Just as the sun rises in the east and sets in the west, there are some consistent patterns with government.

Politicians, for instance, will enact a policy that distorts the economy and causes damage (with regards to trade, bailouts, guns, health, whatever). And they’ll then point to the damage and assert that even more intervention is needed.

And they’ll then point to the damage and assert that even more intervention is needed.

I call this Mitchell’s Law, though I certainly don’t claim to be the first to observe this distressing tendency.

Today, we’re going to examine a classic example of this phenomenon by looking at how politicians are distorting the housing market with supply restrictions that produce higher costs, and then compounding their mistake with subsidies and price controls.

Edward Pinto of the American Enterprise Institute offers some economic analysis.

Recently there has been a flurry of legislative proposals to add yet more housing subsidies to the housing sector, already one of the most heavily subsidized. …These are the most recent in a long history of ill-conceived policies that increase housing demand but do nothing about supply. The result: higher home prices and rents, particularly for low-income and minority households, the very ones these initiatives profess to help. …layers of subsidies combined with federal, state, and local regulations act to drive up costs while simultaneously constraining supply. …For example, Los Angeles has a median home price that is 8.8 times median income, up from 4.2 times in 1979. And median rent in LA is 49% of the median income, up from 32% in 1979. These results are largely driven by (i) easy access to credit which drive demand and prices ever higher, (ii) local land use restrictions and regulations that constrain new supply and drive building costs higher, and (iii) housing subsidies that make it even more difficult for market rate housing to compete. …Market-based solutions are the only way to bring home prices and rents back in line with median incomes and improve accessibility.

particularly for low-income and minority households, the very ones these initiatives profess to help. …layers of subsidies combined with federal, state, and local regulations act to drive up costs while simultaneously constraining supply. …For example, Los Angeles has a median home price that is 8.8 times median income, up from 4.2 times in 1979. And median rent in LA is 49% of the median income, up from 32% in 1979. These results are largely driven by (i) easy access to credit which drive demand and prices ever higher, (ii) local land use restrictions and regulations that constrain new supply and drive building costs higher, and (iii) housing subsidies that make it even more difficult for market rate housing to compete. …Market-based solutions are the only way to bring home prices and rents back in line with median incomes and improve accessibility.

While there are plenty of bad housing policies in Washington (Fannie Mae and Freddie Mac, Department of Housing and Urban Development, mortgage-interest deduction, etc), much of the problem is caused by state and local governments.

Kevin Williamson of National Review cites a regulation in Dallas to show that government intervention causes problems.

…smaller secondary residences built on the lots of other houses..have long been a go-to source of cheap housing in college towns and other places with substantial itinerant populations of temporarily penniless young people. …Dallas…prohibited the building and rental of these residences in the 1970s on the theory that this would help to improve the living conditions on the south side of town… To the great surprise of nobody except politicians and their creatures, prohibiting the construction and rental of affordable housing did not do much to help poor people in Dallas connect with affordable housing. …The politicians have decided that there is an affordable-housing crisis in America. They should know: They created it. …Why? Because people who own homes have more political power than people who might want to buy one at some point in the future.

on the theory that this would help to improve the living conditions on the south side of town… To the great surprise of nobody except politicians and their creatures, prohibiting the construction and rental of affordable housing did not do much to help poor people in Dallas connect with affordable housing. …The politicians have decided that there is an affordable-housing crisis in America. They should know: They created it. …Why? Because people who own homes have more political power than people who might want to buy one at some point in the future.

The Wall Street Journal opined today about the inane anti-housing policies in the Beaver State.

Politicians bemoan the lack of affordable housing, but their policies often create the problem. Look no further than Oregon… Oregon’s population grew by nearly 400,000 between 2010 and 2019. But the state added a mere 37 housing permits for every 100 new residents…  Oregon’s land-use rules have been dysfunctional for decades. …strict limits on urban expansion…urban growth boundaries… Rising housing prices are the inevitable result of this government-imposed scarcity. …Portland has enforced an “inclusionary zoning” requirement on new residential buildings with 20 or more units. The city now compels many landlords to rent up to a fifth of new units at below-market rates. …Permits for 20-plus-unit residential buildings plummeted 64% in 25 months after inclusionary zoning took effect, while applications to build smaller multi-family structures spiked… The rest of Oregon is following Portland’s bad example with more price controls. Last year it became the first state to impose universal rent control.

Oregon’s land-use rules have been dysfunctional for decades. …strict limits on urban expansion…urban growth boundaries… Rising housing prices are the inevitable result of this government-imposed scarcity. …Portland has enforced an “inclusionary zoning” requirement on new residential buildings with 20 or more units. The city now compels many landlords to rent up to a fifth of new units at below-market rates. …Permits for 20-plus-unit residential buildings plummeted 64% in 25 months after inclusionary zoning took effect, while applications to build smaller multi-family structures spiked… The rest of Oregon is following Portland’s bad example with more price controls. Last year it became the first state to impose universal rent control.

To show the impact of regulatory restrictions, the invaluable Mark Perry of the American Enterprise Institute has a must-read comparison of Los Angeles with two Texas cities.

Adjusting for population, there are about 600 homeless people per 1 million population in Houston and Dallas, but nearly five times as many in LA at 2,707. The comparisons…highlight the simple economic logic that if you restrict the supply of new housing units  (especially multifamily homes, duplexes, and large apartment buildings) in states like California with onerous building, land use, and zoning regulations, those restrictions are guaranteed to result in higher housing costs, higher apartment rents, and ultimately a greater homeless population. …The increasing rents, escalating home prices, and growing homelessness problem in California cities like LA are a direct result of local and state restrictions that artificially constrict the supply of new housing units. The solution is therefore simple, but politically unpopular and probably not politically feasible: California should increase its supply of housing by reducing its onerous restrictions on building new housing units.

(especially multifamily homes, duplexes, and large apartment buildings) in states like California with onerous building, land use, and zoning regulations, those restrictions are guaranteed to result in higher housing costs, higher apartment rents, and ultimately a greater homeless population. …The increasing rents, escalating home prices, and growing homelessness problem in California cities like LA are a direct result of local and state restrictions that artificially constrict the supply of new housing units. The solution is therefore simple, but politically unpopular and probably not politically feasible: California should increase its supply of housing by reducing its onerous restrictions on building new housing units.

Here’s his accompanying table. Notice how Dallas and Houston are much more affordable than Los Angeles.

And there’s less homelessness as well, in large part because housing is cheaper.

Kevin Williamson wrote in National Review about the anti-housing policies of New York’s governor.

Some of the inflated expenses associated with life in New York can be avoided… But you have to live somewhere. As in the Bay Area, Washington, and other Democrat-dominated cities, housing is the real killer in New York City and environs. …Like most U.S. cities advertising themselves as “progressive,” New York has a lot of political leaders who talk about affordable housing and a lot  of political policies that keep affordable housing — and many other kinds of housing — from being built. This is not accidental: People who already own property typically have a lot more political influence than people in the first-time home-buyer market. …At the behest of moneyed environmental interests, Cuomo has stood athwart the building of practically any new conventional energy infrastructure, including pipelines for clean-burning natural gas. …Much of New York’s gas comes from Pennsylvania and West Virginia, but there isn’t enough carrying capacity to get it to New York. And New York has plenty of gas of its own, too, but New Yorkers can’t use it — thanks again to Cuomo, who has banned modern gas-extraction techniques in the state, again at the behest of the anti-energy ideologues who enjoy an outsized financial footprint in the Democratic party.

of political policies that keep affordable housing — and many other kinds of housing — from being built. This is not accidental: People who already own property typically have a lot more political influence than people in the first-time home-buyer market. …At the behest of moneyed environmental interests, Cuomo has stood athwart the building of practically any new conventional energy infrastructure, including pipelines for clean-burning natural gas. …Much of New York’s gas comes from Pennsylvania and West Virginia, but there isn’t enough carrying capacity to get it to New York. And New York has plenty of gas of its own, too, but New Yorkers can’t use it — thanks again to Cuomo, who has banned modern gas-extraction techniques in the state, again at the behest of the anti-energy ideologues who enjoy an outsized financial footprint in the Democratic party.

In addition to zoning laws and other land-use restrictions, the government also makes construction more expensive, as explained in a report in the Wall Street Journal.

The average cost for home builders to comply with regulations for new home construction has increased by nearly 30% over the last five years, according to new research from the National Association of Home Builders. Regulatory costs such as local impact fees, storm-water discharge permits and new construction codes,  which have risen at roughly the same rate as the average price for new homes, make it increasingly difficult for builders to pursue affordable single-family construction projects… The cost of regulation imposed during the land development and construction process on average represented $84,671 of the cost of the average new single-family home in March. That is up from $65,224 in 2011, the last time the home-building industry group conducted a similar survey on regulatory costs. …A study this week from housing research firm Zelman & Associates found that local infrastructure “impact fees” have increased by 45% on average since 2005 in 37 key home building markets across the country, to about $21,000 per home.

which have risen at roughly the same rate as the average price for new homes, make it increasingly difficult for builders to pursue affordable single-family construction projects… The cost of regulation imposed during the land development and construction process on average represented $84,671 of the cost of the average new single-family home in March. That is up from $65,224 in 2011, the last time the home-building industry group conducted a similar survey on regulatory costs. …A study this week from housing research firm Zelman & Associates found that local infrastructure “impact fees” have increased by 45% on average since 2005 in 37 key home building markets across the country, to about $21,000 per home.

Here’s a sobering graphic from the article.

All this regulation is bad for macroeconomic performance.

A recent study by two economists finds that land-use restrictions result in substantial misallocation of labor, causing a non-trivial reduction in economic output and family income.

The increase in spatial wage dispersion is driven at least in part by cities like New York, San Francisco, and San Jose, which…adopted land use restrictions that significantly constrained the amount of new housing that can be built. As described by Glaeser (2014), since the 1960s coastal US cities have gone through a property rights revolution that has significantly reduced the elasticity of housing supply… Instead of increasing local employment,  productivity growth in housing-constrained cities primarily pushes up housing prices and nominal wages. The resulting misallocation of workers lowers aggregate output and welfare of workers in all US cities. This paper measures the aggregate productivity costs of local housing constraints… We use data from 220 metropolitan areas in the United States from 1964 to 2009… we calculate that increasing housing supply in New York, San Jose, and San Francisco by relaxing land use restrictions to the level of the median US city would increase the growth rate of aggregate output by 36.3 percent. In this scenario, US GDP in 2009 would be 3.7 percent higher, which translates into an additional $3,685 in average annual earnings. …We conclude that local land use regulations that restrict housing supply in dynamic labor markets have important externalities on the rest of the country. Incumbent homeowners in high productivity cities have a private incentive to restrict housing supply. …this lowers income and welfare of all US workers.

productivity growth in housing-constrained cities primarily pushes up housing prices and nominal wages. The resulting misallocation of workers lowers aggregate output and welfare of workers in all US cities. This paper measures the aggregate productivity costs of local housing constraints… We use data from 220 metropolitan areas in the United States from 1964 to 2009… we calculate that increasing housing supply in New York, San Jose, and San Francisco by relaxing land use restrictions to the level of the median US city would increase the growth rate of aggregate output by 36.3 percent. In this scenario, US GDP in 2009 would be 3.7 percent higher, which translates into an additional $3,685 in average annual earnings. …We conclude that local land use regulations that restrict housing supply in dynamic labor markets have important externalities on the rest of the country. Incumbent homeowners in high productivity cities have a private incentive to restrict housing supply. …this lowers income and welfare of all US workers.

So how can this problem be fixed?

In a column for the Foundation for Economic Education, Cathy Reisenwitz explains that state and local politicians need to remove barriers.

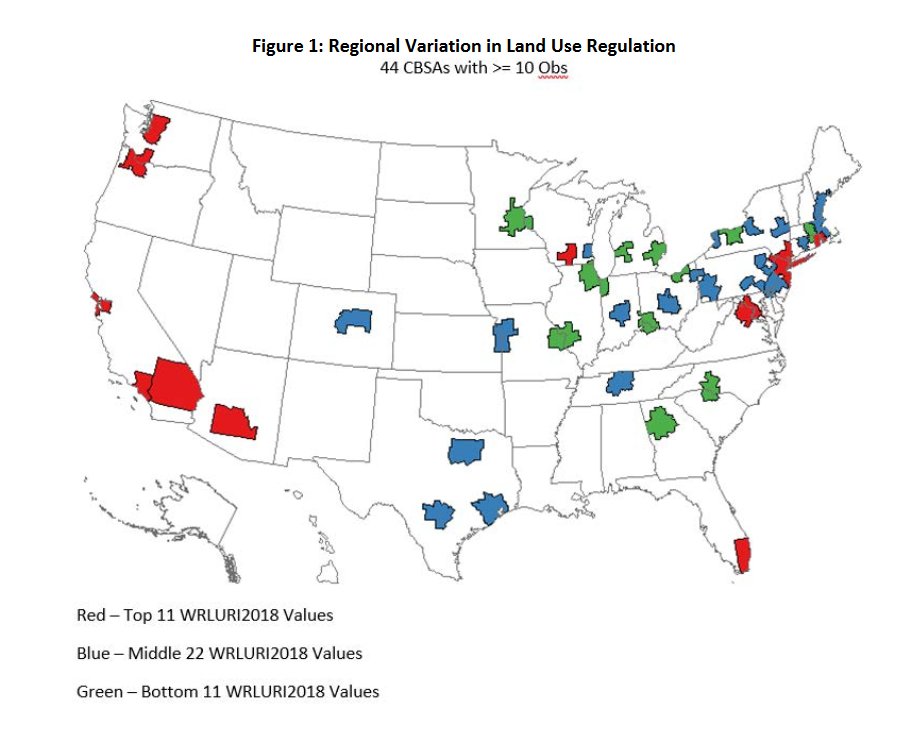

America is in the middle of a housing crisis. The cause is simple: we’re not building housing fast enough to keep up with jobs. While the number of U.S. households grew by 11.2 million between 2005 and 2015, we only added about 9.9 million new housing units. …this isn’t a problem Washington can fix.  That’s because this problem, and its solution, lies in cities and towns across the country. …Cities across the country make it impossible to build enough housing to meet demand by blocking, restricting, and delaying housing developments. …Even in areas where you can technically build multi-unit homes, other land-use restrictions make it all-but-impossible. These exclusionary land use practices include height restrictions, setback requirements, parking minimums, community review, aesthetic considerations, and minimum lot sizes. …A recent statistical analysis…showed that in 44 out of 50 states, the more land-use regulations on the books, the more homes cost. Reducing land use regulations is the right move for getting Americans out of poverty and into work.

That’s because this problem, and its solution, lies in cities and towns across the country. …Cities across the country make it impossible to build enough housing to meet demand by blocking, restricting, and delaying housing developments. …Even in areas where you can technically build multi-unit homes, other land-use restrictions make it all-but-impossible. These exclusionary land use practices include height restrictions, setback requirements, parking minimums, community review, aesthetic considerations, and minimum lot sizes. …A recent statistical analysis…showed that in 44 out of 50 states, the more land-use regulations on the books, the more homes cost. Reducing land use regulations is the right move for getting Americans out of poverty and into work.

Let’s close with some good news.

Salim Furth has a new article for City Journal, and he argues that all the evidence is actually changing minds and leading to some deregulation.

Last year, Democratic- and Republican-led states and municipalities passed legislation addressing housing affordability, a hopeful sign that housing deregulation is beginning to attract bipartisan support… Encouragingly, Arkansas and Texas have squelched such requirements through bipartisan state legislation. Arkansas has restored autonomy to homeowners on virtually all building-design choices, from color to roof pitch, while Texas has purged local restrictions on building materials. …North Carolina and Texas…passed legislation requires cities and counties to issue project approvals within a few weeks. In Texas, a developer can now move forward with construction if a municipality takes more than 30 days to review a completed application. North Carolina now imposes a 15-business-day limit for building permits involving one- and two-family dwellings. …State legislators will likely continue to address housing-supply restrictions in the years ahead. …The battle over rent control and inclusionary zoning could intensify as well, as it already has in California and Oregon. …policymakers in blue and red states alike should consider how current regulations restrict housing supply and drive up prices.

from color to roof pitch, while Texas has purged local restrictions on building materials. …North Carolina and Texas…passed legislation requires cities and counties to issue project approvals within a few weeks. In Texas, a developer can now move forward with construction if a municipality takes more than 30 days to review a completed application. North Carolina now imposes a 15-business-day limit for building permits involving one- and two-family dwellings. …State legislators will likely continue to address housing-supply restrictions in the years ahead. …The battle over rent control and inclusionary zoning could intensify as well, as it already has in California and Oregon. …policymakers in blue and red states alike should consider how current regulations restrict housing supply and drive up prices.

The bottom line is that housing across the nation will be much more affordable if state and local governments let markets operate.

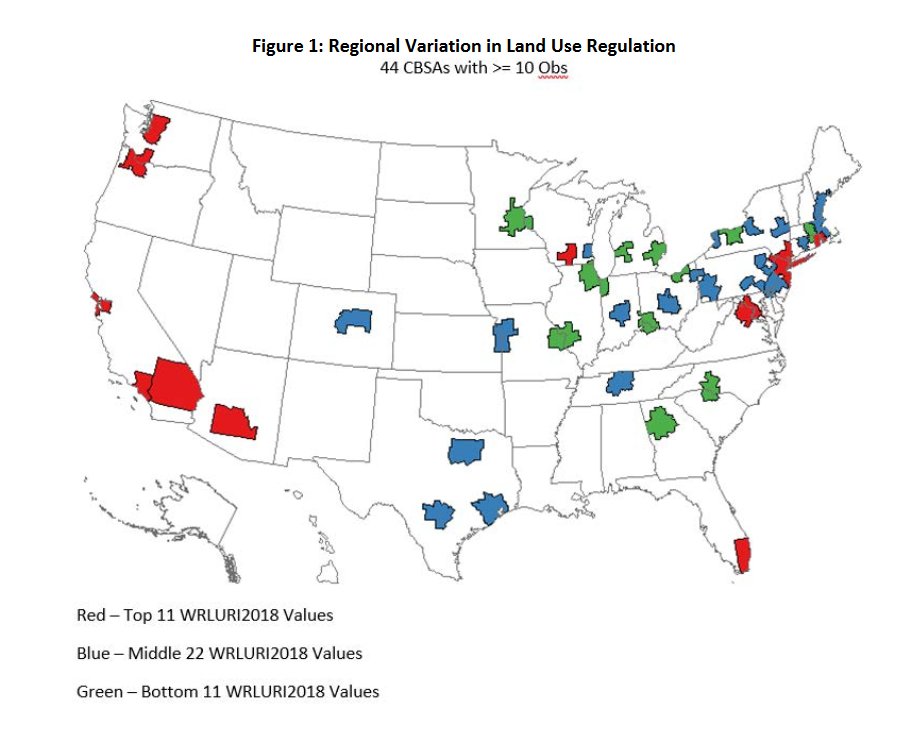

Here’s a map showing estimates of land-use restrictions in major metropolitan areas. The goal for the nation should be more green and less red.

Incidentally, Fairfax, VA, is part of the D.C. area, so that red spot indicates that my home’s value is being subsidized (as are the homes of Washington’s parasite class).

But since I believe in a just society, I hope my part of the map becomes green, even if it means my home becomes less valuable (folks on the left are willing to hurt the poor so long as they also hurt the rich, whereas I’m willing to sacrifice myself so long as unjust favoritism for others also vanishes).

Read Full Post »

caused by the European’s Union’s dirigiste economic model and grim demographic outlook.

caused by the European’s Union’s dirigiste economic model and grim demographic outlook.…One feature of this new politics is how immune voters have become to economic scaremongering… Britons instead have heard European anxiety that Brexit will trigger a “race to the bottom” on economic policy. What this really means is that EU politicians are aware that a freer economy more open to commerce at home and trade outside the EU would deliver more prosperity to more people than continental social democracy. British voters may not embrace this open vision in the end, but they’ve given themselves the choice. …All of this frightens so-called good Europeans…because it’s a direct challenge to…their “European project.” Central to this worldview is a distrust of…markets… A Britain with greater political independence and deep trading ties to Europe without all the useless red tape and hopeless centralizing could be a model. …Britain’s voters in 2016, and again in 2019, chose peaceful and prosperous coexistence with their neighbors rather than mindless but relentless integration. It’s the most consequential choice any European electorate has made in at least a generation.

t means more jurisdictional competition, which is good news for those of us who want some sort of restraint on government greed.

t means more jurisdictional competition, which is good news for those of us who want some sort of restraint on government greed.