The bad news is that America is about to elect a statist president. But will we get Hillary’s corruption or Donald’s buffoonery?

According to RealClearPolitics, Hillary Clinton will prevail, albeit by a very narrow margin, with 272 electoral votes. They have a very close race because Trump is projected to prevail in the swing states of Florida, North Carolina, and Nevada. If you believe these numbers, Trump simply has to flip semi-competitive New Hampshire (home to thousands of free-state libertarians) and he is the next President. At which point this joke about emigration to Canada becomes reality.

According to RealClearPolitics, Hillary Clinton will prevail, albeit by a very narrow margin, with 272 electoral votes. They have a very close race because Trump is projected to prevail in the swing states of Florida, North Carolina, and Nevada. If you believe these numbers, Trump simply has to flip semi-competitive New Hampshire (home to thousands of free-state libertarians) and he is the next President. At which point this joke about emigration to Canada becomes reality.

According to Nate Silver, a highly regarded statistics expert, Hillary Clinton wins comfortably because she carries the swing states of Florida, North Carolina, and Nevada. That should give her 323 electoral votes, but Silver’s model is based on probabilities, so she instead is projected to get 302.4 electoral votes. For what it’s worth, Gary Johnson easily breaks the record for the Libertarian Party, but he falls just short of the 5-percent mark.

According to Nate Silver, a highly regarded statistics expert, Hillary Clinton wins comfortably because she carries the swing states of Florida, North Carolina, and Nevada. That should give her 323 electoral votes, but Silver’s model is based on probabilities, so she instead is projected to get 302.4 electoral votes. For what it’s worth, Gary Johnson easily breaks the record for the Libertarian Party, but he falls just short of the 5-percent mark.

According the political betting markets, Hillary Clinton will prevail with 323 electoral votes. The people waging cash believe she will come out on top in Nevada, Florida, and North Carolina, matching Nate Silver’s projection (interestingly, Trump is seen as having a better chance in Michigan than in Nevada). All of the third-party candidates, including Gary Johnson, apparently have a 0.1 percent chance of winning.

According the political betting markets, Hillary Clinton will prevail with 323 electoral votes. The people waging cash believe she will come out on top in Nevada, Florida, and North Carolina, matching Nate Silver’s projection (interestingly, Trump is seen as having a better chance in Michigan than in Nevada). All of the third-party candidates, including Gary Johnson, apparently have a 0.1 percent chance of winning.

Last but not least, we have Professor Larry Sabato’s Crystal Ball. He picks Hillary and says she will get 322 electoral votes. Sabato has the same state-by-state breakdown as Silver and the betting markets, but he projects that Trump will win one electoral vote from Maine, which (like Nebraska) allocates two votes to the statewide winner and then one vote to the winner of each congressional district. In the for-what-it’s-worth department, there are twice as many (90) vulnerable electoral votes that Democrats have to worry about compared to Republicans (43).

Last but not least, we have Professor Larry Sabato’s Crystal Ball. He picks Hillary and says she will get 322 electoral votes. Sabato has the same state-by-state breakdown as Silver and the betting markets, but he projects that Trump will win one electoral vote from Maine, which (like Nebraska) allocates two votes to the statewide winner and then one vote to the winner of each congressional district. In the for-what-it’s-worth department, there are twice as many (90) vulnerable electoral votes that Democrats have to worry about compared to Republicans (43).

So what’s my prediction?

If I wanted to torture the American people by prolonging the race, I would take the RealClearPolitics prediction, shift New Hampshire to Trump and shift Maine’s second congressional district to Hillary. The net result would be a 269-269 tie and the result would be total turmoil since the election would then be decided based on skullduggery in the electoral college or a state-by-state vote in the House of Representatives.

But I don’t expect that to happen, even though it would be highly entertaining (it would make Bush-vs.-Gore in 2000 seem like a bipartisan picnic).

I’m tempted to simply recycle the prediction I put forth one month ago. I showed Hillary winning with 328 electoral votes (basically similar to the consensus above, but with Iowa going for Hillary).

I’m tempted to simply recycle the prediction I put forth one month ago. I showed Hillary winning with 328 electoral votes (basically similar to the consensus above, but with Iowa going for Hillary).

But it does indeed look like Trump will prevail in Iowa, so my final prediction will move the Hawkeye State back in the GOP column.

But I don’t want to have the same guess as almost everyone else (we libertarians have a tendency to be obstreperous), so let’s mix things up. The easy adjustment would be to give one or two of the “leaning Democrat” states to Trump. But my gut instinct tells me that growing Hispanic populations in Nevada and Florida make that unlikely. And North Carolina has too many college-educated whites, as well as an increased Hispanic presence, neither of which is good news for Trump.

So I’m going to defy all the experts and give Trump an extra state from the rust belt. Let’s say Michigan, which means my final electoral prediction is a 306-232 victory for Tweedledee. Or is she Tweedledum? Whatever.

Some of my Republican friends will be disappointed by this outcome, so time to make some predictions that will make them happy. The House stays Republican in my humble opinion, with a final total of 239 seats (my one success in the business of political prognostication occurred six years ago when I was exactly right in my House prediction).

The Senate outcome is even more important and GOPers will be very happen if I am correct in predicting that Republicans will hold the Senate 51-49, which would be a remarkable achievement since they are defending more than twice as many seats as Democrats this cycle. Nonetheless, that still means they will lose three seats, and my guess is that Wisconsin, Illinois, and Pennsylvania is where Republicans incumbents will fall short.

By the way, this outcome is not too bad for libertarians and other advocates of limited government. Consider these implications.

- Hillary will enter office widely disliked and distrusted, and the media will pay much closer attention to her misdeeds once she defeats Trump.

- She’ll have very little opportunity to expand the burden of government since the House (and maybe the Senate) will be controlled by Republicans.

- The 2018 mid-term elections are usually bad news for the party that controls the White House and Democrats have to defend a disproportionate number of Senate seats that cycle.

- The GOP might nominate someone in 2020 who believes in smaller government and that candidate may sweep into office with a Republican House and a Republican Senate.

- In 2021, genuine entitlement reform and sweeping tax reform could get enacted and Dan Mitchell could then safely retire to the Cayman Islands and introduce softball to that population.

Nice scenario, huh?

Then again, I basically made the same argument four years ago, and that didn’t turn out so well.

So if you’re done laughing at my optimistic take, here’s some meant-to-be-funny material to carry you through the day.

So if you’re done laughing at my optimistic take, here’s some meant-to-be-funny material to carry you through the day.

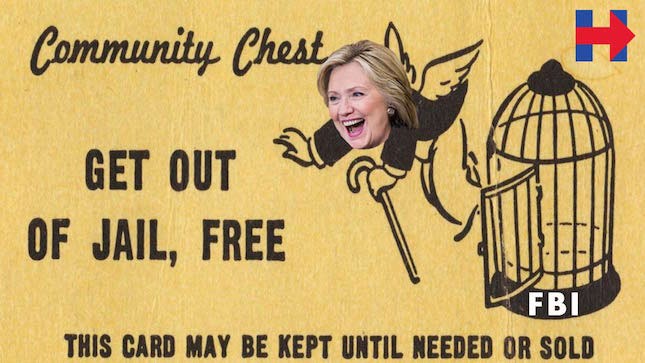

We’ll start with Anthony Weiner learning why it’s not a good idea to get on Hillary’s bad side (by the way, I have run into people who actually think that the Clintons have had people murdered and I always give them this column in hopes of calming them down).

And since Donald Trump is on the bad side of lots of Hispanic voters (presumably enough to give the election to Hillary),  this quip by Seth Meyers is particularly (and appropriately) savage. Indeed, if Trump loses by a narrow margin and if he is capable of introspection, one wonders whether he will regret some of his rhetoric.

this quip by Seth Meyers is particularly (and appropriately) savage. Indeed, if Trump loses by a narrow margin and if he is capable of introspection, one wonders whether he will regret some of his rhetoric.

Last but not least, if you liked the “Mitt Romney Style” video from 2012, we can balance it with a video about Hillary, showing how the White House will operate under when pay-to-play become the modus operandi at 1600 Pennsylvania Avenue.

P.S. Don’t forget that there are several important ballot initiatives today.

Addendum: Can’t resist adding this cleverly doctored photo of Chelsea reading a bedtime story.

Though, to her credit, Chelsea isn’t associated with any bad policy ideas. The same can’t be said for Ivanka Trump.