A good tax system (like the flat tax) does not impose extra layers of tax on income that is saved and invested.

I’ve tried to emphasize this point with a flowchart, and I’ve defended so-called trickle-down economics, which is nothing more than the common-sense notion that investment boosts wages for workers by making them more productive.

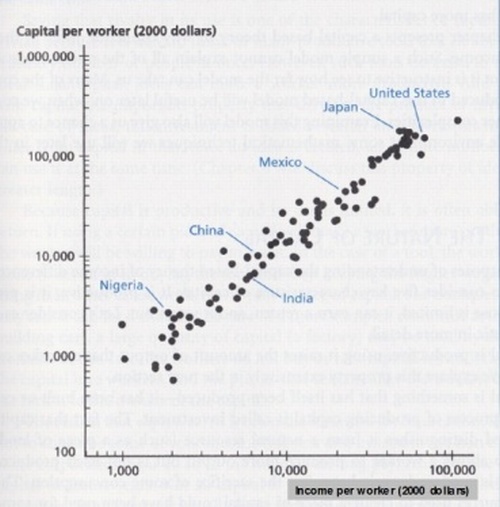

But if you doubt this relationship, just take a look at this chart posted by Steve Landsburg.

(H/T: Cafe Hayek)

That’s an amazingly powerful relationship. Wages for workers are very much tied to the amount of capital that’s invested. In other words, capitalists are the best friends of workers.

Something to think about with the President proposing big increases in the double taxation of capital gains. And something to consider since he wants America to have the highest level of dividend double taxation in the industrialized world.

[…] The productivity of workers (and therefore the pay of workers) is dependent on the quantity and quality of capital. […]

[…] The productivity of workers (and therefore the pay of workers) is dependent on the quantity and quality of capital. […]

[…] The productivity of workers (and therefore the pay of workers) is dependent on the quantity and quality of capital. […]

[…] The productivity of workers (and therefore the pay of workers) is dependent on the quantity and quality of capital. […]

[…] of my left-leaning friends dismiss this as “trickle-down economics,” but the relationship between capital and wages is a core component of every economic […]

[…] of my left-leaning friends dismiss this as “trickle-down economics,” but the relationship between capital and wages is a core component of every economic […]

[…] since there’s such a strong relationship between investment and worker […]

[…] since there’s such a strong relationship between investment and worker […]

[…] is why there’s such a strong relationship in the databetween the amount of capital and workers’ […]

[…] is why there’s such a strong relationship in the data between the amount of capital and workers’ […]

[…] And his staff economists apparently don’t understand (or don’t care about) the link between investment and wages. […]

[…] And his staff economists apparently don’t understand (or don’t care about) the link between investment and wages. […]

[…] most cases, the fundamental problem with class-warfare taxes is that they penalize saving and investment with double taxation. This is […]

[…] most cases, the fundamental problem with class-warfare taxes is that they penalize saving and investment with double taxation. This is […]

[…] bottom line is that is that you get higher wages with more productivity…and you get more productivity with more investment…and you get more […]

[…] bottom line is that is that you get higher wages with more productivity…and you get more productivity with more investment…and you get […]

[…] because it would exacerbate the tax code’s bias against saving and investment and thus have a negative effect on jobs, wages, productivity, and […]

[…] I’ve periodically explained that capital formation (more machines, technology, etc) is necessary if we want higher wages. […]

[…] that translates into less income for […]

[…] I probably don’t spend enough time highlighting how they are complementary, meaning that workers and capitalists both benefit when the two factors are combined. Simply […]

[…] as illustrated by this chart, we get more productivity with greater levels of […]

[…] Call me crazy, but I want capital to be allocated efficiently since that’s one of the keys to economic growth and rising wages. […]

[…] This chart makes the same point. […]

[…] In the former case, the government would take more money as income is spent, so workers wouldn’t benefit. And in the latter case, there would be less investment, so workers wouldn’t benefit since their pre-tax wages would suffer. […]

[…] Call me crazy, but I want capital to be allocated efficiently since that’s one of the keys for economic growth and rising wages. […]

[…] I wrote just a few days ago, investment is what leads to productivity growth, and that’s how we earn higher wages and get higher living […]

[…] Investment is a key for long-run growth and higher living standards. All economic theories – even Marxism ans socialism – agree that capital formation is necessary to increase productivity and thus boost wages. […]

[…] This means that the effective tax rate is a combination of the corporate income tax rate and the tax rate imposed on dividends. And this higher tax rate is an example of why double taxation discourages capital formation and thus leads to lower wages. […]

[…] and investment is a key driver of long-run growth. Simply stated, employees can produce more (and therefore earn more) when they work with better machines, equipment, and technology (i.e., the stock of […]

[…] This is very bad tax policy. In a good system, there shouldn’t be any double taxation of income that is saved and invested, especially since that approach means a smaller capital stock (i.e., less machinery, technology, equipment, tools, etc). And every single economic school of thought – even Marxism and socialism – agrees that this means lower productivity for workers and therefore lower wages. […]

[…] the tax burden on saving and investment, that reduces an economy’s stock of capital, and workers wind up with less pre-tax income than they would have earned […]

[…] As part of my comments, I spoke about the damaging impact of the tax code’s bias against saving and investment and explained that this lowered wages because of the link between the capital stock (machinery, technology, etc) and employee compensation. […]

[…] If you want more output and higher living standards, you need to boost worker pay by increasing the quality and quantity of capital in the […]

[…] The productivity of workers (and therefore the pay of workers) is dependent on the quantity and quality of capital. […]

Democrats’ economic policies are bad for workers.

[…] The productivity of workers (and therefore the pay of workers) is dependent on the quantity and quality of capital. […]

[…] The productivity of workers (and therefore the pay of workers) is dependent on the quantity and quality of capital. […]

[…] The productivity of workers (and therefore the pay of workers) is dependent on the quantity and quality of capital. […]

[…] The productivity of workers (and therefore the pay of workers) is dependent on the quantity and quality of capital. […]

[…] The productivity of workers (and therefore the pay of workers) is dependent on the quantity and quality of capital. […]

[…] to the degree we want to boost labor productivity, more investment is the best option. That’s why I’m so critical of class-warfare policies that penalize capital formation. When […]

[…] to the degree we want to boost labor productivity, more investment is the best option. That’s why I’m so critical of class-warfare policies that penalize capital formation. […]

[…] this argument for lower taxes on capital as an example. First there is a chart taken from this […]

[…] From an economic perspective, there’s a lot to like. Thanks to the low tax rate, the government no longer would be imposing harsh penalties on productive behavior. Major forms of double taxation such as the death tax would be abolished, creating a much better environment for wage-boosting capital formation. […]

[…] Particularly when politicians are imposing taxes – like the corporate income tax – that hurt workers by impeding capital […]

[…] In any event, the purpose of good tax policy is to generate faster growth by improving incentives for work, saving, investment, and entrepreneurship, and that’s where you get the big benefits for lower- and middle-income taxpayers. […]

[…] In any event, the purpose of good tax policy is to generate faster growth by improving incentives for work, saving, investment, and entrepreneurship, and that’s where you get the big benefits for lower- and middle-income taxpayers. […]

[…] bad for the shareholders who own companies, and it’s also bad for workers and […]

[…] The bottom line is that high taxes on capital ultimately lead to lower wages for workers. […]

[…] Let me explain. All economic theories – even Marxism and socialism – agree that capital formation is a necessary condition for long-run growth and higher wages. […]

[…] Let me explain. All economic theories – even Marxism and socialism – agree that capital formation is a necessary condition for long-run growth and higher wages. […]

[…] look at this chart showing the relationship between capital formation and labor […]

[…] look at this chart showing the relationship between capital formation and labor […]

[…] Reposted from International Liberty. […]

[…] look at this chart showing the relationship between capital formation and labor […]

[…] But if I had to pick a graph that belongs in second place, it would be this relationship between investment and labor compensation. […]

[…] this remarkable chart shows that workers are victimized when there is less […]

[…] as shown in this powerful chart, that will have adverse consequences for wages and living […]

[…] workers are enemies, but that’s utter nonsense. Both prosper by cooperating. There’s a very strong correlation between a nation’s capital stock (the amount of investment) and the compensation of its […]

“So….,profits….., the government want their share FIRST so they can help the people, giving them everything that there is a reason to work for … sounds like a “short-circuit” to me…and that means…SystemFailure,…The fuses start blowing,nothing works…mmmmm… But let Capital invest Capital, in the American way…Invest in Production, research, and LABOR… everybody wins…Now, taxes are killing growth,businesses, jobs, families, the” strength of our nation”,… at OUR expense, IN ORDER to “Strengthen Our Central Government.’ Sound about right to you?

Do you mean to tell me…

that countries with a higher GDP and higher cost of living both invest in their workers more and pay higher wages? Really? Wow, that’s stunning. Just really stunning.

Seriously, maybe you should bother to point out where all of the rich countries with developed economies (besides Japan) are on this chart? Ya know, the ones in Europe with high wages and high taxation?

[…] Let’s look at two remarkable charts, starting with one that shows the very powerful link between total investment and wages for workers. […]

[…] as shown in this powerful chart, that will have adverse consequences for wages and living […]

[…] as shown in this powerful chart, that will have adverse consequences for wages and living […]

[…] importance of saving and investment if we want workers to enjoy higher […]

[…] the way, this shouldn’t be an ideological issue. If this amazing chart is any indication, leftists who want workers to enjoy more income should be clamoring the loudest […]

[…] I can’t resist a final comment about this tax having a terrible impact on capital formation. This is bad for workers, since it translates into lower […]

[…] I can’t resist a final comment about this tax having a terrible impact on capital formation. This is bad for workers, since it translates into lower […]

[…] of tax. But if you save and invest your after-tax income (which is very good for future growth and necessary to boost workers’ wages), then the government tries to whack you with several additional layers of […]

[…] chart showing the importance of saving and investment if we want workers to enjoy higher […]

[…] can anybody look at this chart and think […]

[…] They could point out that increased double taxation of saving and investment will hurt workers by reducing capital formation. […]

[…] They could point out that increased double taxation of saving and investment will hurt workers by reducing capital formation. […]

[…] They could point out that increased double taxation of saving and investment will hurt workers by reducing capital formation. […]

[…] a bad tax even worse. Especially since the tax causes the liquidation of private capital, thus putting downward pressure on wages. And even though the tax doesn’t collect much revenue, it probably does result in some upward […]

[…] a bad tax even worse. Especially since the tax causes the liquidation of private capital, thus putting downward pressure on wages. And even though the tax doesn’t collect much revenue, it probably does result in some upward […]

[…] a bad tax even worse. Especially since the tax causes the liquidation of private capital, thus putting downward pressure on wages. And even though the tax doesn’t collect much revenue, it probably does result in some upward […]

[…] a bad tax even worse. Especially since the tax causes the liquidation of private capital, thus putting downward pressure on wages. And even though the tax doesn’t collect much revenue, it probably does result in some upward […]

[…] importance of saving and investment if we want workers to enjoy higher […]

[…] standards and worker compensation are closely correlated with the amount of capital in an economy (this picture is a compelling illustration of the relationship), one would think that politicians – particularly those who say they want to improve wages – […]

[…] isn’t very prudent or wise since every economic theory agrees that capital formation is key to long-run growth and higher living standards. Even Marxist and socialist theory is based on this notion (they want government to be in charge of […]

[…] isn’t very prudent or wise since every economic theory agrees that capital formation is key to long-run growth and higher living standards. Even Marxist and socialist theory is based on this notion (they want government to be in charge of […]

[…] isn’t very prudent or wise since every economic theory agrees that capital formation is key to long-run growth and higher living standards. Even Marxist and socialist theory is based on this notion (they want government to be in charge of […]

howie37@hotmail.com

If an economic model is no longer working then find one that works. Austria is a good example as is Canada. Simple fact is if it is bad for a family to spend more money than it takes in each month or year why not apply this to governments? A welfare state can only last so long with current wage earners bearing the burden of funding it. We now have less tax payers in the USA to continue our welfare state, etc.

Thank you

Howie

[…] standards and worker compensation are closely correlated with the amount of capital in an economy (this picture is a compelling illustration of the relationship), one would think that politicians – particularly those who say they want to improve wages – […]

[…] standards and worker compensation are closely correlated with the amount of capital in an economy (this picture is a compelling illustration of the relationship), one would think that politicians – particularly those who say they want to improve wages – […]

[…] standards and worker compensation are closely correlated with the amount of capital in an economy (this picture is a compelling illustration of the relationship), one would think that politicians – particularly those who say they want to improve wages […]

[…] standards and worker compensation are closely correlated with the amount of capital in an economy (this picture is a compelling illustration of the relationship), one would think that politicians – particularly those who say they want to improve wages […]

[…] is a remarkably radical and misguided assertion, as you can see from this chart. Henry is basically saying that money should be diverted from private capital markets, where it […]

[…] standards and worker compensation are closely correlated with the amount of capital in an economy (this picture is a compelling illustration of the relationship), one would think that politicians – particularly those who say they want to improve wages – […]

[…] standards and worker compensation are closely correlated with the amount of capital in an economy (this picture is a compelling illustration of the relationship), one would think that politicians – particularly those who say they want to improve wages […]

[…] is a remarkably radical and misguided assertion, as you can see from this chart. Henry is basically saying that money should be diverted from private capital markets, where it […]

This is the MOST IMPORTANT GRAPH that I have seen in my entire life!!! CAPITAL per worker and income per worker goes hand in hand! CAPITAL per owrker is THE CAUSE of higher income per WORKER. This graph will become my Facebook image. Most important graph ever! Thanks for bringing us this! Thanks!!!!

You can post all the facts you want. The left doesn’t care about facts.

[…] If You Want To Understand Why Obama’s Tax Agenda Is Bad for Workers, this Picture Says a Thousand …. Share this:TwitterFacebookLinkedInStumbleUponEmailPrintLike this:LikeBe the first to like this […]

[…] This is interesting from Daniel Mitchell at his blog, International Liberty. […]

[…] If You Want To Understand Why Obama’s Tax Agenda Is Bad for Workers, this Picture Says a Thousand … I’ve tried to emphasize this point with a flowchart , and I’ve defended so-called trickle-down economics , which is nothing more than the common-sense notion that investment boosts wages for workers by making them more productive. […]

Reblogged this on Gds44's Blog.