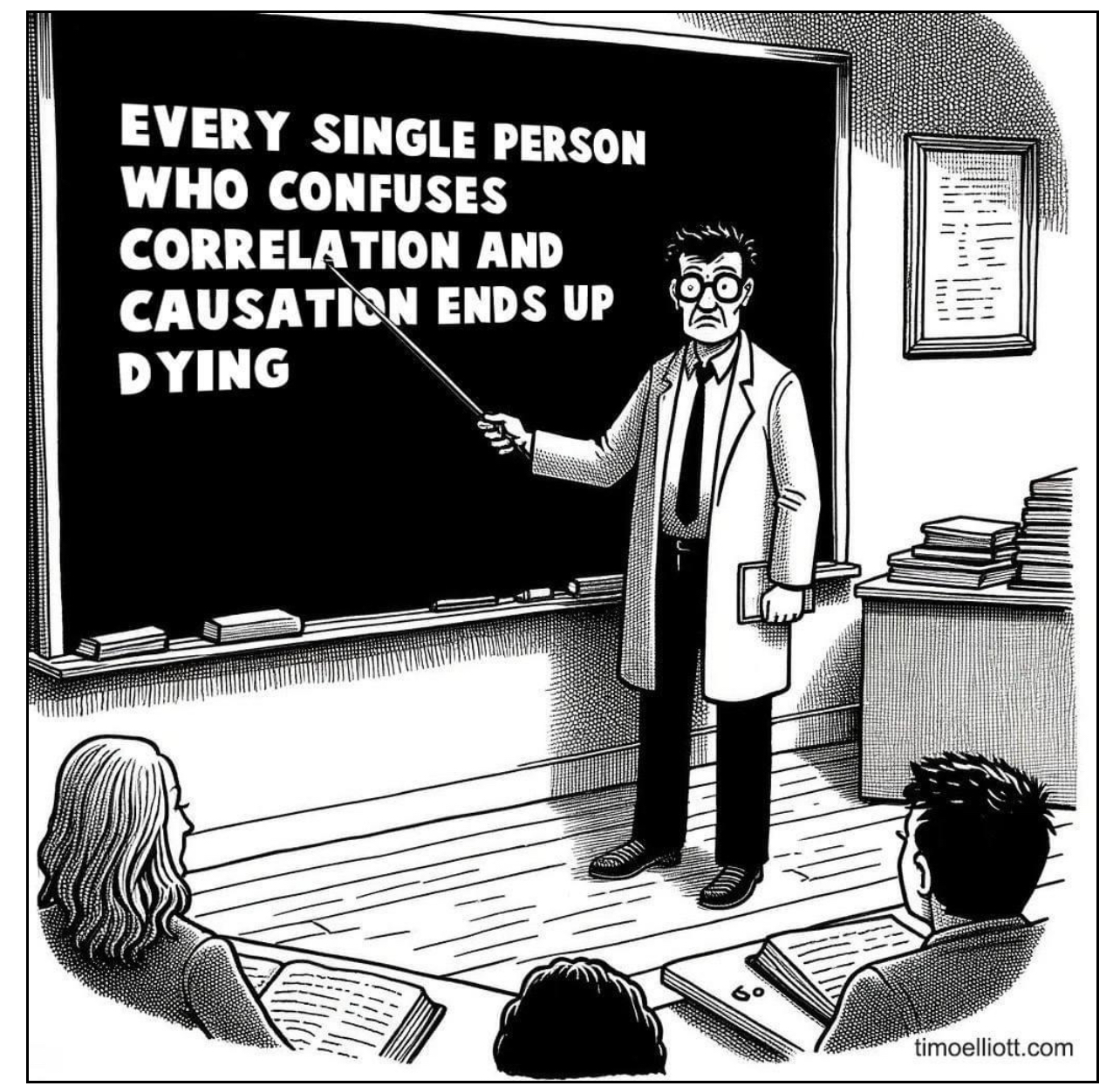

Inexplicably, I’ve only shared one column this year mocking politicians. So let’s rectify that oversight with five new examples of satire.

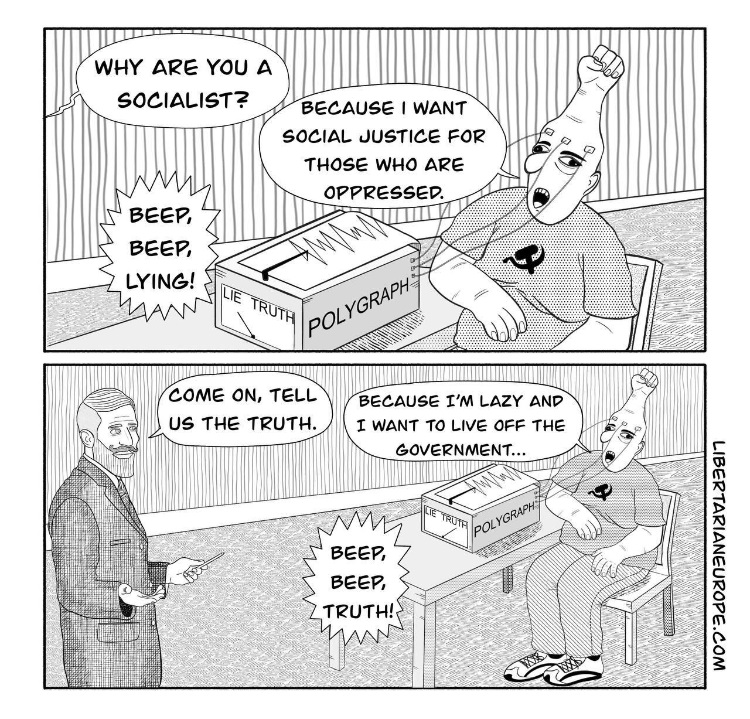

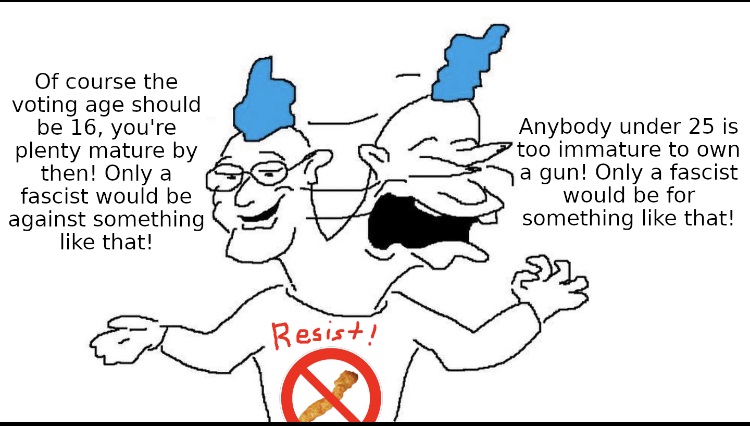

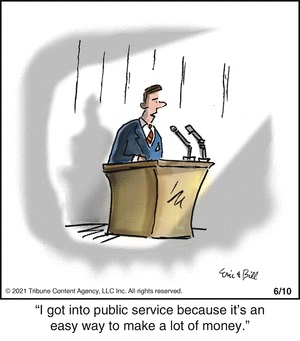

We’ll start with this cartoon. I think Crazy Bernie is the one yelling, but it could be Biden.

Our second item is a headline from the Babylon Bee, though the entire story is worth reading.

Movie buffs will appreciate our next item, which sort of copies the message from my series about the “wretched hive of scum and villainy.”

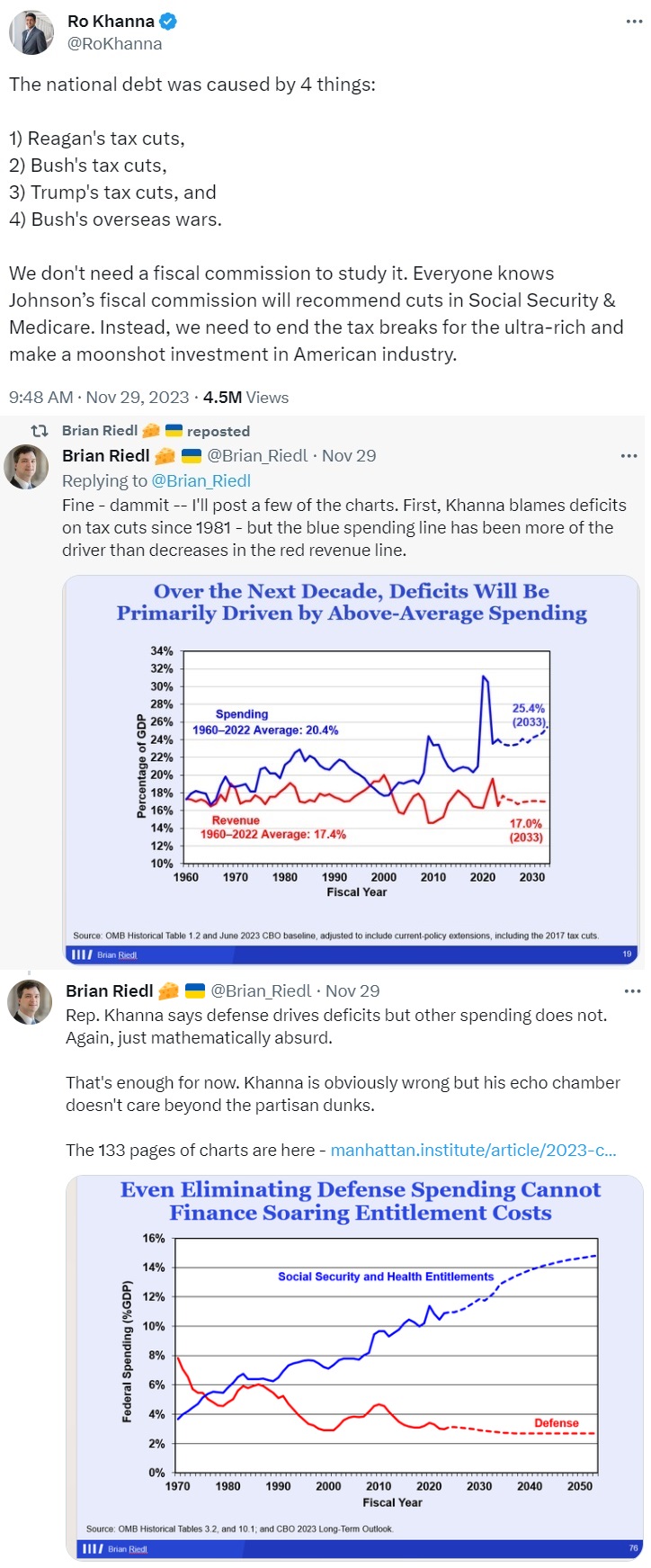

Speaking of which, here’s a typical denizen of that wretched hive.

As usual, I’ve saved the best for last. In this case, though, it’s a written joke rather than a cartoon or meme.

Only weeks after leaving office on January 20, 2017, former President Barack Obama discovers the AC in one of his mansions is not cooling so he calls Troy the Serviceman to come out and fix it.

Troy drives to President Obama’s new house, which is located in a very exclusive, gated community near Washington where all the residents have a net income of way more than $250,000 per year.

Troy arrives and takes his tools into the house. He is led to the guest house that isn’t cooling. Troy assesses the problem and tells President Obama that it’s an easy repair that will take less than 10 minutes. President Obama asks Troy how much it will cost. Troy checks his rate chart and says, “$9,500.

“What?! $9,500?!” Obama asks, stunned, “But you said it’s an easy repair. Michelle will whip me if I pay an AC mechanic that much!” Troy says, “Yes, but what I do is charge those who make more than $250,000 per year a much higher amount so I can fix the air conditioning of poorer people for free. This has always been my philosophy.

As a matter of fact, I lobbied the Democrat Congress, who passed this philosophy into law. Now all AC techs must do business this way. It’s known as the ‘Affordable Heating and Air Conditioning Act of 2014’. I’m surprised you haven’t heard of it.” In spite of that, Obama tells Troy there’s no way he’s paying that much for a small repair, so Troy leaves.

Obama spends the next hour flipping through the phone book calling for another AC company but he finds that all other AC service businesses in the area have gone out of business. Not wanting to pay Troy’s price, Obama does nothing and the AC goes un-repaired for several more days. A week later the heat is so bad President Obama has had to put a wet towel on Michelle and she is not happy as she has Oprah and guests arriving the next morning.

Obama calls Troy and pleads with him to return. Troy goes back to President Obama’s house, looks at the AC unit, checks his new rate chart and says, “Let’s see, this will now cost you $21,000.”

President Obama quickly fires back, “What? A few days ago you told me it would cost $9,500!”

Troy explains, “Well, because of the ‘Affordable Heating and Air Conditioning Act,’ a lot of wealthier people are learning how to maintain and take care of their own units so there are fewer payers in the AC exchanges. As a result, the price I have to charge wealthy people like you keeps rising. Not only that, but for some reason the demand for AC work by those who get it for free has skyrocketed! There’s a long waiting list of those who need repairs, but the amount we get doesn’t cover our costs, especially paperwork and record-keeping. This unfortunately has put a lot of my fellow AC mechanics out of business, they’re not being replaced, and nobody is going into the Air Conditioning business because they know they can’t make any money at it. I’m hurting too, all thanks to greedy rich people like you who won’t pay their ‘fair share’.

On the other hand, why didn’t you buy HVAC insurance last December? If you had bought HVAC insurance available under the ‘Affordable Heating and Air Conditioning Act,’ all this would have been covered by your policy.”

“You mean I wouldn’t have to pay anything to have you fix my AC problem?” asks Obama.

“Well, not exactly,” replies Troy. “You would have had to buy the insurance before the deadline, which has passed now. And, because you’re rich, you would have had to pay $34,000 in premiums, which would have given you a ‘silver’ plan, and then, since this would have been your first repair, you would have to pay up to the $21,000 deductible, and anything over that would have a $7,500 co-pay, and then there’s the mandatory maintenance program, which is covered up to 17.5%, so there are some costs involved. Nothing is for free.”

“WHAT?!” exclaims Obama. “Why so much for a small AC unit?

With a bland look, Troy replies, “Well, paperwork, mostly, like I said. And the internal cost of the program itself. You don’t think a program of this complexity and scope can run itself, do you? Besides, there are millions of folks with lower incomes than you, even many in the ‘middle class’, who qualify for subsidies that people like you must support. That’s why they call it the ‘Affordable Heating and Air Conditioning Act’! Only people who don’t make much money can afford it. If you want affordable Air Conditioning you’ll have to give away most of what you have accumulated and cut your and Michelle’s income by about 90%. Then you can qualify to GET your ‘Fair Share’ instead of GIVING it.” “But who would pass a crazy act like the ‘Affordable Heating and Air Conditioning Act’?!” exclaims the exasperated Obama.

After a sigh, Troy replies, “Congress… because they didn’t read it.”

Now you understand how the health care system works thanks not only to Obamacare, but also because of lots of other policies (Medicare, Medicaid, the healthcare exclusion, etc) that distort prices and create perverse incentives.

P.S. If you want another Obama-specific joke, click here.

Read Full Post »