Writing about federal spending last week, I shared five charts illustrating how the process works and what’s causing America’s fiscal problems.

Most important, I showed that the ever-increasing burden of federal spending is almost entirely the result of domestic spending increasing much faster than what would be needed to keep pace with inflation.

increasing much faster than what would be needed to keep pace with inflation.

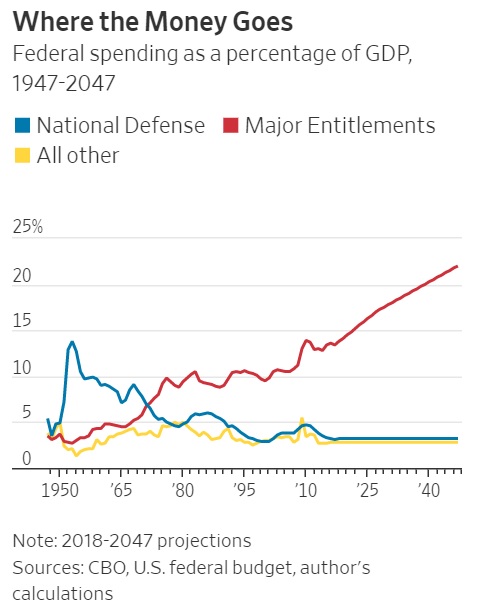

And when I further sliced and diced the numbers, I showed that outlays for entitlements (programs such as Social Security, Medicare, Medicaid, and Obamacare) were the real problem.

Let’s elaborate.

John Cogan, writing for the Wall Street Journal, summarizes our current predicament.

Since the end of World War II, federal tax revenue has grown 15% faster than national income—while federal spending has grown 50% faster. …all—yes, all—of the increase in federal spending relative to GDP over the past seven decades is attributable to entitlement spending.

Since the late 1940s, entitlement claims on the nation’s output of goods and services have risen from less than 4% to 14%. …If you’re seeking the reason for the federal government’s chronic budget deficits and crushing national debt, look no further than entitlement programs. …entitlement spending accounts for nearly two-thirds of federal spending. …What about the future? Social Security and Medicare expenditures are accelerating now that baby boomers have begun to collect their government-financed retirement and health-care benefits. If left unchecked, these programs will push government spending to levels never seen during peacetime. Financing this spending will require either record levels of taxation or debt.

Here’s a chart from his column. Only instead of looking at inflation-adjusted growth of past spending, he looks at what will happen to future entitlement spending, measured as a share of economic output.

And he concludes with a very dismal point.

…restraint is not possible without presidential leadership. Unfortunately, President Trump has failed to step up.

I largely agree. Trump has nominally endorsed some reforms, but the White House hasn’t expended the slightest bit of effort to fix any of the entitlement programs.

Now let’s see what another expert has to say on the topic. Brian Riedl of the Manhattan Institute paints a rather gloomy picture in an article for National Review.

…the $82 trillion avalanche of Social Security and Medicare deficits that will come over the next three decades elicits a collective shrug. Future historians — and taxpayers — are unlikely to forgive our casual indifference to what has been called “the most predictable economic crisis in history.”

…Between 2008 and 2030, 74 million Americans born between 1946 and 1964 — or 10,000 per day — will retire into Social Security and Medicare. And despite trust-fund accounting games, all spending will be financed by current taxpayers. That was all right in 1960, when five workers supported each retiree. The ratio has since fallen below three-to-one today, on its way to two-to-one by the 2030s. …These demographic challenges are worsened by rising health-care costs and repeated benefit expansions from Congress. Today’s typical retiring couple has paid $140,000 into Medicare and will receive $420,000 in benefits (in net present value)… Most Social Security recipients also come out ahead. In other words, seniors are not merely getting back what they paid in. …the spending avalanche has already begun. Since 2008 — when the first Baby Boomers qualified for early retirement — Social Security and Medicare have accounted for 72 percent of all inflation-adjusted federal-spending growth (with other health entitlements responsible for the rest). …

Brian speculates on what will happen if politicians kick the can down the road.

…something has to give. Will it be responsible policy changes now, or a Greek-style crisis of debt and taxes later? …Restructuring cannot wait. Every year of delay sees 4 million more Baby Boomers retire and get locked into benefits that will be difficult to alter… Unless Washington reins in Social Security and Medicare, no tax cuts can be sustained over the long run. Ultimately, the math always wins. …Frédéric Bastiat long ago observed that “government is the great fiction through which everybody endeavors to live at the expense of everybody else.” Reality will soon fall like an anvil on Generation X and Millennials, as they find themselves on the wrong side of the largest intergenerational wealth transfer in world history.

Not exactly a cause for optimism!

Last but not least, Charles Hughes writes on the looming entitlement crisis for E21.

Medicare and Social Security already account for roughly two-fifths of all federal outlays, and they will account for a growing share of the federal budget over the coming decade.

…Entitlement spending growth is a major reason that budget deficits are projected to surge over the next decade. …The unsustainable nature of these programs face mean that some reforms will have to be implemented: the only questions are when and what kind of changes will be made. The longer these reforms are put off, the inevitable changes will by necessity be larger and more abrupt. …Without real reform, the important task of placing entitlement programs back on a sustainable trajectory will be left for later generations—at which point the country will be farther down this unsustainable path.

By the way, it’s not just libertarians and conservatives who recognize there is a problem.

There have been several proposals from centrists and bipartisan groups to address the problem, such as the Simpson-Bowles plan, the Debt Reduction Task Force, and Obama’s Fiscal Commission.

For what it’s worth, I’m not a big fan of these initiatives since they include big tax increases. And oftentimes, they even propose the wrong kind of entitlement reform.

Heck, even folks on the left recognize there’s a problem. Paul Krugman correctly notes that America is facing a massive demographic shift that will lead to much higher levels of spending. And he admits that entitlement spending is driving the budget further into the red. That’s a welcome acknowledgement of reality.

Sadly, he concludes that we should somehow fix this spending problem with tax hikes.

That hasn’t worked for Europe, though, so it’s silly to think that same tax-and-spend approach will work for the United States.

I’ll close by also offering some friendly criticism of conservatives and libertarians. If you read what Cogan, Riedl, and Hughes wrote, they all stated that entitlement programs were a problem in part because they would produce rising levels of red ink.

It’s certainly true that deficits and debt will increase in the absence of genuine entitlement reform, but what irks me about this rhetoric is that a focus on red ink might lead some people to conclude that rising levels of entitlements somehow wouldn’t be a problem if matched by big tax hikes.

Wrong. Tax-financed spending diverts resources from the private economy, just as debt-financed spending diverts resources from the private economy.

In other words, the real problem is spending, not how it’s financed.

I’m almost tempted to give all of them the Bob Dole Award.

P.S. For more on America’s built-in entitlement crisis, click here, here, here, and here.

[…] the bottom line: Genuine patriots recognize America has a problem and they have the courage to advocate reforms that will actually solve the […]

[…] the bottom line: Genuine patriots recognize America has a problem and they have the courage to advocate reforms that will actually solve the […]

[…] the bottom line: Genuine patriots recognize America has a problem and they have the courage to advocate reforms that will actually solve the […]

[…] The burden of spending in the United States is going to dramatically expand in coming decades because of demographic change combined with poorly designed entitlement programs. […]

[…] I have also explained that entitlements are the main reason the United States faces a very grim fiscal future. […]

[…] bottom line is that the United States has a built-in spending crisis. Democrats are not serious about addressing the problem. So if Republicans bail as well, the nation […]

[…] bottom line is that the United States has a built-in spending crisis. Democrats are not serious about addressing the problem. So if Republicans bail as well, the nation […]

[…] that approach means America’s economy is weakened by an ever-growing burden of federal spending and eventually […]

[…] that approach means America’s economy is weakened by an ever-growing burden of federal spending and […]

[…] how do we solve this mess. I’ve written about the needed reforms for Medicare and Medicaid, so let’s focus today on […]

[…] how do we solve this mess. I’ve written about the needed reforms for Medicare and Medicaid, so let’s focus today […]

[…] Are there any solutions to this “most predictable crisis“? […]

[…] Are there any solutions to this “most predictable crisis“? […]

[…] but it is definitely better than nothing since it would force lawmakers to somehow prevent the huge future spending increases that will be caused by America’s poorly designed entitlement […]

[…] but it is definitely better than nothing since it would force lawmakers to somehow prevent the huge future spending increases that will be caused by America’s poorly designed entitlement […]

[…] this leaves out all the entitlement programs – which are the biggest and fastest growing part of the federal […]

[…] this leaves out all the entitlement programs – which are the biggest and fastest growing part of the federal […]

[…] The United States already faces a huge long-run challengebecause of entitlement spending, so it’s remarkable – in a bad way – that Biden wants to step on the gas rather than hit the […]

[…] The United States already faces a huge long-run challengebecause of entitlement spending, so it’s remarkable – in a bad way – that Biden wants to step on the gas rather than hit the […]

[…] The United States already faces a huge long-run challengebecause of entitlement spending, so it’s remarkable – in a bad way – that Biden wants to step on the gas rather than hit the […]

[…] The United States already faces a huge long-run challengebecause of entitlement spending, so it’s remarkable – in a bad way – that Biden wants to step on the gas rather than hit the […]

[…] because of demographic change and poorly designed entitlement programs, we’re already on a path to become a European welfare […]

[…] because of demographic change and poorly designed entitlement programs, we’re already on a path to become a European welfare […]

[…] final bit of satire touches a nerve with me because I worry a lot about a potential descent into Greek-style fiscal chaos (and, since the US is too big for a bailout, that presumably will be […]

[…] already written how this is a big problem for the United […]

[…] The United States already faces a huge long-run challengebecause of entitlement spending, so it’s remarkable – in a bad way – that Biden wants to step on the gas rather than hit the […]

[…] The United States already faces a huge long-run challengebecause of entitlement spending, so it’s remarkable – in a bad way – that Biden wants to step on the gas rather than hit the […]

[…] The United States already faces a huge long-run challenge because of entitlement spending, so it’s remarkable – in a bad way – that Biden wants to step on the gas rather […]

[…] already written how this is a big problem for the United […]

[…] already written how this is a big problem for the United […]

[…] Are there any solutions to this “most predictable crisis“? […]

[…] will become another Greece if we don’t reform entitlements. That will be bad for the nation. It will be bad for our economy. It will be bad for our children and grandchildren. It will be bad […]

[…] will become another Greece if we don’t reform entitlements. That will be bad for the nation. It will be bad for our economy. It will be bad for our children and grandchildren. It will be bad […]

[…] being said, America’s grim long-run fiscal outlook, combined with the other factors such as young people’s senseless support of socialism, […]

[…] recognized that some sort of corrective action was needed on entitlements because of enormous unfunded promises, driven by demographic change and poorly designed […]

[…] To make matters worse, all this new spending is in addition to already-legislated spending increases for everything from boondoggle discretionary programs to behemoth entitlement programs. […]

[…] I gave a speech this past weekend about the economy and fiscal policy, and I made my usual points about government being too big and warned that the problem would get much worse in the future because of demographic change and poorly designed entitlement programs. […]

[…] of government spending – The federal government is far too big, and it keeps growing in size. Entitlements are the main problem, but Trump added to the mess by capitulating to another budget deal that […]

[…] Because of poorly designed entitlement programs and an ageing population, our fiscal situation will deteriorate even faster in the […]

[…] Or, to make it personal, don’t they have any inkling of the fact that they are going to get screwed by entitlement programs? […]

[…] Or, to make it personal, don’t they have any inkling of the fact that they are going to get screwed by entitlement programs? […]

[…] demographic change is why the program is bankrupt, with an inflation-adjusted cash-flow deficit of more than $42 […]

[…] And those caps have never applied to entitlements, which are the part of the budget that eventually will bankrupt the nation. […]

[…] These charts show why I’m so depressed. And let’s not forget that they are only measures of discretionary spending. The outlook for entitlement spending is even worse! […]

[…] First, America faces a grim future because Washington spending will consume an ever-larger share of economic output because of demographic changes and poorly designed entitlement programs. […]

[…] all intents and purposes, we’re on a trajectory (the “most predictable crisis in history“) to become another […]

[…] Are there any solutions to this “most predictable crisis“? […]

[…] But it shouldn’t matter whether other countries have good systems or bad systems. What does matter is that America’s demographic profile is changing. We’re living longer and having fewer children and our system of entitlements is a mess. […]

[…] irresponsible for both of them to propose any sort of new tax-and-transfer scheme when the country already faces a long-run crisis because of entitlement […]

[…] irresponsible for both of them to propose any sort of new tax-and-transfer scheme when the country already faces a long-run crisis because of entitlement […]

[…] not sure when we’ll have a chance to address this simmering crisis. But if you’re wondering whether changes are necessary, check out this chart I put together […]

[…] not sure when we’ll have a chance to address this simmering crisis. But if you’re wondering whether changes are necessary, check out this chart I put together […]

[…] not sure when we’ll have a chance to address this simmering crisis. But if you’re wondering whether changes are necessary, check out this chart I put together […]

[…] the chart also doesn’t reveal that entitlement programs are the main cause of ever-expanding […]

[…] government spending resulting from demographic change and […]

[…] stated, we’ve entered the era of baby boomer retirement. And because we have some very poorly designed entitlement programs, that means the federal budget – assuming we leave it on autopilot – is going to […]

[…] The good news is that they at least recognize that there’s a future problem. […]

[…] is entitlement spending rather than appropriated spending. They’re right that entitlements are the biggest long-run problem. But I point out that if GOPers aren’t willing to tackle the low-hanging fruit of pork-filled […]

Alexander Fraser Tytler said it all: A democracy will continue to exist up until the time that voters discover that they can vote themselves generous gifts from the public treasury.

[…] The threat isn’t the red ink. The real danger is an ever-increasing burden of government spending, driven by entitlements. […]

[…] crisis. I’m not sure if this has to be inevitable, but from a practical perspective, he is right. Demographic change and entitlements are a poisonous […]

[…] crisis. I’m not sure if this has to be inevitable, but from a practical perspective, he is right. Demographic change and entitlements are a poisonous […]

[…] for a payroll-tax-funded paid leave program is the very bad idea. The United States already has a baked-in-the-cake entitlement crisis, so the last thing we need is the creation of another tax-and-transfer […]

Not making a decision is a decision itself. By not acting on this easily-predicted crisis, government is quietly transforming this from a governance responsibility to the individuals’ financial security problem. How many people are in for a rude awakening in 10-20 years? Presenting the illusion of a future benefit is more damaging than simply guaranteeing nothing.

There is a market based solution to this problem.

https://www.forbes.com/sites/pensionresearchcouncil/2018/01/30/fintechs-answer-to-the-global-retirement-crisis/

You joke, Zorba, but I remember from decades past that some people made the argument that high taxes would encourage greater industry and work. The taxed person was supposed to work harder to recover what he had lost in taxes.

Ridiculous, right? But they were quite serious.

By that logic, we should apply a 99% tax rate, then stand back and watch the wave of prosperity roll in!

Not to worry. Strong economic growth in Europe (a whole one third the average world growth rate!) suggests that tax increases can fix the problem. Once productive people are taxed more heavily, they will have to work harder to achieve the nice lifestyle they’ve been addicted to — leading to stronger economic growth. On the flip side, less productive people will be so enthusiastic and grateful at all the government redistribution freebies, that they too will increase their success efforts — thus leading to even more economic growth, a double boost. Then America will follow the same bright future the statist countries of Europe are forging ahead with.

Preposterous indeed but nobody wins elections with the slogan: “It’s the effort-reward curve stupid voter lemming!”

Santa Claus wins elections, not realists.

…so then, when Democracy becomes so inefficient and stupid, more sinister authoritarian systems find a competitive opening. That is what we see happening in large swaths of the developed democracy world. Democracies that propelled themselves into the top ranks of worldwide prosperity when their growth rates far surpassed the average world growth rates, but whose voters followed the siren song of welfare and statism and now growth comparisons have reversed.

Currently rich countries that grow at one third to one half the average world growth rate are destined to enter the third world club of AD 2050. That’s also the most predictable trajectory ever.

Red ink is the symptom of spending and spending is the symptom of statism. A statism that is gaining ground amongst the electorate. An electorate that is abandoning the American values of self sufficiency for the welfare mentality of an anemically growing Europe. Europeans are not stupid people. Just as they fell into the siren song of statism, so will you dear Americans.

With the ability to work everywhere from anywhere in the world ever increasing, the wiser stay mobile.

Reblogged this on THE SOVEREIGN PATIENT.

Great article. Sound logic. Is anyone listening on Capitol Hill?