I’ve shared three reasons why Biden’s tax plan is misguided (the tax code is biased against rich taxpayers, the tax hike would have Laffer-Curve implications, and it would saddle America with the world’s highest corporate tax burden).

For Part IV of the series, let’s explain why every piece of his plan will backfire.

There are three main arguments for higher taxes, though I don’t find any of them convincing.

- Spite and envy against successful entrepreneurs, investors, innovators, and business owners.

- Bringing more money to Washington to finance a larger burden of government spending.

- Bringing more money to Washington to ostensibly lower the burden of deficits and debt.

For what it’s worth, Biden’s proposed spending increases are far larger than his proposed tax increases, so we can rule out reason #3.

So we have to ask ourselves whether reasons #1 and #2 are compelling.

So we have to ask ourselves whether reasons #1 and #2 are compelling.

And when considering those two arguments, we also should ask whether those reasons are sufficiently compelling to justify throwing millions of Americans into unemployment and reducing the nation’s competitiveness.

The answer should be a resounding no.

In a column in the Wall Street Journal from last July, Philip DeMuth elaborated on the damage that would be inflicted by Biden’s class-warfare agenda.

Mr. Biden has proposed to reinstate the Obama tax rates for top earners while simultaneously imposing an unlimited 12.4% Social Security payroll tax on earnings over $400,000. …Mr. Biden proposes to eliminate the capital gains reset to fair market value at death. For long-term holdings, much of that gain is merely inflation, created by the government’s failure to maintain price stability, so this is effectively a tax on a tax.

The remaining gains are usually from corporate earnings, which were already taxed once, when they came in the door. It will be difficult to keep your business or farm in the family if the Biden scheme forces it to be liquidated to pay the death taxes. …If a President Biden has his way, the top capital-gains tax rate will be 39.6%—the same as for ordinary income. This could be a triple whammy: cutting the estate tax exemption in half, eliminating the capital gains reset to fair market value, and then doubling the capital-gains tax rate. A small step for the government, a giant loss for the American family. …The former vice president’s ambitious spending programs would more than offset any new revenue from his tax proposals. …This isn’t a debate between growing the pie vs. redistributing the pie; it is about everyone settling for a smaller pie.

The final two sentences deserve extra attention.

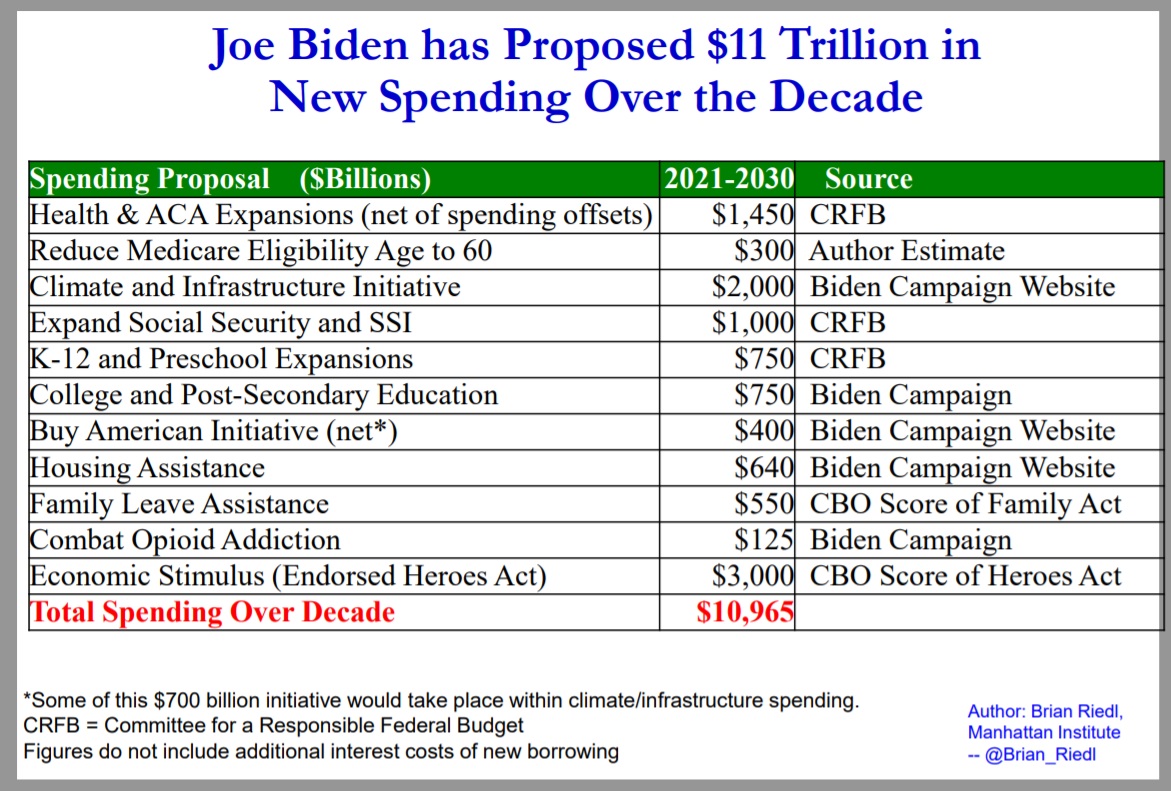

First, nobody should be deluded that tax increases will be used to reduce red ink. Yes, Biden is proposing to collect a lot more money, but he’s proposing about $2 of new spending for every $1 of projected tax revenue.

Brian Riedl’s Chartbook has the grim details on Biden’s spending agenda.

Second, the point about “growing the pie” is critically important since even a very small reduction in long-run growth will have a surprisingly large impact on household finances within a few decades.

The bottom line is that living standards in the United States are significantly higher than living standards in Europe, in large part because fiscal burdens are not as onerous in America.

Biden’s plan to make America more like France, Italy, and Greece is not a good idea.

[…] the obvious takeaway is that Biden’s class-warfare plan should never be resuscitated and that lawmakers instead should lower (or ideally eliminate) the […]

[…] the obvious takeaway is that Biden’s class-warfare plan should never be resuscitated and that lawmakers instead should lower (or ideally eliminate) the […]

[…] the obvious takeaway is that Biden’s class-warfare plan should never be resuscitated and that lawmakers instead should lower (or ideally eliminate) the […]

[…] the obvious takeaway is that Biden’s class-warfare plan should never be resuscitated and that lawmakers instead should lower (or ideally eliminate) the […]

[…] the obvious takeaway is that Biden’s class-warfare plan should never be resuscitated and that lawmakers instead should lower (or ideally eliminate) the […]

[…] tax proposals. Consider this Part VI in a series (Parts I-V can be found here, here, here, here, and here), and we’ll use data from the folks at the Tax […]

[…] tax proposals. Consider this Part VI in a series (Parts I-V can be found here, here, here, here, and here), and we’ll use data from the folks at the Tax […]

[…] 2020 and 2021, I wrote a four-part series (here, here, here, and here) about Biden’s class-warfare tax […]

[…] also is being criticized for his tax-and-spendfiscal agenda. And mocked for his assertions about red […]

[…] also is being criticized for his tax-and-spend fiscal agenda. And mocked for his assertions about red […]

[…] The obvious takeaway is that the United States should not throw away its competitive advantage. Yet another reason to reject Joe Biden’s class-warfare fiscal agenda. […]

[…] The obvious takeaway is that the United States should not throw away its competitive advantage. Yet another reason to reject Joe Biden’s class-warfare fiscal agenda. […]

[…] if you read this, this, this, and this, you already knew […]

[…] if you read this, this, this, and this, you already knew […]

[…] since Joe Biden is motivated by class warfare (see here, here, here, and here), he apparently doesn’t care about the economic […]

[…] since Joe Biden is motivated by class warfare (see here, here, here, and here), he apparently doesn’t care about the economic […]

[…] column was a completely serious look at five graphs and tables that show why Biden’s tax plan is […]

[…] I don’t rely on this comparison when debating tax policy because a clever leftist will point out that it implies anarcho-capitalism (i.e, if all taxes are […]

[…] column was a completely serious look at five graphs and tables that show why Biden’s tax plan is […]

[…] The IRS played partisan politics during the Obama years by targeting taxpayer organizations such “Tea Party” groups. Now the IRS is at it again, this time leaking the tax returns of selected rich people to advance Biden’s class-warfare agenda. […]

[…] those were the good ol’ days. Biden is proposing to divert trillions of dollars from the private sector to expand the welfare […]

[…] explained here, here, here, and here, I don’t like Biden’s class-warfare tax […]

[…] column was a completely serious look at five graphs and tables that show why Biden’s tax plan is […]

[…] The IRS played partisan politics during the Obama years by targeting taxpayer organizations such “Tea Party” groups. Now the IRS is at it again, this time leaking the tax returns of selected rich people to advance Biden’s class-warfare agenda. […]

[…] column was a completely serious look at five graphs and tables that show why Biden’s tax plan is […]

[…] those were the good ol’ days. Biden is proposing to divert trillions of dollars from the private sector to expand the welfare […]

[…] those were the good ol’ days. Biden is proposing to divert trillions of dollars from the private sector to expand the welfare […]

[…] explained here, here, here, and here, I don’t like Biden’s class-warfare tax […]

[…] those were the good ol’ days. Biden is proposing to divert trillions of dollars from the private sector to expand the welfare […]

[…] column was a completely serious look at five graphs and tables that show why Biden’s tax plan is […]

[…] wants lots of class-warfare tax increases to fund a big increase in the welfare […]

[…] The Biden Administration’s approach to tax policy is awful, as documented here, here, here, and here. […]

[…] https://danieljmitchell.wordpress.com/2021/01/21/the-case-against-bidens-class-warfare-tax-policy-pa… Biden and Pelosi’s Tax Plan Will Penalize […]

[…] column was a completely serious look at five graphs and tables that show why Biden’s tax plan is […]

[…] column was a completely serious look at five graphs and tables that show why Biden’s tax plan is […]

[…] The Biden Administration’s approach to tax policy is awful, as documented here, here, here, and here. […]

[…] those were the good ol’ days. Biden is proposing to divert trillions of dollars from the private sector to expand the welfare […]

[…] to President Biden’s destructive tax plan (which you can read about here, here, here, and here). Instead, today’s column will focus on the tax increase being considered by the city’s local […]

[…] to President Biden’s destructive tax plan (which you can read about here, here, here, and here). Instead, today’s column will focus on the tax increase being considered by the city’s […]

[…] is why it’s so depressing that Joe Biden has a radical agenda of higher tax rates and much bigger […]

[…] is why it’s so depressing that Joe Biden has a radical agenda of higher tax rates and much bigger […]

[…] No recognition of the negative consequences of higher taxes. […]

[…] Part IV, I shared data on the negative economic impactof higher taxes on productive […]

[…] those were the good ol’ days. Biden is proposing to divert trillions of dollars from the private sector to expand the welfare […]

[…] those were the good ol’ days. Biden is proposing to divert trillions of dollars from the private sector to expand the welfare […]

[…] P.S. We conducted a very successful experiment in the 1980sinvolving lower tax rates. Biden now wants to see what happens if we try the opposite approach. […]

[…] P.S. We conducted a very successful experiment in the 1980s involving lower tax rates. Biden now wants to see what happens if we try the opposite approach. […]

[…] I’m pessimistic about the direction of public policy, especially on fiscal issues such as taxes and spending. […]

[…] The IRS played partisan politics during the Obama years by targeting taxpayer organizations such “Tea Party” groups. Now the IRS is at it again, this time leaking the tax returns of selected rich people to advance Biden’s class-warfare agenda. […]

[…] The IRS played partisan politics during the Obama years by targeting taxpayer organizations such “Tea Party” groups. Now the IRS is at it again, this time leaking the tax returns of selected rich people to advance Biden’s class-warfare agenda. […]

[…] Now Biden wants to run this experiment in reverse. […]

[…] explained here, here, here, and here, I don’t like Biden’s class-warfare tax […]

[…] Part IV, I shared data on the negative economic impactof higher taxes on productive […]

[…] Part IV, I shared data on the negative economic impact of higher taxes on productive […]

[…] explained here, here, here, and here, I don’t like Biden’s class-warfare tax […]

[…] explained here, here, here, and here, I don’t like Biden’s class-warfare tax […]

[…] Now Biden wants to run this experiment in reverse. […]

[…] Now Biden wants to run this experiment in reverse. […]

[…] Now Biden wants to run this experiment in reverse. […]

[…] have a four-part series (here, here, here, and here) about the conceptual downsides of Joe Biden’s class-warfare approach to tax […]

[…] Like beauty, the interpretation of “modest” may be in the eye of the beholder, but it certainly seems like “massive” is a better description of Biden’s proposed tax hikes. […]

[…] I’m pessimistic about the direction of public policy, especially on fiscal issues such as taxes and spending. […]

[…] pessimistic about the direction of public policy, especially on fiscal issues such as taxes and […]

[…] Starting with this look at the Biden Administration’s philosophy. […]

[…] Next we have a couple of tweets from Brian Riedl of the Manhattan Institute. He correctly points out that Democrats are using just about every available class-warfare tax scheme, yet that money will only finance a fraction of their spending wish list. […]

[…] especially if Biden is able to push through his agendaof higher taxes on work, saving, and […]

[…] Next we have a couple of tweets from Brian Riedl of the Manhattan Institute. He correctly points out that Democrats are using just about every available class-warfare tax scheme, yet that money will only finance a fraction of their spending wish list. […]

[…] Next we have a couple of tweets from Brian Riedl of the Manhattan Institute. He correctly points out that Democrats are using just about every available class-warfare tax scheme, yet that money will only finance a fraction of their spending wish list. […]

[…] Next we have a couple of tweets from Brian Riedl of the Manhattan Institute. He correctly points out that Democrats are using just about every available class-warfare tax scheme, yet that money will only finance a fraction of their spending wish list. […]

[…] have a four-part series (here, here, here, and here) about the conceptual downsides of Joe Biden’s class-warfare approach to tax […]

[…] have a four-part series (here, here, here, and here) about the conceptual downsides of Joe Biden’s class-warfare approach to tax […]

[…] debate last year (where I also discussed wealth taxation, poverty reduction, and the inadvisability of tax increases), I pontificated on the negative economic impact of class-warfare […]

[…] part of a video debate last year (where I also discussed wealth taxation, poverty reduction, and the inadvisability of tax increases), I pontificated on the negative economic impact of class-warfare […]

[…] especially if Biden is able to push through his agendaof higher taxes on work, saving, and […]

[…] especially if Biden is able to push through his agendaof higher taxes on work, saving, and […]

[…] especially if Biden is able to push through his agenda of higher taxes on work, saving, and […]

[…] obvious takeaway is that the study shows that Biden’s class-warfare tax agenda will be bad for American competitiveness and American […]

[…] And Walter’s analysis also applies to Joe Biden’s proposed tax increases. […]

[…] And Walter’s analysis also applies to Joe Biden’s proposed tax increases. […]

[…] And Walter’s analysis also applies to Joe Biden’s proposed tax increases. […]

[…] The Case Against Biden’s Class-Warfare Tax Policy, Part IV […]

Arguments that do “the last ten times they tried this” work better than “X would Y.” Visit any looter website, godly or pagan, and everything is couched in terms of “X would Y,” or “They plan to enslave US.”

Reblogged this on boudica.us.