I must be perversely masochistic because I have the strange habit of reading reports issued by international bureaucracies such as the International Monetary Fund, World Bank, United Nations, and Organization for Economic Cooperation and Development.

But one tiny silver lining to this dark cloud is that it’s given me an opportunity to notice how these groups have settled on a common strategy of urging higher taxes for the ostensible purpose of promoting growth and development.

Seriously, this is their argument, though they always rely on euphemisms when asserting that politicians should get more money to spend.

- The OECD, for instance, has written that “Increased domestic resource mobilisation is widely accepted as crucial for countries to successfully meet the challenges of development and achieve higher living standards for their people.”

The Paris-based bureaucrats of the OECD also asserted that “now is the time to consider reforms that generate long-term, stable resources for governments to finance development.”

The Paris-based bureaucrats of the OECD also asserted that “now is the time to consider reforms that generate long-term, stable resources for governments to finance development.”- The IMF is banging on this drum as well, with news reports quoting the organization’s top bureaucrat stating that “…economies need to strengthen their fiscal frameworks…by boosting…sources of revenues.” while also reporting that “The IMF chief said taxation allows governments to mobilize their revenues.”

- And the UN, which has “…called for a tax on billionaires to help raise more than $400 billion a year” routinely categorizes such money grabs as “financing for development.”

As you can see, these bureaucracies are singing from the same hymnal, but it’s a new version.

In the past, the left agitated for higher taxes simply in hopes for having more redistribution.

And they’ve urged higher taxes because of spite and hostility against those with high incomes.

Some folks on the left also have supported higher taxes on the theory that the economy’s performance is boosted when deficits are smaller.

But now, they are advocating higher taxes (oops, excuse me, I mean they are urging “resource mobilization” to generate “stable resources” so there can be “financing for development” in order to “strengthen fiscal frameworks”) on the theory that bigger government is the way to get more growth.

You probably won’t be surprised to learn, however, that these reports from international bureaucracies never provide any evidence for this novel hypothesis. None. Zero. Zilch. Nada. The null set.

They simply assert that governments will be able to make presumably wonderful growth-generating “investments” if politicians can squeeze more money from the private sector.

And I strongly suspect that this absence of evidence is deliberate. Simply stated, international bureaucracies are willing to produce shoddy research (just look at what the IMF and OECD wrote about the relationship between growth and inequality), but there’s a limit to how far data can be tortured and manipulated.

Especially when there’s so much evidence from real scholars that economic performance is weakened when government gets bigger.

Especially when there’s so much evidence from real scholars that economic performance is weakened when government gets bigger.

Not to mention that most sentient beings can look around the world and look at the moribund economies of nations with large governments (such as France, Italy, and Greece) and compare them with the better performance of places with smaller government (such as Hong Kong, Switzerland, and Singapore).

But if you read the aforementioned reports from the international bureaucracies, you’ll notice that some of them focus on getting more growth in poor nations.

Perhaps, some statists might argue, government is big enough in Europe, but not big enough in poorer regions such as sub-Saharan Africa.

So let’s look at the numbers. Is it true that governments in the developing world don’t have enough money to provide core public goods?

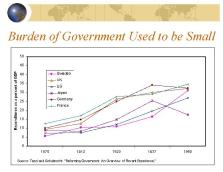

But before sharing those numbers, let’s look at some historical data. A few years ago, I shared some research demonstrating that countries in North America and Western Europe became rich in the 1800s and early 1900s when the burden of government spending was very modest.

One would logically conclude from this data that today’s poor nations should copy that approach.

Yet here’s the data from the International Monetary Fund on government expenditures in various poor regions of the world. As you can see, the burden of government spending in these areas is two or three times larger than it was in America and other nations that when they made the move from agricultural poverty to middle class prosperity.

The bottom line is that small government and free markets is the recipe for growth and prosperity in all nations.

Just don’t expect international bureaucracies to share that recipe since one of the obvious conclusions is that we therefore don’t need parasitical bodies like the IMF, OECD, World Bank, and UN.

P.S. Unsurprisingly, Hillary Clinton also has adopted the mantra of higher-taxes → bigger government → more growth.

[…] other words, higher taxes and bigger government based on the anti-empirical notion that this will magically deliver […]

[…] you need to understand is that “strengthening social protection systems and public services” is […]

[…] P.S. During the era of the “Washington Consensus,” there were people in the foreign aid establishment who understood that free markets and limited government were the only effective way of helping poor nations. Today, by contrast, international organizations openly push for bigger government. […]

[…] all intents and purposes, he’s embracing the absurd notion that more growth will materialize if politicians impose higher tax rates and use the money to […]

[…] Here’s their theory. […]

[…] agree with Okun, but I applaud him for honesty. Unlike many modern politicians, as well as most international bureaucracies (and even the occasional journalist), he didn’t pretend that big government was a free […]

[…] Economic Cooperation and Development also have claimed that there will be more prosperity if governments get more control over the […]

[…] for Economic Cooperation and Development also have claimed that there will be more prosperity if governments get more control over the […]

[…] IMF, which abandoned the “Washington Consensus” for economic liberalization and instead have been making the odd argument that prosperity can be achieved with higher taxes and a bigger burden of government […]

[…] The official reason, though, is that the bureaucrats want people to believe – notwithstanding reams of evidence – that higher taxes are good for prosperity. And it’s not just the OECD pushing this bizarre theory. It’s now routine for international bureaucracies to push this upside-down analysis, based on the anti-empirical notion that economies will prosper if governments can finance more spending. […]

[…] But the bottom line is that we now have some good evidence that the Washington Consensus led to better results. Simply stated, capitalism produces more growth and less poverty. Too bad the IMF and other international bureaucracies have forgotten this lesson. […]

[…] IMF types, as well as others on the left, actually want people to believe that Pakistan should have a bigger burden of government […]

[…] matters today is that politicians are promising lots of freebies. Notwithstanding the “investment” argument made by Stiglitz and others, those new handouts will undermine […]

[…] only hard-left politicians and international bureaucracies have the gall to claim that you can strengthen an economy by having […]

[…] I’m both amused and disgusted that the OECD report has creative euphemisms for higher taxes, such as “domestic resource mobilization” and “capacity […]

[…] the risk of stating the obvious, the problem in developing nations is bad government policy, not insufficient revenue in the hands of […]

[…] produce more growth by financing a bigger burden of government (which – no joke – was the core argument in the 2105 study), this new report claims higher taxes will produce more growth by reducing […]

[…] points are important because some folks on the left misinterpret Wagner’s Law and actually try to argue that bigger government is good for […]

[…] points are important because some folks on the left misinterpret Wagner’s Law and actually try to argue that bigger government is good for […]

[…] points are important because some folks on the left misinterpret Wagner’s Law and actually try to argue that bigger government is good for […]

[…] Some argue, by the way, that spending restraint is bad for an economy. The Keynesians think that more government is “stimulus.” And many of the international bureaucracies (including the IMF) argue that more government is an “investment.” […]

[…] wants us to believe that a low fiscal burden is a bad thing. The bureaucrats at the IMF (and at other international bureaucracies) actually want people to believe that bigger government means more prosperity. Which is why the […]

[…] it’s like the Pope is applying for a job at the IMF or OECD. Or even with the scam charity […]

[…] it’s like the Pope is applying for a job at the IMF or OECD. Or even with the scam charity […]

[…] it’s like the Pope is applying for a job at the IMF or OECD. Or even with the scam charity […]

[…] el FMI quiere que creamos que una baja carga fiscal es algo malo. Los burócratas en el FMI (y en otras burocracias internacionales) en realidad quieren que la gente crea que un gobierno más grande significa más prosperidad. Por […]

[…] IMF wants us to believe that a low fiscal burden is a bad thing. The bureaucrats at the IMF (and at other international bureaucracies) actually want people to believe that bigger government means more prosperity. Which is why the […]

[…] Moreover, there’s not a single example of a country that adopted big government and then became rich (and therefore capable of achieving the UN’s goals). So the notion that higher taxes and bigger governments can produce better outcomes for poor nations is utter bunk. […]

[…] that the OECD’s bad advice for Costa Rica is not an anomaly. International bureaucracies are routinely urging higher tax […]

[…] Je n’apprécie guère les bureaucraties internationales qui poussent aux politiques étatistes. Mais de façon perverse, j’ai de l’admiration pour leur outrance. Elles prétendent maintenant que des prélèvements plus élevés sont bons pour la croissance. […]

[…] Je n’apprécie guère les bureaucraties internationales qui poussent aux politiques étatistes. Mais de façon perverse, j’ai de l’admiration pour leur outrance. Elles prétendent maintenant que des prélèvements plus élevés sont bons pour la croissance. […]

[…] not joking. I wrote last year about how many of the international bureaucracies are blindly asserting that higher taxes are […]

[…] In a perverse way, though, I admire their brassiness. They’re now arguing that higher taxes are good for growth. […]

[…] I’m not joking. […]

[…] not joking. I wrote last year about how many of the international bureaucracies are blindly asserting that higher taxes are […]

[…] appropriate size of government in the long run. Folks on the left argue that government spending generates a lot of value and that bigger government is a recipe for more prosperity. Libertarians and their allies, by […]

[…] makes some other assertions that deserve a bit of attention. Most notably, the authors repeat the silly claim by some leftists that the way to get more growth is with a bigger government financed by higher […]

[…] Source: Notwithstanding the New Left-Wing Rhetorical Strategy, Higher Taxes and Bigger Government Is Not a R… […]

A concise, enormously significant view that one will never see in the popular media is here expressed by Daniel Mitchell.

More (totally) depreciation allowances might be a good idea !