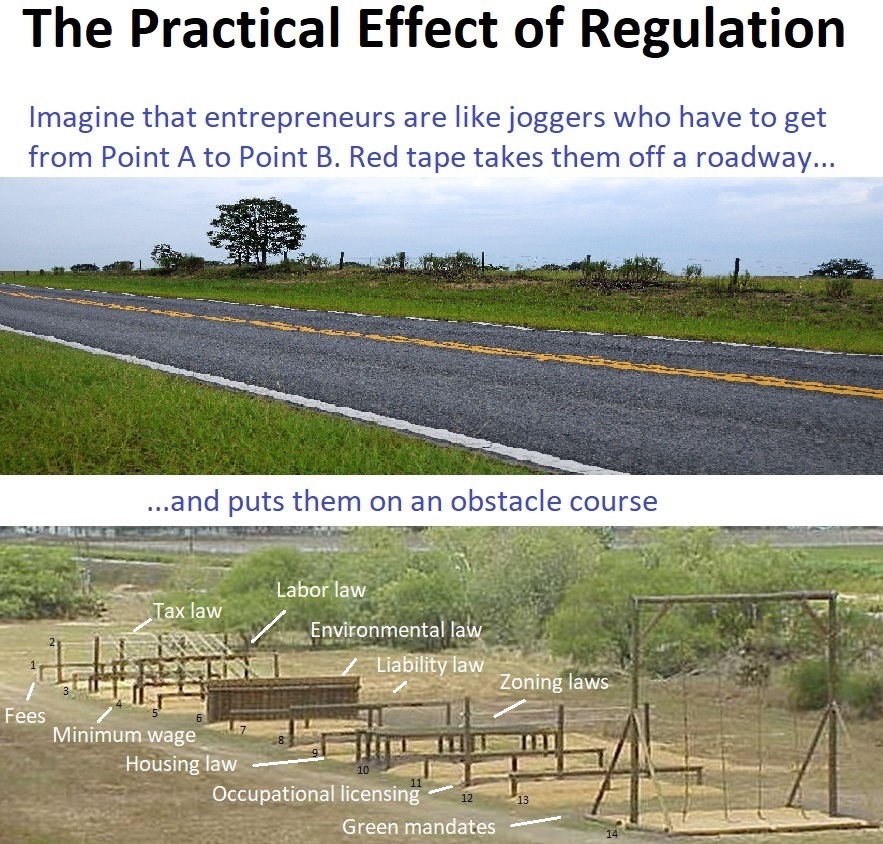

While specific examples can be very complex, the economic analysis of regulation is, at least in theory, quite simple.

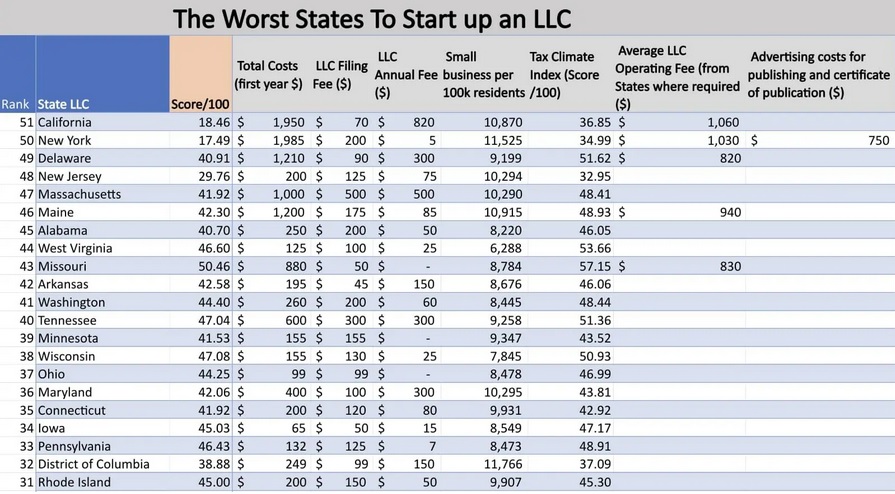

Rules and red tape impose burdens that hinder economic activity, and this leads to higher costs for businesses and consumers.

Rules and red tape impose burdens that hinder economic activity, and this leads to higher costs for businesses and consumers.

These higher costs may be justified in some cases. That’s why it’s important to have high-quality cost-benefit analysis.

But in many cases, such analysis will show that regulation doesn’t make sense.

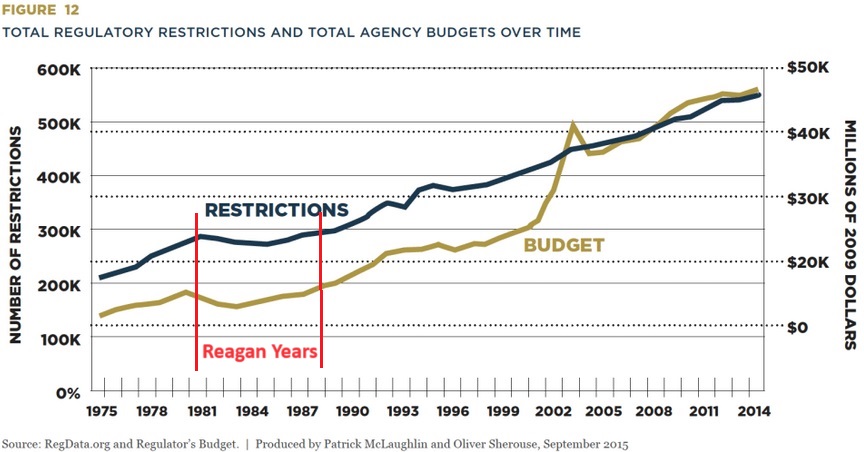

Fortunately, some presidents have understood that too much regulation is bad for prosperity.

Consider, for instance, the excellent track record of Jimmy Carter. We’ll start with an article by Norm Singleton for RealClearMarkets.

…deregulation was a major part of Carter’s economic agenda and one of the greatest aspects of his legacy. It’s something that Carter and Reagan had in common, not something that set them apart. Carter—and other leading progressives at the time such as Ralph Nader—understood…Regulation frequently, if not always, benefits big businesses…at the expense of small businesses and most importantly, consumers.  …the Civil Aeronautics Board (CAB), set airline routes, flight, schedules, and even prices. The result was 10 airlines enjoyed a de facto government-protected 90% of the air travel market: a monopoly with extra steps. This supposedly “pro-consumer” regulatory system made flying unaffordable for many Americans. Consequently, Carter signed the Airline Deregulation Act of 1978, ending the CAB’s power to control air travel. The result was new airlines entering the market offering lower prices and expanded routes. …Carter also pushed Congress to deregulate trucking and railroads.

…the Civil Aeronautics Board (CAB), set airline routes, flight, schedules, and even prices. The result was 10 airlines enjoyed a de facto government-protected 90% of the air travel market: a monopoly with extra steps. This supposedly “pro-consumer” regulatory system made flying unaffordable for many Americans. Consequently, Carter signed the Airline Deregulation Act of 1978, ending the CAB’s power to control air travel. The result was new airlines entering the market offering lower prices and expanded routes. …Carter also pushed Congress to deregulate trucking and railroads.

Here are some details on the benefits of trucking deregulation, from a study by Andrew Crain published in the Journal on Telecommunication and High Tech Law.

The ICC was given jurisdiction over trucking companies and prevented competitive entry by rarely granting new trucking permits. The development of efficient trucks should have been a great boon to shippers. …ICC regulations, however, prevented truckers from offering those benefits to consumers. Trucking companies were forced to travel set routes at set prices. …During his presidential campaign, Carter promised to pursue deregulation. …Carter was good to his word. In 1979, he appointed three deregulation proponents to the ICC, Darius B. Gaskins, Marcus Alexis and Thomas Trantum. …In July 1980, Carter signed the Motor Carrier Act, which lifted most restrictions on entry, on the goods truckers could carry, and on the routes they could travel. …Rates fell, and trucking companies multiplied.

Trucking companies were forced to travel set routes at set prices. …During his presidential campaign, Carter promised to pursue deregulation. …Carter was good to his word. In 1979, he appointed three deregulation proponents to the ICC, Darius B. Gaskins, Marcus Alexis and Thomas Trantum. …In July 1980, Carter signed the Motor Carrier Act, which lifted most restrictions on entry, on the goods truckers could carry, and on the routes they could travel. …Rates fell, and trucking companies multiplied.

Jeremy Lott discusses Carter’s achievement on rail deregulation in a piece for the Washington Examiner.

The same regulatory regime had been in place since the Interstate Commerce Act of 1887, which regulated railroads…with price controls and mandates…. The elected official who took the lead on changing things is the person for whom the Staggers Act is named, Democratic Rep. Harley Staggers of West Virginia, then the chairman of the House Interstate and Foreign Commerce Committee. “The good thing about the Staggers Act is that it eliminated or greatly reduced federal regulation over most railroad operations that had been slowly killing the industry over decades. Freight railroads on life support were freed from rigid price controls and service mandates and quickly began to rebound, became profitable again, and U.S. freight railroads are once again the top-performing freight rail system in the world,” Marc Scribner…told the Washington Examiner. …”Over the past 40 years, rail traffic has doubled … rail rates are down more than 40% when adjusted for inflation … and recent years have been the safest on record,” the AAR said.

“The good thing about the Staggers Act is that it eliminated or greatly reduced federal regulation over most railroad operations that had been slowly killing the industry over decades. Freight railroads on life support were freed from rigid price controls and service mandates and quickly began to rebound, became profitable again, and U.S. freight railroads are once again the top-performing freight rail system in the world,” Marc Scribner…told the Washington Examiner. …”Over the past 40 years, rail traffic has doubled … rail rates are down more than 40% when adjusted for inflation … and recent years have been the safest on record,” the AAR said.

And Ian Jefferies of the Association of American Railroads, in a column for the Wall Street Journal, explained how the industry has improved with less red tape.

…there was a time when both parties could agree on the benefit of…regulatory reform. The bipartisan Staggers Rail Act of 1980, passed by a Democratic Congress and signed by President Jimmy Carter, deregulated the freight railroad industry. …Previously, railroad rates and service were set by government, and carriers were often forced to provide service on lines lacking commercial viability. …The impact on railroads was predictable and disastrous. At one point, 1 in 5 rail miles was serviced by bankrupt railroads. …deregulation was chosen over nationalization, which would have cost taxpayers billions of dollars. …the Staggers Act not only improved service along the mainline network; it helped give birth to a short-line rail industry that today operates 50,000 miles of the 140,000-mile network that spans across the United States. …Since 1980, freight railroads have poured more than $710 billion of their own funds back into their operations. Average rail rates are 43% lower today than in 1981 when adjusted for inflation. This translates into at least $10 billion in annual savings for U.S. consumers.

…The impact on railroads was predictable and disastrous. At one point, 1 in 5 rail miles was serviced by bankrupt railroads. …deregulation was chosen over nationalization, which would have cost taxpayers billions of dollars. …the Staggers Act not only improved service along the mainline network; it helped give birth to a short-line rail industry that today operates 50,000 miles of the 140,000-mile network that spans across the United States. …Since 1980, freight railroads have poured more than $710 billion of their own funds back into their operations. Average rail rates are 43% lower today than in 1981 when adjusted for inflation. This translates into at least $10 billion in annual savings for U.S. consumers.

Michael Derchin’s column in the Wall Street Journal notes how a retiring Supreme Court Justice played a key role in deregulating air travel.

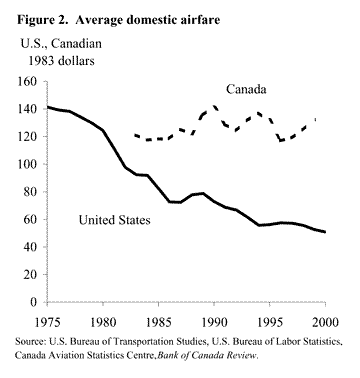

Justice Breyer, who joined the Supreme Court in 1994 and plans to retire this summer, has cited his research for the Airline Deregulation Act as among his best and most significant work. …The late Sen. Edward M. Kennedy reached out to Mr. Breyer in 1975. Kennedy…saw deregulation as key to increasing competition and making air travel more affordable. Mr. Breyer, then a professor at Harvard Law School, worked with Kennedy… The Airline Deregulation Act of 1978 passed with bipartisan support and created a free market in the commercial airline industry. Government control of fares, routes and market entry for airlines was removed, and the Civil Aeronautics Board’s regulatory powers were phased out. …Since deregulation, average domestic round-trip real airfares have plunged about 60%, to $302 from $695. Load factors—the percentage of seats filled on each flight—stood at 84% just before the pandemic, compared with 55% before deregulation. In the early 1970s, 49% of U.S. adults had flown. In 2020 the share was 87%.

Mr. Breyer, then a professor at Harvard Law School, worked with Kennedy… The Airline Deregulation Act of 1978 passed with bipartisan support and created a free market in the commercial airline industry. Government control of fares, routes and market entry for airlines was removed, and the Civil Aeronautics Board’s regulatory powers were phased out. …Since deregulation, average domestic round-trip real airfares have plunged about 60%, to $302 from $695. Load factors—the percentage of seats filled on each flight—stood at 84% just before the pandemic, compared with 55% before deregulation. In the early 1970s, 49% of U.S. adults had flown. In 2020 the share was 87%.

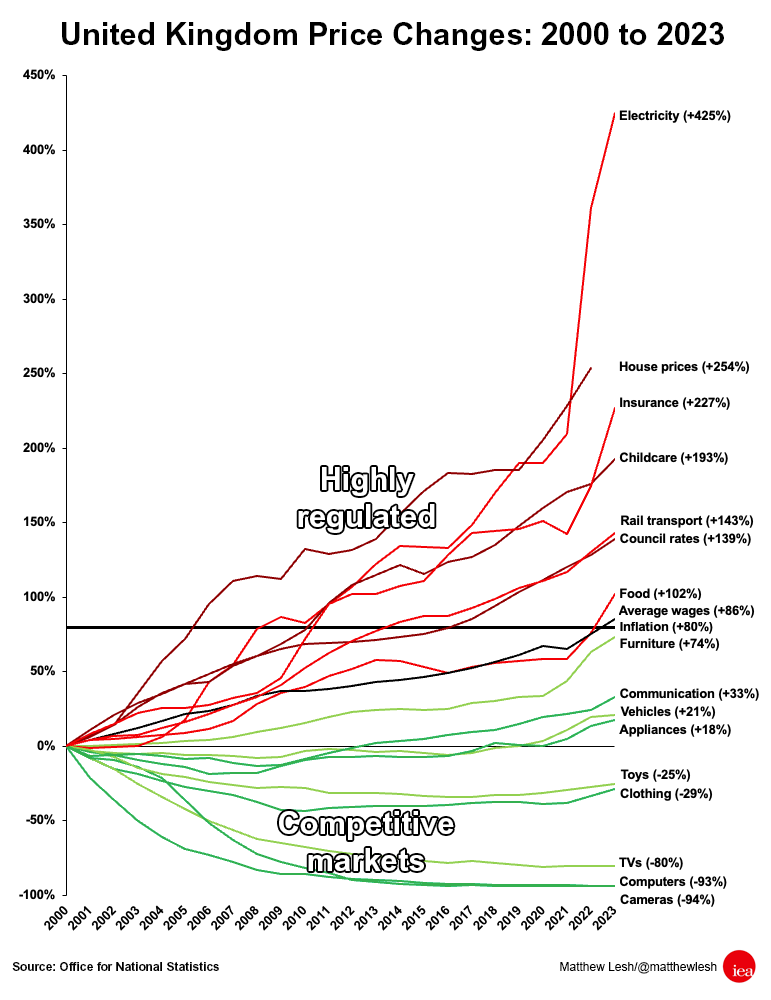

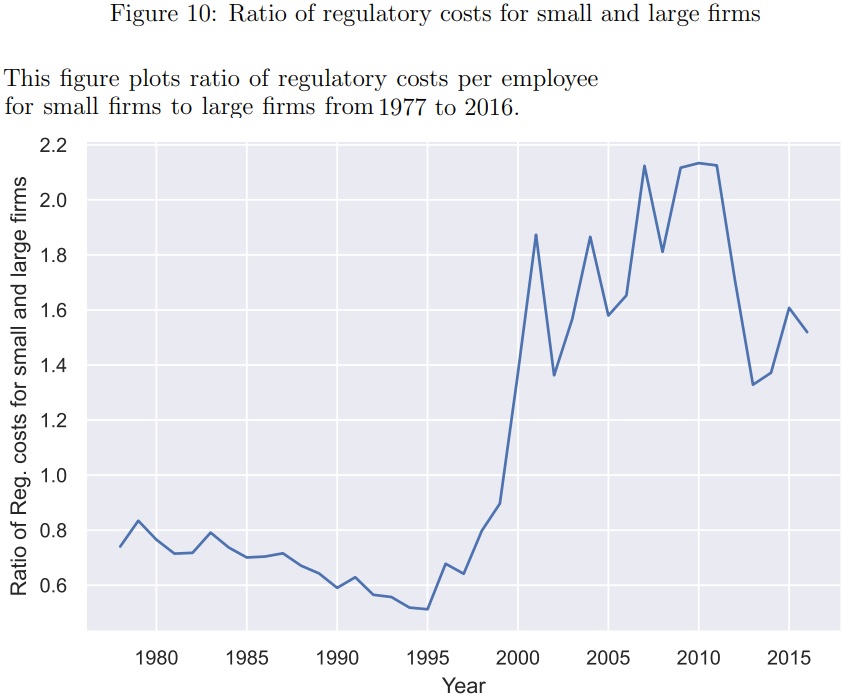

Here’s a chart showing how consumers have been big winners.

So what’s the bottom line?

As Phil Gramm and Mike Solon explained last year in the Wall Street Journal, the United States is still enjoying the fruits of Jimmy Carter’s deregulatory achievements.

Far from hurting consumers, as progressive myth alleges, deregulation of the U.S. transportation system unleashed a wave of invention and innovation that reduced logistical transportation cost—the cost of moving goods as a percentage of gross domestic product—by an astonishing 50% over 40 years. Airline fares were cut in half on a per mile basis, while air cargo surged from 5.4% of all shipments to 14.5% by 2012… In this Carter-Kennedy led reform, the duty of government was to protect the consumer from harm, not to protect the producer from competition. Without the productive energy released by deregulating airlines, trucking, railroads…, the U.S. might not have found its competitive legs as its postwar dominance in manufacturing ended in the late 1970s. The benefits of deregulation to this day continue to make possible powerful innovations that remake the world.

That’s the good news.

The bad news is that Joe Biden is hardly another Jimmy Carter.

P.S. Daniel Bier, in a column for the Foundation for Economic Education, points out that Carter even deserves credit for deregulating the beer market.

Carter’s most lasting legacy is as the Great Deregulator. Carter deregulated oil, trucking, railroads, airlines, and beer. …In 1978, the USA had just 44 domestic breweries. After deregulation, creativity and innovation flourished in the above-ground economy. Today, there are 1,400 American breweries. And home brewing for personal consumption is also now legal.

…In 1978, the USA had just 44 domestic breweries. After deregulation, creativity and innovation flourished in the above-ground economy. Today, there are 1,400 American breweries. And home brewing for personal consumption is also now legal.

If you want to know more about beer deregulation, click here. If you want to know who makes a lot of money from beer sales, click here.

P.P.S. Jimmy Carter didn’t have a good record on fiscal issues, but he was more frugal than almost every Republican president over the past six decades (with Reagan being the obvious exception).

Read Full Post »

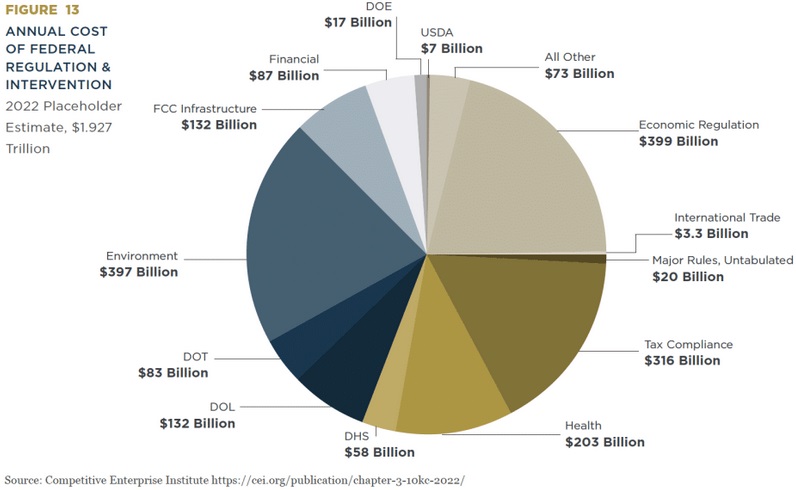

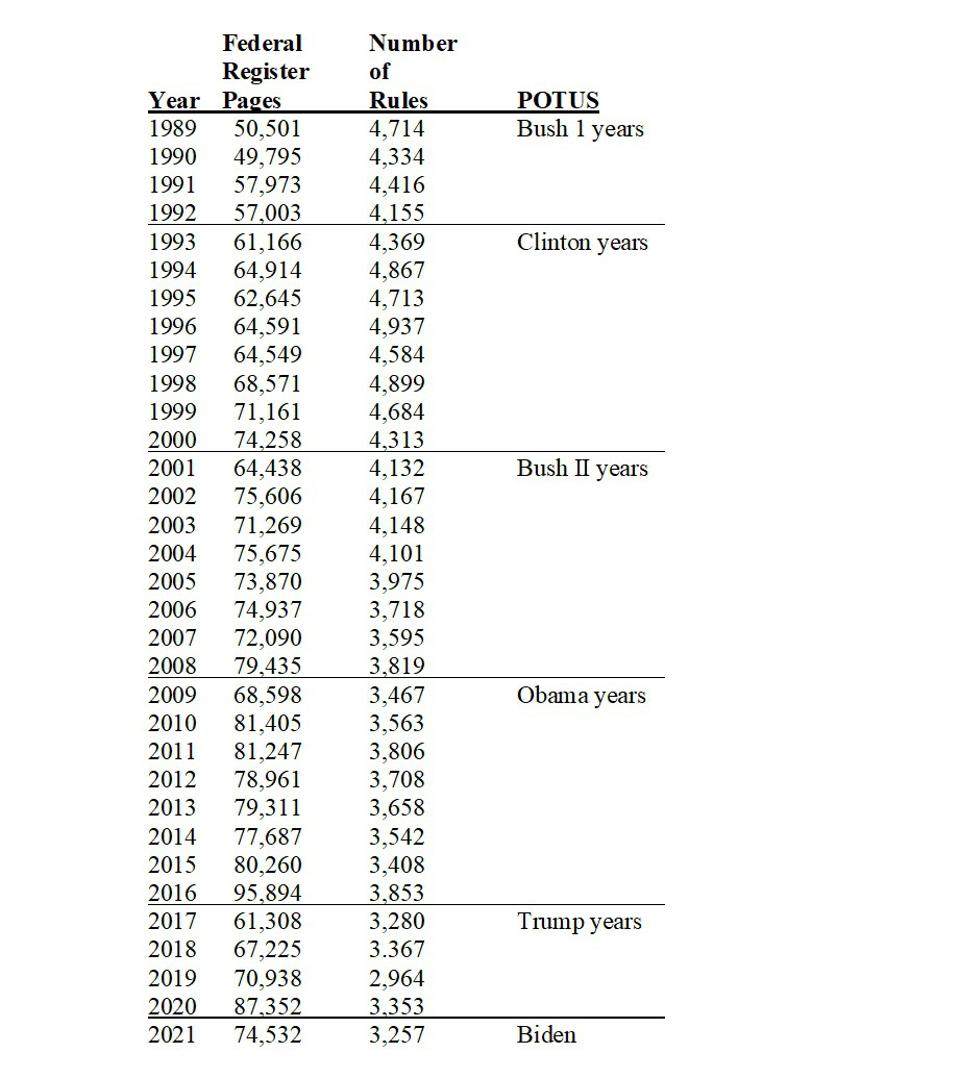

it is possible to provide weekly updates on how the top-level trends of President Biden’s regulatory record track with those of his two most recent predecessors. …This past week’s regulatory haul has pushed the Biden Administration’s final rule cost tally into truly uncharted territory. …For perspective, if “Biden Administration Regulatory Costs” were a country, its gross domestic product would rank 17th in the world, just behind Indonesia.