I just spent several days in London, where I met with journalists and experts at think tanks to find out what’s happening with Brexit.

By way of background, I think voters in the UK made the right decision for the simple reason that  the Brussels-based European Union is a slowly sinking ship based on centralization, harmonization, and bureaucratization.

the Brussels-based European Union is a slowly sinking ship based on centralization, harmonization, and bureaucratization.

Membership already involves onerous regulations, and remaining a member of the EU would mean – sooner or later – sending ever-larger amounts of money to Brussels, where it then would be used to prop up Europe’s failing welfare states.

Getting out may involve some short-term pain, but it will avert far greater pain in the future.

At least that was the theory.

The reality is that the Tory-led government in London has made a mess of the negotiations. The newly announced deal isn’t a real Brexit.

Writing for the Telegraph, Dan Hannan, a British member of the European Parliament, sums up why the deal is a joke.

The deal, as one Italian newspaper puts it, represents “a resounding victory for the EU over Her Majesty’s subjects”. Yet there was nothing inevitable about this climbdown. On the contrary, there is something extraordinary, awe-inspiring even, about the slow-witted cowardice that led British negotiators to this point. …there is something extraordinary, awe-inspiring even, about the slow-witted cowardice that led British negotiators to this point. …the disastrous acceptance of the EU’s sequencing, which meant that all British leverage, including the exaggerated financial contributions, would be tossed away before the EU even began to discuss trade. …Can you blame Eurocrats for gloating? They sensed right at the start that they were dealing with a defeated and dispirited British team, whose only objective was to come back with something – anything – that could be described as a technical fulfilment of the referendum mandate. …we have ended up with the sort of deal that a defeated nation signs under duress. Britain will be subject to all the costs and obligations of EU membership with no vote, no voice and no veto.

…there is something extraordinary, awe-inspiring even, about the slow-witted cowardice that led British negotiators to this point. …the disastrous acceptance of the EU’s sequencing, which meant that all British leverage, including the exaggerated financial contributions, would be tossed away before the EU even began to discuss trade. …Can you blame Eurocrats for gloating? They sensed right at the start that they were dealing with a defeated and dispirited British team, whose only objective was to come back with something – anything – that could be described as a technical fulfilment of the referendum mandate. …we have ended up with the sort of deal that a defeated nation signs under duress. Britain will be subject to all the costs and obligations of EU membership with no vote, no voice and no veto.

But it gets worse.

Unbelievably, Britain has given the EU a veto over whether it can leave these arrangements: unlike EU membership itself, we have no right to walk away. Brussels will run our trade policy, our economy, even elements of our taxation for as long as it likes. As the usually Euro-fanatical Bloomberg asked incredulously last week, “Once Britain has acceded to this, what reason is there for the EU to agree to any other kind of deal?” …Leavers never did “own” this process. From the start, it has been controlled by those who wished it wasn’t happening, and who defined success as salvaging as much as they could of the old dispensation.

That final sentence is key. Theresa May was not a Brexit supporter. She failed to play some very strong cards and she basically worked to come up with a fake Brexit.

It remains to be seen, though, whether Parliament will approve this humiliating package. The House of Commons will vote in about two weeks and here’s how the UK-based Times describes the possible outcomes if the plan gets rejected.

Scenario 1: a second Commons vote The prime minister fails to secure Commons support for her withdrawal agreement… Her response is to…then bring…it back for a second vote…, as happened in America after Congress initially rejected its government’s bank rescue plan in 2008. …Scenario 2: change of prime minister May fails to get the deal through and either resigns, or faces a confidence vote among Tory MPs which, if she lost, would also see her step down. …The question for Tory MPs would then be whether to back the deal mainly negotiated under May… Scenario 3: a second referendum A defeat for May could result in a second referendum but only if she or her successor supported it. Tory policy is to oppose a second referendum. …Scenario 4: no-deal Brexit Tory Brexiteers in the cabinet and in the party would respond to a defeat for the May proposals by pushing for a no-deal Brexit, or a “managed” no-deal. …Scenario 5: the Norway option Though there is no parliamentary majority at present for the May deal, or for no deal, there could be for a closer relationship with the EU. This could take the form of…the EEA (European Economic Area), the so-called Norway option.

and either resigns, or faces a confidence vote among Tory MPs which, if she lost, would also see her step down. …The question for Tory MPs would then be whether to back the deal mainly negotiated under May… Scenario 3: a second referendum A defeat for May could result in a second referendum but only if she or her successor supported it. Tory policy is to oppose a second referendum. …Scenario 4: no-deal Brexit Tory Brexiteers in the cabinet and in the party would respond to a defeat for the May proposals by pushing for a no-deal Brexit, or a “managed” no-deal. …Scenario 5: the Norway option Though there is no parliamentary majority at present for the May deal, or for no deal, there could be for a closer relationship with the EU. This could take the form of…the EEA (European Economic Area), the so-called Norway option.

For what it’s worth, I fear “Scenario 1.” Members of the Conservative Party are like American Republicans. They occasionally spout the right rhetoric, but most of them are go-along-to-get-along hacks who happily will trade their votes for a back-room favor.

So I will be disappointed but not surprised if this deal is enacted. It’s even possible it will be approved on the first vote.

My preference is for “Scenario 4” leading to something akin to “Scenario 5.”

A report from the Adam Smith Institute offers a user-friendly description of this “Norway option.”

We cannot however be subordinate to a supranational institution… Nor should we make do with a semi-detached position inside the EU that also gives us semi-detached influence  while still constraining the UK in the wider world. …we have to leave and reform the relationship in a characteristically British, outward-looking and open way. …The UK therefore requires something of a “soft” exit that maintains open trade but removes Britain from political union and from all that Britain has consistently struggled with – the Common Agricultural Policy, the Common Fisheries Policy, the hollowing out and the outsourcing of democracy, the constraints on global trade deals.

while still constraining the UK in the wider world. …we have to leave and reform the relationship in a characteristically British, outward-looking and open way. …The UK therefore requires something of a “soft” exit that maintains open trade but removes Britain from political union and from all that Britain has consistently struggled with – the Common Agricultural Policy, the Common Fisheries Policy, the hollowing out and the outsourcing of democracy, the constraints on global trade deals.

And what does that look like?

…the most optimal way to exit would be to take up a position outside the EU but inside the European Economic Area (‘EEA’), which very likely means re-joining the European Free Trade Association (‘EFTA’). As Britain is already a contracting party to the EEA Agreement there would be no serious legal obstacle and it would mean no regulatory divergence or tariffs but it would mean retaining freedom of movement for EU/EEA nationals. …Such a deal would require agreement from the EU and EFTA but both would have strong reasons for allowing it…with the UK on board, EFTA would instantly become the fourth largest trade grouping in the world. …In short, EEA countries have a market-based relationship with the EU by having full single market access. They are free of the EU’s political union ambitions, and can class themselves as self-governing nation states. …The EEA position also opens up the ability to make trade agreements with third countries (something the UK cannot do now), would provide the UK with the freedom to set its own levels of VAT, and would allow the UK to step away from its joint liability of EU debts. That would be very attractive to Britain seeking a liberal soft exit.

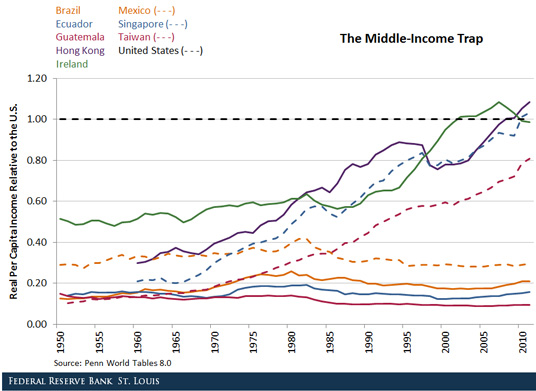

Here’s a table showing the difference between EU membership and EEA membership.

Sounds like the outline of a acceptable deal, right?

Not so fast. The crowd in Brussels doesn’t want a good deal, even though it would be positive for the economic well-being of EU member nations. They have an ideological desire to turn the European Union into a technocratic superstate and they deeply resent the British for choosing self-government and democracy.

As such, the goal is to either maneuver the British government into a humiliating surrender (Theresa May was happy to oblige) or to force a hard Brexit, which would probably cause some short-term economic disruption.

But there was also resistance on the British end to this option since it ostensibly (but perhaps not necessarily) requires free movement of people. In other words, it might mean unchecked migration from EU/EEA nations, which arouses some nativist concerns.

Since I mentioned that a hard Brexit could lead to potential short-term economic disruption, this is a good opportunity to cite a very key section of Mark Littlewood’s recent column in the UK-based Times.

The Treasury has suggested that GDP could fall by as much as 7.7 per cent if Britain exited the EU without a deal. However, is there any reason to treat this projection any more seriously than the Treasury’s view that the Leave vote itself would lead to a recession and a reduction in GDP by between 3 per cent and 6 per cent? Almost all official predictions relating to the economic impact of the Brexit vote have been shown to be enormously over-pessimistic. Why should one assume that present forecasts are not beset by the same flaws?

Amen. The anti-Brexit crowd (the “remainers”) tried to win by arguing that a vote for Brexit would cause an economic collapse. That “Project Fear” was exposed as a joke (and was the target of some clever humor).

And the new version of Project Fear is similarly dishonest.

In a column for CapX, Julian Jessop of the Institute of Economic Affairs has additional details.

The public is being bombarded with warnings of potentially devastating impacts on the economy, their security and their welfare if the UK becomes a “third country” at 11pm on 29th March 2019, without the Withdrawal Agreement and framework for a future relationship anticipated in Article 50. …the daftest headline…is that a “no-deal” Brexit means that the UK would run out of food by August 2019 (the 7th, to be precise). This relies on the bizarre assumption that the UK would no longer be able to import food, not just from the EU but from anywhere in the world, and that we would continue to export food even as our own people starve. …it is often assumed that the EU would ignore its other legal obligations, including WTO rules. …the EU would not be able to treat the UK any less favourably than other WTO members.. Relying on the courts to fix things is also ra.rely a good idea. But it is absolutely right that the EU can’t go out of its way to make life difficult for the UK either.

…the daftest headline…is that a “no-deal” Brexit means that the UK would run out of food by August 2019 (the 7th, to be precise). This relies on the bizarre assumption that the UK would no longer be able to import food, not just from the EU but from anywhere in the world, and that we would continue to export food even as our own people starve. …it is often assumed that the EU would ignore its other legal obligations, including WTO rules. …the EU would not be able to treat the UK any less favourably than other WTO members.. Relying on the courts to fix things is also ra.rely a good idea. But it is absolutely right that the EU can’t go out of its way to make life difficult for the UK either.

Run out of food? Good grief, I thought the global-warming Cassandras were the world’s worst when it comes to exaggeration, but they’re amateurs compared to the anti-Brexit crowd.

Anyhow, this column is already too long, but here are links to four other CapX columns for interested parties.

I especially like the last column. One of the behind-the-scenes aspects of the Brexit debate is that the eurocrats in Brussels are scared that the UK will become more market-oriented once it has escaped the EU’s regulatory clutches.

And just as the EU has gone after Ireland and Switzerland for supposedly insufficient taxation, it also now is trying to hamstring the United Kingdom. All the more reason to escape and become the Singapore of Europe.

P.S. Donald Trump could help the United Kingdom by negotiating a quick and clean free-trade agreement. Sadly, that violates his protectionist instincts.

Read Full Post »

even if one nation is better than another at producing everything. Here’s a homespun illustration. Suppose a surgeon is also a whiz at house painting—better than most professional painters. Should she therefore take time off from her medical practice to paint her own house? Certainly not. For while she may have a slight edge over most painters when it comes to painting walls, she has an enormous edge when it comes to performing surgery. Surgery is her comparative advantage, so she should specialize in it and let some others, who don’t know their way around an operating room, specialize in painting—their comparative advantage. That way, the whole economy becomes more efficient. The same principle applies to nations.

Does this reflect a causal relationship? We adopt the Frankel and Romer (1999) identification strategy, and exploit countries’ exogenous geographic characteristics to estimate the causal effect of trade on income and inequality. Our cross-country estimates for trade’s impact on real income are consistently positive and significant over time.

are on the order of $1 trillion. The estimated gain in 2003 income is in the range of $2,800 to $5,000 additional income for the average person and between $7,100 and $12,900 for the average household. Future gains are harder to quantify, not surprisingly since the future is always difficult to predict. The estimates range from $450 billion to $1.3 trillion.