I’m not a fan of the International Monetary Fund (IMF).

Since I work mostly on fiscal issues, I don’t like the fact that the bureaucracy is an avid cheerleader for ever-higher taxes (which is disgustingly hypocritical since IMF employees get lavish, tax-free salaries).

(which is disgustingly hypocritical since IMF employees get lavish, tax-free salaries).

But the biggest problem with the IMF is that it promotes “moral hazard.” More specifically, it provides bailouts for irresponsible governments and for those who foolishly lend to those governments.

The net result is that bad behavior is rewarded, which is a recipe for more bad behavior.

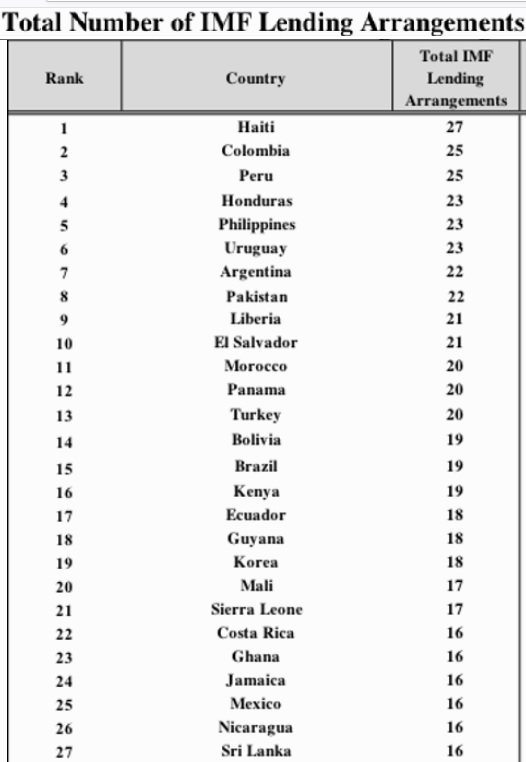

All of which explains why some nations (and their foolish lenders) have received dozens of bailouts.

Oh, and let’s not forget that these endless bailouts also lead to a misallocation of capital, thus reducing global growth.

In an article for the New York Times, Patricia Cohen reports on discussions to expand the IMF’s powers.

Once narrowly viewed as a financial watchdog and a first responder to countries in financial crises, the I.M.F. has more recently helped manage two of the biggest risks to the worldwide economy: the extreme inequality and climate change.

…long-held beliefs like the single-minded focus on how much an economy grows, without regard to problems like inequality and environmental damage, are widely considered outdated. And the preferred cocktail for helping debt-ridden nations that was popular in the 1990s and early 2000s — austerity, privatization of government services and deregulation — has lost favor in many circles as punitive and often counterproductive.

There’s a lot to dislike about the above excerpts.

Starting with the article’s title, since it would be more accurate to say that the IMF’s bailout policies encourage fires.

Multiple fires.

Looking at the text, the part about “extreme inequality” is nonsensical, both because the IMF hasn’t done anything to “manage” the issue, other than to advocate for class-warfare taxes.

Moreover, there’s no support for the empty assertion that inequality is a “risk” to the world economy (sensible people point out that the real problem is poverty, not inequality).

Ms. Cohen also asserts that the “preferred cocktail” of pro-market policies (known as the Washington Consensus) has “lost favor,” which certainly is accurate.

But she offers another empty – and inaccurate – assertion by writing that it was “counterproductive.”

Here are some additional excerpts.

The debate about the role of the I.M.F. was bubbling before the appointment of Ms. Georgieva… But she has embraced an expanded role for the agency. …she stepped up her predecessors’ attention to the widening inequality and made climate change a priority, calling for an end to all fossil fuel subsidies, for a tax on carbon and for significant investment in green technology. …Sustainable debt replaced austerity as the catchword. …The I.M.F. opposed the hard line taken by some Wall Street creditors in 2020 toward Argentina, emphasizing instead the need to protect “society’s most vulnerable” and to forgive debt that exceeds a country’s ability to repay.

The last thing the world needs is “an expanded role” for the IMF.

It’s especially troubling to read that the bureaucrats want dodgy governments to have more leeway to spend money  (that’s the real meaning of “sustainable debt”).

(that’s the real meaning of “sustainable debt”).

And if the folks at the IMF are actually concerned about “society’s most vulnerable” in poorly run nations such as Argentina, they would be demanding that the country copy the very successful poverty-reducing policies in neighboring Chile.

Needless to say, that’s not what’s happening.

The article does acknowledge that not everyone is happy with the IMF’s statist agenda.

Some stakeholders…object to what’s perceived as a progressive tilt. …Ms. Georgieva’s activist climate agenda has…run afoul of Republicans in Congress… So has her advocacy for a minimum global corporate tax.

It would be nice, though, if Ms. Cohen had made the article more balanced by quoting some of the critics.

The bottom line, as I wrote last year, is that the world would be better off if the IMF was eliminated.

Simply stated, we don’t need an international bureaucracy that actually argues it’s okay to hurt the poor so long as the rich are hurt by a greater amount.

P.S. The political leadership of the IMF is hopelessly bad, as is the bureaucracy’s policy agenda. That being said, there are many good economists who work at the IMF and they often produce high-quality research (see here, here, here, here, here, here, here, here, here, and here). Sadly, their sensible analyses doesn’t seem to have any impact on the decisions of the organization’s top bureaucrats.

[…] So what’s the main lesson to be learned? In part, it will be good if Argentinian voters reject Peronism later this year in their presidential election. But I worry that won’t be enough if international bureaucracies like the IMF continue to play a malignant role. […]

[…] for their subpar appointees to central banks, the IMF did their bidding. Yet another reason to shut down this bureaucracy. In any event, I feel sorry for the economists at that bureaucracy, most of whom […]

[…] suspect they figured they could get bailouts, just like Greece. In other words, the IMF and otherscreated a system corrupted by moral […]

[…] bottom line is that the IMF needs to be shut down (or at least cut off from US backing) if we want nations to […]

[…] bottom line is that the IMF needs to be shut down (or at least cut off from US backing) if we want nations to […]

[…] suspect they figured they could get bailouts, just like Greece. In other words, the IMF and otherscreated a system corrupted by moral […]

[…] suspect they figured they could get bailouts, just like Greece. In other words, the IMF and others created a system corrupted by moral […]

[…] One obvious takeaway is that the IMF should be […]

[…] But one good suggestion doesn’t excuse a dozen proposals to increase the burden of government. This report on Estonia is further evidence that the OECD arguably is the world’s worst bureaucracy (which is quite an achievement considering the many shortcomings of the IMF). […]

[…] Here’s my solution to the IMF […]

[…] to international bureaucracies such as the IMF and OECD, the United Nations has very little power to impose bad […]

[…] to international bureaucracies such as the IMF and OECD, the United Nations has very little power to impose bad […]

[…] bailouts since 1958, which works out to be one bailout every three years (Professor Steve Hanke counts 22 bailouts, for what it’s […]

[…] the risk of understatement, I’m not a fan of the International Monetary […]

[…] P.S. Argentina probably wouldn’t be such a basket case if the IMF didn’t provide endless bailouts. […]

[…] P.S. Argentina probably wouldn’t be such a basket case if the IMF didn’t provide endless bailouts. […]

[…] posted on Additional survival tricks: https://danieljmitchell.wordpress.com/2021/10/11/the-imf-should-be-eliminated-not-expanded/ I’m not a fan of the International Monetary Fund (IMF). Since I work mostly on fiscal issues, I […]

The IMF has the same faults as the “Deep State” in the U.S. It has the instincts to grow, rather than the will to improve operations. After all, it is an institution of the “command economy” responding to politics, resulting in the collusion of bureaucrats with client states, at the expense of the people of all nations who are unrepresented. The log rolling, and back scratching that rewards corruption of the governing classes is its reason for existence..

This is so true, I’m from India and in 1991, we faced an economic crisis due to lack of foreign exchange, balance of payment crisis mainly caused by the collapse of the USSR (Indian Govt was highly dependent on the USSR and used to follow five year economic welfare plans and democratic socialist aka Fabian model copied from our former coloniser which also ended up not only loosing it’s empire, but also becoming poorer than West Germany after World War 2 until Thatcher became PM). So, Indian Govt was supposed to go bankrupt, but IMF saved it unfortunately and the then Bush Administration influenced IMF to order India to adopt “some” ‘liberalisation, privatisation and globalisation’ reforms which actually boosted the per capita income of Indians within just a decade and recorded massive reduction of poverty since then and Indian Govt not only paid back the loan but also recorded a foreign reserve surplus for the first time in so many years, however the fact is that Indian Govt’s power still remains and we’re often back on track to our pre-1991 pathetic bureaucratic ‘license raj’ because politicians are politicians afterall

[…] – Zero HedgeIMF boss Georgieva risks losing her job over China bias claims – CNBCThe IMF Should Be Eliminated, not Expanded – Daniel J. MitchellGovernments fall as the EU battles corruption – The EconomistSome […]

[…] https://danieljmitchell.wordpress.com/2021/10/11/the-imf-should-be-eliminated-not-expanded/ I’m not a fan of the International Monetary Fund (IMF). Since I work mostly on fiscal issues, I don’t like the factthat the bureaucracy is an avid cheerleader for ever-higher taxes (which is disgustingly hypocritical since IMF employees get lavish, tax-freesalaries). But the biggest problem with the IMF is that it promotes “moral hazard.” More specifically, it provides bailouts for irresponsible governments and for those who foolishly lend to those governments. The net result is that bad behavior is rewarded, which is a recipe for more bad behavior. All of which explains why some nations (and their foolish lenders) have received dozens of bailouts. Oh, and let’s not forget that these endless bailouts also lead to a misallocation of capital, thus reducing global growth. In an article for the New York Times, Patricia Cohen reports on discussions to expand the IMF’s powers… […]