If Republicans do as well as expected in next Tuesday’s mid-term elections, especially with regard to gubernatorial and state legislative contests, I expect that more states will enact and expand on school choice in 2023.

That will be great news for families.

But I also want great news for taxpayers, and that’s why I’m hoping that we also will see progress on fiscal policy. To be more specific, I want to see more states copy Colorado’s very successful spending cap.

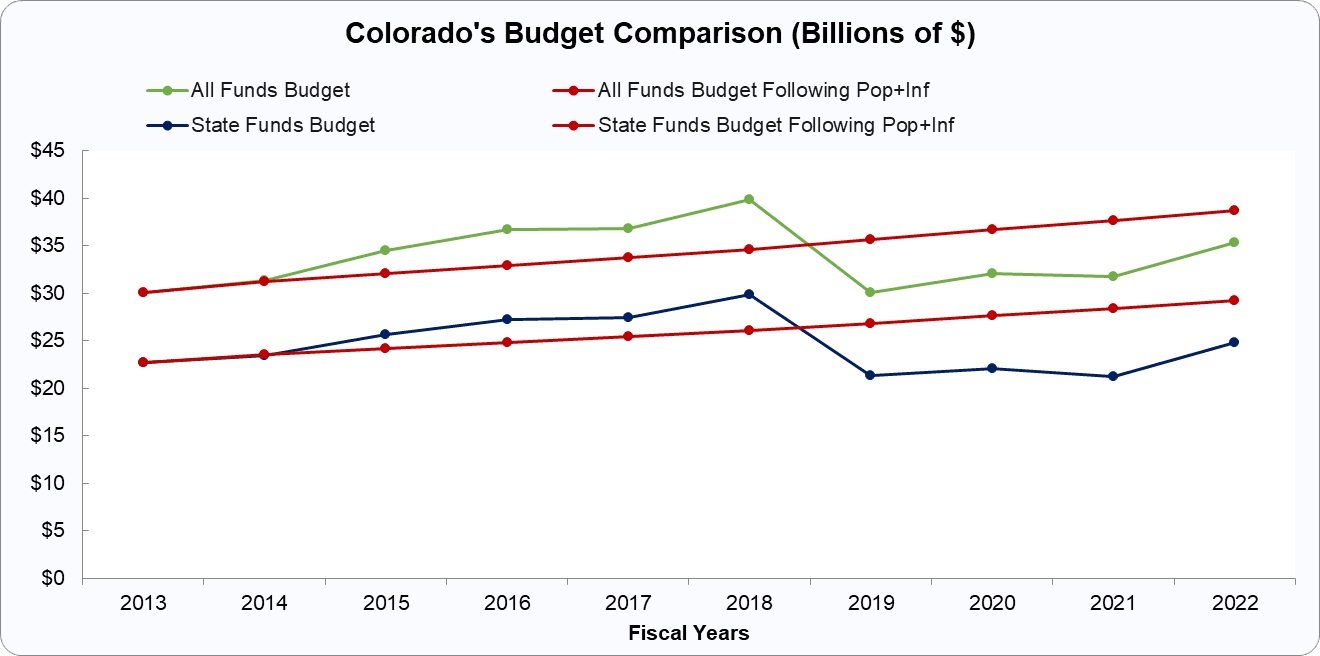

Known as the Taxpayer Bill of Rights (TABOR), it basically limits the growth of annual tax revenue to the growth of population-plus-inflation. Any revenue above that amount automatically must be returned to taxpayers.

And since the state also has a balanced-budget requirement, that means spending can only increase as fast as population-plus-inflation as well. A very simple concept.

Has TABOR been successful? Has it produced better fiscal policy and more economic prosperity?

The answer is yes. In a column for National Review, Jonathan Williams and Nick Stark say it is the “gold standard” for state fiscal policy.

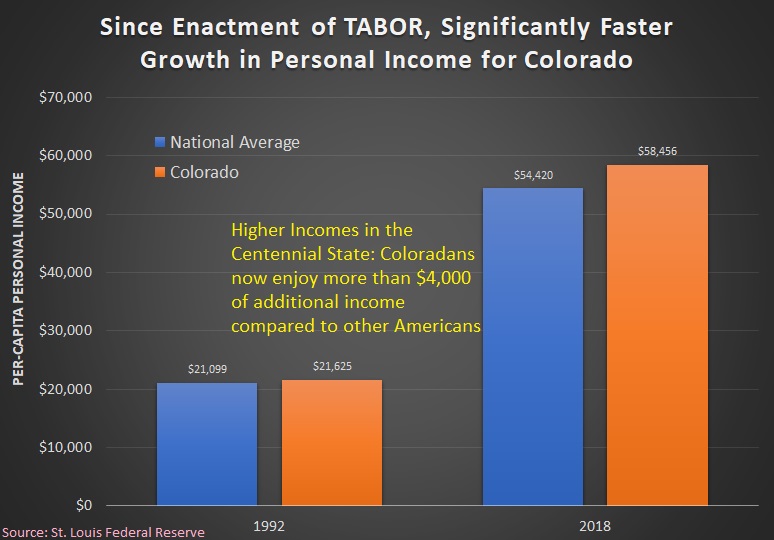

TABOR is a state constitutional amendment that limits the amount of revenue Colorado lawmakers can retain and spend to a reasonable formula of population plus inflation growth. If the state government collects more tax revenue than TABOR allows, the money is returned to taxpayers as a refund. Just this year, Colorado taxpayers will receive nearly $4 billion in TABOR refund checks. If any government in Colorado intends to spend surplus revenue, increase taxes or fees, or increase debt,  it must submit the proposed measure to the ballot and win the approval of a majority of voters. …Following the low-tax-plus-limited-government formula, Colorado developed into one of the most competitive business climates in the nation in the years following TABOR’s adoption. During the past three decades, Colorado has been one of the most competitive and fastest-growing economies in the nation. …Even in the face of this tremendous economic-success story, the tax-and-spend crowd have spent a tremendous amount of resources trying to demonize TABOR, often attempting to find work-arounds or suing to have TABOR declared unconstitutional. Why? In short, because it is an effective limit on the growth of government, and it restricts the wild spending increases that fund their constituencies — who generally favor big government. …Other states trying to implement meaningful checks and balances on the inexorable government-growth machine…should follow Colorado’s example.

it must submit the proposed measure to the ballot and win the approval of a majority of voters. …Following the low-tax-plus-limited-government formula, Colorado developed into one of the most competitive business climates in the nation in the years following TABOR’s adoption. During the past three decades, Colorado has been one of the most competitive and fastest-growing economies in the nation. …Even in the face of this tremendous economic-success story, the tax-and-spend crowd have spent a tremendous amount of resources trying to demonize TABOR, often attempting to find work-arounds or suing to have TABOR declared unconstitutional. Why? In short, because it is an effective limit on the growth of government, and it restricts the wild spending increases that fund their constituencies — who generally favor big government. …Other states trying to implement meaningful checks and balances on the inexorable government-growth machine…should follow Colorado’s example.

Courtesy of Jon Caldera, here’s some of Colorado’s fiscal history, which began with a flat tax in the 1980s and then culminated with TABOR in the 1990s.

Colorado used to have a progressive income tax where people and companies would pay a higher tax rate the more money they earned. Thanks to the Independence Institute…and…economist Barry Poulson, the legislature was convinced to switch from the progressive tax to a flat one in the mid-1980s. Poulson urged that the new tax rate be 4.5% so that it would bring in the same amount of revenue as the system it was replacing.  …So, of course, the legislature set the new rate at 5% to create a fine windfall, which it did. Even so, the flat income tax did what it was predicted to do. It lit the engine of Colorado’s economy. When productive people and their companies are looking to locate, they are attracted to states with low and stable tax policy. The flat tax began the Colorado boom. That boom resulted in massive tax receipts to the state. So much so that the legislature quickly felt the growing pressure of a tax rebellion. …So, we then passed the Taxpayer’s Bill of Rights in 1992. The combination of our flat tax and TABOR attracted more and more businesses and jobs to Colorado. So much so that in the late 1990s the state had to refund some $3.2 billion of surplus tax revenue to taxpayers. …The combination of our flat-rate income tax and TABOR has made for a sustainable gold rush which has turned Colorado into one of the most economically vibrant states in the country with one of the lowest unemployment rates.

…So, of course, the legislature set the new rate at 5% to create a fine windfall, which it did. Even so, the flat income tax did what it was predicted to do. It lit the engine of Colorado’s economy. When productive people and their companies are looking to locate, they are attracted to states with low and stable tax policy. The flat tax began the Colorado boom. That boom resulted in massive tax receipts to the state. So much so that the legislature quickly felt the growing pressure of a tax rebellion. …So, we then passed the Taxpayer’s Bill of Rights in 1992. The combination of our flat tax and TABOR attracted more and more businesses and jobs to Colorado. So much so that in the late 1990s the state had to refund some $3.2 billion of surplus tax revenue to taxpayers. …The combination of our flat-rate income tax and TABOR has made for a sustainable gold rush which has turned Colorado into one of the most economically vibrant states in the country with one of the lowest unemployment rates.

I’ll close by explaining why folks on the left also should support TABOR-style spending caps.

Part of the reason is that they should care about future generations.

Part of the reason is that they should care about economic growth.

But another reason is that it may be politically beneficial. Check out these excerpts from a column in the Denver Post by Scott Gessler.

TABOR requires a vote of the people to raise taxes, incur debt, or spend excess government funds. Practically, it makes all three much harder. So Democrats hate TABOR. …conservatives love TABOR. They rarely support tax increases or additional borrowing,  and for them TABOR imposes fiscal discipline and forces government to live within its means. And Colorado has avoided the ongoing fiscal crises that have plagued other states like Illinois or California. Plus, it’s hard to argue against the public’s right to vote on taxes and debt. …But what about Republicans? They’re the ones who have paid the political price. …Today, voters can oppose Republicans and support Democrats, with little fear taxes will go up. …So expect the continued irony, as Democrats attack TABOR with a unified voice, while Republicans usually support it, yet lose political strength.

and for them TABOR imposes fiscal discipline and forces government to live within its means. And Colorado has avoided the ongoing fiscal crises that have plagued other states like Illinois or California. Plus, it’s hard to argue against the public’s right to vote on taxes and debt. …But what about Republicans? They’re the ones who have paid the political price. …Today, voters can oppose Republicans and support Democrats, with little fear taxes will go up. …So expect the continued irony, as Democrats attack TABOR with a unified voice, while Republicans usually support it, yet lose political strength.

Since I care about policy rather than partisanship, I hope lots of Democrats read this article and then embrace spending caps. If they don’t want to copy Colorado, they can opt for the Swiss version of a spending cap. So long as they choose something real, it will work.

That would be bad for Republicans, but good for prosperity.

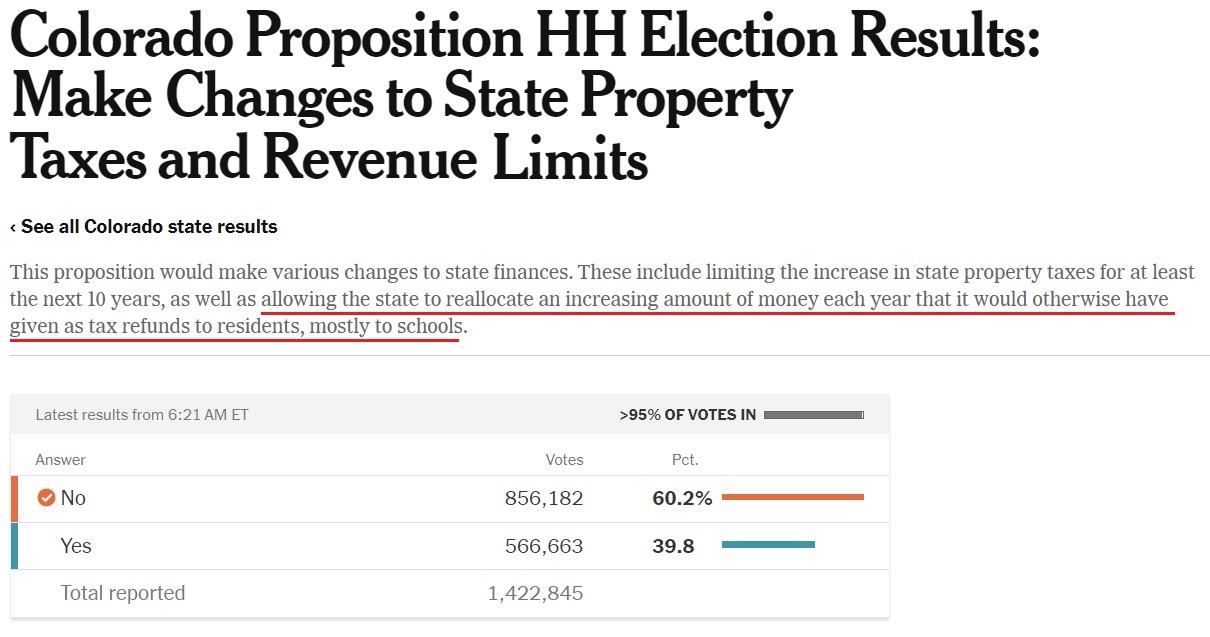

P.S. Colorado is now a blue-leaning state, but voters in 2019 rejected an effort by the pro-spending lobbies to eviscerate TABOR.

Read Full Post »

Does Colorado’s spending cap work perfectly? Of course not.

Does Colorado’s spending cap work perfectly? Of course not.can only increase by 5.8% this budget year rather than the 6.1% legislative forecasters were expecting. Two, the state is now expected to collect $185 million more in road usage fees and retail delivery charges this year than last, under the legislative staff estimates. Taken together, the two forecast changes mean state lawmakers could have to issue larger than expected TABOR refunds to Coloradans next year, leaving the state with fewer General Fund tax dollars to spend… That would translate to a nearly $400 refund for the average single-filer in 2025 under the current refund formula, which is tiered based on income.