My recent three-part series (here, here, and here) explained why policy makers should seek to reduce poverty rather than inequality.

I want to expand on that point today by showing why growing the pie is more important than how it is sliced.

I’ve previously opined on why economic growth is important, showing that the United States today would be almost as poor as Mexico if our rate of economic growth since 1895 was just one-percentage point less than it actually was.

Moreover, I also showed in that 2017 column how much smaller increments of additional growth over time can mean thousands of dollars of additional income for an average household.

And, the previous year, I shared two excellent videos from Marginal Revolution University while writing about Hong Kong’s remarkable jump from poverty to prosperity.

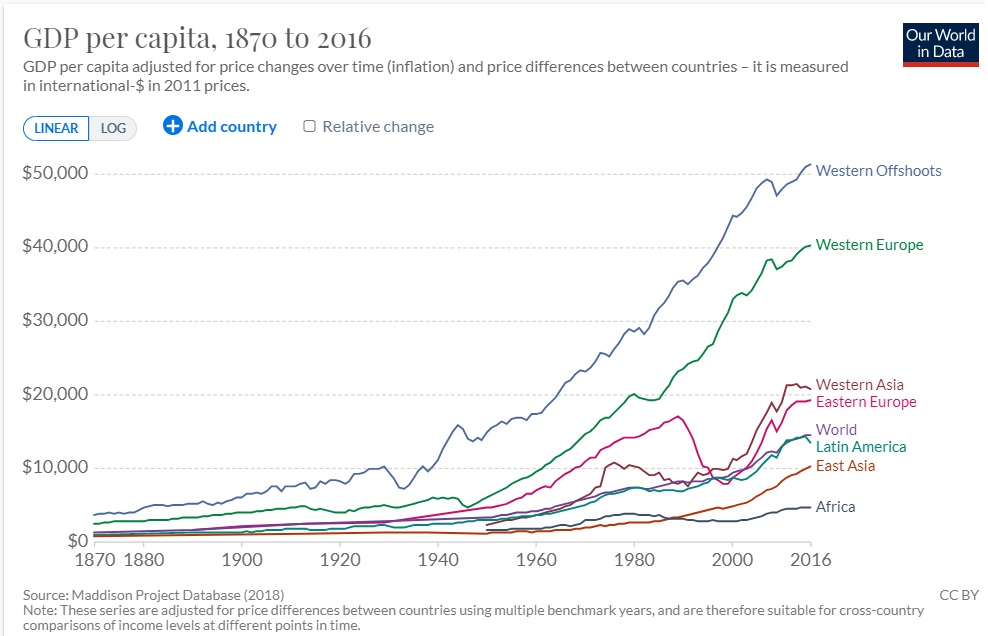

For today’s column, I want to expand on this point using the economic growth page from Max Roser’s great site, Our World in Data. We’ll start with this chart showing how per-capita economic output dramatically increased a few hundred years ago.

This kind of data won’t be news to regular readers. I’ve already shared great videos from Deirdre McCloskey and Don Boudreaux that make the same point about the explosion of prosperity in the modern era.

And if anyone somehow thinks this growth doesn’t matter, Roser’s page shows that there are countless ways of graphing the relationship between economic output and good outcomes, such as how long we live, child mortality, access to electricity, hunger, and literacy.

The bottom line is that we are unimaginably rich compared to prior generations, largely thanks to the rule of law, expanded trade, and limited government.

That recipe for growth and prosperity works anywhere and everywhere it is tried. Here’s another chart showing how other parts of the world are being to prosper thanks to economic liberalization.

I want to cite two additional charts from Roser’s page.

First, here’s a chart showing productivity rates in selected nations. Why is this important? Because economic prosperity is basically driven by how much we work and how productive we are.

There are all sorts of interesting things embedded in the above chart.

- Productivity is vitally important, which is why it is so misguided to have tax systems that punish saving and investment.

- Nations such as China still way behind the western world, a point I’ve been making for a long time.

- The United States has a big income advantage over European nations, but it’s driven by hours worked rather than productivity.

Our final chart shows the importance of convergence.

Once again, there are some important observations embedded in the above chart.

- Very poor nations such as Botwsana and China can enjoy meaningful gains with partial economic liberalization.

- Western nations can enjoy more prosperity over time, but they won’t catch the United States so long as they are burdened with too much government.

- Singapore shows that full convergence is not only possible, but also that laissez-faire countries can even surpass the United States.

P.S. I can’t resist recycling my “never-answered question” in hopes of getting any of my left-leaning friends to cite a single example of their policies producing mass prosperity.

[…] periodically tried to explain that even small differences in long-run growth can lead to immense benefits, including huge reductions in […]

[…] some folks on the left are not very receptive to this argument. They genuinely (but incorrectly) seem to think the economy is a fixed pie (which also explains, at least in part, why they […]

[…] some folks on the left are not very receptive to this argument. They genuinely (but incorrectly) seem to think the economy is a fixed pie (which also explains, at least in part, why they […]

[…] some folks on the left are not very receptive to this argument. They genuinely (but incorrectly) seem to think the economy is a fixed pie (which also explains, at least in part, why they […]

[…] some folks on the left are not very receptive to this argument. They genuinely (but incorrectly) seem to think the economy is a fixed pie (which also explains, at least in part, why they […]

[…] some folks on the left are not very receptive to this argument. They genuinely (but incorrectly) seem to think the economy is a fixed pie (which also explains, at least in part, why they […]

[…] showing that Western Europeans became rich during the 1800s and early 1900s – and this didn’t happen at the expense of the […]

[…] showing that Western Europeans became rich during the 1800s and early 1900s – and this didn’t happen at the expense of the […]

[…] some folks on the left are not very receptive to this argument. They genuinely (but incorrectly) seem to think the economy is a fixed pie (which also explains, at least in part, why they […]

[…] differences in economic growth lead to big differences in long-run living standards. And the “size of the pie” is a good predictor of whether a nation enjoys broadly shared […]

[…] differences in economic growth lead to big differences in long-run living standards. And the “size of the pie” is a good predictor of whether a nation enjoys broadly shared […]

[…] that’s why there’s less growth and people wind up with lower living standards as time […]

[…] Singapore vs Botswana, United States, China, France, and Japan […]

[…] some folks on the left are not very receptive to this argument. They genuinely (but incorrectly) seem to think the economy is a fixed pie (which also explains, at least in part, why they […]

[…] some folks on the left are not very receptive to this argument. They genuinely (but incorrectly) seem to think the economy is a fixed pie (which also explains, at least in part, why they […]

[…] some folks on the left are not very receptive to this argument. They genuinely (but incorrectly) seem to think the economy is a fixed pie (which also explains, at least in part, why they […]

[…] some folks on the left are not very receptive to this argument. They genuinely (but incorrectly) seem to think the economy is a fixed pie (which also explains, at least in part, why they […]

[…] some folks on the left are not very receptive to this argument. They genuinely (but incorrectly) seem to think the economy is a fixed pie (which also explains, at least in part, why they are so […]

[…] I’ve written many times to show that the rich nations of the western world made the leap to industrial prosperity in the 1800s and early 1900s – at a time when they had no welfare states and very low fiscal […]

[…] part of a video debate last year (where I also discussed wealth taxation, poverty reduction, and the inadvisability of tax increases), I pontificated on the negative economic […]

[…] part of a video debate last year (where I also discussed wealth taxation, poverty reduction, and the inadvisability of tax increases), I pontificated on the negative economic impact of […]

[…] But people who work closely with economic data surely understand that you don’t just want to focus on how the pie is sliced. You also want to know the size of the pie. […]

[…] The rich are getting richer and the poor are getting richer as well. […]

[…] than the result of handouts, bailouts, and subsidies from politicians). What matters is “growing the pie” so all of us have a chance to enjoy more […]

[…] the should-be-obvious case that it’s possible for all groups in a society to become richer if the economic pie expands. I’ve shown this with U.S. data and I’ve shown it with global […]

[…] That being said, lower tax rates are better for prosperity than higher tax rates (as illustrated by academic studies from economists). And since even small differences in economic performance can lead to big long-run benefits, the main takeaway is that it’s a good idea to enact policies to expand the economic pie. […]

[…] That being said, lower tax rates are better for prosperity than higher tax rates (as illustrated by academic studies from economists). And since even small differences in economic performance can lead to big long-run benefits, the main takeaway is that it’s a good idea to enact policies to expand the economic pie. […]

[…] the point about “growing the pie” is critically important since even a very small reduction in long-run growth will have a […]

[…] the point about “growing the pie” is critically important since even a very small reduction in long-run growth will have a […]

[…] broadly, I want a bigger economic pie so that everyone can have a larger slice. And I don’t particularly care if some people get richer faster than other people get richer […]

[…] on December 28, I shared four charts for the explicit reason that I wanted everyone to understand that average living standards in the […]

Reblogged this on boudica.us.

[…] Economic Growth and the “Size of the Pie” […]

[…] Source: Economic Growth and the “Size of the Pie” | International Liberty […]

I’d say the only country that qualifies is the US itself. Since the 1930’s we have gotten big government (maybe not as big as some).

But we’ve really made a hash of it, and we could be growing faster.

A different tax code would add 2% to annual growth.

We currently spend 7.6 billion man-hours in wasted time on compliance with the tax code. With an efficient tax code we could drop that to 2 billion releasing the equivalent of 2.5 million productive workers. (I don’t count the 1 million bureaucrats released to the private market as a plus.)

We currently give welfare benefits, but then take them away, if people begin to work.

We give huge tax deductions to the rich.

Combine a Flat Tax with a UBI (paid for, with money currently spent) and you have it.

The free market works great, but there are times (like the present) when the system breaks down, and those at the bottom need a boost. It doesn’t have to be either free market or socialism, but rather a bit toward the middle.