Exactly one year ago, we looked at the best and worst policy developments of 2013.

Now it’s time for a look back at 2014 to see what’s worth celebrating and what are reasons for despair.

Here’s the good news for 2014.

1. Gridlock – I’ve been arguing for nearly three years that divided government is producing better economic performance. To be sure, it would have been difficult for the economy to move in the wrong direction after the stagnation of Obama’s first two years, but heading in the wrong direction at a slower pace is better than speeding toward European-style statism.

but heading in the wrong direction at a slower pace is better than speeding toward European-style statism.

Indeed, the fact that policy stopped getting worse even boosted America’s relative competitiveness, so there’s a lot to be thankful for when politicians disagree with each other and can’t enact new laws.

David Harsanyi explains the glory of gridlock for The Federalist.

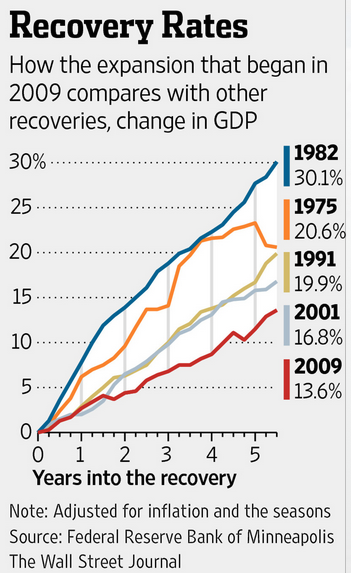

Gross domestic product grew by a healthy 5 percent in the third quarter, the strongest growth we’ve seen since 2003. Consumer spending looks like it’s going to be strong in 2015, unemployment numbers have looked good, buying power is up and the stock market closed at 18,000 for the first time ever. All good things. So what happened? …the predominant agenda of Washington was doing nothing. It was only when the tinkering and superfluous stimulus spending wound down that fortunes began to turn around. …spending as a percent of GDP has gone down. In 2009, 125 bills were enacted into law. In 2010, 258. After that, Congress, year by year, became one of the least productive in history. And the more unproductive Washington became, the more the economy began to improve. …Gridlock has caused an odd, but pervasive, stability in Washington. Spending has been static. No jarring reforms have passed — no cap-and-trade, which would have artificially spiked energy prices and undercut the growth we’re now experiencing. The inadvertent, but reigning, policy over the past four years has been, do no harm.

Amen. Though I should hasten to add that while gridlock has been helpful in the short run (stopping Obama from achieving his dream of becoming a second FDR), at some point we will need unified government in order to adopt much-needed tax reform and entitlement reform.

The key question is whether we will ever get good politicians controlling both ends of Pennsylvania Avenue.

2. Restrained Spending – This is the most under-reported and under-celebrated news of the past few years, not just 2014.

Allow me to cite one of my favorite people.

Allow me to cite one of my favorite people.

In fiscal year 2009, the federal government spent about $3.52 trillion. In fiscal year 2014 (which ended on September 30), the federal government spent about $3.50 trillion. In other words, there’s been no growth in nominal government spending over the past five years. It hasn’t received nearly as much attention as it deserves, but there’s been a spending freeze in Washington. …the fiscal restraint over the past five years has resulted in a bigger drop in the relative size of government in America than what Switzerland achieved over the past ten years thanks to the “debt brake.” …The bottom line is that the past five years have been a victory for advocates of limited government.

And this spending restraint is producing economic dividends, though Paul Krugman somehow wants people to believe that Keynesian economics deserves the credit.

3. Limits on Unemployment Benefits – Although the labor force participation rate is still disturbingly low, the unemployment rate has declined and  job creation numbers have improved.

job creation numbers have improved.

The aforementioned policies surely deserve some of the credit, but it’s also worth noting that Congress wisely put a stop to the initiative-sapping policy of endlessly extending unemployment benefits. Such policies sound compassionate, but they basically pay people not to work and cause more joblessness.

Phil Kerpen of American Commitment elaborates, citing recent research from the New York Fed.

According to empirical research by the Federal Reserve Bank of New York: “most of the persistent increase in unemployment during the Great Recession can be accounted for by the unprecedented extensions of unemployment benefit eligibility.” Those benefits finally ended at the end of 2013, triggering a sharp rise in hiring… Specifically, they found that the average extended unemployment benefits duration of 82.5 weeks for four years had the impact of raising the unemployment rate from 5 percent to 8.6 percent. …Good intentions are not enough in public policy. It might seem kind and compassionate to spend billions of taxpayer dollars on “emergency” unemployment benefits forever, but the effect is to keep millions of people unemployed. Results matter.

Phil’s right. If you pay people not to work, you’re going to get foolish results.

But the three above stories are not the only rays of sunshine in 2014. Honorable mention goes to North Carolina and Kansas for implementing pro-growth tax reforms.

I’m also pleased that GOPers passed the first half of my test and told the Democrat appointee at the Congressional Budget Office that he would be replaced. Now the question is whether they appoint someone who will make the long-overdue changes that are needed to get better and more accurate assessments of fiscal policy. That didn’t happen when the GOP had control between 1995 and 2007, so victory is far from assured.

And another honorable mention is that Congress has not expanded the IMF’s bailout authority.

Now let’s look at the three worst policy developments of 2014.

1. Obamacare Subsidies – Yes, Obamacare has been a giant albatross for the President and his party. Yes, the law has helped more and more people realize that big government isn’t a good idea.  Those are positive developments.

Those are positive developments.

Nonetheless, 2014 was the year when the subsidies began to flow. And once handouts begin, politicians get very squeamish about taking them away.

This is why I wrote back in 2012 that Obamacare may have been a victory (in the long run) for the left, even though it caused dozens of Democrats to lose their seats in the House and Senate.

I think the left made a clever calculation that losses in the last cycle would be an acceptable price to get more people dependent on the federal government. And once people have to rely on government for something like healthcare, they are more likely to vote for the party that promises to make government bigger. …This is why Obamacare – and the rest of the entitlement state – is so worrisome. If more and more Americans decide to ride in the wagon of government dependency, it will be less and less likely that those people will vote for candidates who want to restrain government.

Simply stated, when more and more people get hooked on the heroin of government dependency, I fear you get the result portrayed in this set of cartoons.

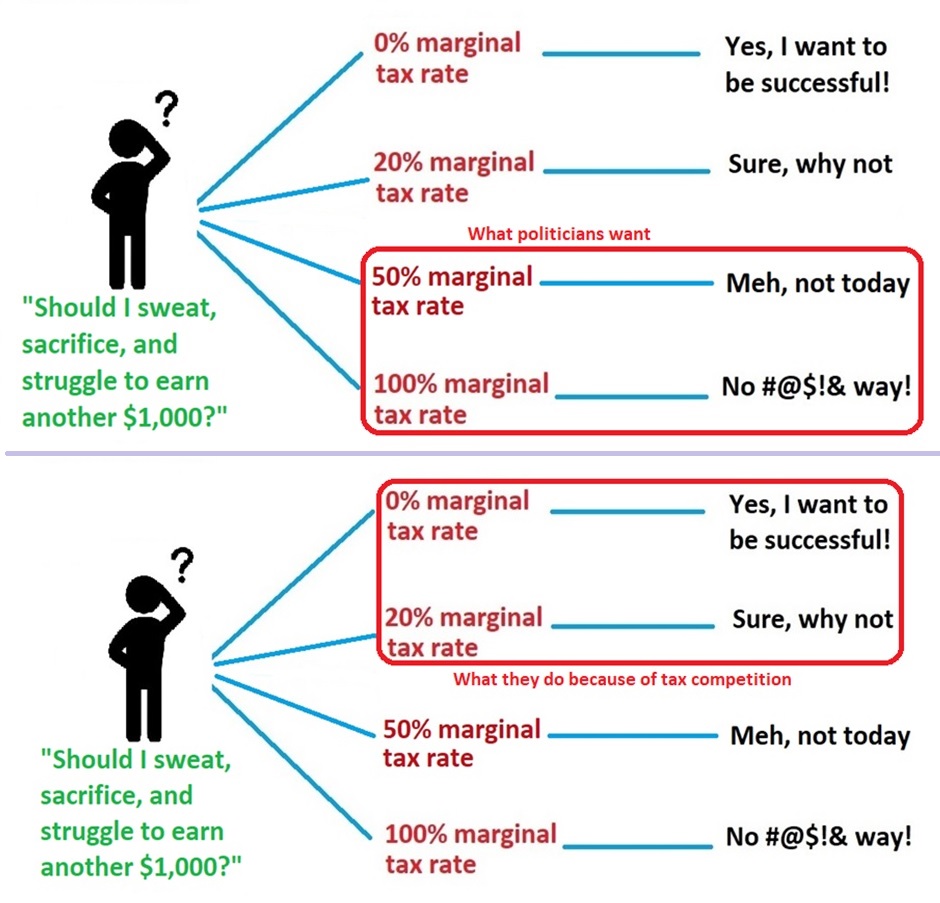

2. Continuing Erosion of Tax Competition – Regular readers know that I view jurisdictional competition as a very valuable constraint on the greed of the political class.

Simply stated, politicians will be less likely to impose punitive tax policies if the geese with the golden eggs can fly away.  That’s why I cheer when taxpayers escape high-tax jurisdictions, whether we’re looking at New Jersey and California, or France and the United States.

That’s why I cheer when taxpayers escape high-tax jurisdictions, whether we’re looking at New Jersey and California, or France and the United States.

But this also helps to explain why governments, either unilaterally or multilaterally, are trying to prevent taxpayers from shifting economic activity to low-tax jurisdictions.

And 2014 was not a good year for taxpayers. We saw further implementation of FATCA, ongoing efforts by the OECD to raise the tax burden on the business community, and even efforts by the United Nations to further erode tax competition.

Here’s an example, from the Wall Street Journal, of politicians treating taxpayers like captive serfs.

Japan could become the latest country to consider taxing wealthy individuals who move abroad to take advantage of lower rates. The government and ruling party lawmakers are considering an “exit tax”… Such a rule would prevent wealthy individuals moving to a location where taxes are low–such as Singapore or Hong Kong… some expats in Tokyo are concerned the rule could make companies think twice about sending senior professionals to Japan or make Japanese entrepreneurs more reluctant to go abroad.

My reaction, for what it’s worth, is that Japan should reduce tax rates if it wants to keep people (and their money) from emigrating.

3. Repeating the Mistakes that Caused the Housing Crisis – A corrupt system of subsidies for Fannie Mae and Freddie Mac, combined with other misguided policies from Washington,  backfired with a housing bubble and financial crisis in 2008.

backfired with a housing bubble and financial crisis in 2008.

Inexplicably, the crowd in Washington has learned nothing from that disaster. New regulations are being proposed to once again provide big subsidies that will destabilize the housing market.

Peter Wallison of the American Enterprise Institute warns that politicians are planting the seeds for another mess.

New standards were supposed to raise the quality of the “prime” mortgages that get packaged and sold to investors; instead, they will have the opposite effect. …the standards have been watered down. …The regulators believe that lower underwriting standards promote homeownership and make mortgages and homes more affordable. The facts, however, show that the opposite is true. …low underwriting standards — especially low down payments — drive housing prices up, making them less affordable for low- and moderate-income buyers, while also inducing would-be homeowners to take more risk. That’s why homes were more affordable before the 1990s than they are today. … The losers, as we saw in the financial crisis, are borrowers of modest means who are lured into financing arrangements they can’t afford. When the result is foreclosure and eviction, one of the central goals of homeownership — building equity — is undone.

Gee, it’s almost as if Chuck Asay had perfect foresight when drawing this cartoon.

Let’s end today’s post with a few dishonorable mentions.

In addition to the three developments we just discussed, I’m also very worried about the ever-growing red tape burden. This is a hidden tax that undermines economic efficiency and enables cronyism.

I continue to be irked that my tax dollars are being used to subsidize a very left-wing international bureaucracy in Paris.

And it’s very sad that one of the big success stories of economic liberalization is now being undermined.

P.S. This is the feel-good story of the year.

Read Full Post »

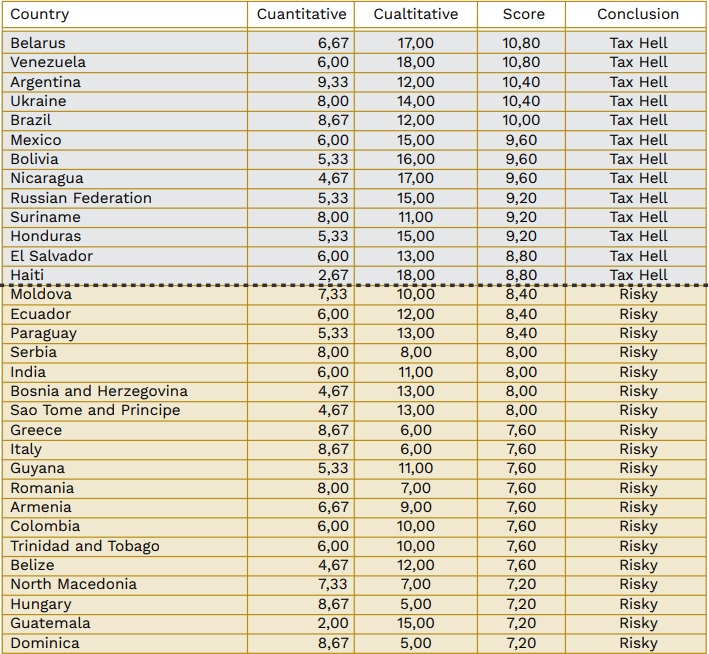

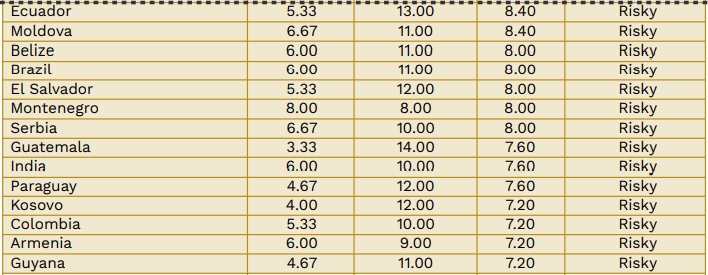

…Therefore, when considering the results, countries with high government quality and economic and legal stability may have high taxes (i.e., Denmark), but are very far from being considered tax hells. …In fact, there are countries with both low and high taxes in the top-13 tax hells; all of them, however, have low quality of government, high levels of corruption and use of discretionary power, poor economic management, weak institutions, and low or complete lack of legal certainty.

a

a

government was very small

government was very small