I’m a big proponent of tax reform, so at first I was very excited to learn that Senators Max Baucus (D-MT) and Orrin Hatch (R-UT) were launching an effort to clean up the tax code.

But on closer inspection, I don’t think this will lead to a simple and fair system like the flat tax. Or even a national sales tax (assuming we could trust politicians not to pull a bait-and-switch, adding a new tax and never getting rid of the income tax).

But judge for yourself. Here’s some of what’s contained in a letter they sent to their colleagues, starting with some language about the growing complexity of the tax code and the compliance cost for taxpayers.

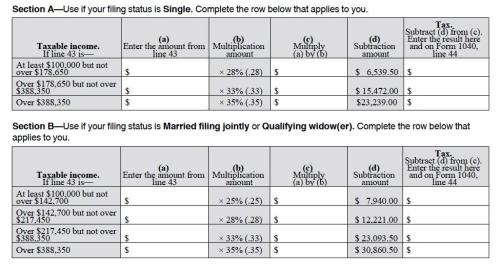

…since then, the economy has changed dramatically and Congress has made more than 15,000 changes to the tax code. The result is a tax base riddled with exclusions, deductions and credits. In addition, each year, it costs individuals and businesses more than $160 billion to comply with the tax code. The complexity, inefficiency and unfairness of the tax code are acting as a brake on our economy. We cannot afford to be complacent.

Sounds good, though they also could have mentioned other indicators of nightmarish complexity, such as the number of pages in the tax code, the number of special tax provisions, or the number of pages in the 1040 instruction manual.

I’m a bit mystified, however, at the low-ball estimate of $160 billion of compliance costs. As explained in this video, there are far higher estimates that are based on very sound methodology.

But perhaps I’m nit-picking. Let’s see with Senators Baucus and Hatch want to do.

In order to make sure that we end up with a simpler, more efficient and fairer tax code, we believe it is important to start with a “blank slate”—that is, a tax code without all of the special provisions in the form of exclusions, deductions and credits and other preferences that some refer to as “tax expenditures.”

I don’t like the term “tax expenditure” since it implies that the government taking money from person A and giving it to person B is equivalent to the government simply letting person B keep their own money. These two approaches may be economically equivalent in certain cases, but they’re not morally equivalent.

Once again, however, I may be guilty of nit-picking.

That being said, there is a feature of the “blank slate” approach which does generate legitimate angst. There’s a footnote in the letter that states that the Joint Committee on Taxation is in charge of determining so-called tax expenditures.

A complete list of these special tax provisions as defined by the non-partisan Joint Committee on Taxation.

This is very troubling. The JCT may be non-partisan, but it’s definitely not non-ideological. These are the bureaucrats, for instance, who assume that the revenue-maximizing tax rate is 100 percent! Moreover, the JCT uses the “Haig-Simons” tax system as a benchmark, which means they start with the assumption that there should be pervasive double taxation of income that is saved and invested.

This is not nit-picking. The definition of “tax expenditure” is a critical policy decision, not something to be ceded to the other side before the debate even begins.

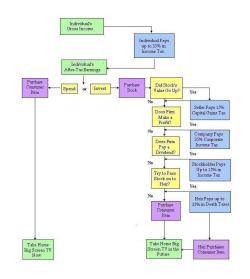

As illustrated by this chart, the tax code is very biased against saving and investment.

As illustrated by this chart, the tax code is very biased against saving and investment.

Between the capital gains tax, the corporate income tax, the double tax on dividends, and the death tax, it’s possible for a single dollar of income to be taxed as many as four different times.

This is a very foolish policy, particularly since every school of thought in the economics profession agrees that capital formation is a key to long-run growth. Even the Marxists and socialists!

To make matters worse, double taxation puts America at competitive disadvantage. To get a sense of how the U.S. tax system is a self-inflicted wound, check out these sobering international comparisons of death tax burdens and the degree of double taxation of dividends and capital gains.

Here’s what the Haig-Simons tax base means.

1. An assumption that new business investment should be penalized with depreciation instead of being treated neutrally with expensing.

2. An assumption that IRAs and 401(k)s are loopholes to be eliminated, when they’re actually ways to protect against double taxation.

3. An assumption that various other forms of double taxation – such as the capital gains tax – should be retained.

But that’s not the only preemptive capitulation to bad policy.

The “blank slate” assumes that the class-warfare bias in the tax code also should be part of the benchmark against which possible reforms will be judged.

…we asked the nonpartisan Joint Committee on Taxation and Finance Committee tax staff to estimate the relationship between tax expenditures and the current tax rates if the current level of progressivity is maintained. …The blank slate approach would allow significant deficit reduction or rate reduction, while maintaining the current level of progressivity.

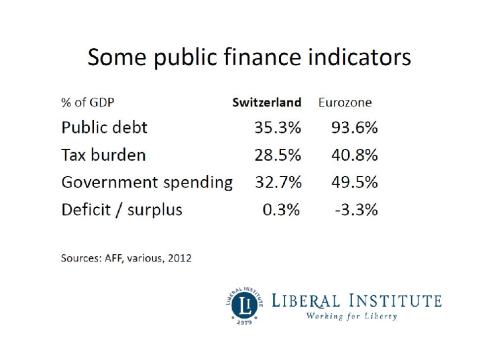

Since the internal revenue code already imposes a disproportionate burden on upper-income taxpayers – even when compared to European welfare states, it doesn’t make sense to automatically assume an ideological agenda such as progressivity.

This has been a very long answer to a simple question, but it’s very important to realize that tax reform is a three-legged stool. If we want to minimize the economic damage of generating revenue for government, we should have 1) a low tax rate, 2) no distorting tax preferences, and 3) no distorting tax penalties such as double taxation.

Unfortunately, too many people focus only on the first and second legs of the stool. And while tax rates and deductions are important, so is double taxation.

I’m not asserting that the “blank slate” should have assumed no double taxation (sometimes referred to as the “Fisher-Ture” tax base or “consumption” tax base).

But I don’t think it would have been unreasonable for Senators Baucus and Hatch to have told other Senators that one of their choices would be to pick either the Haig-Simons approach or the Fisher-Ture approach.

Heck, even the Congressional Budget Office acknowledged that there are two ways of measuring tax expenditures. To reiterate, the choice of tax base should be a policy decision, not a built-in assumption.