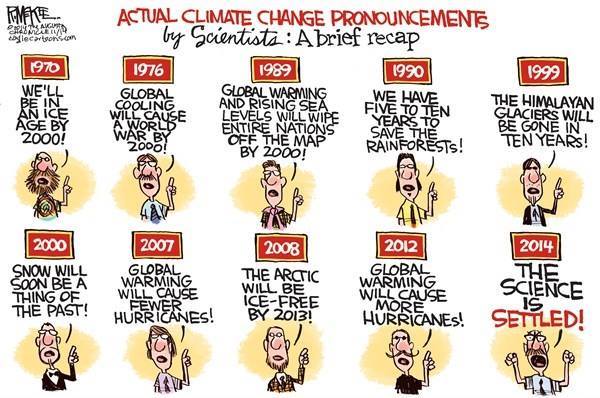

I’ve written dozens of articles about the Laffer Curve and most of that verbiage can be summarized in these five points.

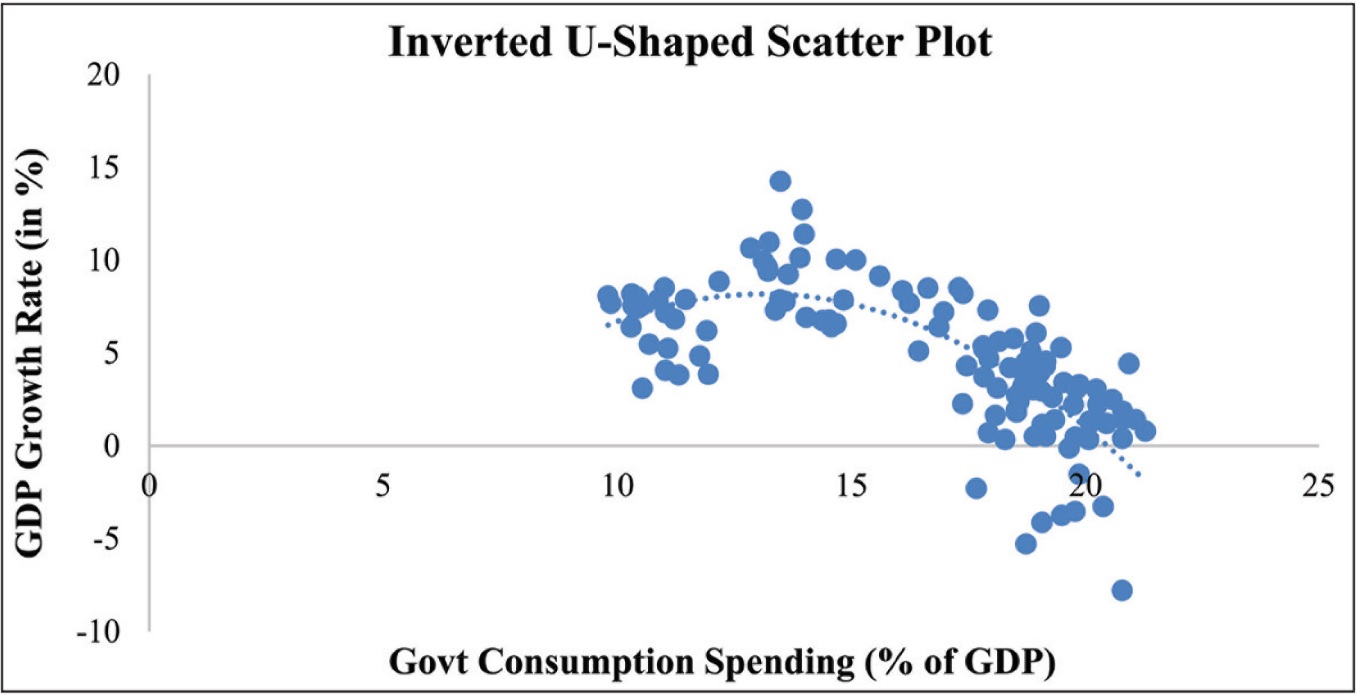

- The Laffer Curve helps to illustrate that excessive tax rates result in less taxable activity.

- All public finance economists – even those on the left – agree there is a Laffer Curve.

- The Laffer Curve does not mean tax cuts are self-financing or that tax increases lose revenue.

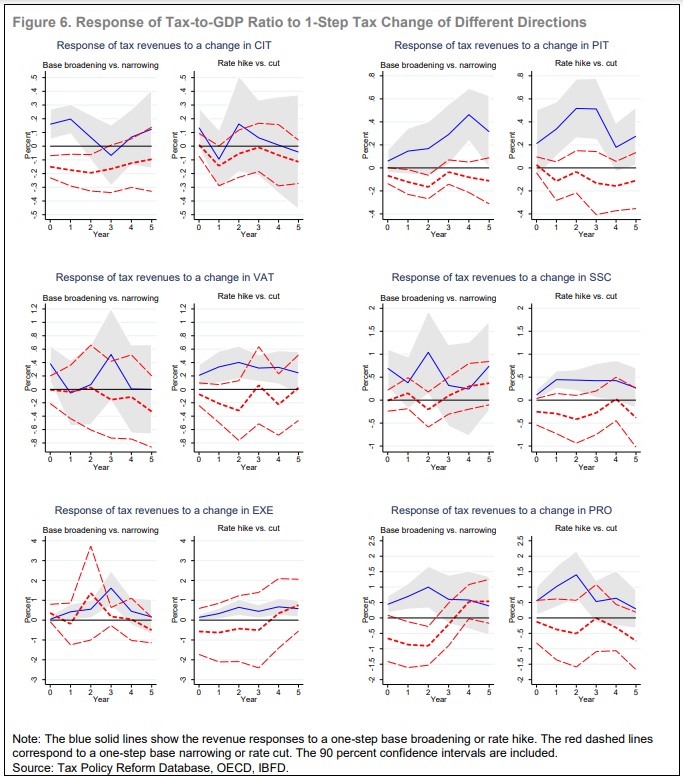

- Different types of taxes produce different responses, so there is more than one Laffer Curve.

- There is a real debate about the shape of the Laffer Curve and the ideal point on the curve.

The fifth point recognizes that well-meaning and knowledgeable people can vigorously disagree.

Do changes in tax policy have big effects or small effects on the economy? How much revenue feedback will occur if there is a change in tax rates?

Just a couple of examples of questions that I have endlessly debated with reasonable folks on the left.

But let’s focus today on the unreasonable left. Or, to be more specific, let’s look at an editorial from the St. Louis Post-Dispatch.

Here are some portions of that newspaper’s simplistic screed.

…the deficit explosion…effectively disproved his theory that cutting taxes on the rich would increase government tax revenue. …Laffer continues to be unchastened…, even as Britain reels from a leadership shuffle caused by the catastrophic application of his very theories. Hand it to Laffer: Seldom does someone who is so often proven wrong have the gumption to maintain he’s right…

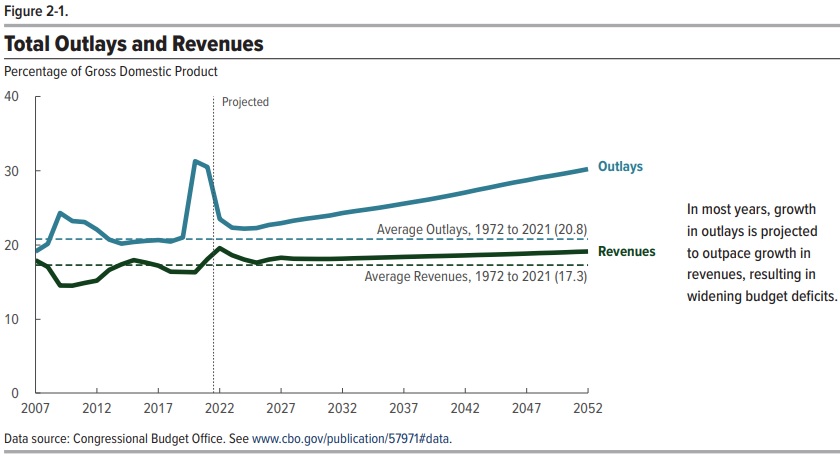

His famous “Laffer curve” presumes to prove that tax cuts for the rich will spur economic investment, causing such strong economic growth that the government’s tax revenue would actually rise instead of falling. …Yes, the economy was robust in the 1980s after Reagan’s historic tax cuts. But that’s also when the era of big budget deficits began. …congressional Republicans and President Donald Trump in 2017 slashed corporate taxes in what they claimed was a necessary economy-booster… Then-Treasury Secretary Stephen Mnuchin’s famous vow that the tax-cut plan would “pay for itself” in growth — the very definition of Laffer’s theory — has since been exposed as the voodoo it always was.

Almost every sentence in the above excerpt cries out for correction.

For instance, Reagan and his team never claimed that the 1981 tax cuts would be self-financing (though IRS data shows that lower tax rates on the rich did produce more revenue).

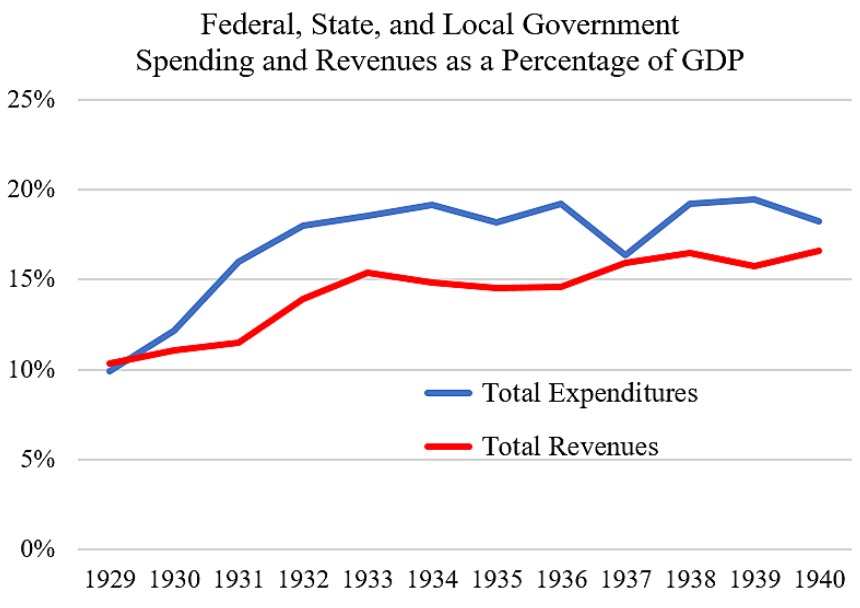

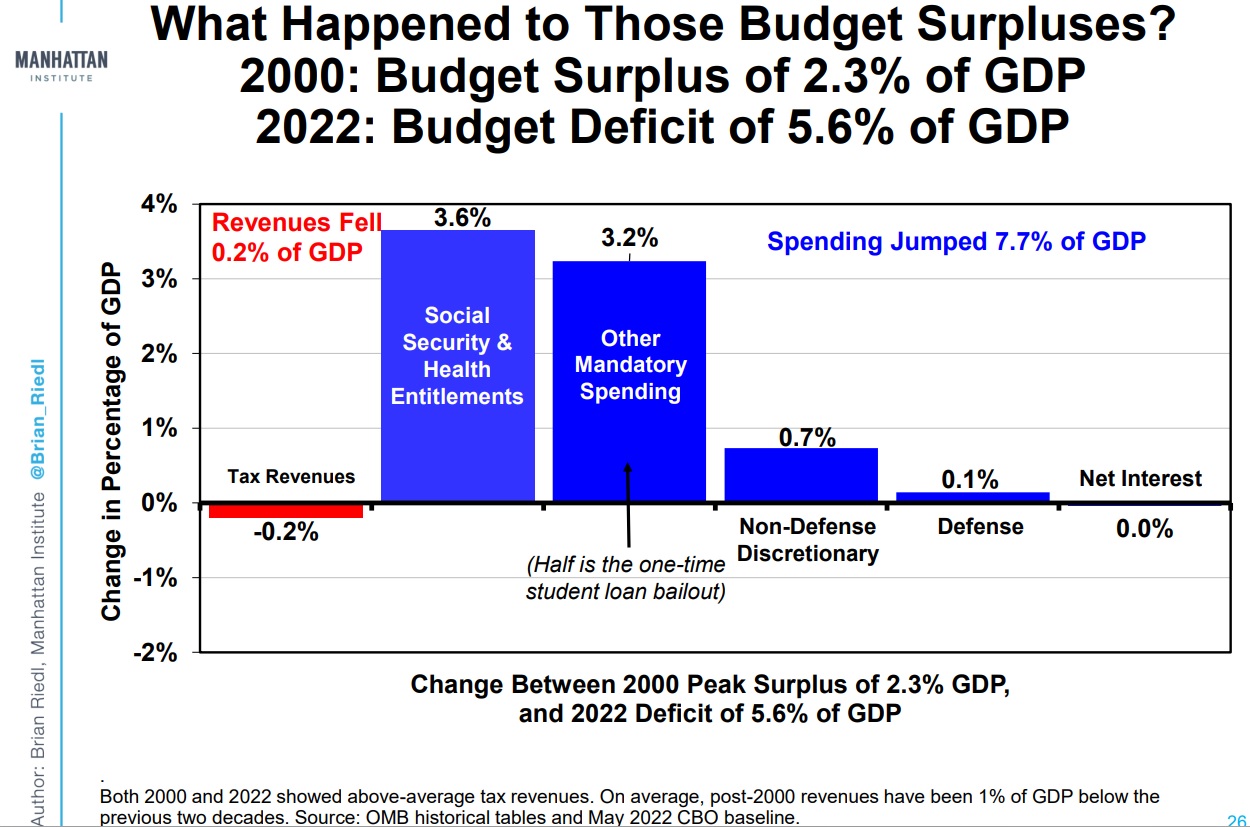

There were big deficits because of the 1980-1982 double-dip recession, and that spike in red ink mostly took place before Reagan’s tax cuts went into effect.

There were big deficits because of the 1980-1982 double-dip recession, and that spike in red ink mostly took place before Reagan’s tax cuts went into effect.

And it’s absurd to blame the United Kingdom’s political instability on tax cuts that never occurred.

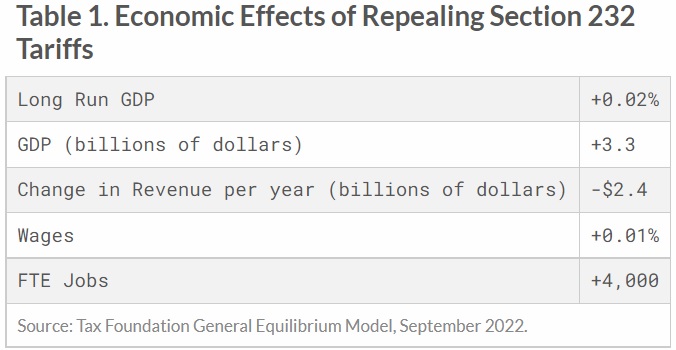

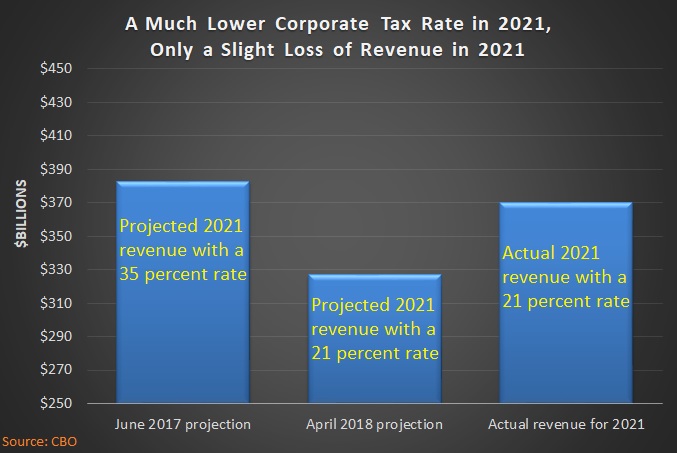

If Secretary Mnunchin claimed the entire tax cut would pay for itself, he clearly deserves to be mocked, but it’s worth noting that the lower corporate tax rate from the 2017 reform is very close to being self-financing.

Not that we should be surprised. Both the IMF and OECD have research showing that lower corporate tax rates do not necessarily lead to lower corporate tax revenues.

The bottom line is that the editorial board of the St. Louis Post-Dispatch obviously puts ideology above accuracy.

P.S. I can’t resist sharing one other excerpt from the editorial.

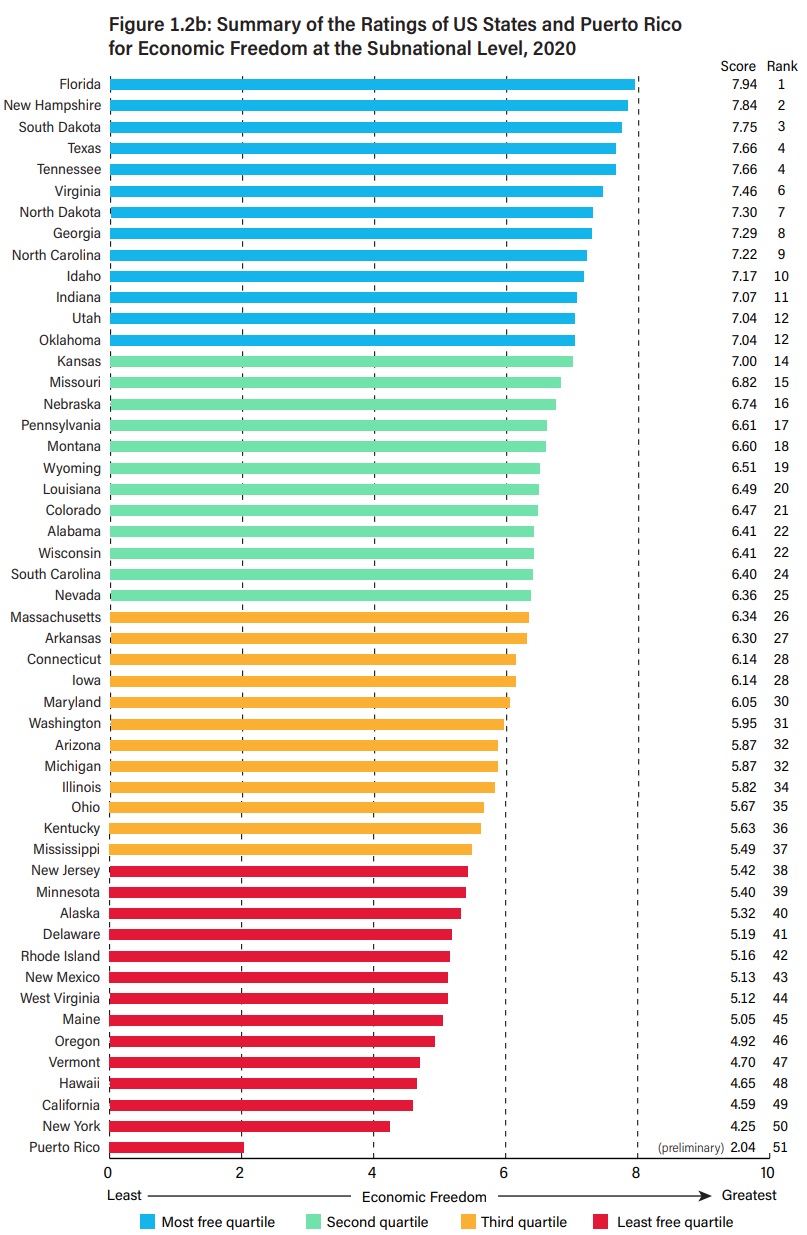

“The Kansas Experiment,” was a debacle. The state’s economy didn’t skyrocket, but the deficit did, forcing deep cuts to education before the legislature finally acknowledged defeat and reversed the tax cuts.

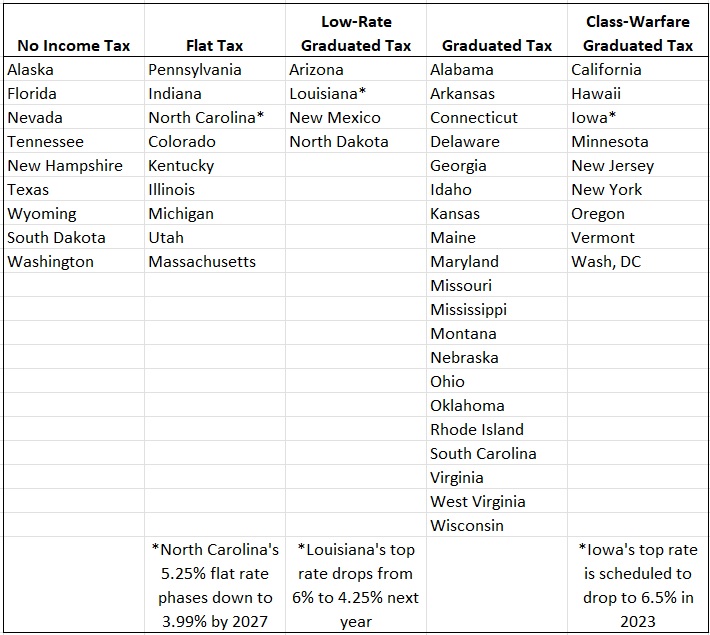

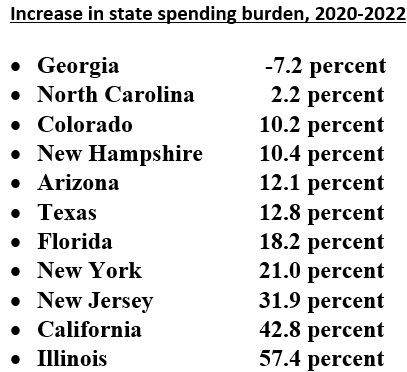

Once again, the editors are showing that ideology trumps accuracy. Here’s what really happened in Kansas. I hope we can have more defeats like that! Though I’ll be the first to admit that North Carolina is a much better role model.