The War against Cash continues.

- In Part I, we looked at the argument that cash should be banned or restricted so governments could more easily collect additional tax revenue.

- In Part II, we reviewed the argument that cash should be curtailed so that governments could more easily impose Keynesian-style monetary policy.

- In Part III, written back in March, we examined additional arguments by people on both sides of the issue and considered the risks of expanded government power.

Now it’s time for Part IV.

Professor Larry Summers of Harvard University is President Obama’s former top economic adviser and he’s a relentless advocate of higher taxes and bigger government. If he favors an idea, it doesn’t automatically make it bad, but it’s surely a reason to be suspicious. So you won’t be surprised to learn that he wrote a column for the Washington Post applauding the move in Europe to eliminate €500 notes. Indeed, he wants to ban all large-denomination notes.

There is little if any legitimate use for 500-euro notes. Carrying out a transaction with 20 50-euro notes hardly seems burdensome, and this would represent over $1,000 in purchasing power. Twenty 200-euro notes would be almost $5,000. Who in today’s world needs cash for a legitimate $5,000 transaction? …Cash transactions of more than 3,000 euros have in fact been made illegal in Italy, while France has placed the limit at 1,000 euros. …In contrast to the absence of an important role for 500-euro notes in normal commerce, these bills have a major role facilitating illicit activity, as suggested by their nickname —“Bin Ladens.” …Estimates by the International Monetary Fund and others of total annual money laundering consistently exceed $1 trillion. High-denomination notes also have a substantial role in facilitating tax evasion and capital flight.

Who “needs cash” for transactions, he asks, but isn’t the real issue whether people should have the freedom to use cash if that’s what they prefer?

Also, in dozens of trips to Europe since the adoption of the euro, I’ve never heard anyone refer to the €500 note as a “Bin Laden,” so I suspect that’s an example of Summers trying to demonize something that he doesn’t like.

Also, in dozens of trips to Europe since the adoption of the euro, I’ve never heard anyone refer to the €500 note as a “Bin Laden,” so I suspect that’s an example of Summers trying to demonize something that he doesn’t like.

But perhaps the most important revelation from his column is that he admits there’s no evidence that crime would be stopped by his plan to restrict cash.

To be sure, it is difficult to estimate how much crime would be prevented by stopping the creation of 500-euro notes. It would surely impose some burdens on criminals and might interfere with some transactions, which is not unimportant.

Unsurprisingly, he wants to coerce other governments into restricting high-value notes.

Europe has led on a significant security issue. But its action should be seen as a beginning, not an end. As a first follow-on, the world should demand that Switzerland stop issuing 1,000-Swiss-franc notes. After Europe’s action, these will stand out as the world’s highest-denomination note by a huge margin. Switzerland has a long and unfortunate history with illicit finance. It would be tragic if it were to profit from criminal currency substitution following Europe’s bold step. …There would be a strong case for stopping the creation of notes with values greater than perhaps $50.

Summers isn’t the only academic from Harvard who is agitating to restrict cash. Prof. Kenneth Rogoff (who’s also the former Chief Economist at the IMF) recently wrote a piece for the Wall Street Journal explaining his hostility.

…paper currency lies at the heart of some of today’s most intractable public-finance and monetary problems. …There is little debate among law-enforcement agencies that paper currency, especially large notes such as the U.S. $100 bill, facilitates crime: racketeering, extortion, money laundering, drug and human trafficking, the corruption of public officials, not to mention terrorism.

At the risk of bursting his balloon, cash played almost no role in the most notorious terrorist event, the 9-11 attacks. And Rogoff admits that bad guys would use easy substitutes.

There are substitutes for cash—cryptocurrencies, uncut diamonds, gold coins, prepaid cards.

So he then dredges up the argument that cash facilitates tax evasion.

Cash is also deeply implicated in tax evasion, which costs the federal government some $500 billion a year in revenue. According to the Internal Revenue Service, a lot of the action is concentrated in small cash-intensive businesses, where it is difficult to verify sales and the self-reporting of income.

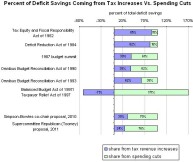

I addressed these issues in Part I of this series, but I’ll simply add that the academic evidence shows that lower tax rates are the best way of boosting tax compliance (as even the IMF has admitted).

To his credit, Rogoff acknowledges that his preferred policy would reduce the rights of individuals.

Perhaps the most challenging and fundamental objection to getting rid of cash has to do with privacy—with our ability to spend anonymously. But where does one draw the line between this individual right and the government’s need to tax and regulate.

His main argument is that our rights should be reduced to give government more power. He especially wants central bankers to have more power to impose Keynesian monetary policy.

Cutting interest rates delivers quick and effective stimulus by giving consumers and businesses an incentive to borrow more. It also drives up the price of stocks and homes, which makes people feel wealthier and induces them to spend more. Countercyclical monetary policy has a long-established record, while political constraints will always interfere with timely and effective fiscal stimulus.

Yes, he’s right. Activist monetary policy does have a long-established track record. It played a key role in causing the Great Depression, the 1970s stagflation, and the recent financial crisis.

Hooray, Federal Reserve!

And Rogoff wants the arsonists at the Fed to have more power to create boom-bust cycles.

In principle, cutting interest rates below zero ought to stimulate consumption and investment in the same way as normal monetary policy, by encouraging borrowing. Unfortunately, the existence of cash gums up the works. If you are a saver, you will simply withdraw your funds, turning them into cash, rather than watch them shrink too rapidly. Enormous sums might be withdrawn to avoid these loses, which could make it difficult for banks to make loans—thus defeating the whole purpose of the policy. Take cash away, however, or make the cost of hoarding high enough, and central banks would be free to drive rates as deep into negative territory as they needed in a severe recession. …if a strong dose of negative rates can power an economy out of a downturn, it could bring inflation and interest rates back to positive levels relatively quickly, arguably reducing vulnerability to bubbles rather than increasing it.

Needless to say, I disagree with Rogoff and agree with Thomas Sowell that an institution that repeatedly screws up shouldn’t be given more power.

Especially since I’m concerned that the option to use bad monetary policy may actually be one of the excuses that politicians use for not fixing the problems that actually are hindering growth.

So, yes, instead of expanding their power, I want to clip the wings of the Federal Reserve and other central banks.

Now let’s consider the harm that would be caused by restricting or banning cash. Two professors from NYU Law School looked at some of the logistical issues of a shift to digital money. The echoed some of the points raised by Summers and Rogoff, but they also pointed out some downsides. Such as government being able to monitor everything we buy.

…centralization of banking under this system would also create a Leviathan with the power to monitor and control the personal finances of every citizen in the country. This is one of the chief reasons why many are loath to give up on hard currency. With digital money, the government could view any financial transaction and obtain a flow of information about personal spending that could be used against an individual in a whole host of scenarios.

It also would cause a mess because so many people around the world rely on dollars, something that’s beneficial to the U.S. Treasury and foreigners from places with untrustworthy central banks.

…a transition to digital currency might come at a large cost for the U.S. in particular, because the dollar remains the world’s de facto reserve currency. The U.S. collects enormous seigniorage revenue that accrues to the economy when the Federal Reserve prints dollars that are exported abroad in exchange for foreign goods and services. These bank notes ultimately end up in countries with less reliable central banks where locals prefer to hold U.S. currency instead of their own. Forfeiting this franchise as the world’s reserve currency might be too costly, as the U.S. currency held abroad exceeds half a trillion dollars, according to reliable estimates.

Professor Larry White of George Mason University (also a Senior Fellow at Cato) writes about what he calls “currency prohibitionists.”

The rhetoric of the anti-high-denomination gang has gotten increasingly shrill. …Charles Goodhart in September called the European Central Bank and the Swiss National Bank “shameless” for issuing “vastly high-denomination notes,” namely the €500 and SWF 1000, “which are there to finance the drug deals.” …I have an alternative suggestion for removing $100 bills from the illegal drug trades: Legalize the trade. …My suggestion would reduce the demand for high-denomination currency.

Nice plug for sensible libertarian policy.

But even if one favors drug prohibition, that doesn’t mean currency prohibition will be effective.

Today’s high-denomination-currency prohibitionists, like today’s drug prohibitionists and yesterday’s alcohol prohibitionists, only think about the supply side. But does anyone think that banning the $100 bill during Prohibition (when it had a purchasing power more than 11 times today’s, as evaluated using the CPI) and even higher denominations would have put a major dent in the rum-running business, if an army of T-Men couldn’t? …eliminating high denomination, high value notes we would make life harder” for such criminal enterprises. No doubt. But we would also make life harder for everyone else. The rest of us also find high-denomination notes convenient now and again for completely legal and non-controversial purposes, like buying automobiles and carrying vacation cash compactly. …currency prohibitionists too often regard those who defend high-denomination notes not as intellectually honest but mistaken opponents, but rather as morally suspect characters. Larry Summers goes out of his way to smear an ECB executive from Luxembourg (who has had the temerity to ask for better evidence before accepting the case for prohibiting high-denomination notes)… The case for prohibiting large-denomination currency, to summarize, is largely based on guilt by association or on wishful thinking about the benefits of allowing greater range of action to discretionary monetary policy.

On the topic of crime and cash, an article for the WSJ debunks one of the left’s main talking points. If using cash is supposed to be a sign of criminal activity, why are the world’s two most cash-friendly nations also two of the safest and crime-free countries?

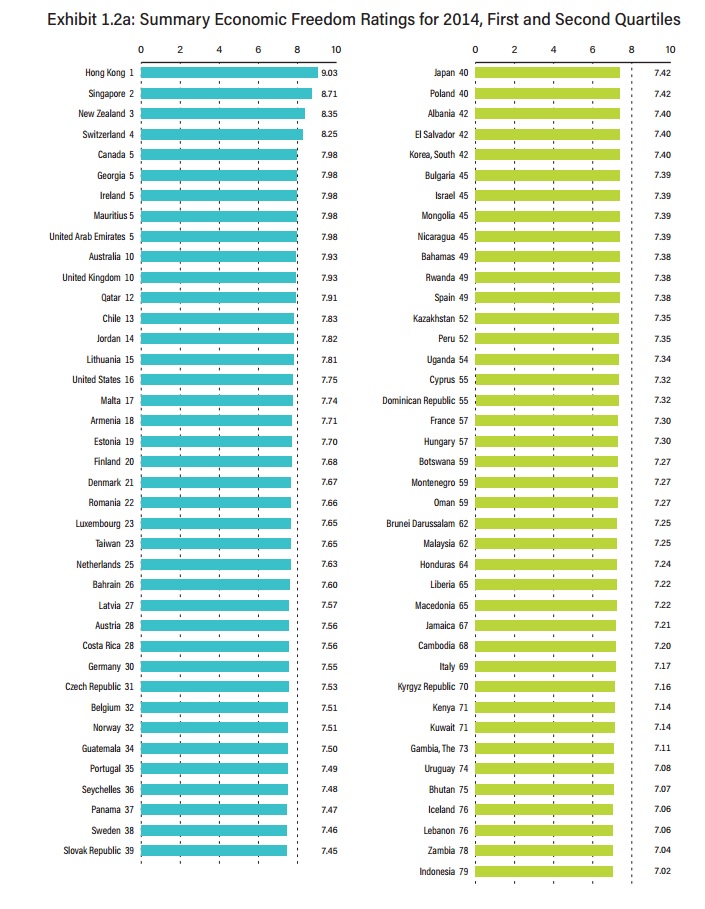

Are Japan and Switzerland havens for terrorists and drug lords? High-denomination bills are in high demand in both places, a trend that some politicians claim is a sign of nefarious behavior. Yet the two countries boast some of the lowest crime rates in the world. The cash hoarders are ordinary citizens… The current hoarding in Switzerland and Japan thus underscores one of many ways in which cash is a basic tool of economic liberty: It lets people shield themselves from monetary policies that would force their savings into weak economies that can’t attract sufficient spending or investment on their own. These economies need reforms that boost incentives to work and invest, not negative interest rates and cash limits that raid the bank accounts of law-abiding citizens.

A column by Sarah Jeong in Bloomberg explores some of the additional implications of cash restrictions.

…wherever information gathers and flows, two predators follow closely behind it: censorship and surveillance. The case of digital money is no exception. Where money becomes a series of signals, it can be censored; where money becomes information, it will inform on you. …the Department of Justice began to come under fire for Operation Choke Point…the means were highly dubious. …the DOJ got creative, and asked banks and payment processors to comply with government policies, and proactively police “high-risk” activity. Banks were asked to voluntarily shut down the kinds of merchant activities that government bureaucrats described as suspicious. The price of resistance was an active investigation by the Department of Justice. …Where paternalism is bluntly enforced through a bureaucratic game of telephone, unpleasant or even inhumane unintended consequences are bound to result. …the cashless society offers the government entirely new forms of coercion, surveillance, and censorship. …As paper money evaporates from our pockets and the whole country—even world—becomes enveloped by the cashless society, financial censorship could become pervasive, unbarred by any meaningful legal rights or guarantees.

Her observation on Operation Choke Point is very important since that campaign has been a chilling example of how government abuses its power in the financial sector.

Megan McArdle’s Bloomberg column touches on some additional concerns.

What’s not to like? Very little. Except, and I’m afraid it’s a rather large exception, the amount of power that this gives the government over its citizens. Consider the online gamblers who lost their money in overseas operations when the government froze their accounts. Now, what they were doing was indisputably illegal in these here United States, and I am not claiming that they were somehow deeply wronged. But consider how immense the power that was conferred upon the government by the electronic payments system; at a word, your money could simply vanish. …Unmonitored resources like cash…create a sort of cushion between ordinary people and a government with extraordinary powers. Removing that cushion leaves people who aren’t criminals vulnerable to intrusion into every remote corner of their lives. …If we want to move toward a cashless society — and apparently we do — then we also need to think seriously about limiting the ability of the government to use the payments system as an instrument to control the behavior of its citizens.

For what it’s worth, one way of getting the benefits of a cashless world without the risks is with private digital monies such as bitcoin.

Steve Forbes nails the issue.

Gaining attention these days is the idea of abolishing high denominations of the dollar and the euro. This concept graphically displays the astonishing stupidity–and intellectual bankruptcy–of today’s liberal economic policymakers and the economics profession. …The ostensible reason is to help in the fight against terrorists, bribers, drug dealers and tax evaders by making it more inconvenient for these bad guys to move around and store their ill-gotten cash. …The notion that such evildoers as the Mexican drug cartels and ISIS will be seriously disrupted by the absence of the Benjamin–”These sacks of cash are too heavy now. Let’s surrender!”–is so comical… Monetary expert Seth Lipsky pithily points out in the New York Post, “When criminals use guns, the Democrats want to take guns from law-abiding citizens. When terrorists use hundreds, the liberals want to deny the rest of us the Benjamins.”

Excellent point. Politicians should concentrate on restricting the freedom of bad guys, not ordinary citizens.

So what are the implications of the war against cash? They aren’t pretty.

The real reason for this war on cash–start with the big bills and then work your way down–is an ugly power grab by Big Government. People will have less privacy: Electronic commerce makes it easier for Big Brother to see what we’re doing, thereby making it simpler to bar activities it doesn’t like, such as purchasing salt, sugar, big bottles of soda and Big Macs.

Steve raises a good point about tracking certain purchases. Imagine the potential mischief if politicians had a mechanism to easily impose discriminatory taxes on disapproved products.

He also notes that the war on cash is motivated by a desire to more effectively implement an ineffective policy.

Policymakers in Washington, Tokyo and the EU think the reason that their economies are stagnant is that ornery people aren’t spending and investing the way they should. How to make these benighted, recalcitrant beings do what they’re supposed to do? The latest nostrum from our overlords is negative interest rates. If people have to pay fees to store their money, as they do to put their stuff in storage facilities, then, by golly, they might be more inclined to spend it.

And Steve correctly observes that bad monetary policy is now an excuse to not fix the problems that actually are contributing to economic stagnation.

Manipulating the value of money and controlling interest rates, i.e., the price of money, never works. Money measures value. It is a claim on services and is a tool for facilitating commerce and investing. The reason economies around the world are in the ditch–which is fueling anger, discontent and ugly politics–is structural, government-created barriers: unstable money, suffocating rules and too-high rates of taxation.

James Grant, in a column for the Wall Street Journal, is not impressed by the anti-cash agitprop and specifically debunks some of the arguments put forth by Rogoff. He starts with some very sensible observation that politicians should reform drug laws and tax laws rather than restricting our freedom to use cash.

Terrorists traffic in cash, Mr. Rogoff observes. So do drug dealers and tax cheats. Good, compliant citizens rarely touch the $100 bills that constitute a sizable portion of the suspiciously immense volume of greenbacks outstanding—$4,200 per capita. Get rid of them is the author’s message. Then, again, one could legalize certain narcotics to discommode the drug dealers and adopt Steve Forbes’s flat tax to fill up the Treasury. Mr. Rogoff considers neither policy option. Government control is not only his preferred position. It is the only position that seems to cross his mind.

Grant makes the (obvious-to-folks not-in-Washington) point that restricting cash to enable Keynesian monetary policy is akin to throwing good money after bad.

Mr. Rogoff lays the blame for America’s lamentable post-financial-crisis economic record not on the Obama administration’s suffocating tax and regulatory policies. The problem is rather the Fed’s inability to put its main interest rate, the federal funds rate, where it has never been before. In a deep recession, Mr. Rogoff proposes, the Fed ought not to stop cutting rates when it comes to zero. It should plunge right ahead, to minus 1%, minus 2%, minus 3% and so forth. At one negative rate or another, the theory goes, despoiled bank depositors will stop saving and start spending. …What would you do if your bank docked you, say, 3% a year for the privilege of holding your money? Why, you might convert your deposit into $100 bills, rent a safe deposit box and count yourself a shrewd investor. Hence the shooting war against currency. …In the topsy-turvy world of Mr. Rogoff, negative rates would be the reward to impetuousness and the cost of thrift. …Never mind that, in post-crisis America, near 0% interest rates have failed to deliver the promised macroeconomic goods. Come the next crackup, Mr. Rogoff would double down—and down.

And he echoes the insights of Austrian-school scholars about how easy-money policies are the cause of problems rather than the cure.

Interest rates are prices. They impart information. They tell a business person whether or not to undertake a certain capital investment. They measure financial risk. They translate the value of future cash flows into present-day dollars. Manipulate those prices—as central banks the world over compulsively do—and you distort information, therefore perception and judgment. The ultra-low rates of recent years have distorted judgment in a bullish fashion. True, they have not, at least in America, ignited a wave of capital investment—who needs it in a comatose economy? They have rather facilitated financial investment. They have inflated projected cash flows and anesthesized perceptions of risk (witness the rock-bottom yields attached to corporate junk bonds). In so doing, they have raised the present value of financial assets. Wall Street has enjoyed a wonderful bull market. The trouble is that the Fed has become hostage to that very bull market. The higher that asset prices fly, the greater the risk of the kind of crash that impels new rounds of intervention, new cries for government spending, bigger deficits—more “stimulus.”

Let’s close with the good news is that Switzerland doesn’t seem very interested in following Europe and the United States down the primrose path of seeking to curtail monetary freedom.

Manuel Brandenberg, a lawmaker in the Swiss canton of Zug, loves cash. …That belief in bills is shared by many of his compatriots, who have a penchant for hard currency even when electronic options are available. In a country whose wealth managers flourished thanks to banking secrecy,  citizens often cherish the untraceable privacy conferred by notes and coins. “Cash is property and cash is freedom,” said Brandenberg… Unlike their neighbors, the Swiss have no plans to reconsider banknote denominations — 10, 20, 50, 100 and 200 francs. Not even the highest of 1,000 francs ($1,040). …The predilection for notes and coins is evident on the streets of Zurich, where a number of stores don’t take plastic — among them Belcafe at Bellevue, a busy transport hub in the center. …Roughly 20 percent of purchases — including large sums for jewelry — were paid in cash, then-Finance Minister Eveline Widmer-Schlumpf told parliament in 2014. …“There’s no reason to change things,” said Rickli. “I don’t want the state to know who goes to what restaurant. That’s none of the government’s business.”

citizens often cherish the untraceable privacy conferred by notes and coins. “Cash is property and cash is freedom,” said Brandenberg… Unlike their neighbors, the Swiss have no plans to reconsider banknote denominations — 10, 20, 50, 100 and 200 francs. Not even the highest of 1,000 francs ($1,040). …The predilection for notes and coins is evident on the streets of Zurich, where a number of stores don’t take plastic — among them Belcafe at Bellevue, a busy transport hub in the center. …Roughly 20 percent of purchases — including large sums for jewelry — were paid in cash, then-Finance Minister Eveline Widmer-Schlumpf told parliament in 2014. …“There’s no reason to change things,” said Rickli. “I don’t want the state to know who goes to what restaurant. That’s none of the government’s business.”

Thank goodness for the “sensible Swiss.” On so many issues, Switzerland is a beacon of common sense and individual freedom.

Read Full Post »

Sadly, that system largely broke down in the 1930s and 1940s as the Supreme Court ceded its role of protecting economic liberty (with John Roberts a few years ago providing the icing on the cake of untrammeled government power).

Sadly, that system largely broke down in the 1930s and 1940s as the Supreme Court ceded its role of protecting economic liberty (with John Roberts a few years ago providing the icing on the cake of untrammeled government power). Speaking of personal liberty, one of the thorniest challenges is that we want government to fight crime, but we also want to make sure that it doesn’t have the power and authority to trample individual rights.

Speaking of personal liberty, one of the thorniest challenges is that we want government to fight crime, but we also want to make sure that it doesn’t have the power and authority to trample individual rights. P.S. And if we have fewer bad and needless laws, we’ll have less police abuse.

P.S. And if we have fewer bad and needless laws, we’ll have less police abuse.