In my lifetime, the only good president has been Ronald Reagan, whose policies restored America’s economy and led to the end of the Soviet Union’s evil empire.

But if we look at the past 100 years, Calvin Coolidge might rank even higher.

Amity Shlaes was the right person to narrate that video. She’s written the definitive biography of Coolidge.

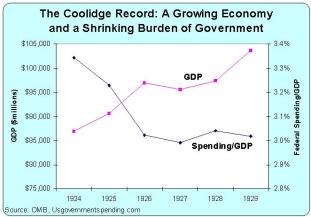

Indeed, I’ve previously cited her expertise on Coolidge’s fiscal restraint, as well as Silent Cal’s wisdom on tax policy.

Given the tendency of politicians to buy votes with other people’s money, I’m especially impressed by his frugality. He followed my Golden Rule about 90 years before I ever proposed the concept.

Let’s further investigate his performance.

Larry Reed of the Foundation for Economic Education has two must-read articles about Coolidge’s track record.

First, to illustrate Coolidge’s admirable philosophy of fiscal restraint, he shares these key passages from his 1925 inauguration.

I favor the policy of economy, not because I wish to save money, but because I wish to save people. The men and women of this country who toil are the ones who bear the cost of the Government. Every dollar that we carelessly waste means that their life will be so much the more meager. Every dollar that we prudently save means that their life will be so much the more abundant. Economy is idealism in its most practical form.

…The wisest and soundest method of solving our tax problem is through economy…The collection of any taxes which are not absolutely required, which do not beyond reasonable doubt contribute to the public welfare, is only a species of legalized larceny. …They do not support any privileged class; they do not need to maintain great military forces; they ought not to be burdened with a great array of public employees…. I am opposed to extremely high rates, because they produce little or no revenue, because they are bad for the country, and, finally, because they are wrong. …The wise and correct course to follow in taxation and all other economic legislation is not to destroy those who have already secured success but to create conditions under which everyone will have a better chance to be successful.

Magnificent.

And you should also see what he said in 1926, when celebrating the 150th anniversary of America’s independence.

Larry Reed also debunked the silly notion that Coolidge was responsible for the Great Depression of the 1930s.

So-called “progressives” tell us that Calvin Coolidge was a bad president because the Great Depression started just months after he left office. …Should Coolidge get any of the blame for the Great Depression? The Federal Reserve’s expansion of money and credit in the 1920s certainly set the country up for at least a mild fall, but that wasn’t Coolidge’s fault.

He saw the Fed as the “independent” entity it was supposed to be and didn’t meddle with it. At least once he expressed concern that the Fed might be fostering a bubble but he otherwise didn’t make a stink about it. “Not my bailiwick,” he believed. We can legitimately say that Coolidge should have criticized the Fed’s easy money policy more loudly. …In any event, far worse than the Fed’s inflation was its deflation, which didn’t begin in earnest until the final weeks of the Coolidge administration. …Every good economist concedes that erratic monetary policy at the Fed was at least a minor cause of the 1920s boom and surely a major cause of the 1930s bust. You can’t blame that on Coolidge.

If you want more information about the Fed’s role in causing economic turmoil, I recommend this video presentation from George Selgin.

Larry’s column points out that both Herbert Hoover and Franklin Roosevelt then imposed policies that lengthened and deepened the downturn.

Markets were, in fact, making a comeback in the spring of 1930 and unemployment had not yet hit double digits. Not until June 1930, when Congress and President Hoover raised tariffs and triggered an international trade war, did recession cascade into depression. Two years later, they flattened just about everybody who was still standing by doubling the income tax. …Franklin Roosevelt…then delivered…absurd interventions kept the economy in depression for another seven years.

What especially tragic about the Great Depression is that Warren Harding showed, just a decade earlier, how to quickly put an end to a deep downturn.

I’ll close with by emphasizing this quote from Coolidge’s inaugural address. Every supporter of limited government should withhold support from any politician who is unable to echo this sentiment today.

P.S. There is another president that I admire, though the number of good presidents is greatly outnumbered by the motley – and bipartisan – collection of bad presidents.