Since I’m not a fan of either Donald Trump or Hillary Clinton, I think that puts me in a good position to fairly assess whether the candidates are being dishonest.

And since several media outlets just produced their “fact-checks” on Donald Trump’s acceptance speech to the Republican convention, this is a perfect opportunity to see not only whether Trump was being dishonest but also whether media fact-checking is honest.

Here’s some of the “fact-checking” from NBC., with each indented example being followed by my two cents.

TRUMP CLAIM: Nearly four in 10 African-American children are living in poverty, while 58 percent of African-American youth are now not employed. Two million more Latinos are in poverty today than when the President took his oath of office less than eight years ago.

THE FACTS: Yes, 38 percent of African American children are living in poverty, according to Census data. But Trump isn’t correct that 58 percent of African American youth are unemployed. The Bureau of Labor Statistics finds that the African American unemployment rate for those ages 16-19 is 28.4 percent (versus 16.9 percent for all youth that age). And Trump is misleading on his claim about Latinos living in poverty. In 2009, 12.3 million Latinos were living in poverty (with a rate of 25.3 percent). In 2014, the number jumped to 13 million — but the rate actually DECLINED to 23.6 percent.

Shame on NBC for pulling a bait-and-switch. Trump didn’t say that there is a 58-percent unemployment rate among black youth. He said that 58 percent of them aren’t employed.

What NBC doesn’t understand (or deliberately chooses to hide) is  that the unemployment rate only counts those “actively” looking for work.

that the unemployment rate only counts those “actively” looking for work.

Trump was focusing on labor-force participation.

I’m sure he made that choice because it gave him a number that sounded bad, but there are very good reasons to focus on the share of people employed rather than the unemployment rate (though it’s worth noting that a 28.4 percent unemployment rate for young blacks is plenty scandalous, which raises the question of why Trump didn’t point out that African-Americans have been hurt by Obamanomics).

On the other hand, Trump may be factually wrong about the number of Latinos living in poverty, though you’ll notice below that National Public Radio basically said Trump is right on this issue.

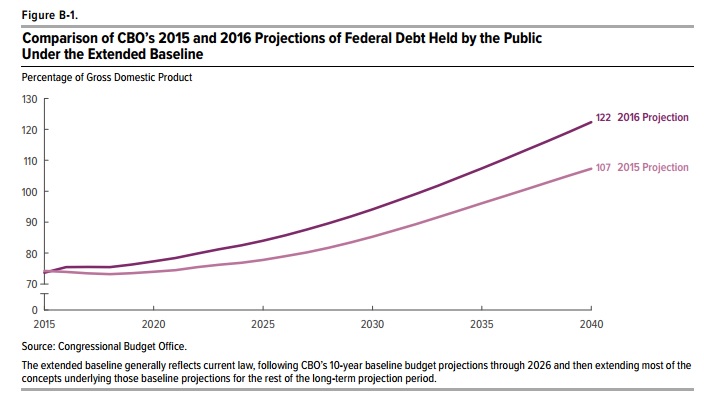

TRUMP CLAIM: President Obama has almost doubled our national debt to more than 19 trillion dollars, and growing.

THE FACTS: He’s right. When Obama took office on Jan. 20, 2009, the public debt stood at $10.6 trillion. It is now $19.4 trillion, according to the U.S. Treasury Department.

Since I’ve already explained that George W. Bush deserves the overwhelming share of the blame for the budget numbers in Fiscal Year 2009 (which started on October 1, 2008), I think NBC actually missed a chance to criticize Trump for either being dishonest or for overstating the case against Obama.

Now let’s see what the New York Times wrote about Trump’s accuracy.

• “Nearly four in 10 African-American children are living in poverty, while 58 percent of African-American youth are not employed.”

Fact Check: According to the Bureau of Labor Statistics, the unemployment rate of African Americans ages 16-19 in June was 31.2 percent (among whites of the same age, it was 14.1 percent).

The NYT does the same bait-and-switch as NBC, accusing Trump of saying A when he actually said B.

Is this because of dishonesty or sloppiness? Beats me, though I suspect the former.

• “Household incomes are down more than $4,000 since the year 2000.”

Fact Check: This is mostly true. Median household income in 2000 was $57,724; in 2014, which has the most recent available data, it was $53,657.

My only comment is that I’m surprised the NYT didn’t go after Trump for using 2000 as his starting year, which obviously includes the stagnant big-government Bush years as well as the stagnant big-government Obama years.

• “Our manufacturing trade deficit has reached an all-time high – nearly $800 billion in a single year.”

Fact Check: The goods deficit — more imported goods, less exported goods — was $763 billion last year. But that includes agricultural products and raw materials like coal. Moreover, the total trade deficit last year was only $500 billion because the U.S. runs a trade surplus in services.

I think Trump is wrong about trade. Wildly wrong.

But the NYT is once again doing a bait-and-switch. Trump was talking about the trade is goods, not the overall trade balance.

They could have accurately accused him of selective use of statistics, or even misleading use of statistics. But his claim was accurate (depending whether you think $763 billion is “nearly” $800 billion).

• “President Obama has doubled our national debt to more than $19 trillion, and growing.”

Fact Check: The national debt was $10.6 trillion on the day Obama took office. It was $19.2 trillion in April, so not quite double, but close.

As I explained above, this is an example of the media missing a chance to hit Trump, presumably because journalists don’t understand the budget process.

• “Forty-three million Americans are on food stamps.”

Fact Check: As of October, this figure was largely accurate, according to the United States Department of Agriculture.

At least the New York Times didn’t try to spin this number by claiming food stamps are “stimulus.”

Speaking of spin, here’s the fact-checking from National Public Radio.

Nearly 4 in 10 African-American children are living in poverty, while 58% of African-American youth are now not employed.

[Thirty-six percent of African-Americans under 18 were below the poverty line as of 2014, according to the Census Bureau. It’s not entirely clear what Trump means by “not employed,” which is not technically the same as “unemployed,” which counts people who aren’t working and are looking for work. However, the unemployment rate for black Americans ages 16 to 19 was 38.1 percent as of June. — Danielle Kurtzleben]

It’s actually very clear what Trump meant by “not employed.” As should be obvious, it means the share of the population that is not working.

But NPR presumably is pretending to be stupid so they can do a bait-and-switch and focus on the unemployment rate.

2 million more Latinos are in poverty today than when President Obama took his oath of office less than eight years ago.

[That’s roughly true, by the latest data available. Around 11 million Hispanic-Americans were in poverty in 2008, compared with 13.1 million in 2014. The poverty rate makes more sense to compare, though — that has grown 0.4 points since 2008, but it has also declined lately, down by nearly 3 points since 2010. As for whether President Obama is responsible for this, we get to that below. — Danielle Kurtzleben]

The fact that NBC and NPR disagree appears to be based on whether one uses the total number of poor Latinos in 2008 or 2009.

poor Latinos in 2008 or 2009.

Obama took his oath of office in early 2009, so it seems that NPR missed a chance to attack Trump.

Though without knowing how the Census Bureau measures the number of people in poverty in any given year (average for the entire year? the number as of January 1? July 1? December 31?), there’s no way to know whether Trump exaggerated or misspoke.

Another 14 million people have left the workforce entirely.

[There’s a lot going on in this statistic. So here goes: Trump may be talking about the number of adults not in the labor force — that is, neither working nor looking for work (so it includes retirees and students, for example). That figure has climbed by 14 million since January 2009 (importantly, this isn’t people leaving the labor force; it’s just people not in it, period). But while labor force participation is relatively low, the labor force has still been growing — Trump’s 14 million figure might imply that it’s not. And that low labor force participation isn’t entirely about a tough economy — a lot of it is simple demographics. In 2014, the Congressional Budget Office found that half of a recent 3-point drop in the rate had been due to baby boomers retiring. The other half was economic factors. — Danielle Kurtzleben]

That’s a long-winded way of saying that Trump’s number was accurate, but they want to imply his number is inaccurate.

Household incomes are down more than $4,000 since the year 2000. That’s sixteen years ago.

[That’s true, using median household income data, though he is not measuring from the start of the Obama administration as he is for the other stats here. If he measured from 2008, the drop was $1,656. Measuring from 2000 means measuring from the figure’s near-peak.

[A broader point about all of these economic statistics: A lot of them have been true, but the question is whether Obama is to blame. Higher poverty, for example, doesn’t appear to be Obama’s doing, as we wrote in a fact check last year. Moreover, many experts believe a president generally has only very limited ability to affect the economy. — Danielle Kurtzleben]

As suggested from my earlier analysis, I think it’s fair to point out that Trump was being somewhat arbitrary to use 2000 as his base year.

But it’s amusing to see NPR admit that the number is right but then engage in gymnastics in an effort to excuse the weak economic numbers during Obama’s tenure.

Excessive regulation is costing our country as much as $2 trillion a year, and we will end it very, very quickly.

[A few analyses have found that regulation costs around $2 trillion — one of the best-known, from the Competitive Enterprise Institute, estimated it at around $1.9 trillion this year. But as the Washington Post‘s Fact Checker has pointed out, in the past this figure has been characterized as a “back of the envelope” count, and that moreover, it doesn’t make sense to talk about costs without trying to count the benefits of regulation. — Danielle Kurtzleben]

This is another example of Trump making an accurate point, but NPR then blowing smoke in an attempt to imply he was being dodgy.

Last but not least, here are some assertions from Factcheck.org.

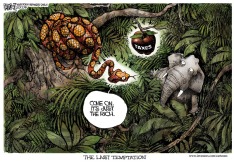

Trump claimed Clinton “plans a massive … tax increase,” but tax experts say 95 percent of taxpayers would see “little or no change” in their taxes under Clinton’s plan.

The fact that Clinton targets the top-5 percent doesn’t change the fact that she’s proposing a very large tax hike.

Trump claimed Clinton “illegally” stored emails on her private server while secretary of state, and deleted 33,000 to cover-up “her crime.” But the FBI cleared Clinton of criminal wrongdoing, and found no evidence of a cover-up.

This isn’t an economic issue, but I can’t resist  making a correction.

making a correction.

The FBI Director explicitly pointed out that she repeatedly broke the law.

He simply chose not to recommend prosecution.

He said the “trade deficit in goods … is $800 billion last year alone.” It was nearly that, but it discounts the services the U.S. exports. The total trade deficit for goods and services is just over $500 billion.

As I noted above, Trump is wrong on trade, but the media shouldn’t do a bait-and-switch and criticize him for something he didn’t say.

By the way, the fact that media fact-checkers are largely wrong and dishonest is not a reason to be pro-Trump.

People can decide, if they want, to choose between the lesser of two evils.

My only message is that Trump is wrong on lots of issues, but that’s no excuse for hackery from self-styled fact-checkers.

P.S. Here’s my best Trump humor and here’s my best Hillary humor.

Read Full Post »

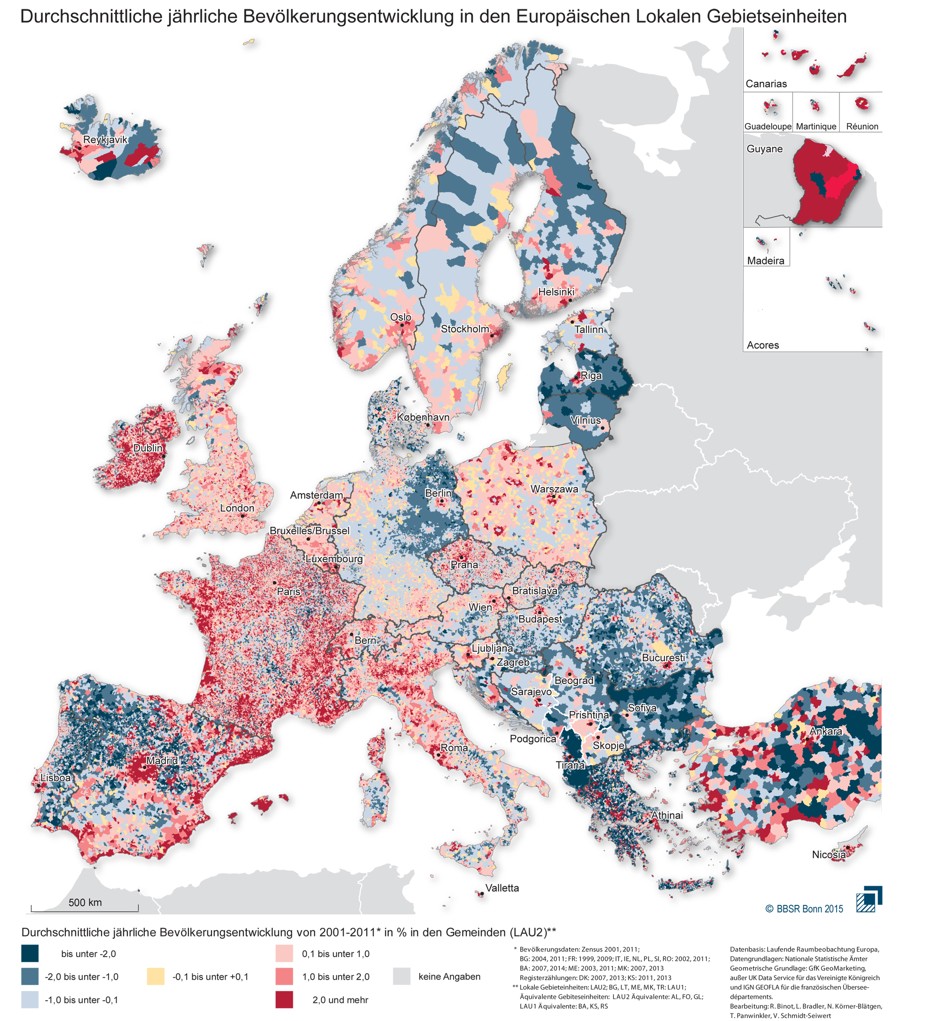

Heck, about the only really interesting thing about German policy is whether the country’s politicians will be dumb enough to underwrite the profligacy of some of their neighbors.

Heck, about the only really interesting thing about German policy is whether the country’s politicians will be dumb enough to underwrite the profligacy of some of their neighbors.The bills included a conversion from the Nazi-era Reichsmark currency into euros for the original road surface, first laid in 1937… The figures were also adjusted for inflation. …a court has now confirmed that they must cough up the cash. It determined that while construction began in the 1930s, the road was only officially completed in 2009 when pavements were added. For the intervening period it was considered to be under development. …Auf’m Rott’s current residents will be shelling out for the “Hitler asphalt”, streetlamps dating back to 1956, a sewer from the 1970s, and pavements and greenery added in 2009.

all the trouble of adjusting the numbers for inflation.

all the trouble of adjusting the numbers for inflation. P.P.S. Though I’ve also given the Germans some modest praise for a period of spending restraint last decade and also for largely resisting the siren song of Keynesianism during and after the recent recession (by the way, you won’t be surprised to learn Krugman botched the numbers when writing about Germany’s fiscal policy during that period).

P.P.S. Though I’ve also given the Germans some modest praise for a period of spending restraint last decade and also for largely resisting the siren song of Keynesianism during and after the recent recession (by the way, you won’t be surprised to learn Krugman botched the numbers when writing about Germany’s fiscal policy during that period).