While it’s quite clear that the establishment media leans to the left, I don’t get too agitated about bias. Though every so often I can’t resist the temptation to comment when I come across egregious examples  on issues such as poverty, guns, Greece, jobs, taxes, and education.

on issues such as poverty, guns, Greece, jobs, taxes, and education.

The bias extends to politics, of course, though the only time I felt compelled to comment was when ABC News rushed to imply that the Tea Party somehow was connected to a mass shooting in Colorado.

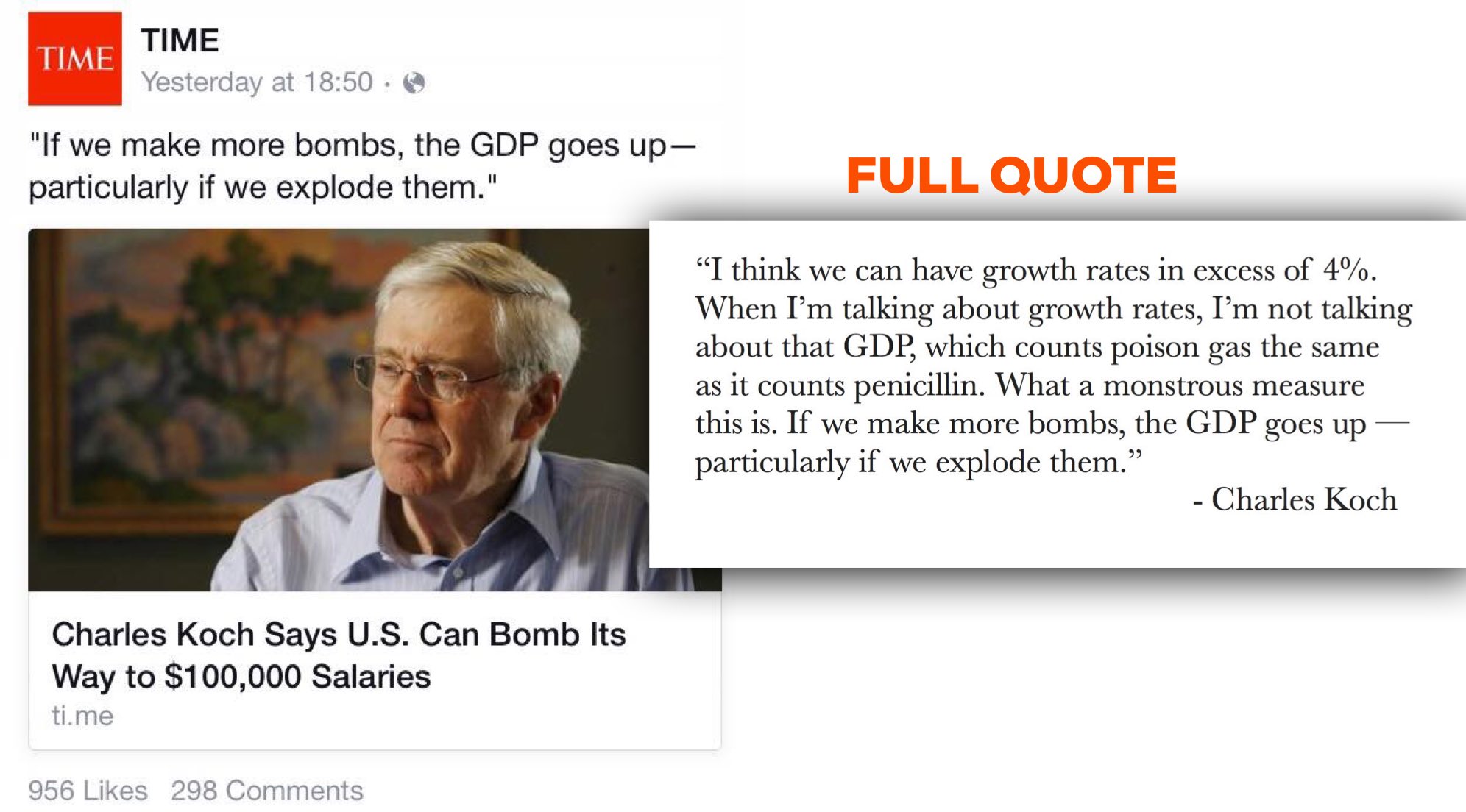

Well, I now feel compelled to comment again. But this example goes beyond bias and should be characterized as blatant and disgusting dishonesty. The hacks at Time took a quote from Charles Koch and then used selective editing to completely misrepresent what he actually said.

In a just world, the person who engaged in this bit of mendacity would lose his or her job and never again work in journalism. But I would hold my breath waiting for that to happen.

But let’s set aside the issue of media bias and dishonesty.

I want to highlight what Mr. Koch said about GDP. He expressed skepticism of that measure because it doesn’t distinguish between good expenditures and bad expenditures.

That’s one of the reasons why I prefer gross domestic income instead of gross domestic product. In simple terms, GDI measures how our national income is generated and GDP measures how it is allocated.

As the Bureau of Economic Analysis explains, the two numbers are basically different sides of the same coin.

In national economic accounting, GDP and GDI are conceptually equal. GDP measures overall economic activity by final expenditures, and GDI measures it by the incomes generated from producing GDP. In practice, GDP and GDI differ because they are constructed using different sources of information. …when one looks at annual data – where the timing differences are less important, the correlation between GDP and GDI is 0.97.

That correlation shouldn’t be a surprise. Indeed, over a longer period of time, the two numbers should be identical.

Both go up when the economy is doing well, and both go down when there is a recession.

Both go up when the economy is doing well, and both go down when there is a recession.

But I want to make a more subtle point.

The reason I like GDI over GDP is because one the former is more likely to lead people to support good policy while the latter is more likely to lead people in the direction of bad policy.

Here’s some of what I wrote on the topic back in 2013.

GDP numbers only measure how we spend or allocate our national income. It’s a very indirect way of measuring economic health. Sort of like assessing the status of your household finances by adding together how much you spend on everything from mortgage and groceries to your cable bill and your tab at the local pub. Wouldn’t it make much more sense to directly measure income? Isn’t the amount of money going into our bank accounts the key variable? The same principle is true – or should be true – for a country. That’s why the better variable is gross domestic income (GDI). It measures things such as employee compensation, corporate profits, and small business income. …We should be focusing on how to increase national income, not what share of it is being redistributed by politicians.

And, on a related note, you can back to 2009 for a column I wrote explaining that consumer spending is a reflection of a strong economy, not the cause of a strong economy.

And this video ties everything together by debunking the Keynesian argument that politicians should focus on goosing consumer spending.

[…] Time […]

[…] Time […]

[…] Time […]

[…] In reality, high levels of consumption should be viewed an indicator of a strong economy. […]

[…] In reality, high levels of consumption should be viewed an indicator of a strong economy. […]

[…] sort of agree with her […]

[…] I also wrote about GDP vs. GDI in 2017, in part to debunk some grotesquely dishonest reporting by […]

[…] At best, the borrow-and-spend approach only produces a transitory bump in consumption, but does nothing for real problem of inadequate income (which is why we should focus on GDI rather than GDP). […]

[…] At best, the borrow-and-spend approach only produces a transitory bump in consumption, but does nothing for real problem of inadequate income (which is why we should focus on GDI rather than GDP). […]

[…] bias, most often from the Washington Post or New York Times, but also from other outlets (Reuters, Time, ABC, the Associated Press, […]

[…] but there’s no increase in production. At the risk of stating the obvious, a nation’s gross domestic income does not increase when the government borrows money from one group of people and redistributes it […]

[…] that’s not the case. As I explained two years ago, consumer spending is a reflection of a strong economy, not the driver of a strong […]

[…] por eso que el ingreso interno bruto es un número preferible. Muestra las formas (sueldos y salarios, ingresos de pequeñas empresas, ganancias corporativas, […]

[…] why gross domestic income is a preferable number. It shows the ways – wages and salaries, small business income, corporate profits, etc – that […]

[…] why gross domestic income is a preferable number. It shows the ways – wages and salaries, small business income, corporate profits, etc […]

[…] I got my point across effectively in a 30-second sound bite, but it’s a point worth making since people who understand GDI are much less susceptible to the Keynesian perpetual-motion-machine […]

[…] my point across effectively in a 30-second sound bite, but it’s a point worth making since people who understand GDI are much less susceptible to the Keynesian perpetual-motion-machine […]

[…] on Keynesian economics, I usually begin with a theoretical discussion on why consumer spending is a consequence of growth rather than the cause of […]

[…] a recent interview, I pointed out that investment and production are the real keys to growth (which is why I prefer GDI over GDP). Increased consumption, I explained, is a result of growth, not the cause of […]

[…] I definitely think gross domestic income is a better measure than gross domestic product if we want insights on growth, so I’m not a big fan of GDP […]

[…] out that increases in national income (usually measured by gross domestic product, though I prefer gross domestic income) are driven by two […]

[…] Egregious Media Dishonesty Overshadows Important Economic Observation […]

Fire the hacks? !

Seems to me…. that is what they were hired for in the first place.

“We should be focusing on how to increase national income, not what share of it is being redistributed by politicians.”

Indeed. Redistribution is a fixed (but unfortunately immediate) factor. By contrast growth is slower but infinitely compounding, an exponent.

In the longer term which one wins? The fixed factor or the exponent? The exponent! Hands down, of course.

If voters could correctly assess this long vs short term tradeoff, they would stop making self-destructive choices. You can redistribute all you want in Cuba. You will still be miserable. Greece is getting there, France is firmly on the same trajectory, followed by the rest of Europe and then the US.

“I wrote explaining that consumer spending is a reflection of a strong economy, not the cause of a strong economy.”

If people would only understand that, they would stop paying attention to the narrative of temporary Keynesian gimmicks and focus on incentives to produce, not incentives to consume. Nothing wrong with consumption, but it is an effect, not cause, of production. I want almost infinitely more things than I have. The incentive to consume is always there. The theory whereby I need to be handed money to prime the supposedly deadlocked economic engine is bogus. Even if that (deadlock) had once been the case in a few isolated cases, it cannot be permanent policy. People and markets internalize the now predictable and dominant reaction of Keynesian economics and act ahead before the Keynesian policies are even placed into effect. In a way, once Keynes disclosed his theory, and a predictable knee jerk Keynesian reaction became the norm, the very Keynesian intervention lost it’s effect. Even in the few cases where it would have once perhaps worked.

Reblogged this on Gds44's Blog.