I don’t like illegal drugs and I’ve never consumed any, not even marijuana. But that’s because of my staid preferences, not because politicians made them illegal.

That being said, I oppose the War on Drugs. In part, this is because of libertarian sensibilities. If people want to risk their own health by taking drugs, that should be their right.

That being said, I oppose the War on Drugs. In part, this is because of libertarian sensibilities. If people want to risk their own health by taking drugs, that should be their right.

But there’s also a cost-benefit angle to this issue. As I wrote in 2018, “I think the social harm of prohibition is greater than the social harm of legalization.”

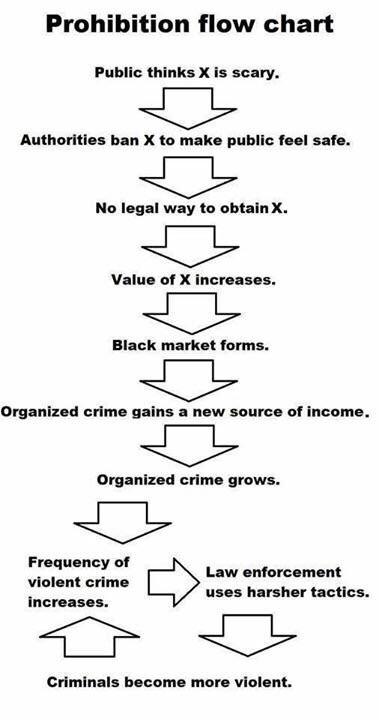

The black market is a very obvious example of the social harm caused by prohibition, as illustrated by the accompanying flowchart. Or this one.

But what about the social harm of legalization? Won’t we have more societal harm if drugs are more accessible?

That does not seem to be the case in states where marijuana is now legal.

But harder drugs may be different, at least if what’s happened in Oregon is any indication.

Voters approved a decriminalization referendum (Measure 110) a few years ago, but Mike Baker of the New York Times reports that the state legislature is reversing that outcome.

Here are some excerpts.

Three years ago, …Oregon voters approved a pioneering plan to decriminalize hard drugs… Overdoses soared… And while many other downtowns emerged from the dark days of the pandemic, Portland continued to struggle, with scenes of drugs and despair.

Lately, even some of the liberal politicians who had embraced a new approach to drugs have supported an end to the experiment. …On Friday, a bill that will reimpose criminal penalties for possession of some drugs won final passage in the State Legislature… The abrupt rollback is a devastating turn for decriminalization proponents… Several prominent Democrats have expressed support for a rollback, including Mike Schmidt, a progressive prosecutor in the Portland area. …“We have been hearing from constituents for a while that this has been really detrimental to our community and to our streets,” he said.

Is Oregon evidence of failure? Were libertarians wrong?

Jacob Sullum of Reason has a different perspective. He blames ongoing criminalization.

It is not surprising that opioid-related deaths continued to climb after Measure 110 took effect in February 2021, because the initiative did nothing to address the iffy quality and unpredictable potency of black-market drugs. That problem is created by drug prohibition and aggravated by attempts to enforce it.

The government’s crackdown on pain pills replaced legally produced, reliably dosed pharmaceuticals with illegal drugs of unknown provenance and composition. The deadly impact of that shift was magnified by the emergence of fentanyl as a heroin booster and replacement—a phenomenon that also was driven by prohibition, which favors highly potent drugs that are easier to conceal and smuggle.

He also argued that Measure 110 did not produce more users or drug tourism.

Critics of Measure 110 argued that it encouraged drug use. Yet an RTI International study of 468 drug users in eight Oregon counties found that just 1.5 percent of them had begun using drugs since Measure 110 took effect. And contrary to the claim that decriminalization had attracted hordes of drug users to the state, the subjects’ median length of residence in Oregon was 24 years.

Meanwhile, Robert Gebelhoff of the Washington Post opined that people began to oppose Measure 110 in part because it made problems more visible.

A “disaster.” A “radical experiment in lawlessness.” A “five-alarm fire of drug abuse, addiction and death.” This is a taste of the hyperbolic reaction to Oregon’s three-year-old law that decriminalized drug possession. The criticism was so intense that the state legislature voted last week to roll back the law, known as Measure 110.

…For most Oregonians, the biggest problem with the law was how they believed it manifested in their lives: drug paraphernalia and human excrement littering the sidewalks; intoxicated individuals loitering outside businesses; bus shelters converted into smoking dens. Reasonable people found such behavior uncomfortable — harrowing, even — and assumed Measure 110 was behind it all… Frustrated voters are upset not so much because the problem has gotten worse but because it’s become more visible. …But make no mistake: Even if you don’t see the carnage of the overdose epidemic, it’s still there.

For what it’s worth, I’m very sympathetic to the normal people. I wouldn’t want to deal with junkies and their detritus.And I’d be super agitated if my family was exposed.

I still think legalization is the logical approach. But I confess there’s no easy answer for how to deal with people who ruin their lives with drug use.

P.S. The same thing is happening in Portugal, where there is now a backlash. Though when I wrote about that nation’s legalization experiment back in 2017, I did warn that “…redistribution programs enable reckless behavior. In other words, people may decide it’s okay to be stoners because they can rely on handouts to stay alive instead of staying clean and having a job.”