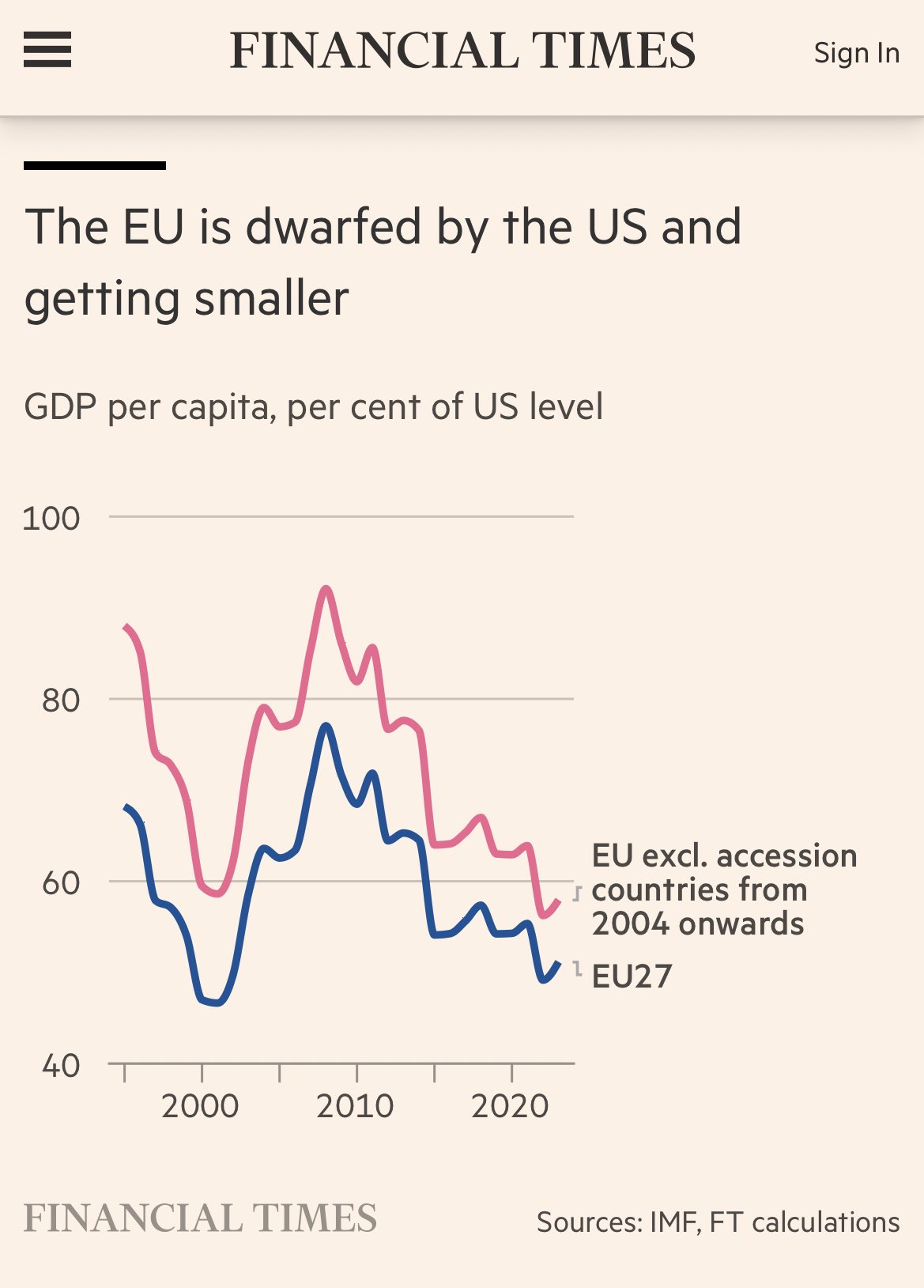

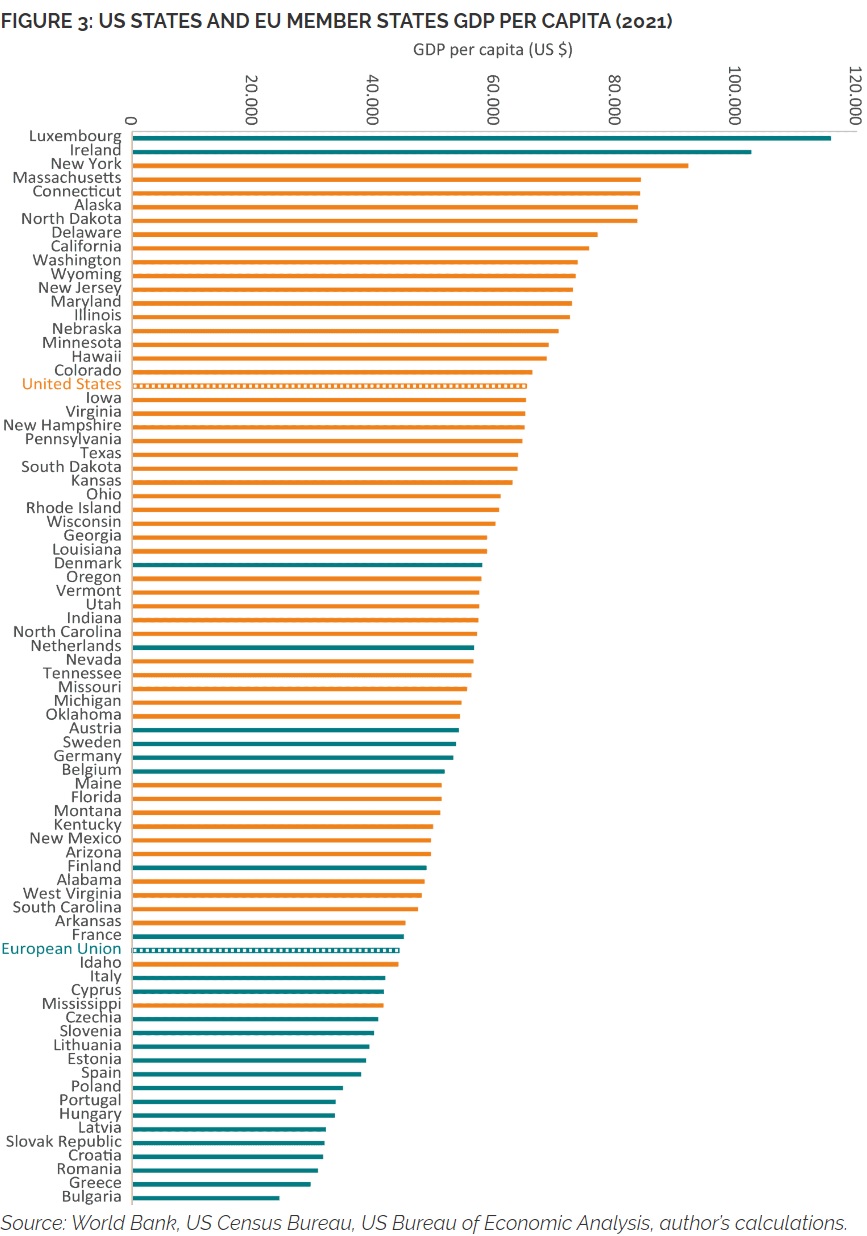

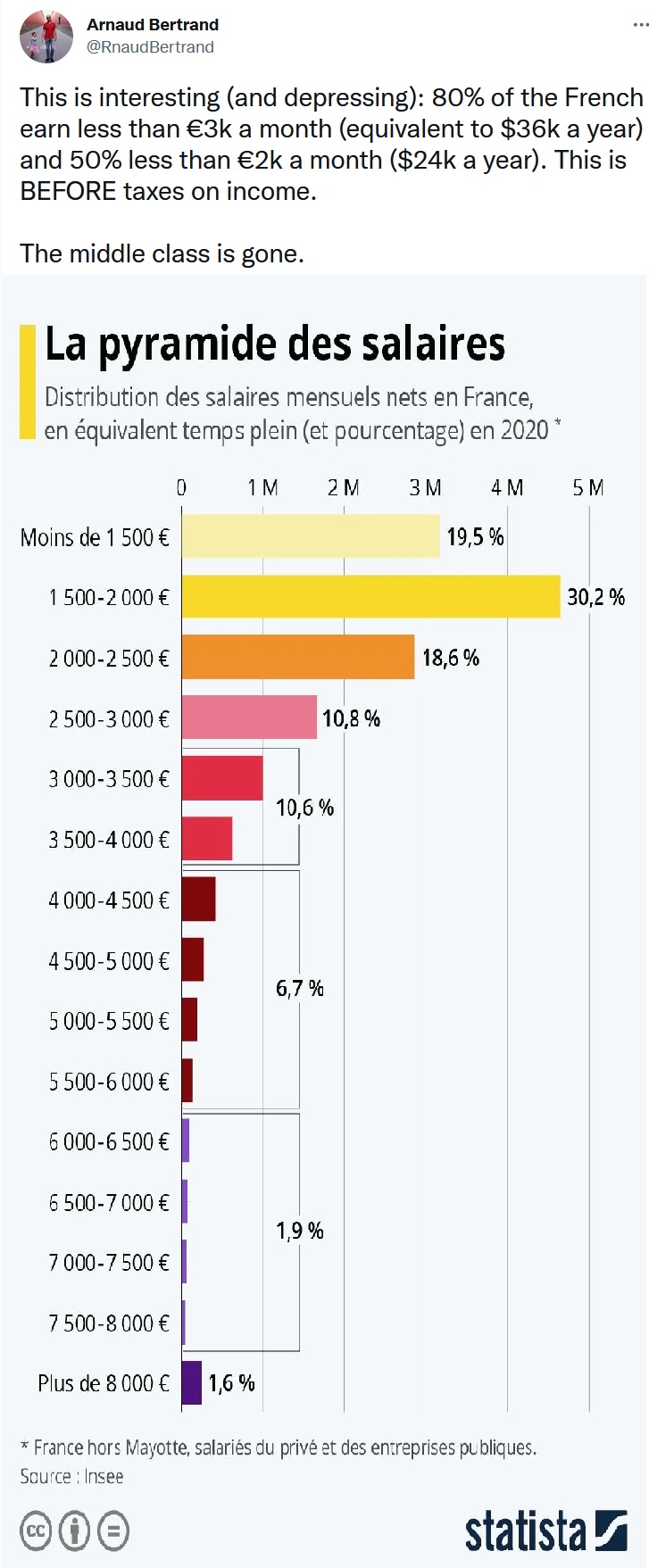

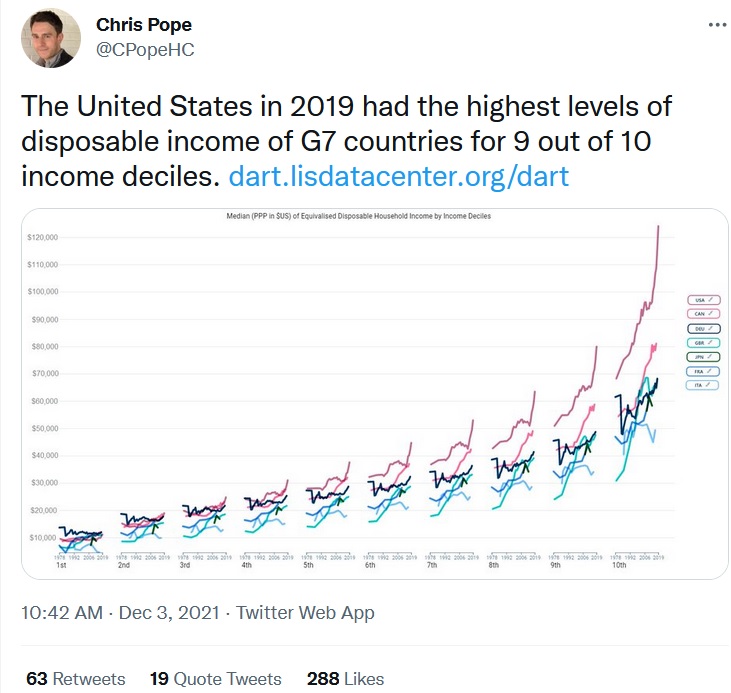

Many people are stunned by the data I shared early last year showing that ordinary people in the United States tend to be much richer than their peers in advanced European nations.

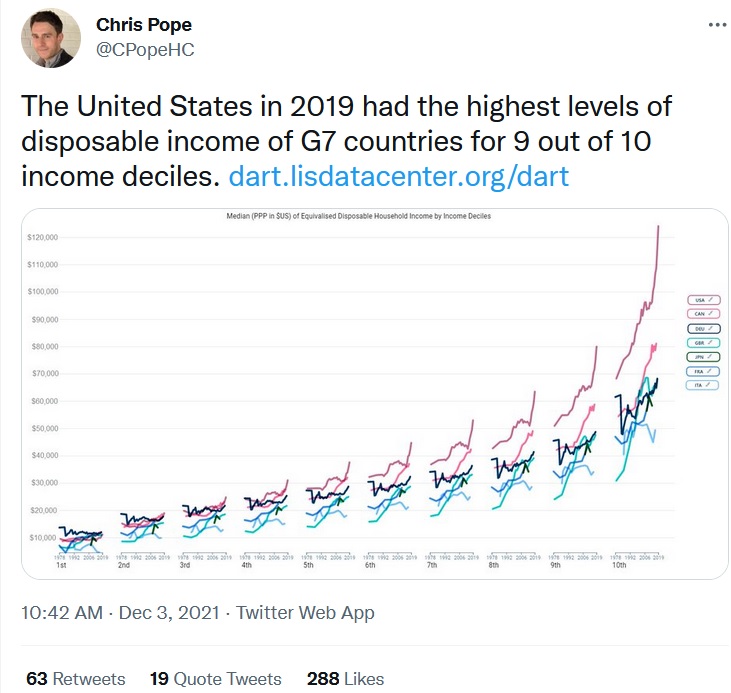

Here’s some more evidence, courtesy of the Manhattan Institute’s Chris Pope.

As you can see, the poorest people in America are about equal to the poorest people in Germany, France, Canada, and the United Kingdom, but Americans are ahead of their peers when looking at the top 90 percent of the population.

For the top 70 percent, Americans are comfortably ahead.

But not everybody agrees.

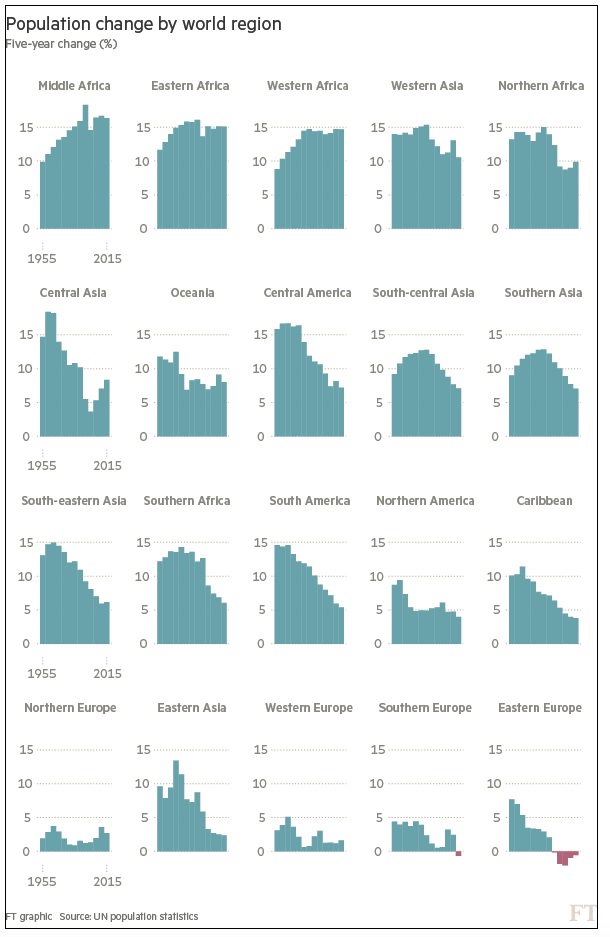

Here’s a tweet from John Burn-Murdoch of the U.K.-based Financial Times. He has a very negative portrayal of the United States (and the United Kingdom).

The tweet from Burn-Murdoch includes a link to an article he wrote.

Here are some excerpts.

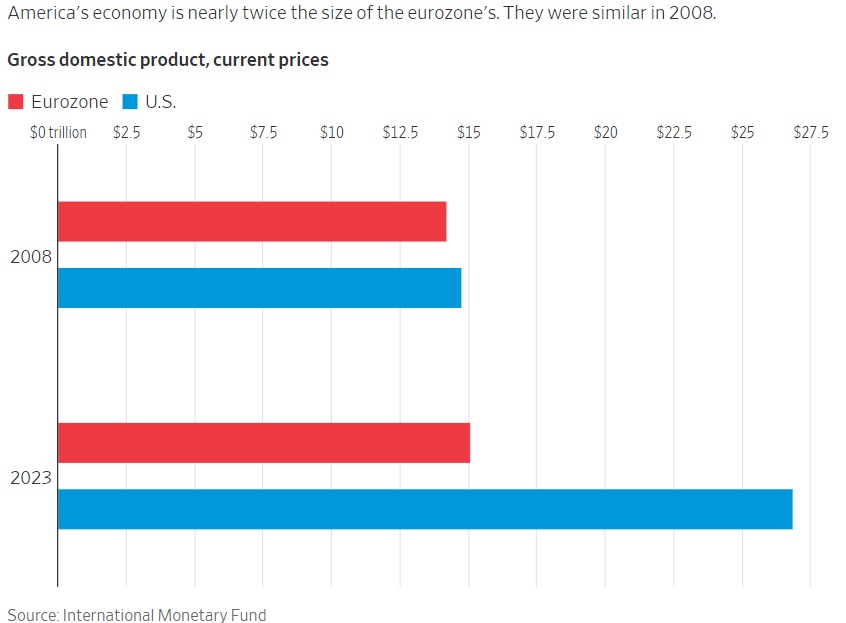

…one good way to evaluate which countries are better places to live than others is to ask: is life good for everyone there, or is it only good for rich people? …If you’re a proud Brit or American, you may want to look away now. …Norway is a good place to live, whether you are rich or poor. …The rich in the US are exceptionally rich  — the top 10 per cent have the highest top-decile disposable incomes in the world, 50 per cent above their British counterparts. But the bottom decile struggle by with a standard of living that is worse than the poorest in 14 European countries including Slovenia. …transpose Norway’s inequality gradient on to the US, and the poorest decile of Americans would be a further 40 per cent better off while the top decile would remain richer than the top of almost every other country on the planet. …Until those gradients are made less steep, the UK and US will remain poor societies with pockets of rich people.

— the top 10 per cent have the highest top-decile disposable incomes in the world, 50 per cent above their British counterparts. But the bottom decile struggle by with a standard of living that is worse than the poorest in 14 European countries including Slovenia. …transpose Norway’s inequality gradient on to the US, and the poorest decile of Americans would be a further 40 per cent better off while the top decile would remain richer than the top of almost every other country on the planet. …Until those gradients are made less steep, the UK and US will remain poor societies with pockets of rich people.

The United States is a poor society with some very rich people?!?

Is that possibly true?

Is that possibly true?

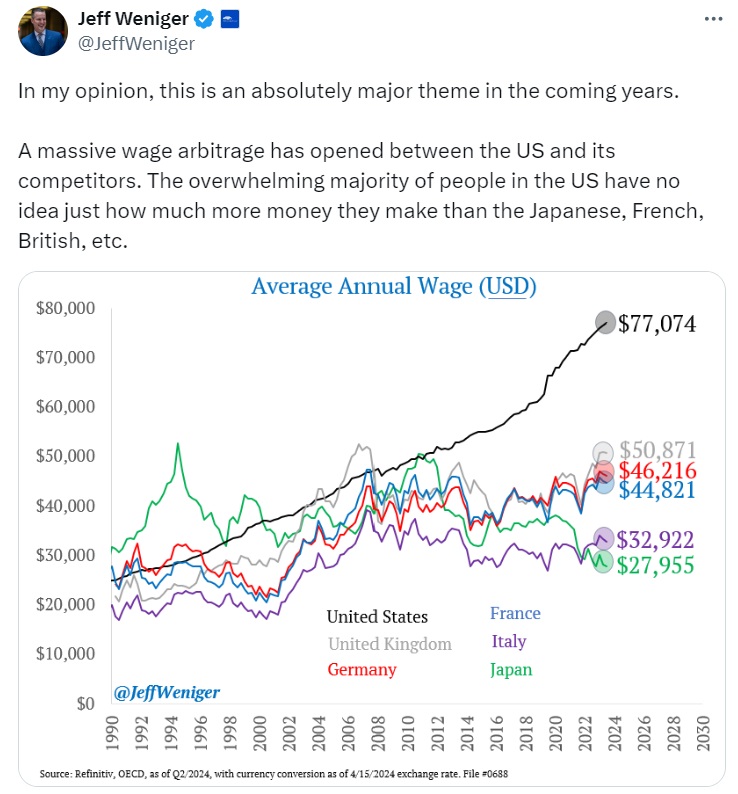

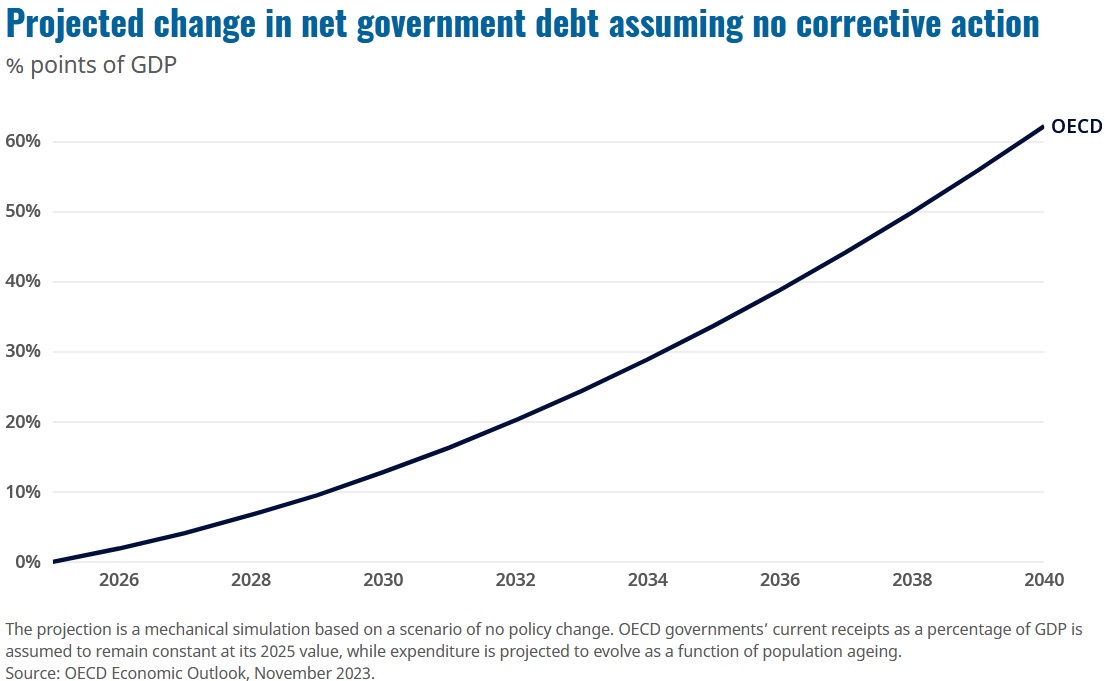

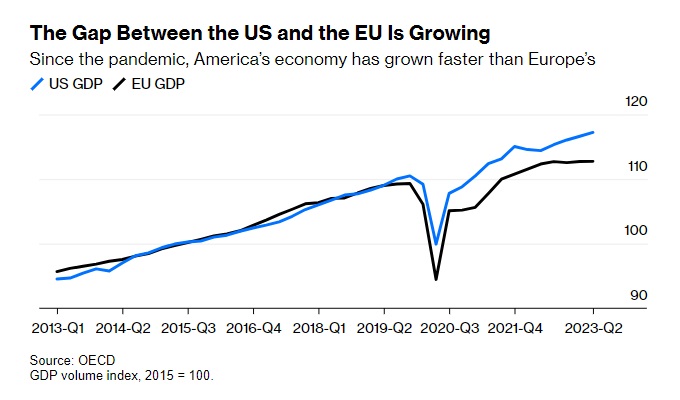

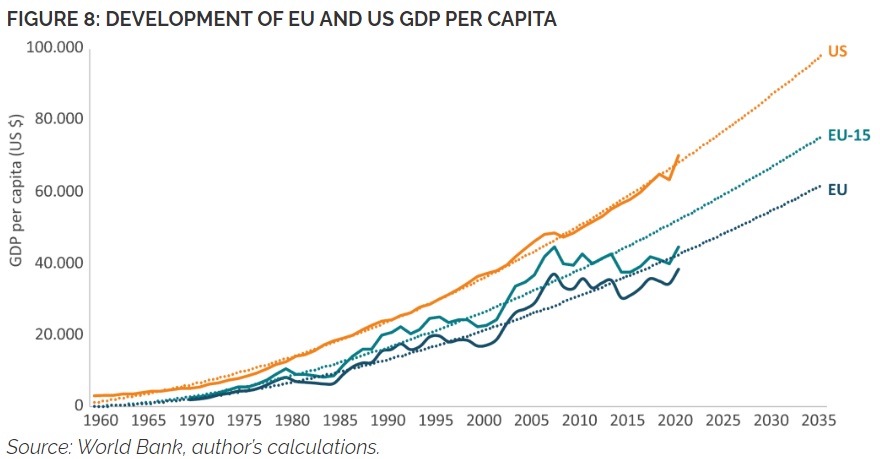

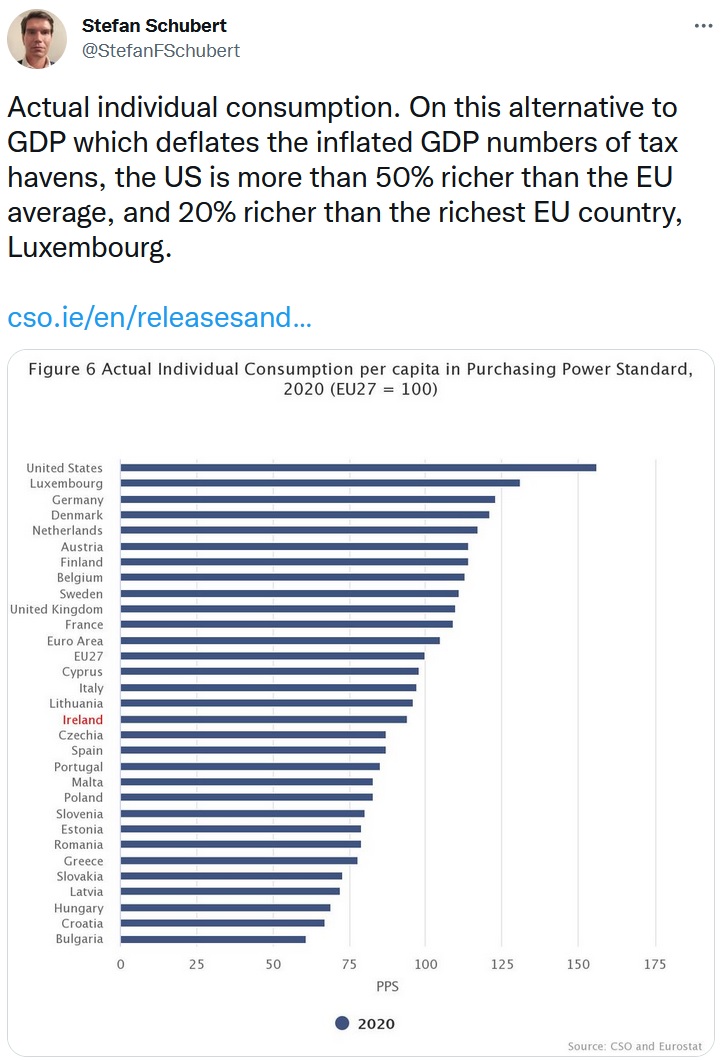

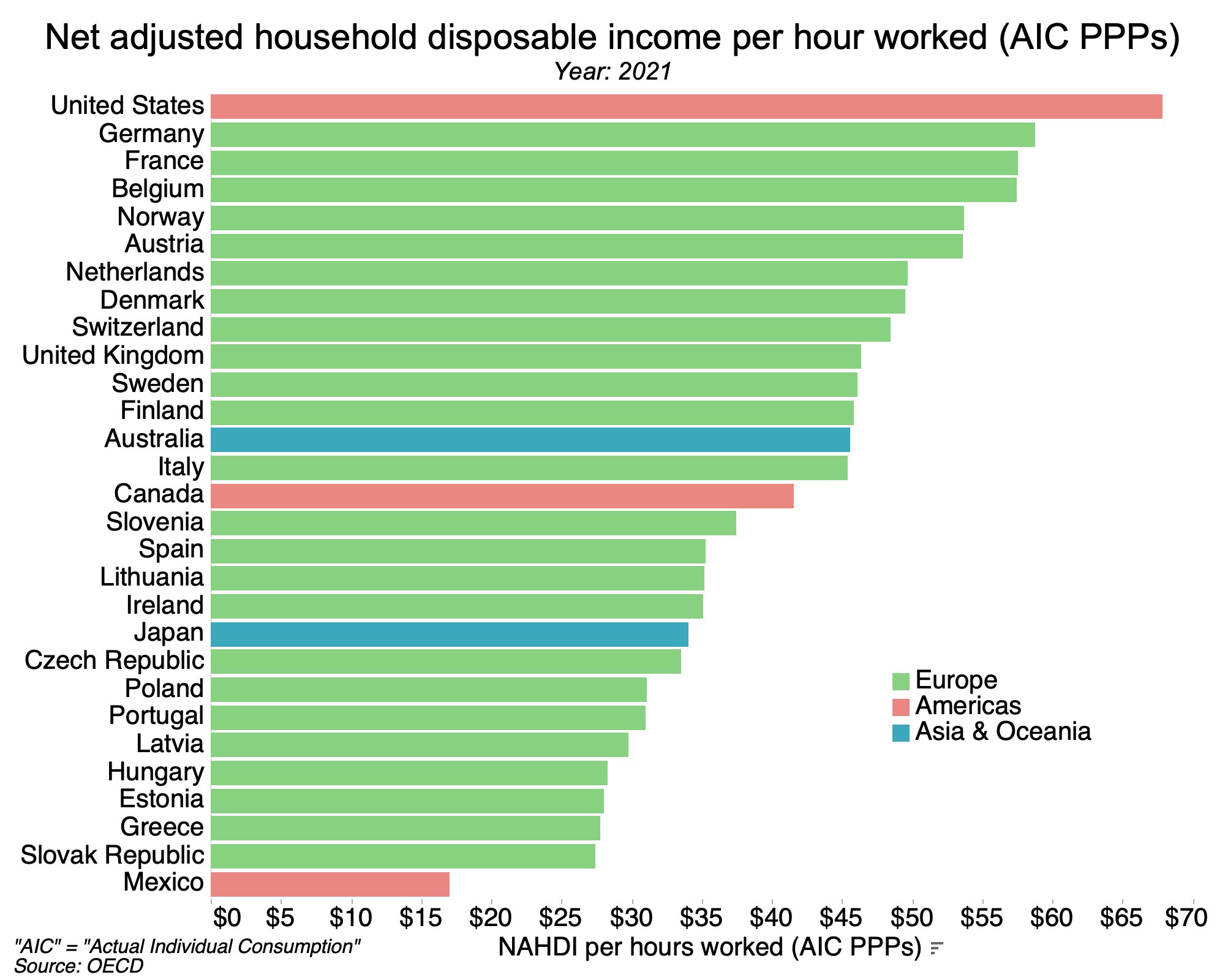

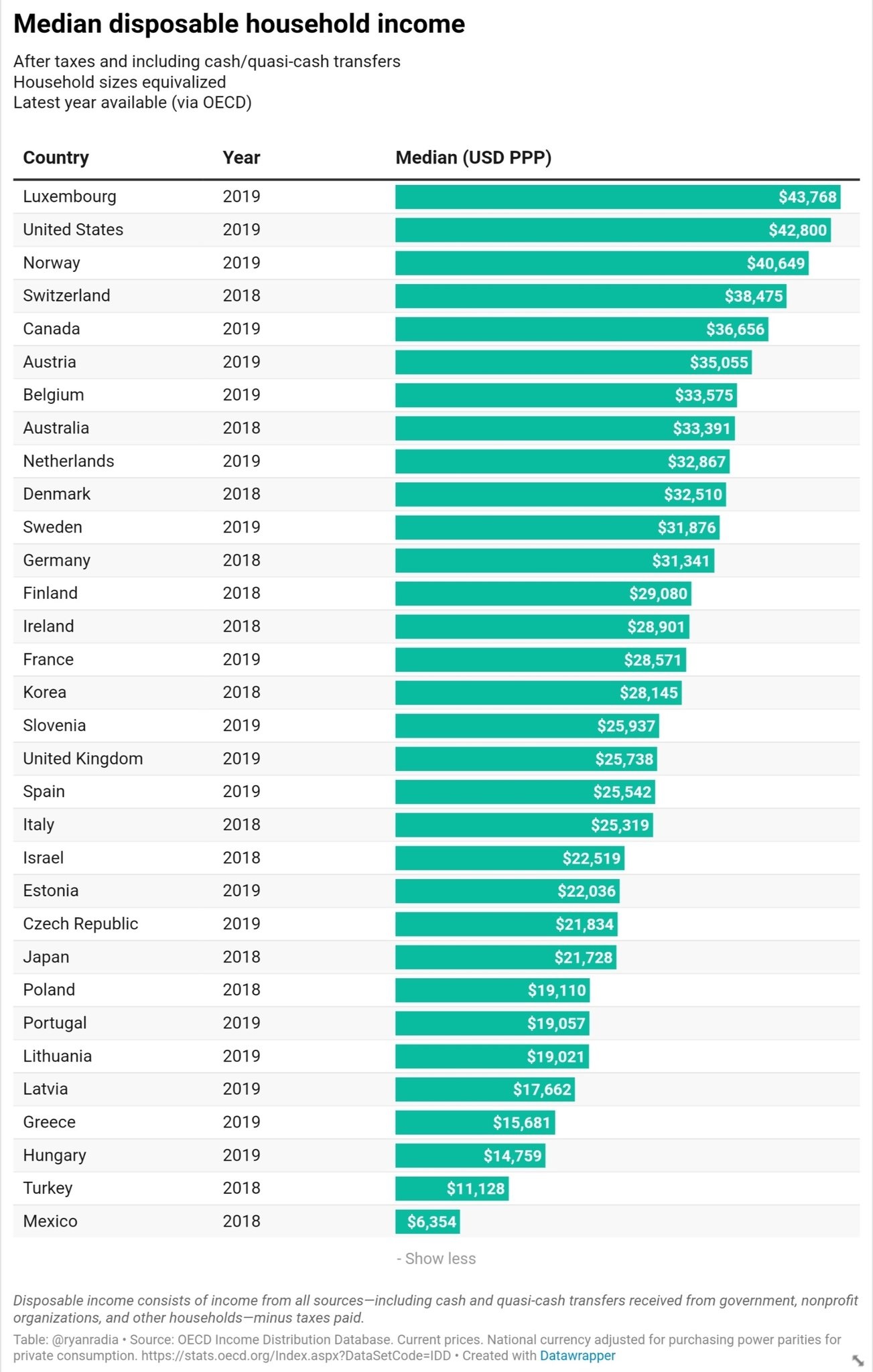

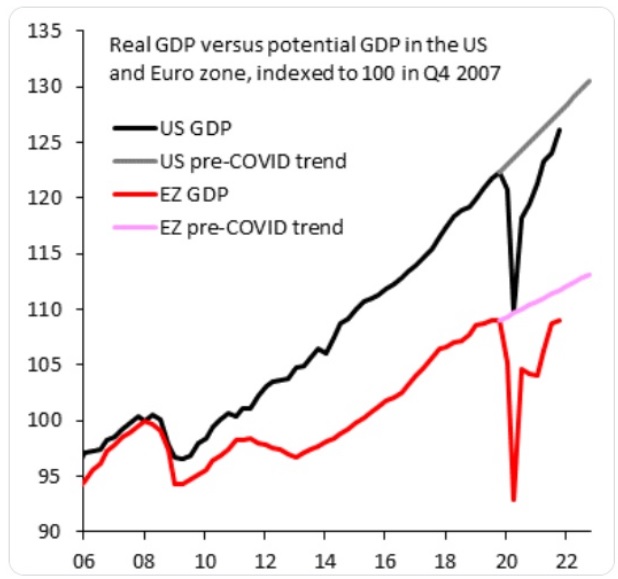

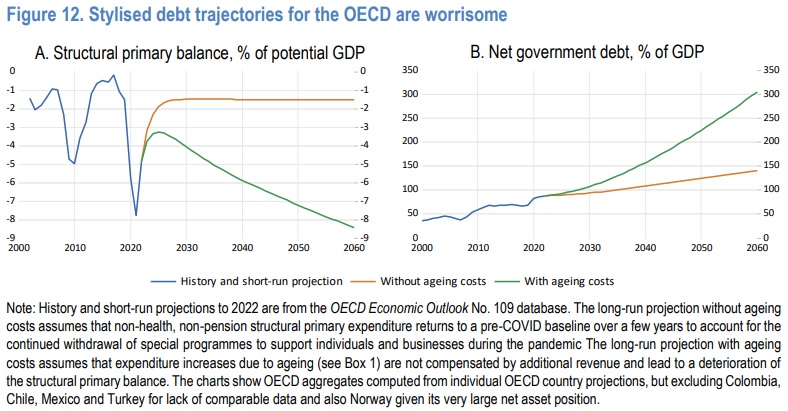

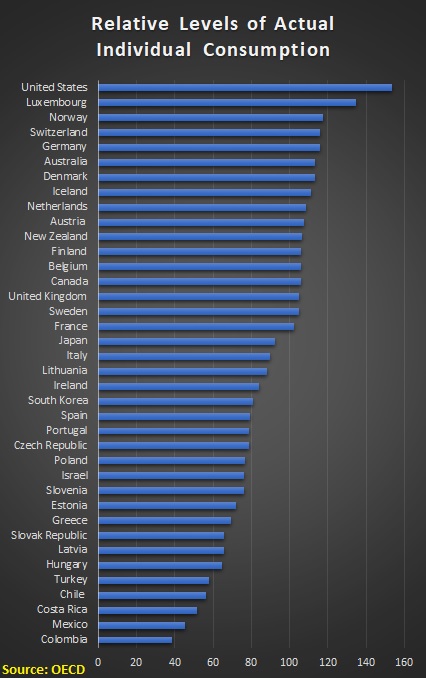

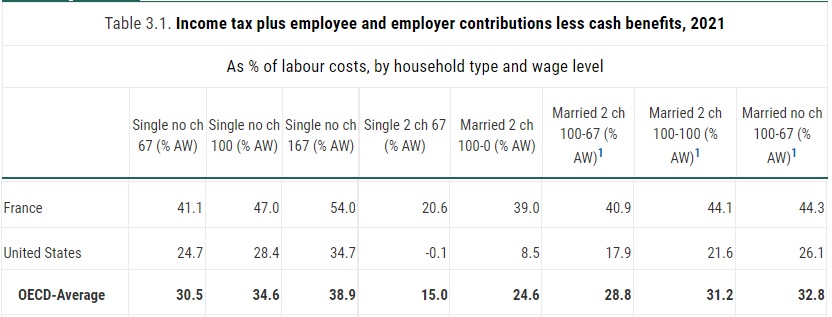

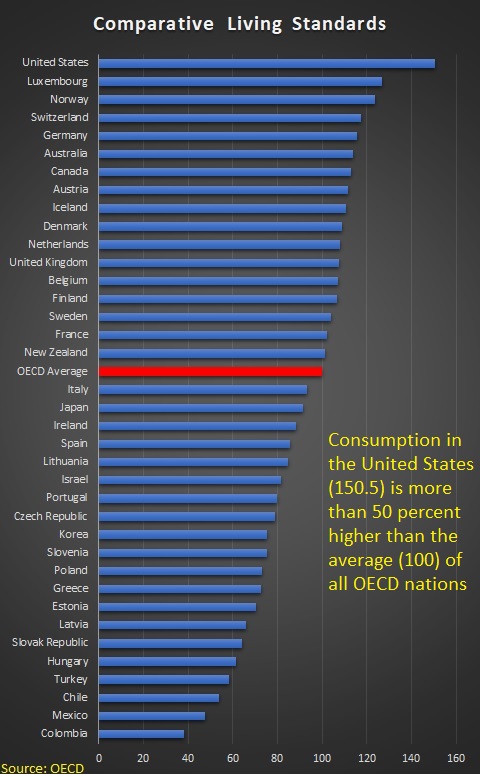

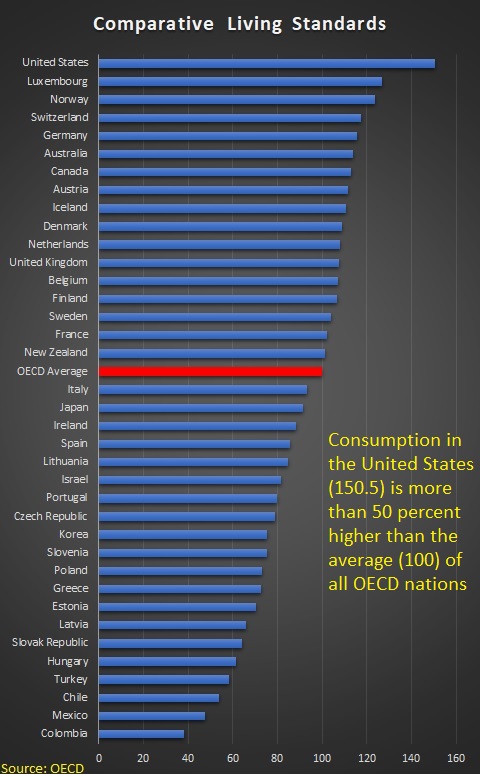

As you might expect, that is utter hogwash. Here’s a chart, based on data from the Paris-based (and left-leaning) Organization for Economic Cooperation and Development.

It shows “actual individual consumption” in the OECD’s member nations, and people in the United States are far better off than people in any other nations.

Indeed, they have 50 percent more consumption than the average person in other OECD countries.

All you need to know is that Burn-Murdoch took some data about America’s poorest people and wants to mislead readers into thinking it also applies to the general population.

And he doesn’t even show his calculations. For what it’s worth, his numbers are not very consistent with some other data sources that are publicly accessible.

Professor Noah Smith also debunks the FT‘s report.

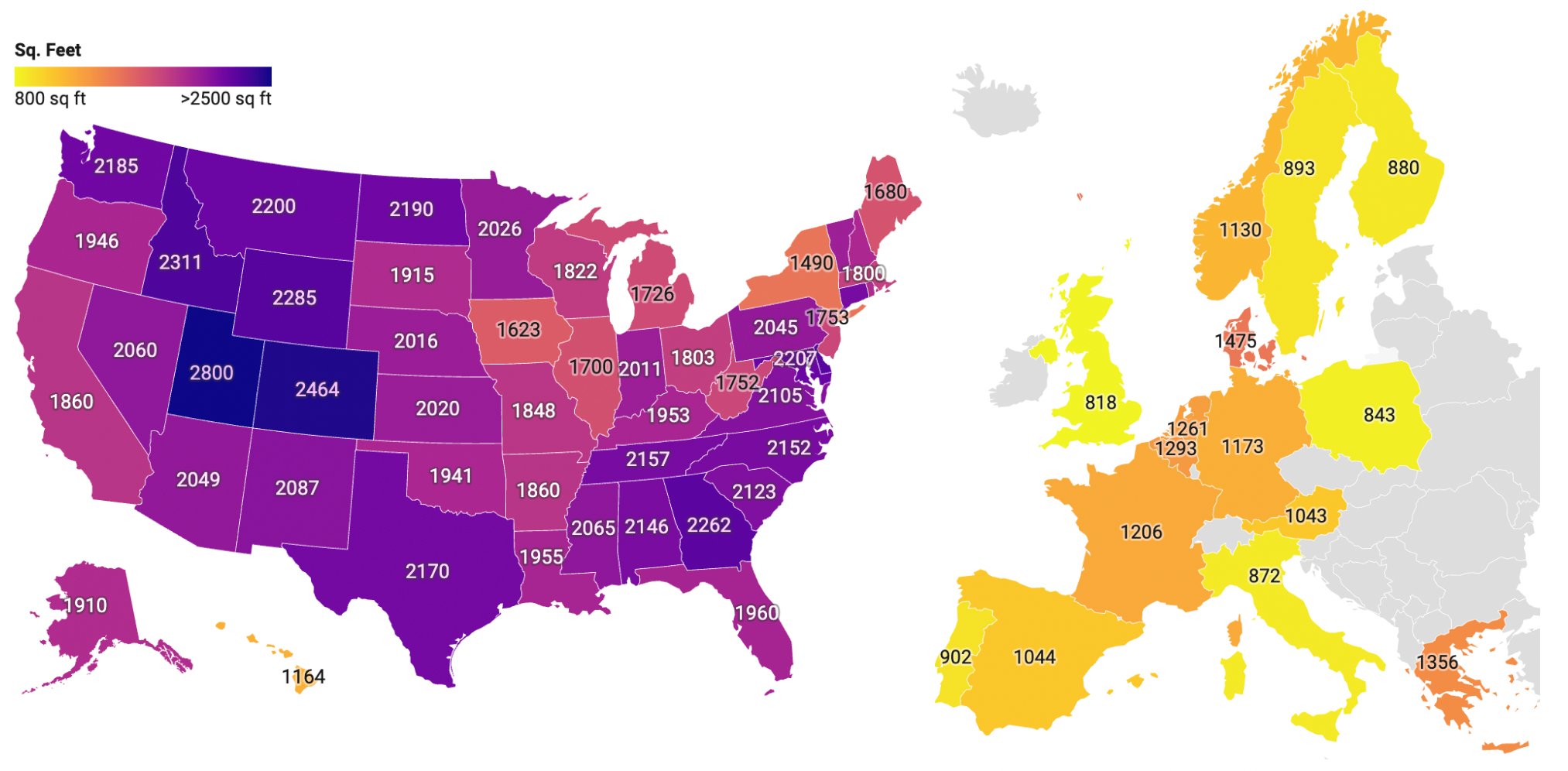

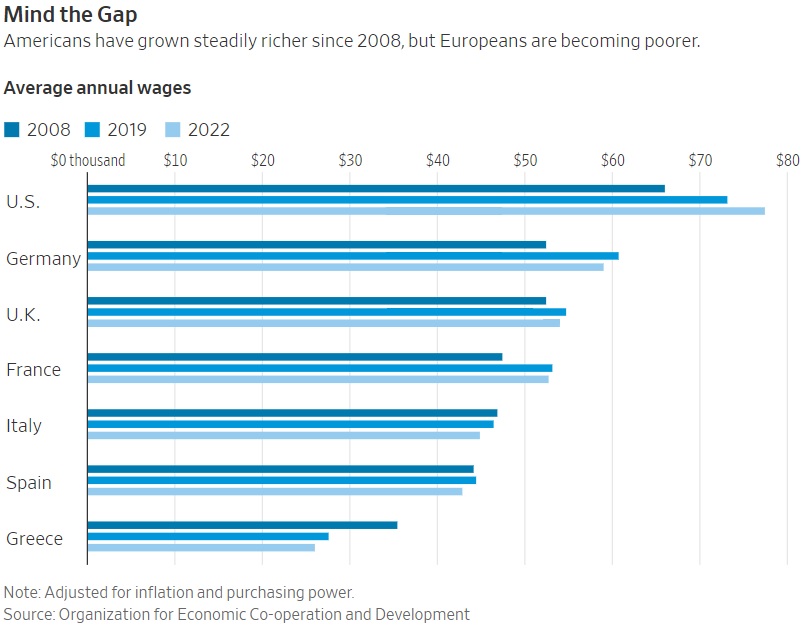

…when we look at how Americans in the middle of the distribution are doing, we see that America is not a “poor society” at all — in fact, it’s one of the richest on Earth. …the median American has a higher income than the median resident of almost any other country… Some people argue that because European countries buy health care for their citizens via the government — which is not counted in disposable income — that it’s not fair to use disposable income as the comparison measure here. But this isn’t right. The U.S. has a relatively low percentage of out-of-pocket health spending — our employers and our government pick up most of the tab. In fact, when we look at “adjusted disposable income”, which includes the value of government services like health care, we find out that the U.S. comes out even more ahead relative to other countries. …someone at around the 18th percentile of income in America in 2019 — a working-class person on the edge of being considered poor — lived in a household making $21,400 a year. That’s about the same as the median income of households in Japan, and about 84% of the median income of households in the UK. In other words, a working-class American on the edge of poverty makes as much as a middle-class person in some rich countries.

But this isn’t right. The U.S. has a relatively low percentage of out-of-pocket health spending — our employers and our government pick up most of the tab. In fact, when we look at “adjusted disposable income”, which includes the value of government services like health care, we find out that the U.S. comes out even more ahead relative to other countries. …someone at around the 18th percentile of income in America in 2019 — a working-class person on the edge of being considered poor — lived in a household making $21,400 a year. That’s about the same as the median income of households in Japan, and about 84% of the median income of households in the UK. In other words, a working-class American on the edge of poverty makes as much as a middle-class person in some rich countries.

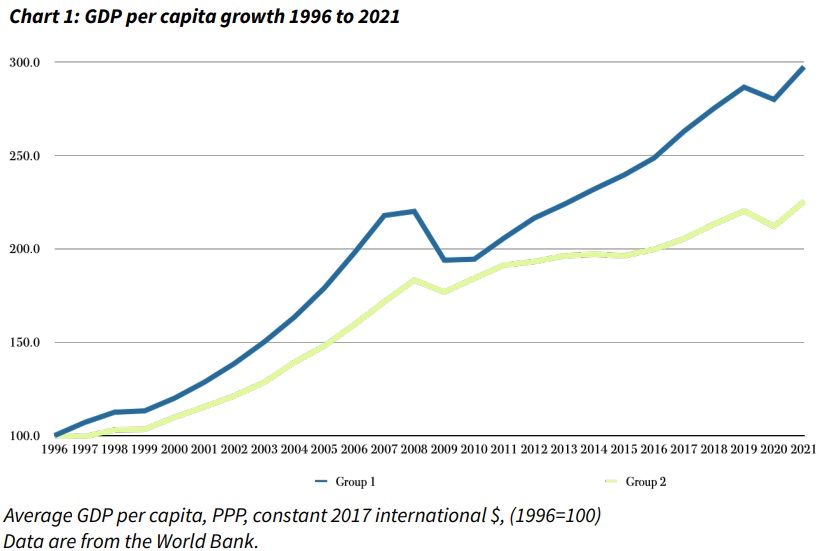

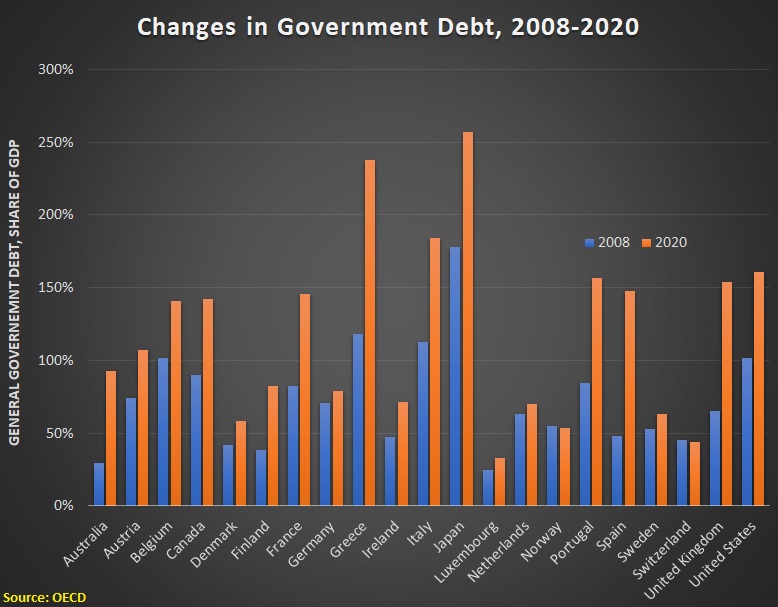

I’ll close by noting something else that was misleading in the FT report. Burn-Murdoch compares Norway to the U.S. and U.K., but that nation’s oil wealth makes it very unrepresentative.

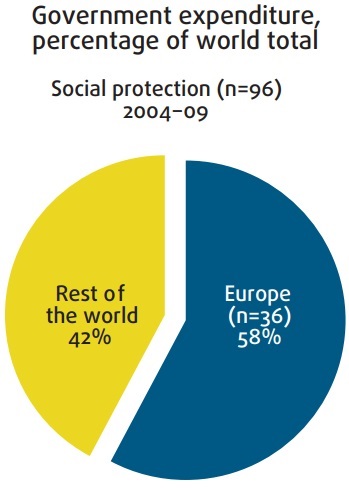

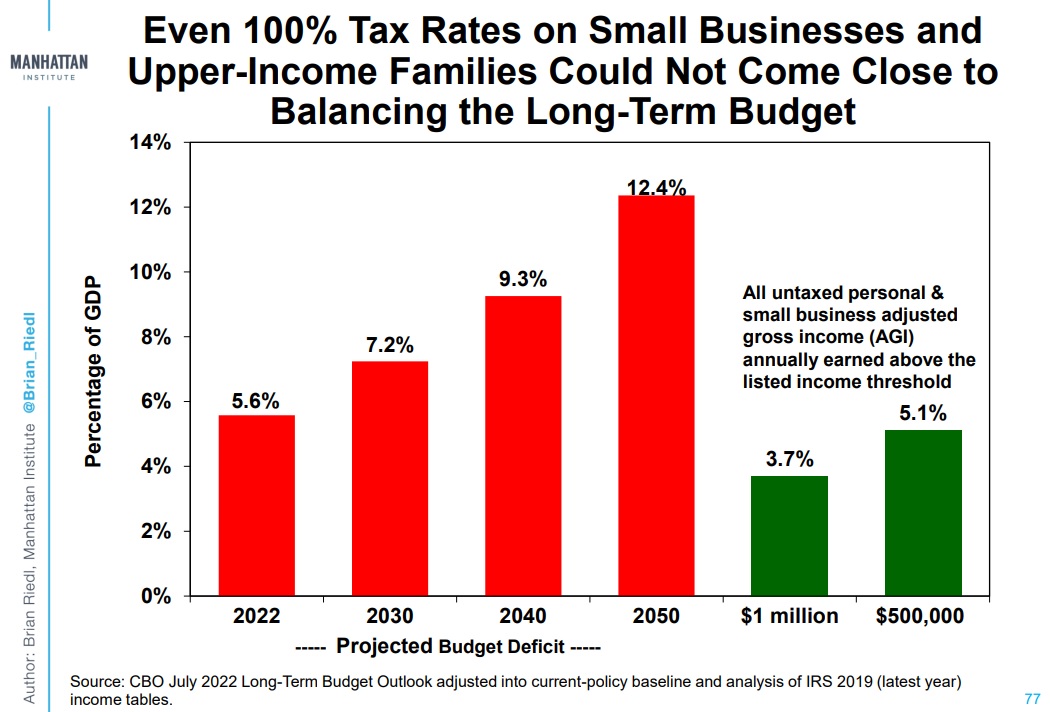

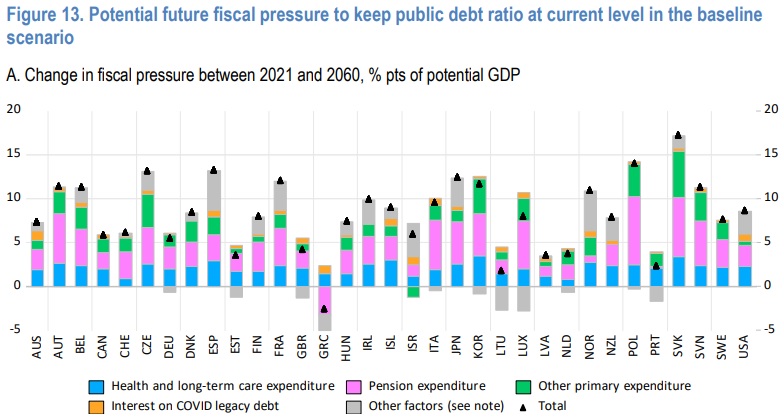

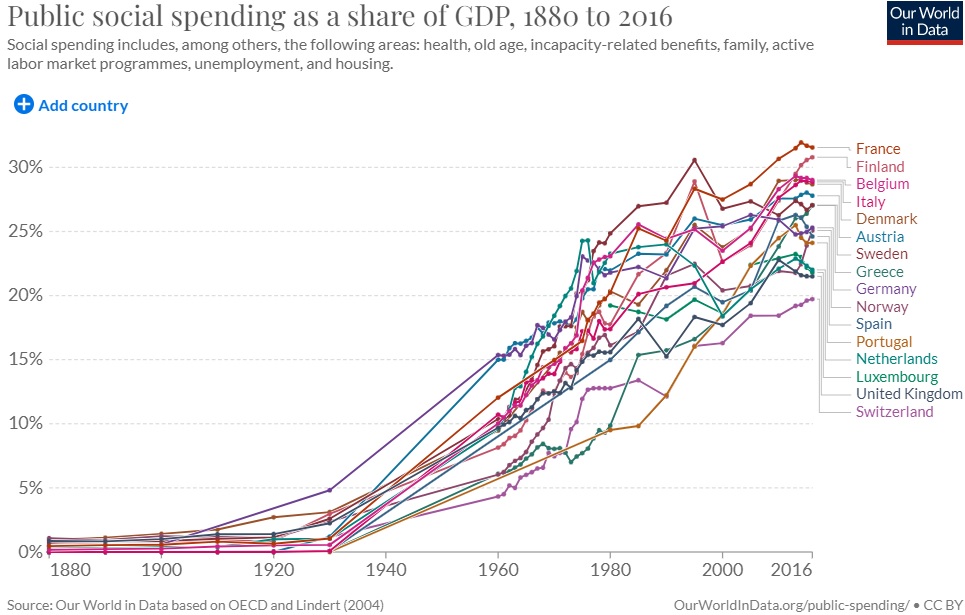

Since the report concludes by endorsing more redistribution, it would be more honest and appropriate to compare American living standards to the performance of Europe’s other welfare states.

But Burn-Murdoch did not do that because his already flimsy case would look even weaker.

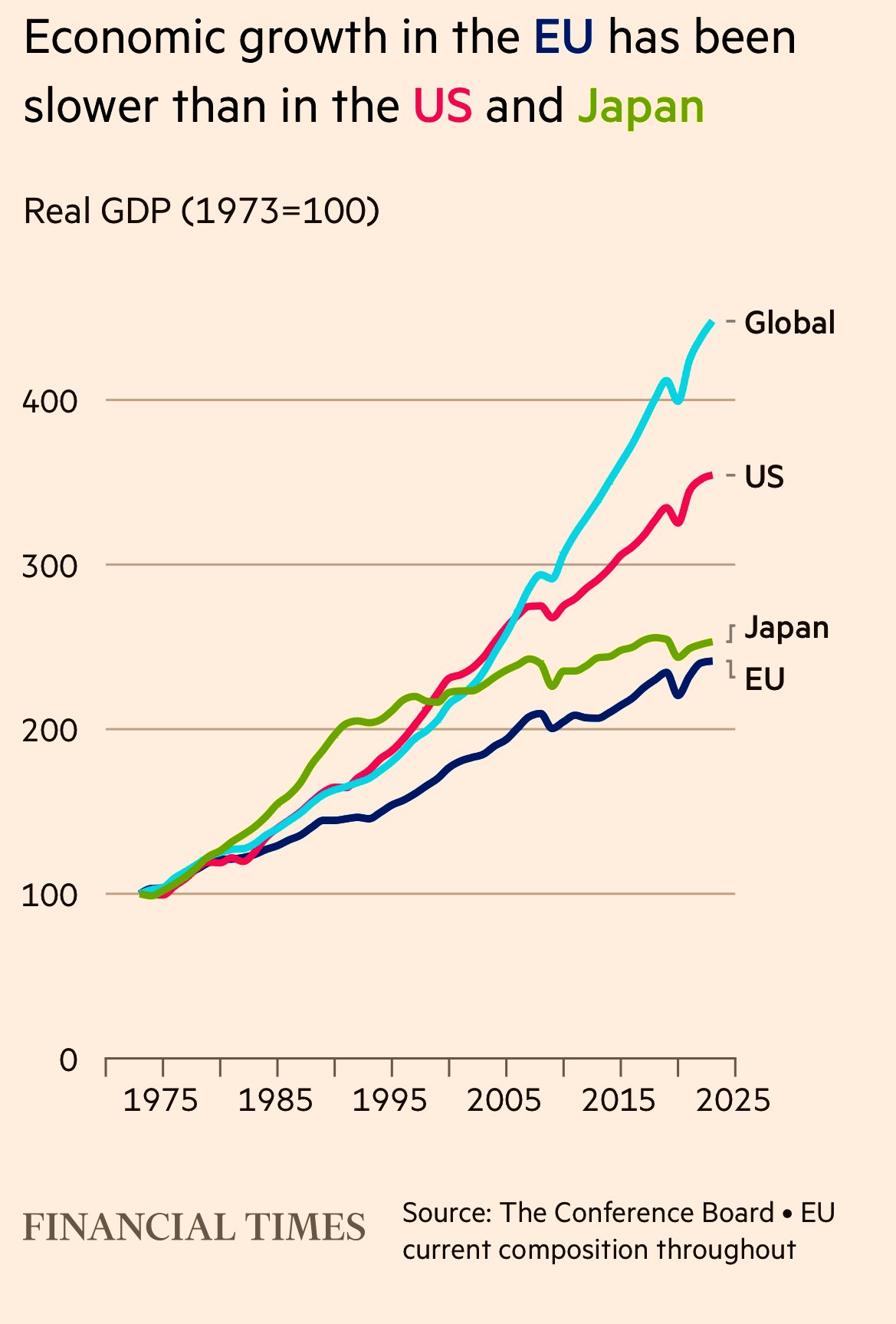

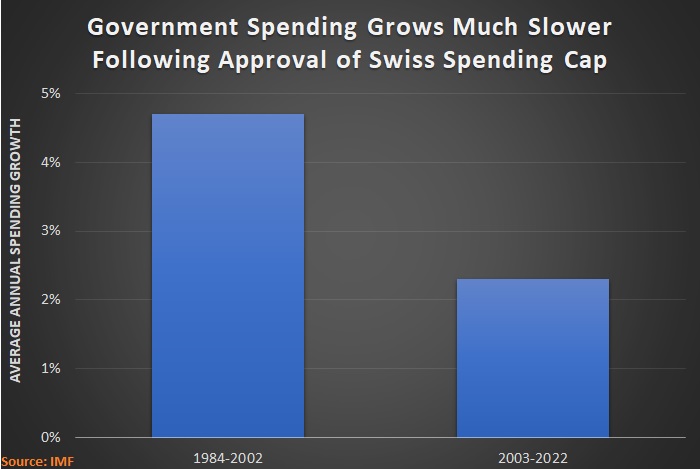

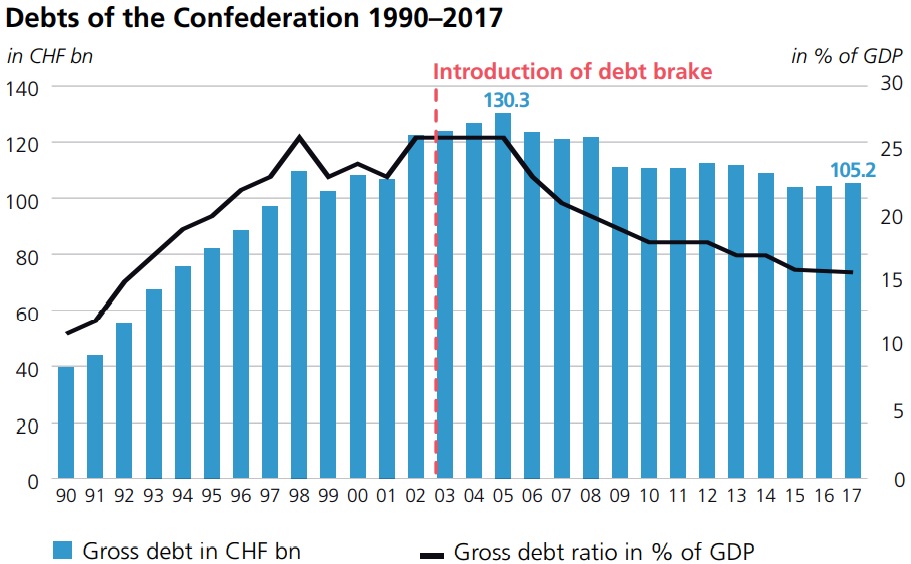

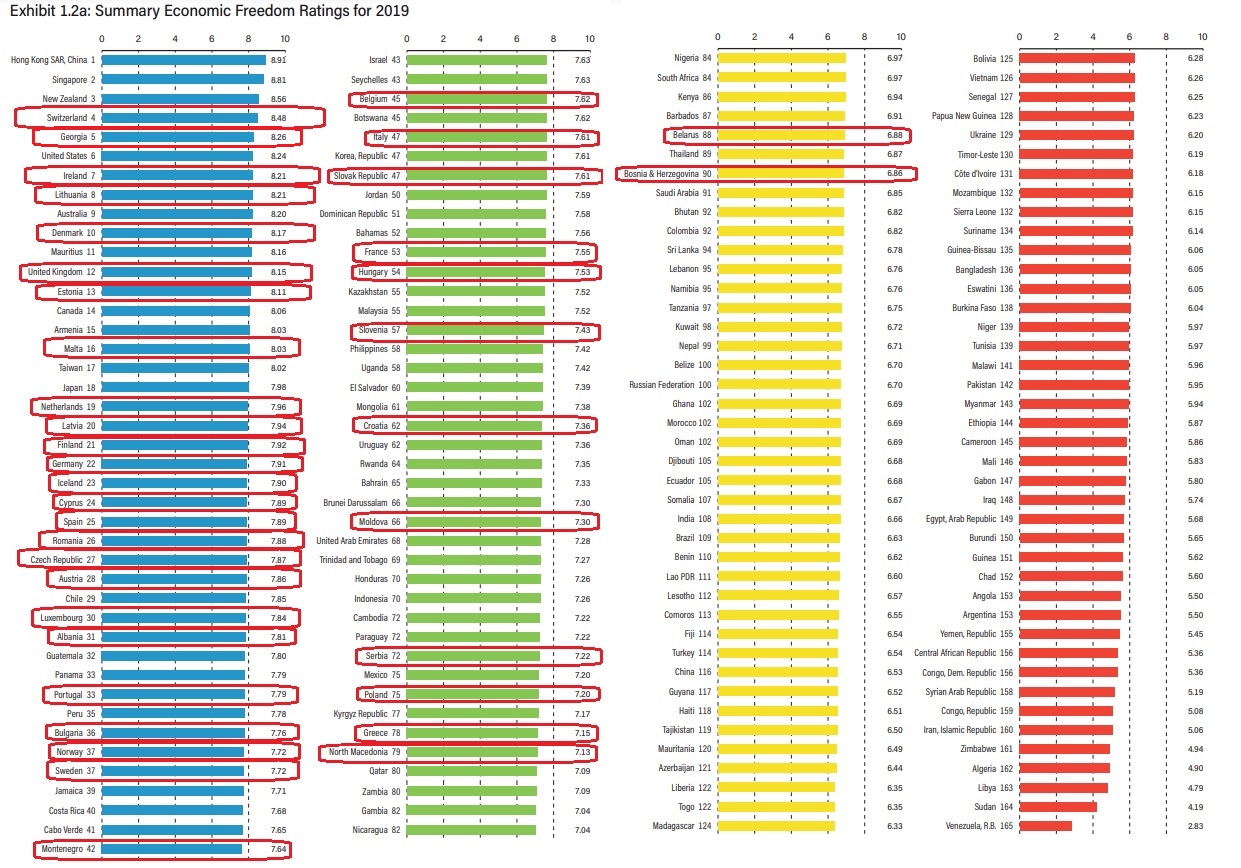

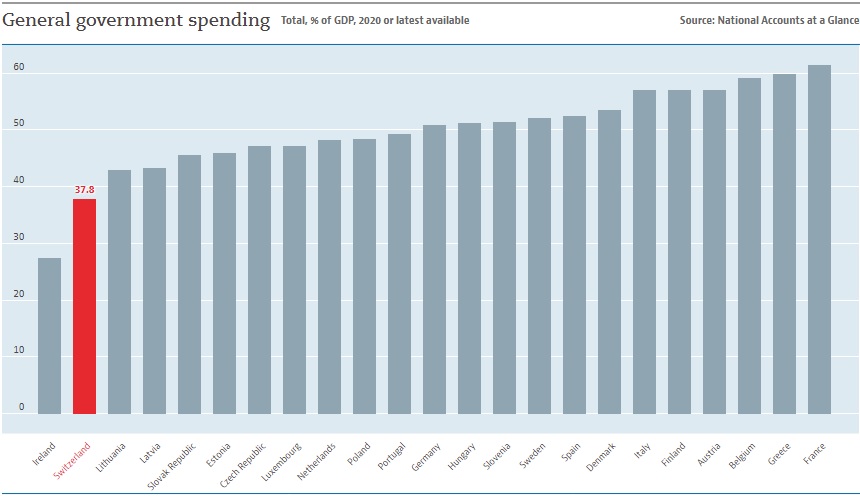

Also, note that he did not highlight Switzerland. After all, it is richer than Norway, even though it does not enjoy abundant natural resources.

I suspect that’s because Switzerland is a libertarian-oriented nation with a comparatively small welfare state. In other words, it’s a role model for good policy, whereas the reporter seems interested in promoting dirigisme.

P.S. Speaking of libertarians, the Burn-Murcoch story in the Financial Times begins with this passage.

Where would you rather live? A society where the rich are extraordinarily rich and the poor are very poor, or one where the rich are merely very well off but even those on the lowest incomes also enjoy a decent standard of living? For all but the most ardent free-market libertarians, the answer would be the latter.

At the risk of stating the obvious, libertarians want a society with the smallest-possible government. Limiting coercion (the non-aggression principle) is the main motive.

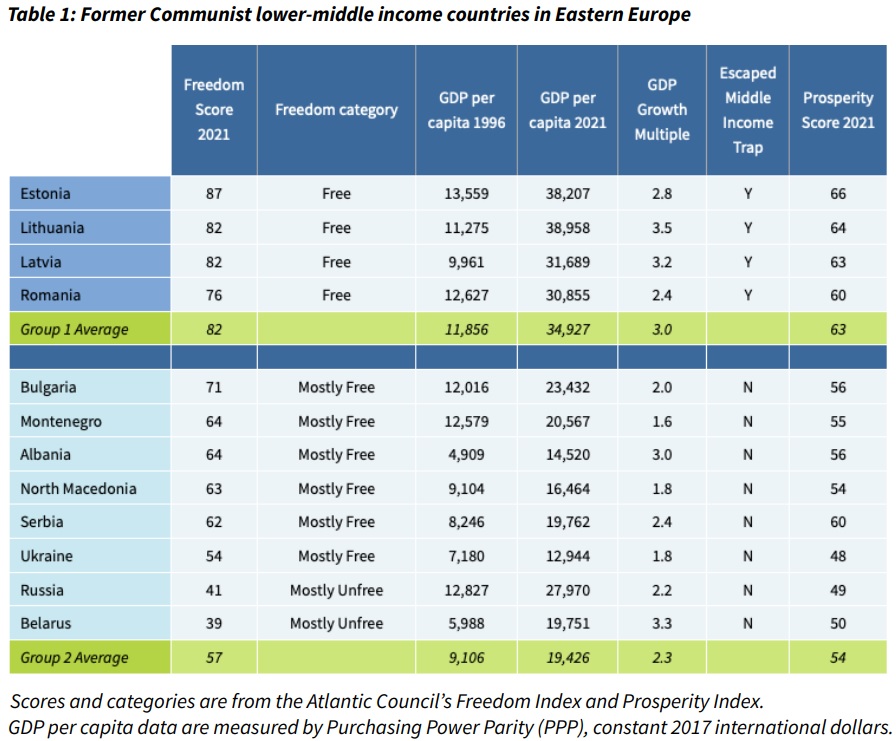

Libertarians will view the resulting distribution of income as just, but they also will point out that freer societies do a much better job of generating broadly shared prosperity than government-dominated societies.

The bottom line is that Burn-Murdoch is either extraordinarily ignorant about libertarianism or he suffers from Nancy MacLean levels of bad faith and dishonesty.

Read Full Post »