Whenever I review a tax proposal, I automatically check whether it is consistent with the “Holy Trinity” of good policy.

Low marginal tax rates on productive activity such as work and entrepreneurship.

Low marginal tax rates on productive activity such as work and entrepreneurship.- No tax bias (i.e., extra layers of tax) penalizing saving and investment.

- No complicating preferences and loopholes that encourage inefficient economic choices.

A good proposal satisfies one of these three principles. A great proposals satisfies all of them.

And that’s a good way of introducing today’s topic, which is about whether we should replace “depreciation” with “expensing.” Or, for those who aren’t familiar with technical tax terminology, this issue revolves around whether there should be a tax penalty on new investment.

Erica York of the Tax Foundation has a nice summary of the issue.

While tax rates matter to businesses, so too does the measure of income to which those tax rates apply. The corporate income tax is a tax on profits, normally defined as revenue minus costs. However, under the current tax code, businesses are unable to deduct the full cost of certain expenses—their capital investments—meaning the tax code is not neutral and actually increases the cost of investment. …Typically, when businesses incur capital investment costs, they must deduct them over several years according to preset depreciation schedules, instead of deducting them immediately in the year the investment occurs. …the delay in taking deductions means the present value of the write-offs (adjusted for inflation and the time value of money) is smaller than the original cost. …The delay effectively shifts the tax burden forward in time as businesses face a higher tax burden today because they cannot fully deduct their costs, and it decreases the after-tax return on the investment. …Ultimately, this means that the corporate income tax is biased against investment in capital assets to the extent that it makes the investor wait years or decades to claim the cost of machines, equipment, or factories on their tax returns.

…Typically, when businesses incur capital investment costs, they must deduct them over several years according to preset depreciation schedules, instead of deducting them immediately in the year the investment occurs. …the delay in taking deductions means the present value of the write-offs (adjusted for inflation and the time value of money) is smaller than the original cost. …The delay effectively shifts the tax burden forward in time as businesses face a higher tax burden today because they cannot fully deduct their costs, and it decreases the after-tax return on the investment. …Ultimately, this means that the corporate income tax is biased against investment in capital assets to the extent that it makes the investor wait years or decades to claim the cost of machines, equipment, or factories on their tax returns.

Here’s a visual depiction of how the current system works.

The key thing to understand is that businesses are forced to overstate their income, which basically means a higher tax rate on actual income (thus violating principle #1).

Back in 2017, Adam Michel and Salim Furth wrote about this topic for the Heritage Foundation.

Here is their main argument.

The current system gives companies a partial deduction for each dollar invested in the economy. The real value of the deduction depends on the vagaries of the tax code, future inflation, and the company’s cost of borrowing. The classification of investments by type and the somewhat arbitrary assignment of the number of years over which each investment must be written off are called depreciation schedules. The imperfect design of these schedules creates unequal tax rates on investment across industries. …Adopting full expensing would reduce effective tax rates everywhere, but especially in industries disfavored under the current system. The result would be more economically efficient: The tax code would no longer be steering investment to arbitrarily favored industries. …Expensing lowers the cost of capital investments. …Both the U.S. capital stock and the demand for labor to operate and service the new investments would be permanently larger. A larger capital stock and higher labor demand would increase the number of jobs and place upward pressure on wages.

The imperfect design of these schedules creates unequal tax rates on investment across industries. …Adopting full expensing would reduce effective tax rates everywhere, but especially in industries disfavored under the current system. The result would be more economically efficient: The tax code would no longer be steering investment to arbitrarily favored industries. …Expensing lowers the cost of capital investments. …Both the U.S. capital stock and the demand for labor to operate and service the new investments would be permanently larger. A larger capital stock and higher labor demand would increase the number of jobs and place upward pressure on wages.

A key takeaway is that the tax bias created by the current system is a penalty on new investment (thus violating principle #2).

And the current approach of depreciation also is incredibly complicated (thus violating principle #3).

Expensing can also significantly cut compliance costs. According to IRS research, business tax compliance costs are over $100 billion per year, representing a massive waste of money and effort. Other estimates place the cost of complying with depreciation schedules alone at over $23 billion annually, or 448 million hours each year. Considering that the total compliance cost for traditional C corporations is equal to 14 percent of their taxes paid, expensing could make major inroads toward simplifying business taxpaying and lowering compliance costs.

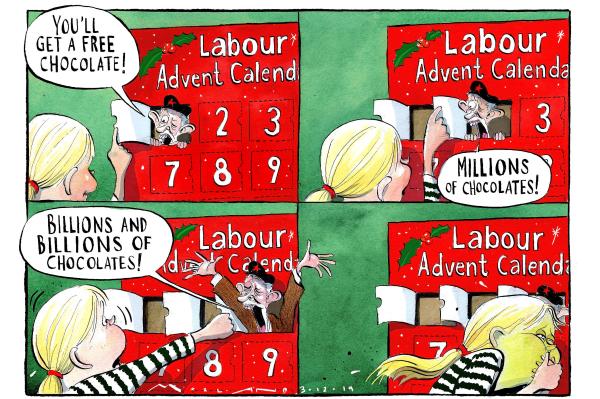

Unsurprisingly, some politicians are on the wrong side.

Not only are they against a neutral system based on expensing, Erica York explains that they want to make the current system even more biased against new investment.

…proposals to stretch deductions over longer periods of time, such as those from Senators Warren (D-MA) and Sanders (I-VT)…would increase the cost of capital, bias the tax code against investment, and lead to less capital accumulation and lower productivity, output, and wages.

Yes, I know readers are shocked to learn that “Crazy Bernie” and “Looney Liz” want to make a bad situation even worse.

Returning to the policy discussion, the fight over depreciation vs. expensing also matters for national competitiveness.

In another study for the Tax Foundation, Amir El-Sibaie looks at how the U.S. compares to other developed nations.

Currently, the U.S. tax code only allows businesses to recover an average of 67.7 percent of a capital investment (e.g., an investment in buildings, machinery, intangibles, etc.). This is slightly higher than the Organisation for Economic Co-operation and Development’s (OECD) average capital allowance of 67.2 percent. …Since 1979, overall treatment of capital assets has worsened in the U.S., dropping from an average capital allowance of 75.8 percent in the 1980s to an average capital allowance of 67.7 percent in 2018. Capital allowances across the OECD have also declined, but by a lesser extent over the same period: 72.4 percent in the 1980s to 67.2 percent in 2018. …The countries with the best average treatment of capital assets are Estonia (100 percent), Latvia (100 percent), and Slovakia (78.2 percent). Countries with the worst treatment of capital assets are Chile (41.7 percent), the United Kingdom (45.7 percent), and Spain (54.5 percent).

…Since 1979, overall treatment of capital assets has worsened in the U.S., dropping from an average capital allowance of 75.8 percent in the 1980s to an average capital allowance of 67.7 percent in 2018. Capital allowances across the OECD have also declined, but by a lesser extent over the same period: 72.4 percent in the 1980s to 67.2 percent in 2018. …The countries with the best average treatment of capital assets are Estonia (100 percent), Latvia (100 percent), and Slovakia (78.2 percent). Countries with the worst treatment of capital assets are Chile (41.7 percent), the United Kingdom (45.7 percent), and Spain (54.5 percent).

The bad news is that the United States is much worse than Estonia (the gold standard for neutral business taxation).

The good news is that we’re not in last place. Here’s a comparison of the United States to the average of other developed nations.

By the way, there are folks in the United Kingdom who want to improve that nation’s next-to-last score.

Here are some excerpts from a column in CapX by Eamonn Ives.

…successive governments have…cut the headline rate of corporation tax. …That said, some of the positive effects of the cuts to corporation tax were blunted by changes to the tax code which allow businesses to write off the cost of capital expenditure… Typically, corporate tax systems let firms deduct day to day expenses – like labour and materials – right away. However, the cost of longer-term investments – such as those in machinery and industrial premises – can only be deducted in a piecemeal manner, over a set period of time. …this creates a problem for businesses, because the more a tax deduction for capital investment is spread out, the less valuable it becomes to a firm. This is not only because of inflationary effects, but also due to what economists would call the time value of money… Thankfully, however, a solution is at hand to iron out this peculiarity. ‘Full expensing’ allows firms to immediately and entirely deduct the cost of any investment they undertake from their corporation tax bill.

However, the cost of longer-term investments – such as those in machinery and industrial premises – can only be deducted in a piecemeal manner, over a set period of time. …this creates a problem for businesses, because the more a tax deduction for capital investment is spread out, the less valuable it becomes to a firm. This is not only because of inflationary effects, but also due to what economists would call the time value of money… Thankfully, however, a solution is at hand to iron out this peculiarity. ‘Full expensing’ allows firms to immediately and entirely deduct the cost of any investment they undertake from their corporation tax bill.

He cites some of the research on the topic.

A 2017 study, from Eric Ohrn, found that in parts of America, full expensing has increased investment by 17.5%, and has increased wages by 2.5%. Employment also rose, by 7.7% after five years, as did production, by 10.5%. If the same results were replicated in the UK, the average worker could stand to earn a staggering additional £700 a year. Another academic study, this time from the UK itself, found that access to more generous capital allowances for small and medium sized enterprises which were offered prior to fiscal year 2008/09 increased the investment rate by 11%.

Let’s conclude.

When I discuss this issue, I usually start by asking an audience for a definition of profit.

That part is easy. Everyone agrees that profit is the difference between cost and revenue.

To show why depreciation should be replaced by expensing, I then use the very simple example of a lemonade stand.

In the start-up year for this hypothetical lemonade stand, our entrepreneur has total costs of $25 (investment costs for the actual stand and operating costs for the lemons) and total revenue of $30. I then explain the different tax implications of expensing and depreciation.

As you can see, our budding entrepreneur faces a much higher tax burden when forced to depreciate the cost of the lemonade stand.

For all intents and purposes, depreciation mandates that businesses overstate profits.

This is unfair. And it’s also bad economic policy because some people will respond to these perverse incentives by deciding not to invest or be entrepreneurial.

To be fair, businesses eventually are allowed to deduct the full cost of investments. But this process can take as long as 39 years.

Here’s another comparison, which shows the difference over time between expensing and a five-year deprecation schedule. I’ve also made it more realistic by showing a loss in the first year.

In both examples, our entrepreneur’s five-year tax bill is $3.

But the timing of the tax matters, both because of inflation and the “time value” of money. That’s why, in a good system, there should only be a tax when there’s an actual profit.

Needless to say, good tax reform plans such as the flat tax are based on expensing rather than depreciation.

P.S. This principle applies even if businesses are investing in private jets.

Read Full Post »

Macroeconomic strength – A strong economy also isn’t a policy, but it’s partially the result of good tax reforms and much-needed regulatory easing. This has pushed up the value of stocks (though I worry we may be experiencing a bubble), but I’m much happier that it’s led to a tight labor market and increased wages for lower-skilled workers.

Macroeconomic strength – A strong economy also isn’t a policy, but it’s partially the result of good tax reforms and much-needed regulatory easing. This has pushed up the value of stocks (though I worry we may be experiencing a bubble), but I’m much happier that it’s led to a tight labor market and increased wages for lower-skilled workers.