I was interviewed a couple of days ago about rival tax plans by various Democratic presidential candidates.

It’s the “Class Warfare Olympics,” and even Joe Biden is thinking about going hard left with a tax on financial transactions.

It’s not just Joe Biden’s crazy idea. Other Democratic candidates have endorsed the idea, as has Nancy Pelosi, and CNBC reports that legislation has been introduced in the House and the Senate.

House Democrats are reintroducing their proposal of a financial transaction tax on stock, bond and derivative deals, and this time they’ve signed on a key new supporter: left-wing firebrand Rep. Alexandria Ocasio-Cortez.

…“This option would increase revenues by $777 billion from 2019 through 2028, according to an estimate by the staff of the Joint Committee on Taxation,” the Congressional Budget Office’s website says. …The House bill comes on the heels of its companion legislation introduced by Sen. Brian Schatz, D-Hawaii, in the other chamber. Republicans have a 53-47 majority in the Senate.

Needless to say, I’m not surprised to see that AOC is on board. I don’t think there’s a tax she doesn’t want to impose and/or increase.

By the way, I should note that she and other advocates generally are looking at more limited FTTs that would tax transactions only in financial markets, so there wouldn’t necessarily be any direct burden when we write a check or visit the ATM.

But even this more restrained FTT would be very bad news, with significant indirect costs on ordinary people.

Some analysis from the Tax Foundation highlights some of the drawbacks from this tax.

Policymakers should be wary about adopting a financial transactions tax. Like a gross receipts tax, a financial transactions tax results in tax pyramiding. The same economic activity is taxed multiple times. For example, an individual might sell a stock worth $100 to diversify her portfolio and then purchase stock in a new company with that same $100.

The $100 is being taxed twice: first, when the individual sells the stock, and then again when the money is used to buy the new security. Imagine this happening thousands of times a day. …That is why this tax would generate nearly $770 billion over a decade. …Supporters, however, argue that the Wall Street Tax Act is needed, because it would reduce volatility in financial markets. It’s not clear that it would reduce volatility. In 2012, the Bank of Canada studied the issue and concluded that “little evidence is found to suggest that an FTT [financial transactions tax] would reduce speculative trading or volatility. In fact, several studies conclude that an FTT increases volatility and bid-ask spreads and decreases trading volume.” …Sweden’s imposition of a financial transactions tax in the 1980s illustrates the challenges perfectly. The country experienced a 60 percent decrease in trading volume as it moved to other markets, as well as a decrease in revenue.

Another report from the Tax Foundation notes the tax can increase volatility and cause direct and indirect revenue losses.

A financial transactions tax would distort asset markets, as types of securities traded more frequently would be taxed much more than assets traded less frequently. This distortion would lead to investors holding certain assets longer than they should in order to avoid the tax.

The tax also decreases liquidity and increases transaction costs. …it will also discourage transactions between well-informed investors; furthermore, much of the research on the issue of volatility suggests that higher transaction costs correlate with more volatility, not less. Financial transactions taxes are also not surefire revenue generators. In the 1980s, Sweden imposed a financial transactions tax, and, thanks to the relative mobility of capital markets, 60 percent of trades moved to different markets. Not only did this behavior mean that the financial transactions tax raised little revenue, it also drove down revenue for the capital gains tax, ultimately lowering total government receipts.

A column in the Wall Street Journal notes that such a levy would directly and indirectly hurt ordinary people.

The proposed 0.1% tax on all financial transactions—trades in stocks, bonds, derivatives—may sound small, but it could make markets less stable and hurt small investors. …advocates overlook the breadth of smaller investors… Each day, more than $1 trillion in securities are traded in the U.S., mostly by large investment managers that represent not only wealthy investors, but also 401(k) plans, public pensions and middle-income families. …even a small tax is significant enough to affect trading strategy and raise costs.

Such firms…use the minimal cost of automated, high-frequency trading to reduce the need for paid traders, generating savings for investors. …high-frequency traders provide liquidity and have reduced the gap between bid and ask rates in almost every asset class. The disruptive effect of transaction taxes is more than theoretical. The Chinese government has taxed trades since the early 1990s, and its gradual reduction of the tax on certain types of stocks offers an occasion to measure the tax’s effects. A 2014 study by University of Southern California finance professor Yongxiang Wang found that as the tax decreased, affected companies saw corresponding increases in capital investment, innovation and equity financing. …Sweden and France similarly have introduced financial-transactions taxes over the past few decades, resulting in heightened market volatility and declining liquidity, respectively. …Even at a 0.1% rate, the Joint Committee on Taxation estimates the proposed tax would raise $777 billion over 10 years—all taken out of potentially productive private investment. …financial transactions are highly mobile and easy to move to another jurisdiction. Two parties to a financial contract settled in New York can just as easily sign and enforce the contract in the Cayman Islands, for instance, avoiding the tax.

Interestingly, the Washington Post‘s editorial on the topic back in 2016 noted some significant downsides.

It’s worth noting that the United States had a 0.02 percent tax on stock trades in force during the 1920s, and the market still crashed in 1929. If the tax is too high, however, you could stamp out needed price-discovery, hedging and liquidity, thus destroying efficiency and economic growth.

Oh, and you also could end up collecting no revenue, or less than you expected, as market activity dried up or fled to more lightly taxed jurisdictions overseas. For these and other reasons, in 1991 Sweden had to repeal a financial transaction tax it had imposed just seven years earlier. An analysis of financial transaction taxes, both actual and proposed, by the nonpartisan Tax Policy Center…shows rapidly diminishing returns once the tax rate exceeds a certain level; a 0.5 percent tax brings in about the same amount of revenue as a 0.1 percent rate.

For what it’s worth, I expect that the Post will do an about-face and embrace the tax as we get closer to the 2020 election.

Though I hope I’m wrong about that.

Let’s close with some excerpts from three substantive studies.

Tim Worstall, in a report for London’s Institute for Economic Affairs, analyzes the harmful effect of a proposed European-wide FTT.

The Robin Hood Tax campaign seems to think that hundreds of billions of dollars can be extracted from the financial markets without anyone really noticing very much: a rather naïve if cute idea. The European Commission is continuing its decades-long campaign to have its ‘own resources’. Under its proposal, FTT revenue would be sent to the Commission, which would thus become less dependent on national governments for its budget.

This is neither unusual nor reprehensible in a bureaucracy. It is the nature of the beast that it would like to have its own money to spend without being beholden. …The first and great lesson of tax incidence is that taxes on companies are not paid by companies. …The importance of this effect is still argued over. Various reports from various people with different assumptions about capital openness and so on lead to estimates of 30-70% of corporation tax really being paid by the workers, the rest by the shareholders. One study, Atkinson and Stiglitz (1980), points to the at least theoretical possibility that the incidence on the workers’ wages can be over 100%. That is, that the employees lose in wages more than the revenue raised by the tax. So what will be the incidence of an FTT? … the incidence of the FTT will be upon workers in the form of lower wages, upon consumers of financial products in higher prices and that the incidence, the loss of income resulting from the tax, will be over 100%. The loss will be greater than the revenues raised.

here’s some research from the Committee for Capital Markets Regulation.

For over 300 years, financial transaction taxes (“FTTs”) have been proposed, discussed, and implemented in various forms across global financial markets. And for over 300 years, FTTs have been a failure wherever imposed, frequently failing to raise the promised revenues,

while simultaneously damaging the efficiency of the affected markets. Recent proposals for an FTT in the United States would likely have a similar result. …FTT proponents also ignore the empirical evidence from other countries that have imposed FTTs that universally demonstrates that (i) FTTs fall far short of revenue expectations and (ii) securities markets – and by extension the real economy as well as all investors and taxpayers – are significantly harmed by FTTs due to the wide array of beneficial trading activity that is indiscriminately targeted. In fact, many of the G20 countries that have experimented with FTTs in the past, including Germany, Italy, Japan, the Netherlands, Portugal and Sweden, ultimately repealed such taxes due to the damage that they caused.

Last but not least, a study from the Center for Capital Markets Competitiveness has lots of valuable information.

Lower stock prices make it harder for growing businesses to sell stock to raise the capital they need to grow their businesses. At the same time, business borrowing costs through the corporate bond market will go up for the same reason. Lenders will require a higher pre-tax return in order to retain the same after-tax return. …This increase in the cost of capital due to higher interest rates

means that businesses will have to spend more in order to raise capital, resulting in less capital investment and fewer jobs. …For example, economists for the European Union conducted a 1,223-page study on the impact of a proposed 0.10% transaction tax under consideration, the same tax rate as that proposed by Sen. Schatz. They found that such a tax would lower GDP by 1.76% while raising revenue of only 0.08% of GDP.26 In other words, the cost to the economy is far more than the revenue raised. …We can learn from U.S. history how little revenue an FTT would raise. When the last FTT was abolished, the rate was approximately 0.4% with a limit of 8 cents per share. Congress estimated that the tax would raise a mere $195 million in 1966. This represents 0.0285% of 1966’s $813 billion GDP. Applying the same percentage to today’s $21 trillion GDP yields an annual revenue of less than $6 billon—less than one-tenth of Sen. Schatz’s projections for such a tax today.

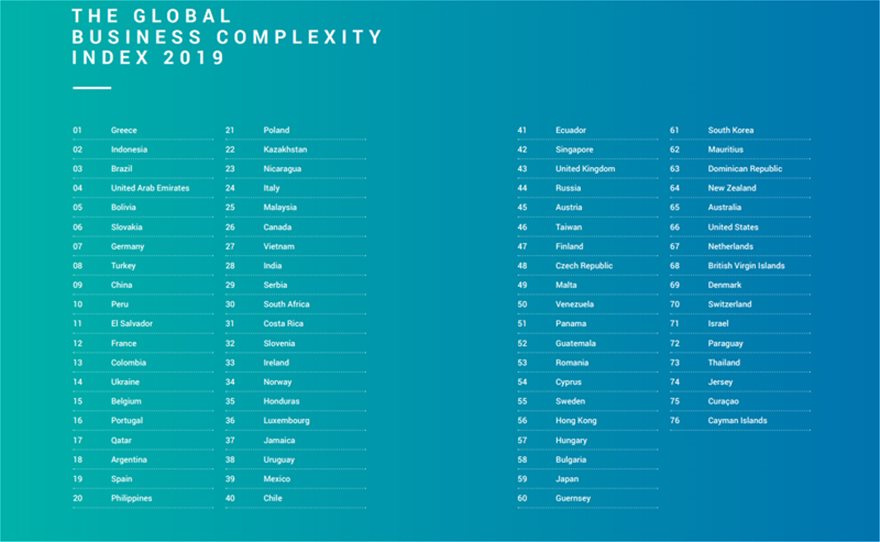

This map from the study is especially helpful.

Just as is the case for wealth taxes, governments have not had positive experiences when they impose this levy.

P.S. Speaking of wealth taxes, I did note in the above interview that those levies are presumably the most destructive because of their negative effect on saving and investment.

P.P.S. If I’m a judge in the Class Warfare Olympics, I’m giving the Gold Medal to Bernie Sanders, the Silver Medal to Elizabeth Warren, and the Bronze Medal to Kamala Harris.

P.P.P.S. As I warned in the interview, the class-warfare taxes won’t collect much revenue, especially compared to the massive spending increases the candidates are proposing. That’s why the middle class is the real target.

P.P.P.P.S. I goofed in the interview when I identified Larry Summers as Obama’s Treasury Secretary. He was Treasury Secretary for Bill Clinton and head of the National Economic Council for Barack Obama.