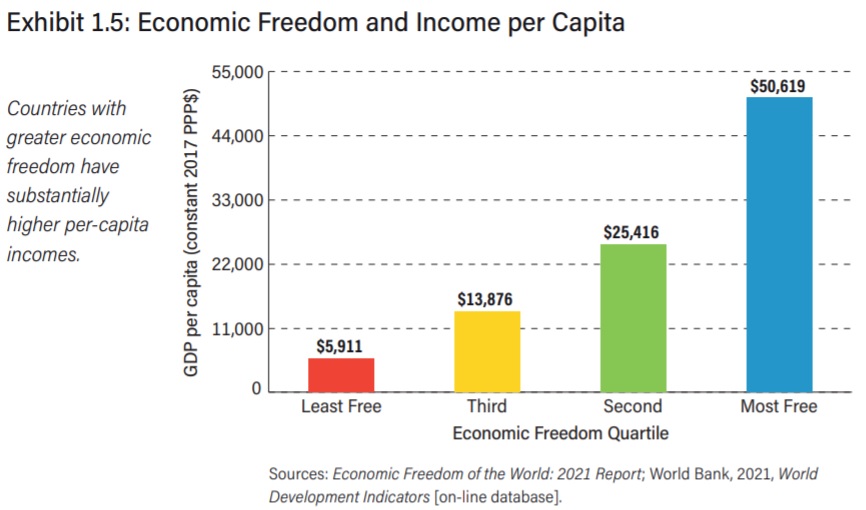

When I opine about class-warfare taxation, I generally focus on the obvious argument that it’s not a good idea to penalize people for creating prosperity.

This argument against punitive tax policy is based on the fact that entrepreneurs, investors, business owners, and other successful people can choose to reduce their levels of work, saving, investment, and risk taking.

This argument against punitive tax policy is based on the fact that entrepreneurs, investors, business owners, and other successful people can choose to reduce their levels of work, saving, investment, and risk taking.

And it’s also based on the fact that they can shift their economic activity to tax-favored (but generally unproductive) sectors such as municipal bonds.

Moreover, I don’t want politicians to have more money to finance a bigger burden of government.

But we should also consider how class-warfare taxes also can cause the “geese with the golden eggs” to simply fly away.

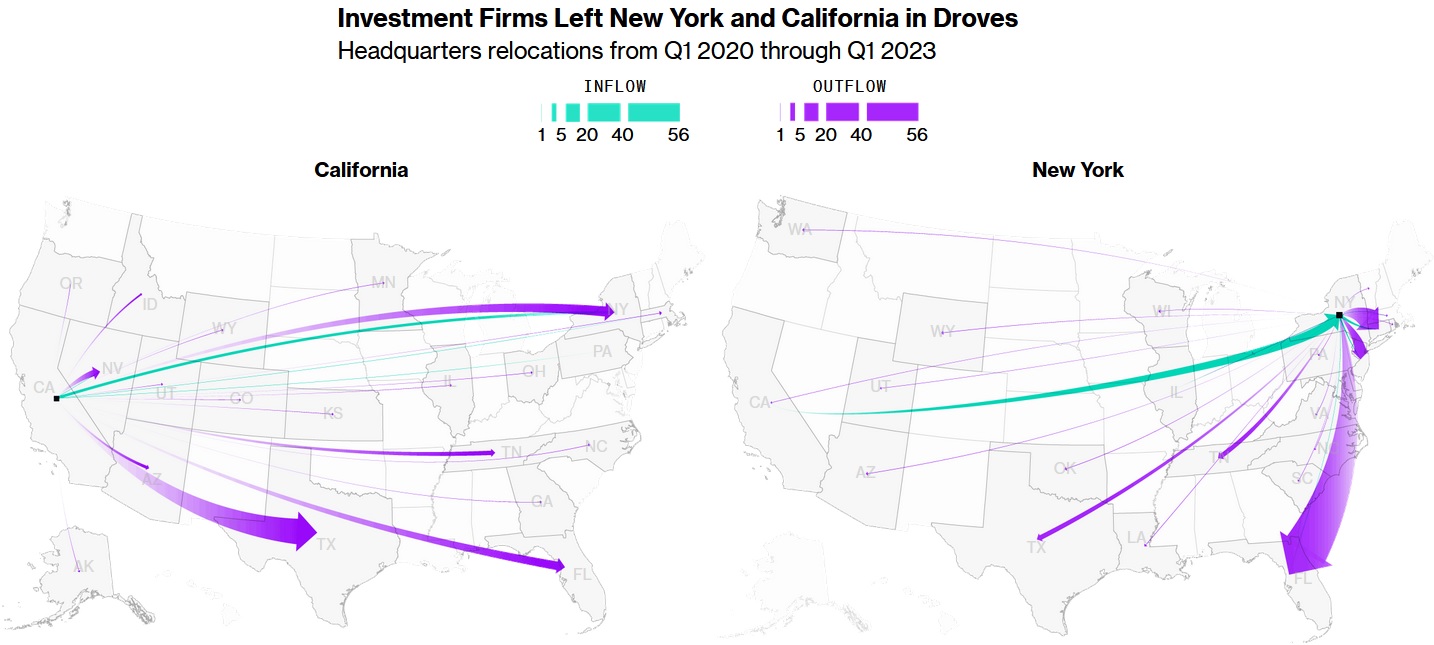

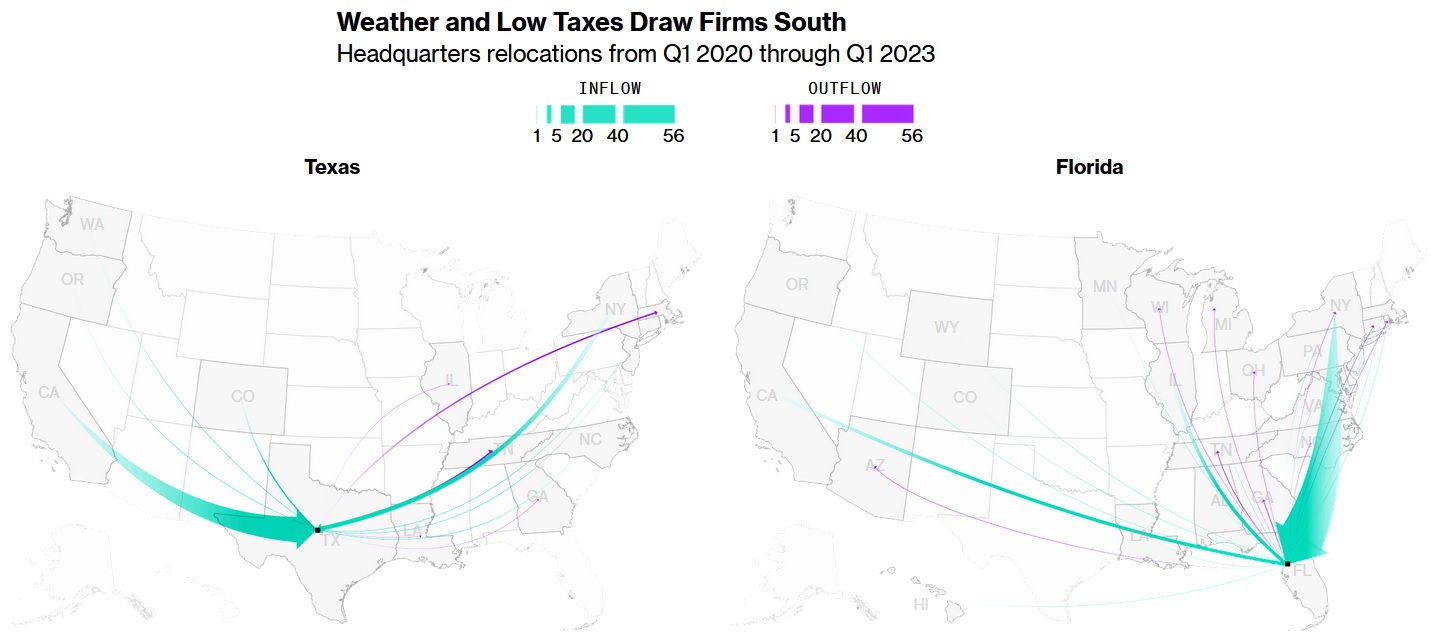

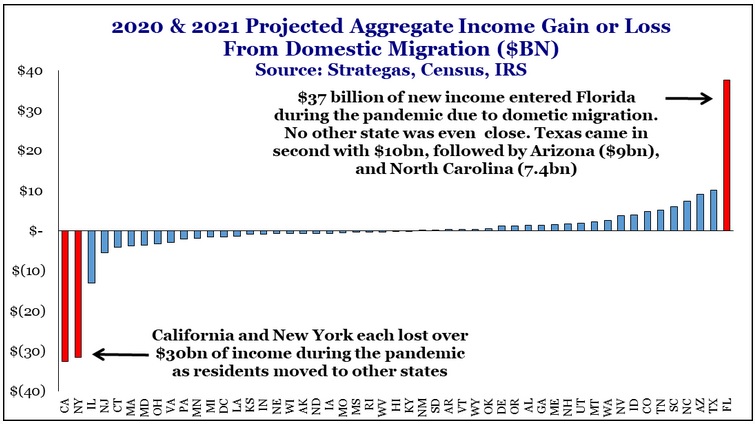

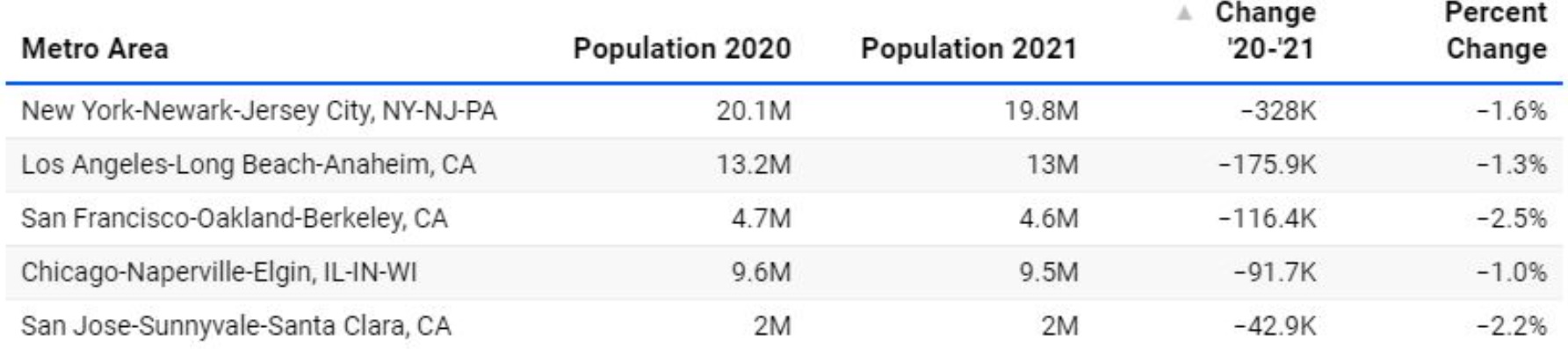

The New York Times reports that one of the New York’s richest taxpayers is moving his business to Florida.

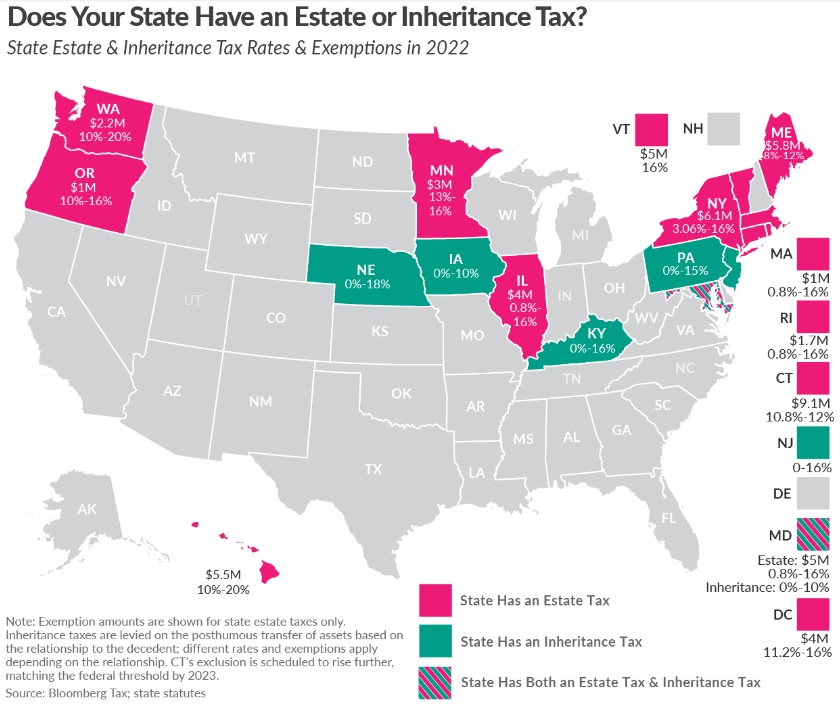

…on Wednesday, Mr. Singer, a billionaire who is one of the wealthiest people in the United States, revealed that he was moving his firm’s headquarters from Midtown Manhattan to West Palm Beach, Fla. …The departure by Elliott Management…follows a similar migration in recent years by other aging billionaire investors, including Carl C. Icahn, who left New York City for Florida, home to sunny weather, beaches and generous tax benefits… Mr. Singer’s move could bode ill for the city… New York City’s personal income tax revenue, which is heavily reliant on wealthy New Yorkers, is expected to drop by $2 billion this fiscal year. …For wealthy taxpayers, moving to Florida can provide a significant windfall. Unlike New York State, Florida has no individual income tax, estate tax or capital gains tax.

in recent years by other aging billionaire investors, including Carl C. Icahn, who left New York City for Florida, home to sunny weather, beaches and generous tax benefits… Mr. Singer’s move could bode ill for the city… New York City’s personal income tax revenue, which is heavily reliant on wealthy New Yorkers, is expected to drop by $2 billion this fiscal year. …For wealthy taxpayers, moving to Florida can provide a significant windfall. Unlike New York State, Florida has no individual income tax, estate tax or capital gains tax.

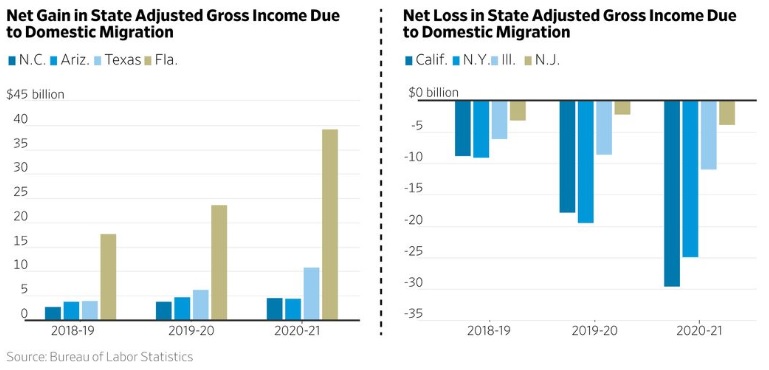

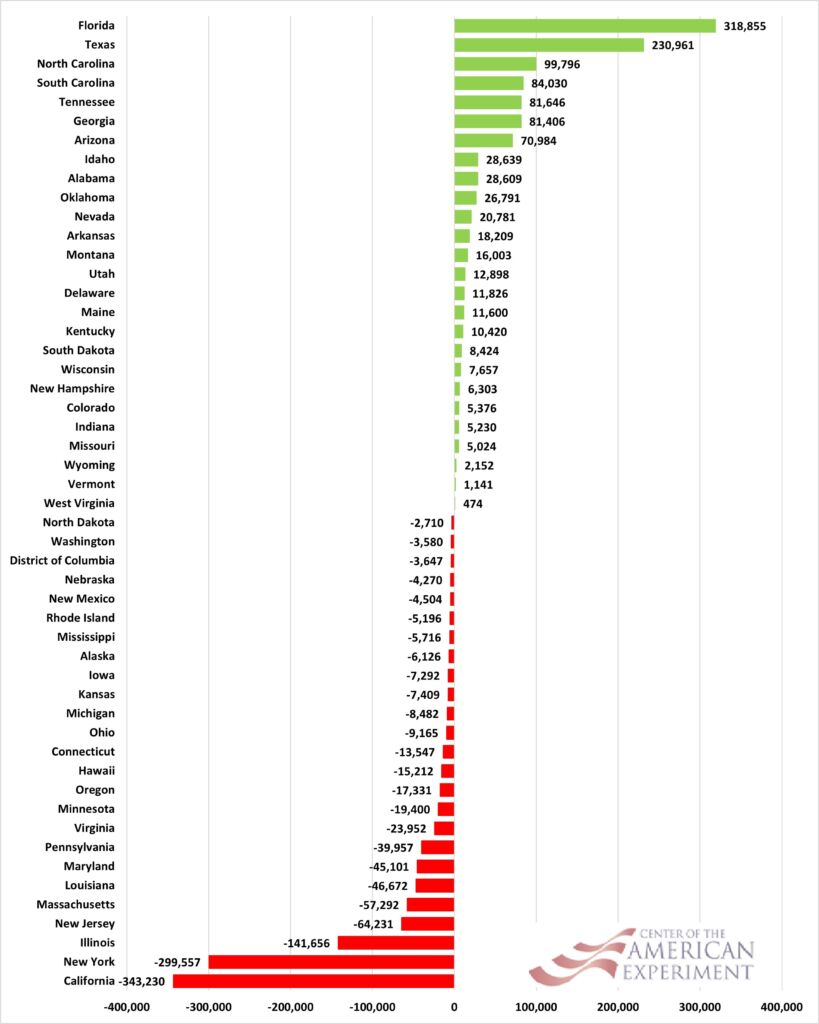

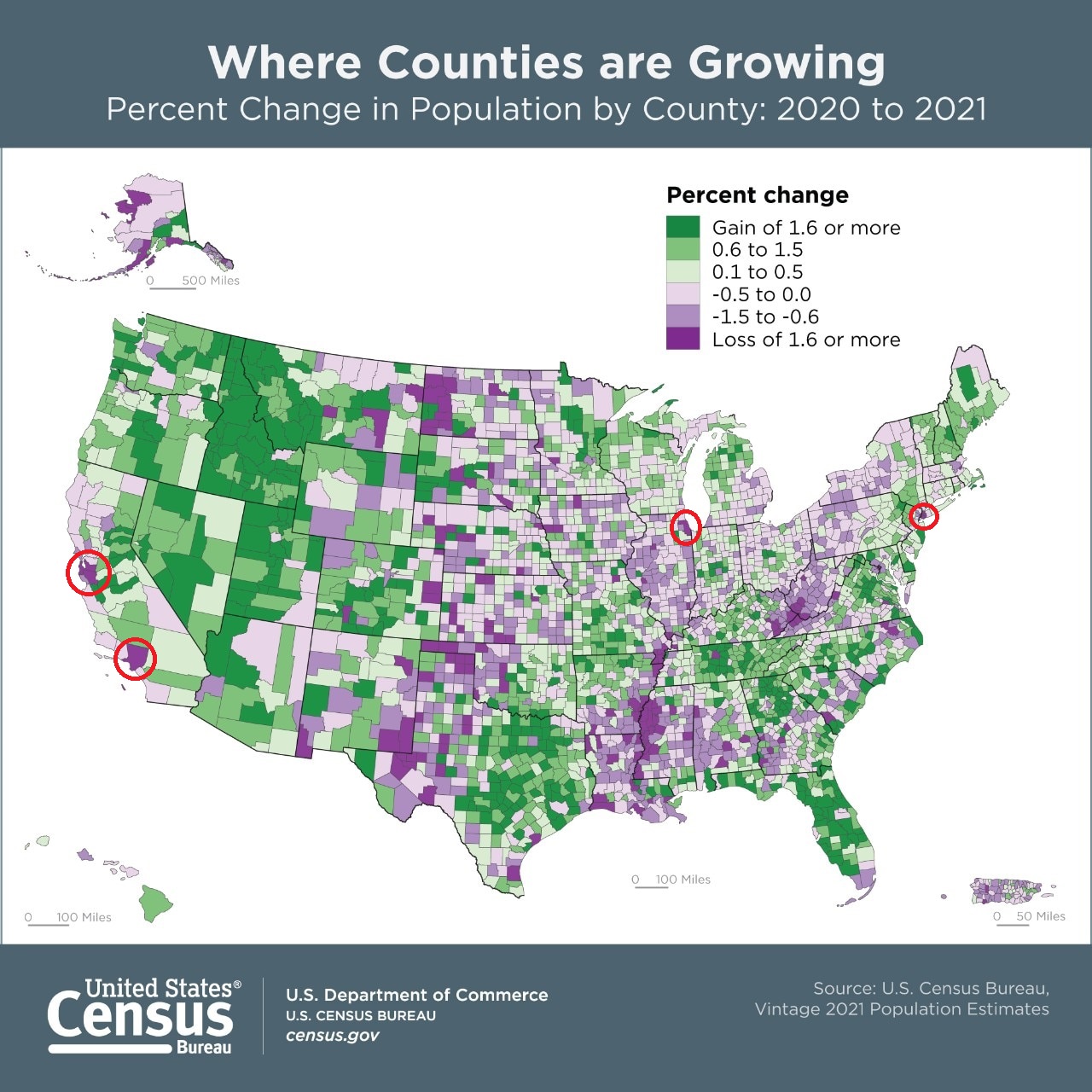

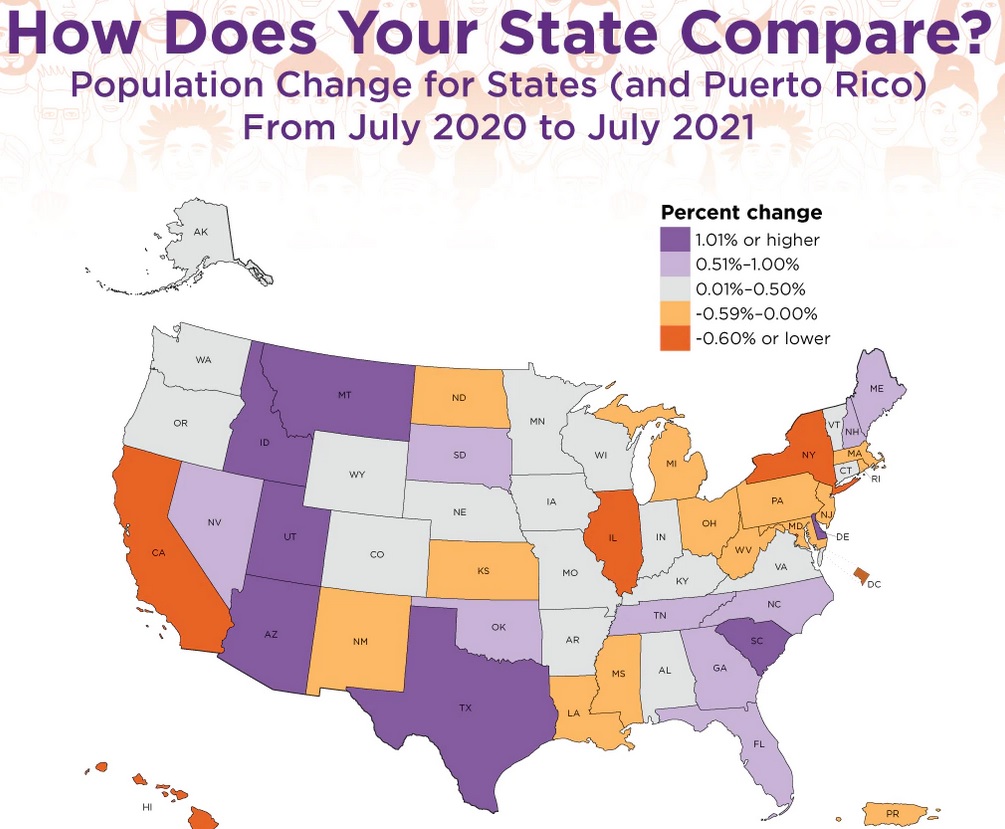

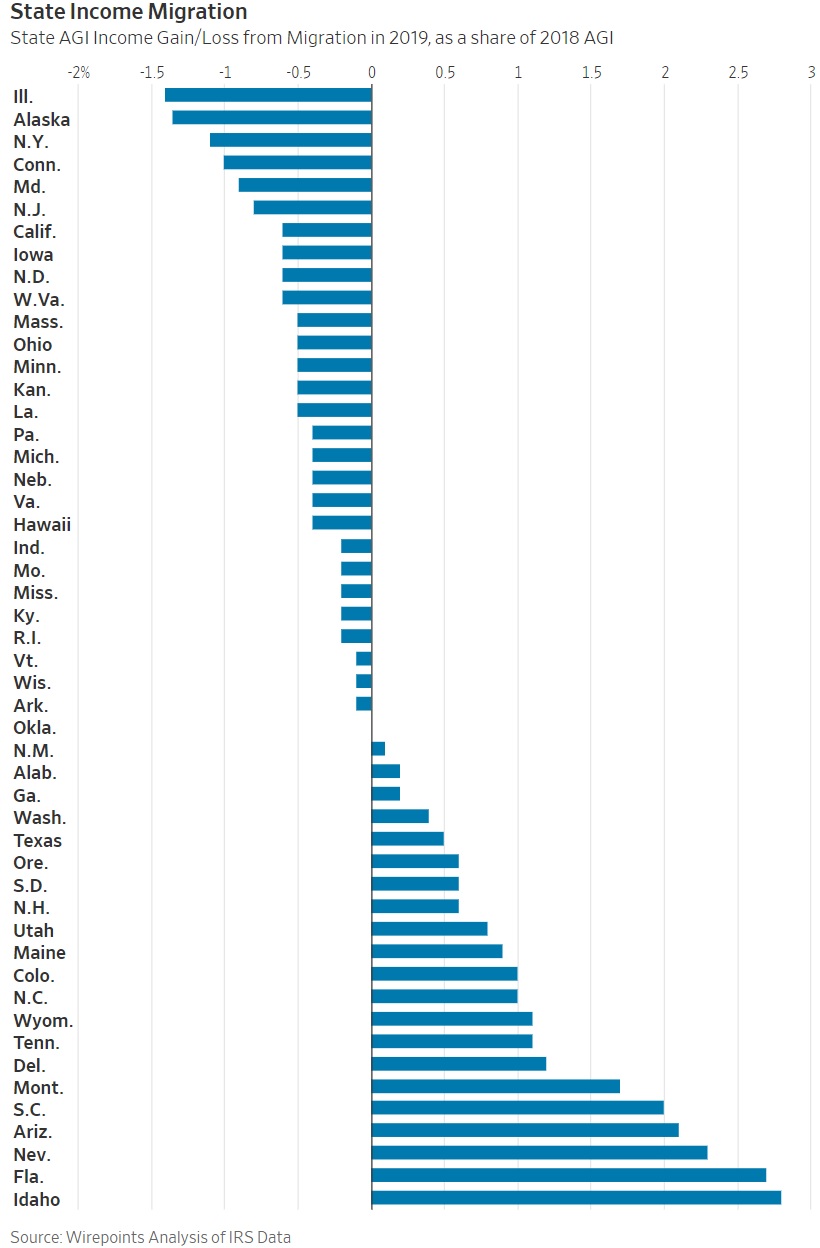

Singer’s move is just the tip of the iceberg.

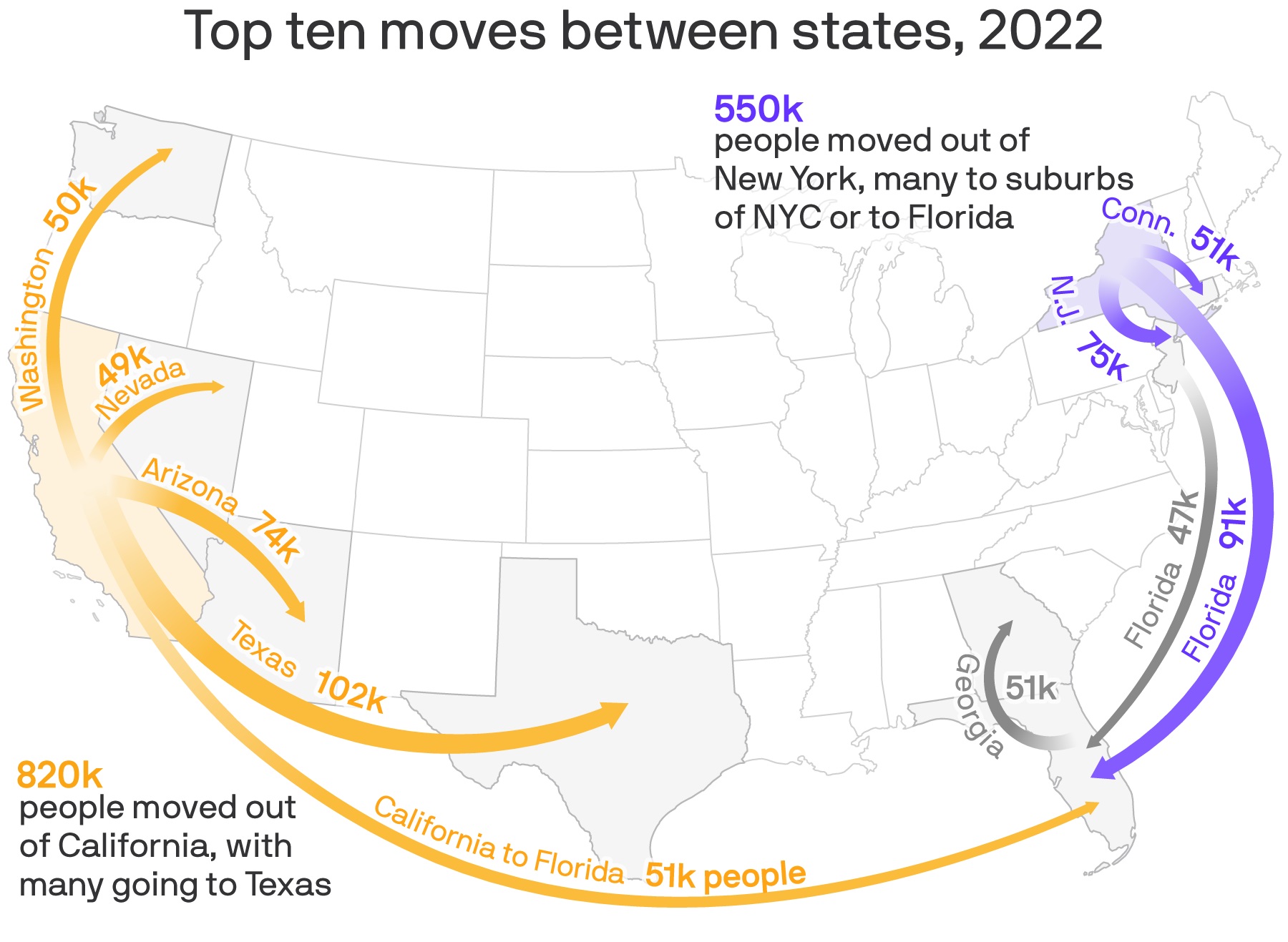

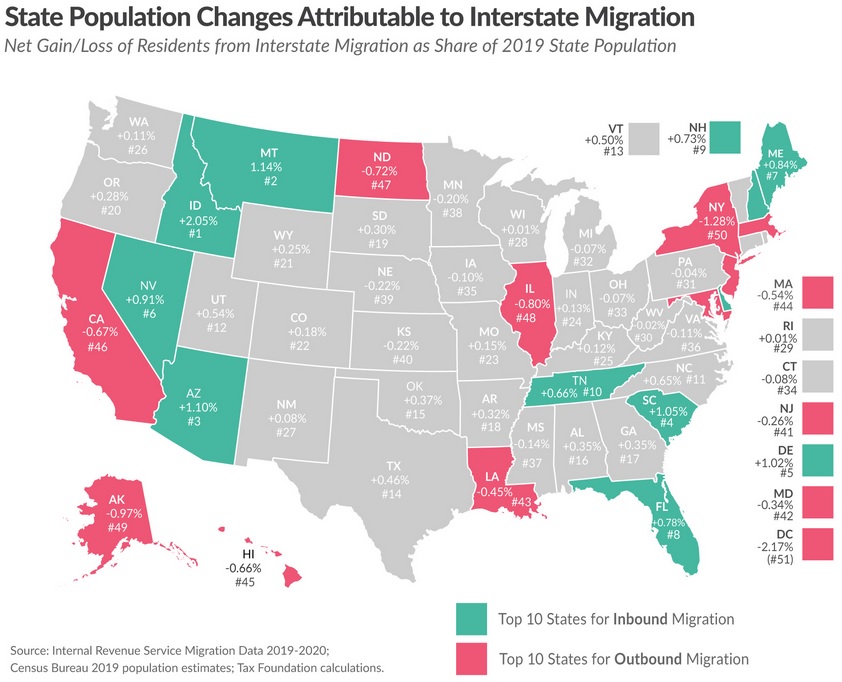

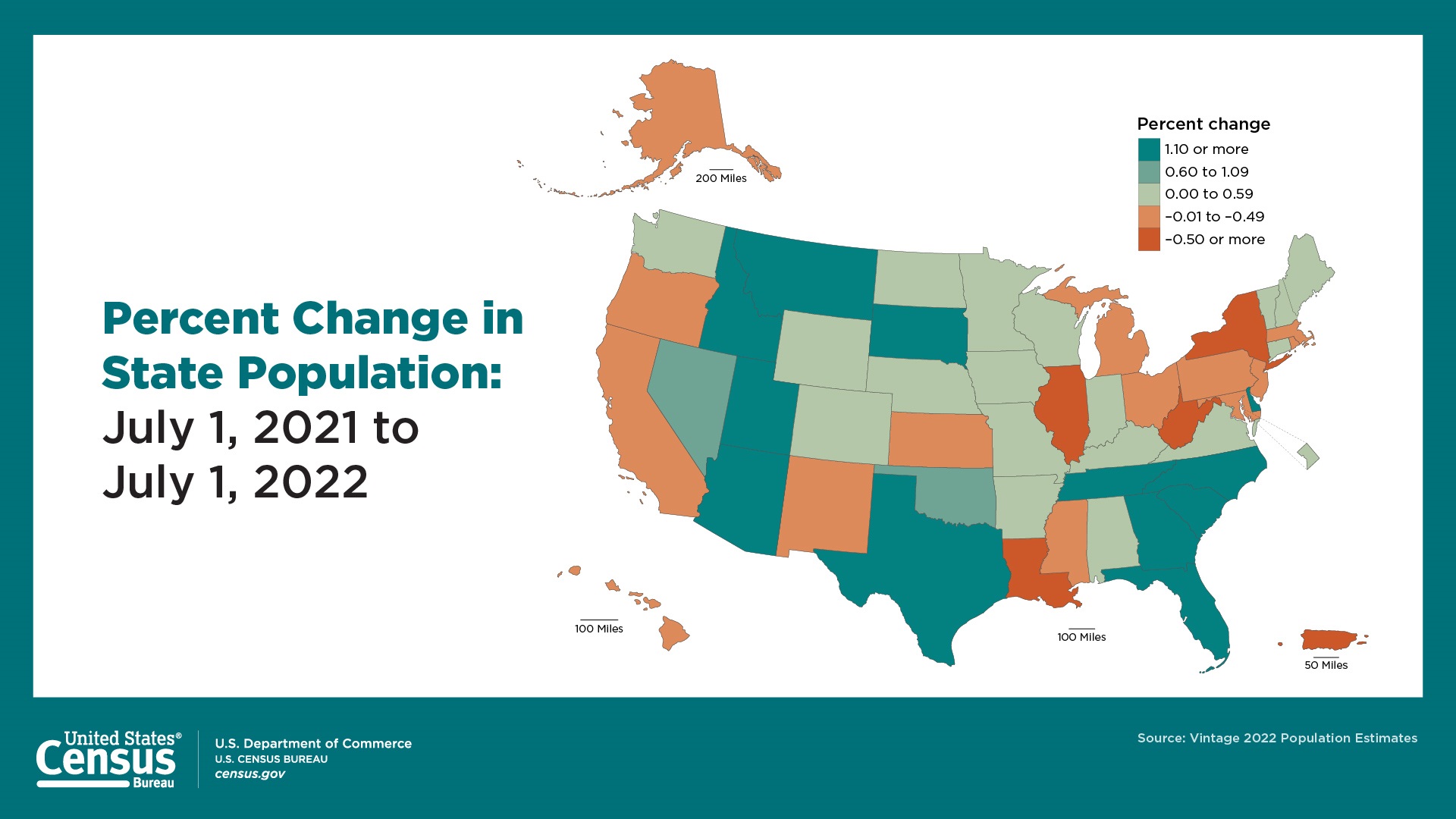

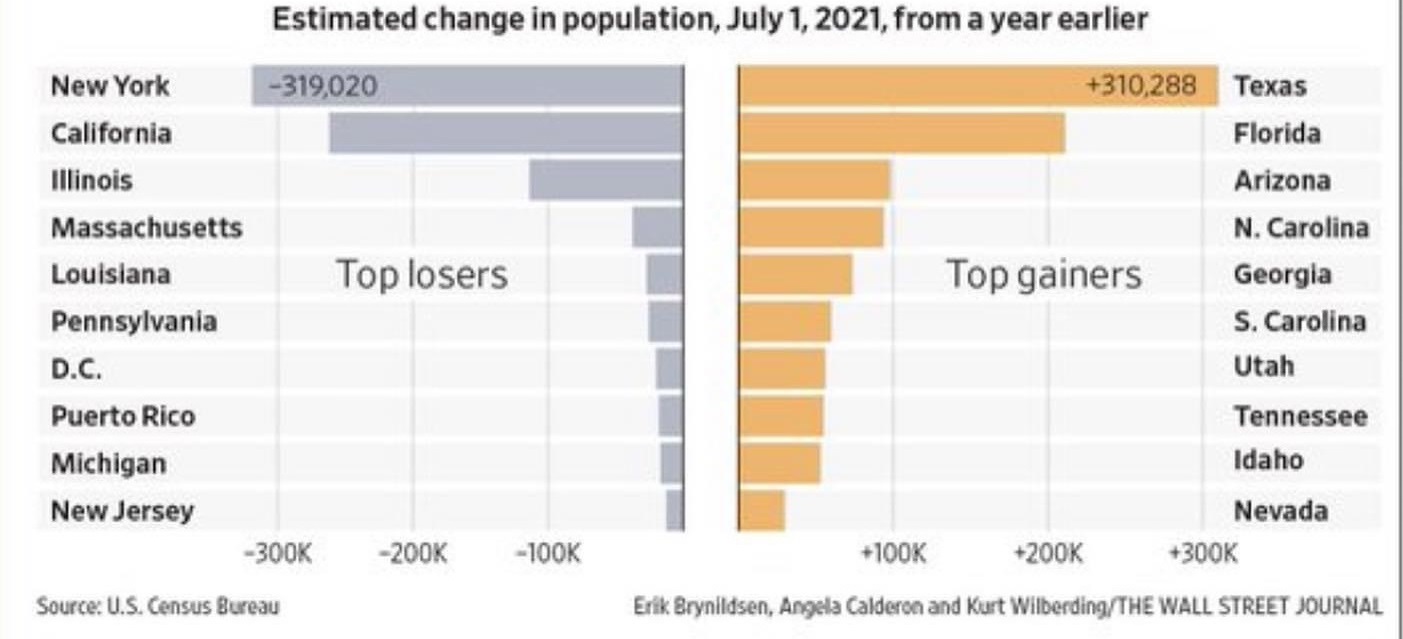

A story in the Wall Street Journal earlier this year documented some of the tax-driven migration happening in the United States.

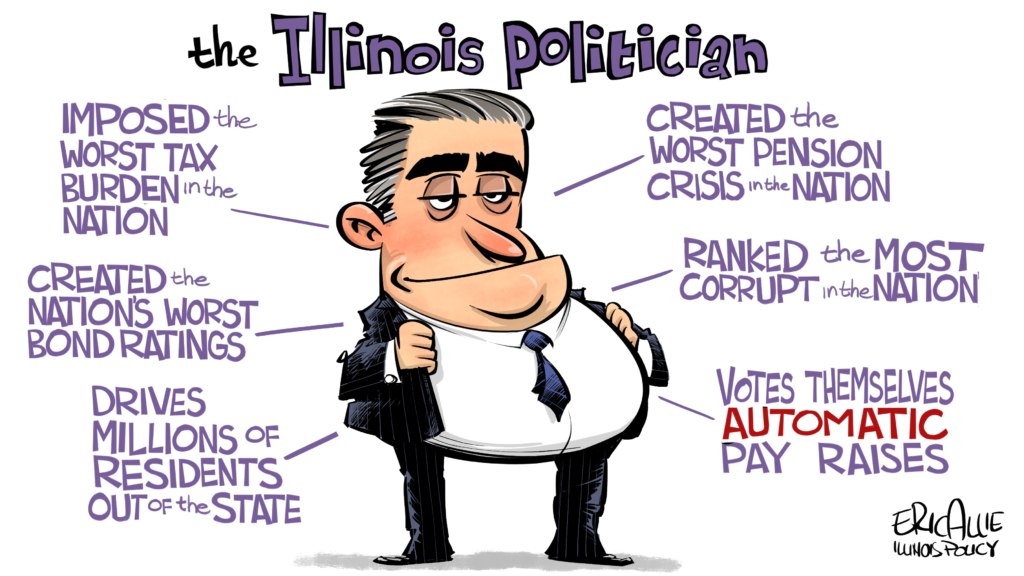

…the federal tax overhaul that Congress passed in late 2017…made it costlier to own a house in many high-price, high-tax areas… its effects are rippling through local economies and housing markets, pushing some people to move from high-tax states where they have long lived. Parts of Florida, for example, are getting an influx of buyers from states such as New York, New Jersey and Illinois. …the 2017 law…curbed how much homeowners can subtract from their federal taxes for paying local property and income taxes,  by capping the state and local tax deduction at $10,000. …many residents in New York, New Jersey, Connecticut and California had been deducting well over $10,000 a year. …Mr. Lee estimates the move to Nevada, which has no state income tax, whacked his state tax bill by 90%. …Rick Bechtel, head of U.S. residential lending at TD Bank, lives in the Chicago area and said he recently went to a party where it felt like everyone was planning their moves to Florida. “It’s unbelievable to me the number of conversations that I’m listening to that begin with ‘When are you leaving?’ and ‘Where are you going?’ ” he said. …California has lost residents to Nevada for years, but that accelerated after the tax law passed. Nevada picked up a net of 28,000 people from California in 2018, according to the U.S. Census Bureau. …Mr. Belardi and Ms. LaPorte, who are planning to leave San Francisco, …have been growing tired of state and local politics, as well as the difficulty of running their two small businesses in California. …They estimate the move will save them tens of thousands of dollars annually. “I just hope all the Californians going to Nevada don’t turn Nevada into a California,” Mr. Belardi said.

by capping the state and local tax deduction at $10,000. …many residents in New York, New Jersey, Connecticut and California had been deducting well over $10,000 a year. …Mr. Lee estimates the move to Nevada, which has no state income tax, whacked his state tax bill by 90%. …Rick Bechtel, head of U.S. residential lending at TD Bank, lives in the Chicago area and said he recently went to a party where it felt like everyone was planning their moves to Florida. “It’s unbelievable to me the number of conversations that I’m listening to that begin with ‘When are you leaving?’ and ‘Where are you going?’ ” he said. …California has lost residents to Nevada for years, but that accelerated after the tax law passed. Nevada picked up a net of 28,000 people from California in 2018, according to the U.S. Census Bureau. …Mr. Belardi and Ms. LaPorte, who are planning to leave San Francisco, …have been growing tired of state and local politics, as well as the difficulty of running their two small businesses in California. …They estimate the move will save them tens of thousands of dollars annually. “I just hope all the Californians going to Nevada don’t turn Nevada into a California,” Mr. Belardi said.

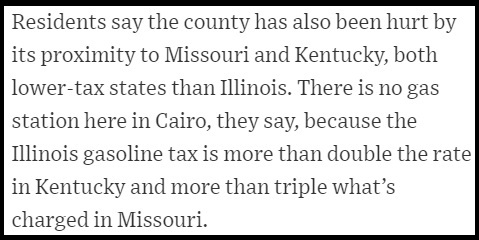

By the way, there’s even tax-driven migration from some low-tax states to states with even lower taxes.

The dynamic is affecting even states typically thought to have low taxes. Mauricio Navarro and his family left Texas last year for Weston, Fla. Neither state collects its own income tax, but Mr. Navarro was paying more than $25,000 annually in property taxes in the Houston area, he said. …Filling out his 2018 tax returns helped motivate him to move with his wife and two children, said Mr. Navarro, who owns a software-development business.

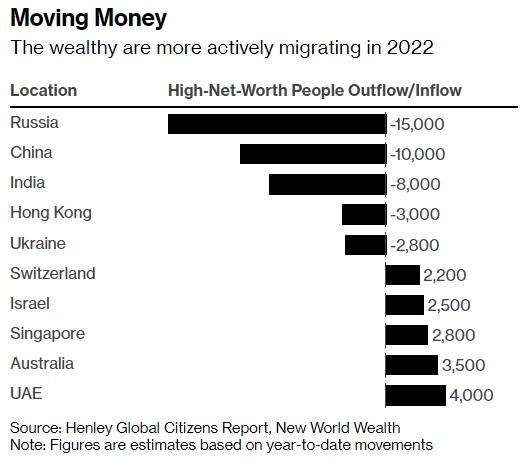

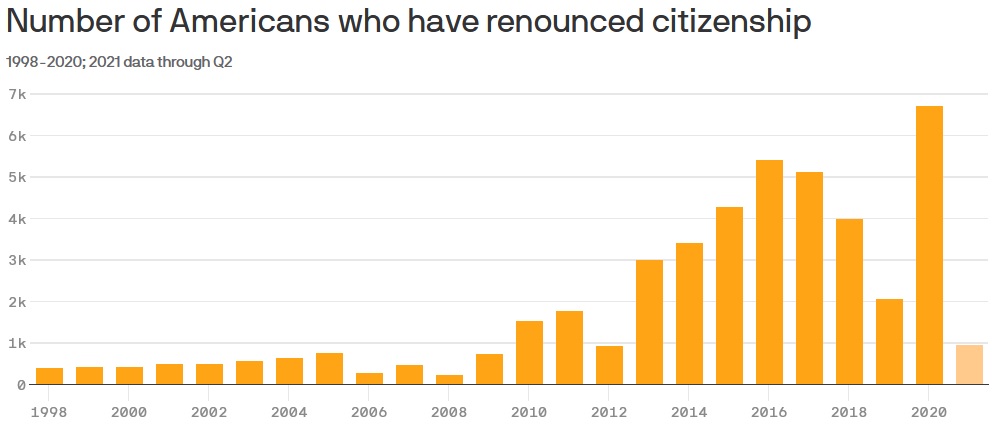

And there’s tax-driven migration from high-tax nations to low-tax nations.

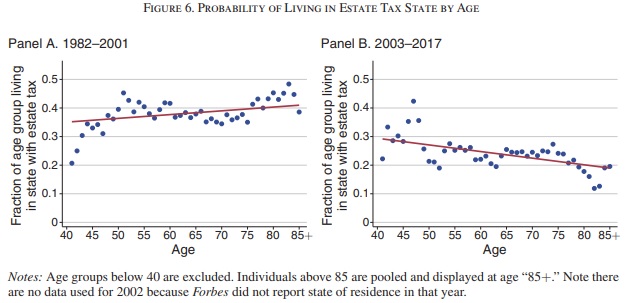

Here are some excerpts from some scholarly research in the Journal of Economic Perspectives, authored by Henrik Kleven, Camille Landais, Mathilde Muñoz, and Stefanie Stantcheva.

Here’s some of their background data.

Tax rates differ substantially across countries and across locations within countries. An important question is whether people choose locations in response to these tax differentials, thus reducing the ability of local and national governments to redistribute income… In this paper, we review what we know about mobility responses to personal taxation and discuss the policy implications.  Our main focus is on the mobility of people, especially high-income people, but we will also discuss the mobility of wealth in response to personal taxes. It is clear that high-income individuals sometimes move across borders to avoid taxes. …The Rolling Stones left England for France in the early 1970s in order to avoid the exceptionally high top marginal tax rates—well above 90 percent—in the UK at the time. Many other British rock stars moved to lower tax jurisdictions, including David Bowie (Switzerland), Ringo Starr (Monte Carlo), Cat Stevens (Brazil), Rod Stewart (United States), and Sting (Ireland). In more recent years, actor Gérard Depardieu moved to Belgium and eventually Russia in response to the 75 percent millionaire tax in France, while a vast number of sports stars in tennis, golf, and motor racing have taken residence in tax havens such as Monte Carlo, Switzerland, and Dubai.

Our main focus is on the mobility of people, especially high-income people, but we will also discuss the mobility of wealth in response to personal taxes. It is clear that high-income individuals sometimes move across borders to avoid taxes. …The Rolling Stones left England for France in the early 1970s in order to avoid the exceptionally high top marginal tax rates—well above 90 percent—in the UK at the time. Many other British rock stars moved to lower tax jurisdictions, including David Bowie (Switzerland), Ringo Starr (Monte Carlo), Cat Stevens (Brazil), Rod Stewart (United States), and Sting (Ireland). In more recent years, actor Gérard Depardieu moved to Belgium and eventually Russia in response to the 75 percent millionaire tax in France, while a vast number of sports stars in tennis, golf, and motor racing have taken residence in tax havens such as Monte Carlo, Switzerland, and Dubai.

The authors point out that there are challenges, however, when trying to move from interesting anecdotes to statistically supported conclusions.

They overcome that challenge by examining a special tax regime in Denmark.

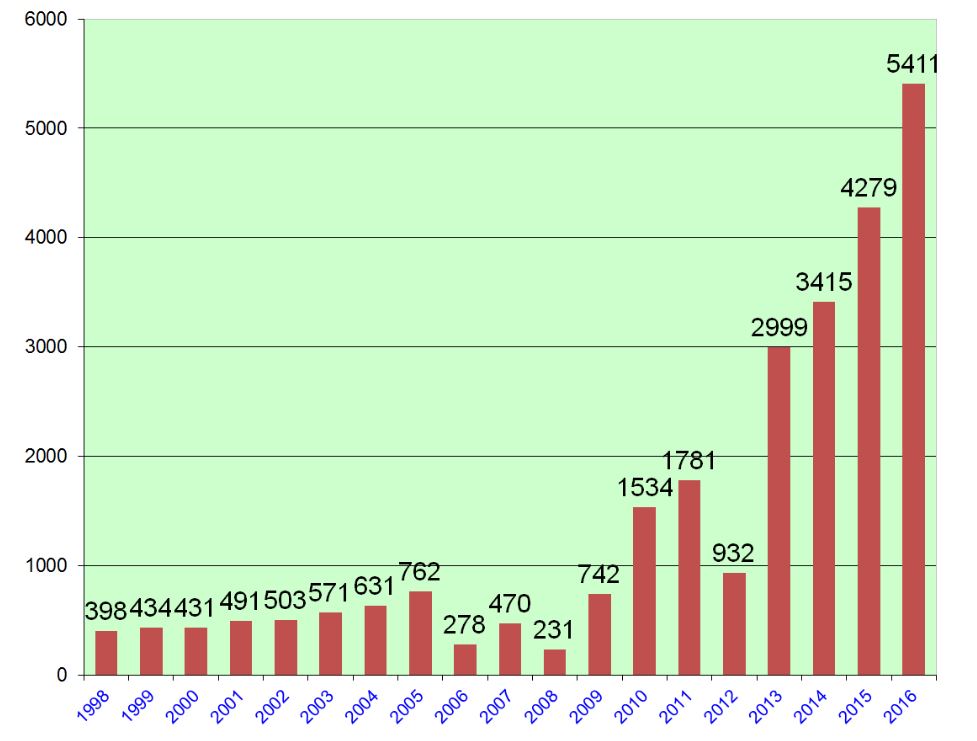

…the introduction of special tax schemes to foreigners provides such compelling quasi-experimental settings. Consider for instance the Danish tax scheme for foreigners… This scheme was enacted in 1992 and applied to the earnings of foreign workers from June 1991 onwards. Eligibility for the scheme requires annual earnings above a threshold located around the ninety-ninth percentile of the earnings distribution. Initially, the scheme offered a flat income tax rate of 30 percent in lieu of the regular progressive income tax with a top marginal tax rate of 68 percent. …The design of the scheme lends itself to a difference-in-differences approach in which we compare the evolution of the number of foreigners above the eligibility threshold (treatments) and below the eligibility threshold (controls). Such an analysis is presented in Figure 3. It shows the stock of foreigners between 1980–2005 in the treated earnings range and in two untreated earnings ranges, between 80–90 percent of the threshold and between 90–99 percent of the threshold. …The graph provides exceptionally compelling evidence of mobility responses.

Here’s a chart from the study showing a pronounced increase in migration from those (the red line) who could benefit from the lower tax rates.

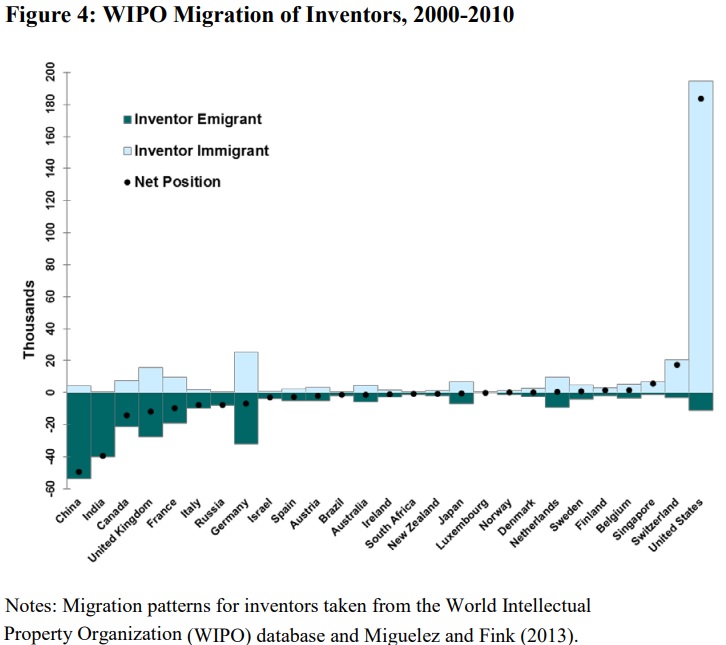

The study also includes some evidence from the 1986 Tax Reform Act in the United States.

Can elasticities be sizable even for large countries that start with a large base of foreigners? Akcigit, Baslandze, and Stantcheva (2016) shed light on this question. They study the effects of top tax rates on the international mobility of “superstar” inventors—those with the most and best patents. …panel B considers the US Tax Reform Act of 1986 which sharply reduced the top marginal income tax rate. … the US Tax Reform Act of 1986 had a strong effect on the growth of foreign superstar inventors. In fact, the estimated mobility elasticity of top 1 percent superstar inventors for the US economy is extremely large, above 3.

Here’s the chart showing how lower tax rates in the United States helped to attract valuable inventors.

If you want more data, I wrote about the tax-driven mobility of super-entrepreneurs in 2015 and I wrote about the tax-driven mobility of super-inventors in 2016

There are two obvious lessons from all of the data and evidence in today’s column.

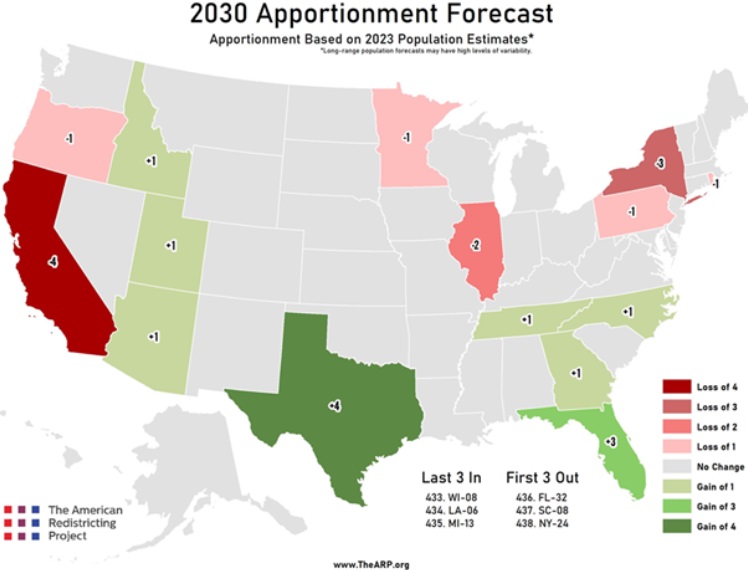

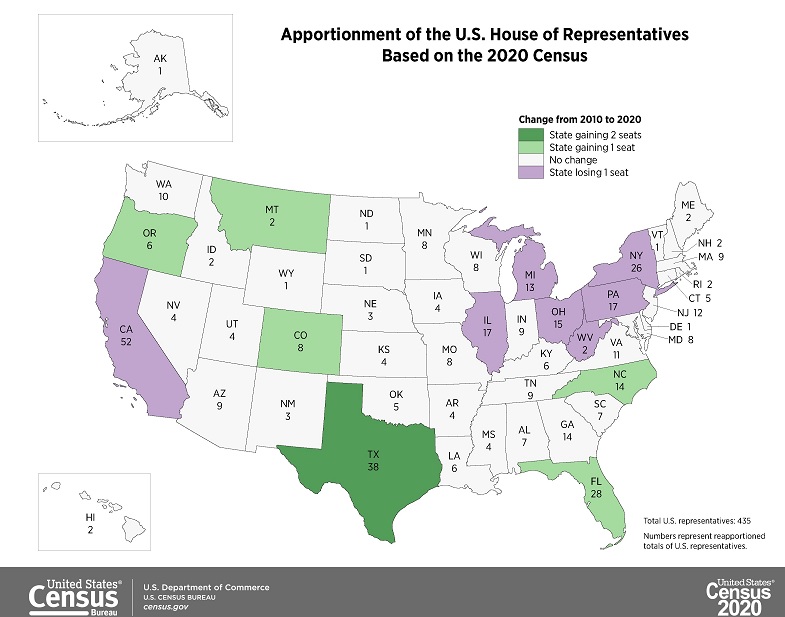

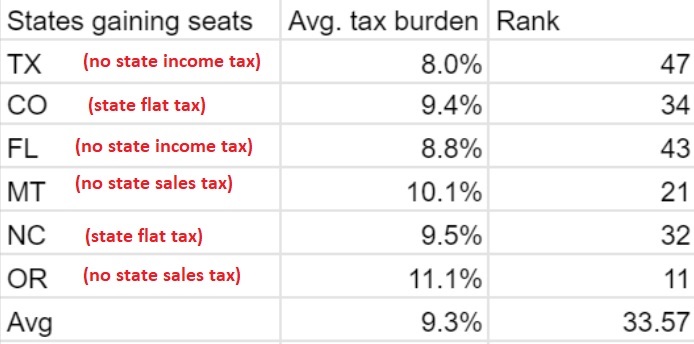

First, high tax rates are very costly because high-value taxpayers are far more likely to move. This means there are greater-than-ever penalties for bad policy and greater-than-ever rewards for good policy. Bad news for states like New Jersey and nations such as France. Good news for Florida and Switzerland.

Second, tax competition is a very valuable check on the greed of politicians (a.k.a., the “stationary bandits“). Simply stated, governments no longer have unconstrained ability to tax and spend. Which explains, of course, why international bureaucracies (acting at the behest of politicians) are working very hard to replace the liberalizing force of tax competition with some sort of global tax cartel.

Read Full Post »

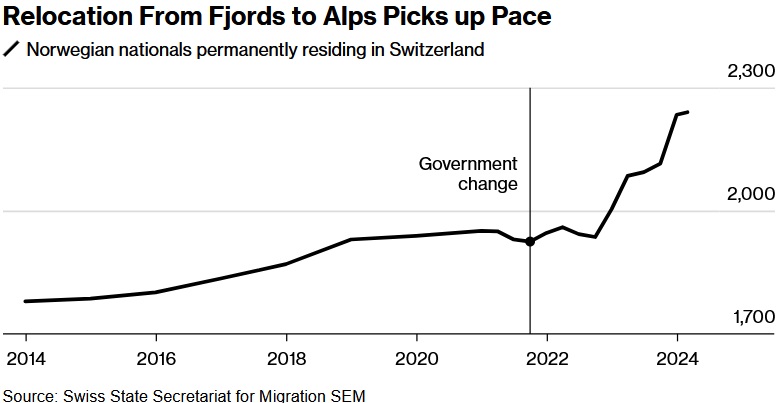

…Eighty-two rich Norwegians with a combined net wealth of about 46 billion kroner ($4.3 billion) left the country in 2022-2023, with 34 moving out last year alone, according to data from the Finance Ministry. More than 70 of those have moved to Switzerland… Swiss taxation varies by canton, but the overall effect is a significantly lower percentage of wealth and income than most other European nations. …Hollup said…”it’s a two-fold issue of losing tax revenue for Norway and the risk that a lot of brain capital has left the country.”