Because of the negative impact on competitiveness, productivity, and worker compensation, it’s a very bad idea to impose double taxation of saving and investment.

Which is why there should be no tax on capital gains, and a few nations sensibly take this approach.

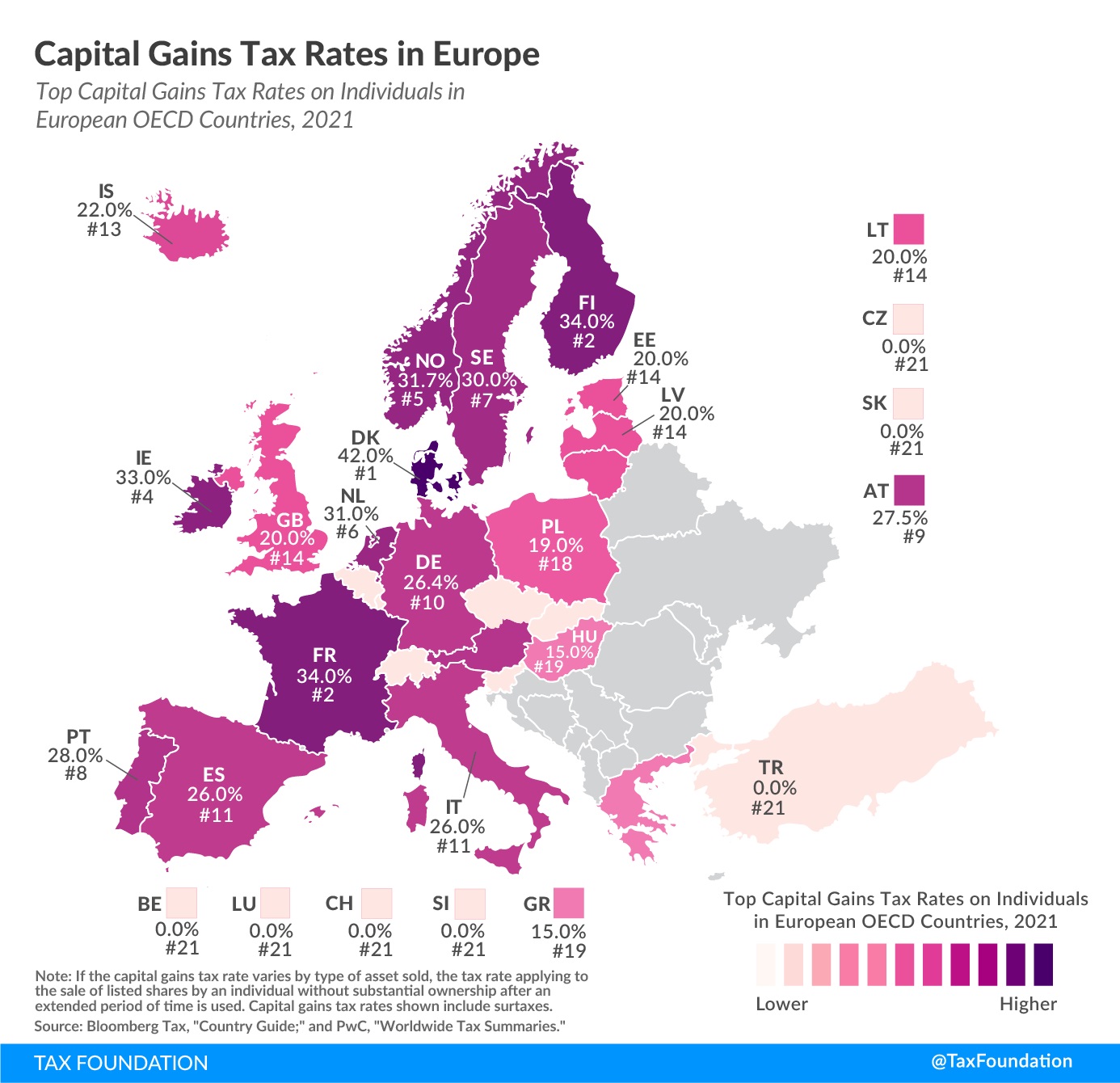

But they’re outnumbered by countries that do impose this pernicious form of double taxation. For instance, the Tax Foundation has a new report about the level of capital gains taxation in Europe, which includes this very instructive map.

As you can see, some countries, such as Denmark (gee, what a surprise), have very punitive rates.

However, other nations (such as Switzerland, Belgium, Czech Republic, Slovakia, Luxembourg, and Slovenia) wisely don’t impose this form of double taxation.

If the United States was included, we would be in the middle of the pack. Actually, we would be a bit worse than average, especially when you include the Obamacare tax on capital gains.

But if Joe Biden succeeds, the United States soon will have the dubious honor of being the worst of the worst.

The Wall Street Journal opined this morning about the grim news.

Biden officials leaked that they will soon propose raising the federal tax on capital gains to 43.4% from a top rate of 23.8% today. …Mr. Biden will tax capital gains for taxpayers who earn more than $1 million at the personal income tax rate, which he also wants to raise to 39.6% from 37%.

Add the 3.8% ObamaCare tax on investment, and you get to 43.4%. And that’s merely the federal rate. Add 13.3% in California and 11.85% in New York (plus 3.88% in New York City), which also tax capital gains as regular income, and you are heading toward the 60% rate range. Keep in mind this is on the sale of gains that are often inflated as assets are held for years without adjustment for inflation. Oh, and Mr. Biden also wants to eliminate the step-up in basis on capital gains that accrues at death.

Beating out Denmark for the highest capital gains tax rate is bad.

But it’s even worse when you realize that capital gains often occur because investors expect an asset to generate more future income. But that future income gets hit by the corporate income tax (as well as the tax on dividends) when it actually materializes.

So the most accurate way to assess the burden on new investment is to look at the combined rate of corporate taxation and capital gains (as as well as the combined rate of corporate taxation and dividend taxation).

By that measure, the United States already has one of the world’s most-punitive tax regimes, And Biden wants to increase all of those tax rates.

Sort of a class-warfare trifecta, and definitely not a recipe for good economic results.

For those interested in more details, here’s a video I narrated on the topic back in 2010.

And I also recommend these columns (here, here, and here) for additional information on why we should be eliminating the capital gains tax rather than increasing it.

P.S. Don’t forget that there’s no indexing to protect taxpayers from having to pay tax on gains that are due only to inflation.

P.P.S. And also keep in mind that some folks on the left want to impose tax on capital gains that only exist on paper.

[…] Biden wants America to have the developed world’s highest capital gains tax rate. […]

[…] nobody told Biden. As part of his class-warfare agenda, he wants to increase the capital gains tax rate from 23.8 percent to 43.4 […]

[…] it is downright crazy to impose that type of tax on economic activity (investment) that also gets hit by other forms […]

[…] it is downright crazy to impose that type of tax on economic activity (investment) that also gets hit by other forms of […]

[…] nobody told Biden. As part of his class-warfare agenda, he wants to increase the capital gains tax rate from 23.8 percent to 43.4 […]

[…] The bottom line is that Biden wants the U.S. to have the highest corporate rate, highest double taxation of dividends, and highest double taxation of capital gains. […]

[…] Biden also wants American to be #1 for capital gains taxation. So at least he is consistent, albeit in a very perverse […]

[…] The highest capital gains tax rate. […]

[…] The highest capital gains tax rate. […]

[…] Higher capital gains tax rates […]

[…] had some very sensible criticisms of a wealth tax. But it also embraced other class-warfare taxes (higher capital gains taxesand more onerous death […]

[…] The highest capital gains tax rate. […]

[…] Higher capital gains tax rates […]

[…] Higher capital gains tax rates […]

[…] The highest capital gains tax rate. […]

[…] highest capital gains tax […]

[…] had some very sensible criticisms of a wealth tax. But it also embraced other class-warfare taxes (higher capital gains taxesand more onerous death […]

[…] He wants a radical increase in the tax rate on capital gains – from 23.8 percent to 43.4 percent, the highest burden in the world. […]

[…] nobody told Biden. As part of his class-warfare agenda, he wants to increase the capital gains tax rate from 23.8 percent to 43.4 […]

[…] Biden Wants America to Have the World’s Highest Tax Burden on Capital Gains […]

[…] had some very sensible criticisms of a wealth tax. But it also embraced other class-warfare taxes (higher capital gains taxesand more onerous death […]

[…] column cited new scholarly research about the negative economic impact of Biden’s plans to increase capital gains […]

[…] He wants a radical increase in the tax rate on capital gains – from 23.8 percent to 43.4 percent, the highest burden in the world. […]

[…] column cited new scholarly research about the negative economic impact of Biden’s plans to increase capital gains […]

[…] He wants a radical increase in the tax rate on capital gains – from 23.8 percent to 43.4 percent, the highest burden in the world. […]

[…] had some very sensible criticisms of a wealth tax. But it also embraced other class-warfare taxes (higher capital gains taxesand more onerous death […]

[…] had some very sensible criticisms of a wealth tax. But it also embraced other class-warfare taxes (higher capital gains taxes and more onerous death […]

[…] instead of wealth taxes, the Post wants much-higher capital gains taxes – including Biden’s hybrid capital gains tax/death […]

[…] instead of wealth taxes, the Post wants much-higher capital gains taxes – including Biden’s hybrid capital gains tax/death […]

[…] nobody told Biden. As part of his class-warfare agenda, he wants to increase the capital gains tax rate from 23.8 percent to 43.4 […]

[…] nobody told Biden. As part of his class-warfare agenda, he wants to increase the capital gains tax rate from 23.8 percent to 43.4 […]

Very good blog?…. people are talking about this on our blog.🤑 😀

[…] Biden Wants America to Have the World’s Highest Tax Burden on Capital Gains […]

Reblogged this on Gds44's Blog.

Actually, I would like to see capital gains, adjusted for inflation, taxed like ordinary income and NO corporation tax. Any corporation tax selectively hurts small businesses that need income to support owners and their families. Small enterprises do not have the luxury of owning their suppliers and distributors, trading offshore or hiring workers in foreign labor camps to make their materials for a pittance.