There are lots of reasons (here are five of them) to dislike the version of the Biden tax hike that was approved by the tax-writing committee in the House of Representatives.

From an economic perspective, it is bad for prosperity to penalize work, saving, investment, and productivity.

So why, then, do politicians pursue such policies?

Part of the answer is spite, but I think the biggest reason is they simply want more money to spend.

And if the economy suffers, they don’t worry about that collateral damage so long as their primary objective – getting more money to buy more votes – is achieved.

But the rest of us should care, and a new report from the Tax Foundation offers a helpful way of showing why pro-tax politicians are misguided.

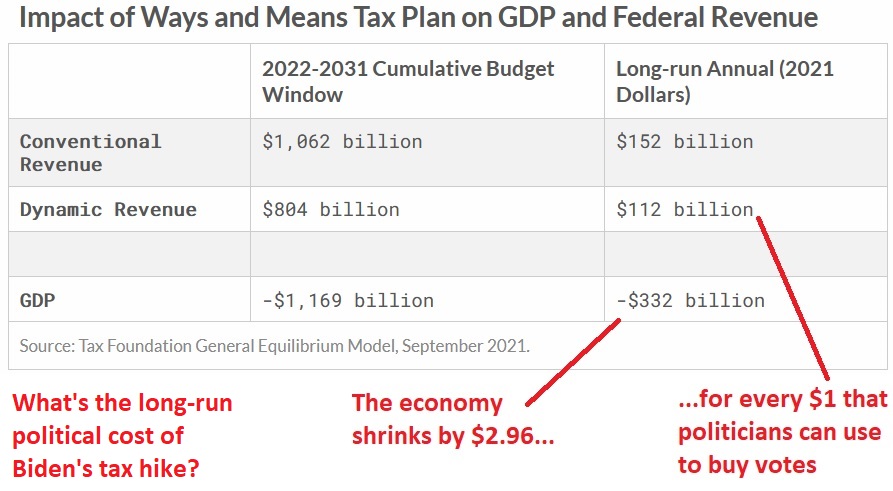

Here’s a table showing that the economy will lose almost $3 of output for every $1 that politicians can use for vote buying.

I added my commentary (in red) to the table.

My takeaway is that it is reprehensible for politicians to cause nearly $3 of foregone prosperity so that they can spend another $1.

Garrett Watson, author of the report, uses more sedate language to describes the findings.

Using Tax Foundation’s General Equilibrium Model, we estimate that the Ways and Means tax plan would reduce long-run GDP by 0.98 percent, which in today’s dollars amounts to about $332 billion of lost output annually.

We estimate the plan would in the long run raise about $152 billion annually in new tax revenue, conventionally estimated in today’s dollars, meaning for every $1 in revenue raised, economic output would fall by $2.18. When the model accounts for the smaller economy, it estimates that the plan’s dynamic effects would reduce expected new tax collections to about $112 billion annually over the long run (also in today’s dollars), meaning for every $1 in revenue raised, economic output would fall by $2.96.

This is excellent analysis.

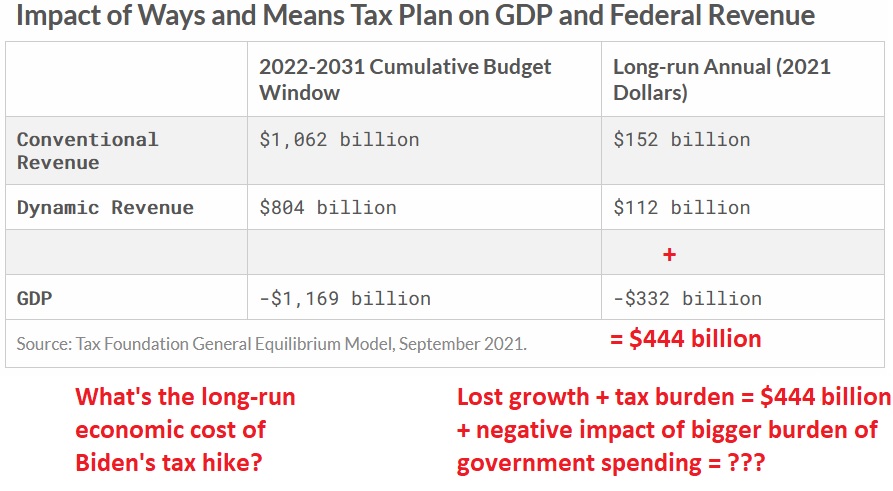

But I think it’s important to specify that political cost-benefit analysis (from the perspective of politicians) is not the same as economic cost-benefit analysis.

From an economic perspective, the foregone economic growth is a cost and the additional tax revenue for politicians also is a cost.

And I’ve augmented the table (again, in red) to show that the additional spending is yet another cost.

In other words, politicians are the main winners from Biden’s tax hike, and some of the interest groups getting additional handouts also might be winners (though I’ve previously pointed out that many of them wind up being losers as well in the long run).

P.S. The Tax Foundation model only measures the economic damage of higher taxes. If you also measure the harmful impact of more spending, the estimates of foregone economic output are much bigger.

[…] who oppose entitlement reform necessarily are embracing huge tax increases and perpetual economic stagnation. Not to mention handing more power to […]

[…] who oppose entitlement reform necessarily are embracing huge tax increases and perpetual economic stagnation. Not to mention handing more power to […]

[…] close with the sad observation that America’s progress will be reversed if Biden’s class-warfare tax plan is enacted. Earlier this year, the Tax Foundation estimated that the President’s plan […]

[…] close with the sad observation that America’s progress will be reversed if Biden’s class-warfare tax plan is enacted. Earlier this year, the Tax Foundation estimated that the President’s plan […]

[…] research is that it would be bad for the economy (and bad for both rich people and poor people) if Joe Biden’s class-warfare tax policy was […]

[…] research is that it would be bad for the economy (and bad for both rich people and poor people) if Joe Biden’s class-warfare tax policy was […]

[…] Biden is pushing for a massive tax increase, for instance, but his proposed spending increase is far […]

[…] Biden is pushing for a massive tax increase, for instance, but his proposed spending increase is far […]

[…] bad on the issues where Trump was good (most notably, […]

[…] bad on the issues where Trump was good (most notably, […]

[…] The anti-growth effect of higher tax rates on work, entrepreneurship, saving, and investment. […]

[…] There is relentless pressure to increase tax rates. […]

[…] the only thing I’m uncertain about is whether I should be more upset about his class-warfare tax agenda or his proposals to expand the burden of government […]

[…] still a significant risk that this economy-sapping plan will get enacted, resulting in big tax increases and a larger burden of government […]

[…] meant that he had a mandate for a radical expansion of the welfare state, accompanied by a plethora of class-warfare tax increases. Fortunately, Congress did not approve Biden’s growth-sapping […]

[…] incumbent meant that he had a mandate for a radical expansion of the welfare state, accompanied by a plethora of class-warfare tax increases. Fortunately, Congress did not approve Biden’s growth-sapping […]

[…] The anti-growth effect of higher tax rates on work, entrepreneurship, saving, and investment. […]

[…] comparison, Biden’s tax plan in the U.S. is awful, but he’s “only” proposing a 4-percent increase in the tax burden (about 1 […]

[…] The anti-growth effect of higher tax rates on work, entrepreneurship, saving, and investment. […]

[…] anti-growth effect of higher tax rates on work, entrepreneurship, saving, and […]

[…] Biden’s fiscal agenda of higher taxes and bigger government is not a recipe for […]

[…] the best result is for Biden’s entire agenda to implode. That would be a win for American taxpayers, a win for the American economy, and a win for long-suffering residents of blue […]

[…] the best result is for Biden’s entire agenda to implode. That would be a win for American taxpayers, a win for the American economy, and a win for long-suffering residents of blue […]

[…] Biden’s fiscal agenda of higher taxes and bigger government is not a recipe for […]

[…] Biden economic agenda can be summarized as follows: As much spending as possible, financed by as much taxation as possible, using lots of dishonest budget gimmicks to glue the pieces […]

[…] Biden economic agenda can be summarized as follows: As much spending as possible, financed by as much taxation as possible, using lots of dishonest budget gimmicks to glue the pieces […]

[…] Biden economic agenda can be summarized as follows: As much spending as possible, financed by as much taxation as possible, using lots of dishonest budget gimmicks to glue the pieces […]

[…] close with the sad observation that America’s progress will be reversed if Biden’s class-warfare tax plan is enacted. Earlier this year, the Tax Foundation estimated that the President’s plan […]

[…] close with the sad observation that America’s progress will be reversed if Biden’s class-warfare tax plan is enacted. Earlier this year, the Tax Foundation estimated that the President’s plan would […]

[…] Biden’s fiscal agenda of higher taxes and bigger government is not a recipe for […]

[…] Biden’s fiscal agenda of higher taxes and bigger government is not a recipe for […]

[…] Biden’s Tax Hike: The Political Calculus and Economic Cost […]

[…] Biden’s Tax Hike: The Political Calculus and Economic Cost […]

Stupidity…..the product of public school teachers, and college elites.