My daily columns usually revolve around public policy issues such as tax reform, entitlements, and corrupt government. And while sometimes get a bit agitated about bad things in Washington, it’s because I’m a curmudgeonly libertarian, not because of some personal stake (other than being an oppressed taxpayer).

But sometimes there is a personal connection, like when I responded to the Washington Post‘s front-page attack on the Center for Freedom and Prosperity, a group that I founded.

But sometimes there is a personal connection, like when I responded to the Washington Post‘s front-page attack on the Center for Freedom and Prosperity, a group that I founded.

Today, I’m writing because of a different kind of personal connection. I got my Ph.D. from George Mason University, and one of the great parts of that experience was taking a couple of classes from James Buchanan, who won the Nobel Prize shortly after I arrived on campus.

Professor Buchanan was more than an economist. He was also a social philosopher. He thought big thoughts and cared deeply about a free society. I didn’t have the opportunity to develop a close relationship with Buchanan, but I felt privileged to take his classes and also to hear his insights in various conferences and colloquia during my years on campus.

I mention this connection because a Duke professor, Nancy MacLean, has just written a book that takes some very cheap shots at Buchanan. Heck, the title makes clear her agenda: Democracy in Chains: The Deep History of the Radical Right’s Stealth Plan for America. Subtle, huh?

I’ll openly admit at this point I have not read the book. I would, if somebody gave me a free copy, but I have no desire to potentially generate royalties for Ms. MacLean by spending money for a copy.

But a review in the Atlantic is a good example of why I think the book merits condemnation.

Nancy MacLean’s Democracy in Chains is part of a new wave of historiography that has been examining the southern roots of modern conservatism. …Her book includes familiar villains—principally the Koch brothers—and devotes many pages to think tanks like the Cato Institute and the Heritage Foundation, whose ideological programs are hardly a secret. But what sets Democracy in Chains apart is that it begins in the South, and emphasizes a genuinely original and very influential political thinker, the economist James M. Buchanan. …she has dug deep into her material—not just Buchanan’s voluminous, unsorted papers, but other archives, too—and she has made powerful and disturbing use of it all.

And what did she find that was so disturbing?

Brace yourself, because the giant scandal that she uncovered is that – gasp! – Buchanan was a classical liberal who believed in small government. And he consorted with other intellectuals with similar views.

The behind-the-scenes days and works of Buchanan show how much deliberation and persistence—in the face of formidable opposition—underlie the antigoverning politics ascendant today. …the University of Chicago, where Buchanan received his doctorate in 1948. During the postwar years, other faculty included Hayek and Friedman, who were shaping a new pro-market economics, part of a growing backlash against the policies of the New Deal. Hayek initiated Buchanan into the Mont Pelerin Society, the select group of intellectuals who convened periodically to talk and plot libertarian doctrine.

But here’s the disgusting part of the book, at least if the review accurately reflects the contents. MacLean does her best to imply that Buchanan somehow must be a racist. In part because of where he was born and raised.

Buchanan owed his tenacity to blood and soil and upbringing. Born in 1919 on a family farm in Tennessee.

By the way, the term “blood and soil” has very odious connotations. I don’t know if that term is used in the book. If not, then the reviewer, Sam Tanenhaus, is the one who deserves condemnation.

The book also implies that Buchanan is racist because he tried to take advantage of Virginia’s desegregation battle to push for school choice.

Buchanan played a part, MacLean writes, by teaming up with another new University of Virginia hire, G. Warren Nutter (who was later a close adviser to Barry Goldwater), on an influential paper. In it they argued that the crux of the desegregation problem was that “state run” schools had become a “monopoly,” which could be broken by privatization. If authorities sold off school buildings and equipment, and limited their own involvement in education to setting minimum standards, then all different kinds of schools might blossom.

And why is this supposed to be racist?

Because some rednecks might choose schools without black people.

…these schemes were…gave ammunition to southern policy makers looking to mount the nonracial case for maintaining Jim Crow in a new form. Friedman himself left race completely out of it. Buchanan did too at first, telling skeptical colleagues in the North that the “transcendent issue” had nothing to do with race; it came down to the question of “whether the federal government shall dictate the solutions.” But in their paper (initially a document submitted to a Virginia education commission and soon published in a Richmond newspaper), Buchanan and Nutter were more direct, stating their belief that “every individual should be free to associate with persons of his own choosing”.

In other words, we’re supposed to believe that Buchanan was racist simply because some people – in a system based on freedom of choice – might make race-based decisions.

But that’s like saying advocates of free speech are racist because some people will make racist statements or write racist books.

For what it’s worth, I wish the racist Democrats who controlled the state in the 1950s had adopted school choice. After all, the ultimate effect of their actions would have been very beneficial for black students.

That would have been delicious irony.

But I’m digressing. I wonder whether Tannenhaus is the one who is guilty of smearing rather than the author. His review, after all, notes that MacLean apparently didn’t think Buchanan’s work was motivated by race.

…race, MacLean acknowledges, was not ultimately a major issue for Buchanan.

The review then shifts to Buchanan’s main intellectual legacy, the “public choice” school of economics (first formally proposed in Calculus of Consent, co-authored with Gordon Tullock).

Governments, they argued, were being assessed in the wrong way. The error was a legacy of New Deal thinking, which glorified elected officials and career bureaucrats as disinterested servants of the public good, despite the obvious coercive effects of the programs they put into place. Why not instead see politicians and government administrators as self-interested players in the marketplace, trying to “maximize their utility”—that is, win the next election or enlarge their department’s budget? This idea turned the whole notion of a beneficent government, and of programs and policies designed more or less selflessly, into a kind of fairy tale expertly woven by politicians and their flacks. Not that politicians were evil. They were looking out for themselves, as most of us do. The difference was in the damage they did.

Sounds quite reasonable to me. And Tanenhaus even grants that the theory has some merit.

You didn’t have to accept Buchanan’s ideology to see that he had a point about the growth of government-centered clientelism—“dependency,” in the term used by a new wave of neoconservatives such as Daniel Patrick Moynihan.

But he then is very critical of Buchanan’s support for rules to constrain government.

The enemy was the public itself, expressed through the tyranny of majority rule… It wasn’t enough to elect true-believing politicians. The rules of government needed to be rewritten.

Actually, the rules don’t need “to be rewritten.” The United States already has a Constitution that was explicitly designed to protect against majoritarianism. The problem is justices who put politics first and the Constitution second.

Now let’s address a second part of the book that irked me. The author links Buchanan to Chile, which to a leftist is an automatic sign of guilt.

…in Chile, after Augusto Pinochet’s coup against the socialist Salvador Allende in 1973. A vogue for public choice had swept Pinochet’s administration. Buchanan’s books were translated, and some of his acolytes helped restructure Chile’s economy. Labor unions were banned, and social security and health care were both privatized. On a week-long visit in 1980, Buchanan gave formal lectures to “top representatives of a governing elite that melded the military and the corporate world,” MacLean reports, and he dispensed counsel in private conversations.

There’s no evidence, from what I can tell, that Buchanan endorsed or supported Pinochet’s bad record on human rights. Instead, he’s simply “guilty” of encouraging a bad government to adopt good policy.

But if providing policy advice supposedly implies support for everything a government does, then I’m guilty of supporting Russia, China, and many other regimes. Needless to say, that’s nonsense.

In any event, here’s the part that doesn’t make sense.

Buchanan said very little about his part in assisting Chile’s reformers—and he said very little, too, when the country’s economy cratered, and Pinochet at last fired the Buchananites.

The economy “cratered”? Really?

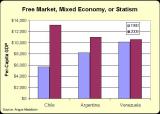

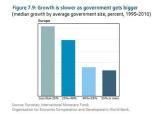

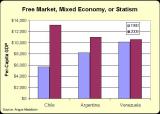

Chile has been a star performer  since the market reforms on the 1980s.

since the market reforms on the 1980s.

Maybe MacLean and/or Tanenhaus are geographically illiterate and meant Venezuela?

Because only a blind ideologue could deny the tremendous success of Chile’s economy.

Now let’s look at some excerpts from a review in Slate written by Rebecca Onion. It starts with a major smear.

When the Supreme Court decided, in the 1954 case of Brown vs. Board of Education, that segregated public schools were unconstitutional, Tennessee-born economist James McGill Buchanan was horrified.

Again, I haven’t read the book. But I have to imagine that if the author had the slightest bit of evidence, one of the reviews would have shared it. Instead, we get nothing but assertions. Is MacLean the one who smears Buchanan, or are the reviewers guilty of asserting that the Nobel Laureate is somehow racist because he doesn’t support a big welfare state?

I don’t know, but someone is being grossly unfair.

For what it’s worth, I never caught even the slightest whiff of racism from Buchanan during my time at GMU. Which stands to reason since libertarians and classical liberals are all about individual rights and view racism as a form of collectivism.

But it is true that Buchanan was not a fan of big government.

…the libertarian thinker found comfortable homes at a series of research universities and spent his time articulating a new grand vision of American society, a country in which government would be close to nonexistent, and would have no obligation to provide education—or health care, or old-age support, or food, or housing—to anyone.

Ms. Onion’s review includes a Q&A section with the author.

Here’s some of what MacLean said, starting with a description of public choice.

He had a very different personality from somebody like Milton Friedman. …His books were really written for other scholars, not so much the general public. …His basic idea is that people had been wrong to think of political actors as concerned with the common good or the public interest, when in fact, according to Buchanan’s way of looking at things, everyone should be understood as a self-interested actor seeking their own advantage.

She then asserts – with no evidence – that public choice isn’t an accurate way of describing the world.

…there were other people who actually tested that empirically and found out that it didn’t hold, so it’s really a caricature of the political process, but it’s a caricature that’s become very, very widespread right now.

This strikes me as nonsense. Anybody who works in DC has a very jaundiced view of the political process.

We see public choice in action every day.

She also criticizes Buchanan’s work in Chile.

…he went from writing that to advising the Pinochet junta in Chile on how to craft their constitution. This document was later called a “constitution of locks and bolts,” [and was designed] to make it so that the majority couldn’t make its will felt in the political system, unless it was a huge supermajority. So yeah, it’s pretty dark.

Well, if that’s a “dark” approach, then America’s Founders were very dark as well.

MacLean also links Buchanan to Cato.

Buchanan helped with the founding of the Cato Institute and with various other intellectual enterprises that were close to Charles Koch’s heart, like this thing called the Institute for Humane Studies.

She then plays armchair psychologist and tries to guess Buchanan’s real motivation. After all, surely he couldn’t have been motivated by a belief in liberty and limited government?

I think it’s also much more about this psychology of threatened domination. People who believe it will harm their liberty for other people to have full citizenship and be able to work together to govern society. And that somehow that goes much deeper than money to me. It’s hard to find the right words for it, but it’s a whole way of being in the world and seeing others. Assuming one’s right to dominate.

In other words, if you don’t want a tax-and-transfer welfare state, that means you want to dominate others. Amazing bit of mind reading.

Or perhaps a bit of projection.

Or perhaps a bit of projection.

It’s folks on the left, after all, who concoct strange theories involving Koch, Cato, and other parts of a vast libertarian conspiracy.

If we really had that much power, I can assure you that government would be much smaller than it is today.

Here’s what MacLean says about Buchanan being part of the supposedly sinister Koch network.

The most important thing I want readers to take from this book is an understanding that the Koch network and all of these people are doing what they’re doing because they understand that their ideas make them a permanent minority. They cannot win if they are honest about what they’re doing.

Let’s close by sharing some very bizarre passages from a review by Genevieve Valentine for NPR.

…economist James Buchanan — an early herald of libertarianism — began to cultivate a group of like-minded thinkers with the goal of changing government. This ideology eventually reached the billionaire Charles Koch… This sixty-year campaign to make libertarianism mainstream…is at the heart of Democracy in Chains.

Here’s Ms. Valentine’s contribution to gutter politics.

…this isn’t the first time Nancy MacLean has investigated the dark side of the American conservative movement (she also wrote Behind the Mask of Chivalry: The Making of the Second Ku Klux Klan).

A collectivist-minded group like the KKK was part of the conservative movement? Is there any evidence for that slanderous assertion?

Of course not.

And besides, what would that have to do with libertarianism?

But Ms. Valentine is just warming up. Did you know that libertarians somehow are at fault for the incompetence of Flint, MI, which is governed by Democrats?

As MacLean lays out in their own words, these men developed a strategy of misinformation and lying about outcomes until they had enough power that the public couldn’t retaliate against policies libertarians knew were destructive. (Look no further than Flint, MacLean says, where the Koch-funded Mackinac Center was behind policies that led to the water crisis.)

And she repeats the crazy assertion that Chile’s shift to free markets backfired, even though the economy boomed and subsequent governments dominated by Social Democrats have left the reforms in place.

By the time we reach Buchanan’s role in the rise of Chilean strongman Augusto Pinochet (which backfired so badly on the people of Chile that Buchanan remained silent about it for the rest of his life), that’s all you need to know about who Buchanan was.

It’s also remarkable that she wants us to think there’s something sinister about Buchanan remaining “silent” about his role in Chile.

This is a man who gave dozens of speeches every year in countries all over the world, while also producing all sorts of books and scholarly articles. Does she really think he was supposed to spend his time reminiscing about a couple of speeches and meetings back in 1980?

Here’s the bottom line. Professor Buchanan is “guilty” of believing in individual liberty and favoring constraints on government. It’s perfectly fair for folks on the left to object to those views (as well as the views of other Nobel Laureates with similar outlooks).

But when they want to ascribe base motives for his views, without the slightest shred of evidence, that’s crossing the line.

P.S. You probably won’t be surprised to learn that Ms. MacLean’s book was subsidized by taxpayers. Isn’t that wonderful. Not only do we subsidize international bureaucracies that push statism, we taxpayers also subsidize hit jobs on scholars who object to statism.

Read Full Post »

We’ve all heard scare stories about how that works in practice; these stories are false.”

We’ve all heard scare stories about how that works in practice; these stories are false.”…the couple, from Bedfont, west London, raised almost £1.4million so they could take their son to America but a series of courts ruled in favour of the British doctors. …the ECHR rejected a last-ditch plea and their ‘final’ decision means the baby’s life support machine will be switched off. …It comes after a High Court judge in April ruled against a trip to America and in favour of Great Ormond Street doctors. …Specialists in the US have offered a therapy called nucleoside. …barrister Richard Gordon QC, who leads Charlie’s parents’ legal team, …said parents should be free to make decisions about their children’s treatment unless any proposal poses a risk of significant harm. …Charlie’s parents have raised nearly £1.4million to pay for therapy in America.

…successive courts in the United Kingdom and in Europe simultaneously found that Connie Yates and Chris Gard had devoted themselves unhesitatingly to their son’s welfare for ten months, and also that Yates and Gard could not be trusted to act in their son’s best interests. …pertinent to this case, under what circumstances should the tightest bonds of affection — those between parent and child — be subordinated to the judgment of the state?