While President Javier Milei is easily the best head of state right now, it would be more difficult to pick the best head of state in my lifetime.

It may turn out to be Milei, depending on whether he ultimately can convince a hostile legislature to unshackle Argentina’s dirigiste economy.

It may turn out to be Milei, depending on whether he ultimately can convince a hostile legislature to unshackle Argentina’s dirigiste economy.

Based on actual accomplishments, however, the choice would be between Ronald Reagan and Margaret Thatcher.

Today, let’s focus on Britain’s Iron Lady.

As explained in a great documentary film, she rejuvenated the U.K. economy with a wide range of good policies that addressed major impediments to national prosperity.

- Slashing confiscatory tax rates

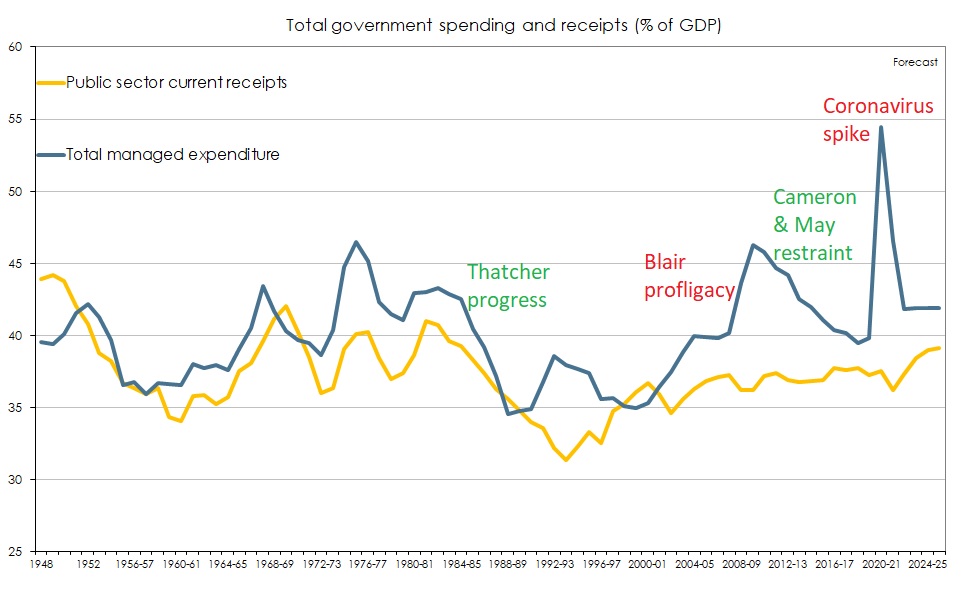

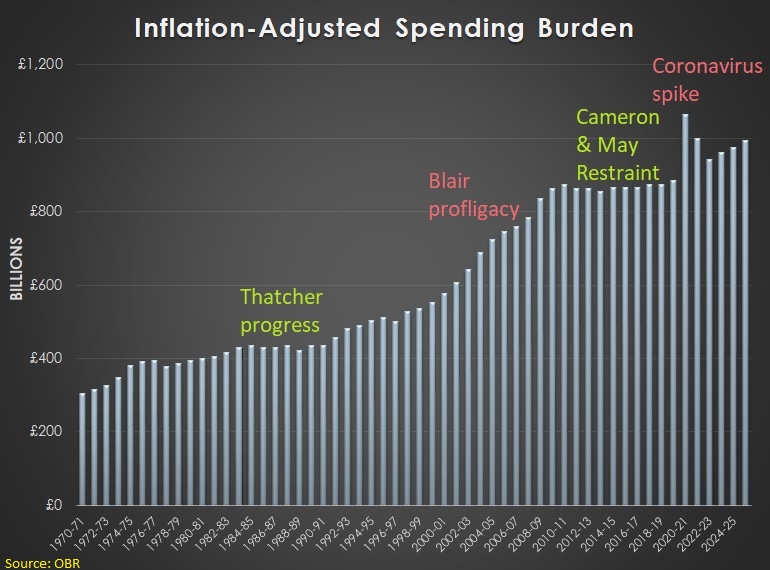

- A reduced burden of government spending

- Privatization of state-run companies

- Reducing runaway inflation

Yet not everyone is a fan of Ms. Thatcher.

In an article for World Politics Review, Alexander Clarkson claims that the Conservative Party is in trouble because it is enthralled with Thatcherism.

…the collapse of support for the Tory Party…may also be the product of…efforts by successive governments since former Prime Minister Margaret Thatcher took power in 1979 to restructure the state along market-oriented lines. …When market-friendly, neoliberal approaches to governance failed to achieve expected outcomes, each new generation of Tory leaders convinced themselves

that success would only be possible through doubling-down on ideological purity… Tory-led governments that followed under then-Prime Minister David Cameron in the 2010s were driven by a deeply held belief that shrinking the state was the only pathway to generating the economic growth needed… there are strong parallels between the former Soviet Union’s obsession with governing along supposedly “scientific” lines and the Thatcherite Tory Party’s belief that societies are shaped by rigidly predetermined laws of economic behavior. …it is no wonder that so much of the working-age population has turned against the political party whose ideological paradigms have dominated British governance since the 1970s.

This is nonsensical analysis.

Yes, various Tory leaders have paid lip service to Thatcher (much as U.S. Republicans in recent decades have said nice things about Reagan), but there’s a big difference between talking and doing.

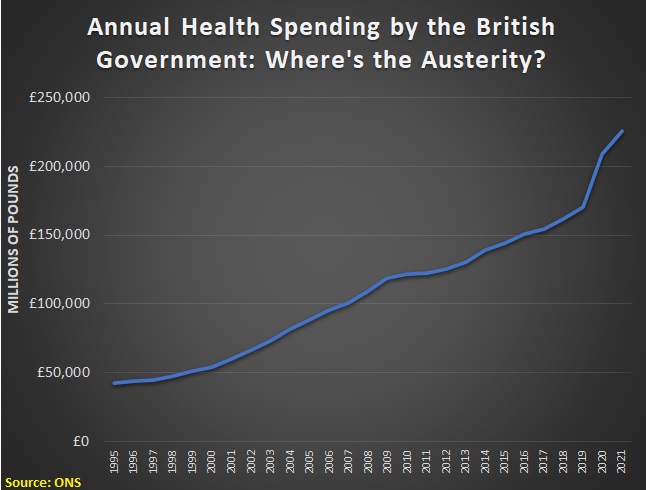

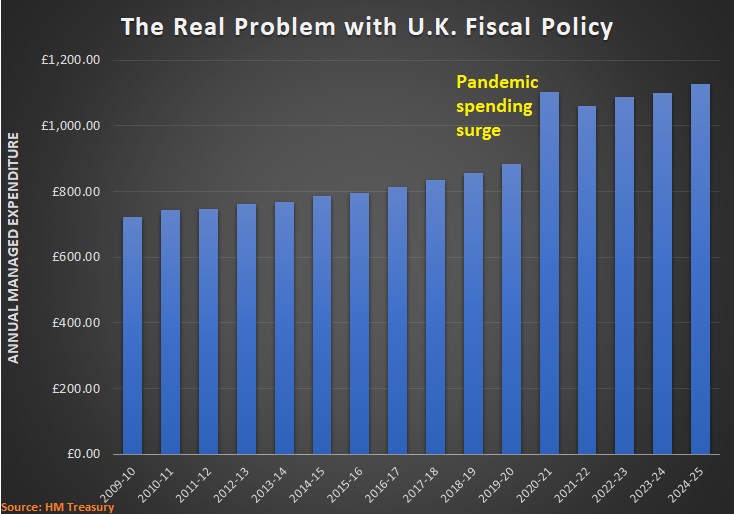

And the various Conservative Party leaders this century (Cameron, May, Johnson, and Sunak) have not delivered Thatcher-type reform.

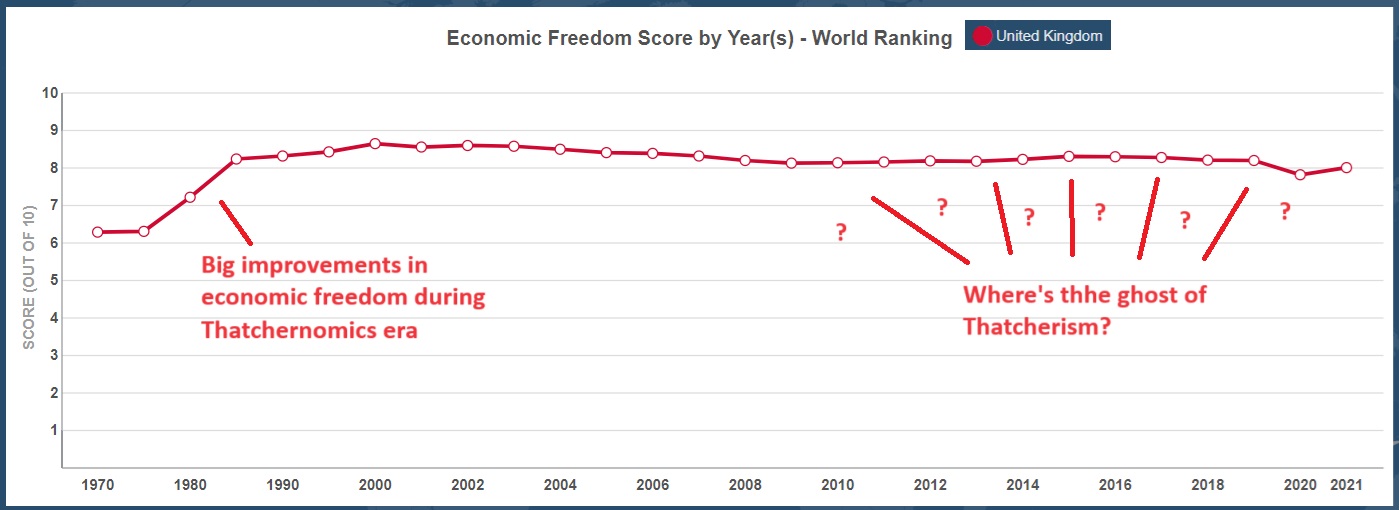

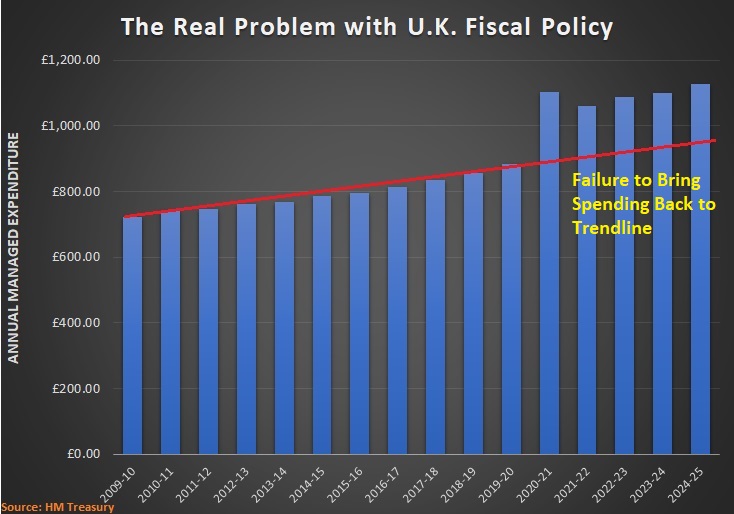

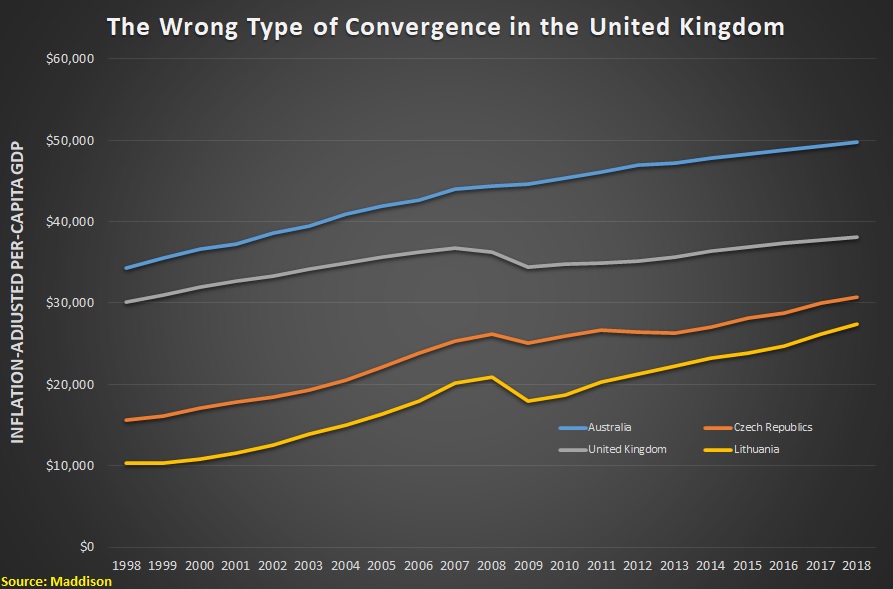

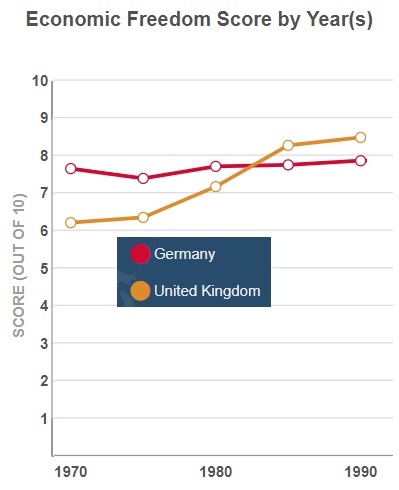

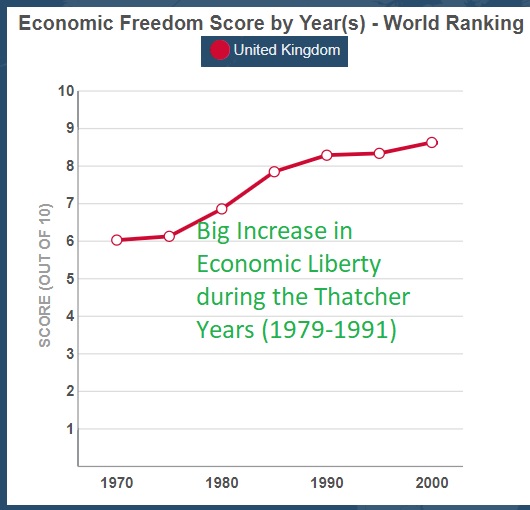

The chart at the start of this column shows how the U.K.’s score for economic freedom jumped significantly under Thatcher. Let’s now look at the same data, but for 1970-2021, not just 1970-2000.

Lo and behold, we see that recent Conservative Party leaders (the Tories have been in power since 2010) have not improved economic policy. At all. Indeed, there’s been a slight downward trajectory.

At the risk of understatement, Thatcher’s ghost must be very disappointed.

To be fair, it would have been very difficult for recent Tory leaders to produce dramatic improvements. After all, policy in 2010 was not nearly as bad as it was when Thatcher took office.

So I would have applauded modest improvement. But I will not cheer for modest decline.

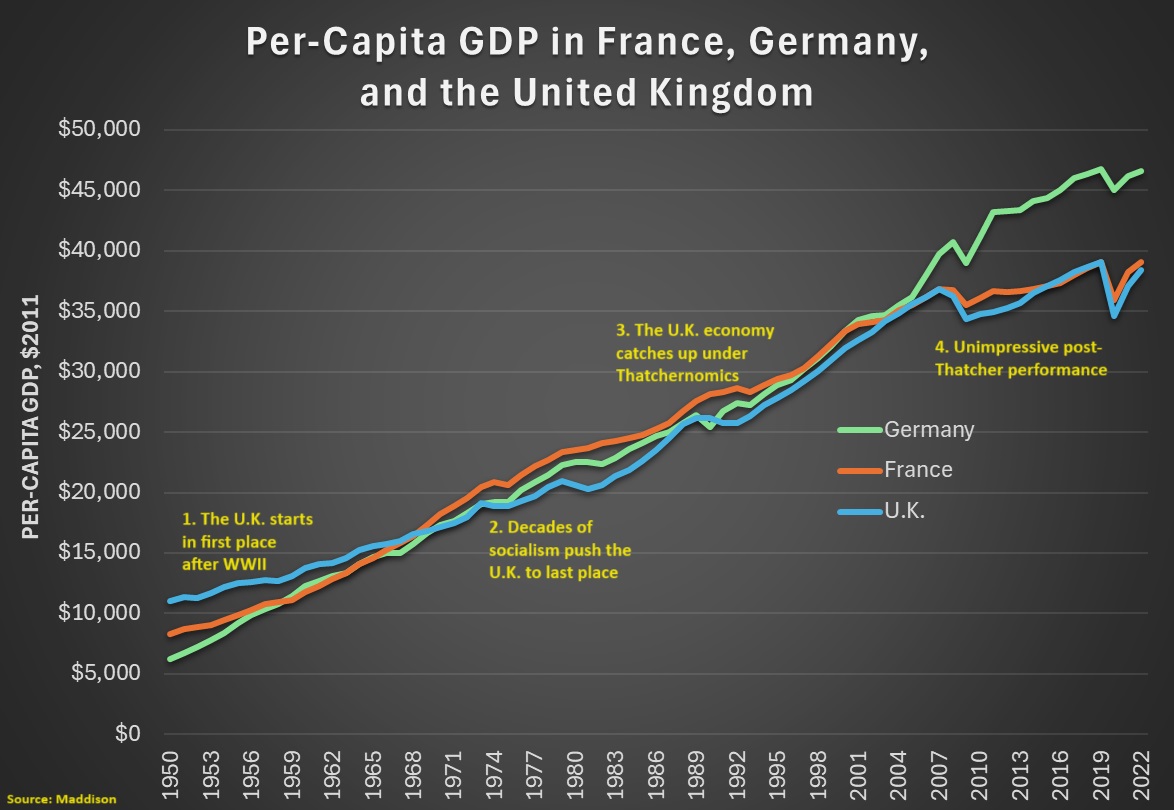

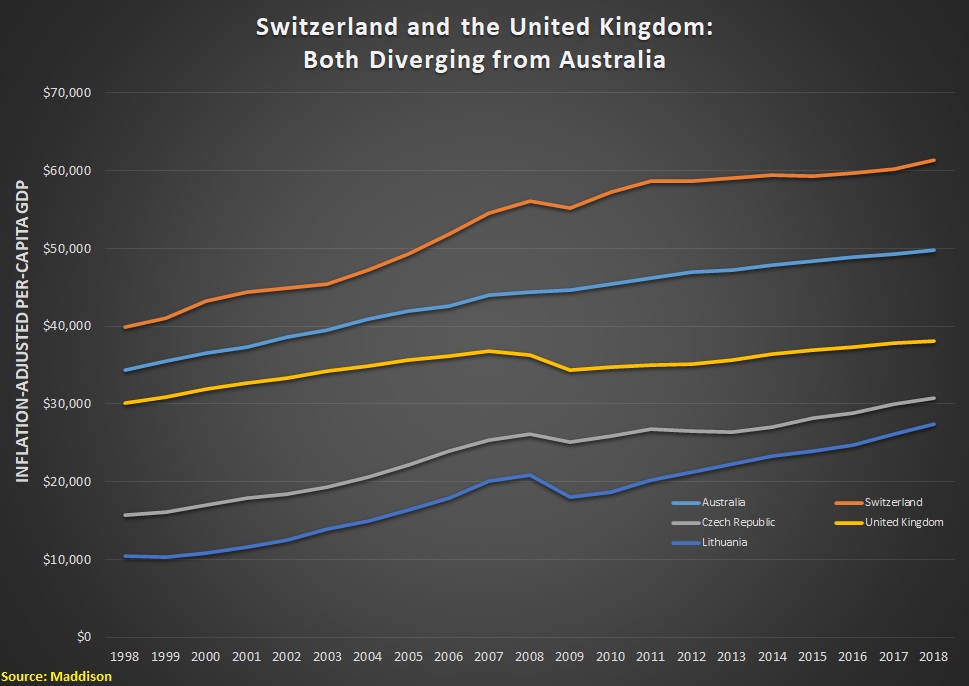

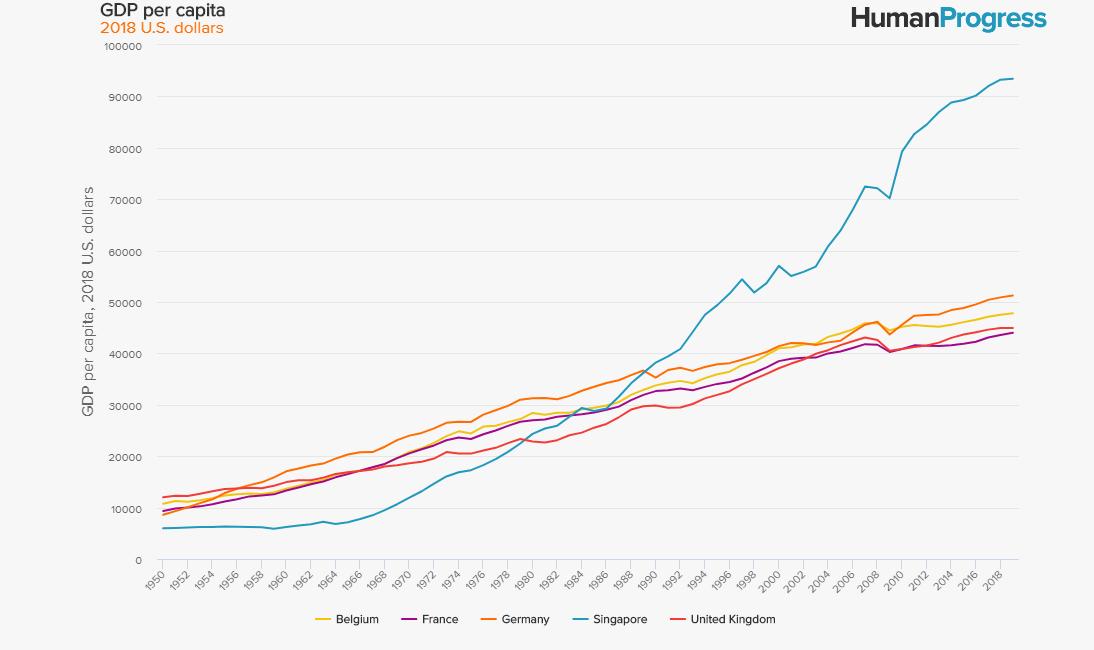

Here’s another chart in defense of Thatchernomics. It shows per-capita GDP in the big economies of Western Europe starting in 1950.

You can see that the United Kingdom started with a big lead (presumably a legacy of WWII destruction on the European mainland).

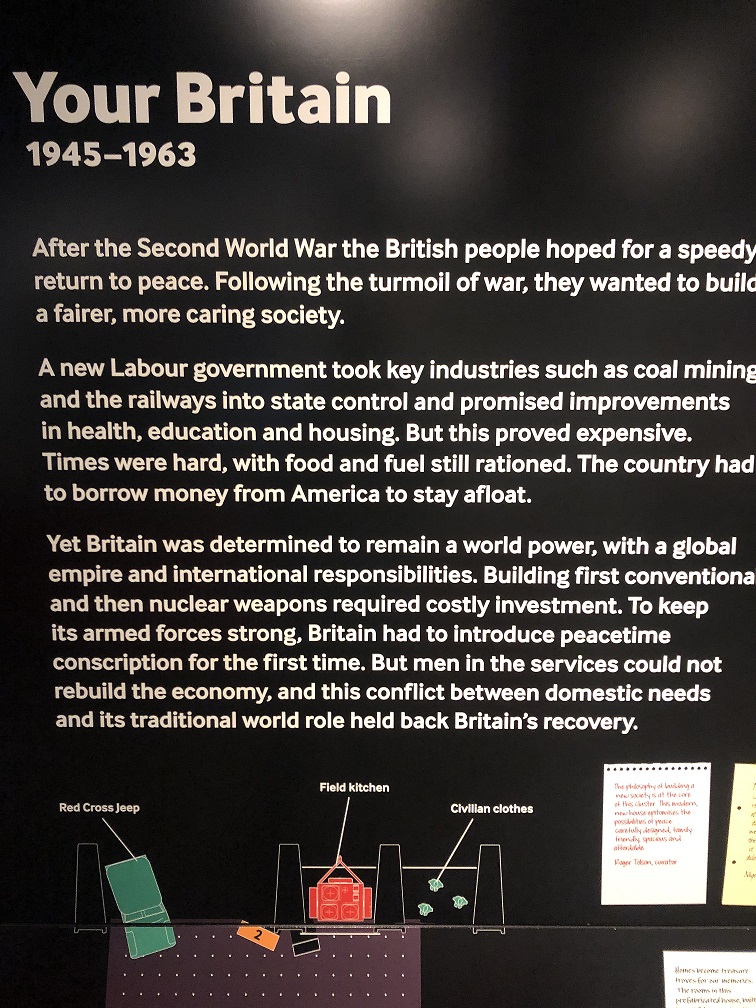

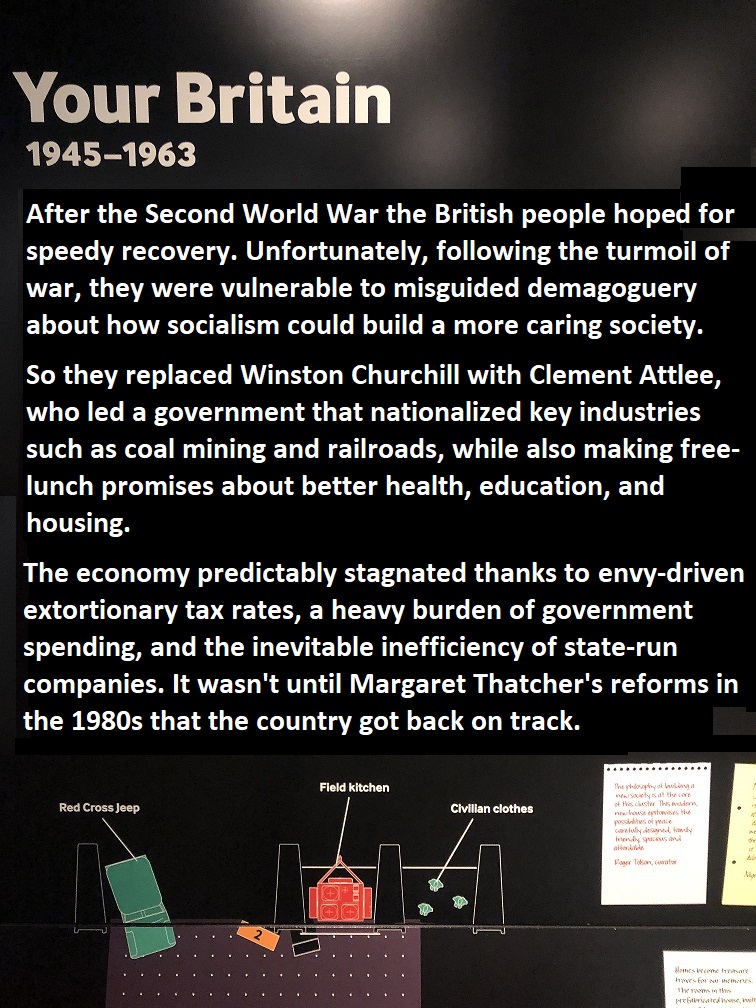

However, France and Germany soon caught up. And then they passed the U.K. (blame Clement Attlee’s post-war socialism).

Notice, though, how the U.K. economy grew faster under Thatchernomics and closed the gap.

Interestingly, while France and the U.K. have been close ever since, Germany opened up a lead (though recent missteps on fiscal and energy policy make me wonder whether the current gap will close.

The bottom line is that the United Kingdom still needs Thatcherism (just like the United States still needs Reaganism).

P.S. I can’t resist sharing one additional excerpt from Clarkson’s article.

Thatcher famously went from championing the deepening of the EU’s Single Market in the 1980s to espousing Euroskepticism.

Clarkson seems to think this reflects poorly on Thatcher, but it actually reflects poorly on the European Union. Thatcher liked the E.U. when it was a free-trade area based on mutual recognition, but she became disillusioned as it morphed into a supra-national bureaucracy pushing harmonization, centralization, and bureaucratization.

P.P.S. I didn’t include Liz Truss in the list of Tory leaders this century because she was only in office 44 days and didn’t have a chance to implement any policies. It would have been interesting if she stayed in power since she wanted pro-growth tax policy, though I wrote back in 2022 that she “should have announced a spending cap, modeled on either the Swiss Debt Brake or Colorado’s TABOR.” I also noted that “In addition to worrying about whether Truss will copy Thatcher’s track record on spending, I’m also worried about her support for misguided energy subsidies.