I’m a big believer in the Laffer Curve, which is the common-sense proposition that changes in tax rates don’t automatically mean proportional changes in tax revenue. This is because you also have to think about what happens to taxable income, which can move up or down in response to changes in tax policy.

The key thing to understand is that incentives matter. If you raise tax rates and therefore increase the cost the engaging in productive behavior, people will be less likely to work, save, invest, and be entrepreneurial. And they’ll figure out ways to engage in tax avoidance and tax evasion to protect the interests of their families. In other words, taxable income will be lower because of higher tax rates.

Likewise, people will be more willing to earn – and report – taxable income if tax rates are reduced.

If you don’t believe me, look at this incredible data showing how the rich paid for more money after Reagan slashed their tax rates.

This doesn’t mean that “tax cuts pay for themselves.” That may happen in rare circumstances, but the real issue is the degree of “revenue feedback.”

For some types of tax changes, such as lowering tax rates on the “rich,” the revenue feedback may be very large because they have considerable control over the timing, level, and composition of their income.

In other cases, such as providing a child tax credit, the feedback may be very small because there’s not much of an impact on incentives to engage in productive behavior.

This doesn’t necessarily mean one type of tax cut is good and the other bad. It just means that some changes in tax policy produce revenue feedback and others don’t.

Even leftists recognize there is a Laffer Curve. They may argue that the “revenue-maximizing rate” is very high, with some claiming the government can impose tax rates of more than 70 percent and still collect additional revenue. But they all recognize that there’s a point where revenue-feedback effects are so strong that higher rates will lose revenue.

Actually, let me rephrase that assertion. There is a small group of people in the nation who claim that there’s no Laffer Curve. But that’s no surprise, the world is filled with weird people. Some genuinely think the world is flat. Some think the moon landings were faked. You can probably find some people who actually think the sun is a giant candle in the sky.

But what is surprising is that this small cadre of anti-Laffer Curve fanatics are at the Joint Committee on Taxation, which is the group on Capitol Hill in charge of providing revenue estimates on tax legislation.

They aren’t completely oblivious to the real world. They do acknowledge some “micro” effects of changes in tax rates, such as people shifting between taxable and non-taxable forms of compensation. But they completely reject “macro” changes such as changes in economic growth and employment.

So if we replaced the nightmarish income tax with a simple and fair flat tax, the JCT would assume no impact of GDP or jobs. If we went the other direction and doubled all tax rates, the JCT would blithely assume no change to the economy.

To give you an idea of why this is an extreme view, I want to share some polling data. Last week, I spoke at the national conference of the American Institute of Certified Public Accountants. As you can imagine, this is a crowd that is very familiar with the internal revenue code. They know the nooks and crannies of the tax code and they have a good sense of how clients respond when tax policy changes.

Prior to my remarks, the audience was polled on certain tax issues.

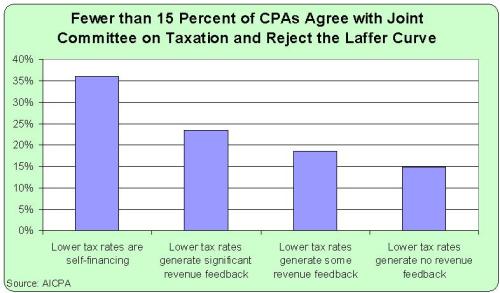

Some of the answers disappointed me. By a narrow margin, the crowd thought it would be a good idea if the overall tax burden increased. But here’s the response that fascinated me the most. The audience was asked what could be described as a Laffer Curve question. Specifically, they were asked, “Do you believe the growth potential of marginal tax rate cuts could lead to some degree of revenue feedback, even if not enough to be self-financing?”

They had four possible responses. Here’s the breakdown of their answers.

These are remarkable results. A plurality (more than 36 percent) think the Laffer Curve is so strong that lower tax rates are self-financing. Even I don’t think that’s the case. Another 23.5 percent of respondents think there are very significant feedback effects, meaning that lower tax rates don’t lose much money.

There were also 18.6 percent who thought there were some Laffer Curve effects, though they thought the revenue feedback wasn’t very significant.

Less than 15 percent of the crowd, however, agreed with the Joint Committee on Taxation and said that lower tax rates have no measurable revenue feedback.

Why am I sharing this information? Well, we’re going to have a big debate in the next month or two about President Obama’s proposed class-warfare tax hike on investors, entrepreneurs, small business owners, and other rich people.

Supporters of that approach will cite Joint Committee on Taxation numbers to claim that the tax hike will generate a big pile of money.

That number will be based on nonsensical and biased methodology. In an ideal world, opponents will mock that number and expose the JCT’s primitive approach.

For additional information, here’s Part III of my video series on the Laffer Curve, exposing the role of the Joint Committee on Taxation.

If you want to see Parts I and II, click here.

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] other words, tax cuts don’t lose as much revenue as predicted by simplistic models (and tax increases don’t generate as much revenue as […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] I have trouble deciding what evidence is most powerful, the views of CPAs or the data from the […]

[…] I have trouble deciding what evidence is most powerful, the views of CPAs or the data from the […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] other words, tax cuts don’t lose as much revenue as predicted by simplistic models (and tax increases don’t generate as much revenue as […]

[…] other words, tax cuts don’t lose as much revenue as predicted by simplistic models (and tax increases don’t generate as much revenue as […]

[…] other words, tax cuts don’t lose as much revenue as predicted by simplistic models (and tax increases don’t generate as much revenue as […]

[…] Tax accountants have a very good understanding of the Laffer […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] very much want to help policymakers understand (especially at the Joint Committee on Taxation) that there’s not a linear relationship between tax rates and tax revenue. In other words, you […]

[…] very much want to help policy makers understand (especially at the Joint Committee on Taxation) that there’s not a linear relationship between tax rates and tax revenue. In other words, […]

[…] P.S. Perhaps because they’re exposed to the real-world impact, America’s CPAs also understand the Laffer Curve is very real. […]

[…] short, simple fairness requires that they benefit if revenues rise faster than projected. Since the bean counters at the Joint Committee on Taxation almost surely will underestimate the pro-growth impact of a lower corporate tax rate, this is […]

[…] By the way, Furman openly admits the Laffer Curve is real. And if the Joint Committee on Taxation shows revenue feedback of 20 percent-30 percent when scoring the Republican plan, that will represent huge progress. […]

[…] I also think this polling data from certified public accountants is very persuasive. I don’t know about you, but I suspect CPAs […]

[…] and real-world examples, my other favorite way of convincing people about the Laffer Curve is to share the poll showing that only 15 percent of certified public accountants agree with the leftist view that taxes have no impact have taxable income. I figure that CPAs are a […]

[…] and real-world examples, my other favorite way of convincing people about the Laffer Curve is to share the poll showing that only 15 percent of certified public accountants agree with the leftist view that taxes have no impact have taxable income. I figure that CPAs are a […]

[…] lead to less revenue, maybe eventually the Republicans on Capitol Hill will install people at the Joint Committee on Taxation who also understand this elementary […]

[…] lead to less revenue, maybe eventually the Republicans on Capitol Hill will install people at the Joint Committee on Taxation who also understand this elementary […]

[…] lead to less revenue, maybe eventually the Republicans on Capitol Hill will install people at the Joint Committee on Taxation who also understand this elementary […]

[…] But from Hillary’s perspective, she won’t care. Under the budget rules governing Washington, she’ll still be able to increase spending (i.e., buy votes) based on how much revenue the Joint Committee on Taxation inaccurately predicts will materialize based on primitive “static scoring” estimates. […]

[…] you’re a bureaucrat at the Joint Committee on Taxation and you over-estimate the amount of revenue generated by a tax hike, that’s good news for politicians since it enables more […]

[…] you’re a bureaucrat at the Joint Committee on Taxation and you over-estimate the amount of revenue generated by a tax hike, that’s good news for politicians since it enables more […]

[…] you’re a bureaucrat at the Joint Committee on Taxation and you over-estimate the amount of revenue generated by a tax hike, that’s good news for politicians since it enables more […]

[…] Dynamic Model. He made a very persuasive argument about the need to modernize and improve the Joint Committee on Taxation’s antiquated revenue-estimating process by estimating the degree to which changes in tax policy impact economic performance. The use of […]

[…] Dynamic Model. He made a very persuasive argument about the need to modernize and improve the Joint Committee on Taxation’s antiquated revenue-estimating process by estimating the degree to which changes in tax policy impact economic […]

[…] Dynamic Model. He made a very persuasive argument about the need to modernize and improve the Joint Committee on Taxation’s antiquated revenue-estimating process by estimating the degree to which changes in tax policy impact economic performance. The use of […]

[…] on the shoddy methodology of the Joint Committee on Taxation (JCT), which is in charge of the revenue-estimating process on […]

[…] on the shoddy methodology of the Joint Committee on Taxation (JCT), which is in charge of the revenue-estimating process on […]

[…] that’s basically the methodology used by the Joint Committee on Taxation when estimating the revenue impact of changes in tax […]

[…] since they’re part of the real world (unlike, say, the Joint Committee on Taxation or the Obama Administration), they recognize that higher tax rates impose costs on the economy that […]

[…] fact that the overwhelming majority of CPAs believe in significant feedback […]

[…] fact that the overwhelming majority of CPAs believe in significant feedback […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] I also think this polling data from certified public accountants is very […]

[…] I also think this polling data from certified public accountants is very […]

[…] unrestricted ability to get rid of the bureaucrats that generated bad economic analysis at both the Joint Committee on Taxation and the Congressional Budget […]

[…] 100 percent. Mon Dieu, they’re acknowledging the Laffer Curve! This means they’re not as far to the left as the bureaucrats at the Joint Committee on Taxation. I guess this is what people mean when they talk about damning with faint […]

[…] observation about tax rates, taxable income, and tax revenue has not had any impact on the pro-tax bureaucrats at the Joint Committee on Taxation in Washington. But that’s a separate […]

[…] Only 15 percent of CPAs (the folks who see first-hand how taxes impact behavior) agree with the Joint Committee on […]

[…] Only 15 percent of CPAs (the folks who see first-hand how taxes impact behavior) agree with the Joint Committee on […]

[…] Only 15 percent of CPAs (the folks who see first-hand how taxes impact behavior) agree with the Joint Committee on […]

[…] lawmakers put themselves in the straitjacket of “static scoring” as practiced by the Joint Committee on Taxation, then a solution is very […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy […]

[…] P.S. Notwithstanding all the academic evidence, there’s one group of people in Washington who deliberately assume that tax policy has no impact on economic output. […]

[…] but it’s definitely not non-ideological. These are the bureaucrats, for instance, who assume that the revenue-maximizing tax rate is 100 percent! Moreover, the JCT uses the “Haig-Simons” tax system as a benchmark, which means they […]

[…] the ideological left still controls the Joint Committee on Taxation, the congressional bureaucracy that refuses to acknowledge that changes in tax policy can impact […]

[…] By the way, I shared some polling data last week showing that CPAs think that changes in tax rates lead to substantial Laffer Curve effects. […]

[…] I think the only people who now cling to that absurd view are the bureaucrats at the Joint Committee on […]

[…] So we have offshore wealth of somewhere “between $8 trillion and $32 trillion”? With that level of precision, or lack thereof, perhaps you now understand why the make-believe numbers about alleged tax evasion are about as credible as a revenue estimate from the Joint Committee on Taxation. […]

[…] doesn’t just apply to depreciation. The Joint Committee on Taxation (the same folks who basically assume that the revenue-maximizing tax rate is 100 percent) also tells lawmakers that it’s a loophole if you don’t double-tax capital gains, or if you […]

[…] just apply to depreciation. The Joint Committee on Taxation (the same folks who basically assume that the revenue-maximizing tax rate is 100 percent) also tells lawmakers that it’s a loophole if you don’t double-tax capital gains, or if […]

[…] been very critical of both CBO and JCT, so I’m one of the people in “think tanks” the article is talking […]

[…] By the way, I shared some polling data last week showing that CPAs think that changes in tax rates lead to substantial Laffer Curve effects. […]

[…] performance in at least some circumstances puts them ahead of the Congressional Budget Office and Joint Committee on Taxation. That’s damning with faint praise, to be sure, but I wanted to close on an upbeat […]

[…] By the way, I shared some polling data last week showing that CPAs think that changes in tax rates lead to substantial Laffer Curve effects. […]

[…] performance in at least some circumstances puts them ahead of the Congressional Budget Office and Joint Committee on Taxation. That’s damning with faint praise, to be sure, but I wanted to close on an upbeat […]

John – I think you are missing the point of the Laffer Curve. Sure, taxes are high in those other countries just like they were higher in our country prior to Reagan. However, when Reagan lowered taxes, the “rich” declared far more taxable income and thus paid more taxes. The same effect can take place in other countries, as well. Perhaps you’ve noticed how Canada lowered their Corporate tax rate and even the UK is considering doing so?

@Alex makes entire sense. The Laffer curve is common sense as well as mathematical sense.

There’s incontrovertible proof that the Laffer curve reflects reality, unless you’re deceiving yourself by “being right” – ignoring all the abundant supporting evidence while grasping at any straws, no matter how fragile, that you mistakenly think don’t. See the whole page at: http://www.lifestrategies.net/being-right

Just look at the several states and the impact of tax hikes and cuts on each one’s income. There’s enough data there to provide unshakeable comparisons, genuine empirical evidence!

Just heard a piece on NPR’s Morning Edition (11/15) criticizing the Republicans number of expected job losses from the tax increase on the wealthy. According to John Itstee (sp?), the CBO (which the piece painted as the more reasonable analysis) said that the 200,000 jobs initially lost due to tax increases on the weatlhy would be recovered in the long run because of the economic benefits of reducing the deficit. With just a moment’s logical reflection, one can see that, therefore, we should raise taxes even higher. If a 40% tax rate would create more jobs in the long run than a 35% tax rate, then let’s go for 80, 90, or even 100%.

I think there is one flaw in the Laffer curve: It misses one important variable, which I would call an effectiveness of the government. I understand that the whole functioning of the Laffer curve was tested on the US, which is OK and I don´t reject the evidence. But what about Europe or Canada? They have higher taxes, yet they don´t have problems with the “rich” paying them. Why?

I suggest you to check How to Fight Global Economic Crisis, I think it speaks clearly about how the taxation grows and also includes the important variable, which is apparently missing in the Laffer curve.

OMG, a ‘believer’ in Laffer Curve. It is trivial math. The tax collection is continuous function, tax collection is zero on both ends hence there is a maximum somewhere in between.

Taxes decrease the end value of work compared to the myriad non-pecuniary away-from-work activities one can engage in. Non pecuniary activities that increase one’s standard of living more than tax haircut income, but otherwise do little for the very “people” trying to extract the taxes. And if “free stuff” lowers even more the threshold of indolence, then all the more the better for those who opt to withdraw from the rat race of what used to be the most dynamic economy in the world and the most prosperous nation in the world.

Once the most important basics of life, such as healthcare, education and housing is provided unconditionally, few people, including otherwise competent people will strive for more. One immediately realizes this once they start working in Europe and compares the motivational and ambition levels of Americans, with fewer safety nets, to the otherwise more competent (we are talking about averages here) European individuals with lower correlations of exceptionalism/reward. Of course, the very subdued upward mobility and anemic growth rate trendlines of Europe, which plague otherwise very competent European individuals, are perhaps the best testament to the effects of the rather flat effort-reward curves created by high taxation, welfare programs and unimaginative central planning favoritism towards certain industries – those industries approved by the public in their majoritarian collective economic central planning. i.e. planning by average voter intelligence vs planning by total aggregate voter intelligence, which is what free markets and enterprise create.

——

But back to the post, as not to miss the forest for the tree,

Laffer curve is fine, but “the American people’s” nemesis is the Rahn Curve just as it has been the nemesis of most other nations. You, Americans, are already way past the peak on the Rahn Curve and headed for worse. Welcome naive American people to perpetually compounding European economic growth rate trendlines – down to deterministic decline.

The fact that the discussion is about the Laffer rather than the Rahn curve means that the point of no return for America has passed. A society that operates at the mythical top of the Laffer curve, as the leftist dream would be, is a society that is already grossly inefficient, with growth trendlines that are half or a third of what one could achieve at the peak of the rahn Curve. These top of Laffer curve, maximum communitarian revenue to be distributed by political criteria societies, are societies that cannot keep up with today’s average world economic growth rates. They therefore are, by definition, societies in relative decline. Those who do not understand that the bar of merely maintaining current prosperity is at the five percent annual growth have their heads in the sand. Many irrelevant quarrels will unfold as the once great empire of freedom mimics the rest of the world and declines. That is exactly the stuff declines are made of.

Once the vicious cycle of decline takes hold, all rational arguments against further flattening of the effort reward curves will vanish. Welcome Americans to Europe and march together into decline, drowned by three billion sea of emerging world people who are finally on their way to (even partial for now) liberation from mandatory collectivism.