When I wrote about the wealth tax early this year, I made three simple points.

I obviously have not been very persuasive.

At least in certain quarters.

A story in the Wall Street Journal explores the growing interest on the left in this new form of taxation.

The income tax..system could change fundamentally if Democrats win the White House and Congress. …Democrats want to shift toward taxing their wealth, instead of just their salaries and the income their assets generate. …At the end of 2017, U.S. households had $3.8 trillion in unrealized gains in stocks and investment funds, plus more in real estate, private businesses and artwork… Democrats are eager to tap that mountain of wealth to finance priorities such as expanding health-insurance coverage, combating climate change and aiding low-income households. …The most ambitious plan comes from Sen. Warren of Massachusetts, whose annual wealth tax would fund spending proposals such as universal child care and student-loan forgiveness. …rich would pay whether they make money or not, whether they sell assets or not and whether their assets are growing or shrinking.

in stocks and investment funds, plus more in real estate, private businesses and artwork… Democrats are eager to tap that mountain of wealth to finance priorities such as expanding health-insurance coverage, combating climate change and aiding low-income households. …The most ambitious plan comes from Sen. Warren of Massachusetts, whose annual wealth tax would fund spending proposals such as universal child care and student-loan forgiveness. …rich would pay whether they make money or not, whether they sell assets or not and whether their assets are growing or shrinking.

The report includes this comparison of current law with various soak-the-rich proposals (click here for my thoughts on the Wyden plan).

The article does acknowledge that there are some critiques of this class-warfare tax proposal.

European countries tried—and largely abandoned—wealth taxes. …For an investment yielding a steady 1.5% return, a 2% wealth levy would be equivalent to an income-tax rate above 100% and cause the asset to shrink. …The wealth tax also has an extra asterisk: it would be challenged as unconstitutional.

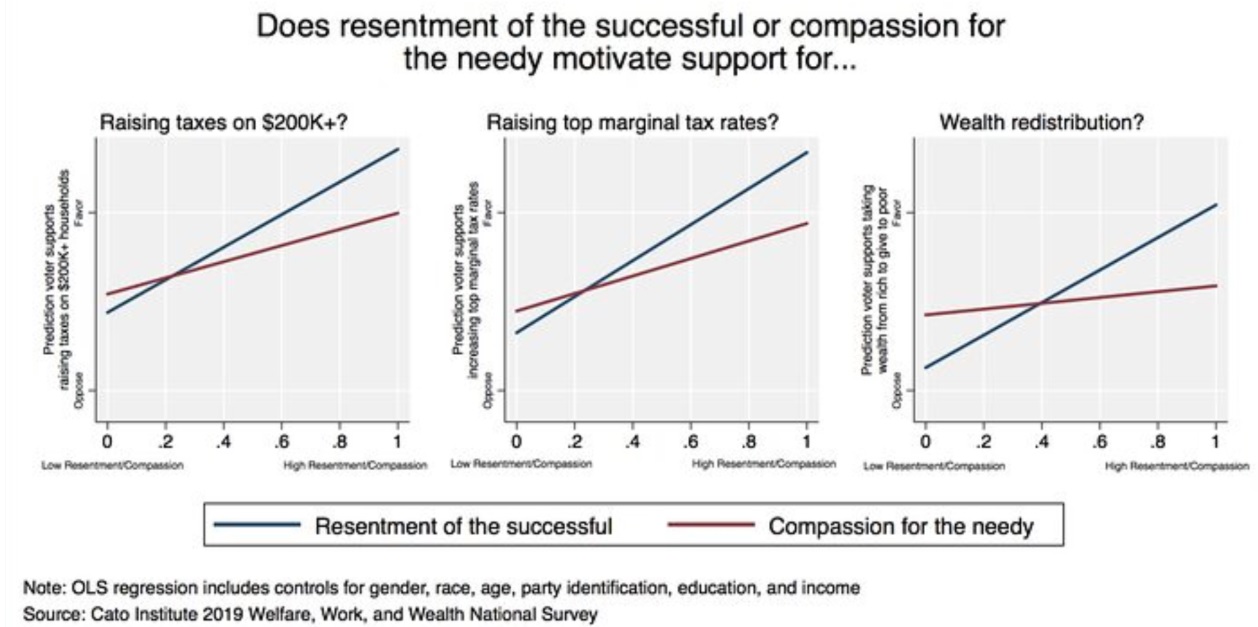

The two economists advising Elizabeth Warren, Emmanuel Saez and Gabriel Zucman, have a new study extolling the ostensible benefits of a wealth tax.

I want to focus on their economic arguments, but I can’t resist starting with an observation that I was right when I warned that the attack on financial privacy and the assault on so-called tax havens was a precursor to big tax increases.

Indeed, Saez and Zucman explicitly argue this is a big reason to push their punitive new wealth tax.

European countries were exposed to tax competition and tax evasion through offshore accounts, in a context where until recently there was no  cross-border information sharing. …offshore tax evasion can be fought more effectively today than in the past, thanks to recent breakthrough in cross-border information exchange, and wealth taxes could be applied to expatriates (for at least some years), mitigating concerns about tax competition. …Cracking down on offshore tax evasion, as the US has started doing with FATCA, is crucial.

cross-border information sharing. …offshore tax evasion can be fought more effectively today than in the past, thanks to recent breakthrough in cross-border information exchange, and wealth taxes could be applied to expatriates (for at least some years), mitigating concerns about tax competition. …Cracking down on offshore tax evasion, as the US has started doing with FATCA, is crucial.

Now that I’m done patting myself on the back for my foresight (not that it took any special insight to realize that politicians were attacking tax competition in order to grab more money), let’s look at what they wrote about the potential economic impact.

A potential concern with wealth taxation is that by reducing large wealth holdings, it may reduce the capital stock in the economy–thus lowering the productivity of U.S. workers and their wages. However, these effects are likely to be dampened in the case of a progressive wealth tax for two reasons. First, the United States is an open economy and a significant fraction of U.S. saving is invested abroad while a large fraction of U.S. domestic investment is financed by foreign saving. Therefore, a reduction in U.S. savings does not necessarily translate into a large reduction in the capital stock used in the United States. …Second, a progressive wealth tax applies to only the wealthiest families. For example, we estimated that a wealth tax above $50 million would apply only to about 10% of the household wealth stock. Therefore increased savings from the rest of the population or the government sector could possibly offset any reduction in the capital stock. …A wealth tax would reduce the financial payoff to extreme cases of business success, but would it reduce the socially valuable innovation that can be associated with such success? And would any such reduction exceed the social gains of discouraging extractive wealth accumulation? In our assessment the effect on innovation and productivity is likely to be modest, and if anything slightly positive.

I’m not overly impressed by these two arguments.

- Yes, foreign savings could offset some of the damage caused by the new wealth tax. But it’s highly likely that other nations would copy Washington’s revenue grab. Especially now that it’s easier for governments to track money around the world.

- Yes, it’s theoretically possible that other people may save more to offset the damage caused by the new wealth tax. But why would that happen when Warren and other proponents want to give people more goodies, thus reducing the necessity for saving and personal responsibility?

By the way, they openly admit that there are Laffer Curve effects because their proposed levy will reduce taxable activity.

With successful enforcement, a wealth tax has to deliver either revenue or de-concentrate wealth. Set the rates low (1%) and you get revenue in perpetuity but little (or very slow) de-concentration. Set the rates medium (2-3%) and you get revenue for quite a while and de-concentration eventually. Set the rates high (significantly above 3%) and you get de-concentration fast but revenue does not last long.

Now let’s look at experts from the other side.

In a column for Bloomberg, Michael Strain of the American Enterprise Institute takes aim at Elizabeth Warren’s bad math.

Warren’s plan would augment the existing income tax by adding a tax on wealth. …The tax would apply to fortunes above $50 million, hitting them with a 2% annual rate; there would be a surcharge of 1% per year on wealth in excess of $1 billion. …Not only would such a tax be very hard to administer, as many have pointed out. It likely won’t collect nearly as much revenue as Warren claims.  …Under Warren’s proposal, the fair market value of all assets for the wealthiest 0.06% of households would have to be assessed every year. It would be difficult to determine the market value of partially held private businesses, works of art and the like… This helps to explain why the number of countries in the high-income OECD that administer a wealth tax fell from 14 in 1996 to only four in 2017. …It is highly unlikely that the tax would yield the $2.75 trillion estimated by Emmanuel Saez and Gabriel Zucman, the University of California, Berkeley, professors who are Warren’s economic advisers. Lawrence Summers, the economist and top adviser to the last two Democratic presidents, and University of Pennsylvania professor Natasha Sarin…convincingly argued Warren’s plan would bring in a fraction of what Saez and Zucman expect once real-world factors like tax avoidance…are factored in. …economists Matthew Smith, Owen Zidar and Eric Zwick present preliminary estimates suggesting that the Warren proposal would raise half as much as projected.

…Under Warren’s proposal, the fair market value of all assets for the wealthiest 0.06% of households would have to be assessed every year. It would be difficult to determine the market value of partially held private businesses, works of art and the like… This helps to explain why the number of countries in the high-income OECD that administer a wealth tax fell from 14 in 1996 to only four in 2017. …It is highly unlikely that the tax would yield the $2.75 trillion estimated by Emmanuel Saez and Gabriel Zucman, the University of California, Berkeley, professors who are Warren’s economic advisers. Lawrence Summers, the economist and top adviser to the last two Democratic presidents, and University of Pennsylvania professor Natasha Sarin…convincingly argued Warren’s plan would bring in a fraction of what Saez and Zucman expect once real-world factors like tax avoidance…are factored in. …economists Matthew Smith, Owen Zidar and Eric Zwick present preliminary estimates suggesting that the Warren proposal would raise half as much as projected.

But a much bigger problem is her bad economics.

…a household worth $50 million would lose 2% of its wealth every year to the tax, or 20% over the first decade. For an asset yielding a steady 1.5% return, a 2% wealth tax is equivalent to an income tax of 133%. …And remember that the wealth tax would operate along with the existing income tax system. The combined (equivalent income) tax rate would often be well over 100%. Underlying assets would routinely shrink. …The tax would likely reduce national savings, resulting in less business investment in the U.S… Less investment spending would reduce productivity and wages to some extent over the longer term.

Strain’s point is key. A wealth tax is equivalent to a very high marginal tax rate on saving and investment.

Of course that’s going to have a negative effect.

Chris Edwards, in a report on wealth taxes, shared some of the scholarly research on the economic effects of the levy.

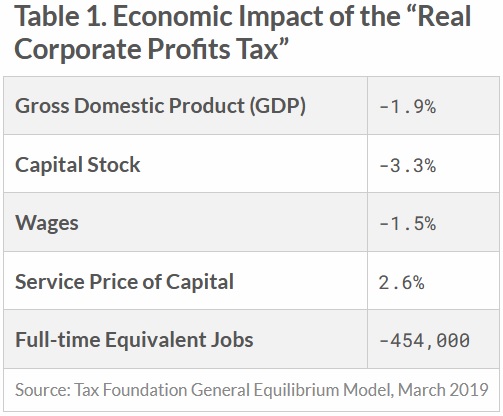

Because wealth taxes suppress savings and investment, they undermine economic growth. A 2010 study by Asa Hansson examined the relationship between wealth taxes and economic growth across 20 OECD countries from 1980 to 1999. She found “fairly robust support for the popular contention that wealth taxes dampen economic growth,” although the magnitude of the measured effect was modest. The Tax Foundation simulated  an annual net wealth tax of 1 percent above $1.3 million and 2 percent above $6.5 million. They estimated that such a tax would reduce the U.S. capital stock in the long run by 13 percent, which in turn would reduce GDP by 4.9 percent and reduce wages by 4.2 percent. The government would raise about $20 billion a year from such a wealth tax, but in the long run GDP would be reduced by hundreds of billions of dollars a year.Germany’s Ifo Institute recently simulated a wealth tax for that nation. The study assumed a tax rate of 0.8 percent on individual net wealth above 1 million euros. Such a wealth tax would reduce employment by 2 percent and GDP by 5 percent in the long run. The government would raise about 15 billion euros a year from the tax, but because growth was undermined the government would lose 46 billion euros in other revenues, resulting in a net revenue loss of 31 billion euros. The study concluded, “the burden of the wealth tax is practically borne by every citizen, even if the wealth tax is designed to target only the wealthiest individuals in society.”

an annual net wealth tax of 1 percent above $1.3 million and 2 percent above $6.5 million. They estimated that such a tax would reduce the U.S. capital stock in the long run by 13 percent, which in turn would reduce GDP by 4.9 percent and reduce wages by 4.2 percent. The government would raise about $20 billion a year from such a wealth tax, but in the long run GDP would be reduced by hundreds of billions of dollars a year.Germany’s Ifo Institute recently simulated a wealth tax for that nation. The study assumed a tax rate of 0.8 percent on individual net wealth above 1 million euros. Such a wealth tax would reduce employment by 2 percent and GDP by 5 percent in the long run. The government would raise about 15 billion euros a year from the tax, but because growth was undermined the government would lose 46 billion euros in other revenues, resulting in a net revenue loss of 31 billion euros. The study concluded, “the burden of the wealth tax is practically borne by every citizen, even if the wealth tax is designed to target only the wealthiest individuals in society.”

The last part of the excerpt is key.

Yes, the tax is a hassle for rich people, but it’s the rest of us who suffer most because we’re much dependent on a vibrant economy to improve our living standards.

My contribution to this discussion it to put this argument in visual form. Here’s a simply depiction of how income is generated in our economy.

Now here’s the same process, but with a wealth tax.

For the sake of argument, as you can see from the letters that have been fully or partially erased, I assumed the wealth tax would depress the capital stock by 10 percent and that this would reduce national income by 5 percent.

I’m not wedded to these specific numbers. Both might be higher (especially in the long run), both might be lower (at least in the short run), or one of them might be higher or lower.

What’s important to understand is that rich people won’t be the only ones hurt by this tax. Indeed, this is a very accurate criticism of almost all class-warfare taxes.

The bottom line is that you can’t punish capital without simultaneously punishing labor.

But some of our friends on the left – as Margaret Thatcher noted many years ago – seem to think such taxes are okay if rich people are hurt by a greater amount than poor people.

P.S. Since I mentioned foresight above, I was warning about wealth taxation more than five years ago.

Read Full Post »

Richard Blumenthal

Richard Blumenthal