Everything you need to know about wealth taxation can be summarized in two sentences.

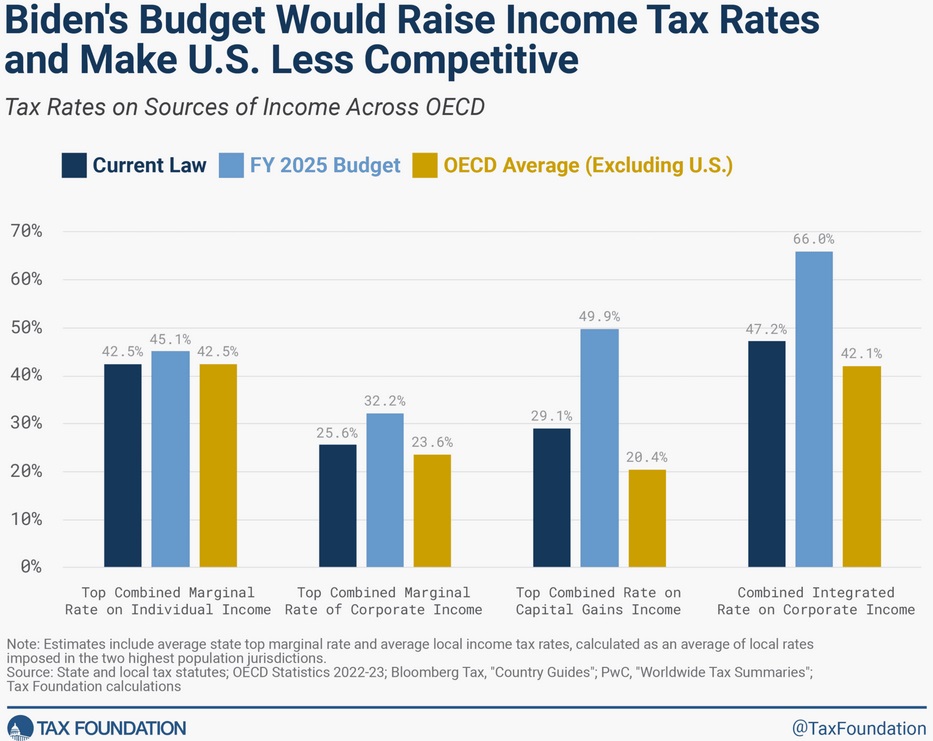

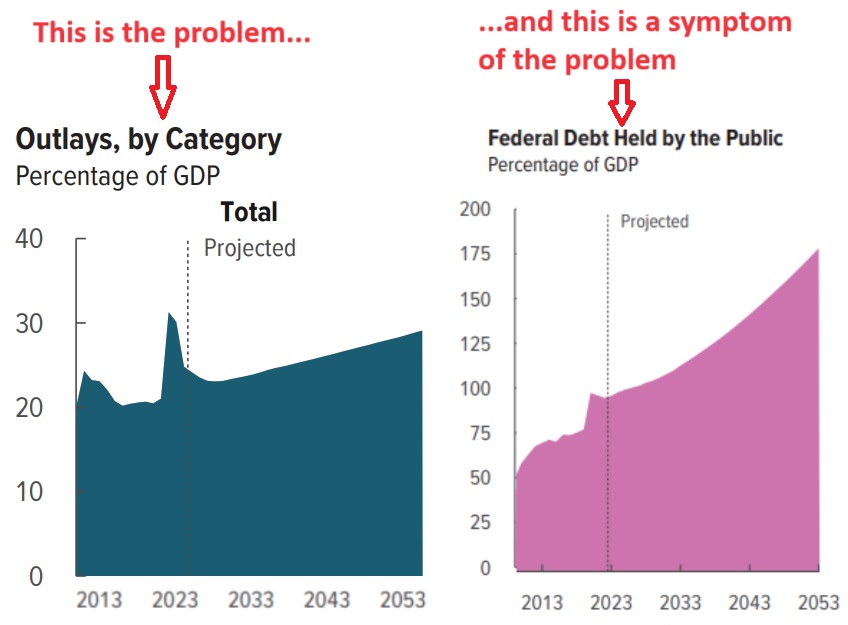

- The biggest problem with most tax systems is the pervasive tax bias against income that is saved and invested, which discourages the accumulation of capital that helps to finance future growth.

- Wealth taxes would dramatically increase the tax bias against saving and investment and easily could result in implicit marginal tax rates on capital of more than 100 percent.

Unfortunately, economic arguments don’t matter to the class-warfare crowd. They mistakenly think the economy is a fixed pie, so if Jeff Bezos and Elon Musk have a lot of money, then the rest of us have less money.

This is empirically nonsensical.

Or perhaps they simply resent people who are very successful. There’s certainly a good amount of evidence that folks on the left have a hate-and-envy mentality.

I don’t know Prof. Gabriel Zucman’s motives, but he’s a big advocate of a global wealth tax. Here are some passages from his recent column in the New York Times.

…the ultrawealthy consistently avoid paying their fair share in taxes. …Why do the world’s most fortunate people pay among the least in taxes, relative to the amount of money they make? The simple answer is that while most of us live off our salaries, tycoons like Jeff Bezos live off their wealth. In 2019, when Mr. Bezos was still Amazon’s chief executive, he took home an annual salary of just $81,840.

But he owns roughly 10 percent of the company, which made a profit of $30 billion in 2023. …Unless Mr. Bezos, Warren Buffett or Elon Musk sell their stock, their taxable income is relatively minuscule. …There is a way to make tax dodging less attractive: a global minimum tax. …The idea is simple. Let’s agree that billionaires should pay income taxes equivalent to a small portion — say, 2 percent — of their wealth each year. …the proposal would allow countries to collect an estimated $250 billion in additional tax revenue per year, which is even more than what the global minimum tax on corporations is expected to add.

There are many problems with Zucman’s analysis.

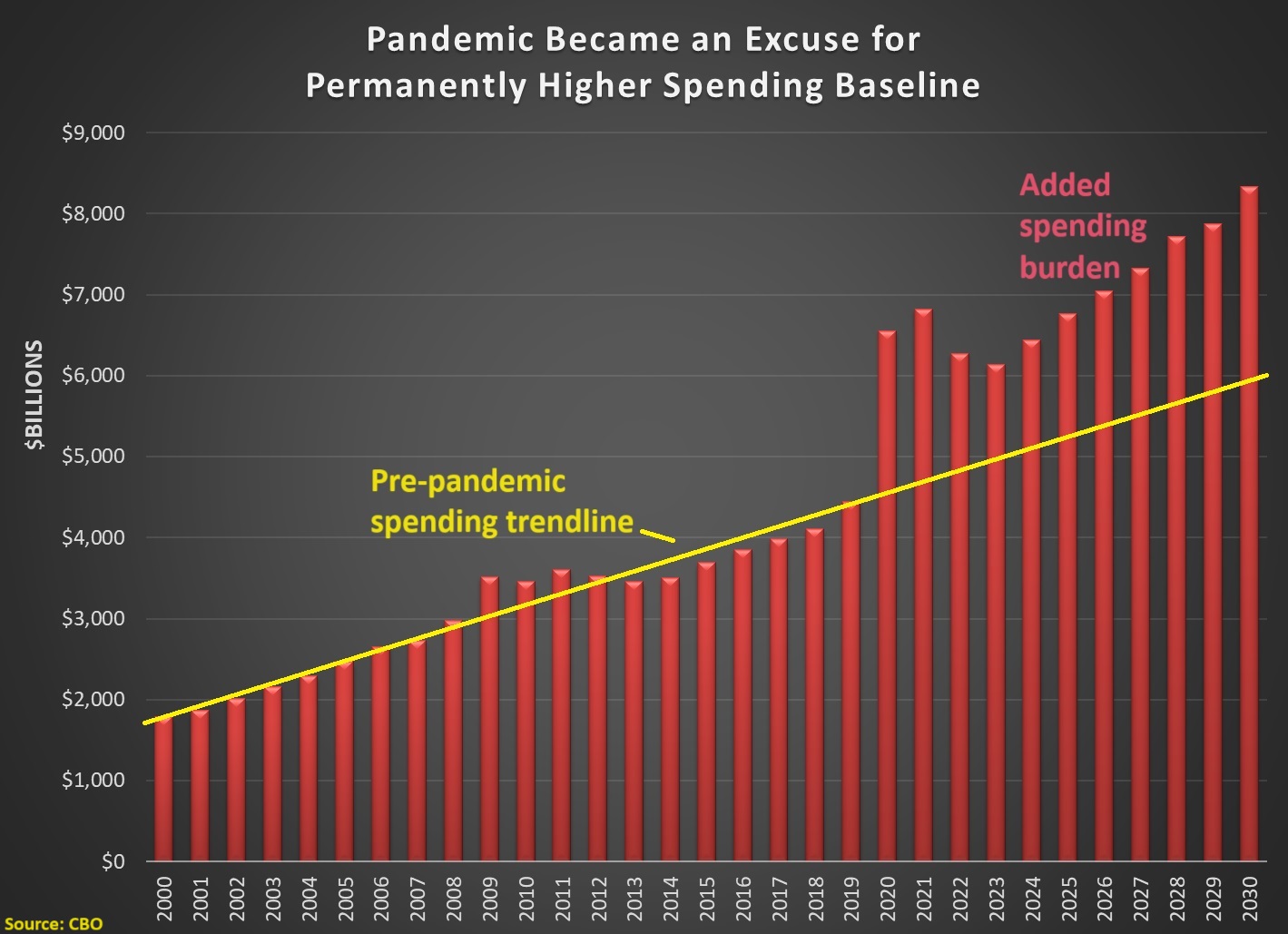

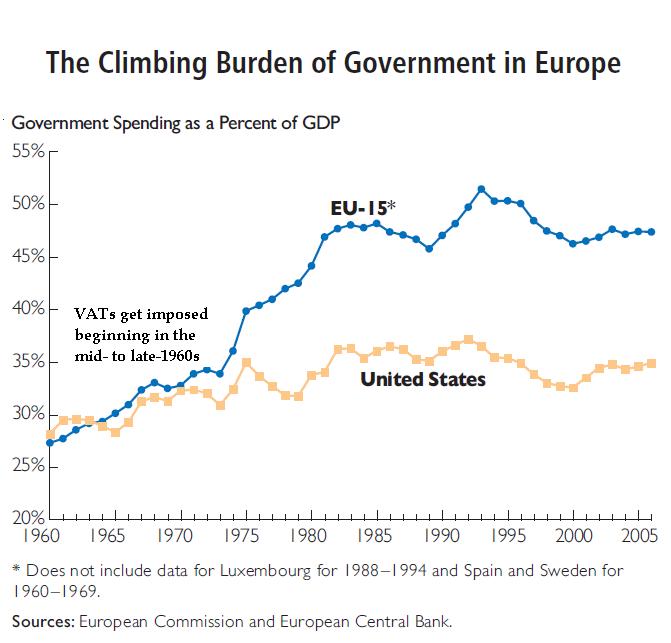

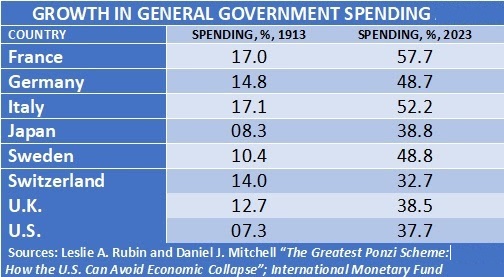

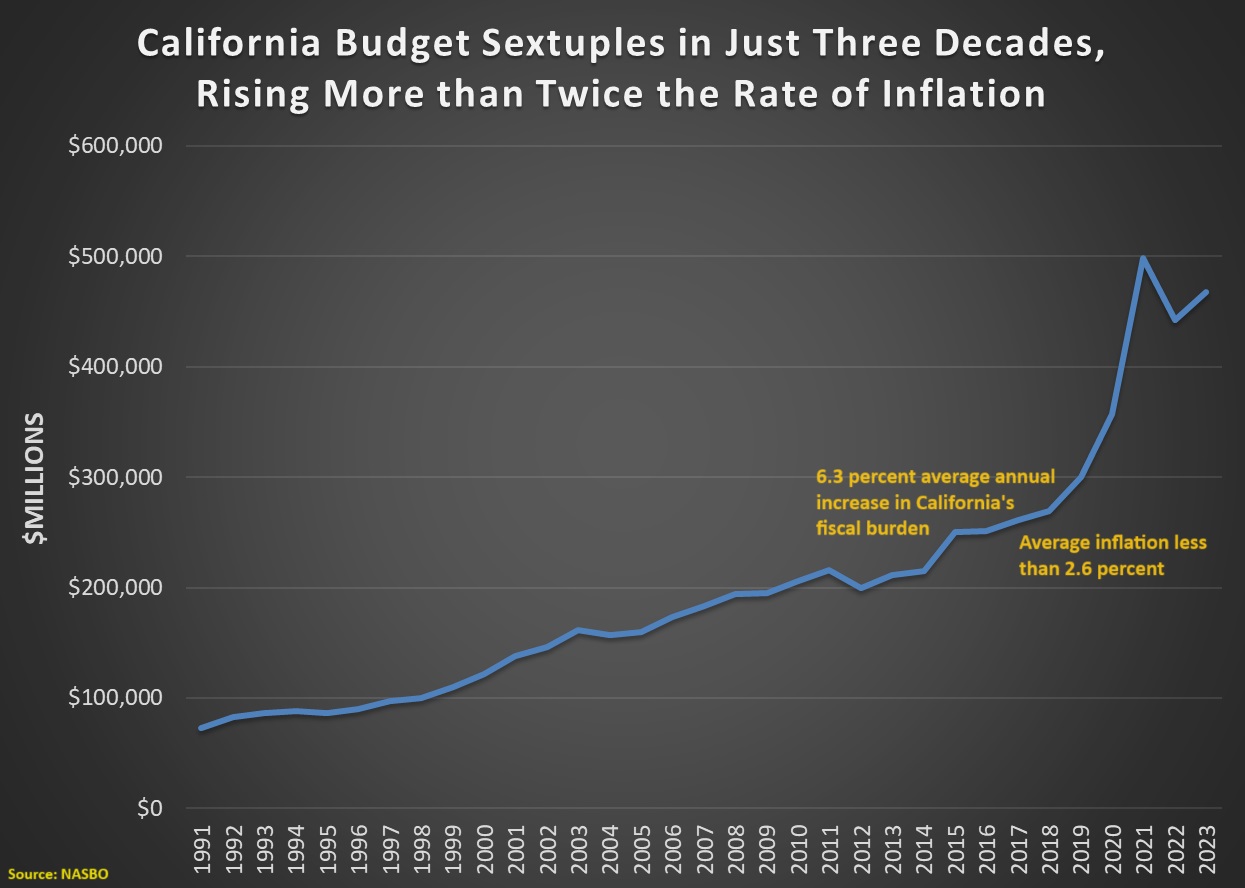

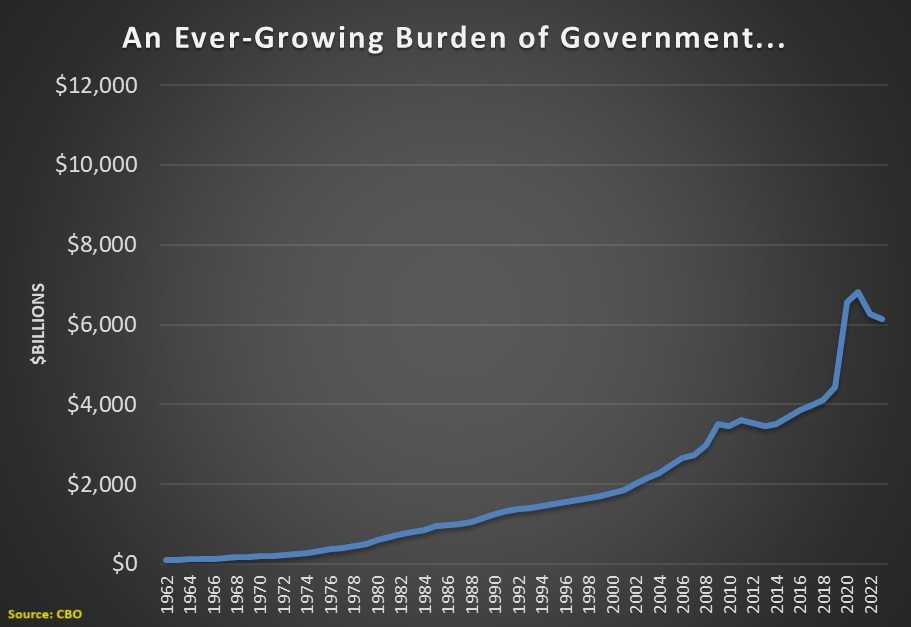

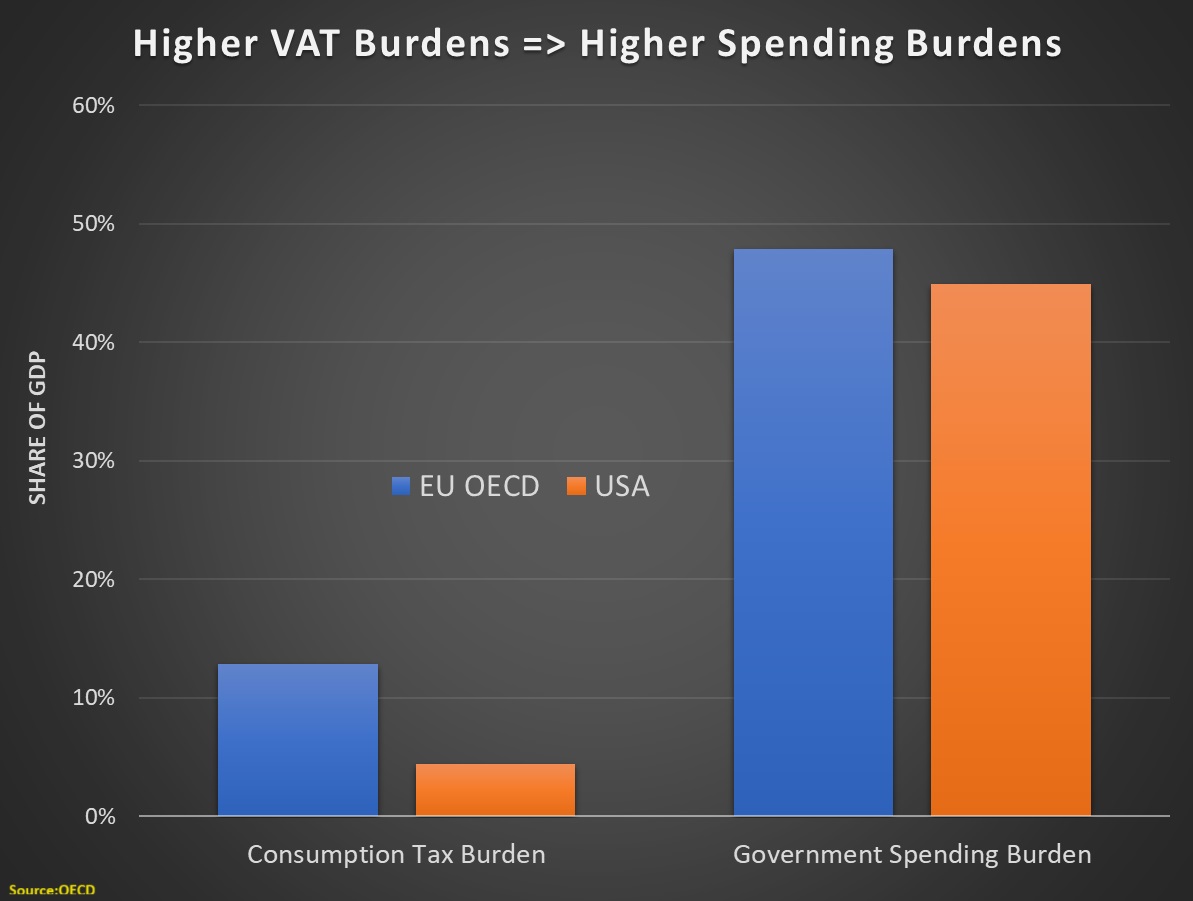

One concern is that it’s a bad idea to finance bigger government, which is a goal of the class-warfare crowd.

Another problem is that Zucman never acknowledges or addresses the disincentive effect of higher taxes on saving and investment.

Here are some excerpts from the Wall Street Journal‘s editorial on the topic.

In our new socialist age, the demand to tax and redistribute income is insatiable. The latest brainstorm arrives in a proposal by four countries in the G-20 group of nations to impose a 2% wealth tax on the world’s billionaires. …As you might expect,

this would principally be a tax raid on Americans, who are the most numerous billionaires. It would also be taxation without representation, since it would be a body of global elites attempting to impose a tax without having passed Congress. …Once a global wealth tax is in place, you can be sure that billionaires won’t be the last target. …the G-20 is becoming a vehicle for the world’s left-wing governments to gang up on the U.S. …For this crowd, taxing American billionaires to redistribute income around the world is all too imaginable.

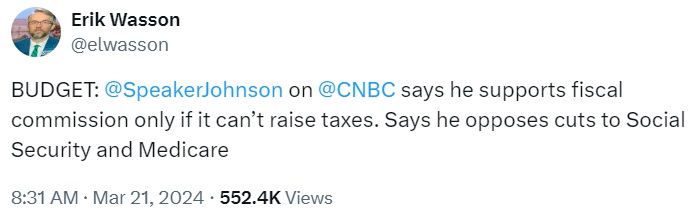

By the way, Zucman’s problem is not merely bad economics.

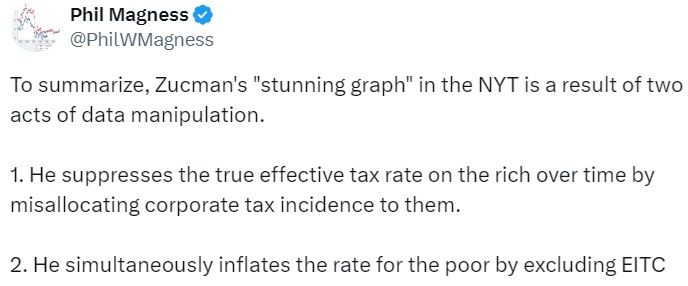

He also uses misleading numbers. Phil Magness of the Independent Institute exposes his dodgy manipulations in a thread on Twitter (now called X).

There are dozens of tweets in his thread, but here’s his summary if you don’t have time to read everything.

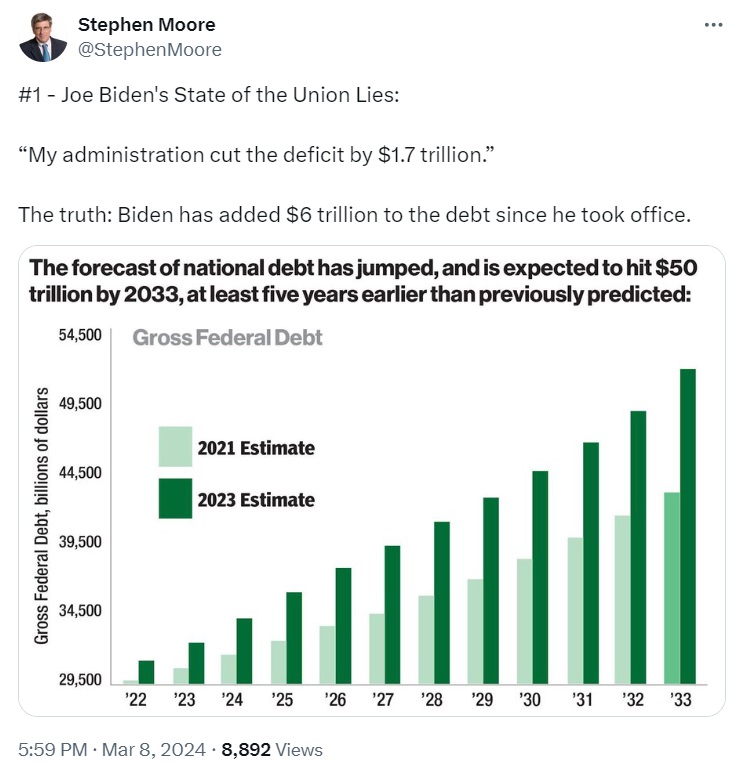

P.S. Another French economist, Thomas Piketty, also uses dodgy numbers while pushing for class-warfare taxes. Seems to be a pattern on the left (as illustrated by one of Biden’s tweets that was based on make-believe numbers).