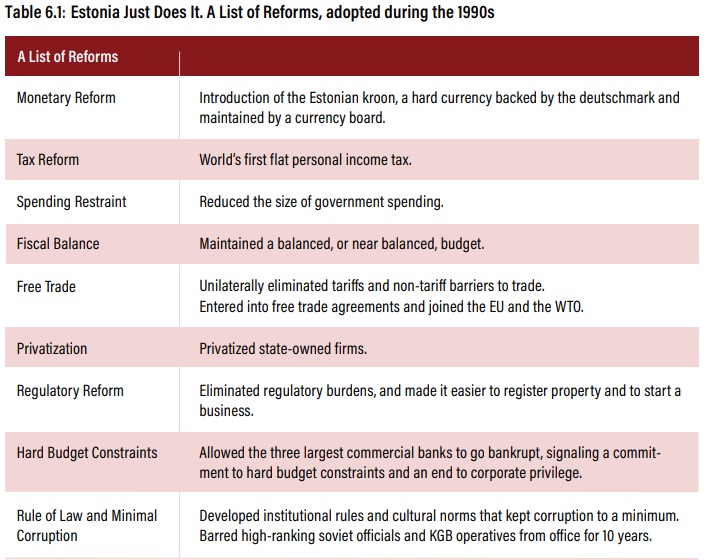

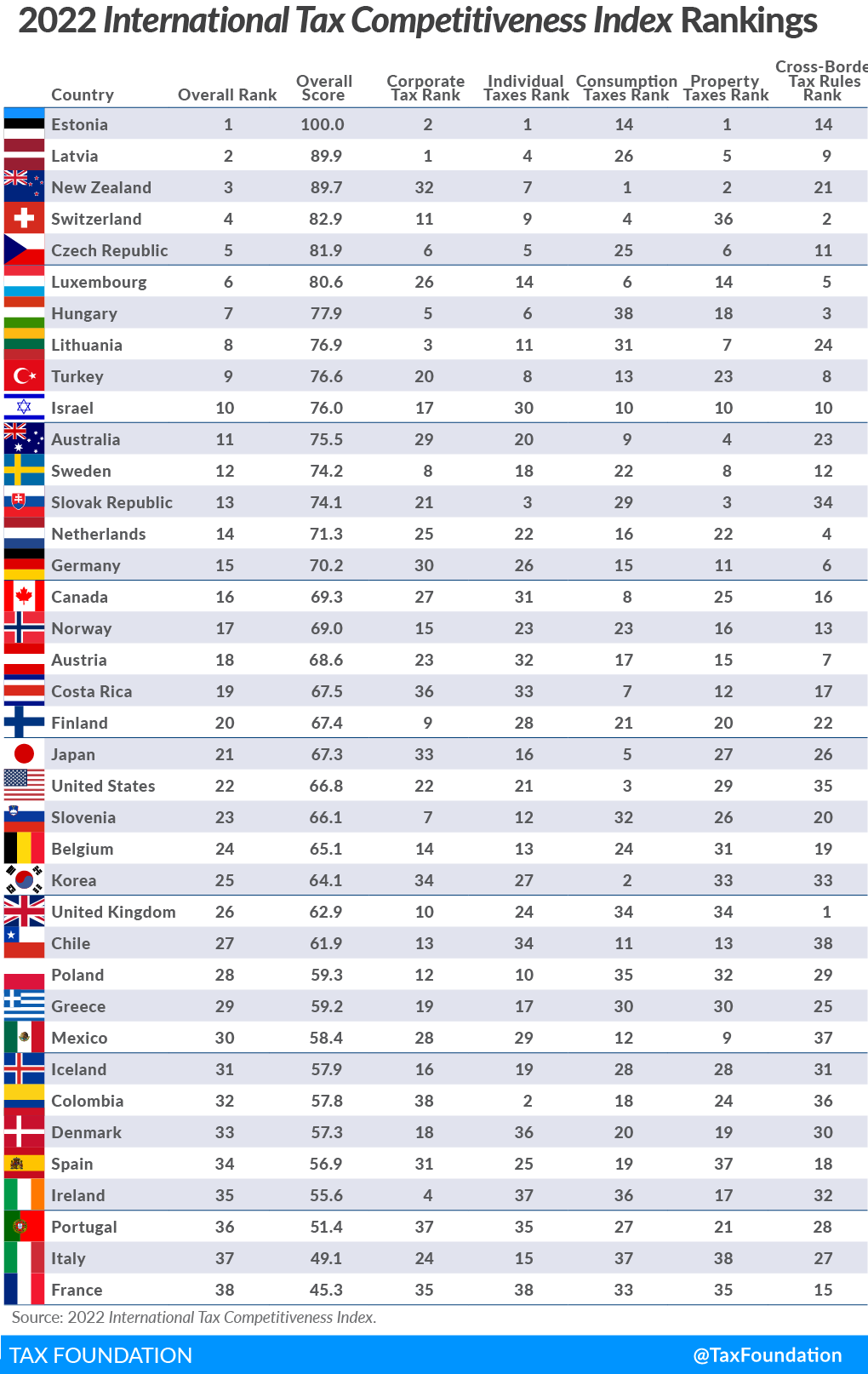

In Part I of this series, we looked at the many pro-market reforms that turned Estonia into an “improbable success.”

For Part II, let’s look at fiscal policy. And we’ll start with the country’s best feature: Estonia has a very simple and fair flat tax with a relatively low rate.

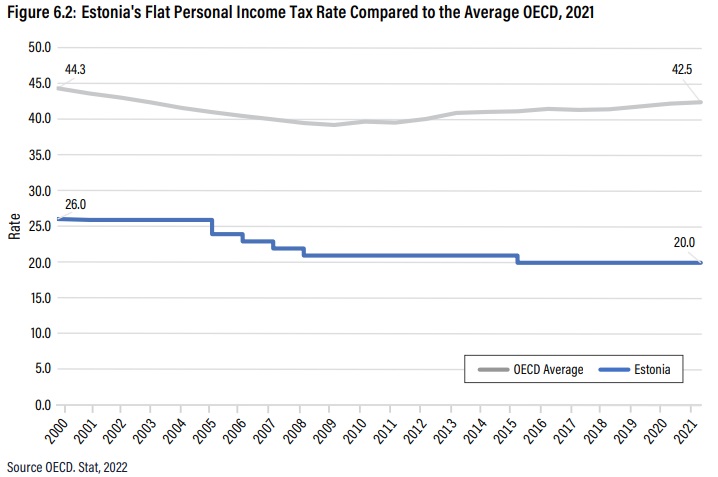

Here’s the Estonian income tax compared to the average of other developed nations.

The above chart comes from a new book, The Road to Freedom, which describes Estonia’s escape from communist oppression.

Here’s some of what the authors, Matthew Mitchell, Peter Boettke, and Konstantin Zhukov, wrote about the nation’s tax reform.

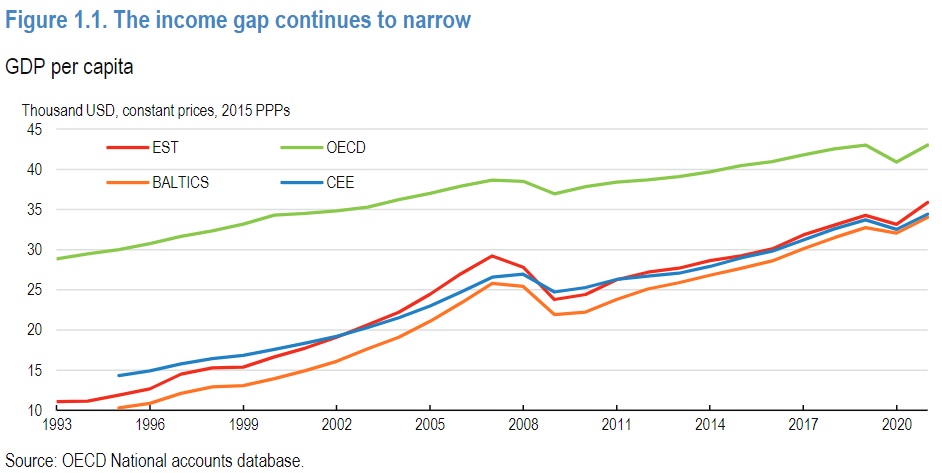

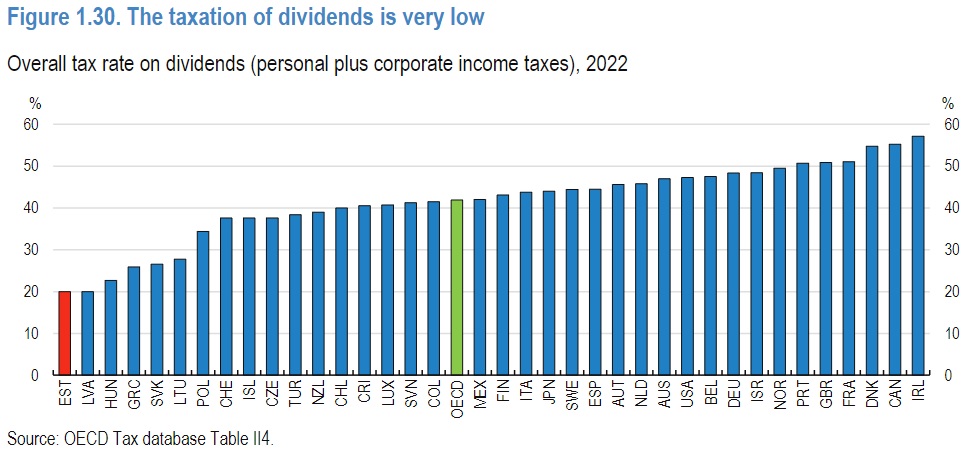

Laar’s government implemented the world’s first flat tax in 1994. Initially set at 26 percent, it was reduced in several steps to 20 percent by 2015… In 2021, it was the second-lowest top rate and less than half the average rate in the OECD (see Figure 6.3). Estonia’s flat tax applies to all personal and corporate income above a minimum threshold, with no exemptions, deductions, or credits. To avoid double-taxation, it does not apply to dividends when the underlying profits have already been taxed.

…Estonians soon found that their simple and easy to administer flat tax raised revenue without discouraging economic activity. …Estonia’s flat tax also applies to corporate income. The marginal effective corporate tax rate…is close to the statutory rate, reflecting the system’s minimal loopholes. And while many countries distinguish between different forms of businesses (LLC, S-Corp, etc.), and between service companies and manufacturers, Estonia taxes all corporate income the same. …Estonia’s flat tax also applies to corporate income. The marginal effective corporate tax rate…is close to the statutory rate, reflecting the system’s minimal loopholes. And while many countries distinguish between different forms of businesses (LLC, S-Corp, etc.), and between service companies and manufacturers, Estonia taxes all corporate income the same. …Estonian firms only spend about five hours a year on tax compliance, whereas American firms spend 87 hours on compliance.

As you just read, it’s not just that Estonia has a flat tax. It’s also a properly designed flat tax, with no double taxation and expensing rather than depreciation.

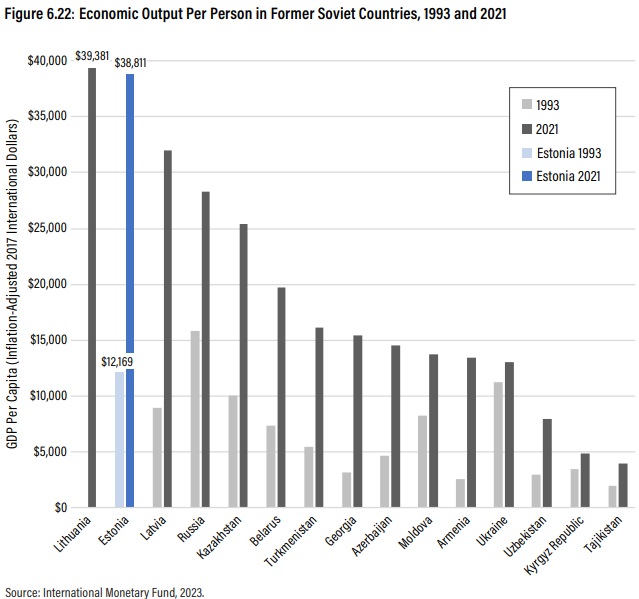

No wonder Estonia routinely ranks at the top of the Tax Foundation’s International Tax Competitiveness Index.

But it’s important to understand that Estonia isn’t the Cayman Islands or Monaco. It’s not even Singapore or Jersey (the island in the English Channel, not the over-taxed American state).

In a column last year for National Review, Meelis Kitsing provided a balanced assessment of his country’s tax regime. Here are some excerpts.

A maximum of 20 percent tax on any income exceeding 2,100 euros per month may seem a good deal, but, on top of that, employers have to pay social taxes of 33 percent on salaries, which can (even if there are no direct employee contributions) operate as an indirect tax on income.

…According to the OECD, Estonia had a tax-to-GDP ratio of 33.5 percent in 2021. This was slightly lower than the OECD average of 34.1 percent. …it is far from being a tax haven. The U.S. tax-to-GDP ratio was 26.6 percent. …Estonia has…consumption taxes above the OECD average. …Tax policy has been an important ingredient in Estonia’s reform efforts that have been among the most radical and far-reaching of all those seen in Central and Eastern Europe since the breakup of the Soviet Union and the fall of communism in its satellite states. …Tax policy should not be seen in isolation; carried out well, it can be key to a sound economic environment. In Estonia, that has been the case.

To put it in simple terms, Estonia has a well-designed tax system, but it is not a low-tax economy.

Which brings us to the bad news. The reason Estonia is not a low-tax nation is because it is not a small-government nation.

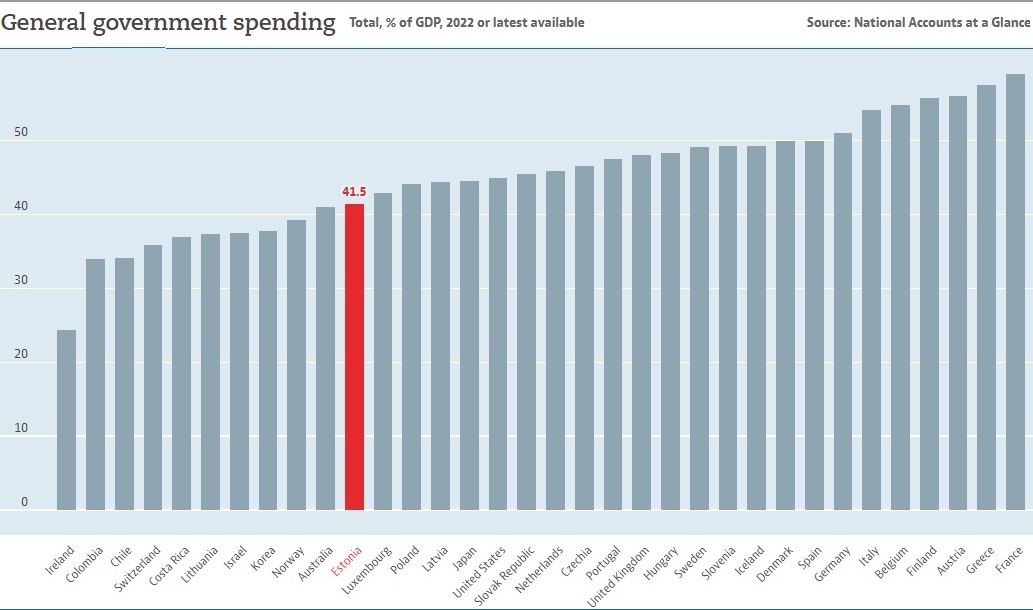

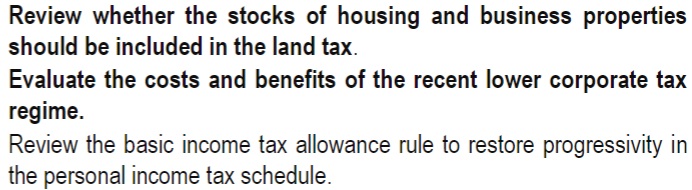

Here’s the latest data from the OECD on the burden of government spending in member nations.

Yes, Estonia is not as bad as most other European countries, but that’s hardly a big achievement given the continent’s propensity for profligacy. What matters most is that the public sector is far above the growth-maximizing level.

To make matters worse, Estonia has major demographic challenges, which means there will be long-run pressure for even more spending.

Which helps to explain our final bit of bad news, which is that Estonia recently increased its flat tax to 22 percent as part of a broad tax-hike pacakge.

The moral of the story, as I have written before, is that you can’t have a good tax system with big government.

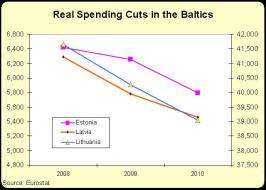

P.S. Estonia should have learned a lesson after a tax increase backfired a few years ago.