Government intervention has made a mess of health care in America. Programs such as Medicare and Medicaid, along with the tax code’s healthcare exclusion,  have created a massive third-party-payer problem.

have created a massive third-party-payer problem.

The inevitable result is systemic inefficiency and ever-rising prices.

Some politicians look at these government-created problems and want us to believe that the right solution is to have even more government.

Consider, for example, the radical Medicare-for-All scheme that is supported by “Crazy Bernie” and “Looney Liz.” That’s like driving in the wrong direction at 100 miles per hour.

It’s also a bad idea to head the wrong direction at 50 miles per hour.

In a column for the Wall Street Journal, Lanhee Chen exposes the reckless nature of the so-called public option that is supported by other candidates.

Joe Biden, Pete Buttigieg and Mike Bloomberg claim they’re proposing a moderate, less disruptive approach to health-care reform when they advocate a public option—a government policy  offered as an alternative to private health insurance—in lieu of Medicare for All. Don’t believe it. …those effects are predicated on two flawed assumptions: first, that the government will negotiate hospital and provider reimbursement rates similar to Medicare’s fee schedules and far below what private insurers pay; second, that the government would charge “actuarially fair premiums,” which cover 100% of provided benefits and administrative costs.

offered as an alternative to private health insurance—in lieu of Medicare for All. Don’t believe it. …those effects are predicated on two flawed assumptions: first, that the government will negotiate hospital and provider reimbursement rates similar to Medicare’s fee schedules and far below what private insurers pay; second, that the government would charge “actuarially fair premiums,” which cover 100% of provided benefits and administrative costs.

Mr. Chen explains that politicians can’t resist buying votes by offering ever-more goodies at ever-lower costs (I made similar points in a video explaining why Obamacare would be a fiscal boondoggle).

Political pressure upended similar financing assumptions in Medicare Part B only two years after the entitlement’s creation. The Johnson administration in 1968 and then Congress in 1972 had to intervene to shield seniors from premium increases. Objections from health-care providers to low reimbursement rates have regularly led to federal spending increases in Medicare and Medicaid.

And when politicians offer more goodies at lower cost, that means someone else will have to pay.

Either taxpayers today (higher income taxes and payroll taxes) or taxpayers tomorrow (more borrowing).

If premiums can’t rise to cover program costs, or reimbursement rates are raised to ensure access to a reasonable number of providers, who’ll pay? Taxpayers… If Congress’s past behavior is a guide, a public option available to all individuals and employers would add more than $700 billion to the 10-year federal deficit. The annual deficit increase would hit $100 billion within a few years. Some 123 million people—roughly 1 in 3 Americans—would be enrolled in the public option by 2025, broadly displacing existing insurance. These estimates don’t include the costs of additional Affordable Care Act subsidies and eligibility expansions proposed by Messrs. Biden, Buttigieg and Bloomberg. …if tax increases to pay for a politically realistic public option were limited to high-income filers, the top marginal rate would have to rise from the current 37% to 73% in 2049… Congress could enact a new broad-based tax similar to Medicare’s 2.9% Hospital Insurance payroll tax. The new tax would be levied on all wage and salary income and would reach 4.8% in 2049.

Mr. Chen also reminds us that the public option would surely have a very bad effect on private insurance.

Beyond fiscal considerations, the public option would quickly displace employer-based and other private insurance. …Consumers seeking coverage would be left with fewer insurance options and higher premiums. …Longer wait times and narrower provider networks would likely follow for those enrolled in the public option, harming patients’ health and reducing consumer choice.

For those of you who like lots of numbers, I also recommend a new report from the Committee for a Responsible Federal Budget.

The folks at CRFB are a bit misguided in that they focus too much on deficits and debt when they should be mostly concerned about the size of government.

But they do reliable work and their new report, Primary Care: Estimating Leading Democratic Candidates’ Health Plans, is filled with horrifying data.

We’ll start with this table looking at the details of the plans that have been put forth by Biden, Buttigieg, Sanders, and Warren. The red numbers are new spending. The black numbers are offsets (mostly tax increases).

As you can see from the above table, Warren and Sanders are definitely in the go-rapidly-in-the-wrong-direction camp.

But that shouldn’t distract us from the fact that Biden and Buttigieg also are proposing a big expansion in the burden of government.

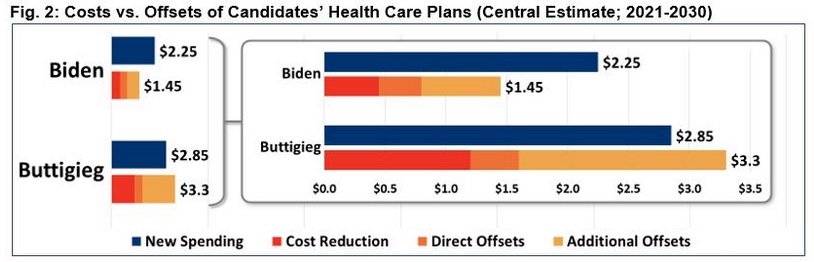

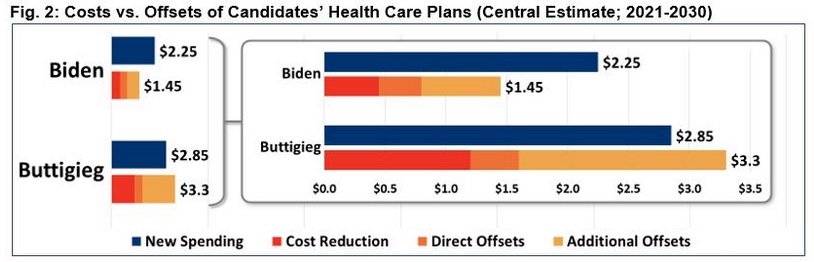

Here’s another graphic from the CRFB report, but I’m focusing solely on the numbers for Biden and Buttigieg so that it’s clear to see that they both want about $2 trillion of new spending over the next decade.

If you look closely at the numbers for Buttigieg in Figure 2, you’ll notice that his health plan supposedly will reduce the deficit by $415 billion over 10 years (the difference between $3.3 trillion of new spending and $2.85 trillion of cost reductions and offsets).

Does that make his plan desirable? Of course not. What he’s really proposing (and this is how CRFB should have presented the data) is $1.65 trillion of net new spending (the difference between his “new spending” and his “cost reductions” ) accompanied by $2.1 trillion of new taxes.

P.S. Most of the “cost reductions” in Buttigieg’s plan are achieved with price controls on prescription drugs. At the risk of understatement, that’s a very costly way of trying to save money.

P.P.S. And if his plan is ever enacted, don’t forget that the actual amount of “new spending” will be much higher than the estimate of “new spending.”

Read Full Post »

with people asking how a political party that can’t properly count 200,000 votes somehow can effectively run a healthcare system for 340 million people.

with people asking how a political party that can’t properly count 200,000 votes somehow can effectively run a healthcare system for 340 million people. Bernie Sanders is proposing a staggering $4.9 trillion of new spending – more than doubling the burden of government spending!

Bernie Sanders is proposing a staggering $4.9 trillion of new spending – more than doubling the burden of government spending!