I’ve written repeatedly about how anti-money laundering (AML) laws  are pointless, expensive, intrusive, discriminatory, and ineffective.

are pointless, expensive, intrusive, discriminatory, and ineffective.

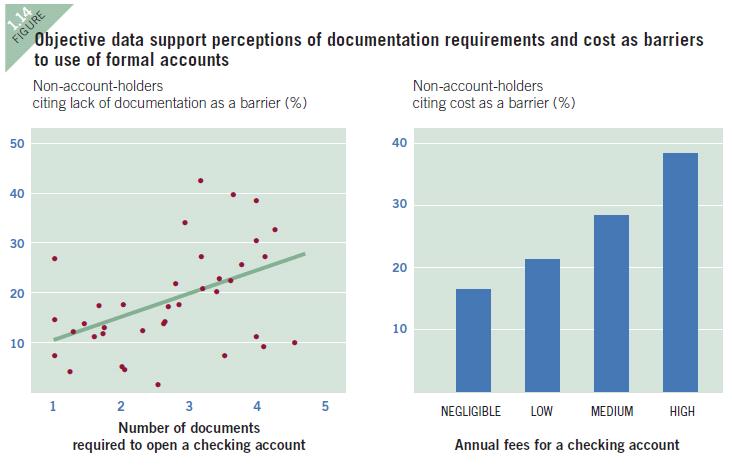

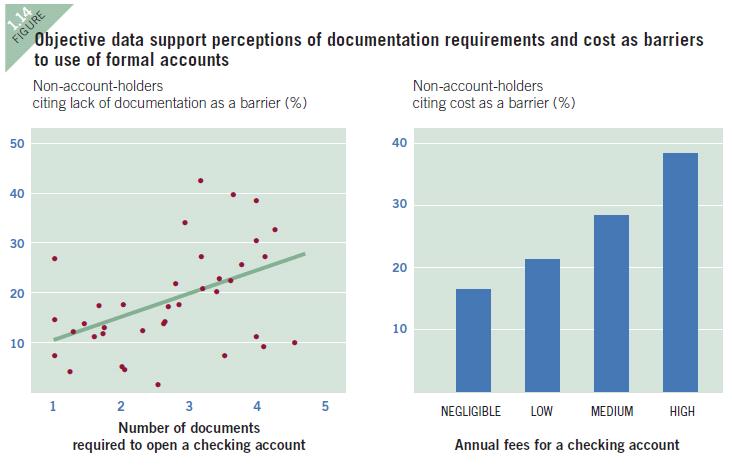

And they especially hurt poor people according to the World Bank.

That’s a miserable track record, even by government standards.

Now it’s time to share two personal stories to illustrate how AML laws work in practice.

Episode 1

Last decade, I wrote an article for a U.K.-based publication that focused on the insurance industry. I didn’t even realize they paid, so I was obviously happy when a check arrived in the mail.

The only catch was that the check was in British pounds and various charges and conversion fees would have consumed almost all the money if I tried to deposit the money in my local bank.

But that wasn’t too much of a problem since I had an upcoming trip to give a speech in England.

I figured I would swing by the British bank where the magazine had an account, show them my passport, and get my cash.

Oh, such youthful naiveté.

Here’s what actually happened. I stopped by a branch and was told that I couldn’t cash the check because anti-money laundering rules required that I have an address in the U.K. (my hotel didn’t count).

Needless to say, I was a bit irritated. Though I didn’t give up. In hopes that my experience was an anomaly (i.e., a particularly silly teller with a bureaucratic mindset), I stopped at another branch of the bank.

But that didn’t work. I got the same excuse about AML requirements.

And I was similarly thwarted at a third branch. By the way, the tellers sympathized with my plight, but they said the government was being very strict.

So I figured the way to get around this regulatory barrier would be to sign the check and have a friend deposit the money in her account and then give me some cash.

But her bank said this was also against the AML rules.

Fortunately, we got lucky when we went to another branch of her bank. A teller basically acknowledged that government’s rules made it impossible for me to get my money and she decided to engage in a much-appreciated act of civil disobedience.

This episode was annoying, but the silver lining is that I was in the U.K. to speak at an international economic crime conference in Cambridge on the topic of money laundering.

So I began my speech a day or two later by pseudo-confessing that I had just violated the nation’s silly and counterproductive laws on money laundering (I said “this may have happened to me” to give me some legal wiggle room since the audience was dominated by government officials, and I didn’t want to take any risks).

Episode 2

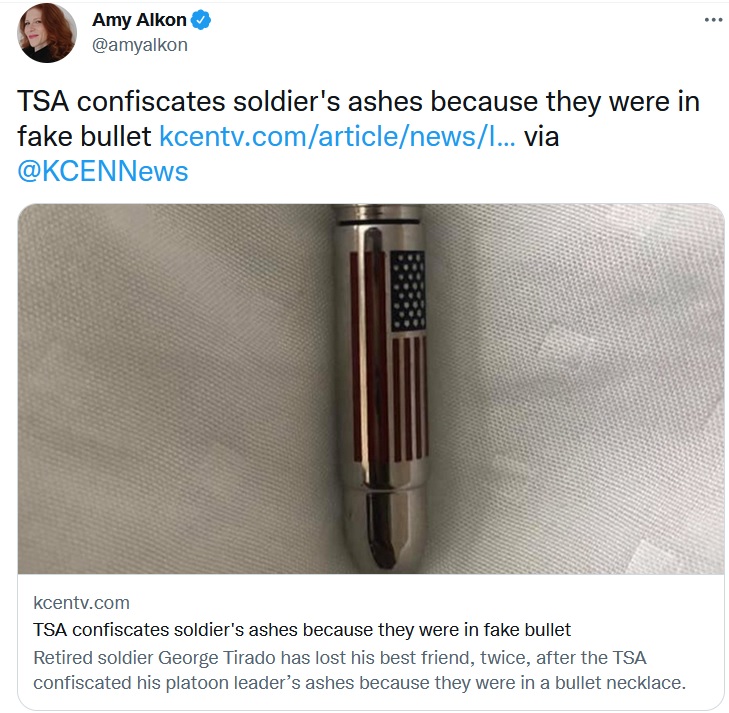

Today, I had my second incident with anti-money laundering laws.

I have a friend from the Caribbean who now operates a small Dubai-based business and he asked me if I could use Western Union to wire some money to an employee in the Dominican Republic.

I’ve done this for him a couple of times in the past (it is far cheaper to send money from the U.S.), so I stopped by a branch this morning, filled out the paperwork and sent the money.

Or, to be more accurate, I thought I sent the money.

As I was walking out, I got a text from Western Union saying that they put a hold on the transfer and that I needed to call a 1-800 number to answer some questions.

So I made the call and was told that they blocked the transfer because they were trying to “protect me” from potential consumer fraud.

It’s possible that this was a potential reason, but I immediately suspected that Western Union was actually trying to comply with the various inane and counter-productive AML laws and regulations imposed by Washington.

My suspicions were warranted. Even though I explained that I wasn’t a victim of fraud and answered 10 minutes of pointless questions (how long did I know my friend in Dubai? when did I last see him? what would the employee use the money for?), Western Union ultimately decided to reject the transfer.

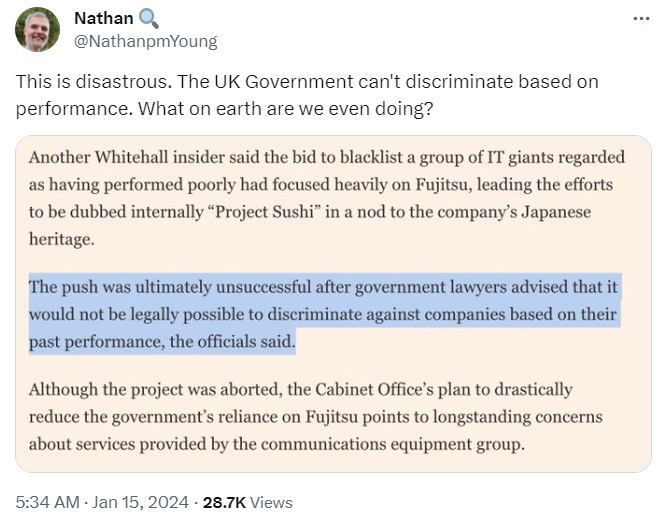

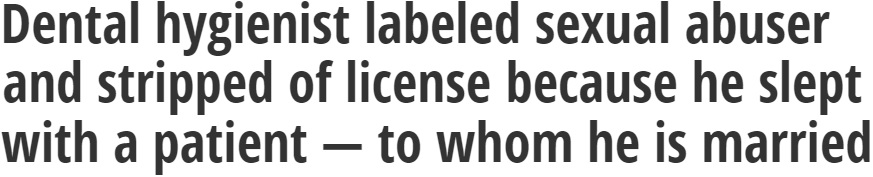

Why? I assume because AML laws and regulations require companies to flag “unusual transactions,” and financial institutions would rather turn away business rather than risk getting some bureaucrat upset.

So my unblemished track record of being a successful “money launderer” came to an end.

But here’s the real bottom line.

Other than wasting about 30 minutes, I didn’t lose anything. But a small business owner will now have to pay $150 more for a transaction, and an employee from a poor country will have to wait longer to get money.

In some sense, even Western Union is a victim. The company lost the $20 fee for my transaction. But that’s probably trivial compared to the money that they pay for staffers who have the job of investigating whether various transfers satisfy Uncle Sam’s onerous rules.

Even my “successful” example of money laundering in Episode 1 was costly. I lost about two hours of my day.

And if I wasn’t for the nice teller who decided to break the law, I probably would have lost out on about $100. Perhaps not worst outcome in the world, but now think about how poor people suffer when they suffer similar losses thanks to these policies.

Remember, by the way, all these costs aren’t offset by any benefits. There is zero evidence that AML laws  reduce underlying crime rates (which was the rationale for these laws being imposed in the first place!).

reduce underlying crime rates (which was the rationale for these laws being imposed in the first place!).

P.S. You may not think AML policy lends itself to humor, but here’s an amusing anecdote involving our former President.

P.P.S. Some folks on the left use AML arguments to justify their “war on cash,” and they’re pushing to restrict cash as an interim measure.

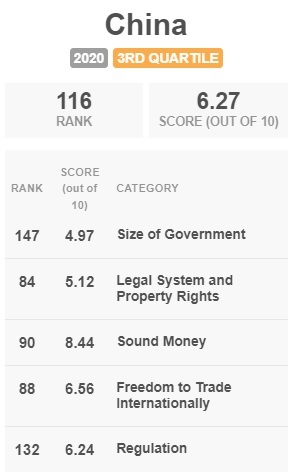

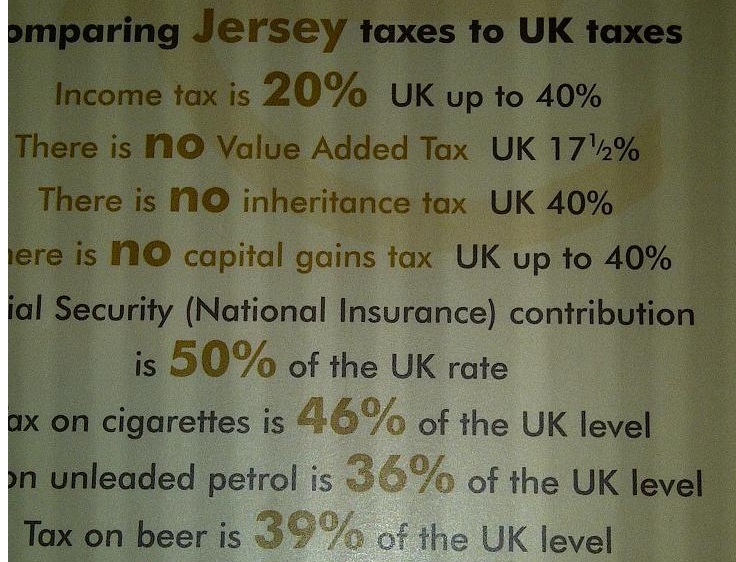

P.P.P.S. Leftist politicians frequently accuse so-called tax havens of being sanctuaries for dirty money, but those low-tax jurisdictions have much better track records than onshore nations.

Read Full Post »

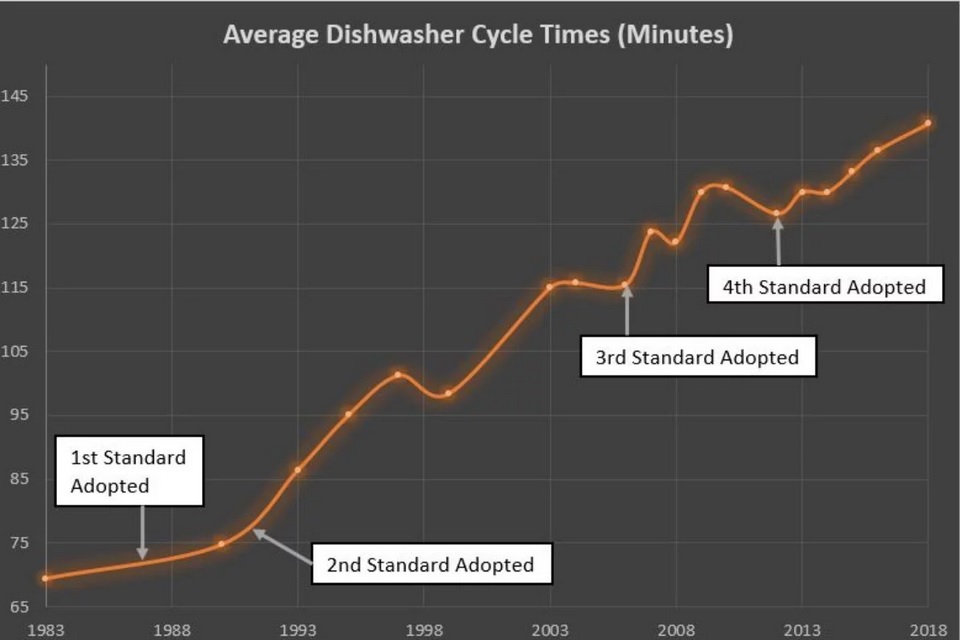

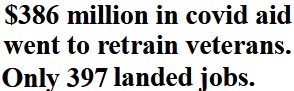

…$5 billion was allocated to individual states in so-called “formula funding” to build a network of fast chargers along major highways… But after two years, that program has only delivered 7 open charging stations with a total of 38 spots where drivers can charge their vehicles… requirements…slow down the build-out of the chargers. “This funding comes with dozens of rules and requirements,” Laska said.