Even though my 2020 prediction for the presidential race was much more accurate than my 2016 prediction, I’m definitely a policy wonk rather than a political pundit.

That being said, I’m very interested in elections because voting patterns eventually can translate into policy changes.

And some of the voting patterns from Tuesday were rather surprising. For instance, I was shocked at the data that compared 2016 exit poll data with 2020 exit poll data and found that Trump got more votes in 2020 from every group other than white men.

And I was also shocked to learn that Trump did a much better job of attracting non-white votes than any other Republican candidate in recent history.

https://twitter.com/adrian_gray/status/1324012494751485952

My pro-Trump friends tell me that this is evidence that a Trumpian approach is capable of attracting new voters, particularly minorities. Indeed, they tell me that Trumpism should be the model for all the politicians who may think about going for the Republican nomination in 2024.

So, as part of my post-election analysis (see here, here, here, and here), let’s explore whether the GOP will be (or should) a Trump party.

We’ll start with an article that Sean Trende authored for Real Clear Politics.

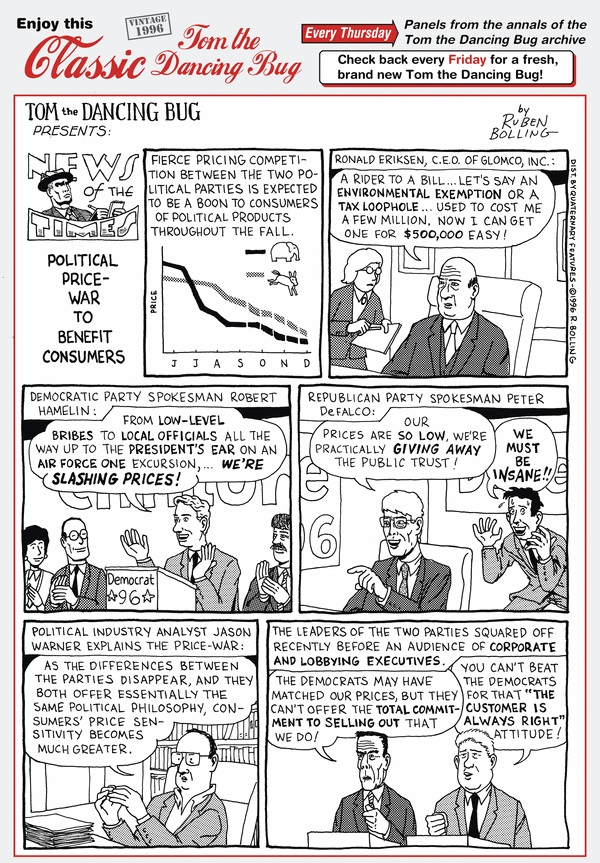

The Democratic playbook against Republicans had remained more or less the same since 1992. You could portray the GOP candidate as someone who wanted to gut Medicare and Social Security. Or, you could portray him as a closet theocrat. …Every major GOP candidate was vulnerable to at least one of these attacks, and usually both. As for Trump?  Neither of those attacks landed. He famously opposed entitlement reform, and ran as a big-spending Republican. And the closet theocrat charge? Needless to say, that mantle is hard to hang on Trump. …there’s no going back for Republicans. …it is a “NeverTrump” delusion that the old GOP coalition is going to be resurrected. The political demand isn’t there, and whomever is nominated in 2024 will likely have an agenda that more closely resembles Trump’s than Mitt Romney’s. …The successful Republican candidates over the past 50 years have all had a cultural connection to what some jokingly call ’Murica. …Reagan spoke the language of Middle America. To be sure, Donald Trump’s vulgarity contrasts sharply with Reagan’s class, and that has limited his opportunities for political success substantially, but he nevertheless connects with a group of voters.

Neither of those attacks landed. He famously opposed entitlement reform, and ran as a big-spending Republican. And the closet theocrat charge? Needless to say, that mantle is hard to hang on Trump. …there’s no going back for Republicans. …it is a “NeverTrump” delusion that the old GOP coalition is going to be resurrected. The political demand isn’t there, and whomever is nominated in 2024 will likely have an agenda that more closely resembles Trump’s than Mitt Romney’s. …The successful Republican candidates over the past 50 years have all had a cultural connection to what some jokingly call ’Murica. …Reagan spoke the language of Middle America. To be sure, Donald Trump’s vulgarity contrasts sharply with Reagan’s class, and that has limited his opportunities for political success substantially, but he nevertheless connects with a group of voters.

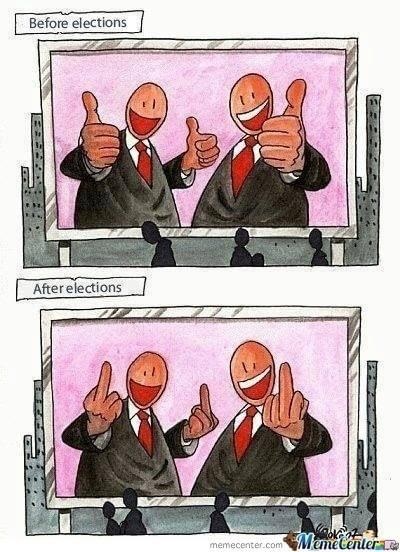

Elaina Plott, in a piece for the New York Times, explains that the GOP is now a Trumpist party, even if that simply means being more willing to fight.

…for all the attention paid to what Trump represents in American politics, the most salient feature of his ascent within the Republican Party might be what he doesn’t represent. When Ronald Reagan overthrew the old order of the Republican Party in the 1980 election, he did so as the figurehead of a conservative movement… Trump’s takeover, by contrast, has been as one-dimensional as it has been total. In the space of one term, the president has co-opted virtually every power center in the Republican Party… But though he has disassembled much of the old order, he has built very little in its place. …That this is no longer Paul Ryan’s party is clear. What Trump has turned it into, though, is less so. …“The party right now is just Trump, right?” said one senior Senate G.O.P. aide. “So when you take him out of it, what do we have left?” …The difficulty with engineering a new paradigm that builds on Trump’s 2016 win is that the president himself is not especially committed to it. …the one thing that truly unified the Republican base in its support of Trump was a belief that he was a “fighter.” …the Republican base today is willing to bend more on policy in service of what it believes to be a more existential war.

In the space of one term, the president has co-opted virtually every power center in the Republican Party… But though he has disassembled much of the old order, he has built very little in its place. …That this is no longer Paul Ryan’s party is clear. What Trump has turned it into, though, is less so. …“The party right now is just Trump, right?” said one senior Senate G.O.P. aide. “So when you take him out of it, what do we have left?” …The difficulty with engineering a new paradigm that builds on Trump’s 2016 win is that the president himself is not especially committed to it. …the one thing that truly unified the Republican base in its support of Trump was a belief that he was a “fighter.” …the Republican base today is willing to bend more on policy in service of what it believes to be a more existential war.

Interestingly, even ardent anti-Trumpers seem to think Trump-style politics will outlast Trump.

In a column for the Chicago Tribune, Eric Zorn frets that post-Trump Trumpism will be very effective.

Trumpism — an unapologetically coarse, swaggering and nasty brand of politics — has been vindicated. Forget competence. Forget dignity. Forget class. Even forget policy (remember Trump’s health care plan that was always just two weeks away from unveiling?). Tribalism is king. Fear clobbers hope. Truth is optional. Character doesn’t count. The guardrails are down.  …The GOP looks likely to hold the Senate, which means Republicans can put a brick on any legislation a President Joe Biden would want to pass. Trump has already given the GOP three U.S. Supreme Court justices and conservative control of the judicial branch of government for at least a generation… a Democratic President Biden, flailing impotently against a recalcitrant Republican Senate, would likely boost the GOP’s fortunes in the 2022 midterms and position the party well for the presidential race two years later. With Trump and his family safely on the sidelines, Republicans could nominate a candidate who inspires their base with shameless bluster and schoolyard insults, but who actually knows a thing or two about governing. Trumpism without Trump. An even more frightening thought in some ways than Trumpism with Trump.

…The GOP looks likely to hold the Senate, which means Republicans can put a brick on any legislation a President Joe Biden would want to pass. Trump has already given the GOP three U.S. Supreme Court justices and conservative control of the judicial branch of government for at least a generation… a Democratic President Biden, flailing impotently against a recalcitrant Republican Senate, would likely boost the GOP’s fortunes in the 2022 midterms and position the party well for the presidential race two years later. With Trump and his family safely on the sidelines, Republicans could nominate a candidate who inspires their base with shameless bluster and schoolyard insults, but who actually knows a thing or two about governing. Trumpism without Trump. An even more frightening thought in some ways than Trumpism with Trump.

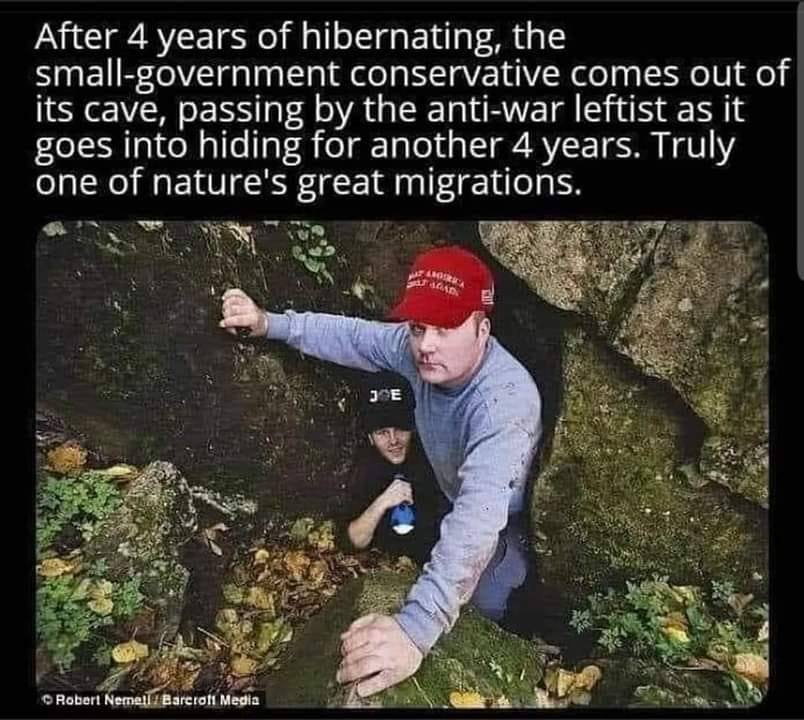

Meanwhile, Jonathan Last of the never-Trumper Bulwark writes that there will be a battle for the GOP’s soul and that the Trumpists will prevail.

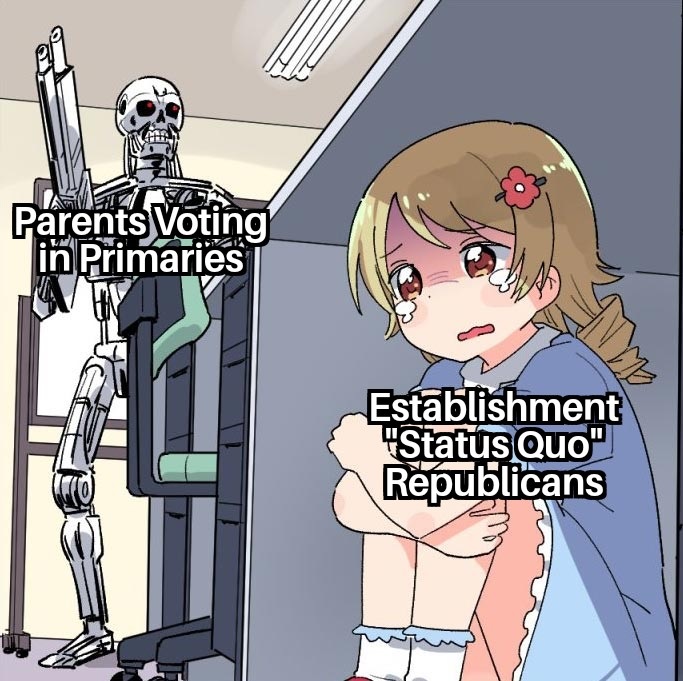

If Donald Trump loses, there is going to be a civil war inside the Republican party and the conservative movement. On one side will be the Trumpists, who believe all of white nationalism and authoritarian stuff. On the other side will be the Vichycons, who never liked Trump, but who went along with Trumpism because they were partisans… Here is how the civil war will play out. …After the inauguration, all three of these groups will join together to oppose anything and everything the Biden administration does and it will look like comity. …Once it becomes clear that Trump plans on being the one to choose the 2024 nominee, he’ll have a large base of support and the Republican party will be faced with the same decision matrix it had in mid-2016. …if Republican primary voters want more Trumpism, then the Republican party will continue down this path, no matter what the Vichycons say. The Vichycons will have the magazines and op-ed pages, and a handful of elected Republicans. The Trumpists will have an active former president of the United States, his family, Fox, …and a floor of probably 30 million voters. I know which side I would bet on.

Here is how the civil war will play out. …After the inauguration, all three of these groups will join together to oppose anything and everything the Biden administration does and it will look like comity. …Once it becomes clear that Trump plans on being the one to choose the 2024 nominee, he’ll have a large base of support and the Republican party will be faced with the same decision matrix it had in mid-2016. …if Republican primary voters want more Trumpism, then the Republican party will continue down this path, no matter what the Vichycons say. The Vichycons will have the magazines and op-ed pages, and a handful of elected Republicans. The Trumpists will have an active former president of the United States, his family, Fox, …and a floor of probably 30 million voters. I know which side I would bet on.

Last but not least, in a must-read article for New Yorker, Nicholas Lemann writes about how Trump won in 2016, how he governed, and what will happen after he leaves.

…is there a future in Trumpism? …An ambitious Republican can’t ignore Trumpism. …But is it possible to address it without opening a Pandora’s box of virulent rage and racism? …The Republican Party has long had a significant nativist, isolationist element. In the Party’s collective memory, this faction was kept in check by “fusionism,” a grand entente between this element and the Party’s business establishment. …Trump…didn’t talk about the need for limited government or for balancing the federal budget. …He didn’t extoll free trade. He didn’t court the Koch brothers. He did not sign the no-new-tax pledge… Trump was opposed by more officials in his own Party (the Never Trumpers of their title) than any Presidential nominee in recent American history. …Trump’s key insight in 2016 was that the Republican establishment could be ignored, and his primary campaign pitched only to the Republican base, which no longer believed in the free-market gospel, if it ever had. …the difference between Trump as a candidate and Trump as the President goes back to fusionism. …appointees without previous connections to Trump but with deep connections to the Party’s libertarian wing have put in place an enhanced version of the standard Republican program. The result has been an odd mix of traditional Republican policies and Trumpian rhetorical flourishes. …As Trump has outsourced economic policy to the establishment, he has outsourced social policy to the evangelicals. …Steven Hayward, a well-connected conservative who has written the two-volume history “The Age of Reagan,” told me, “The biggest surprise about Trump is that he has turned out to govern as a conservative. …That raises the question of where the Republican Party will go after he leaves office. …there are three competing predictions about the future of the Party over the coming years. Let’s call them the Remnant, Restoration, and Reversal scenarios.

He didn’t court the Koch brothers. He did not sign the no-new-tax pledge… Trump was opposed by more officials in his own Party (the Never Trumpers of their title) than any Presidential nominee in recent American history. …Trump’s key insight in 2016 was that the Republican establishment could be ignored, and his primary campaign pitched only to the Republican base, which no longer believed in the free-market gospel, if it ever had. …the difference between Trump as a candidate and Trump as the President goes back to fusionism. …appointees without previous connections to Trump but with deep connections to the Party’s libertarian wing have put in place an enhanced version of the standard Republican program. The result has been an odd mix of traditional Republican policies and Trumpian rhetorical flourishes. …As Trump has outsourced economic policy to the establishment, he has outsourced social policy to the evangelicals. …Steven Hayward, a well-connected conservative who has written the two-volume history “The Age of Reagan,” told me, “The biggest surprise about Trump is that he has turned out to govern as a conservative. …That raises the question of where the Republican Party will go after he leaves office. …there are three competing predictions about the future of the Party over the coming years. Let’s call them the Remnant, Restoration, and Reversal scenarios.

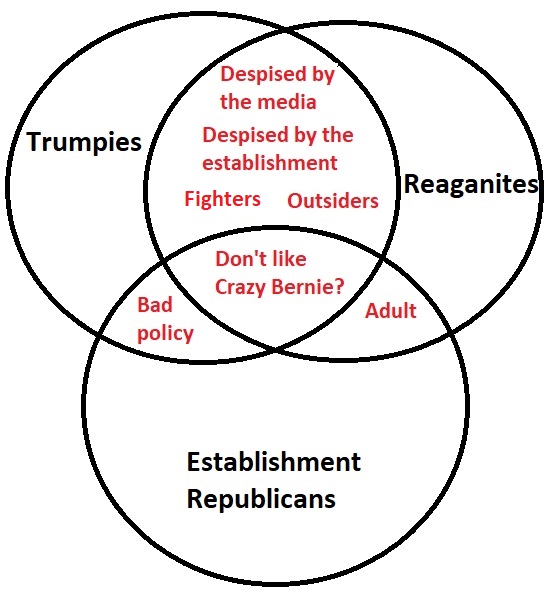

And here are those three camps, starting with the “Remnant” crowd, who are the heirs to Trumpism.

Could somebody else use the Trump playbook to win a Presidential election? Those who believe in the Remnant scenario think so. …The obvious candidate to carry out a high Trumpist strategy in 2024 would be Donald Trump, Jr… Several other potential Republican candidates, most notably Senators Tom Cotton, of Arkansas, and Josh Hawley, of Missouri, have demonstrated that they see Trump’s success as instructive.

Next we have the “Restoration” group, who want the GOP to be a Reagan-style party.

Under the Restoration scenario, …Republicans, as if waking from a bad dream, could recapture their essential identity for the past hundred years as the party of business. They could revive a Reagan-like optimistic rhetoric of freedom and enterprise… Many Never Trumpers would feel comfortable again in a Restorationist Republican Party. Restoration could entail a conventionally positioned Presidential candidate, such as Mike Pence… But the most discussed Restorationist candidate is Nikki Haley, the former governor of South Carolina and a former U.N. ambassador.

Then we have the “Reversal” folks, who want the GOP to be the anti-capitalism party.

The Reversal scenario, though perhaps the least plausible, is the most threatening to the Democratic Party. The parties would essentially switch the roles they have had for the past century: the Republicans would replace the Democrats as the party of the people, the one with a greater emphasis on progressive economic policies… today poorer districts are far more likely to vote Republican and richer districts are far more likely to vote Democratic. …People in this camp talk about the failures of “neoliberalism,” “financialization,” and “market fundamentalism,” and condemn “zombie Reaganism.” …The favored Presidential candidate for 2024 among the Reversalists is Senator Marco Rubio, of Florida.

Now for my two cents.

Since I prefer Reagan over Trump, that presumably puts me in the “Restoration” camp.

But I don’t think many people care what I prefer, so I’ll wrap up by giving my prediction of what will happen.

In the post-Trump environment, I think Republicans will revert to their normal behavior (i.e., the “Restoration” folks will prevail), but only if they absorb two Trump-style flourishes.

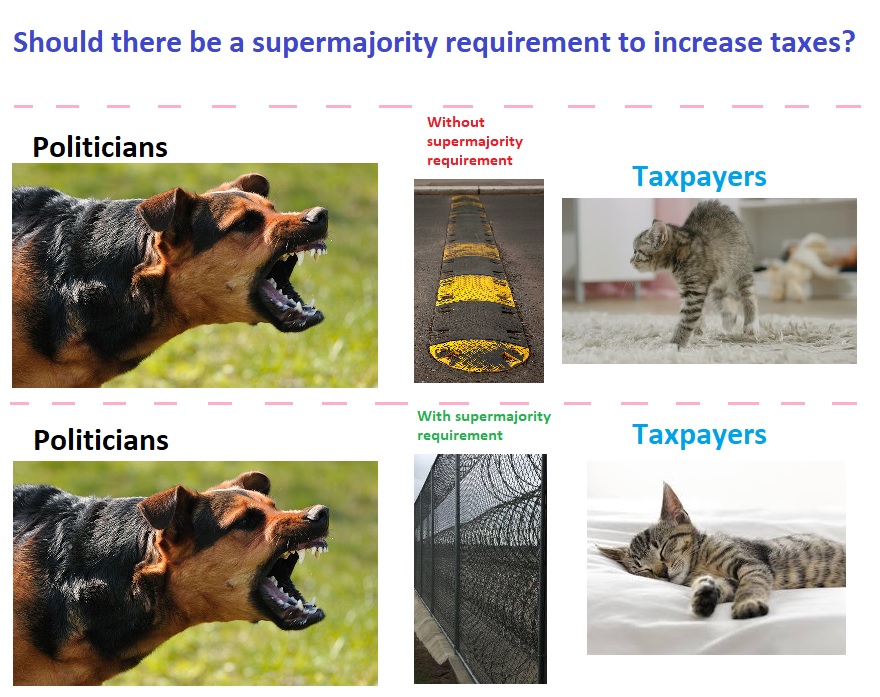

- From a stylistic perspective, I think the desire for “a fighter” is what many voters found appealing about Trump (as was mentioned above in Elaina Plott’s article from the New York Times). My guess is that a lot of Republicans will copy that aspect of Trump’s behavior, but obviously without the silly tweets and insults. I hope that means no tax-hiking budget deals.

- From a policy perspective, I think the biggest change will be less sympathy for trade and immigration. To the extent I have any influence with Republicans, I’ll try to convince them to at least protect and promote free trade with other democratic nations. And I’ll also remind them that high-skill immigration (such as the people we attract with the EB-5 program) is worth preserving.

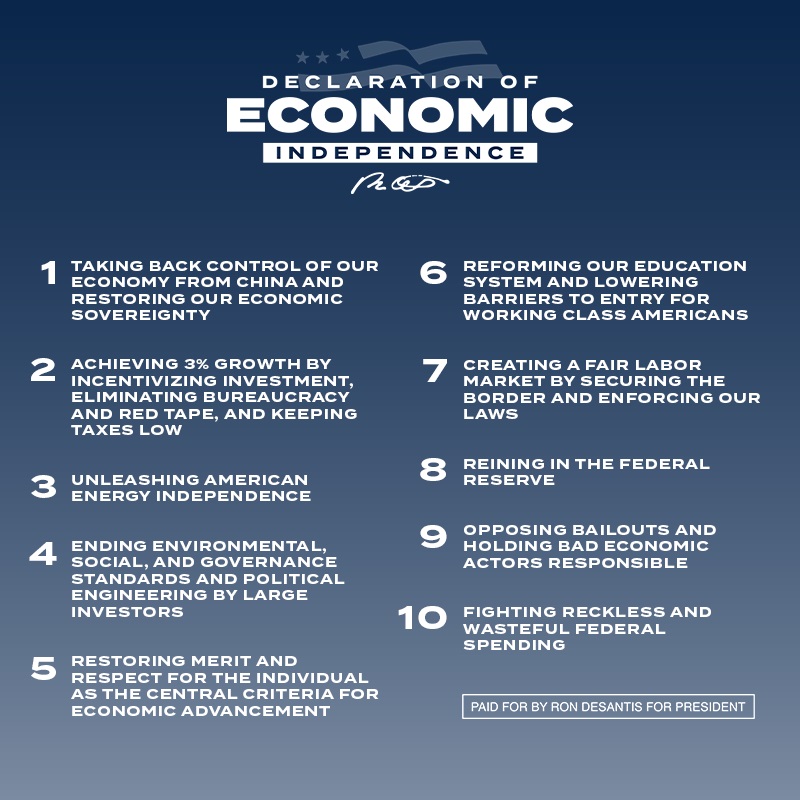

So which Republican can best mix Reaganism with those two bits of Trumpism?

Beats me.

P.S. For what it’s worth (and I don’t think it’s worth much since it’s far too early), here’s some polling data on Republican preferences for the the 2024 nomination.

Keep in mind that this poll took place last year, when the economy was booming and voters presumably had a more positive view of President Trump. I suspect the Trump children would not do as well if the poll was repeated today.

P.P.S. My nightmare scenario is that GOP politicians decide the lesson of Trumpism is that they should copy his approach of being weak-kneed on the issue of genuine entitlement reform.

Read Full Post »

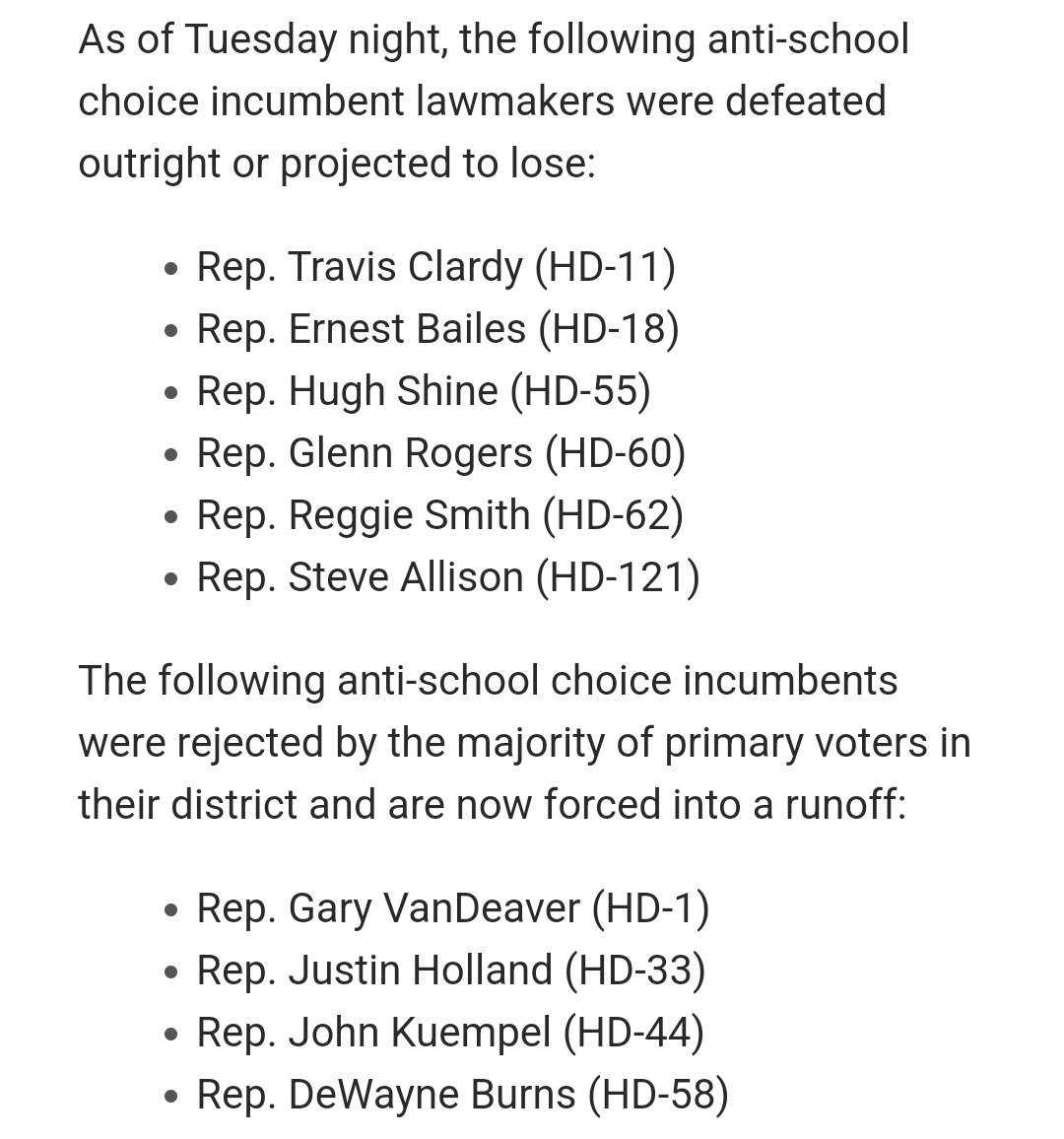

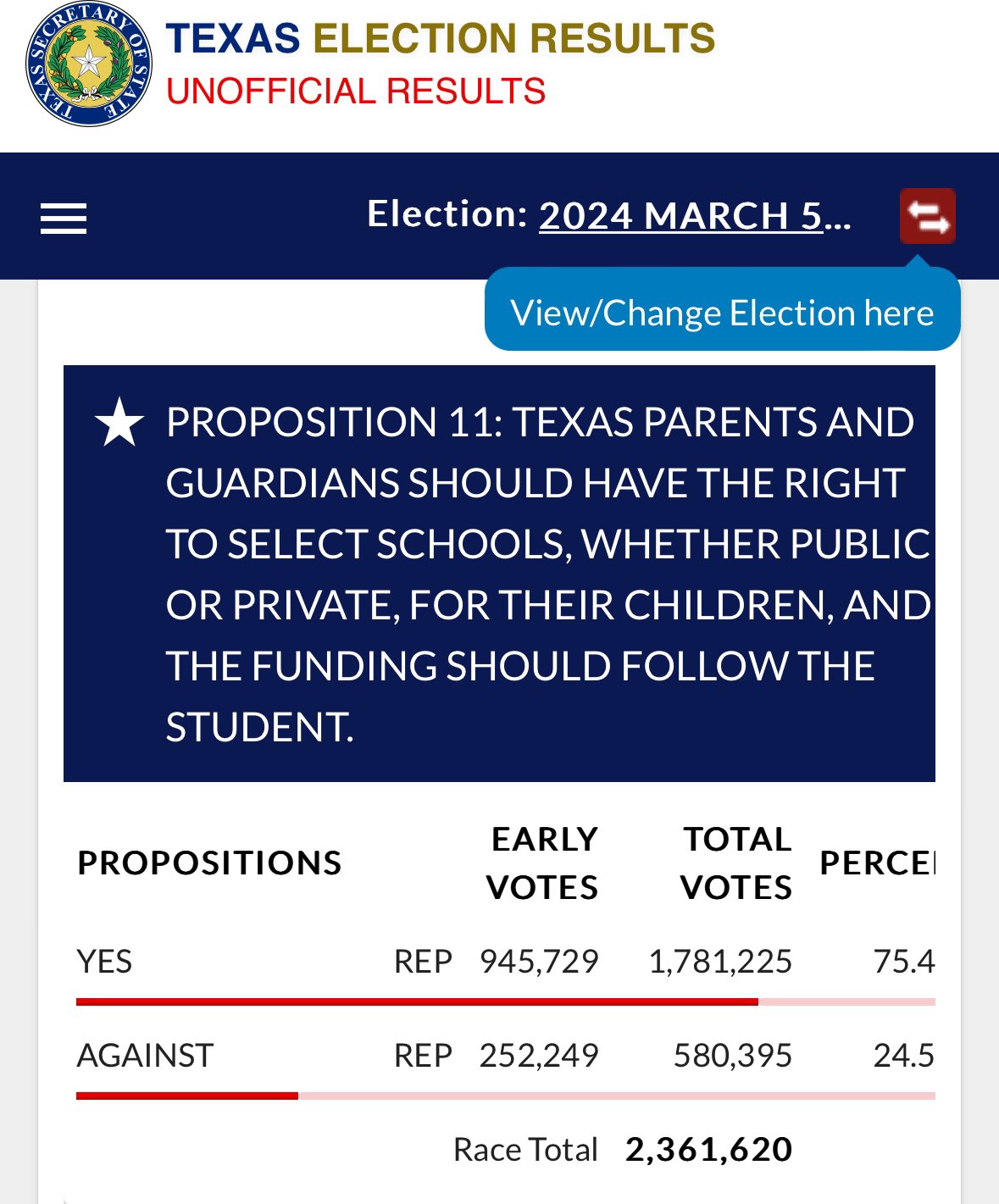

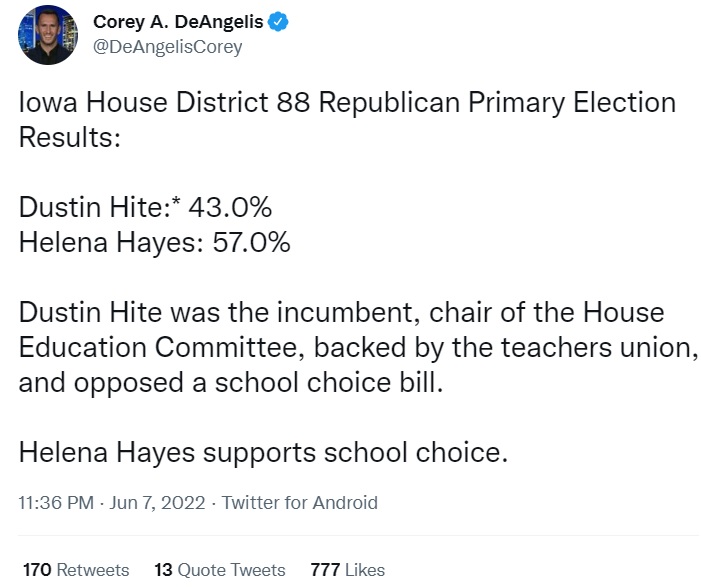

during a battle over school choice last year.

during a battle over school choice last year.