I’ve previously argued that private property rights are a vital component of a pro-environment agenda.

Interestingly, the Washington Post sort of agrees. At least with regards to fisheries. In a recent editorial, it acknowledged that the current communal system doesn’t work.

The world’s fisheries, which feed billions of people, are in serious decline. The authors of a study released Monday in the Proceedings of the National Academy of Sciences examined 4,713 fisheries, accounting for 78 percent of the world’s annual catch, and found that only a third were in decent biological shape.

The editorial then points out that there’s an incentive to over-harvest because the oceans are communal property, which creates a “tragedy-of-the-commons” scenario.

…while the fishing industry as a whole has an interest in sustaining the fisheries that provide it profits and feed the world, individual fishermen have an incentive to take as much as they can as quickly as they can. Over time, they degrade the fisheries on which they rely, but if they want to stay in business, they have little choice.

And the editorial concludes that giving fishermen the property right to a “catch share” would create better incentives.

…governments have extremely effective policy options to eliminate this tragedy of the commons. …governments must give fishermen a stake in the overall health of their fisheries. …require fishermen to hold rights to catch a certain amount of seafood in a certain fishery, which allows governments to manage the total haul and reduces the frenzied competition to scoop up as much as possible as quickly as possible. Ideally, these “catch shares” could be bought and sold so that rights would end up with those who could fish most efficiently.

Some of the language in the editorial rubs me the wrong way, such as “require fishermen” and “allows governments to manage,” but the bottom line is that the new system would be much more akin to a genuine market based on property rights.

To understand, consider the following example. Imagine there’s a communally owned pasture and a bunch of sheep owners.  Would there be any incentive for the individual shepherds to properly conserve and manage the pasture? Not really, because any grass that wasn’t eaten by their sheep would be eaten by another shepherd’s sheep. So you wind up with a system where all the shepherds have an incentive to have their sheep consume as much grass as possible as quickly as possible.

Would there be any incentive for the individual shepherds to properly conserve and manage the pasture? Not really, because any grass that wasn’t eaten by their sheep would be eaten by another shepherd’s sheep. So you wind up with a system where all the shepherds have an incentive to have their sheep consume as much grass as possible as quickly as possible.

That doesn’t end well.

But what if the pasture was divided up so that each shepherd had a plot of land, along with the right to buy and sell that land? With that system, the incentive to practice good husbandry would radically change.

And that’s basically what happens when you create a property rights-based fisheries system.

And the Washington Post believes this kind of approach could be enormously beneficial.

If applied globally, modern management plans could rehabilitate the median fishery in less than a decade. By 2050, nearly every fishery on the planet would be healthy. The resulting benefits would be astonishing. Relative to business as usual, the refreshed catch would grow by an annual 16 million metric tons, and seafood stocks would rise by 619 million metric tons. Fishermen would see an annual $53 billion rise in profit, a jump of 64 percent. The world’s fisheries could feed more people, and the fishing industry could boom, too.

Wow, this is so effusive that it sounds like me describing the benefits of a flat tax.

But just like I rely on real-world evidence for my praise of the flat tax, there’s also real-world evidence for successful fisheries based on property rights.

Consider, for instance, the experience of New Zealand.

By the early 1980s, with dwindling inshore stocks and too many boats, the New Zealand fishing industry and the government realised that a new fisheries management system was needed. Measures such as moratoriums and controlled fisheries failed to work. The common warning that ‘too many boats are chasing too few fish’ was rephrased by one fisherman as, ‘too many boats chasing no fish’. Radical thinking emerged. …In October 1986, after two years of consultation and planning, the Quota Management System was introduced, with widespread industry support. …Under the quota system a sustainable total catch or harvest of fish was set. Individuals or companies were allocated the right to catch certain quantities of particular species. Quotas became like other forms of property  – they could be leased, bought, sold or transferred.

– they could be leased, bought, sold or transferred.

And how has this system worked?

It’s been a big success.

New Zealand’s Quota Management System has been viewed internationally as successful. This is particularly in comparison with many of the world’s fisheries… New Zealand has (so far) largely avoided the significant stock collapses that have occurred in fisheries overseas. In the early 2000s the Ministry of Fisheries had records on the status of 60–70% of stocks. Of these, about 80% were at or near target levels for sustainable harvest, and the total allowable catch for some fish had even increased.

The Economist, meanwhile, has written about Iceland’s system.

Central to its policy are the individual transferable quotas given to each fishing boat for each species on the basis of her average catch of that fish over a three-year period. …Subject to certain conditions, quotas can be traded among boats. Bycatch must not be discarded. Instead it must be landed and recorded as part of that boat’s quota. If she has exhausted her quota, she must buy one from another boat… All quota changes, catches and landings are posted on the internet, enabling everybody to see what is going on. The idea is to let fishermen be guided by the market. …Iceland no longer suffers from overcapacity, and the catch per boat is increasing. …Iceland offers lessons for other countries. The essential elements of its policies are to give fishermen rights that offer a reasonable expectation of profitable long-term fishing by encouraging the conservation of stocks. The system is clear, open and fairly simple, and it is well policed. It thus enjoys the respect of fishermen.

And the contrast to the command-and-control system used by the European Union is dramatic.

This contrasts with the common fisheries policy of the EU… For years, the union has simultaneously discouraged and promoted fishing, even as stocks have declined. Overfishing has intensified and the overcapacity of the fleet a few years ago rose to the point where the number of boats was almost twice the number needed for a sustainable harvest. The EU has offered inducements to those who gave up fishing even as it provided subsidies… The EU’s fisheries policy has long been notorious for its destructiveness, epitomised by the practice it either mandates or encourages of chucking back dead fish that are not big enough or not valuable enough, or just the wrong sort. …No wonder the EU’s stocks are 88% overfished, as the European Commission itself now admits. …No minister is present to represent the taxpayer, the consumer or the environment, let alone the fish.

The key, everywhere in the world, is a system of property rights.

Europe could surely learn from Iceland, but how widely could Iceland’s policies be copied? …The solution for Europe, and for other places, lies in a policy with Icelandic features: transferable quotas for all commercial species… Property rights are nearly always crucial in this. The tragedy of the sea is the tragedy of the commons, which is that anyone with access to a common resource has an interest in over-exploiting it because if he does not, someone else will. …Most fish…live fairly close to land, which is where they can, if the political determination exists, be assigned to the ownership of people with an interest in both exploiting and preserving them for a very long time, if not eternity. That this is so has been shown by Christopher Costello, an economist at the University of California, Santa Barbara, and his colleagues, in a study of over 11,000 fisheries. In the 121 with ownership-share systems, he reported in Science last September, the rates of collapse were significantly lower than in the others.

Having “rates of collapse” suggests that the property rights-based systems don’t always work perfectly. But that fact that those rates are “significantly lower” also indicates that they are far more effective than communal fisheries in preserving fish stocks.

P.S. There’s a worrisome analogy between communal fisheries and the welfare state since both involve a tragedy of the commons. In the case of the welfare state, when too many people decide to rely on the “communal property” of government for their existence, this creates a “tipping point” because productive people at some point are either unable or unwilling to continue pulling the wagon.

P.S. There’s a worrisome analogy between communal fisheries and the welfare state since both involve a tragedy of the commons. In the case of the welfare state, when too many people decide to rely on the “communal property” of government for their existence, this creates a “tipping point” because productive people at some point are either unable or unwilling to continue pulling the wagon.

P.P.S. This is a lesson that the Pilgrims learned very quickly.

P.P.P.S. Unfortunately, larger societies have a tendency to develop “goldfish governments.”

Read Full Post »

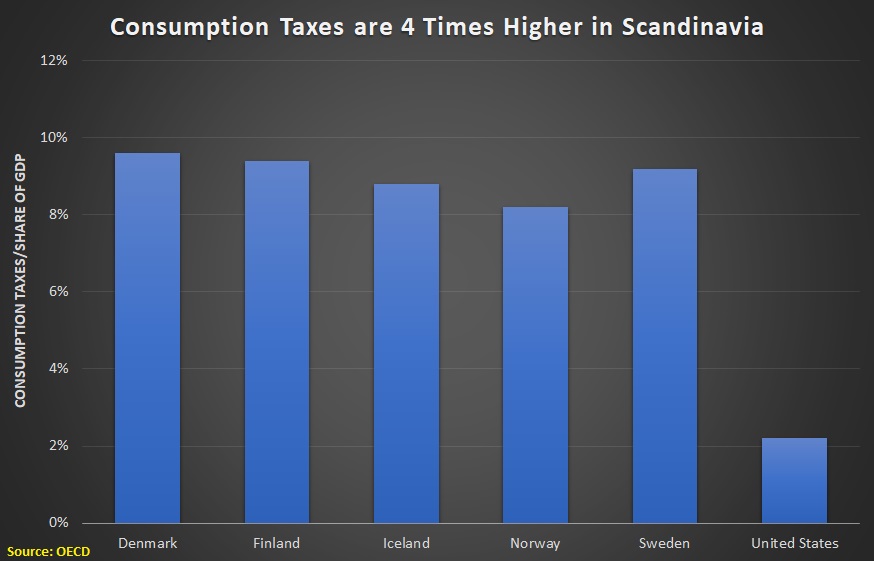

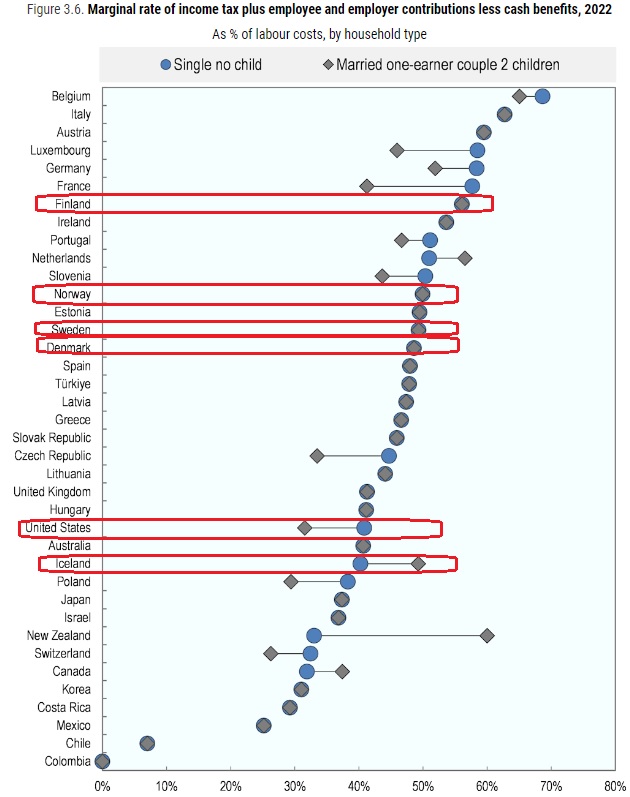

…Scandinavia’s additional tax revenues come mainly from slamming their middle classes with steep social security, consumption, and income taxes. How steep? Total social security taxes (including those employers pay) are twice as high in Sweden (31.42 percent) and nearly one-third higher in Norway than in the United States. Nordic VAT rates of approximately 25 percent raise roughly 9 percent of GDP in revenues, while America has no national VAT.