Because of her support for lower tax rates, I was excited when Liz Truss became Prime Minister of the United Kingdom.

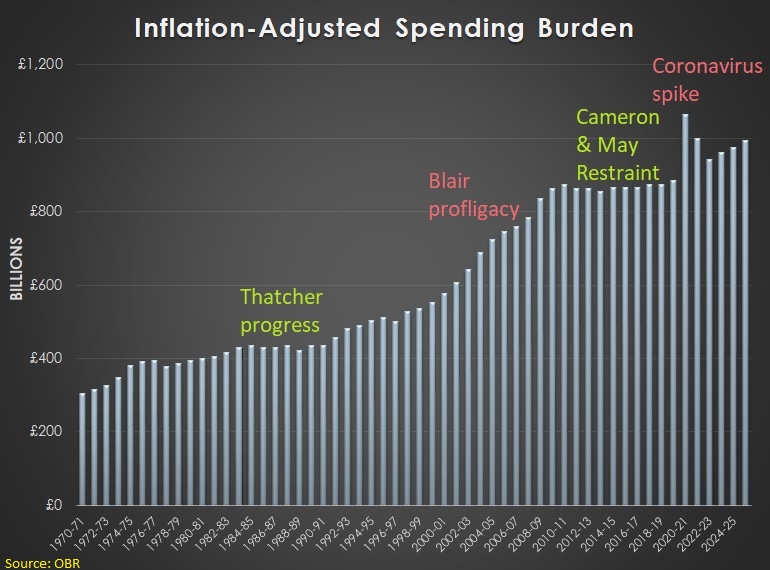

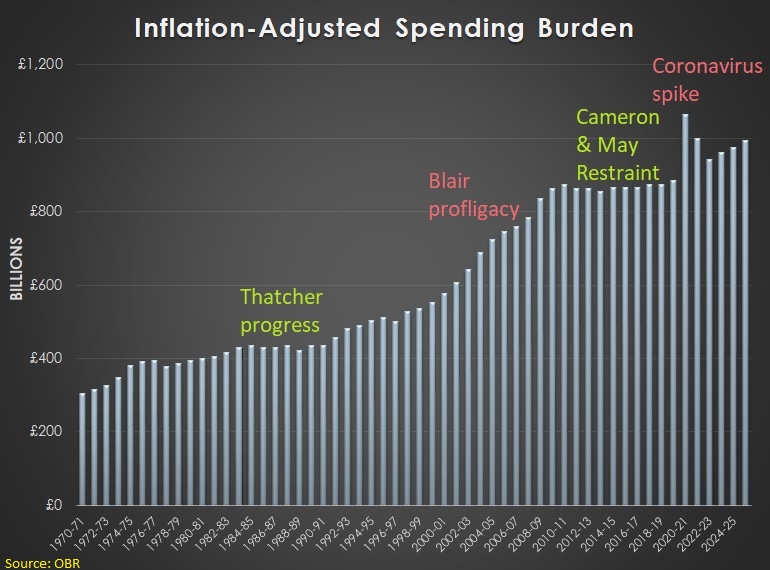

Especially since her predecessor, Boris Johnson, turned out to be an empty-suit populist who supported higher taxes and a bigger burden of government spending.

Especially since her predecessor, Boris Johnson, turned out to be an empty-suit populist who supported higher taxes and a bigger burden of government spending.

But I’m not excited anymore.

Indeed, it’s more accurate to say that I’m despondent since the Prime Minister is abandoning (or is being pressured to abandon) key parts of her pro-growth agenda.

For details, check out this Bloomberg report, written by Julian Harris, about the (rapidly disappearing) tax-cutting agenda of the new British Prime Minister.

Westminster’s most hard-line advocates of free markets and lower taxes are looking on in despair as their agenda crumbles… When Liz Truss became prime minister just over five weeks ago, she promised to deliver a radical set of policies rooted in laissez-faire economics — an attempt to boost the UK‘s sluggish rate of growth.  Yet her chancellor of the exchequer, Kwasi Kwarteng, faced a quick reality check when his mini-budget, packed with unfunded tax cuts and unaccompanied by independent forecasts, …triggered mayhem… Truss fired Kwarteng and replaced him with Jeremy Hunt as she was forced into a dramatic u-turn over her tax plans. …Truss conceded…and dropped her plan to freeze corporation tax. …Still, some believers are sticking by “Trussonomics”…Patrick Minford,..a professor at Cardiff University, said..“Liz Truss’s policies for growth are absolutely right, and to be thrown off them by a bit of market turbulence is insane.” …Eamonn Butler, co-founder of the Adam Smith Institute, similarly insisted that Truss “is not the source of the problem — she’s trying to cure the problem.”

Yet her chancellor of the exchequer, Kwasi Kwarteng, faced a quick reality check when his mini-budget, packed with unfunded tax cuts and unaccompanied by independent forecasts, …triggered mayhem… Truss fired Kwarteng and replaced him with Jeremy Hunt as she was forced into a dramatic u-turn over her tax plans. …Truss conceded…and dropped her plan to freeze corporation tax. …Still, some believers are sticking by “Trussonomics”…Patrick Minford,..a professor at Cardiff University, said..“Liz Truss’s policies for growth are absolutely right, and to be thrown off them by a bit of market turbulence is insane.” …Eamonn Butler, co-founder of the Adam Smith Institute, similarly insisted that Truss “is not the source of the problem — she’s trying to cure the problem.”

Eamonn is right.

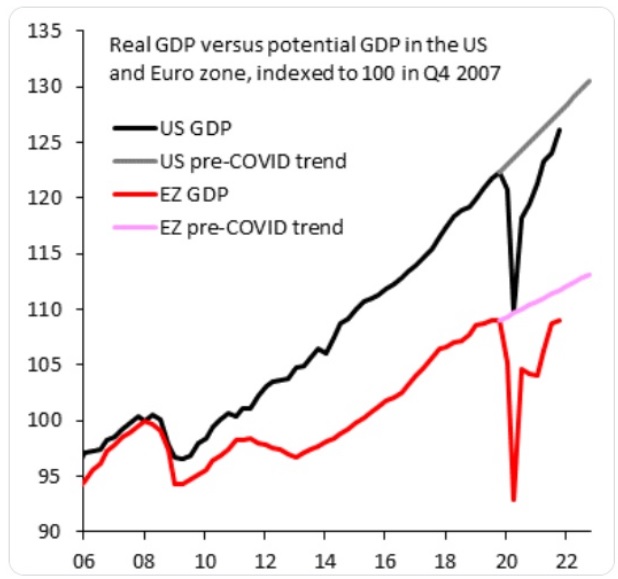

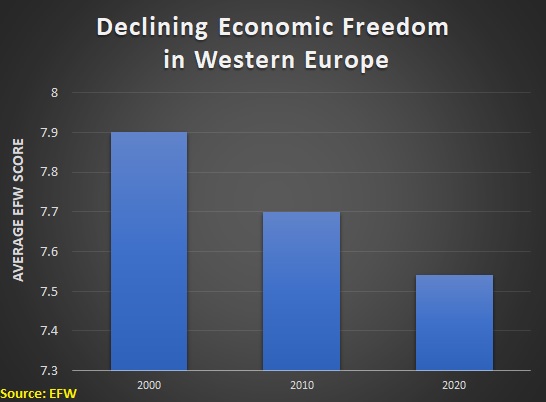

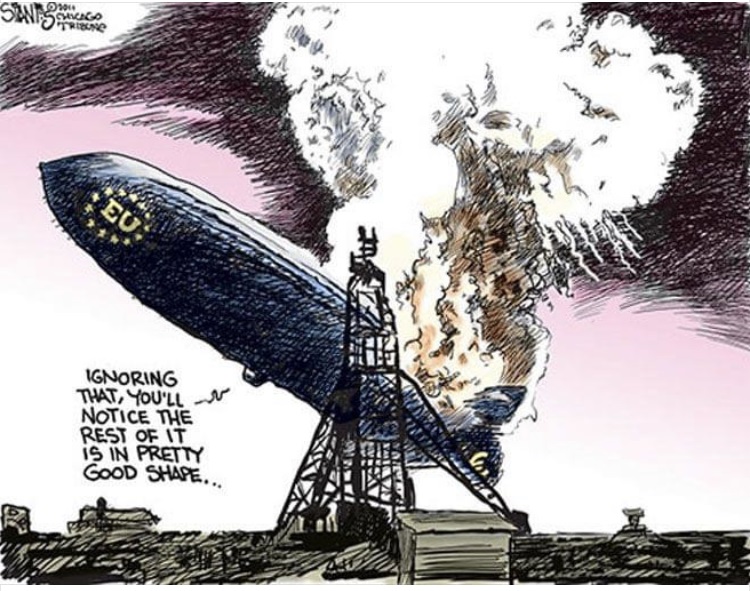

The United Kingdom faces serious economic challenges. But the problems are the result of bad government policies that already exist rather than the possibility of some future tax cuts.

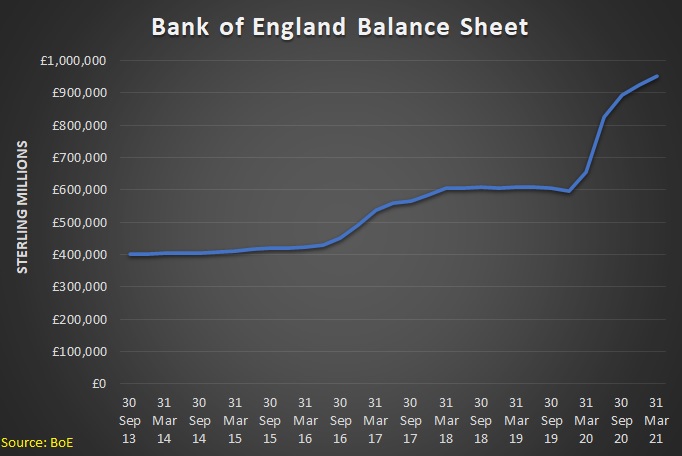

In a column for the Telegraph, Allister Heath says the U.K.’s central bank deserves a big chunk of the blame.

Liz Truss and Kwasi Kwarteng have been doubly unlucky. While almost everybody else in Britain remained in denial, they correctly identified this absurd game for the con-trick that it truly was, warned that it was about to implode and pledged to replace it with a more honest system. Instead of a zombie economy based on rising asset prices and fake, debt-fuelled growth, their mission was to encourage Britain to produce more real goods and services, to work harder and invest more by reforming taxes and regulation. What happened next is dispiriting in the extreme. …Truss and her Chancellor moved too quickly and, paradoxically, given their warnings about the rottenness of the system, ended up pulling out the last block from the Jenga tower, sending all of the pieces tumbling down. …they didn’t crash the economy – it was about to come tumbling down anyway – but they had the misfortune of precipitating and accelerating the day of reckoning. …Andrew Bailey, the Governor of the Bank of England…, has been deeply unimpressive in all of this, helping to keep interest rates too low… The idea, now accepted so widely, that the price of money must be kept extremely low and quantitative easing deployed at every opportunity has undermined every aspect of the economy and society. …Too few people realise how terribly the easy money, high tax, high regulation orthodoxy has failed.

What happened next is dispiriting in the extreme. …Truss and her Chancellor moved too quickly and, paradoxically, given their warnings about the rottenness of the system, ended up pulling out the last block from the Jenga tower, sending all of the pieces tumbling down. …they didn’t crash the economy – it was about to come tumbling down anyway – but they had the misfortune of precipitating and accelerating the day of reckoning. …Andrew Bailey, the Governor of the Bank of England…, has been deeply unimpressive in all of this, helping to keep interest rates too low… The idea, now accepted so widely, that the price of money must be kept extremely low and quantitative easing deployed at every opportunity has undermined every aspect of the economy and society. …Too few people realise how terribly the easy money, high tax, high regulation orthodoxy has failed.

Allister closes with some speculation about possible alternatives. If the Tories in the U.K. decide to reject so-called “free-market fundamentalism,” what’s their alternative?

He thinks the Labour Party will take control, and with very bad results. Jeremy Corbyn will not be in charge, but his economic policies will get enacted.

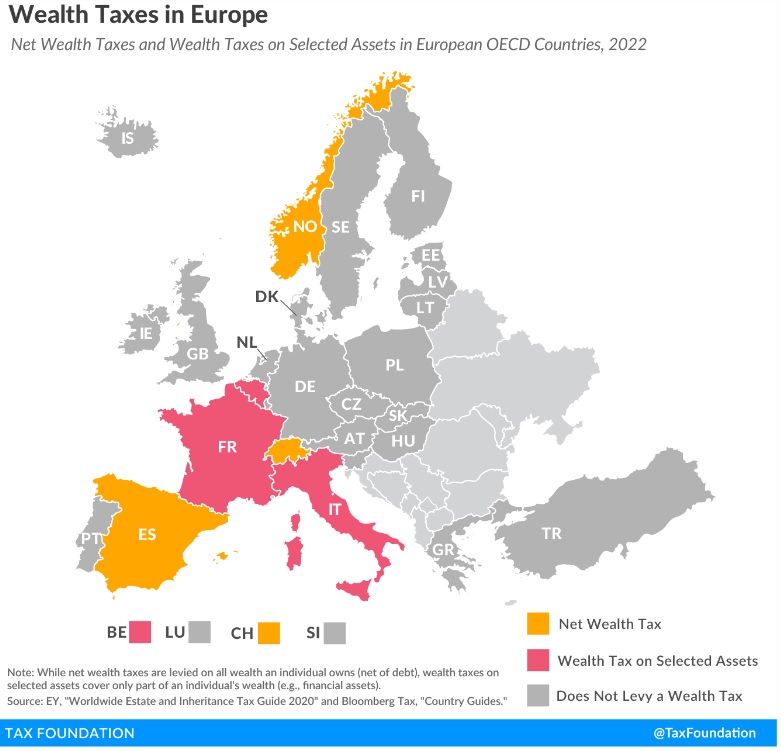

If Truss is destroyed, the alternative won’t even be social democracy: it will be Labour, the hard Left, the full gamut of punitive taxation, including of wealth and housing, and even more spending, culminating rapidly in economic oblivion.

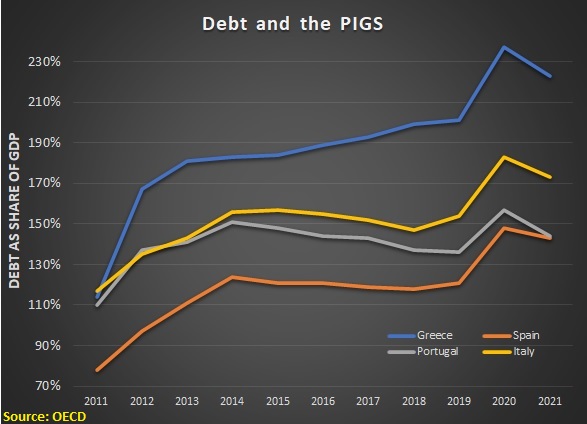

That is an awful scenario. Basically turning the United Kingdom into Greece.

I want to take a different approach, though, and contemplate what will happen if the Conservative Party rejects the Truss approach and embraces big-government conservatism.

Here are some questions I’d like them to answer:

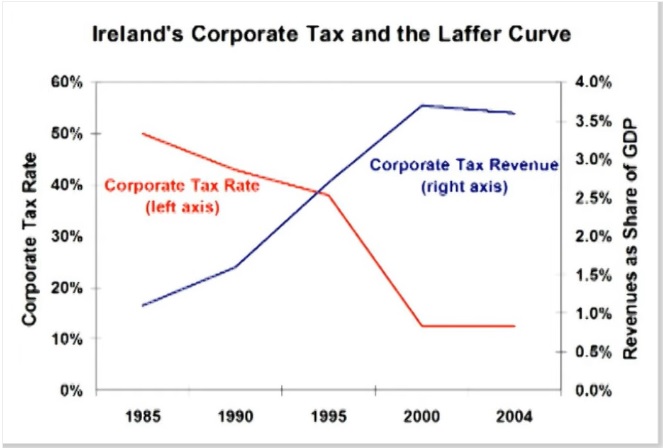

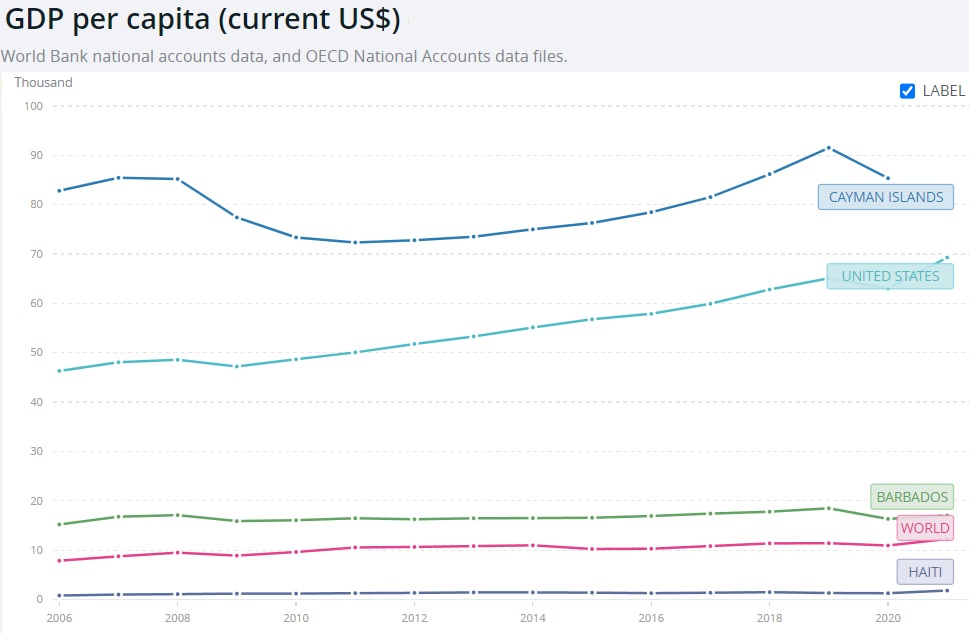

- Do you want improved competitiveness and more economic growth?

- If you want more growth, which of your spending increases will lead to those outcomes?

- Which of your tax increases will lead to more competitiveness or more prosperity?

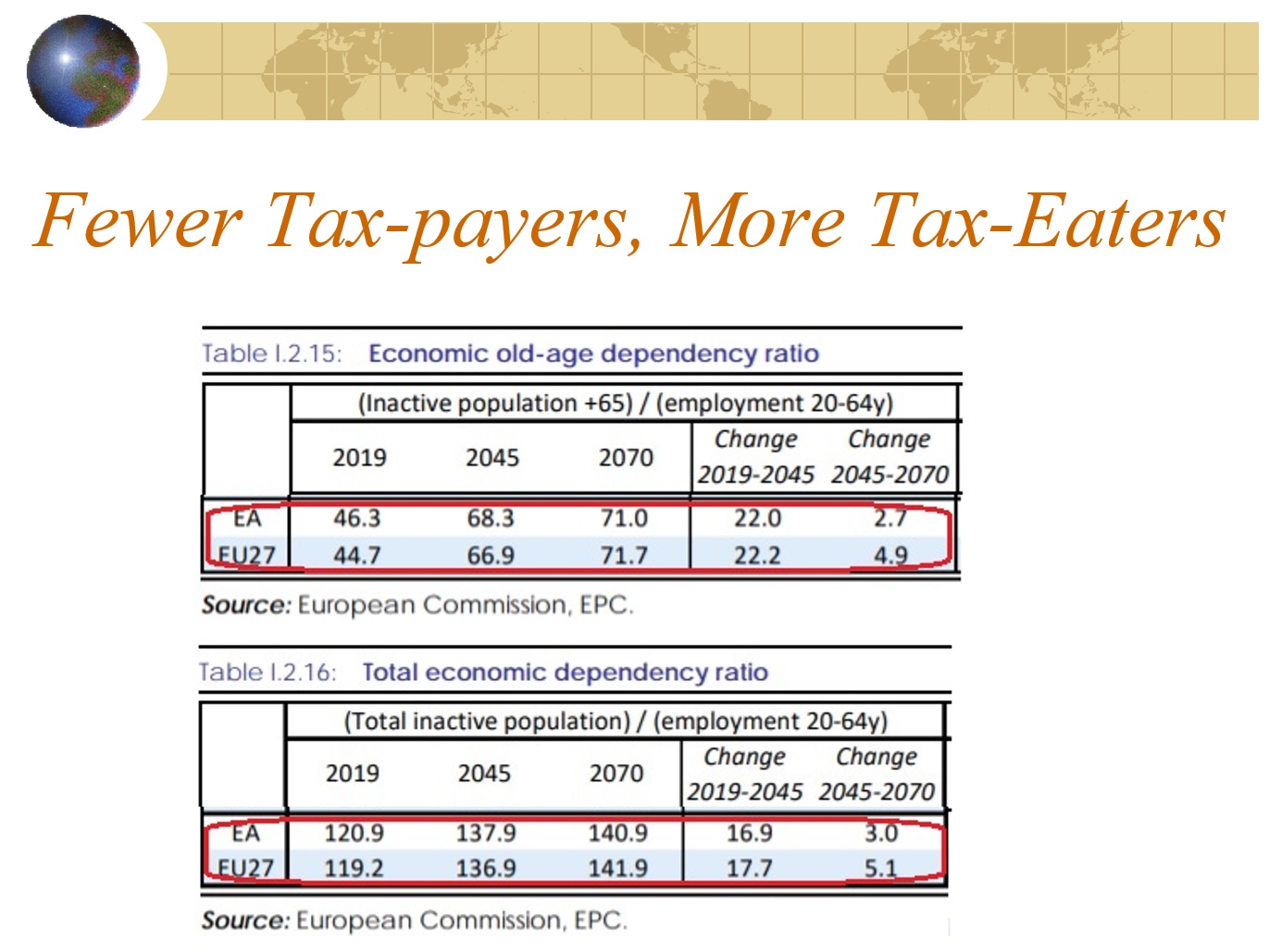

- Will you reform benefit programs to avert built-in spending increases caused by an aging population?

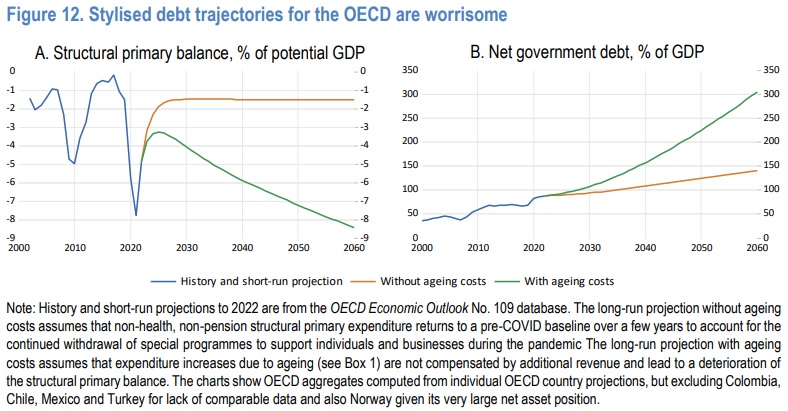

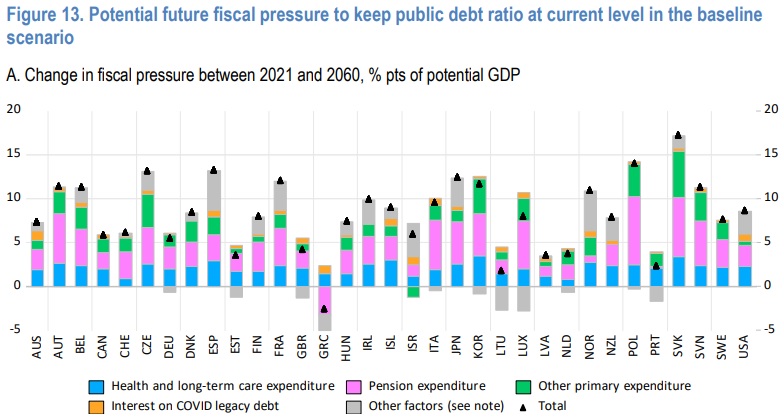

- If you won’t reform entitlements, which taxes will you increase to keep debt under control?

- If you don’t plan major tax increases, do you think the economy can absorb endless debt?

I’m asking these questions for two reasons. First, there are no good answers and I’d like to shame big-government Tories into doing the right thing.

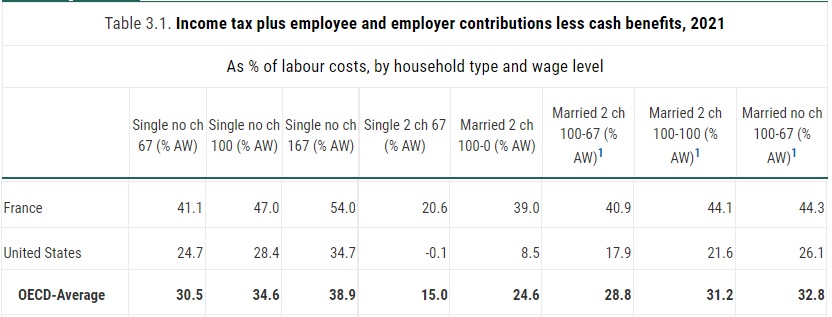

Second, these questions are also very relevant in the United States. Even since the Reagan years, opponents of libertarian economic policies have flitted from one trendy idea to another (national conservatism, compassionate conservatism, kinder-and-gentler conservatism, common-good capitalism, reform conservatism, etc).

To be fair, they usually don’t try to claim their dirigiste policies will produce higher living standards. Instead, they blindly assert that it will be easier to win elections if Republicans abandon Reaganism.

To be fair, they usually don’t try to claim their dirigiste policies will produce higher living standards. Instead, they blindly assert that it will be easier to win elections if Republicans abandon Reaganism.

So I’ll close by observing that Ronald Reagan won two landslide elections and his legacy was strong enough that voters then elected another Republican (the same can’t be said for big-government GOPers like Nixon, Bush, Bush, or Trump).

Switching back to the United Kingdom, Margaret Thatcher repeatedly won election and her legacy was strong enough that voters then elected another Conservative.

The bottom line is that good policy can lead to good political outcomes, whereas bad policy generally leads to bad political outcomes.

P.S. To be sure, there were times when Reagan’s poll numbers were very bad. And the same is true for Thatcher. But because they pursued good policies, economic growth returned and they reaped political benefits. Sadly, it appears that Truss won’t have a chance to adopt good policy, so we will never know if she also would have benefited from a similar economic renaissance.

Read Full Post »