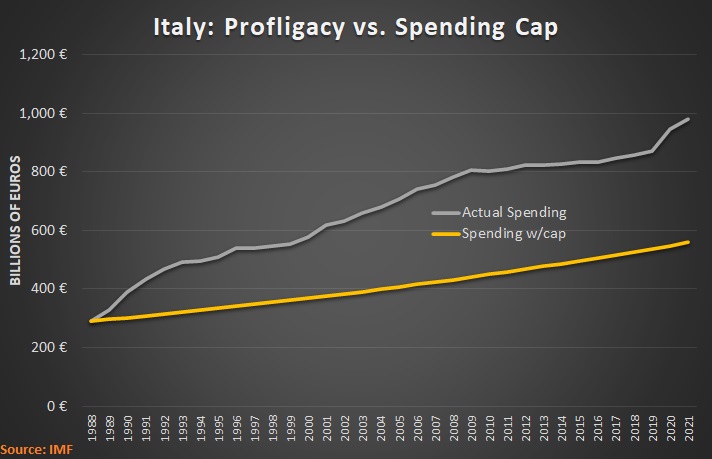

If nothing else, Biden’s big-government agenda is triggering a debate about fundamental issues, such as whether it’s a good idea to make America’s economy more like Singapore or more like Italy.

In making the case for the Italian approach of higher taxes and bigger government during his speech to Congress, President Biden exclaimed that “trickle-down economics has never worked.”

But we need to realize that Biden is using a straw-man definition. In his mind, “trickle-down economics” is giving a tax cut to rich people under the assumption that some of that cash eventually will wind up in other people’s pockets.

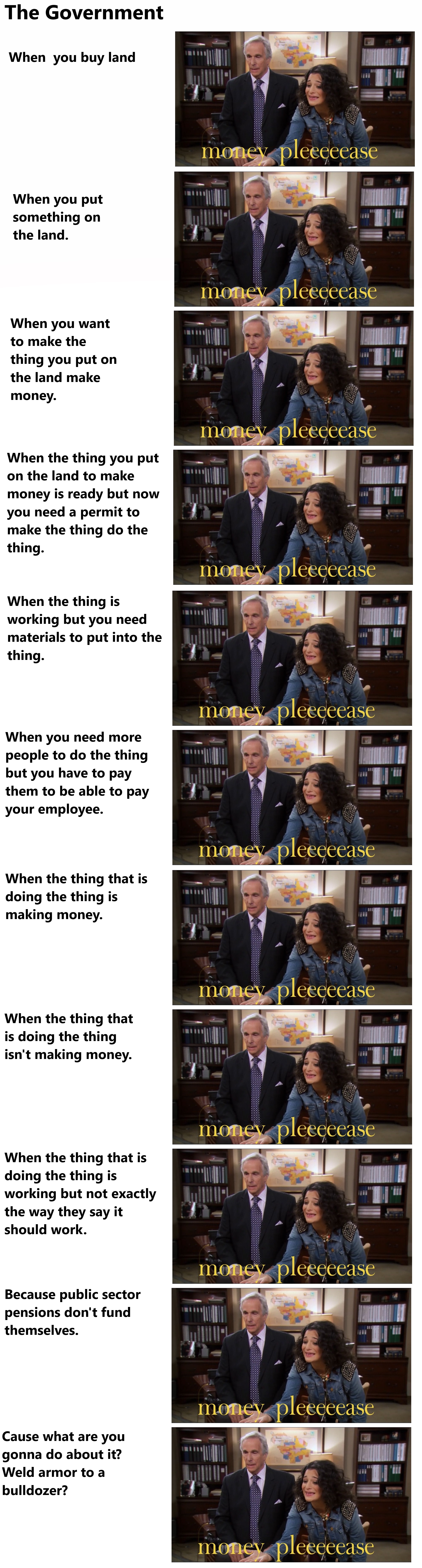

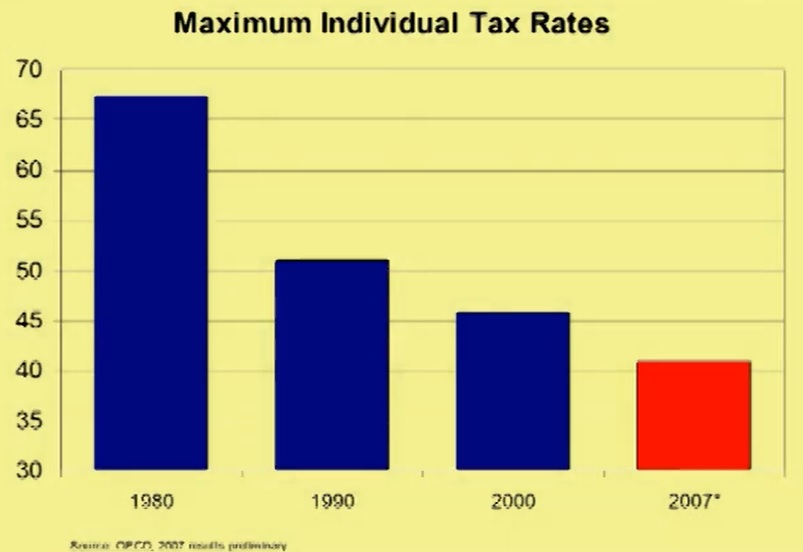

However, if you actually ask proponents of pro-growth tax policy what they support, they will explain that they want lower tax rates for everyone in order to reduce penalties on productive behaviors such as work, saving, investment, and entrepreneurship.

And they will be especially interested in getting rid of the tax code’s bias against saving and investment.

And they will be especially interested in getting rid of the tax code’s bias against saving and investment.

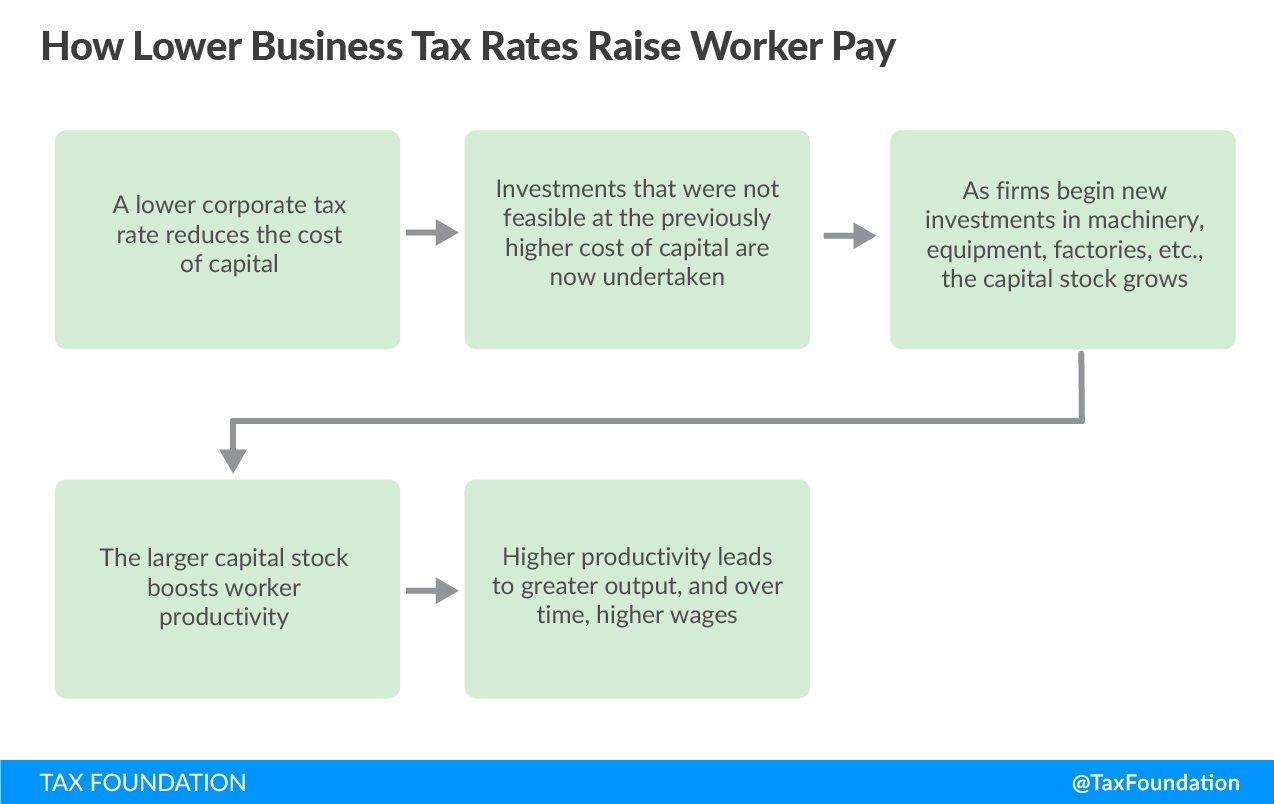

Why? Because every economic theory – even socialism, even Marxism – agrees that saving and investment are a key to long-run growth and rising living standards.

Which is why there’s such a strong relationship in the data between the amount of capital and workers’ wages.

Indeed, it’s almost a tautology to say that this form of “trickle-down taxation” leads to higher productivity, which leads to higher wages for workers.

As Stanford Professor John Shoven observed several decades ago:

The mechanism of raising real wages by stimulating investment is sometimes derisively referred to as “trickle-down” economics. But regardless of the label used, no one doubts that the primary mechanism for raising the return to work is providing each worker with better and more numerous tools. One can wonder about the length of time it takes for such a policy of increasing saving and investments to have a pronounced effect on wages, but I know of no one who doubts the correctness of the underlying mechanism. In fact, most economists would state the only way to increase real wages in the long run is through extra investments per worker.

In other words, everyone agrees with the “trickle-down economics” as a concept, but people disagree on other things.

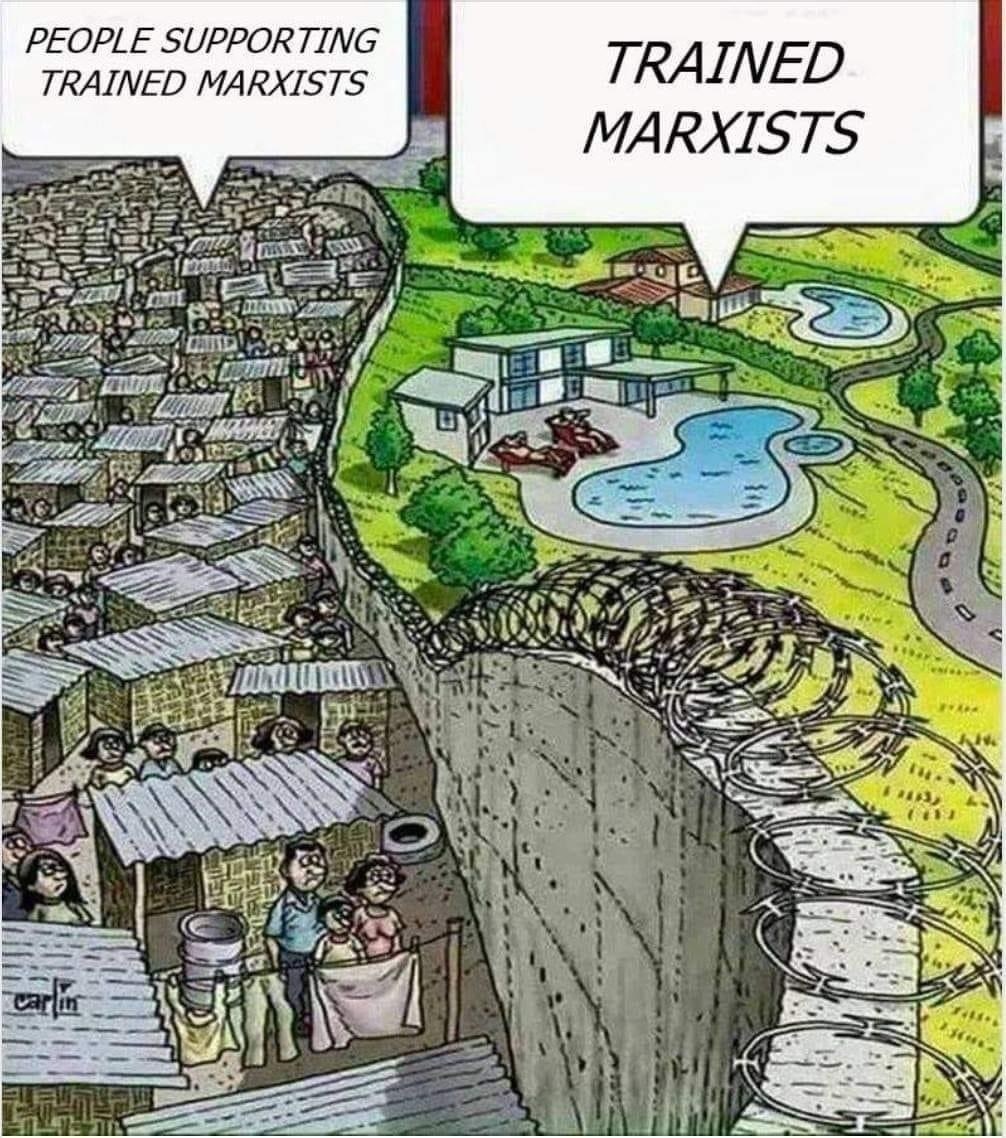

- Such as socialists who say government should be in charge of allocating major investments.

- Such as “supply-siders” who supposedly say lower tax rates are all that is needed for growth.

- Such as honest redistributionists who say we should forgo some growth to have more equality.

So I guess it depends on how the term is defined. If it simply means tax cuts while ignoring other policies (or making those other policies worse, like we saw during the Bush years or Trump years), then you can make an argument that trickle-down economics has a mediocre track record.

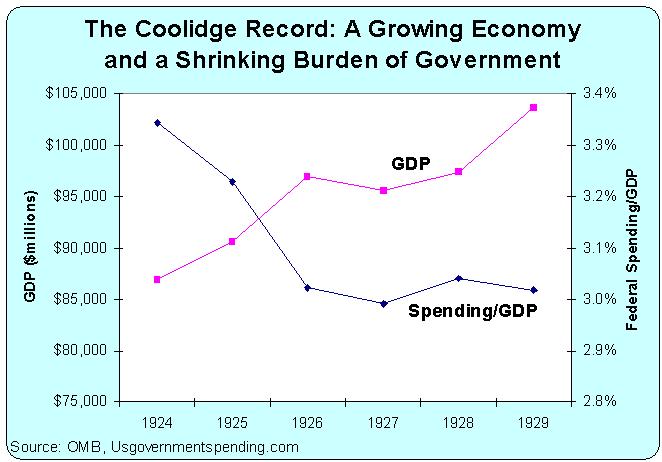

But if the term is simply shorthand for a broader agenda of encouraging more saving and investment with an agenda of small government and free markets, then trickle-down economics has a great track record.

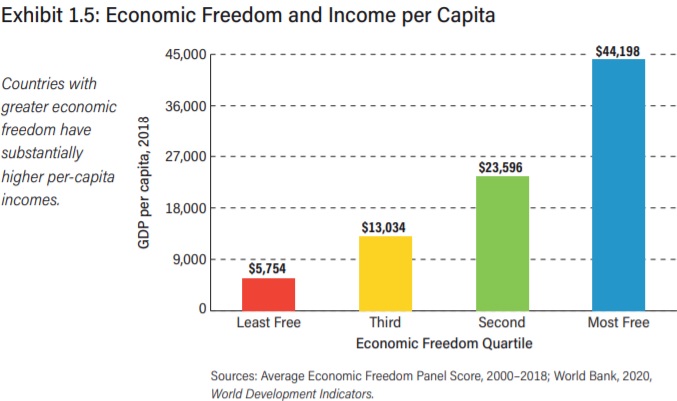

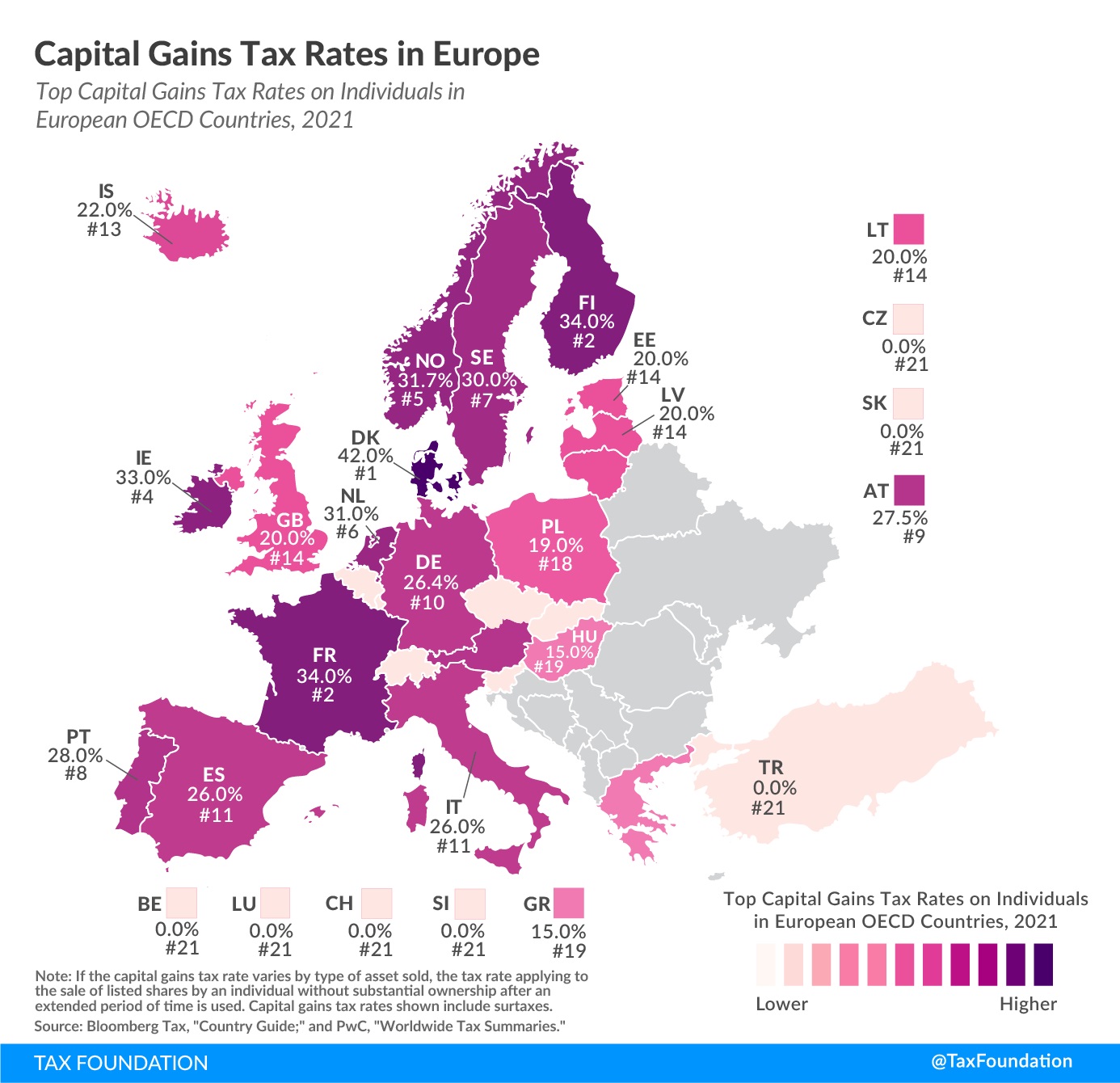

For instance, here’s a chart from the most-recent edition of Economic Freedom of the World. Nations with market-oriented economies are far more prosperous than countries with state-controlled economies.

By the way, Biden is not an honest redistributionist.

Instead of admitting that higher taxes and bigger government will lead to less economic output (and justifying that outcome by saying incomes will be more equal), Biden actually wants people to believe that bigger government somehow will lead to more prosperity.

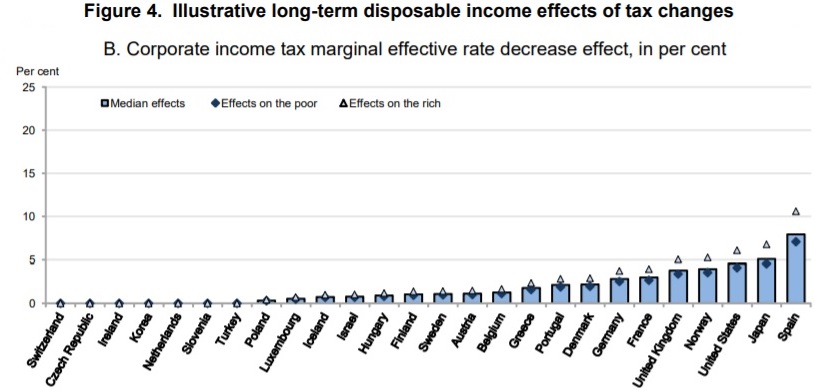

To be fair, he’s not the only one to make this argument. Bureaucracies such as the International Monetary Fund, the United Nations,  and the Organization for Economic Cooperation and Development also have claimed that there will be more prosperity if governments get more control over the economy.

and the Organization for Economic Cooperation and Development also have claimed that there will be more prosperity if governments get more control over the economy.

I call this the “magic beans” theory of economic development.

Which is why I always ask people making this argument to cite a single example – anywhere in the world, at any point in history – of a nation that has prospered by expanding the burden of government.

In other words, I want a response to my never-answered question.

The response is always deafening silence.

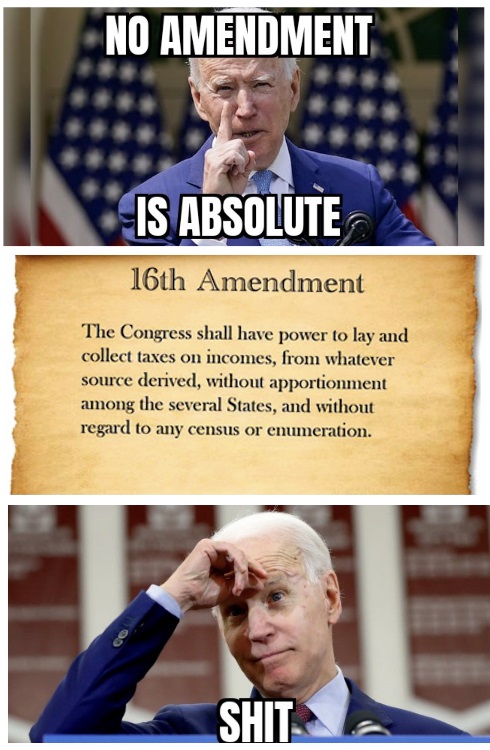

To be sure, I don’t expect Joe Biden to answer the question. Or to understand economics. Heck, I don’t even expect him to care. He’s just trying to buy votes, using other people’s money.

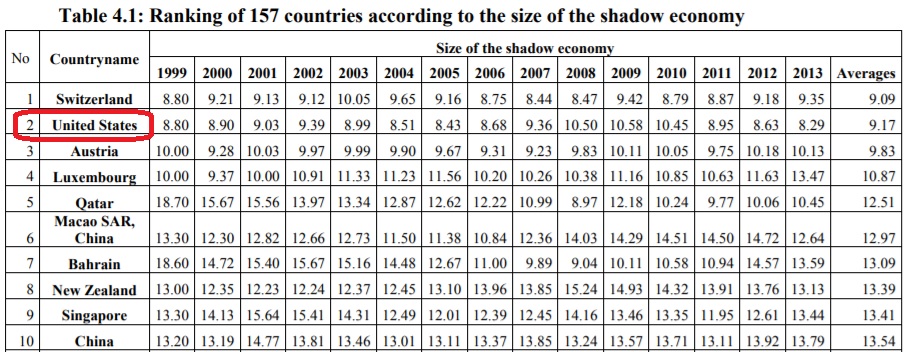

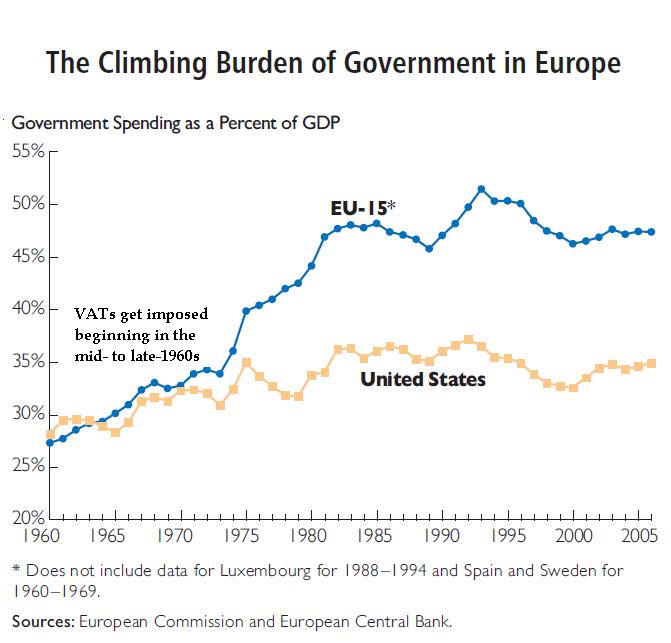

But there are plenty of smart folks on the left, and none of them have a response to the never-answered question, either. Heck, none of them have ever given me a good reason why we should copy Europe when incomes are so much lower on that side of the Atlantic Ocean.