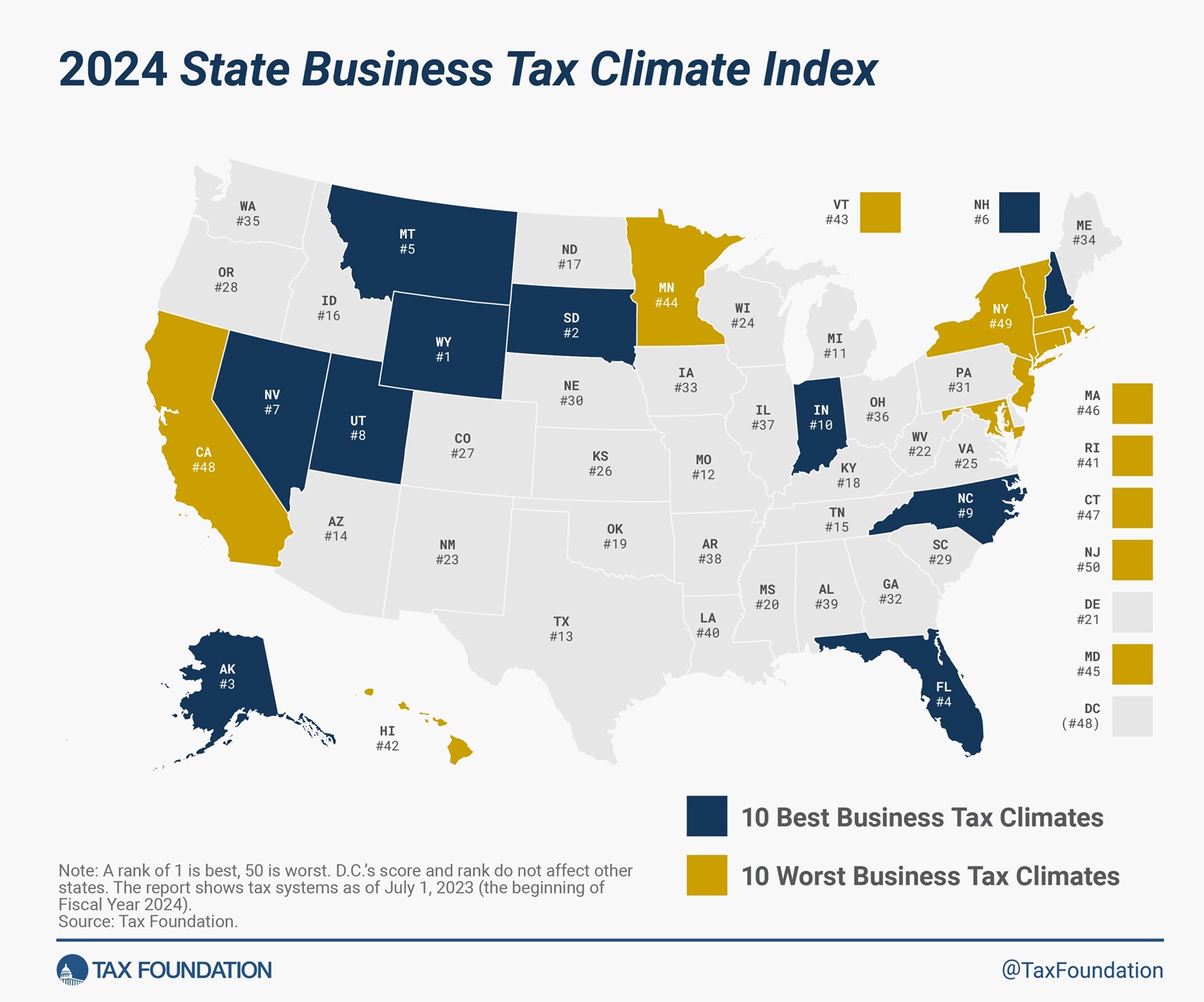

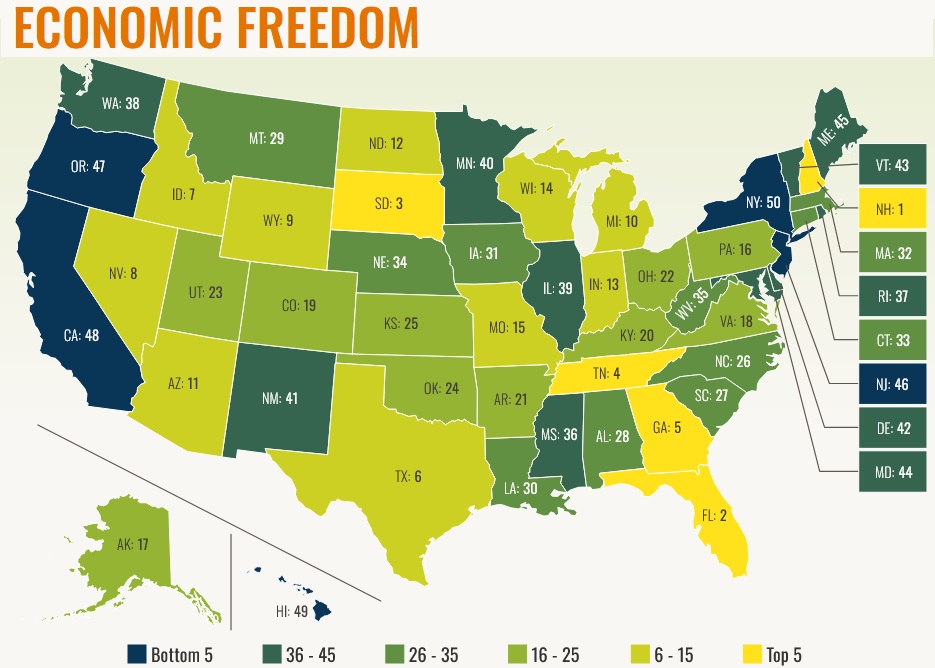

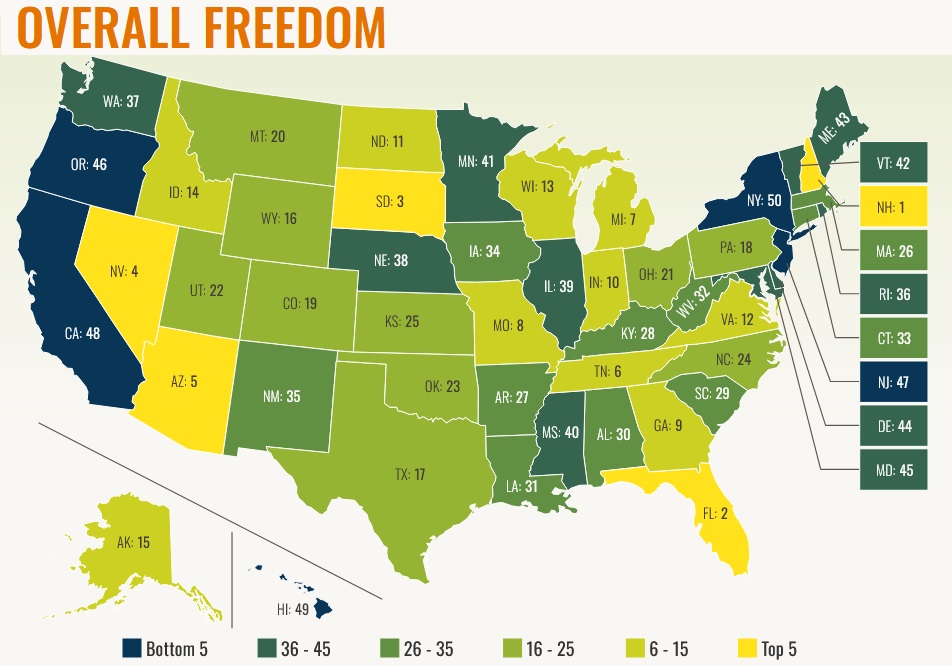

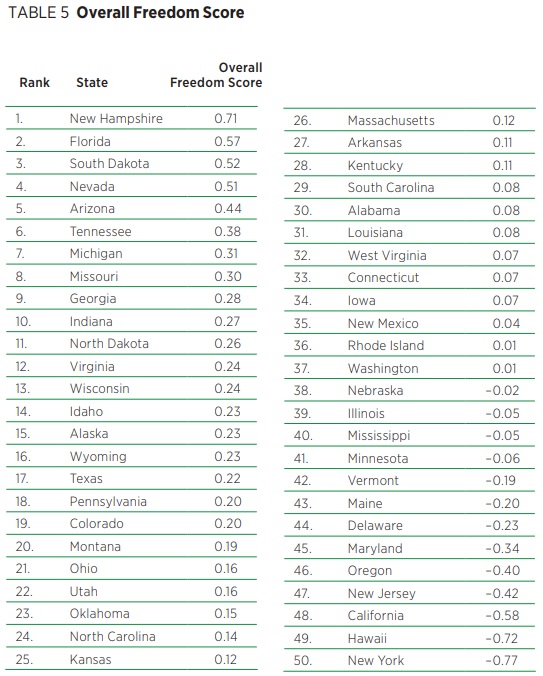

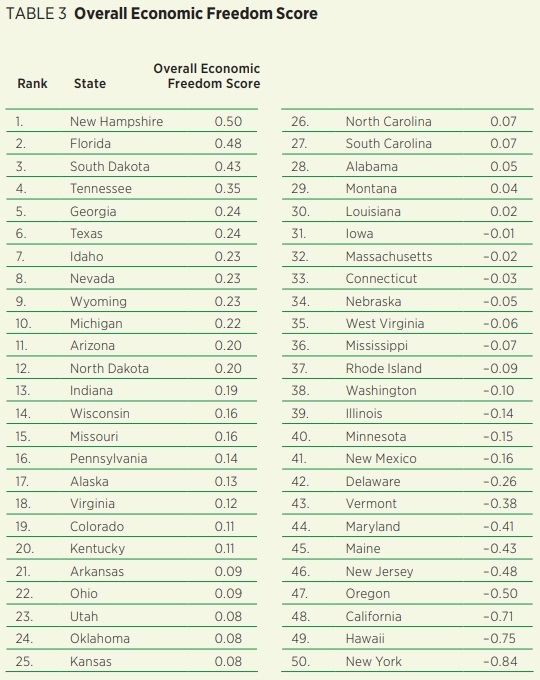

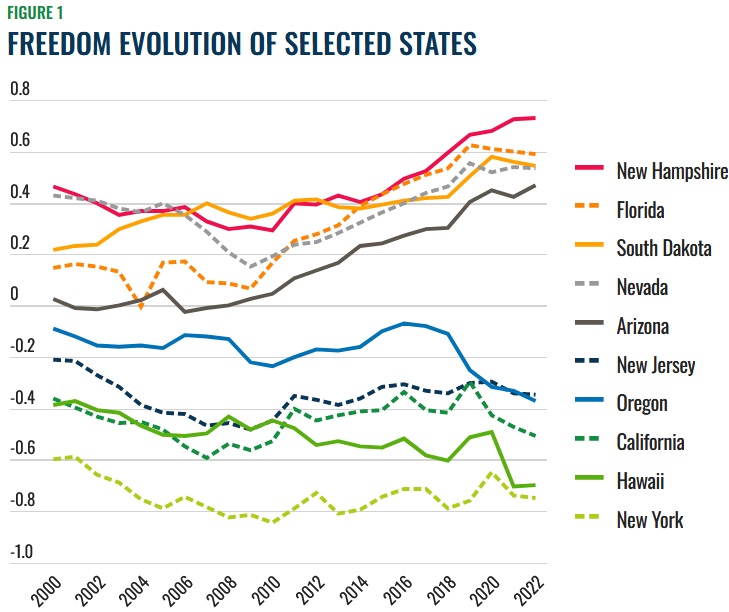

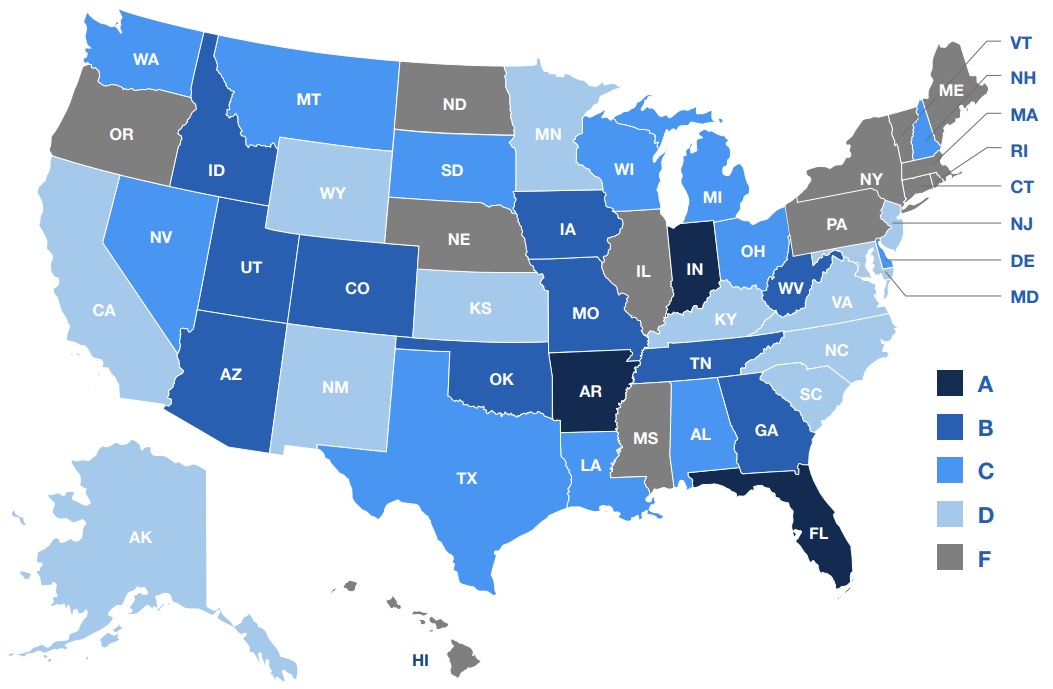

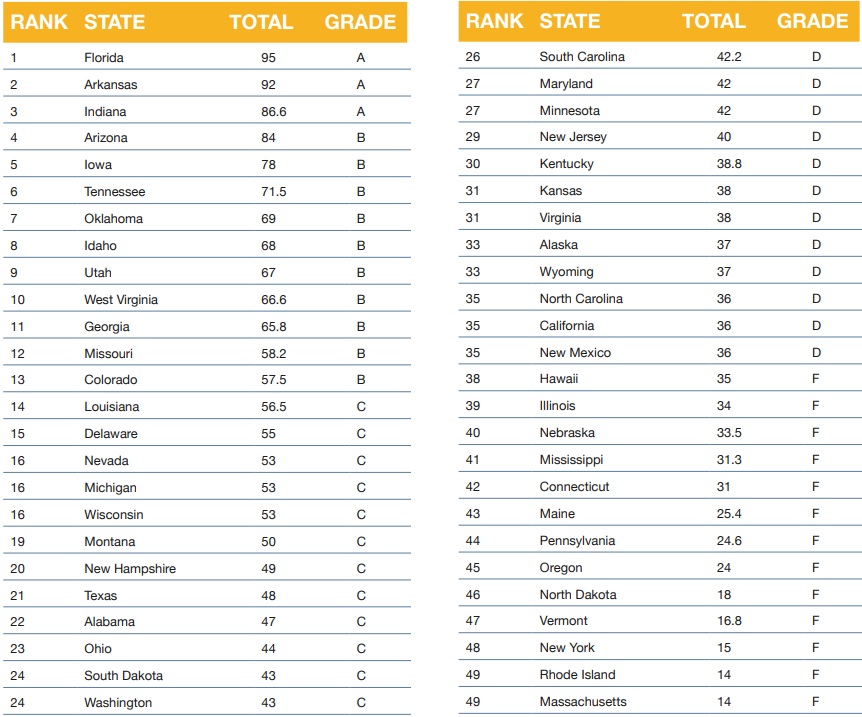

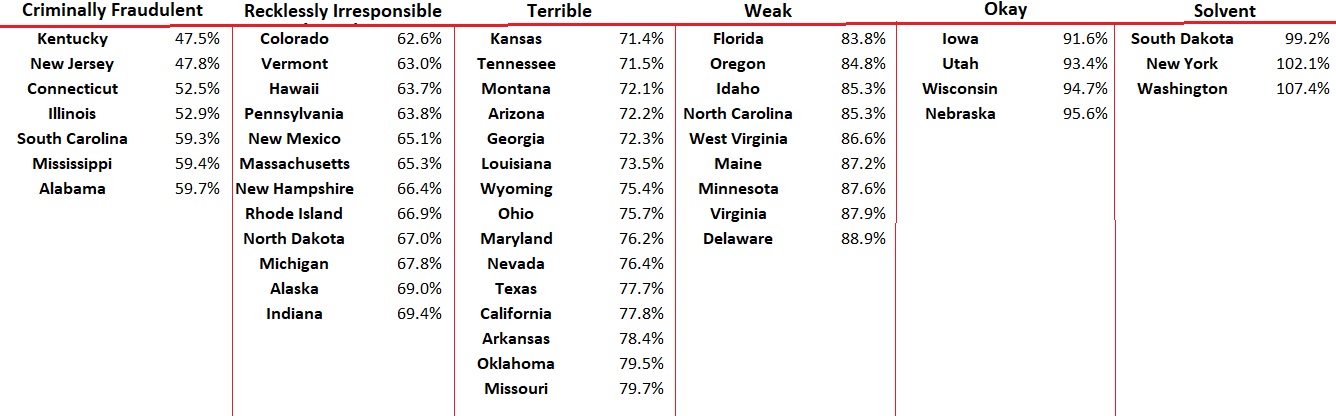

According to both Economic Freedom of North America and Freedom in the 50 States, Iowa is boringly average, ranking in the 20s.

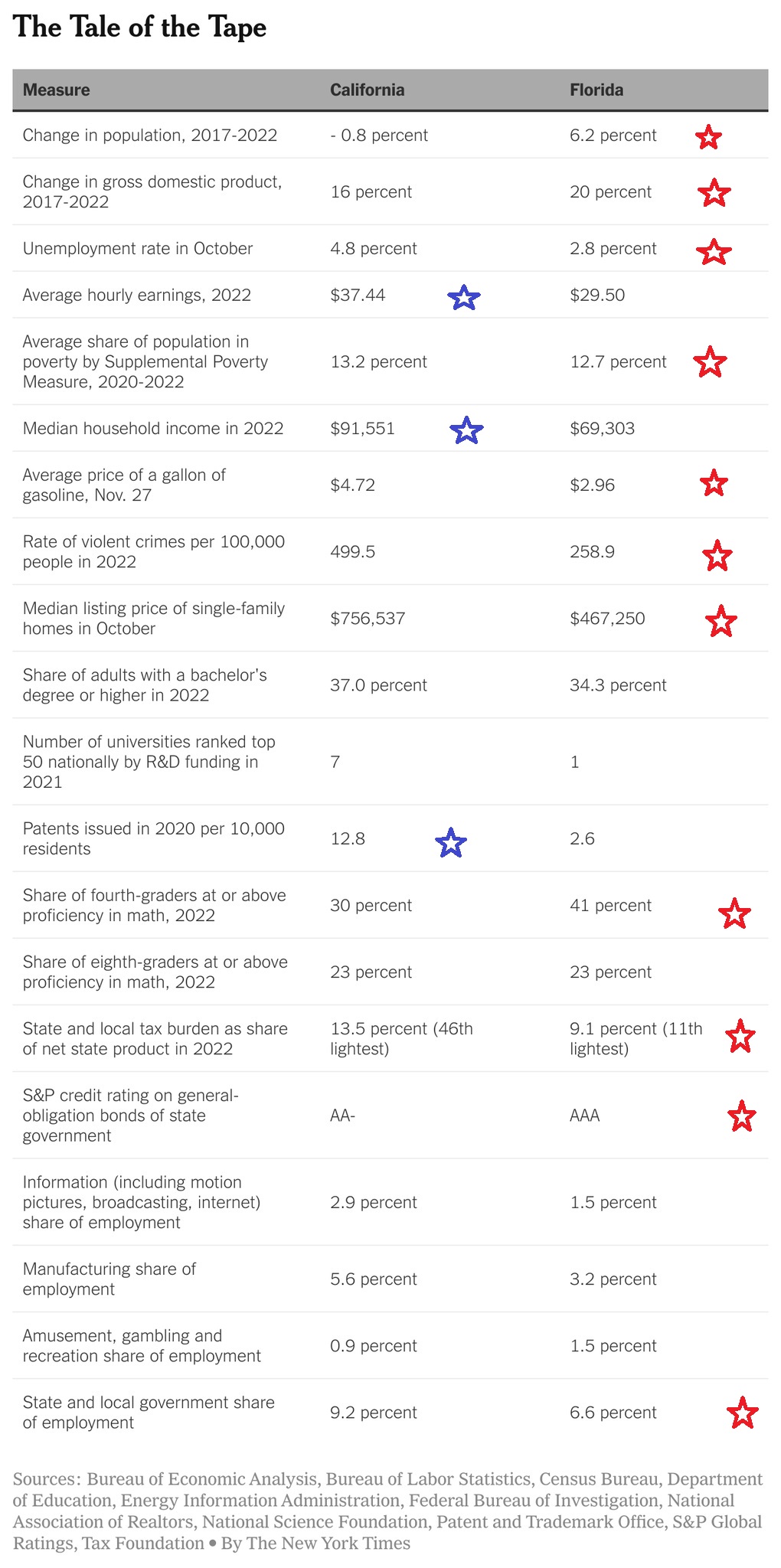

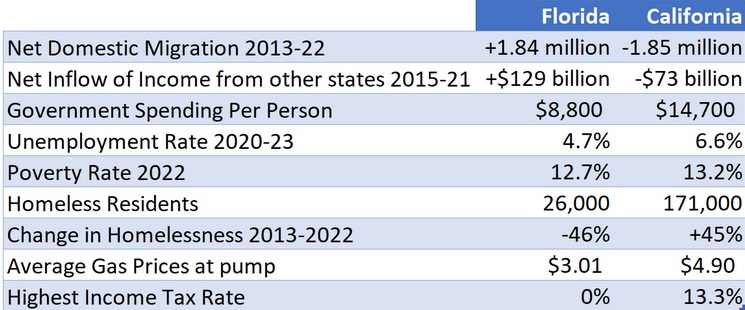

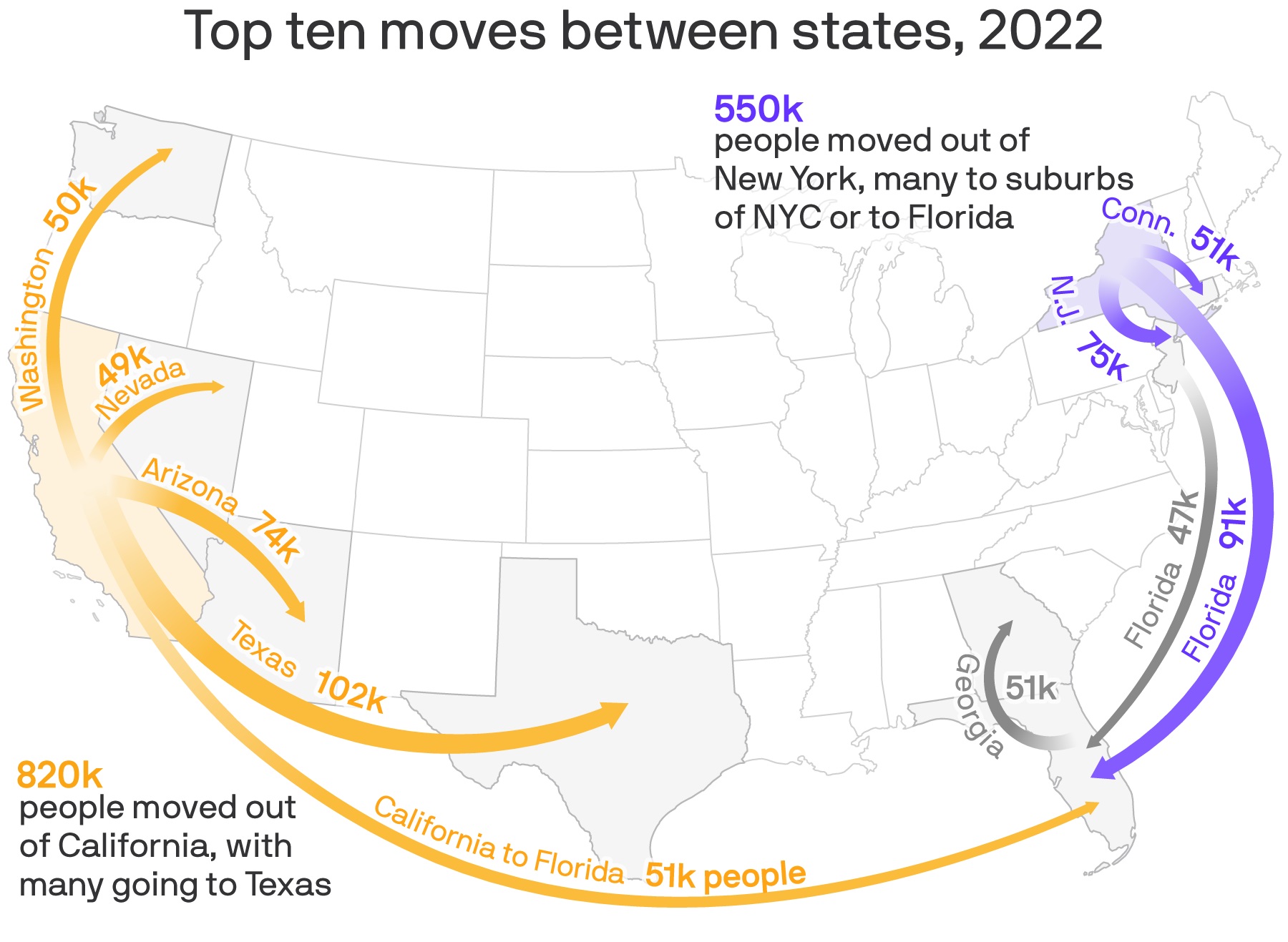

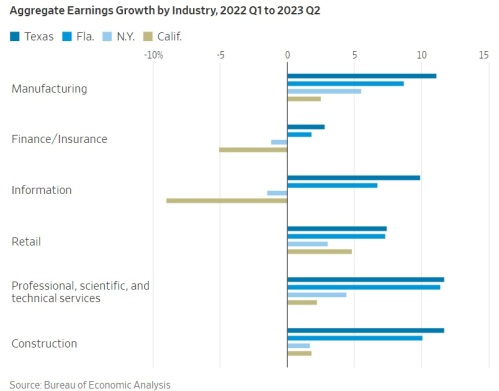

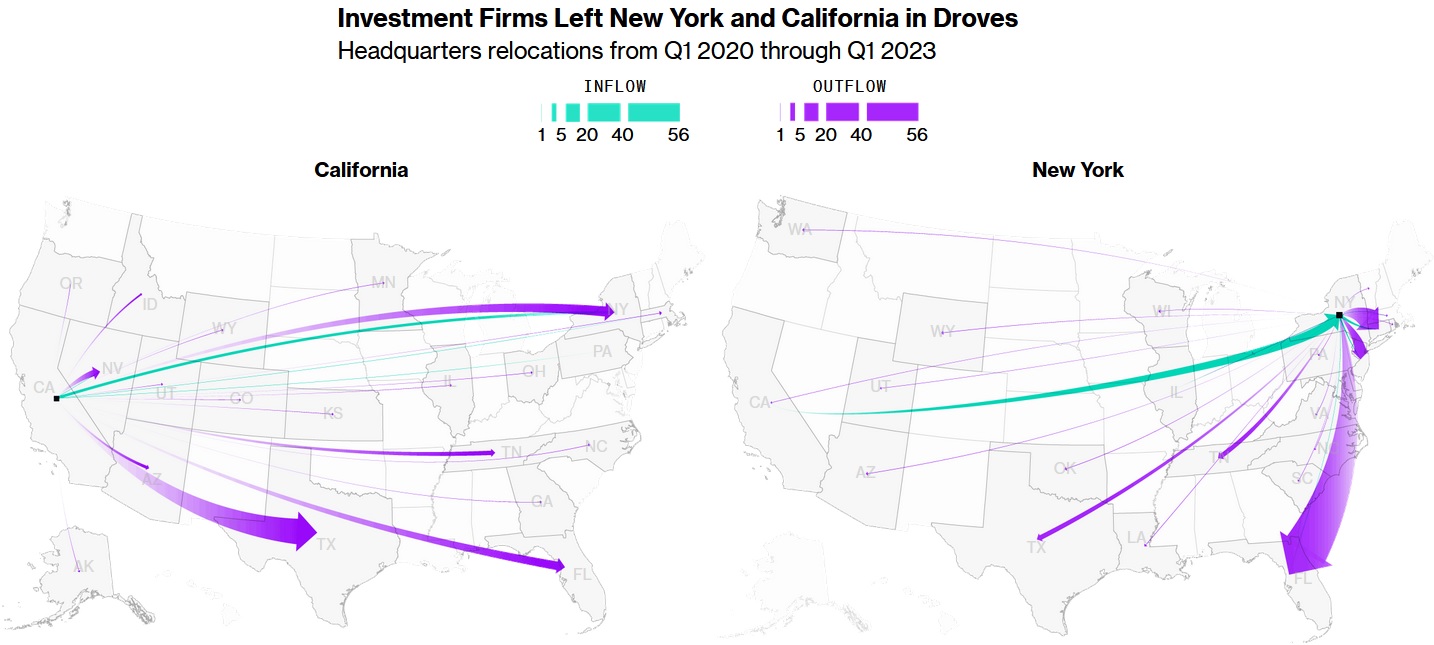

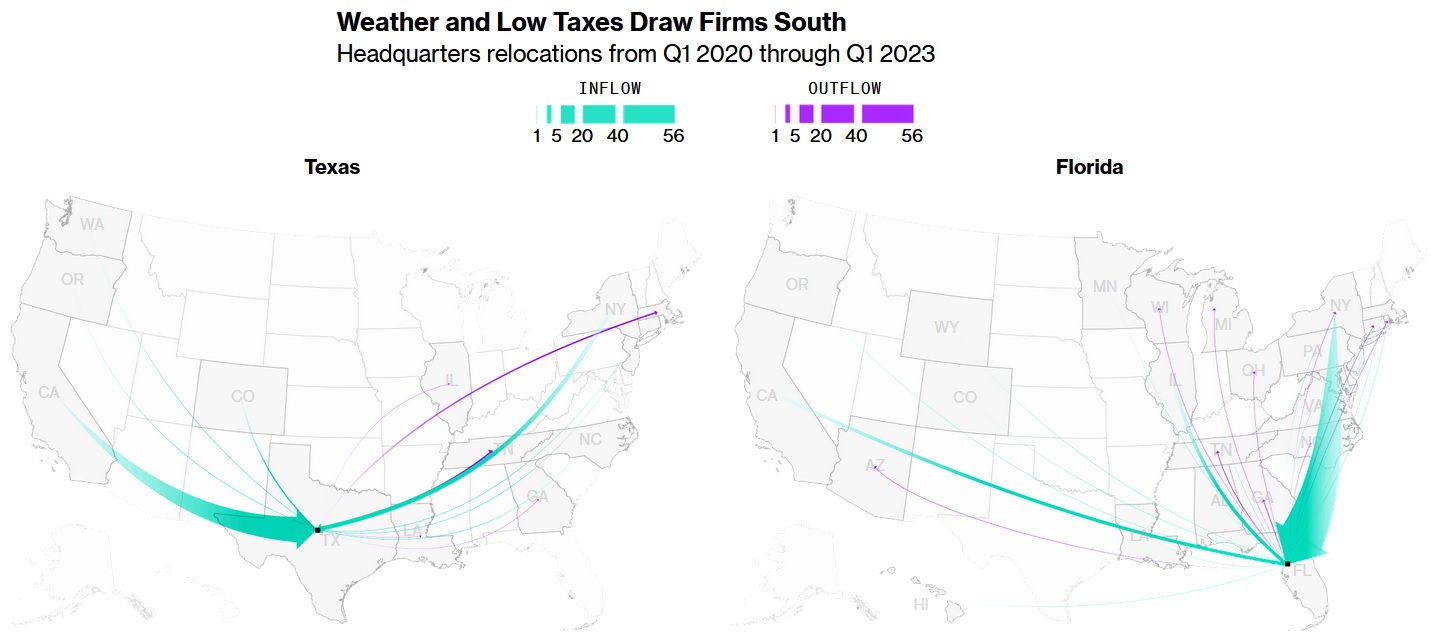

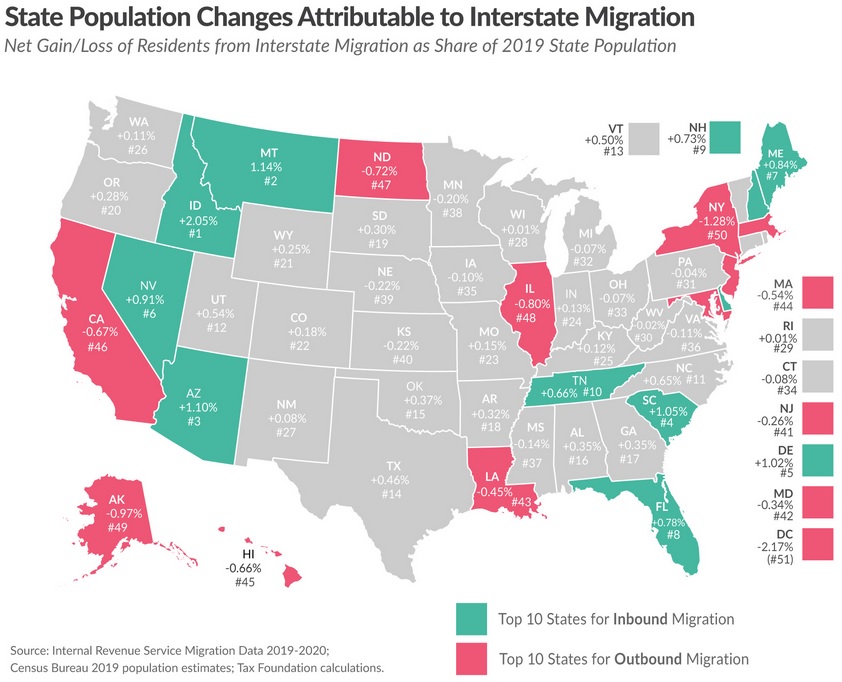

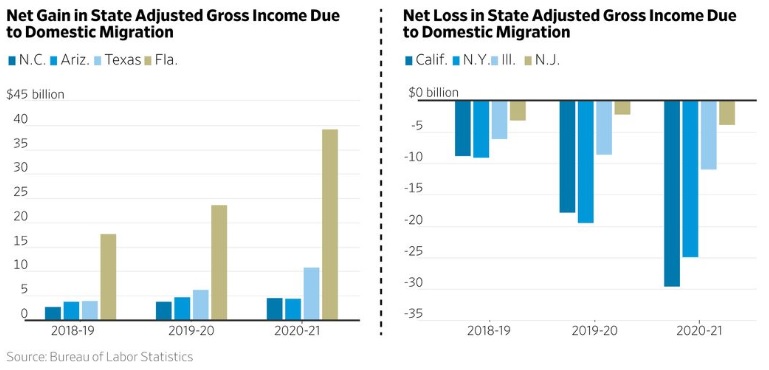

That’s better than being terrible, like New York or California. But it’s worse than being good, like Florida and New Hampshire.

That’s better than being terrible, like New York or California. But it’s worse than being good, like Florida and New Hampshire.

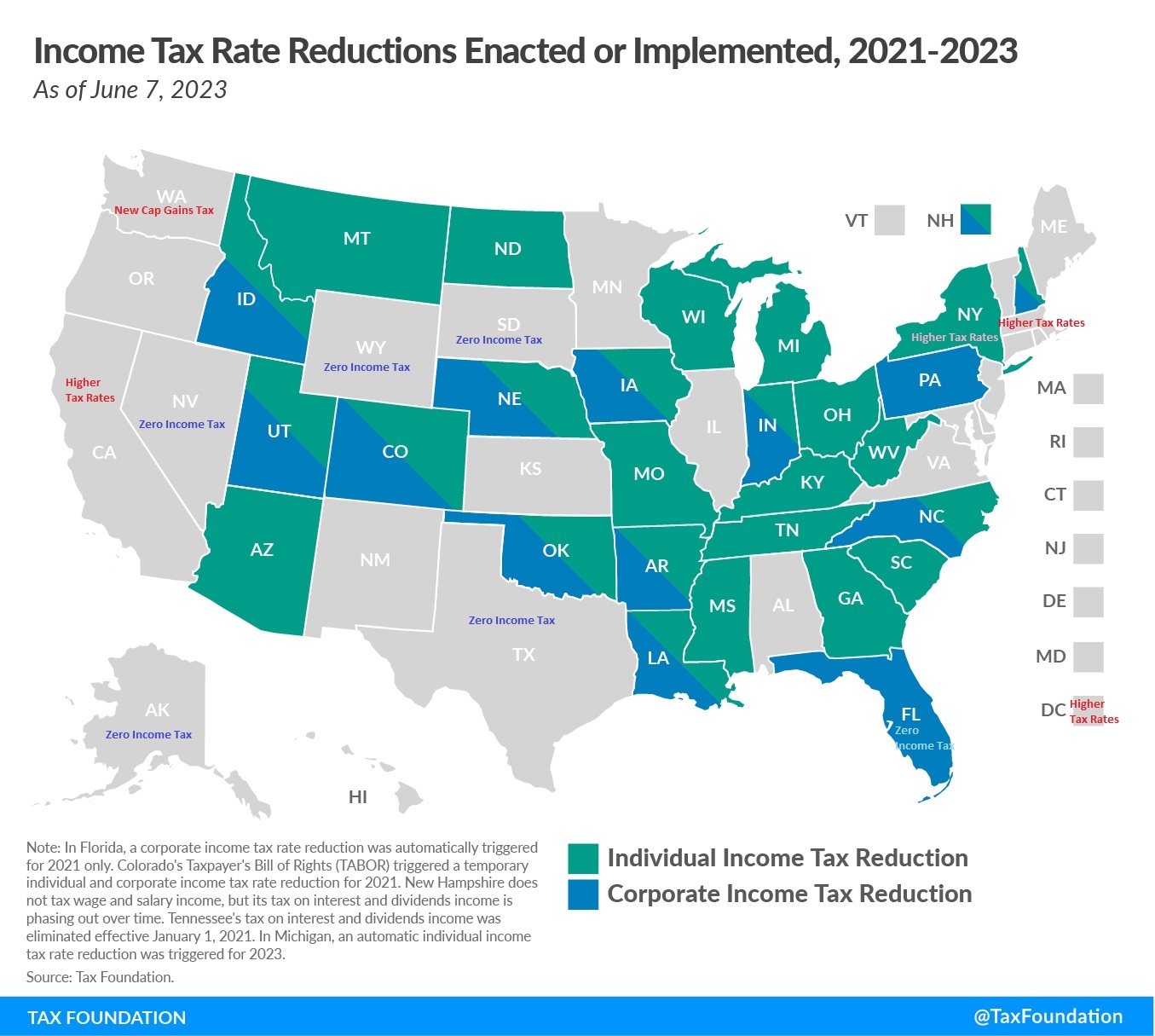

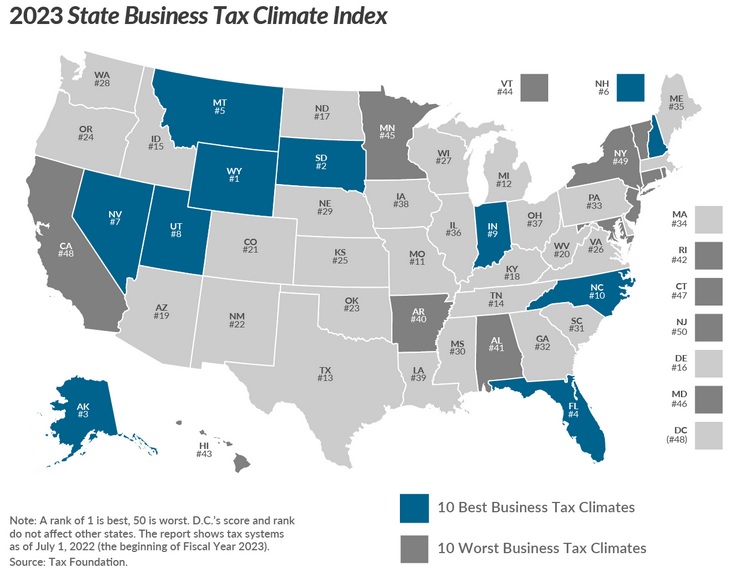

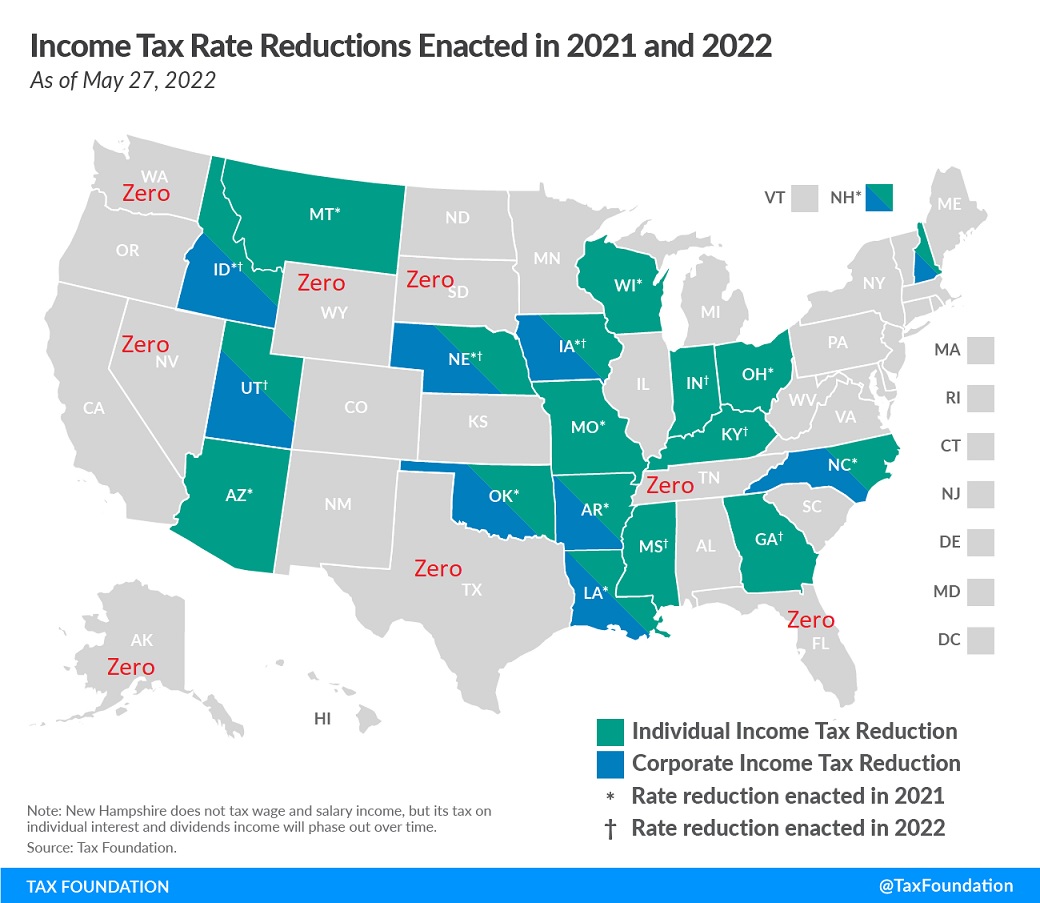

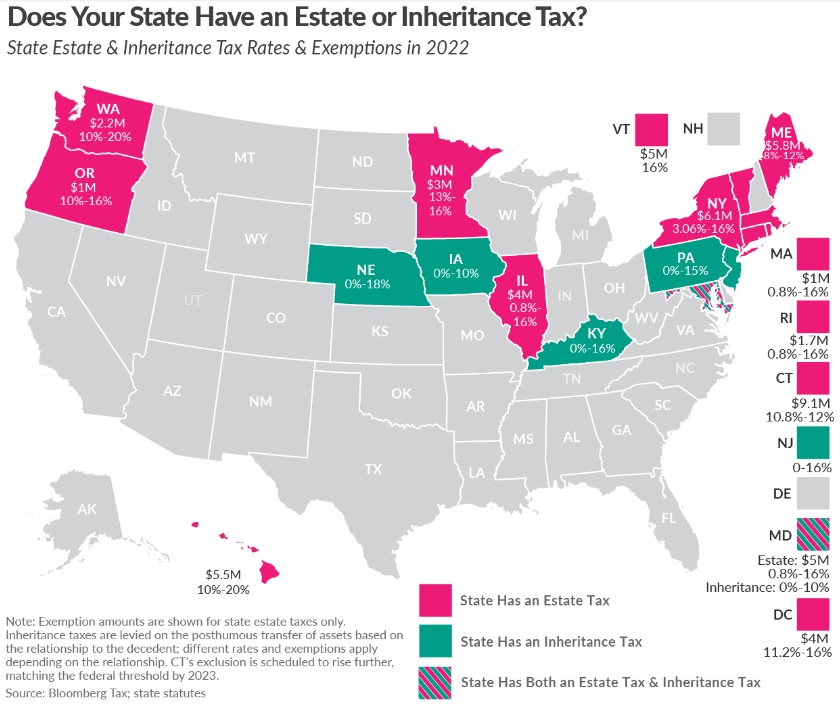

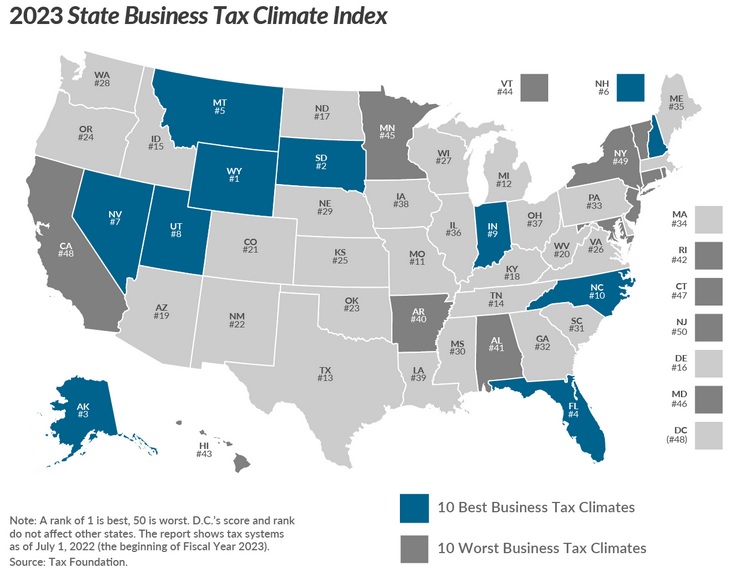

However, if we look solely at tax policy, Iowa goes from average to bad, ranking #38 according to the Tax Foundation’s State Business Tax Climate Index.

I suspect, though, that future editions will show Iowa climbing much higher. Both in the overall ratings and in the rankings for tax policy.

That’s because Iowa lawmakers are enacting big reforms. I’ve written about two of the major changes.

I’m not the only one to notice.

Here are some excerpts from a National Review column by John Hendrickson and Vance Ginn.

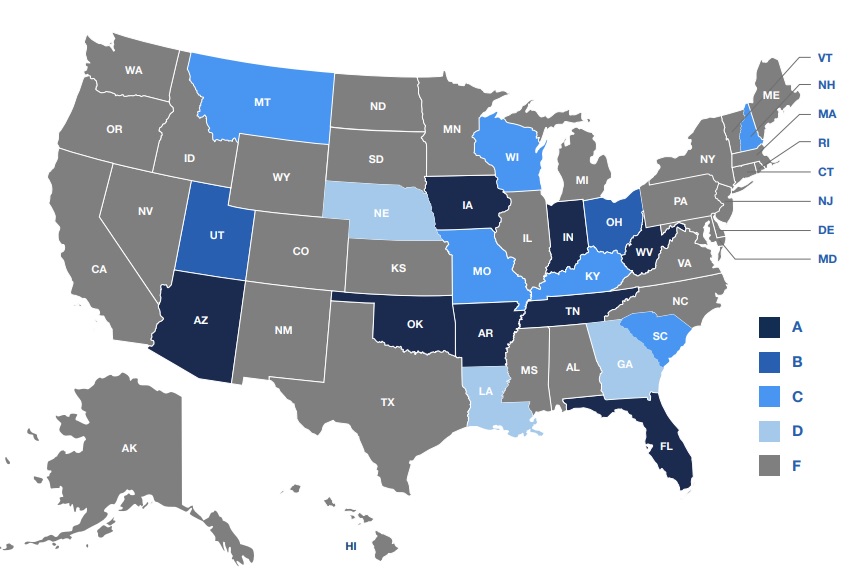

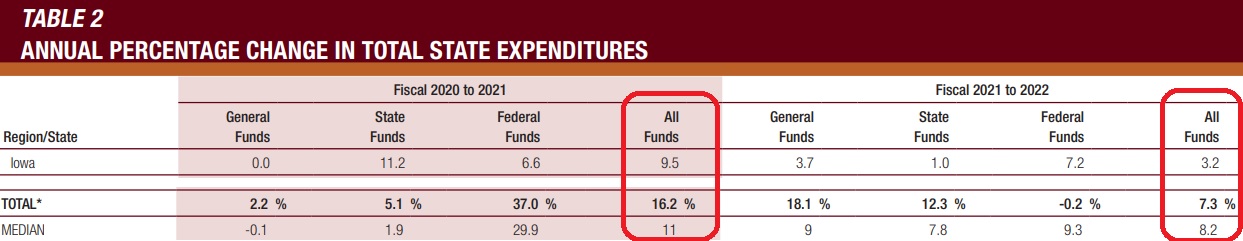

Governor Kim Reynolds has made Iowa a leader in conservative fiscal policy. This approach has already left more money in taxpayers’ pockets, and set the state on course to implement a low, flat income tax… Last year, Governor Reynolds and the Iowa legislature continued to place a priority on prudent budgeting. The $8.2 billion budget for fiscal year 2023 represented a mere 1 percent increase from the prior year.  And for FY 2024, Reynolds has proposed an $8.5 billion budget, with the extra funds meant to cover the universal school-choice plan that the legislature recently passed. …In 2022, Iowa also enacted the most comprehensive income-tax-reform package in the nation. Over four years, the nine-bracket income tax will transform into a flat income tax with a 3.9 percent rate. The corporate tax has also already been reduced from 9.8 percent to 8.4 percent, and is set to gradually shrink until it reaches a flat 5.5 percent rate. …Currently, Iowa has 37 cabinet agencies. The governor’s proposal calls for a 16-agency cabinet. She argues that government is both too big and too expensive, and streamlining it will result in more efficiency.

And for FY 2024, Reynolds has proposed an $8.5 billion budget, with the extra funds meant to cover the universal school-choice plan that the legislature recently passed. …In 2022, Iowa also enacted the most comprehensive income-tax-reform package in the nation. Over four years, the nine-bracket income tax will transform into a flat income tax with a 3.9 percent rate. The corporate tax has also already been reduced from 9.8 percent to 8.4 percent, and is set to gradually shrink until it reaches a flat 5.5 percent rate. …Currently, Iowa has 37 cabinet agencies. The governor’s proposal calls for a 16-agency cabinet. She argues that government is both too big and too expensive, and streamlining it will result in more efficiency.

The Washington Post also has noticed, though from a disapproving perspective.

Here’s some of what Annie Gowen wrote earlier this year.

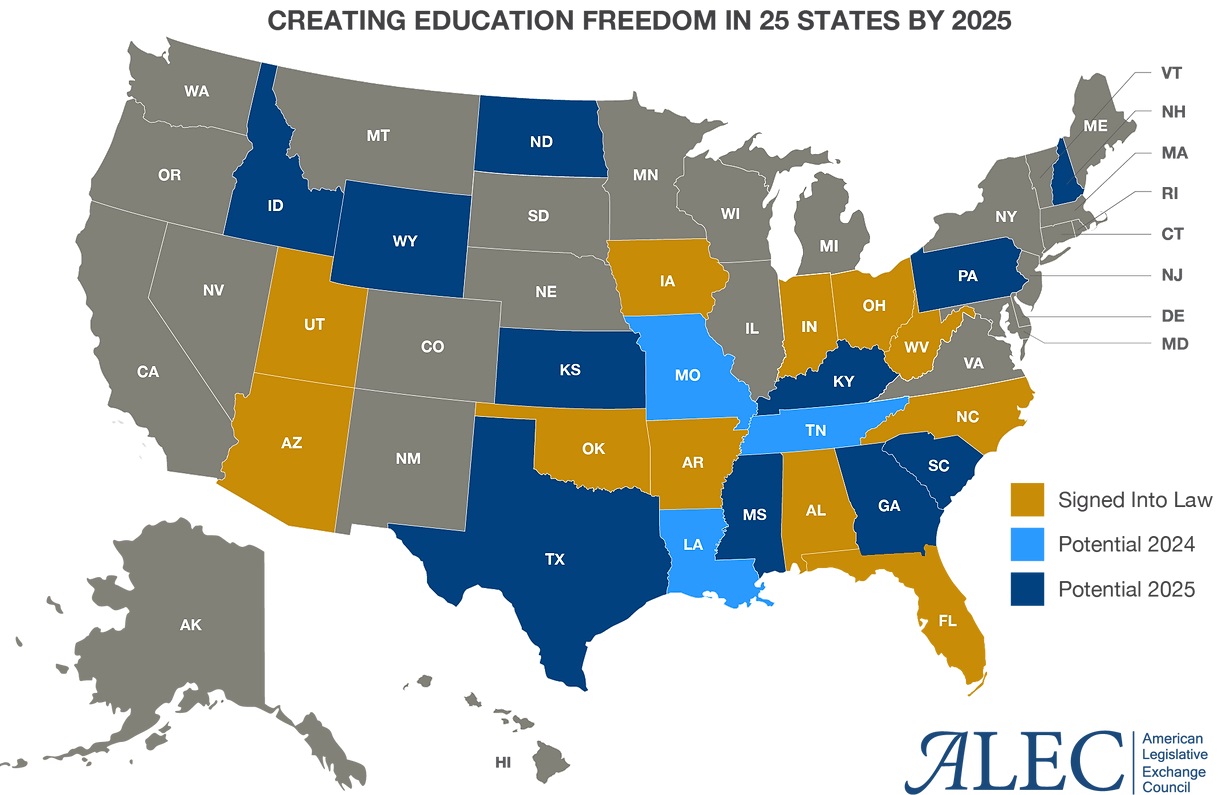

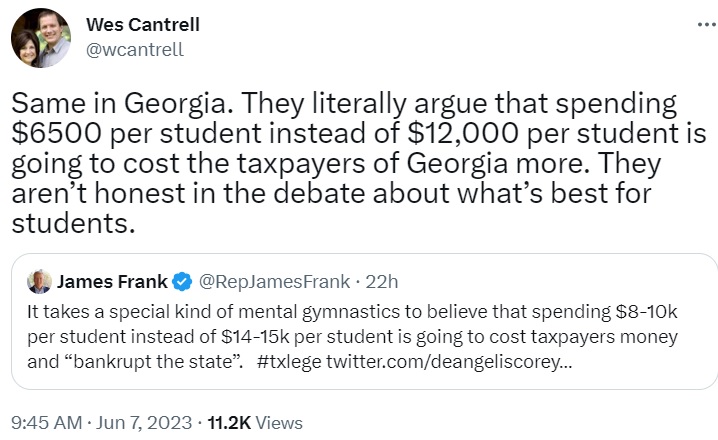

Republicans in the Iowa legislature, empowered by the state’s recent “red wave,” have embarked on an ambitious new agenda… A joke among statehouse reporters is that Iowa is becoming the “Florida of the North” — without the beaches. …With a new school-choice-friendly majority in place, an expanded version of the legislation passed easily in January. When fully implemented, it will allow all Iowa families to use taxpayer-funded “education savings accounts” for private school tuition… “the message the Democrats are using is not the message the average Iowans want to hear,” said state Rep. John H. Wills (R), who helped shepherd the governor’s school choice bill through the legislature.

…With a new school-choice-friendly majority in place, an expanded version of the legislation passed easily in January. When fully implemented, it will allow all Iowa families to use taxpayer-funded “education savings accounts” for private school tuition… “the message the Democrats are using is not the message the average Iowans want to hear,” said state Rep. John H. Wills (R), who helped shepherd the governor’s school choice bill through the legislature.

Oddly, the article does not mention the state’s tax reform or spending restraint.

Let’s close with another National Review column, this one authored by Chris Ingstad and John Hendrickson.

Here are the most relevant passages.

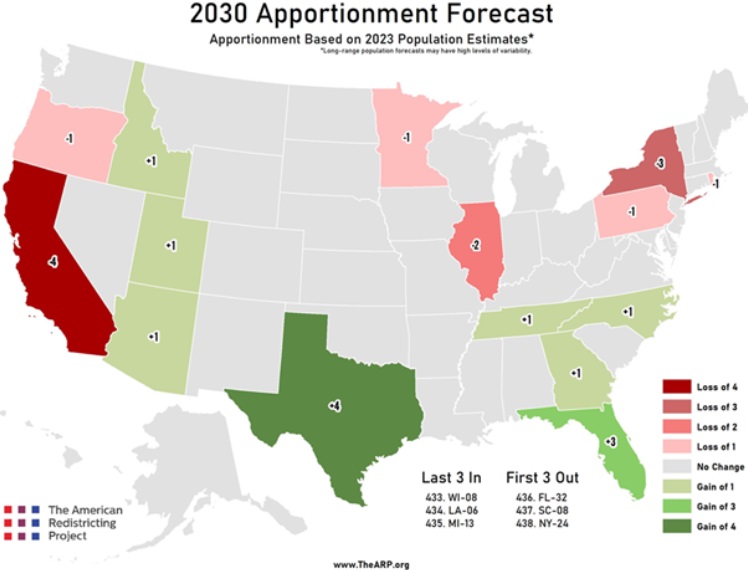

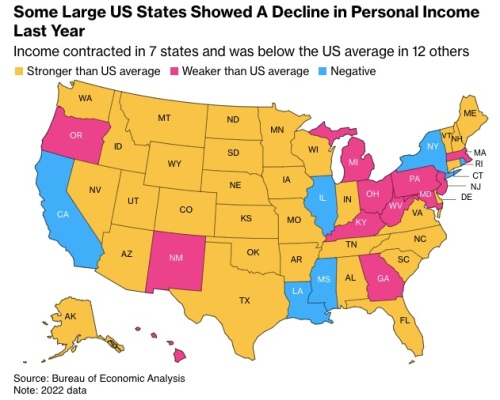

Iowa may rightfully lay claim to being the standard-bearer for conservative, state-based public policy, as no other state has matched what Reynolds and the Iowa legislature have accomplished… Under Reynolds’s leadership, Iowa enacted…universal education savings accounts (ESAs) that will be available to every Iowa student, a bill that reorganized and shrank the size of state government, multiple rounds of income-tax cuts that have reduced the top tax rate by almost 60 percent… The Iowa model demonstrates not only that federalism works, but that applying the same principles to national policy will help restore constitutional government. …These policies are actually improving lives. The impact of three rounds of income-tax cuts has provided Iowa’s largest employers with the confidence to continue hiring and expanding their operations. …For families, 2023’s landmark Students First Act created universal ESAs and is one of the most expansive school-choice policies in the nation. It already is proving to be extremely popular: Nearly 19,000 students will benefit from true educational freedom this fall, with more applications still being considered.

The Iowa model demonstrates not only that federalism works, but that applying the same principles to national policy will help restore constitutional government. …These policies are actually improving lives. The impact of three rounds of income-tax cuts has provided Iowa’s largest employers with the confidence to continue hiring and expanding their operations. …For families, 2023’s landmark Students First Act created universal ESAs and is one of the most expansive school-choice policies in the nation. It already is proving to be extremely popular: Nearly 19,000 students will benefit from true educational freedom this fall, with more applications still being considered.

In addition to highlighting good reforms in Iowa, Ingstad and Hendrickson also use the opportunity to promote federalism.

The United States may not have the same degree of decentralization as Switzerland, but states still have some ability to control their own economic destiny by limiting the burden of government.

Iowas has taken advantage of that ability.

P.S. Even the left-leaning OECD acknowledges that federalism produces good outcomes.

P.P.S. I’ve previously cited North Carolina as an example of a state that has engaged in bold reform.

Read Full Post »

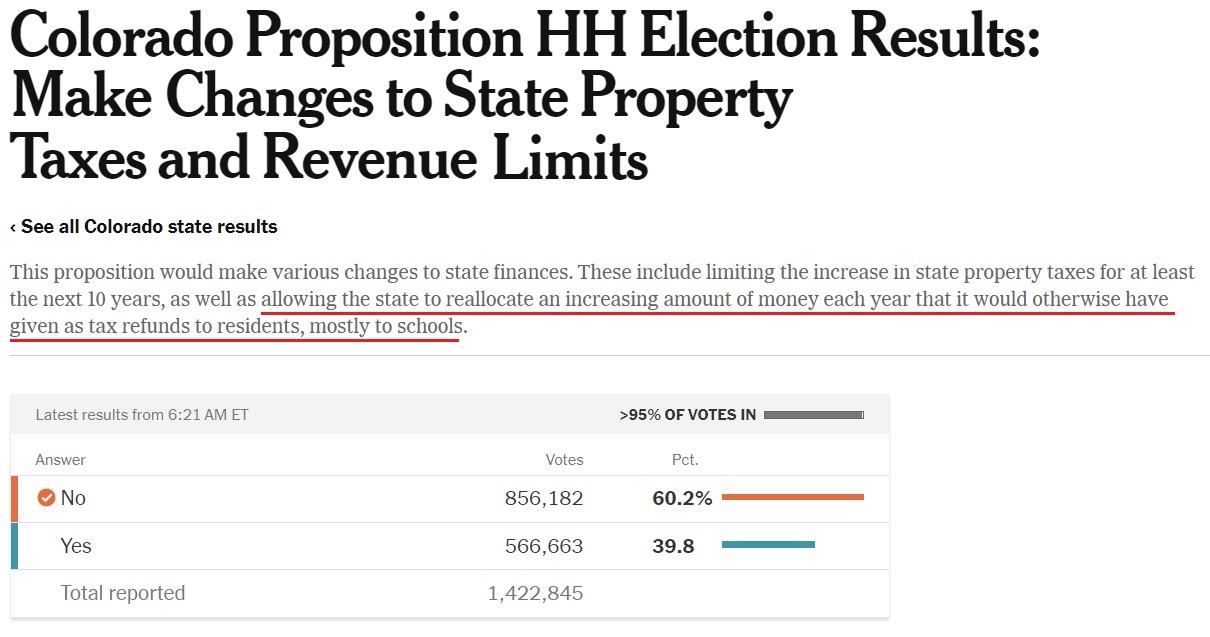

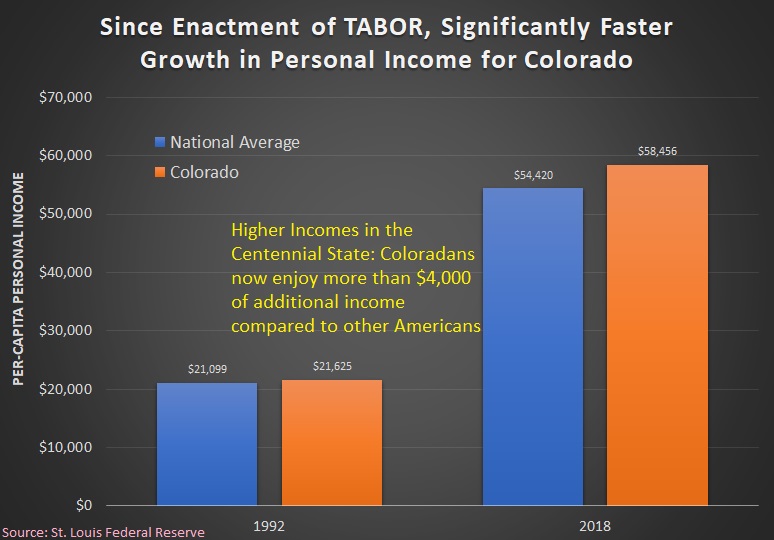

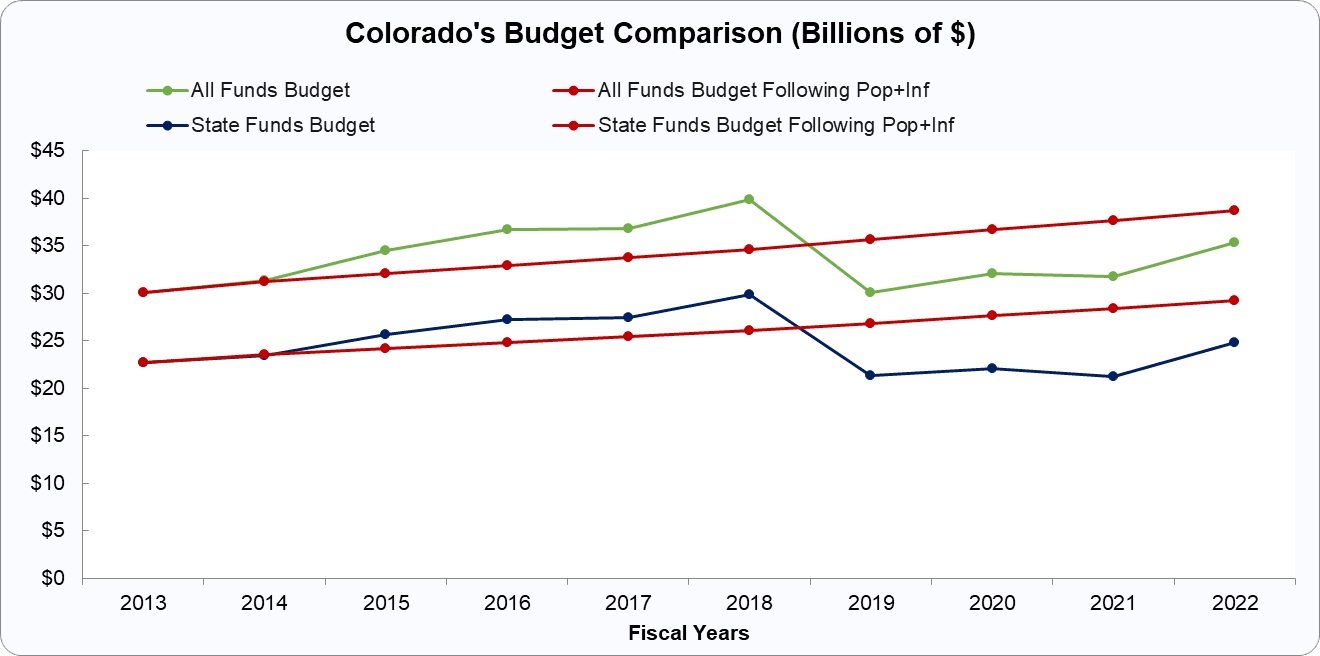

Does Colorado’s spending cap work perfectly? Of course not.

Does Colorado’s spending cap work perfectly? Of course not.can only increase by 5.8% this budget year rather than the 6.1% legislative forecasters were expecting. Two, the state is now expected to collect $185 million more in road usage fees and retail delivery charges this year than last, under the legislative staff estimates. Taken together, the two forecast changes mean state lawmakers could have to issue larger than expected TABOR refunds to Coloradans next year, leaving the state with fewer General Fund tax dollars to spend… That would translate to a nearly $400 refund for the average single-filer in 2025 under the current refund formula, which is tiered based on income.