It’s no secret that I’m a huge fan of Ronald Reagan.

He’s definitely the greatest president of my lifetime and, with one possible rival, he was the greatest President of the 20th century.

If his only accomplishment was ending malaise and restoring American prosperity thanks to lower tax rates and other pro-market reforms, he would be a great President.

He also restored America’s national defenses and reoriented foreign policy, both of which led to the collapse of the Soviet Empire, a stupendous achievement that makes Reagan worthy of Mount Rushmore.

He also restored America’s national defenses and reoriented foreign policy, both of which led to the collapse of the Soviet Empire, a stupendous achievement that makes Reagan worthy of Mount Rushmore.

But he also has another great achievement, one that doesn’t receive nearly the level of appreciation that it deserves. President Reagan demolished the economic cancer of inflation.

Even Paul Krugman has acknowledged that reining in double-digit inflation was a major positive achievement. Because of his anti-Reagan bias, though, he wants to deny the Gipper any credit.

Robert Samuelson, in a column for the Washington Post, corrects the historical record.

Krugman recently wrote a column arguing that the decline of double-digit inflation in the 1980s was the decade’s big economic event, not the cuts in tax rates usually touted by conservatives. Actually, I agree with Krugman on this. But then he asserted that Ronald Reagan had almost nothing to do with it. That’s historically incorrect. Reagan was crucial. …Krugman’s error is so glaring.

Samuelson first provides the historical context.

For those too young to remember, here’s background. From 1960 to 1980, inflation — the general rise of retail prices — marched relentlessly upward. It went from 1.4 percent in 1960 to 5.9 percent in 1969 to 13.3 percent in 1979. The higher it rose, the more unpopular it became. …Worse, government seemed powerless to defeat it. Presidents deployed complex wage and price controls and guidelines. They didn’t work. The Federal Reserve — custodian of credit policies — veered between easy money and tight money, striving both to subdue inflation and to maintain “full employment” (taken as a 4 percent to 5 percent unemployment rate). It achieved neither. From the late 1960s to the early 1980s, there were four recessions. Inflation became a monster, destabilizing the economy.

The column then explains that there was a dramatic turnaround in the early 1980s, as Fed Chairman Paul Volcker adopted a tight-money policy and inflation was squeezed out of the system much faster than almost anybody thought was possible.

But Krugman wants his readers to think that Reagan played no role in this dramatic and positive development.

Samuelson says this is nonsense. Vanquishing inflation would have been impossible without Reagan’s involvement.

What Reagan provided was political protection. The Fed’s previous failures to stifle inflation reflected its unwillingness to maintain tight-money policies long enough… Successive presidents preferred a different approach: the wage-price policies built on the pleasing (but unrealistic) premise that these could quell inflation without jeopardizing full employment. Reagan rejected this futile path. As the gruesome social costs of Volcker’s policies mounted — the monthly unemployment rate would ultimately rise to a post-World War II high of 10.8 percent — Reagan’s approval ratings plunged. In May 1981, they were at 68 percent; by January 1983, 35 percent. Still, he supported the Fed. …It’s doubtful that any other plausible presidential candidate, Republican or Democrat, would have been so forbearing.

What’s the bottom line?

What Volcker and Reagan accomplished was an economic and political triumph. Economically, ending double-digit inflation set the stage for a quarter-century of near-automatic expansion… Politically, Reagan and Volcker showed that leaders can take actions that, though initially painful and unpopular, served the country’s long-term interests. …There was no explicit bargain between them. They had what I’ve called a “compact of conviction.”

By the way, Krugman then put forth a rather lame response to Samuelson, including the rather amazing claim that “[t]he 1980s were a triumph of Keynesian economics.”

Here’s what Samuelson wrote in a follow-up column debunking Krugman.

As preached and practiced since the 1960s, Keynesian economics promised to stabilize the economy at levels of low inflation and high employment. By the early 1980s, this vision was in tatters, and many economists were fatalistic about controlling high inflation. Maybe it could be contained. It couldn’t be eliminated, because the social costs (high unemployment, lost output) would be too great. …This was a clever rationale for tolerating high inflation, and the Volcker-Reagan monetary onslaught demolished it. High inflation was not an intrinsic condition of wealthy democracies. It was the product of bad economic policies. This was the 1980s’ true lesson, not the contrived triumph of Keynesianism.

If anything, Samuelson is being too kind.

One of the key tenets of Keynesian economics is that there’s a tradeoff between inflation and unemployment  (the so-called Phillips Curve).

(the so-called Phillips Curve).

Yet in the 1970s we had rising inflation and rising unemployment.

While in the 1980s, we had falling inflation and falling unemployment.

But if you’re Paul Krugman and you already have a very long list of mistakes (see here, here, here, here, here, here, here, here, and here for a few examples), then why not go for the gold and try to give Keynes credit for the supply-side boom of the 1980s

P.S. Since today’s topic is Reagan, it’s a good opportunity to share my favorite poll of the past five years.

P.P.S. Here are some great videos of Reagan in action. And here’s one more if you need another Reagan fix.

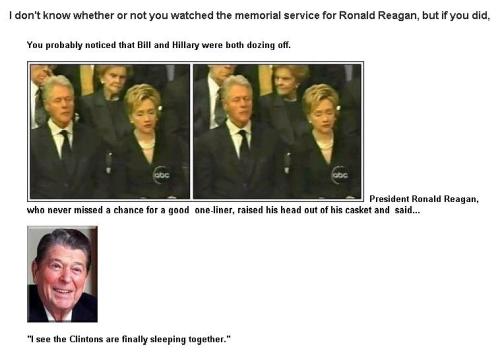

P.P.P.S. And let’s close with some mildly risqué Reagan humor that was sent to me by a former member of Congress.

[…] Ronald Reagan’s Most Under-Appreciated Triumph […]

[…] Ronald Reagan’s Most Under-Appreciated Triumph […]

[…] Ronald Reagan’s Most Under-Appreciated Triumph […]

[…] we should have learned another lesson when the Fed (with strong support from Ronald Reagan) then put the inflation genie back in the bottle in the […]

[…] of the reason for bad policy, the solution is the same. Replicate Reagan’s courage and bring inflation under […]

[…] also worth noting that interest rates were lower in the 1990s than the 1980s, in part because Reagan brought inflation under control, so maybe he should also get some credit for lower interest payments on the national […]

[…] Ronald Reagan’s Most Under-Appreciated Triumph […]

[…] Milei be as successful as Reagan, both with regards to inflation and overall economic rejuvenation? I hope so, though Milei has an even bigger […]

[…] of the reason for bad policy, the solution is the same. Replicate Reagan’s courage and bring inflation under […]

[…] Ronald Reagan’s Most Under-Appreciated Triumph […]

[…] we should have learned another lesson when the Fed (with strong support from Ronald Reagan) then put the inflation genie back in the bottle in the […]

[…] we should have learned another lesson when the Fed (with strong support from Ronald Reagan) then put the inflation genie back in the bottle in the […]

[…] Reaganism, by contrast, can unite all the factions. And when I say Reaganism, I’m not just talking about tax cuts. What we need is the full market-friendly Reagan agenda of spending restraint, deregulation, trade expansion, and sound money. […]

[…] Reaganism, by contrast, can unite all the factions. And when I say Reaganism, I’m not just talking about tax cuts. What we need is the full market-friendly Reagan agenda of spending restraint, deregulation, trade expansion, and sound money. […]

[…] Ronald Reagan’s Most Under-Appreciated Triumph […]

[…] of inflation fighting. And it’s definitely true that Reagan’s tax rate reductions and his restoration of sound money were wonderful […]

[…] Ronald Reagan’s Most Under-Appreciated Triumph […]

[…] Ronald Reagan’s Most Under-Appreciated Triumph […]

[…] Ronald Reagan’s Most Under-Appreciated Triumph […]

[…] Ronald Reagan’s Most Under-Appreciated Triumph […]

[…] Ronald Reagan’s Most Under-Appreciated Triumph […]

[…] Ronald Reagan’s Most Under-Appreciated Triumph […]

[…] Biden did not cause inflation, but (unlike a former president) he does not seem to understand how to solve the […]

[…] falling income under Jimmy Carter’s gave us Ronald Reagan, so bad policy indirectly led to a good outcome. As of now, it’s unclear if there’s a new version of Reagan to rescue us […]

[…] falling income under Jimmy Carter’s gave us Ronald Reagan, so bad policy indirectly led to a good outcome. As of now, it’s unclear if there’s a new version of Reagan to rescue us from […]

[…] default. No inflation. No indirect […]

[…] default. No inflation. No indirect […]

[…] Only one president in my lifetime deserves praise for his approach to monetary […]

[…] For what it’s worth, very few politicians have the intelligence and fortitude to support good monetary […]

[…] What we need is a president – like Ronald Reagan – who understands that the inflation genie needs to be put back in the bottle and thus pushes the Federal Reserve in the right direction. […]

[…] What we need is a president – like Ronald Reagan – who understands that the inflation genie needs to be put back in the bottle and thus pushes the Federal Reserve in the right direction. […]

[…] What we need is a president – like Ronald Reagan – who understands that the inflation genie needs to be put back in the bottle and thus pushes the Federal Reserve in the right direction. […]

[…] On the topic of inflation, Ronald Reagan deserves immense praise for standing firm for good policy in the […]

[…] On the topic of inflation, Ronald Reagan deserves immense praise for standing firm for good policy in the […]

[…] and 2) supports sound-money policies even when it means short-run political pain. We’ve had one president like that in my […]

[…] default. No inflation. No indirect […]

[…] don’t operate in a vacuum. One of Reagan’s great accomplishments – as recognized by unbiased establishment types – was to support the temporarily painful shift to a non-inflationary monetary […]

[…] major challenges as they shifted their nations toward economic liberty (most notably, Reagan tamed inflation and Thatcher denationalized state-run […]

[…] of inflation fighting. And it’s definitely true that Reagan’s tax rate reductions and his restoration of sound money were wonderful […]

[…] inflation fighting. And it’s definitely true that Reagan’s tax rate reductions and his restoration of sound money were wonderful […]

[…] existed. If it’s a long-standing policy, Illinois bureaucrats actually were net losers in the pre-Reagan era when the U.S. suffered from high […]

[…] the fall of the Berlin Wall. The collapse of the Evil Empire truly was one of Reagan’s most amazing accomplishments and a moment of joy for the […]

[…] P.P.P.S. Samuelson did recognize that defeating inflation was one of Reagan’s great accomplishments. […]

[…] default. No inflation. No indirect […]

[…] just as Reagan did the right thing on inflation, even though it was temporarily painful, he also advocated good long-run policy on […]

[…] the Obama years, though I wish that he wouldn’t bash the central bank and instead displayed Reagan’s fortitude about accepting the need to unwind such […]

[…] the recession almost certainly should be blamed on bad monetary policy, and even Robert Samuelson points out that Reagan deserves immense praise for his handling of that […]

[…] Though the really amazing part of that passage is that Ms. Lagarde apparently believes in the silly notion that tax cuts are inflationary. Leftists made the same argument against the Reagan tax cuts. Fortunately, their opposition we ineffective, Reagan slashed tax rates and inflation dramatically declined. […]

[…] I gave extra credit for his tax cuts, the spending restraint, and the taming of inflation. […]

[…] phased in and because some short-run pain was inevitable as inflation was brought under control (an overlooked and very beneficial achievement). But once his policies kicked in, the economic results were very […]

[…] phased in and because some short-run pain was inevitable as inflation was brought under control (an overlooked and very beneficial achievement). But once his policies kicked in, the economic results were very […]

[…] 1980-1982 was the result of economic distortions caused by bad monetary policy (by the way, Reagan deserves immense credit for having the moral courage to wean the country from easy-money […]

[…] good things weren’t random. They happened because Reagan made big positive changes in policy. He tamed inflation. He slashed tax rates. He substantially reduced the burden of domestic spending. He curtailed red […]

[…] things weren’t random. They happened because Reagan made big positive changes in policy. He tamed inflation. He slashed tax rates. He substantially reduced the burden of domestic spending. He curtailed red […]

He loved our country! Unlike the current one I the WH!

[…] approach to monetary policy rarely gets the credit it deserves. By supporting a tough anti-inflation policy, he made it possible for the Federal Reserve to […]

[…] approach to monetary policy rarely gets the credit it deserves. By supporting a tough anti-inflation policy, he made it possible for the Federal Reserve to […]

[…] U.S. and U.K. austerity, German fiscal policy, Estonian economics, British fiscal policy, inflation, European austerity, the financial crisis, and the Heritage […]

[…] U.S. and U.K. austerity, German fiscal policy, Estonian economics, British fiscal policy, inflation, European austerity, the financial crisis, and the Heritage […]

[…] if you enjoyed those examples, you can find more of the same by clicking here,here, here, here, here, here, here, and […]

[…] if you enjoyed those examples, you can find more of the same by clicking here, here, here, here, here, here, here, and […]

[…] in America who take classes from Paul Krugman. If these examples (here, here, here, here, here, here, here, here, here, here, here, and here) are any indication, they probably experience […]

[…] far below the economic performance America enjoyed during the more market-friendly policies of Ronald Reagan and Bill […]

[…] far below the economic performance America enjoyed during the more market-friendly policies of Ronald Reagan and Bill […]

[…] (with Paul Krugman deserving his own special category for sloppiness, as seen here, here, here, here, here, here, here, here, here, here, here, […]

[…] If you want additional examples of Krugman’s factual errors, see here, here, here, here, here, here, here,here, here, and […]

[…] If you want additional examples of Krugman’s factual errors, see here, here, here, here, here, here, here,here, here, […]

[…] would be terrible to let the inflation genie out of the bottle, particularly since there may not be a Ronald Reagan-type leader in the future who will do what’s needed to solve such a […]

[…] would be terrible to let the inflation genie out of the bottle, particularly since there may not be a Ronald Reagan-type leader in the future who will do what’s needed to solve such a […]

kyle edward,

You are correct about Cater. Unfortunately for Carter it was not his natural inclination and so he came to it late and is not given credit for it.

And of course there was Reagan’s shredding of the 4th. Despicable. And the move was purely political. In addition he shut down all research into cannabis and cancer. Can’t give the hippies any ammunition dontcha know. Cancer kills one person a minute. So Reagan is right up there with Stalin and Hitler – indirectly of course.

In 50 years that one move alone will overshadow everything else he did.

The remembrance will be – Reagan the mass murderer.

“If his only accomplishment was ending malaise and restoring American prosperity thanks to lower tax rates and other pro-market reforms, he would be a great President.”

Do you feel like Jimmy Carter has been unfairly blamed for the “malaise” at all? The stagflation that characterized his only term was (I would argue) a remnant of the LBJ and Nixon administrations, more than anything. LBJ with his “great society” and Nixon with his wage and price controls, not to mention their exorbitant spending on the war in Vietnam. Jimmy Carter abolished Nixon’s wage and price controls, deregulated sectors of the gas industry, and appointed Paul Volcker to the Federal Reserve. I feel like Carter should receive some credit for the economic boom of the eighties along with Reagan.

Reagan’s most unappreciated triumph (Nixon helped) was installing judges on the Supreme Court who would gut the 4th Amendment without obvious prompting. Of course it was what he and Meese wanted. So in a sense it was intentional.

We are now all suspects and subject to general warrants – road side safety checks and the like. And don’t forget middle of the night no knock raids. When I was growing up that was the function of Nazis in war propaganda movies. It is still the function of Nazis. Only now they are American.

[…] WAIT, THERE’S MORE… […]

[…] By Dan Mitchell […]