The Nordic nations punch above their weight in global discussions of economic policy.

Advocates of bigger government in the United States, such as Bernie Sanders,  claim that those countries are proof that socialism can work.

claim that those countries are proof that socialism can work.

But there’s a big problem with that claim. The Nordic nations don’t have any of the policies – government ownership, central planning, or price controls – that are characteristics of a socialist economy.

But they do have high taxes and big welfare states. And since some politicians seem to think America should copy those policies, let’s see what we can learn by examining the Nordic nations.

NIma Sanandaji, writing for Foreign Policy, highlights what is good – and not so good – about government policy in the region. He starts by looking specifically at Norway.

Erlend Kvitrud, a member of the Norwegian Green Party, links democratic socialist economic policies and Nordic countries’ prosperity. …the left has for decades showcased the Nordic nations as proof that socialism can work not only in theory but also in practice. …Inconveniently for fans of the Nordic welfare model, though, Norway’s actual economic success rests on its wealth of natural resources. …Norway’s oil fund is the world’s largest sovereign wealth fund, worth around $200,000 per citizen. It wasn’t Norway’s social democratic economic policies that created the country’s wealth. It was nature. …The other Nordic countries, which lack Norway’s oil and natural gas riches, have lower living standards than the United States.

…Inconveniently for fans of the Nordic welfare model, though, Norway’s actual economic success rests on its wealth of natural resources. …Norway’s oil fund is the world’s largest sovereign wealth fund, worth around $200,000 per citizen. It wasn’t Norway’s social democratic economic policies that created the country’s wealth. It was nature. …The other Nordic countries, which lack Norway’s oil and natural gas riches, have lower living standards than the United States.

He’s certainly correct in highlighting the role of oil wealth in Norway.

And he also points out that Norway became a successful and prosperous nation before the welfare state was imposed.

What’s more, the Nordic countries’ social successes predate their high-tax, high-social spending policies. …economists Anthony Barnes Atkinson and Jakob Egholt Sogaard shows that most of the progress toward income inequality in Norway and Sweden happened before 1970, at a time when the two countries had low tax regimes and less redistributive policies. Similarly, the Nordic countries’ social successes were more pronounced in those years. Relative to the rest of the world, for example, they had a greater advantage in life span and child mortality in 1970 than they do today. In other words, the Nordic model arose after those countries were already prosperous and egalitarian.

These are all good points, but I think Nima actually overlooks one very powerful argument.

Yes, per-capita GDP in Norway is very similar to the United States, but gross domestic product is an imperfect measure of living standards. The data in relatively small economies can be misleading if there is a particular sector that distorts national statistics – such as financial services in Luxembourg or corporations in Ireland.

That’s why, if you want to measure the prosperity of households, it’s best to review the OECD’s data on “actual individual consumption.”

it’s best to review the OECD’s data on “actual individual consumption.”

I’ve shared that data for all developed nations in the past, and the Council of Economic Advisers recently did a specific comparison of the United States and Nordic nations.

Norway is still impressive, ranked higher than its neighbors, but not in the same league as the United States.

By the way, in another article, this time for National Review, Nima explains that America actually has more women in management than any of the Nordic nations.

Science Daily once bluntly stated that “the Nordic countries are the most gender equal nations in the world.” There is some truth to this. …A common assumption is that the gender-equality progress of the Nordics is due to their social-democratic welfare policies. …The truth is that Nordic countries have a long history of gender equality, stretching back to the time of the Vikings. …One might expect this to translate  into many women reaching the top of the business world. But this clearly is not the case. …the share of women among managers, as recorded by the International Labour Organization, is 43 percent in the United States, compared with 36 percent in Sweden and 28 percent in Denmark. …a pattern emerges: Those with more extensive welfare-state policies have fewer women on top. Iceland, which has a moderately sized welfare state, has the most women managers. Second is Sweden, which has opened up welfare services such as education, health care, and elder care for private-sector competition. Denmark, which has the highest taxes and the biggest welfare state in the modern world, has the lowest share of women in managerial positions. …The true lesson, that a large welfare state actually can impede women’s progress.

into many women reaching the top of the business world. But this clearly is not the case. …the share of women among managers, as recorded by the International Labour Organization, is 43 percent in the United States, compared with 36 percent in Sweden and 28 percent in Denmark. …a pattern emerges: Those with more extensive welfare-state policies have fewer women on top. Iceland, which has a moderately sized welfare state, has the most women managers. Second is Sweden, which has opened up welfare services such as education, health care, and elder care for private-sector competition. Denmark, which has the highest taxes and the biggest welfare state in the modern world, has the lowest share of women in managerial positions. …The true lesson, that a large welfare state actually can impede women’s progress.

Let’s return to the big-picture economic comparisons.

Professor Hannes Gissurason of the University of Iceland authored a report on the Nordic model for the Foundation for European Reform.

It’s a very detailed study covering lots of issues.

The five Nordic countries, Sweden, Denmark, Finland, Norway, and Iceland, are rightly regarded as successful societies. They are affluent, but without a wide gap between rich and poor.  They provide social security, but without a significant erosion, it seems, of their freedoms. They are small, but they all enjoy a good reputation around the world as peaceful, civilised democracies. The Nordic nations are healthy and well-educated and the crime rate is low. But what is it that other nations can learn from the Nordic success story?

They provide social security, but without a significant erosion, it seems, of their freedoms. They are small, but they all enjoy a good reputation around the world as peaceful, civilised democracies. The Nordic nations are healthy and well-educated and the crime rate is low. But what is it that other nations can learn from the Nordic success story?

For today, let’s focus on the third chapter, which look at three distinct eras of Swedish economic history.

…a distinction can be made between three Swedish models. The liberal model was developed in the mid-19th century, when liberal principles of free trade and unfettered competition  were generally accepted and implemented in Sweden. The years between 1970 and 1990 were the heyday of the social democratic welfare model, although it had of course started its development much earlier and was to last for a few more years. The third model emerged in the 1990s after the experience of the social democratic model: this was the liberal welfare model.

were generally accepted and implemented in Sweden. The years between 1970 and 1990 were the heyday of the social democratic welfare model, although it had of course started its development much earlier and was to last for a few more years. The third model emerged in the 1990s after the experience of the social democratic model: this was the liberal welfare model.

The first era, which was based on classical liberal principles of free markets and limited government, is when Sweden became rich.

It was the liberal model which made Sweden wealthy, as Swedish economist Nima Sanandaji has well documented. Between 1870 and 1936, Sweden enjoyed the highest growth rate in the industrialised world… What produced the astonishing growth after 1870 was the introduction of economic freedom into a relatively poor society, but with strong traditions of self-reliance, hard work, thriftiness, and respect for the law and a high level of education. Money was sound, with the Swedish krona being on the gold standard… The environment was friendly to business and taxes were relatively low, even after the Social Democrats took over. In 1955, for example, tax revenues in Sweden, as a proportion of GDP, were the same as in the US, 24%.

The second era is when Sweden shifted to what some people call democratic socialism, but more accurately should be called the era of big government.

There were high taxes and lots of redistribution programs. And, not surprisingly, this led to economic stagnation.

…In 1975, tax revenues, as a proportion of GDP, had risen to 39% in Sweden, but was still only 25% in the US… In 2004, 38 of the largest companies in Sweden were entrepreneurial which means that they had been started as privately owned enterprises within the country. …Only two had been formed after 1970. While the public sector grew, the private sector stagnated. Between 1950 and 2000, the Swedish population grew from seven to almost nine million. Incredibly, the net job creation in the private sector during this period was close to zero. All the new jobs were in the public sector. …Many entrepreneurs left the country, including the founders of IKEA, Tetra Pak, and H&M.

Big government undermines initiative and weakens economic performance.

The study includes this data on how Swedes get richer in America than they do back home.

All this bad news created the conditions for the third era, which featured market-based reforms – regardless of which party or parties were in control of government.

Reluctantly, the Social Democrats started some reforms, deregulating credit and foreign exchange markets and changing the tax system, lowering marginal income tax from 73% to 51% and the capital gains tax to 30%. In 1991 a non-socialist government was voted in again. Now it was also anti-socialist, and it immediately abolished the wage earner funds… energy, postal, telephone, railway, and airline markets were all deregulated. …The government introduced school vouchers, sold stateowned companies, and carried out reforms in the labour market, especially designed for small businesses and private job agencies. The government also allowed for some choice in health care and assistance to the elderly. …when the Social Democrats returned to power in 1994…welfare benefits were cut; a new pension system was established, partly with self-funded pensions; collective bargaining was reformed; the inheritance tax was abolished. The centre-right government which was in power 2006–2014 continued liberalising the Swedish economy: the wealth tax was abolished, …property rights were strengthened, and the corporate tax was cut to 22%.

In other words, for the past twenty or so years, Sweden has been a leader in pro-market reforms.

Yes, there’s still a big government. But not as big as it used to be.

Yes, there are still high taxes. But not as high as they used to be.

And what’s the lesson we can learn?

This chart is very persuasive. It shows how Swedish prosperity, measured relative to the United States, declined during the era of big government.

But there’s been some convergence ever since policy makers started liberalizing the Swedish economy.

And we see a similar pattern if we compare Sweden to all other industrialized nations.

P.S. A very interesting study suggests that widespread migration to America made Sweden more statist.

Read Full Post »

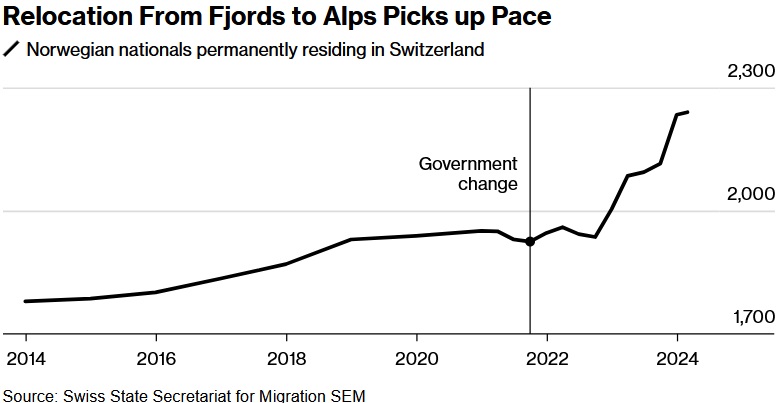

…Eighty-two rich Norwegians with a combined net wealth of about 46 billion kroner ($4.3 billion) left the country in 2022-2023, with 34 moving out last year alone, according to data from the Finance Ministry. More than 70 of those have moved to Switzerland… Swiss taxation varies by canton, but the overall effect is a significantly lower percentage of wealth and income than most other European nations. …Hollup said…”it’s a two-fold issue of losing tax revenue for Norway and the risk that a lot of brain capital has left the country.”