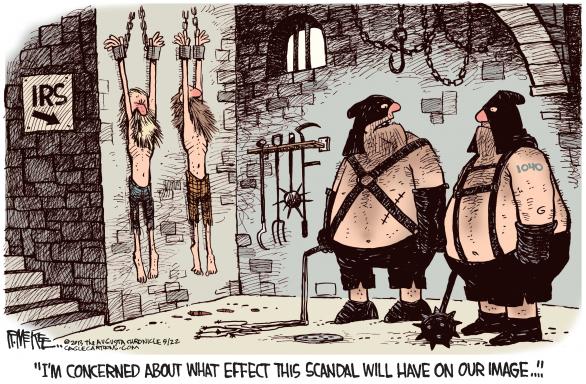

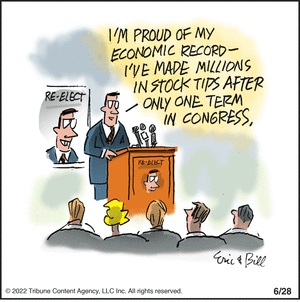

In a two-part series back in 2020 (here and here), I analyzed the unseemly behavior of politicians. For Part III of that series, let’s start with my CNBC discussion earlier this week about insider trading by lawmakers.

The interview focused on legislation proposed by Senators Josh Hawley (R-MO) and Kirsten Gillibrand (D-NY) to ban members of Congress and other senior government officials from owning individuals stocks.

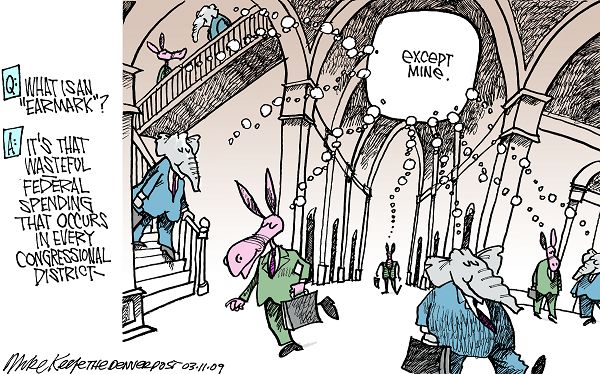

The goal is to prevent lawmakers from being able to obtain unearned riches by, for instance, buying a company’s and then enacting legislation to increase its value.

- Perhaps by imposing regulations that hurt its competitors.

- Perhaps by imposing protectionism that hurts its competitors.

- Perhaps by imposing taxes that hurt its competitors.

Or they can do things that directly help the company, like making sure it gets lucrative government contracts.

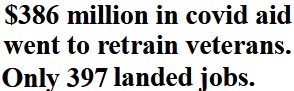

As you can see from the interview, I’m somewhat sympathetic to the Hawley-Gillibrand legislation, but I’m not confident it will make a big difference. So long as we have a big government, that creates too many opportunities for politicians to use their power for personal profit.

So what’s the answer?

Robert Stein wrote a few years ago in National Review that you can try to solve the problem on the back end.

…between 1998 and 2004, more than 40 percent of departing House members and 50 percent of departing senators became lobbyists. …here’s my suggestion: Once someone is elected to federal office — the House, Senate, or White House — they will get that office’s pay for life, guaranteed, plus inflation, no matter how soon they retire or how long they linger in office. However, all other income (except for withdrawals from previously accumulated retirement funds and Social Security) will be taxed at 100 percent.

No speech fees, no lobbying, no consulting, no corporate boards, no book deals, no film deals, no university positions. No other jobs, either. Basically, no nothing. Unless, of course, you just want to work as a labor of love, in which case be my guest. …The proposal would certainly eliminate former federal officeholders’ incentive to earn other income, to be “productive” citizens. But what is it that former politicians produce? To my eye, it looks like what they’re best at is collecting rent on their previous positions by finding ways to tilt the market away from freedom and toward a system rigged in favor of their clients, or collecting bribes through loopholes for having done so while in office.

Stein acknowledges his proposal is not very libertarian, but he concludes by claiming that “confiscating the private-sector pay of former elected officials may be one way to expand the size of the private-sector for the rest of us.”

Glenn Reynolds, a law professor at the University of Tennessee, proposed something similar a few year earlier.

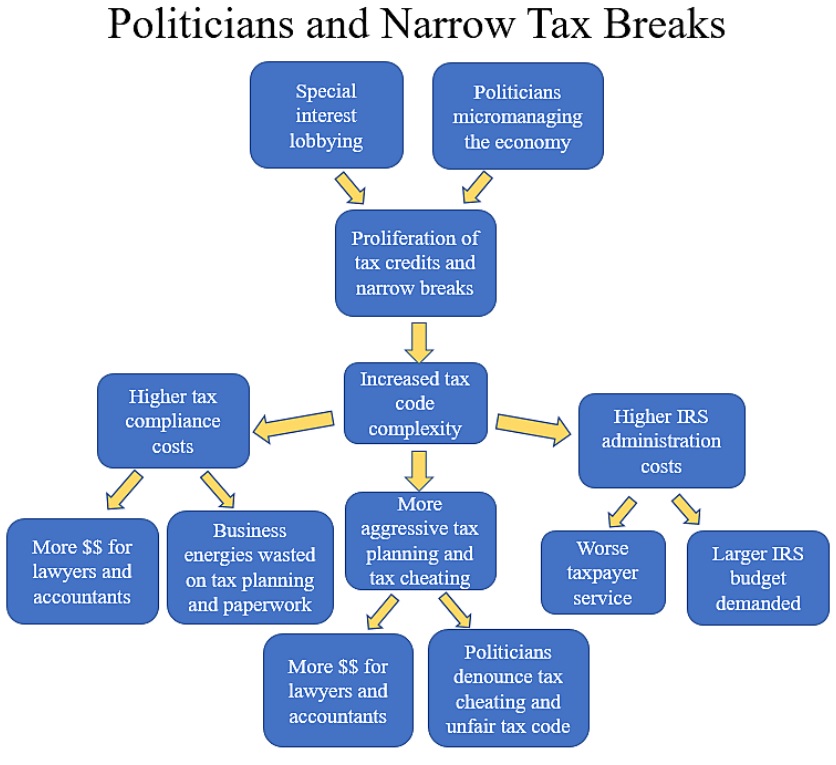

…we see the “revolving door” in almost all industries and sectors of government, and it’s a corrupting influence… It’s easy to see why companies want to hire people like this. First of all, the architects of complicated regulatory schemes are often the only ones who understand them. But more significantly, when you’re the architect of a regulatory scheme,

it’s handy for companies if it’s already in your mind that you might get a lucrative job from them later… I propose putting a 50% surtax — or maybe it should be 75%, I’m open to discussion — on the post-government earnings of government officials. So if you work at a cabinet level job and make $196,700 a year, and you leave for a job that pays a million a year, you’ll pay 50% of the difference — just over $400,000 — to the Treasury… I doubt we can put political corruption out of business, but this should make it at least a bit rarer.

If the goal is to reduce corruption and money in politics, Steven Greenhut of Reason shares my view that the best answer is to shrink the size and scope of government.

…campaign-finance reform is the “thing” that never goes away. The problem—at least with political spending—is government… Reality check: Those groups whose existence is most dependent on the government

are going to spend oodles on lobbying that government. …Maybe we can all embrace a reform idea that would actually work: reducing the size and power of government. Sadly, that is the one idea that will frighten the kind of politicians and activists who support campaign-finance reform.

Amen.

Let’s conclude by looking at a strange approach that is being tried by Spain.

Here are some excerpts from an article in the New York Times by Nicholas Casey.

Carlos Alburquerque isn’t your typical rehab candidate. He’s a 75-year-old grandfather living in Córdoba, a city in southern Spain. …But his isn’t your typical rehab program: It’s an 11-month boot camp to reform corrupt Spanish officials and “reinsert” them into mainstream society.

…Mr. Alburquerque…is serving a four-year prison sentence for stealing around 400,000 euros, nearly a half a million dollars… He will sit in a circle with other convicted officials for group therapy sessions… corruption has captured the public imagination here. Flip open a newspaper or turn on the radio: You will hear of schemes, scandals and skulduggery which almost always lead back to the public purse. …biggest challenge may be convincing Spain’s corrupt officials that there actually might be something wrong with them.

For what it’s worth, I hope it is successful but I don’t expect good results from Spain’s therapeutic approach.

The bottom line is that big government enables big corruption. That’s the problem that needs to be addressed.