I’ve argued that Obama’s not a socialist.

I wasn’t trying to defend him. I was simply making the point that it’s technically more accurate to refer to him as a statist or a corporatist.

But he may be even worse than that, at least according to a must-read Kevin Williamson analysis of Obama for National Review.

He starts with how Obama seems to be a run-of-the-mill leftist.

Obama has been called many things — radical, socialist — labels that may have him dead to rights at the phylum level but not down at his genus or species. His social circle includes an alarming number of authentic radicals, but the president’s politics are utterly conventional managerial liberalism.

But Kevin then suggests that there’s something different about the President.

President Obama is nonetheless something new to the American experience, and troubling. It is not simply the content of his political agenda, which, though wretched, is a good deal less ambitious than was Woodrow Wilson’s or Richard Nixon’s. Barack Obama did not invent managerial liberalism, nor has he contributed any new ideas to it. He is, in fact, a strangely incurious man. …Obama’s most important influences have been tacticians such as Abner Mikva, bush-league propagandists like the Reverend Jeremiah Wright, and his beloved community organizers. Far from being the intellectual hostage of far-left ideologues, President Obama does not appear to have the intellectual energy even to digest their ideas, much less to implement them.

Then we have some examples of Obama’s “managerial liberalism.”

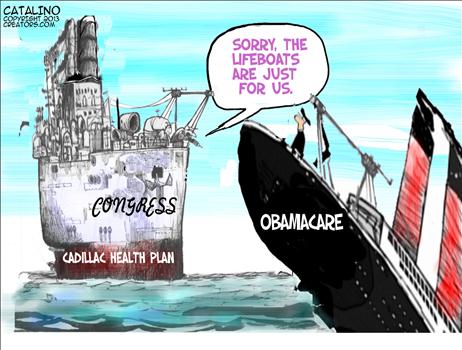

The result of this is his utterly predictable approach to domestic politics: appoint a panel of credentialed experts. …IPAB is the most dramatic example of President Obama’s approach to government by expert decree, but much of the rest of his domestic program, from the Dodd-Frank financial-reform law to his economic agenda, is substantially similar.

While this may appear to be incremental statism, Kevin argues that it represents something quite radical.

…it amounts to that fundamental transformation of American society that President Obama promised as a candidate: but instead of the new birth of hope and change, it is the transformation of a constitutional republic operating under laws passed by democratically accountable legislators into a servile nation under the management of an unaccountable administrative state. The real import of Barack Obama’s political career will be felt long after he leaves office, in the form of a permanently expanded state that is more assertive of its own interests and more ruthless in punishing its enemies.

Echoing Thomas Sowell, who explained that Obama’s agenda technically could be described as fascism, Kevin says that the current administration’s approach is a soft form of totalitarianism.

…he also has advanced it without legislative assistance — and, more troubling still, in plain violation of the law. President Obama and his admirers choose to call this “pragmatism,” but what it is is a mild expression of totalitarianism, under which the interests of the country are conflated with those of the president’s administration and his party.

For all intents and purposes, we are now governed by a leftist bureaucracy.

…the United States is not going to fall for a strongman government. Instead of delegating power to a would-be president-for-life, we delegate it to a bureaucracy-without-death. You do not need to install a dictator when you’ve already had a politically supercharged permanent bureaucracy in place for 40 years or more. As is made clear by everything from campaign donations to the IRS jihad, the bureaucracy is the Left, and the Left is the bureaucracy. Elections will be held, politicians will come and go, but if you expand the power of the bureaucracy, you expand the power of the Left, of the managers and minions who share Barack Obama’s view of the world. Barack Obama isn’t the leader of the free world; he’s the front man for the permanent bureaucracy, the smiley-face mask hiding the pitiless yawning maw of total politics.

And the law apparently doesn’t mean much in this new world.

…he has decided — empowered to do so by precisely nothing — that the law will not be enforced until after the elections. Neither does the law empower him arbitrarily to exempt millions of his donors and allies in organized labor from the law, but he has done that too. This is a remarkable thing. The health-care law gives the executive all sorts of powers to promulgate regulations and make judgments, but it does not give the executive the power to decide which aspects of the law will be enforced and which will not, or to establish a different timeline from the one found in the law itself. For all of the power that Congress legally has given the president in this matter, he feels it necessary to take more — illegally.

Kevin shows that lawlessness goes far beyond Obamacare.

In a similar vein, President Obama has refused to cut off foreign-aid funds to the Egyptian government, though he is required by law to do so in the event of a coup d’état, which is precisely what happened in July in Egypt. …The law also prohibits the president and his allies from using the instruments of government to persecute their rivals, but that is precisely what the IRS has been up to for several years, as it turns out. And not just the IRS: Tea-party activist Catherine Engelbrecht was subject to an IRS audit, two FBI visits, an OSHA investigation, and an ATF inspection of her business (which does not deal in A, T, or F). …The president not only ignores the law but in some cases goes out of his way to subvert it. …He has attempted to make “recess appointments” when Congress is not in recess and has been stopped from doing so by the federal courts, which rightly identified the maneuver as patently unconstitutional.

Another example is the recent IRS regulation that forces American banks to put foreign law above U.S. law.

Indeed, Kevin explains that the White House’s disdain for the law is even worse than Nixon’s.

…what is particularly disturbing is the quiet, polite, workaday manner with which the administration goes about its business — and with which the American public accepts it. As Christopher Hitchens once put it, “The essence of tyranny is not iron law; it is capricious law.” Barack Obama makes a virtue out of that caprice… President Nixon’s lawlessness was sneaky, and he had the decency to be ashamed of it. President Obama’s lawlessness is as bland and bloodless as the man himself, and practiced openly, as though it were a virtue. President Nixon privately kept an enemies list; President Obama publicly promises that “we’re gonna punish our enemies, and we’re gonna reward our friends.”

So what’s the bottom line? According to Williamson, we have a might-makes-right White House.

He has spent the past five years methodically testing the limits of what he can get away with, like one of those crafty velociraptors testing the electric fence in Jurassic Park. Barack Obama is a Harvard Law graduate, and he knows that he cannot make recess appointments when Congress is not in recess. He knows that his HHS is promulgating regulations that conflict with federal statutes. He knows that he is not constitutionally empowered to pick and choose which laws will be enforced. This is a might-makes-right presidency, and if Barack Obama has been from time to time muddled and contradictory, he has been clear on the point that he has no intention of being limited by something so trivial as the law.

In other words, the ends justifies the means.

Do I agree with this analysis? I think Kevin is spot on in terms of policy. Obama unambiguously has expanded the power of the political class in Washington.

The more interesting question, though, is whether the President is following a deliberate plan to change the nation. Or is government expanding – as it normally does – because of corruption, incompetence, politics, ideology, greed, and self interest?

I’m not a big believer in secret plans, so my normal instinct is to accept the conventional explanation for ever-growing government. On the other hand, Kevin points out that Obama is quite open about “fundamentally transforming” America and he pursues his agenda even when that means running roughshod over the law.

All I can say is that you should read the entire article. You’ll have a greater appreciation of the challenges we face if we want to restore the American ideal of economic liberty and personal freedom.

P.S. With regards to the is-Obama-a-socialist debate, Steven Horwitz (a former grad school colleague) makes some insightful observations.

P.S. With regards to the is-Obama-a-socialist debate, Steven Horwitz (a former grad school colleague) makes some insightful observations.

P.P.S. Since we’re discussing who is a socialist and who isn’t, Cal Thomas has some wise words on whether religious faith requires socialist politics.

P.P.P.S. If you really want to see an example of bizarre name calling, there are some people who think Obama is a conservative.

P.P.P.P.S. And if you enjoy irony, some leftists are more rational than others.

P.P.P.P.P.S. Last but not least, I’ve cited some other first-rate Kevin Williamson columns in previous posts, including one on the corrupt nexus of Washington and Wall Street, another on limits to supply-side economics, and a delicious take down of Krugman, which I link to at the bottom of this post.

Read Full Post »

But I’m digressing. Let’s look at what Steyn identifies as the real problem. We account for a huge share of the globe’s military spending, yet we don’t get much bang for the buck.

But I’m digressing. Let’s look at what Steyn identifies as the real problem. We account for a huge share of the globe’s military spending, yet we don’t get much bang for the buck.