For self-interested reasons, I obviously like my video on the merits of free trade and the downside of protectionism.

But now I’ll also be recommending this new video from Liberty International.

It has some great examples, such as Washington’s corrupt trade barriers to sugar (as well as other examples of foolish agriculture subsidy programs).

And there’s some excellent analysis of how developing nations are hurt by the double-edged sword of protectionism and foreign aid.

What happened to Haiti is especially tragic.

My only criticism (and this is a sin of omission) is that there wasn’t enough time to explain why people shouldn’t fixate on the trade deficit – which is, after all, simply the flip side of a capital surplus.

My only criticism (and this is a sin of omission) is that there wasn’t enough time to explain why people shouldn’t fixate on the trade deficit – which is, after all, simply the flip side of a capital surplus.

For purposes of today’s column, though, I want to focus more on the politics of trade rather than the economics of trade.

That’s because Trump and Biden are basically the Bobbsey Twins of protectionism.

In his New York Times column, Binyamin Appelbaum explains why Trump’s China tariffs backfired.

I obviously agree, but Appelbaum only mentions in passing that Biden has not done much to reverse that policy.

Tariffs on imports from China have refilled the employee parking lot at Stoughton Trailers in Evansville, Wis. …the rest of us are paying for those jobs. The tariffs have contributed to a shortage of chassis in the middle of an import boom, one reason that American ports are gridlocked.

Tariffs also drive up prices. American chassis are beginning to roll off production lines, but they cost more than pretariff Chinese chassis, which raises the price of everything that travels by chassis. …the government has decided to limit competition, a lazy approach that is both expensive and counterproductive. Taxing imports from China gives the appearance of punishing China, but the cost of the tariffs is paid by Americans. …Mr. Biden should make a clean break with Mr. Trump’s destructive tariffs. The right recipe is simple…, maintain an environment in which companies can flourish, ensure workers reap the benefits.

So at what point do Trump’s tariffs become Biden’s tariffs?

Technically, we hit that point in late January of 2021.

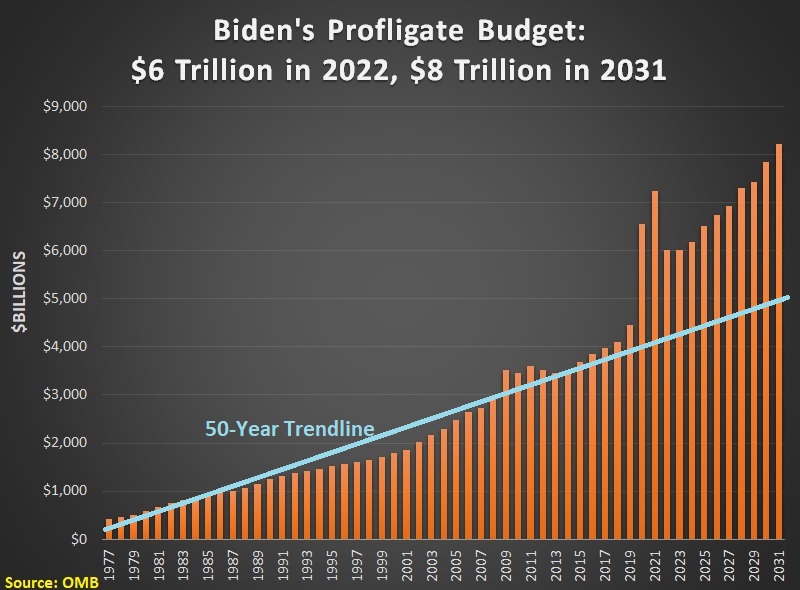

To make matters worse, Biden is also imposing new trade taxes on American consumers and businesses.

The Wall Street Journal opined today on Biden’s latest protectionist initiative.

President Biden says he feels your pain regarding inflation… Too bad his Administration’s policies reveal different priorities. Witness the Commerce Department’s decision to raise tariffs on lumber, which will raise building costs in an already strained housing market.

The Commerce Department said last week that it will double the average tariff on Canadian softwood lumber to 17.9% from 8.99%. …There’s rarely a good time for trade restrictions, but the timing of this one is tragicomical. The same month Commerce revealed its tariff plan, lumber hit a record price of $1,650 per thousand board-feet, more than three times the level before pandemic supply shortages began. …The Biden Administration’s tariff resumes the U.S.-Canada lumber war where President Trump left off. …President Biden campaigned against his predecessor’s tariffs, but his trade policy in office has been nearly as protectionist. He’s kept most tariffs in place.

Kept most in place…and now adding more.

This is very sad, particularly since I had hoped that was one area where Biden might actually move policy in the right direction.

No, I didn’t think Biden actually understood why free trade is good (he’s always been a proponent of bigger government, after all).

But I hoped he would do the right thing simply to show he differed from Trump. Those hopes have been dashed.

P.S. If you want more reasons to be concerned, Biden also hasn’t done much to resuscitate the World Trade Organization and he isn’t pushing back on his party’s embrace of carbon protectionism.