I favor “freedom conservatism” over “national conservatism” because the former is unambiguously based on liberty and the latter veers toward populism.

Of course, it’s never easy to define populism. My shorthand definition is that a populist is someone who exploits economic ignorance to push policies that sound appealing to voters in the short run (such as protectionism, industrial policy, or class warfare) but do economic damage in the long run.

So I was very interested to see that three German economists (Manuel Funke, Moritz Schularick, and Christoph Trebesch) authored some research about populism and economic policy for the Kiel Institute for the World Economy.

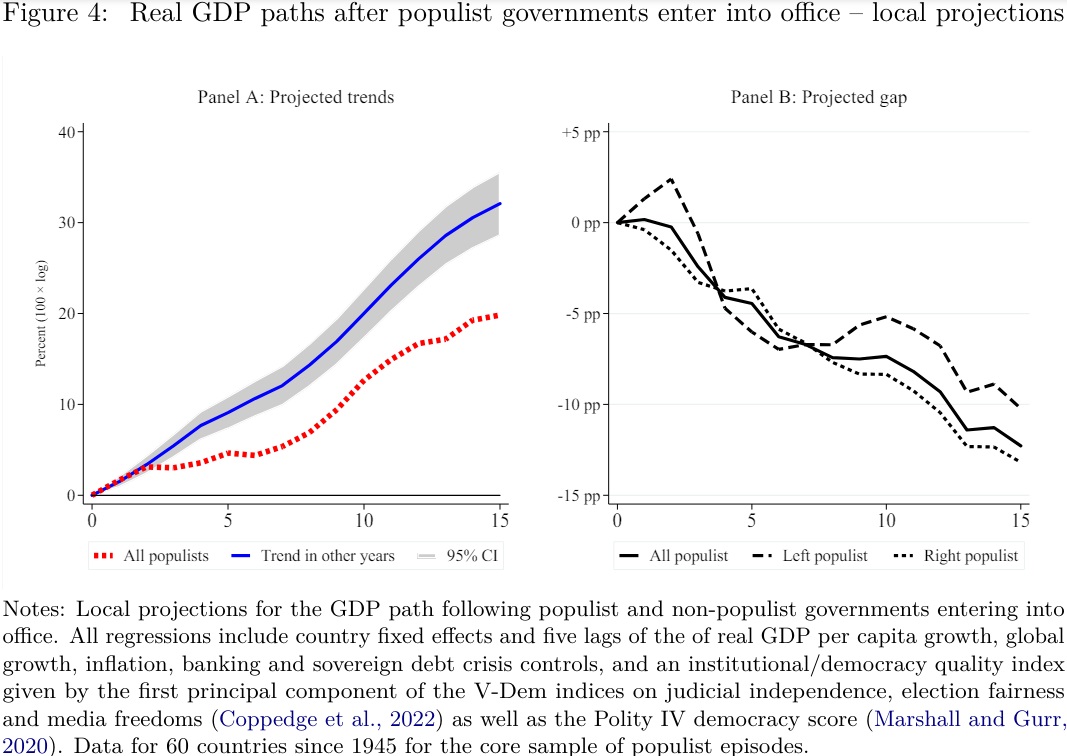

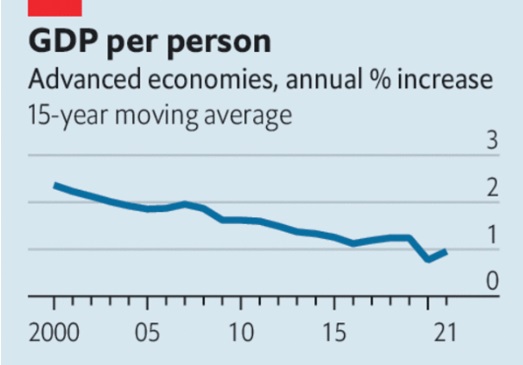

Just in case some readers are pressed for time, the biggest takeaway from their study is that populism leads to less prosperity – as captured by Figure 4.

Their study looks at both left-wing populists and right-wing populists. Both versions produce negative economic consequences.

Though Figure 6 shows that leftist populists seems to do more damage than rightist populists.

Here are some highlights from their findings.

A core empirical challenge is to identify populist leaders. Our database on populists in power is the most ambitious exercise to classify populist leaders to date, spanning more than 100 years and 60 large countries. …According to today’s workhorse definition, populism is defined as a political style centered on the supposed struggle of “people vs. the establishment”…Populists place the narrative of “people vs. elites” at the center of their political agenda…

In the empirical analysis, we use a variety of different empirical strategies that all paint a similar picture: populism has large economic costs. Over 15 years, GDP per capita and consumption decline by more than 10% compared to a plausible non-populist counterfactual. Moreover, despite their claim to pursue the interests of the “common people” against the elites, the income distribution does not improve on average. …we also look at other outcomes and present evidence that economic disintegration, unsustainable macro policies, and the erosion of institutions typically go hand-in-hand with populism. Trade and financial integration falls, suggesting that populists often deliver on their promises of fostering economic nationalism and protectionism

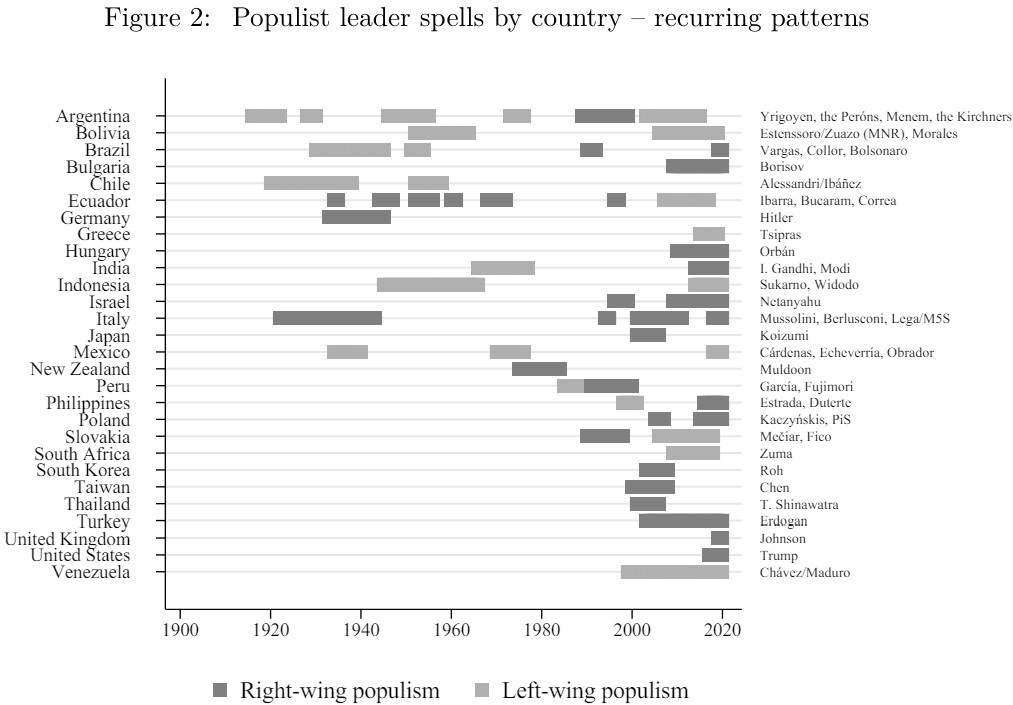

If you’re wondering which politicians are populists, here’s their list.

I don’t have any objections to the politicians listed above, but if populists are politicians who gain power by whipping up antagonism against the “establishment” and the “elite,” then why isn’t Franklin Roosevelt on the list?

Or how about Brazil. I can understand Bolsonaro being included, but why not Rousseff or Lulu?

Moreover, why not include every socialist government, most of which usually gain power after campaigning on class-warfare agendas?

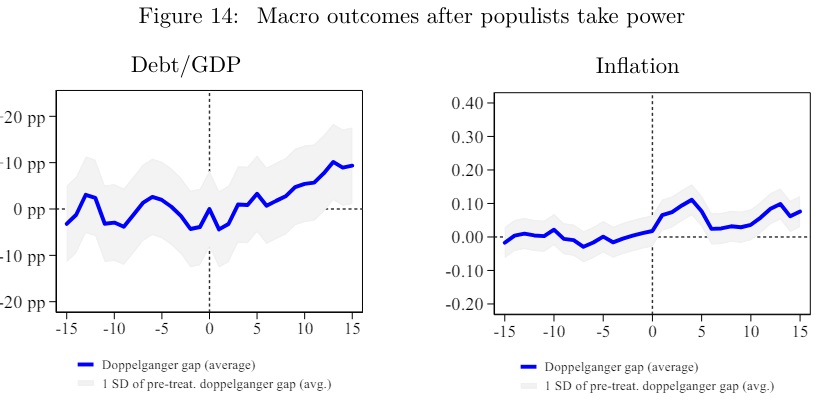

I could list other examples, but let’s return to the study and share more of the findings. Unsurprisingly, populist governments are associated with more debt and more inflation.

All of which confirms my shorthand definition that populists do things that seem popular in the short run (spend money and print money) but do damage in the long run.

P.S. I can’t resist asking whether Argentina’s new libertarian president is a populist. Javier Milei definitely campaigned against the establishment and the elite, so he presumably qualifies. However, his agenda is to shrink the burden of government (and he’s doing a good job so far), which is contrary to the statist agenda of the politicians analyzed in the study.