Why do many people engage in civil disobedience and decide not to comply with tax laws?

Our leftist friends (the ones who think that they’re compassionate because they want to spend other people’s money)  assert that those who don’t obey the revenue demands of government are greedy tax evaders who don’t care about society.

assert that those who don’t obey the revenue demands of government are greedy tax evaders who don’t care about society.

And these leftists support more power and more money for the Internal Revenue Service in hopes of forcing higher levels of compliance.

Will this approach work? Are they right that governments should be more aggressive to obtain more obedience?

To answer questions of how to best deal with tax evasion, we should keep in mind three broad issues about the enforcement of any type of law:

1. Presumably there should be some sort of cost-benefit analysis. We don’t assign every person a cop, after all, even though that presumably would reduce crime. Simply stated, it wouldn’t be worth the cost.

2. We also understand that crime reduction isn’t the only thing that matters. We grant people basic constitutional rights, for instance, even though that frequently makes is more difficult to get convictions.

3. And what if laws are unjust, even to the point of leading citizens to engage in jury nullification? Does our legal system lose moral legitimacy when it is more lenient to those convicted of child pornography than it is to folks guilty of forgetting to file paperwork?

Now let’s consider specific tax-related issues.

I’ve written before that “tough on crime” is the right approach, but only if laws are legitimate. And that leads to a very interesting set of questions.

4. Is it appropriate to track down every penny, even if it results in absurdities such as the German government spending 800,000 euros to track down 25,000 euros of unpaid taxes on coffee beans ordered online?

5. Or what about the draconian FATCA law imposed by the United States government, which is only projected to raise $870 million per year, but will impose several times as much cost on taxpayers, drive investment out of American, and also causing significant anti-US resentment around the world?

6. And is there perhaps a good way of encouraging compliance?

The purpose of today’s (lengthy) column is to answer the final question.

More specifically, the right way to reduce tax evasion is to have a reasonable and non-punitive tax code that finances a modest-sized, non-corrupt government. This make tax compliance more likely and more just.

Here’s some of what I wrote back in 2012.

I don’t blame people from France for evading confiscatory taxation. I don’t blame people in corrupt nations such as Mexico for evading taxation. I don’t blame people in dictatorial nations such as Venezuela for evading taxation. But I would criticize people in Singapore,Switzerland, Hong Kong, or Estonia for dodging their tax liabilities. They are fortunate to live in nations with reasonable tax rates, low levels of corruption, and good rule of law.

Let’s elaborate on this issue.

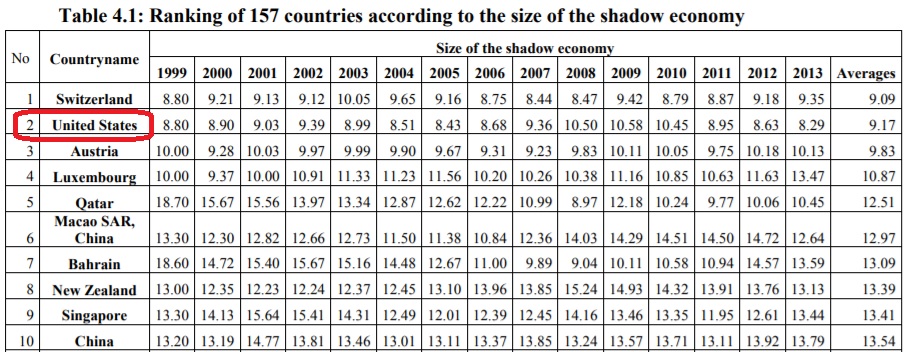

And we’ll start by citing the world’s leading expert, Friedrich Schneider, who made these important points about low tax rates in an article for the International Monetary Fund.

…the major driving forces behind the size and growth of the shadow economy are an increasing burden of tax and social security payments… Several studies have found strong evidence that the tax regime influences the shadow economy. …In the United States, analysis shows that as the marginal federal personal income tax rate increases by one percentage point, other things being equal, the shadow economy grows by 1.4 percentage points.

With this bit of background, let’s look at the magnitude of non-compliance.

The Wall Street Journal reports on the history of dodging greedy governments.

Tax evasion has been around since ancient Mesopotamia, when the Sumerians were cheerfully working the black market. …The Romans were the most efficient tax collectors of all. Unfortunately Emperor Nero (ruling from A.D. 54 to 68) abandoned the high growth, low-tax policies of his predecessors. In their place he created a downward spiral of inflationary measures coupled with excessive taxation. By the third century, widespread tax evasion forced economically stressed Rome to practice expropriation. …Six hundred years later, during the Heian period (794-1185), Japan’s aristocracy acted in a similar manner and with similar consequences. …China’s Qing Dynasty (1644-1912) waged a harsh war against the tax-dodging gentry.

These same fights between governments and taxpayers exist today.

In a column published by the New York Times, we got some first-hand knowledge of the extraordinary steps people take to protect themselves from taxation in China.

In China, businesses have to give out invoices called fapiao to ensure that taxes are being paid. But the fapiao — the very mechanism intended to keep businesses honest — is sometimes the key to cheating on taxes. …My company would disguise my salary as a series of expenses, which would also save me from paying personal income tax. But to show proof of expenses, the accountant needed fapiao. It was my responsibility to collect the invoices. …But evading taxes in China was harder than I expected because everyone else was trying to evade taxes, too. …Though businesses are obligated to give out fapiao, many do not unless customers pester them. They are trying to minimize the paper trail so they too can avoid paying taxes on their true income. …some people are driven to buy fake invoices. It’s not hard; scalpers will sell them on the street, and companies that specialize in printing fake fapiao proliferate.

The author had mixed feelings about the experience.

I couldn’t figure out whether what I was doing was right or wrong. By demanding a fapiao, I was forcing some businesses to pay taxes they would otherwise evade. But all of this was in the service of helping my own company evade taxes. In this strange tale, I was both hero and villain. To me, tax evasion seemed intractable. Like a blown-up balloon, if you push in one part, another swells.

Meanwhile, Leonid Bershidsky, writing for Bloomberg, reviews what people do to escape the grasping hand of government in Greece.

In gross domestic product terms, Greece has the second biggest shadow economy among European Union countries without a Communist past…unreported revenue accounts for 23.3 percent of GDP, or $55.3 billion. …Had it been subject to taxes — at the prevailing 40 percent rate — the shadow economy would have contributed $22 billion to the government’s coffers.

Bershidsky cites some new academic research.

…researchers used loan application data from a big Greek bank. …The bank…regards the reported income figure as a fiction, as do many other banks in eastern and southern Europe. As a result, it uses estimates of “soft” — untaxed — income for its risk-scoring model. Artavanis, Tsoutsoura and Morse recreated these estimates and concluded that the true income of self-employed workers in Greece is 75 percent to 84 percent higher than the reported one.

Greek politician have tried to get more money from the shadow economy but haven’t been very successful.

Even the leftist government of former Prime Minister Alexis Tsipras, which came up with unworkable schemes to crack down on tax evasion — from using housewives and tourists to inform on small businesses to a levy on cash withdrawals — failed.

Bershidsky notes that some have called for indirect forms of taxation that are harder to evade.

The researchers suggest the government should sell occupation licenses through the powerful professional associations: a harsh but effective way to collect more money.

Though his conclusion rubs me the wrong way.

The shadow economy — and particularly the contributions of professionals — is an enormous potential resource for governments.

At the risk of editorializing, I would say that the untaxed money is “money politicians would like to use to buy votes” rather than calling it “an enormous potential resource.” Which is a point Bershidsky should understand since he wrote back in 2014 that European governments have spent themselves into a fiscal ditch.

Now let’s shift to the academic world. What do scholars have to say about tax compliance?

Two economists from the University of Rome have authored a study examining the role of fiscal policy on the underground economy and economic performance. They start by observing that ever-higher taxes are crippling economic performance in Europe.

…most European economies have been experiencing feeble growth and increasing levels of public debt. Compliance with the Stability and Growth Pact, and in particular with the primary deficit clause, has required many governments to raise taxes to exceptional high levels, thus hindering business venture and economic recovery.

And those high tax burdens don’t collect nearly as much money as politicians want because taxpayers have greater incentives to dodge the tax collectors.

…between a country’s tax system and the size of its shadow economy is a two-way relationship. …there exists a positive relationship between the dimension of the tax burden on economic activity and the size of the informal economy. …various tax reform scenarios, recently advocated in economic and policy circles as a means to promote growth, such as…ex-ante budget-neutral tax shifts involving reductions of distortionary taxes on labor and business compensated by an increase in the consumption tax or counterbalanced by decreases of government spending. We will see that all these fiscal reforms give rise to a resource reallocation effect from underground to official production or vice versa and have rather different implications in terms of output, fiscal solvency and welfare.

The authors look at the Italian evidence and find that lower tax rates would create a win-win situation.

Our main results can be summarized as follows. …the dimension of the underground sector is substantially decreased by fiscal interventions envisaging sizeable labor tax wedge reductions. Finally, all the considered tax reforms have positive effects on the fiscal consolidation process due to a combination of larger tax revenues and positive output growth. …consider the case in which the decrease of the business tax is met by a public spending cut…an expansionary effect on output, consumption and investments, and, despite the overall reduction of tax revenues, the public-debt-to-output ratio falls. However, we notice that the expansionary effects are…magnified on consumption and investments. In this model, in fact, public spending is a pure waste that crowds out the private component of aggregate demand, therefore it comes as no surprise that a tax cut on business, counterbalanced by a public spending reduction, is highly beneficial for both consumption and investments. …the underground sector shrinks.

The benefits of lower tax rates are especially significant if paired with reductions in the burden of government spending.

When the reduction of the business tax, personal income tax, and employers’ SSC tax rates are financed through a cut in public spending…we observe positive welfare effects… The main difference…is that consumption is significantly higher…due to the fact that this reform leaves the consumption tax unchanged, while public spending is a pure waste that crowds out private consumption. …all the policy changes that lower the labor tax wedge permanently reduce the dimension of the underground sector. Finally, all the considered tax reforms positively contribute to the fiscal consolidation process.

Let’s now look at some fascinating research produced by some other Italian economists.

They look at factors that lead to higher or lower levels of compliance.

…a high quality of the services provided by the State, and a fair treatment of taxpayers increase tax morale. More generally, a high level of trust in legal and political institutions has a positive effect on tax morale. …two further institutional characteristics that are likely to negatively affect an individual’s tax morale: corruption and complexity of the tax system.

By the way, “tax morale” is a rough measure of whether taxpayers willingly obey based on their perceptions of factors such as tax fairness and waste and corruption in government.

And that measure of morale naturally varies across countries.

…we examine how people from different countries react to varying tax rates and levels of efficiency. …We focus our analysis on three countries: Italy, Sweden and UK. …these three countries show differences concerning the two institutional characteristics we are focused on. Italy and Sweden show a high tax burden while UK shows a low one. Whereas, Sweden and UK can be considered efficient states, Italy is not.

By the way, I don’t particularly consider the United Kingdom to be a low-tax jurisdiction. And I don’t think it’s very efficient, especially if you examine the government-run healthcare system.

But everything is relative, I guess, and the U.K. is probably efficient compared to Italy.

Anyhow, here are the results of the study.

Experimental subjects react to institution incentives, no matter the country. More specifically, tax compliance increases as efficiency increases and decreases as the tax rate increases. However, although people’s reaction to changes in efficiency is homogeneous across countries, subjects from different countries react with a different degree to an increase in the tax rate. In particular, participants who live in Italy or Sweden – countries where the tax burden is usually high – react more strongly to an increase in the tax rate than our British subjects. At the same time, subjects in Sweden – where the efficiency of the public service is high – react less to tax rate increases than Italian subjects.

So low tax rates matter, but competent and frugal government also is part of the story.

In all 3 countries, higher tax rates imply lower compliance. This is in line with experimental evidence: as Alm (2012, p. 66) affirms: “most (but not all) experimental studies have found that a higher tax rate leads to less compliance” and “The presence of a public good financed by voluntary tax payments has been found to increase subject tax compliance”. …The stronger negative reaction of Italian subjects to an increase in the tax rate may be due to the fact that in everyday life they suffer from high tax rates combined with inefficiency and corruption. …In fact, in the final questionnaire, 67.5% of Italian participants state that people would be more likely to pay taxes if the government were more efficient (vs 34.4% and 30.3% in UK and Sweden respectively) and 54.6% would comply with their fiscal obligations if they had some control over how tax money were spent (vs 30.8% and 25.8% in UK and Sweden respectively)… No way to impose a high tax burden on citizens if the tax revenue is wasted through inefficiency and corruption.

Here’s one additional academic study from Columbia University. The author recognizes the role of tax rates in discouraging compliance, but focuses on the impact of tax complexity.

Here’s what he wrote about the underlying theory of tax compliance.

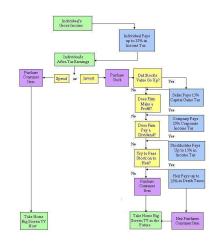

The basic theoretical framework for tax evasion was derived…from the Becker model of crime. This approach views tax evasion as a gamble. …when tax evasion is successful, the taxpayer gains by not paying taxes. In other cases, tax evasion is uncovered by tax authorities, and the taxpayer has to pay taxes due and fines. The taxpayer compares the expected gain to the expected loss. …This approach highlights a number of factors that determine whether and to what extent taxes are evaded. These are: the magnitude of potential savings (which, on the margin, is simply equal to the tax rate)… This model therefore highlights…natural policy parameters that can affect evasion. …the marginal gains from tax evasion could be reduced by imposing lower marginal tax rates.

Interestingly, he doesn’t see much difference between (illegal) evasion and (legal) avoidance.

The ideal compliance policy should target both tax avoidance and tax evasion. While there is a legal distinction between the two, from the economic point of view the difference is less explicit. Both types of activity involve a loss of revenue and both involve a loss of economic welfare.

He then brings tax complexity into the equation.

…the appropriate extent of tax enforcement critically depends on the underlying tax structure. In particular, the role of complexity in the tax system as a factor influencing the size of the tax gap, as well as legal but undesirable tax avoidance, are highlighted. Two principal implications of tax complexity are stressed here. First, complexity permits additional ways to shield income from tax and, consequently, complexity increases the overall cost of taxation. … Reasonable simplification can more adequately combat tax evasion and avoidance than traditional enforcement measures.

Here are some of his findings.

Tax avoidance is a function of ambiguity in the tax system. …Administrative investment in enforcement becomes more important when the tax system is more distortionary. One way to reduce the need for costly tax enforcement is to reduce distortions. … Higher complexity induces tax avoidance and other types of substitution responses. A tax system that allows for many different types of avoidance responses is likely to cause stronger behavioral effects and therefore higher excess burden. …Shutting down extra margins of response can be loosely summarized as expanding the tax base by eliminating preferential treatment of some types of income, deductions, and exemptions. …One of the consequences of complexity is that it makes it difficult for honest taxpayers to fulfill their obligations. …The bottom line is that complexity makes relying on penalties a much less appealing approach to enforcement. …From the complexity point of view, itemized deductions add a multitude of tax avoidance and evasion opportunities. …They stimulate avoidance by introducing extra margins with differential tax treatment.

Sounds to me like an argument for a flat tax.

Incidentally (and importantly), he acknowledges that greater enforcement may not be a wise option if the underlying tax law (such as the code’s harsh bias against income that is saved and invested) is overly destructive.

…tax avoidance—letting well enough alone—may be a simple and practical way of addressing shortcomings of an inefficient tax structure. For example, suppose that, as much of the optimal taxation literature suggests, capital incomes should not be taxed, or should only be taxed lightly. In that case, the best policy response would be cutting tax rates imposed on capital income. If it is not politically feasible to pursue such policies explicitly, a similar outcome can be accomplished by reducing enforcement or increasing avoidance opportunities in this area. …The preferred way of dealing with compliance problems is fixing the tax code.

Amen. Many types of tax evasion only exist because the politicians in Washington have saddled us with bad tax policy.

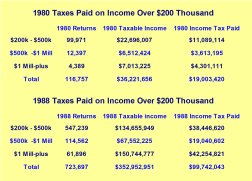

And when tax policy moves in the right direction, compliance improves. Consider what happened in the 1980s when Reagan’s reforms lowered the top tax rate from 70 percent to 28 percent.  Rich people paid five times as much to the IRS, in large part because they declared 10 times as much income.

Rich people paid five times as much to the IRS, in large part because they declared 10 times as much income.

But it’s very unlikely that they actually earned 10 times as much income. Some non-trivial portion of that gain was because of less evasion and less avoidance.

Simply stated, it makes sense to comply with the tax system when rates are low.

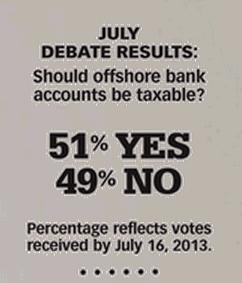

Let’s close by addressing one of the ways that leftists want to improve compliance. They want to destroy financial privacy and give governments near-unlimited ability to collect and share financial information about taxpayers, all for the purpose of supposedly bolstering tax compliance.

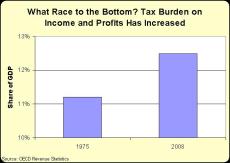

This agenda, if ultimately successful, will cripple tax competition as a liberalizing force in the global economy.

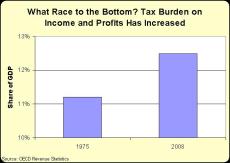

This would be very unfortunate. Tax rates have fallen in recent decades, for instance, largely because governments have felt pressure to compete for jobs and investment.

This would be very unfortunate. Tax rates have fallen in recent decades, for instance, largely because governments have felt pressure to compete for jobs and investment.

That has led to tax systems that are less punitive. And politicians really can’t complain about being pressured to lower tax rates since these reforms generally led to more growth, which generated significant revenue feedback. In other words, the Laffer Curve works.

There’s even some evidence that tax competition leads to less government spending.

But these are bad things from a statist perspective.

This helps to explain why politicians from high-tax governments want to eviscerate tax competition and create some sort of global tax cartel. An “OPEC for politicians” would give them more leeway to impose class-warfare tax policy and buy votes.

The rhetoric they’ll use will be about reducing tax evasion. The real goal will be bigger government.

I’m not joking. Left-wing international bureaucracies such as the Organization for Economic Cooperation and Development have justified their anti-tax competition efforts by asserting that jurisdictional rivalry “may hamper the application of progressive tax rates and the achievement of redistributive goals.”

I suppose we should give them credit for being honest about their ideological agenda. But for those who want good tax policy (and who also understand why that’s the right way to boost tax compliance), it’s particularly galling that the OECD is being financed with American tax dollars to push in the other direction.

P.S. I don’t know if you’ll want to laugh or cry, but here are some very odd examples of tax enforcement.

P.P.S. Here’s more evidence that high tax rates and tax complexity facilitate corruption.

Read Full Post »

But I think today we have a new champion (so to speak). A little-known law called the Foreign Account Tax Compliance Act almost surely wins the prize. And it’s not just cranky libertarians such as myself that think the law is bad news.

But I think today we have a new champion (so to speak). A little-known law called the Foreign Account Tax Compliance Act almost surely wins the prize. And it’s not just cranky libertarians such as myself that think the law is bad news.

But notice the headline that the NYT assigned to the article. Channeling the wisdom of Fox Butterfield, it fails to make an obvious causal link. As I have repeatedly noted in my writings about

But notice the headline that the NYT assigned to the article. Channeling the wisdom of Fox Butterfield, it fails to make an obvious causal link. As I have repeatedly noted in my writings about