As part of my everything-you-need-to-know series, I shared an incomprehensible flowchart showing the ridiculous maze of federal welfare programs back in 2015.

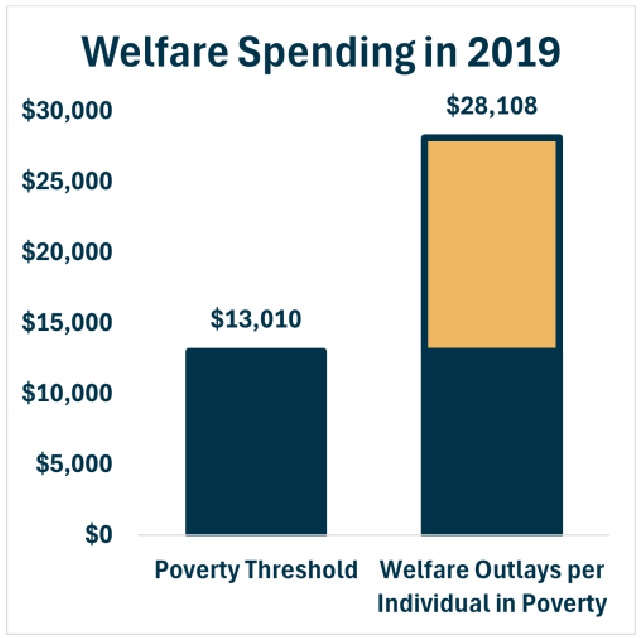

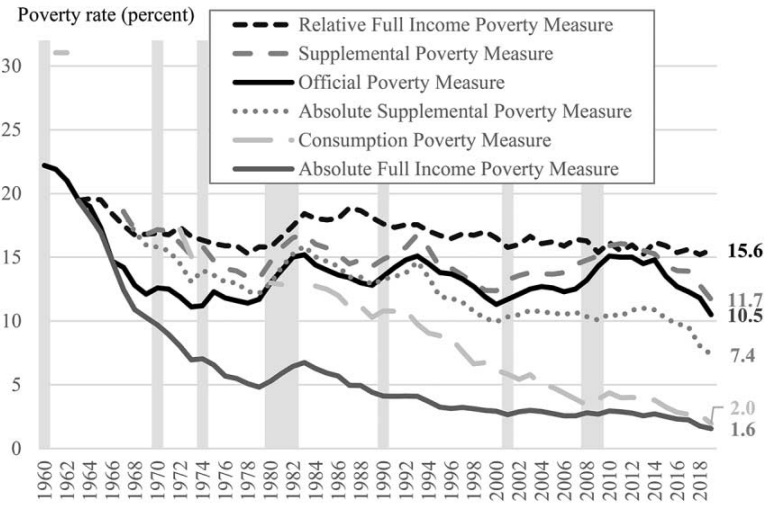

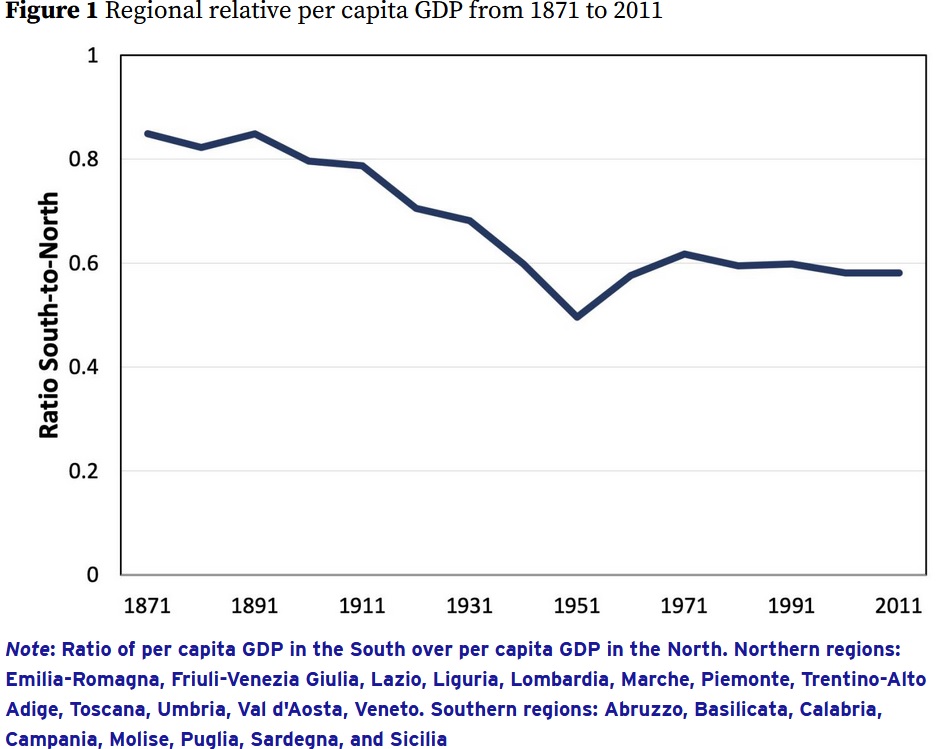

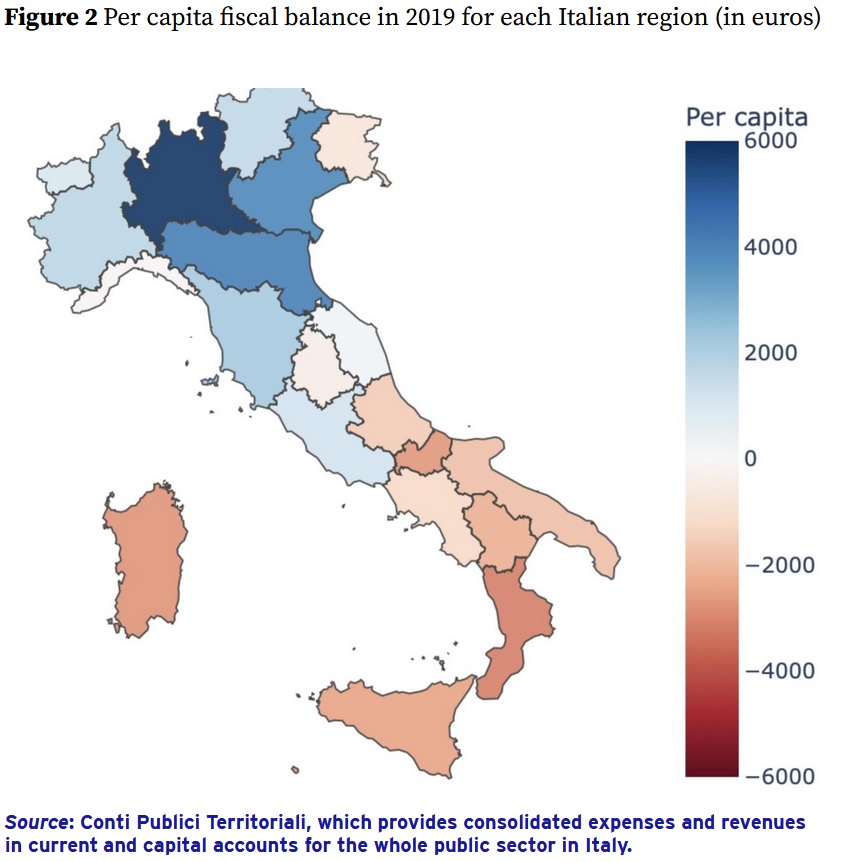

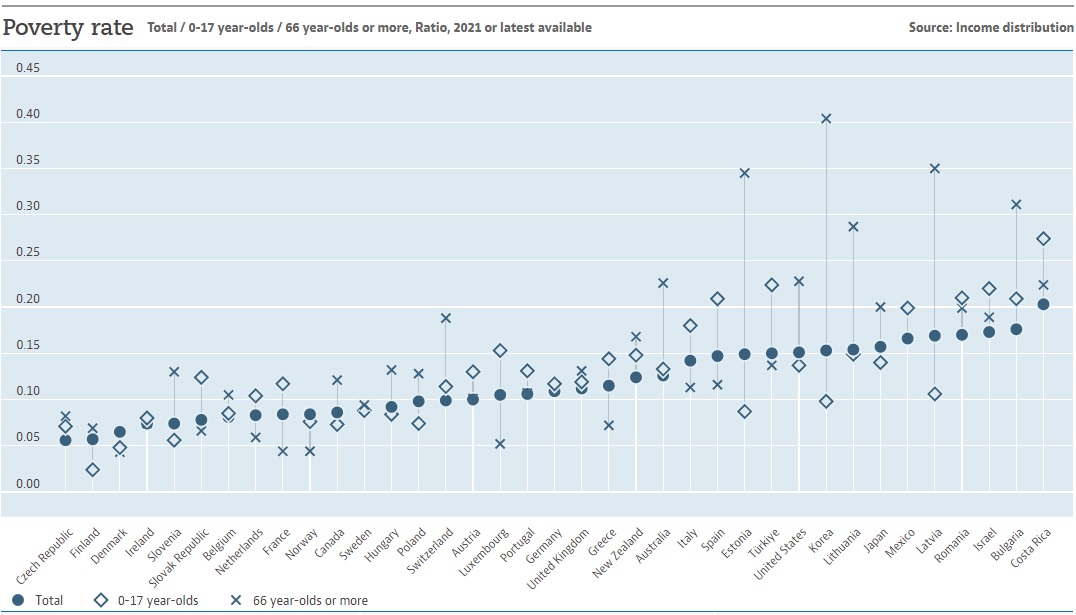

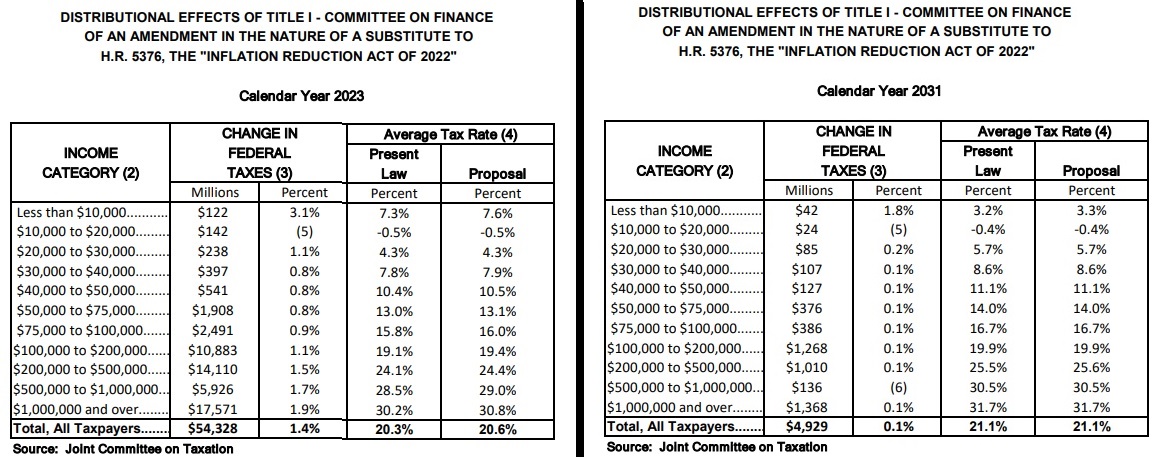

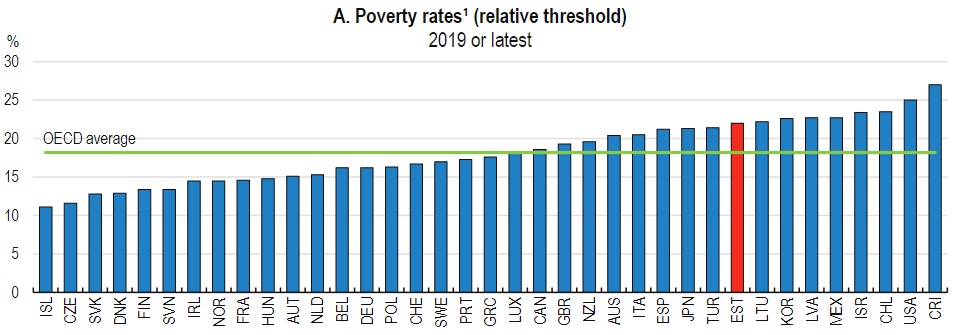

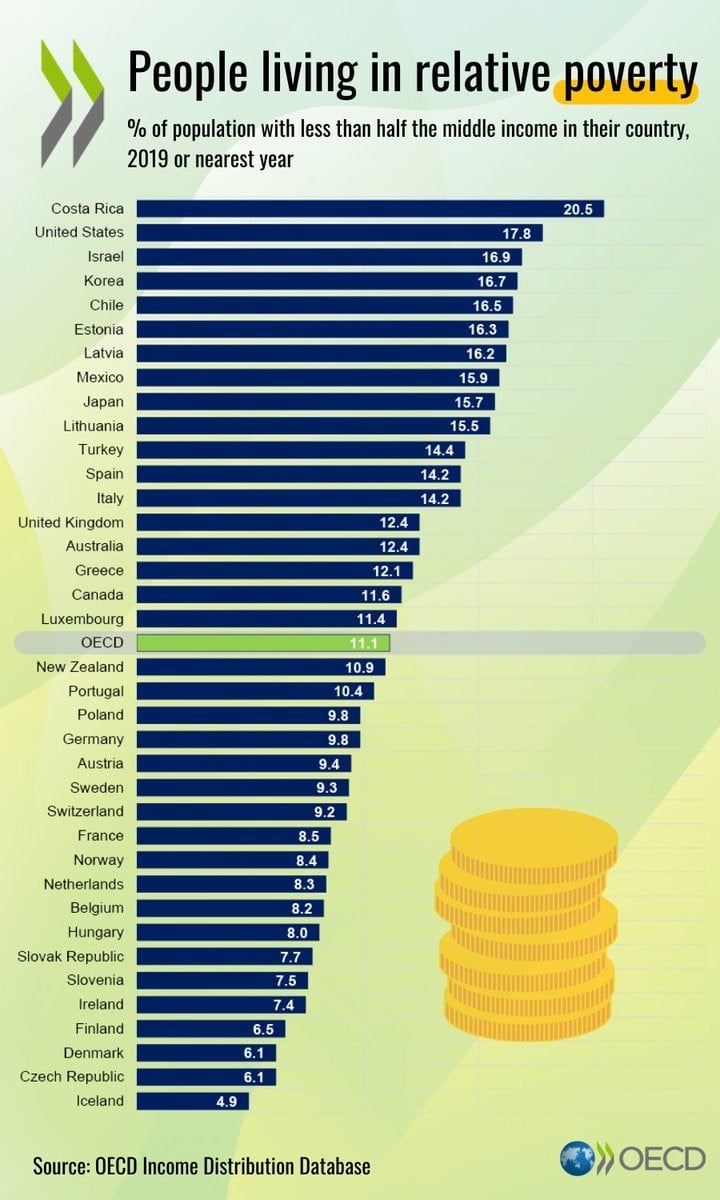

Today, let’s look at another visual that captures what’s wrong with the Washington welfare state. As you can see, taxpayers are footing the bill for a system that spends more than twice what would be required to eliminate all poverty.

The chart comes from a new report by Matt Dickerson for the Economic Policy Innovation Center. And the purpose of the chart is to show that the welfare system is grotesquely inefficient.

Here’s some of what he wrote.

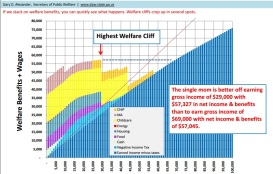

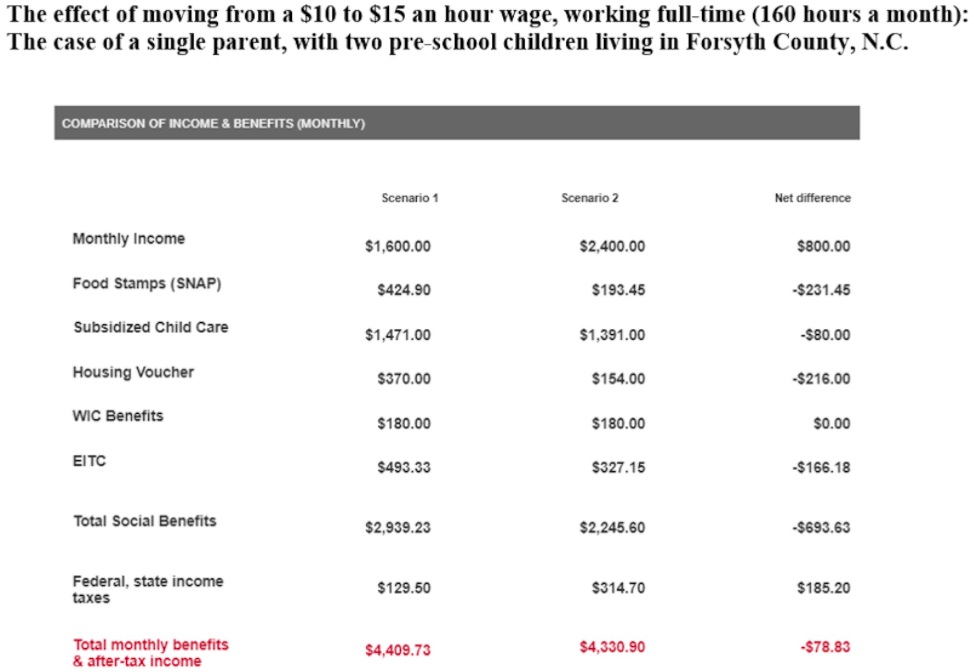

…the welfare bureaucracy is broken, making it more difficult for millions of people to achieve the American Dream. …It is demeaning to believe that many Americans are simply unable to be successful and should be relegated to a life of dependence on perpetual government subsidization of their basic needs. …the welfare bureaucracy undermines and discourages employment.

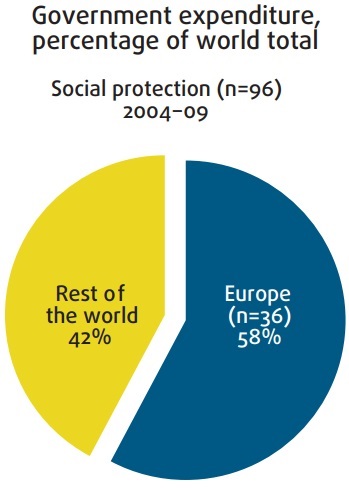

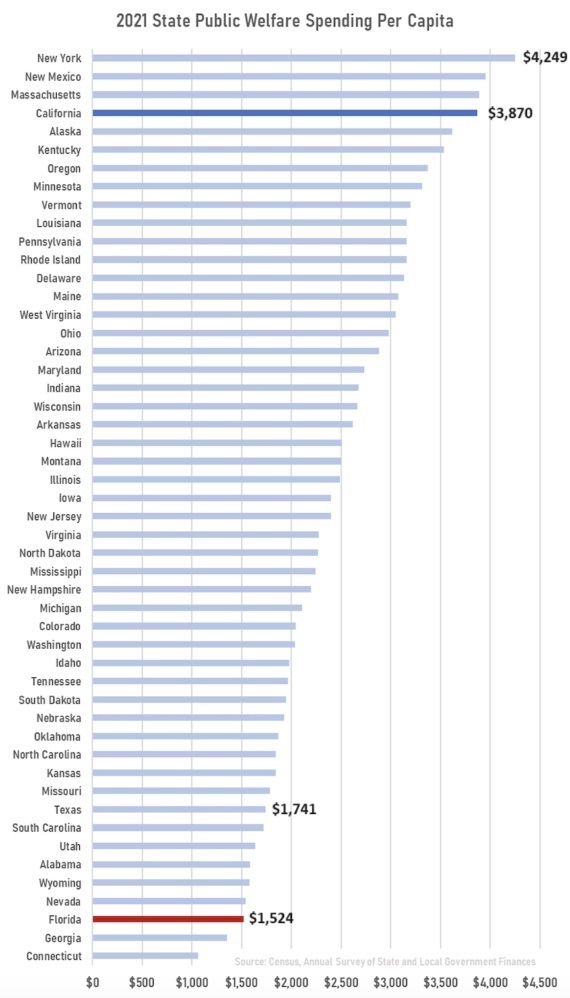

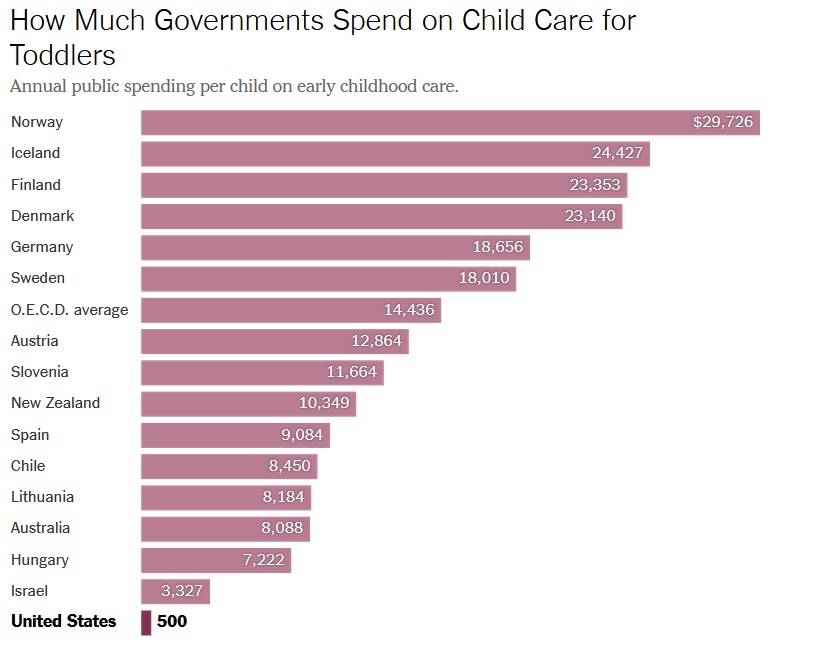

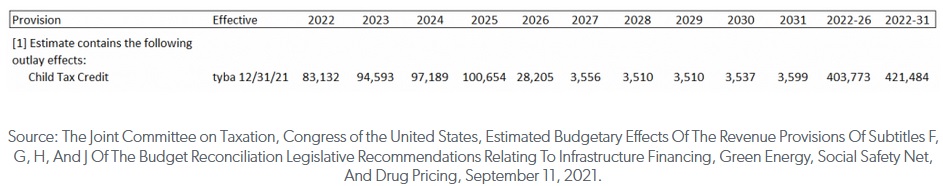

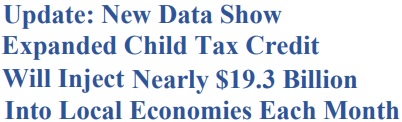

Only 18% of able-bodied adults receiving Food Stamps, who are expected to meet work requirements, actually work 20 hours or more per week. …Many welfare programs undermine the institution of the family — and the benefits brought by stable two-parent households — by including marriage penalties. …The principle of subsidiarity dictates that the independent sector, communities, and local and state governments should be empowered rather than the distant and bureaucratic central government. …The welfare bureaucracy is also filled with duplication and overlapping programs. According to the Congressional Research Service, there are 15 different food aid, 13 housing, 12 health care, and five cash aid programs. …Welfare is one of the largest categories of the federal budget, comprising about 20% of annual spending. …the federal government spent more than $28,100 per person in poverty — providing benefits $15,000 above the poverty threshold for individuals

At the risk of understatement, this is an utter disaster.

Terrible for taxpayers. Terrible for poor people.

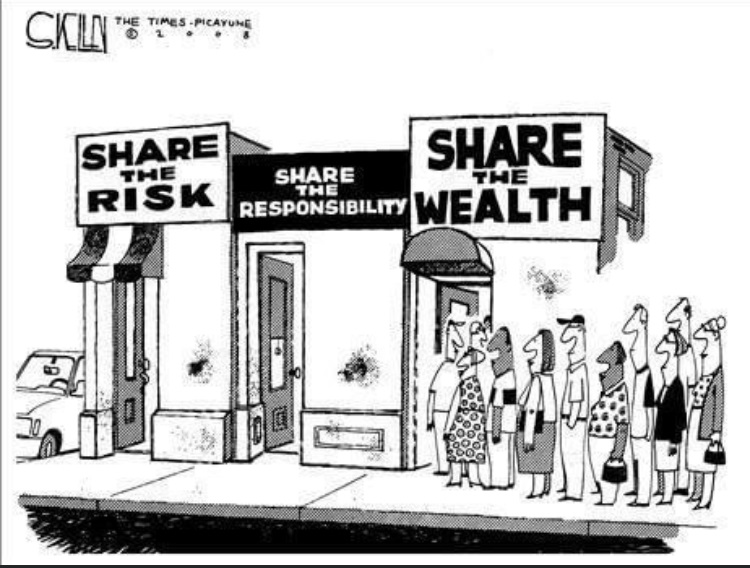

So why does it exist? This clever cartoon tells part of the answer.

But this is only a partial explanation.

Don’t forget all the bureaucrats, consultants, and contractors who make a lot of money administering the programs. Walter Williams called them “poverty pimps” and they have an obvious incentive to maintain the current system.

I’ll close by emphasizing a point from Matt’s EPIC report. The answer is to get Washington out of the redistribution racket. In other words, copy the success of Bill Clinton’s welfare reform by turning all welfare programs into block grants and putting states back in charge. With the ultimate goal, of course, of phasing out the block grants so that states are fully responsible for raising and spending the money.

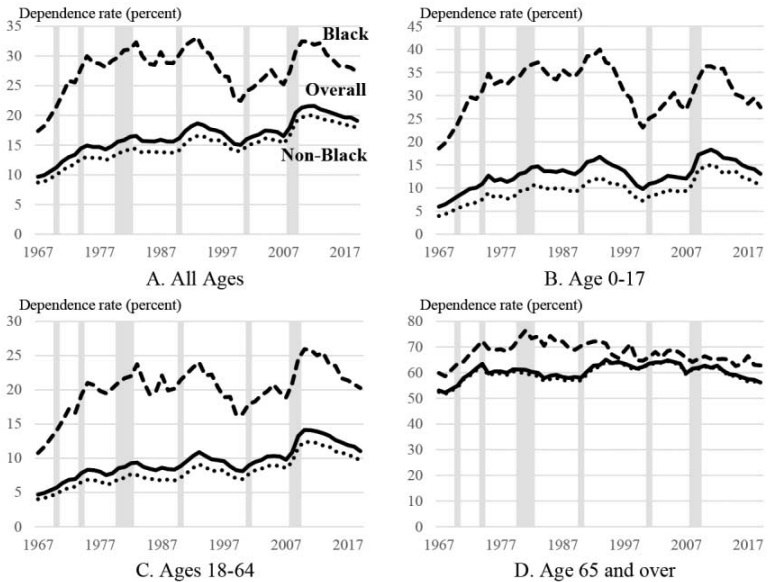

P.S. The goal should not merely be reducing poverty, but also reducing dependency.