As illustrated by this video tutorial, I’m a big advocate of the Laffer Curve.

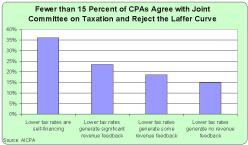

I very much want to help policy makers understand (especially at the Joint Committee on Taxation) that there’s not a linear relationship between tax rates and tax revenue. In other words, you don’t double tax revenue by doubling tax rates.

Having worked on this issue for decades, I can state with great confidence that there are two groups that make my job difficult.

- The folks who don’t like pro-growth tax policy and thus claim that changes in tax policy have no impact on the economy.

- The folks who do like pro-growth tax policy and thus claim that every tax cut will “pay for itself” because of faster growth.

Which was my message in this clip from a recent interview.

For all intents and purposes, I’m Goldilocks in the debate over the Laffer Curve. Except instead of stating that the porridge is too hot or too cold, my message is that it is that changes in tax policy generally lead to more taxable income, but the growth in income is usually not enough to offset the impact of lower tax rates.

In other words, some revenue feedback but not 100 percent revenue feedback.

In other words, some revenue feedback but not 100 percent revenue feedback.

Yes, some tax cuts do pay for themselves. But they tend to be tax cuts on people (such as investors and entrepreneurs) who have a lot of control over the timing, level, and composition of their income.

And, as I said in the interview, I think the lower corporate tax rate will have substantial supply-side effects (see here and here for evidence). This is because a business can make big changes in response to a new tax law, whereas people like you and me don’t have the same flexibility.

But I don’t want this column to be nothing but theory, so here’s a news report from Estonia on the Laffer Curve in action.

After Estonia raised its alcohol excise tax rates considerably in 2017, Estonian daily Postimees has estimated that the target of the

money the alcohol excise tax would bring into state coffers could have been missed by at least EUR 40 million. …Initially, in the state budget of 2017, the ministry had been planned that proceeds from the alcohol excise tax would bring EUR 276.4 million, but last summer, it cut the forecast to EUR 237.5 million.

I guess I’ll make this story Part VII in my collection of examples designed to educate my friends on the left (here’s Part I, Part II, Part III, Part IV, Part V, and Part VI).

But there’s a much more important point I want to make.

The fact that most tax increases produce more revenue is definitely not an argument in favor of higher tax rates.

That argument is wrong in part because government already is far too large. But it’s also wrong because we should consider the health and vitality of the private sector. Here’s some of what I wrote about some academic research in 2012.

…this study implies that the government would reduce private-sector taxable income by about $20 for every $1 of new tax revenue.

Does that seem like good public policy? Ask yourself what sort of politicians are willing to destroy so much private sector output to get their greedy paws on a bit more revenue. What about capital taxation? According to the second chart, the government could increase the tax rate from about 40 percent to 70 percent before getting to the revenue-maximizing point. But that 75 percent increase in the tax rate wouldn’t generate much tax revenue, not even a 10 percent increase. So the question then becomes whether it’s good public policy to destroy a large amount of private output in exchange for a small increase in tax revenue. Once again, the loss of taxable income to the private sector would dwarf the new revenue for the political class.

The bottom line is that I don’t think it’s a good trade to reduce the private sector by any amount simply to generate more money for politicians.

P.S. I’m also Goldilocks when considering the Rahn Curve.

P.P.S. For what it’s worth, Paul Krugman (sort of) agrees with me about the Laffer Curve.

[…] the main takeaway when you look at real-world incentives and real-world […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] of this should be controversial. Even Paul Krugman agrees that the Laffer Curve […]

[…] of this should be controversial. Even Paul Krugman agrees that the Laffer Curve […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] all these varieties, no wonder so many people, both right and left, sometimes misstate its […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for […]

[…] should have shown the students this one-minute video clip of me pointing out that it’s only in rare circumstances that a tax cut generates enough […]

[…] there’s no question that there’s a lot of “revenue feedback” when tax rates are […]

[…] is that we have too much input from the masses and he even put together his own version of the Laffer Curve to show that we would get better outcomes with less […]

[…] By contrast, it’s difficult to generate more revenue from the personal income tax because of the Laffer Curve. […]

[…] tax increases will actually collect $5 trillion of revenue (which won’t happen because of the Laffer Curve) and that GDP won’t be adversely affected (which isn’t true because there will be much […]

[…] authors focus on Laffer-Curve effects and argue that higher tax rates can backfire. I’m sympathetic to that argument, but I’m far […]

[…] an enormous list of goodies they want to dispense, yet their proposed tax hikes (even assuming no Laffer Curve) would only pay for a fraction of their […]

[…] the way, they openly admit that there are Laffer Curve effects because their proposed levy will reduce taxable […]

[…] they may have fixed the problem because they got on the wrong side of the Laffer Curve (i.e., tax revenue was falling), not because of a philosophical preference for lower tax […]

[…] finance and explained issues such as marginal tax rates, double taxation, the Rahn Curve, the Laffer Curve, and the fiscal implications of demographic […]

[…] While I think there’s very strong evidence that lower tax rates can increase revenue, I also think it doesn’t happen very often. […]

[…] commentary from a libertarian […]

[…] also issues where I wish my friends on the right had more insight. For instance, I would like them to understand that tax cuts very rarely pay for themselves. I wish they realized that spending caps are far […]

[…] also issues where I wish my friends on the right had more insight. For instance, I would like them to understand that tax cuts very rarely pay for themselves. I wish they realized that spending caps are far […]

[…] since I’m a big fan of sensible tax policy and the Laffer Curve, we’re going to share Mark’s new chart looking at the inverse relationship between the […]

[…] all depends on how sensitive various taxpayers are to changes in tax […]

[…] noted, these taxes wouldn’t come close to financing the leftist wish list even if one makes absurd assumptions that behavior doesn’t change and the economy is […]

[…] I’m a fan of the Laffer Curve, I think this argument is very reasonable in […]

[…] try to remind people that deadweight loss also represents foregone taxable activity, which is why the Laffer Curve is a very real thing (as even Paul Krugman […]

[…] the chart on the left shows the revenue impact declining over time, presumably because of the Laffer Curve (further confirming that tax hikes are bad even if they generate some […]

[…] the chart on the left shows the revenue impact declining over time, presumably because of the Laffer Curve (further confirming that tax hikes are bad even if they generate some […]

Estonian exanple is very important, as they are one of the least corrupted but also alcohol sector of the market is quite important and the country can lose in many other revenues in other sectors too.

A key aspect in any discussion of the Laffer Curve is time.

The immediate effect on the size of the tax base is zero. However, over time people will adjust their efforts. If taxes are increased, people will eventually seek other avenues for their investment dollar, or they might hide gains. The same is true, if taxes are reduced or eliminated. Initially no impact, but additional growth and compounding over time will make new efforts significant.

This is not true with taxes on investment, since investments are valued by their expected future value. If you have a 20% tax on dividends and capital gain, and you eliminate that tax, investments immediately jump 25% or more. If you raise the tax to 50%, stock prices crater (-37.5%) and your 50% capital gains tax nets very little. Profits will suffer over the long term, so prices may dip further, as people hesitate to reinvest, in aging capital goods.