As I’ve written before, our fight to restrain the size and scope of government will be severely hamstrung – perhaps even mortally wounded – if the crowd in Washington ever succeeds in getting a value-added tax as a new source of revenue.

This is why many statists are pushing so hard for the VAT. It’s a money machine for big government.

This is why many statists are pushing so hard for the VAT. It’s a money machine for big government.

But what makes this battle especially frustrating is that there are some otherwise sensible people who are on the wrong side of the issue. I was stunned, for instance, when Rand Paul and Ted Cruz included VATs as part of their presidential tax plans.

And I’ve been less surprised, but still disappointed, to find support for a VAT from people such as Tom Dolan, Greg Mankiw, and Paul Ryan, as well as Kevin Williamson, Josh Barro, and Andrew Stuttaford. And I wrote that Mitch Daniels, Herman Cain, and Mitt Romney were not overly attractive presidential candidates because they expressed openness to the VAT (methinks it is time to create a VAT Hall of Shame).

Now I have three more people to add to the list.

In a column for the Washington Times, Professor Peter Morici argues for a VAT instead of the income tax.

The current system imposes terribly high rates and a myriad of special-interest credits and deductions. It requires expensive record keeping that drives taxpayers mad and complex auditing functions at the Internal Revenue Service that have proven susceptible to political abuse… The most effective reform would be to simply junk the personal and corporate income taxes in favor of a VAT. The Treasury annually collects about $2 trillion through personal and corporate taxes. This could be replaced by an 11 percent national sales tax on all private purchases and payments.

This is good in theory, but it’s a high-risk fantasy. The politicians in DC who want a VAT are not proposing to get rid of other taxes.  Instead, they want the VAT in addition to income taxes.

Instead, they want the VAT in addition to income taxes.

So unless Morici has some plan to fully repeal income taxes (and to amend the Constitution to prohibit income taxes from being imposed in the future), his support for a VAT plays into the hands of those who want a new levy to finance bigger government (which is exactly what happened in Europe).

Even more troubling, he confirms my fears that the border-adjustable tax serves as a stalking horse for a VAT.

Several House Republicans, led by Ways and Means Chairman Kevin Brady, propose to do essentially this for the corporate but not the personal income tax. …This proposal has…flaws. …The answer is simple — generalize Mr. Brady’s reforms to include the personal income tax as well. Junk it and impose a VAT of 11 percent on all economic activities.

Maybe now people will appreciate my concerns about the BAT.

Last but not least, I can’t resist pointing out that Morici is flat wrong about the VAT and trade. Heck, even Paul Krugman agrees with me on that topic.

Foreign governments rely more on value-added taxes (VAT), which approximates a national sales tax. Those are rebatable on exports and applied to imports under World Trade Organization rules… This places U.S.-based businesses at a competitive disadvantage.

Now let’s look at another column with a misguided message. Writing for The Hill, Jim Carter of Emerson and former Congressman Geoff Davis argue for a VAT.

…enact a payroll tax holiday similar to the one Americans enjoyed in 2011 and 2012. Only this time the tax holiday would be permanent. …How can the government make up for the revenue lost from the payroll tax cut? One idea: eliminate the deduction that businesses get for the wages and benefits they pay their employees. …this would generate a massive $11.6 trillion in revenue over 10 years.

Call me crazy, but I get very nervous about plans that generate “massive…revenue” for Washington. Especially when the plan proposed by Carter and Davis is actually a subtraction-method VAT.

And just like Morici, they think the House Better Way Plan paves the way for that pernicious levy.

Abolishing labor deductibility also generates enough revenue to lower the tax rates on business income five percentage points below the rates envisioned by the House Republican “blueprint” for tax reform… Add the House blueprint’s other provisions…this modified House blueprint would be roughly revenue-neutral.

Moreover, Carter and Davis don’t even pretend that the income tax might be abolished. They prefer instead to go after the payroll tax, which is far less damaging.

Moreover, they want to add other statist policies to their VAT scheme.

Add President Trump’s childcare proposals and a Republican commitment to link tax reform to additional infrastructure funding, and congressional Democrats would have little excuse not to work with Republicans.

Of course Democrats would be interested. They would be getting the VAT they desperately need if they want to take entitlement reform off the table. And they also are being offered bad childcare policy and bad infrastructure policy as a bonus.

Now let’s look at a Washington Post column by Alan Murray.

…in tax policy, as in health-care policy, the United States is notoriously ineffective and inefficient. As the world’s richest nation, the United States has more capacity to tax than any other country. But…we rank near the bottom of industrialized nations in our effectiveness at doing so. …Reid…devotes a chapter to the value-added tax, which he calls “the most successful taxation innovation of the last sixty years.” …it turns out to be relatively easy to enforce. …Reid quotes former Federal Reserve chairman Alan Greenspan saying a VAT is the “least worst” way to raise taxes. “It has been adopted in every major nation on earth and in most small nations as well,” he says.

Yes, you read correctly. He’s grousing that the federal government isn’t demonstrating “effectiveness” when it comes to maximizing its “capacity to tax.”

This is the same statist mentality that led the World Bank to rank the United States near the bottom for “tax effort.”

This is the same statist mentality that led the World Bank to rank the United States near the bottom for “tax effort.”

For what it’s worth, I’m grateful that America hasn’t copied Europe by trying to squeeze every possible penny from taxpayers. And I’m specifically thankful that we haven’t copied them by imposing a VAT to finance bigger government.

I was amused by this passage in Murray’s column.

Critics of Reid’s plan, of course, won’t be hard to find. …Conservatives will attack the value-added tax as a money machine that leads to bigger government.

Of course supporters of limited government will make that complaint. That’s why statists want a VAT. Heck, Murray’s column openly states that the VAT would boost America’s “capacity to tax.”

For those who favor restraints on government, the last thing we want is a government that figures out ways to extract more revenue from the economy’s productive sector.

Let’s close by citing some research published last year.

Writing for the Wall Street Journal, Professor Ed Lazear of Stanford University warns that a VAT, even if part of an otherwise attractive tax plan, almost surely will lead to an increased burden of government spending.

…keeping a value-added tax low and substituting it for other more-regressive taxes has proven almost impossible. All 34 countries in the Organization for Economic Cooperation and Development, except the U.S., have a VAT. …26 countries have higher VATs now than they did when they first instituted the tax. …The U.K., Italy and Denmark have all raised their VATs by 10 percentage points or more. The VAT, wherever it has been implemented, has been a money machine for big government.

What about the notion that VATs simply replace other taxes?

Unfortunately, that’s not the case.

…for every 1 percentage point that the VAT increases, the tax burden rises by about 0.8 of a percentage point. Were it a pure substitute tax, raising the VAT would have no effect on total taxes collected because other taxes would be reduced by a corresponding amount. Unfortunately, that hardly ever happens. …America may be headed toward a European-style VAT tax and ever-larger government.

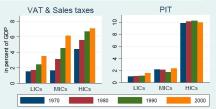

Prof. Lazear has some additional data posted at the Hoover Institution website. Here’s a chart that should frighten every fiscally responsible person.

And don’t forget the chart I shared showing how the VAT has jumped significantly in Europe in the past few years.

To conclude, here’s my video on why the value-added tax is so dangerous to good fiscal policy.

P.S. You can enjoy some amusing – but also painfully accurate – cartoons about the VAT by clicking here and here.

P.P.S. And my clinching argument is that Reagan opposed a VAT and Nixon supported a VAT. That tells you everything you need to know.

Reblogged this on Utopia, you are standing in it!.

[…] My primary argument against the VAT is that it would enable a bigger burden of government spending. […]

[…] points are worth contemplating because I am increasingly worried that we’ll get a VAT because of misguided conservatives rather than because of tax-and-spend […]

[…] written that I don’t want a value-added tax because the money would be used to finance bigger […]

[…] Everything I said back then is even more true today. […]

[…] The bottom line is that the most important fiscal issue facing America is the need for genuine entitlement reform. Achieving that goal is an uphill battle. But if politicians get a big new source of revenue, that uphill battle becomes an impossible battle. […]

[…] first takeaway is that this explains why blocking the VAT is absolutely necessary for advocates of limited government in the United […]

[…] if politicians in America imposed a value-added tax. They overlook that a VAT is bad for growth and are naive if they think a VAT somehow will lead to lower income tax […]

[…] replacing the odious internal revenue code with a flat tax, but if the only thing I achieve is to protect America from a value-added tax, I’ll nonetheless go to my grave feeling like I did something very valuable for my […]

[…] also seen increases in fiscal burdens in nations that imposed value-added taxes (which is why Americans should fight to their dying breaths before allowing that levy in the United […]

[…] written that I don’t want a value-added tax because the money would be used to finance bigger […]

[…] haunting me in the specter of a value-added tax, which some reporters now think is a clear and present danger (my concern, not […]

[…] haunting me in the specter of a value-added tax, which some reporters now think is a clear and present danger (my concern, not […]

[…] welfare states are financed by lower-income and middle-class taxpayers (in large part because of punitive value-added taxes). The bottom line is that we should listen to Bernie Sanders and become more like Europe. But only […]

[…] I strongly disagreed with pro-VAT articles by Peter Morici, Jim Carter, Geoff Davis, and Alan Murray. […]

[…] is why I’m so inflexibly hostile to any tax increase, especially a value-added tax(or anything close to a VAT, such as the BAT) that would vacuum up huge amounts of money from the […]

[…] is why I’m so inflexibly hostile to any tax increase, especially a value-added tax (or anything close to a VAT, such as the BAT) that would vacuum up huge amounts of money from the […]

[…] again, Brian is right. There are ways to significantly increase the tax burden in America, such as a value-added tax. But the class-warfare ideas that attract a lot of support on the left won’t raise much […]

Dragon Eye,

As the old saying goes, you are entitled to your own opinion, but not your own facts.

On a factual basis, you are wrong that the rich pay lower taxes. A CBO report published in 2016 (link is below) shows the following effective tax rates:

Top 1% @ 34%

Middle 20% @ 13%

Bottom 20% @ 3%

Clearly the top 1% pay a higher average tax rate. And this is for ALL federal taxes: income, SS, corporate, and excise. If we looked at income tax alone, it would be more lopsided and the bottom 20% would show a NEGATIVE tax rate. Factually speaking, higher-income folks pay a much higher tax rate. Anyone in the bottom half of the income distribution pays little or nothing.

Now, if when you say “the rich” you mean some smaller group than the top 1%, like the top 0.01%, it is true that those folks pay a lower tax rate. For example, the “top 400” people pay an average tax rate of ‘only’ 23%. That is lower than the top 1%, BUT still higher than the middle class.

If you object to the lower tax rate of The 400, keep in mind two things. One, the tax rate of the uber-wealthy is low because much of their income comes from investments. There are excellent reasons why low or even zero tax rates on investment income make sense and are good for widespread prosperity. Two, why are you obsessing about a veritable handful of people? It cannot be about actual dollars collected because the number of people is so tiny. Whether it’s envy or ignorance, it’s not a good look.

Click to access 51361-HouseholdIncomeFedTaxes.pdf

Dragon:

You’re correct. The rich do not face the highest tax rates, it is those currently receiving means-tested benefits, who make the mistake of earning too much. Not only do they begin paying taxes, but they lose benefits on top of that.

My brilliant quadriplegic nephew receives between $50-60K annually. If he makes more than a certain amount in any month, he loses those benefits and it is difficult to get them back. For him, earning too much income is a death sentence.

If government were to take a fixed percentage of his income and leave his support in place, he could pay back a portion of those benefits through taxes paid, and have the satisfaction of supporting himself in many other ways. I have no doubt that he could earn a substantial amount on the internet. He has no commute and could work 16 hours a day, seven days a week.

In the long run, I have no doubt that he would pay off most of the annual benefit cost, but he is trapped by the current system.

Funny how some STILL believe the “rich” pay the highest income tax rates.

This thinking has been repeatedly dis-proven time and time again! The “rich” are the ones who have well-paid CPAs to find all those loopholes, deductions, and whatever other tax-shelters that are not available to the rest of us. The net result: the rest of us pay those taxes they do not!

The hardest hit group are the middle-class earners (as can be seen WHY it is the middle-class group that is rapidly shrinking and NOT the uber-wealthy). Perhaps we forget that many of the jobs-producing companies were owned/operated by predominantly middle-class earners (which is where market competition was at its best). At one time, middle-class-owned businesses accounted for over seventy percent of the jobs in the labor market! Not so much so today.

The VAT is STILL a bad idea!

Even in lieu of the old promises to replace our current income tax system with it, I was NOT buying all that, because I know that once a government institutes a new tax, and sees it as a big revenue-generation scheme for it, such a tax will NEVER be repealed, but added to later. Greedy governments LOVE taxes, for whatever sources they can pilfer from (and usually, from the citizens).

If we end up with a VAT, this will be an additional burden upon the people, and an additional excuse to demand MORE from the people!

Have we not learned our lesson from the ill-named “Affordable Care Act”? Premiums AND deductibles increasing rapidly, as well as the “penalty” tax! – Have we, as a nation, not learned a thing about government, and its propensity to create more taxes? ? ?

Having dealt with VAT in business, we called VAT by a different name. It is the Accounts full employment act. As a manufacture, the people that support VAT have no idea it takes to calculate the VAT on incoming items and then the vat on outgoing items.

It’s one thing for a business to track the VAT payments of suppliers, in fact they could ask for a summary at the end of the year.

It’s quite another thing for individual consumers to keep and record records from all purchases. While it is true that once the standard income tax exemption is reached collection is no longer necessary, this puts an extra burden on those at the bottom of the income scale who may or may not pass that hurdle.

BTW, Greece — yes Greece — is instituting a VAT (rate is 24%) standard exemption staring with tax year 2017. The way it will work, taxpayers will gradually “build” the equivalent of their standard income tax exemption throughout the year — only if they keep receipts for everything they buy, and tally up the VAT at the end of the year in order to claim an exemption up to the standard exemption.

The bottom is a long way down once you go over the VAT cliff.

First, it is not “my” progressive consumption tax. I did not recommend it. I merely stated that a consumption tax does not need to be as regressive as Zorba suggested. In fact, I think all consumption tax proposals I have seen include something to make them more progressive. Some progressivity is just political reality.

Second, of course such a tax would likely be a lobbyist’s dream and a tax code nightmare. So what? So is the current tax code. That is the nature of politics and rent-seeking. However, steps should still be taken to minimize the lobbying potential and the complexity.

The term “consumption tax” is often misused. Any tax that affects the final price of the item or service is obviously paid by the consumer.

The more limited “final sale tax” would cover the fact that income, payroll, and corporate taxes are not included, however, VAT and FairTax are embedded in final price whereas state sales taxes are tacked on at the point of sale. VAT is further confused by allowing deductions for “final sales taxes” from suppliers.

The upshot is that there is no good term that eliminates confusion.

That being said, Zorba makes very good points.

John

Your “progressive” “consumption” tax is a lobbyist’s wet dream and a tax code nightmare.

Zorba, you make lots of good points, but would like to point out that a consumption tax does not have to be as regressive as you seem to think. For example, basic goods like food etc could be exempt from the consumption tax. For example, there could be a system where the first $25,000 of consumption is untaxed. Etc.

Of course, it’s true that any consumption tax is unlikely to be as progressive as the current income tax system! But the non-rich would still benefit from higher growth, more investment, higher incomes, and more prosperity.

John

As you can see America has already crossed the rubicon towards a nationalized healthcare system. VAT would complete the transformation to a European style society, structural permanent one percent growth in a world that is growing three to four times faster, and thus arithmetically deterministic decline.

Thus elimination of income tax and substitution with a consumption tax would be a system whereby the wealthy pay a lower tax rate than the less well off. I said lower rate because the rich would still pay more tax in absolute terms, even with a consumption only based tax system.

Now regardless of how one feels about this, how long do you realistically feel such a system would last? Even a change in the constitution would not guarantee is viability in my opinion. Income taxes would return soon, and consumption taxes would also stay.

The current American system, whereby the rich pay near European income tax rates but the middle and lower income classes pay little, is at least limited by Laffer curve effects.

Consumption taxes are an attempt to tap the last and biggest (directly) untaxed segment of the population: The middle and lower income classes. I mention “directly” because a large portion of the taxes paid by the rich and productive are ultimately borne by all through significant collateral effects.

Politicians are sensing a weak point in the majority of the voting population, an opportunity to become even greater allocators of (shrinking) wealth. A majority of middle and lower income people support more taxation. “So you want more taxation?” say politicians, “here it is, VAT!”

America taxes heavily only the rich and most productive, while Europe has found ways to tax everyone, primarily through VAT. This is probably the last bastion of American exceptionalism before the complete harmonization and equalization of the entire western world to a big government — and a one percent growth trajectory to decline.

Like many nations before them, American voter-lemmings are likely to fall for it at some point or another. Then, once enacted, it becomes irreversible. Freedom, and prosperity take many generations to build and only one to lose it. How many nations that abolished a VAT do you know?

The best BAT would be total elimination of all tariffs and non-deductibility of imports as an expense for corporate income tax purposes.

The corporation would be able to avoid corporate taxes on exports, but the exported goods would still have embedded taxes like individual income and payroll taxes.

All of these taxes are “consumption” taxes, in that the consumer is the one ultimately paying the tax. The best test of any tax is what effect it has on the final price of the item or service. Obviously the higher the final price the more destructive the tax.

Note that any tax collected along the way, for example income tax withholding, gets built into the price. The type of tax just indicates when and where the tax is collected. If the consumer does not buy the product, no salary is paid and no tax collected.

Any proposal that eliminates the income tax in favor of a VAT, FairTax, or sales tax is a non-starter because of the “phantom tax” problem.

For example, if John makes a gross salary of $100,000 and pays $25,000 in taxes, the cost of his service is $100,000. (excluding for the moment payroll taxes). However, if you eliminate the income tax and instead tack on a 25% FairTax. The cost of his services will be $133,333. That’s because you effectively gave John a 33% raise when you eliminated the income tax. You eliminated the tax but the cost stays to haunt future price increases.

Obviously, those who pay high income taxes love the idea, whereas those with lower incomes or on fixed incomes would be totally screwed.

In “FairTax the Truth” the authors in a footnote state that there will be a one-time inflation hit of 24.8%. (That’s at a FairTax tax rate of 23%.)

Totally unacceptable.

The record of new taxes imposed vs old taxes repealed is so lopsided that even considering such tax as a citizen is suicidal.

It is a (temporary) boon for political power, of course, since politicians will become bigger allocators of (shrinking relative to world GDP) wealth.

VAT will greatly hasten American decline and shrinkage of American relative to world GDP.

Military power retreat will inevitably follow since military might derives from economic might.

“…the tax holiday will be permanent…”

Now, how naive does one have to be to believe that.

Oppose it. It’s existential.

Yes, Democrats will work with Republicans … and shave a few more tenths if a percent from our two percent growth arithmetically deterministic trendline to decline.