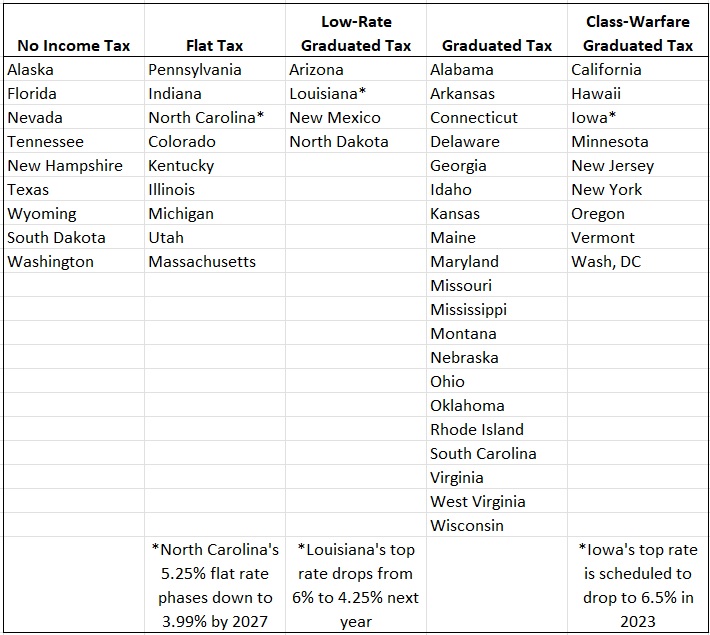

Motivated in part by an excellent graphic that I shared in 2016, I put together a five-column ranking of state personal income tax systems in 2018.

Given some changes that have since occurred, it’s time for a new version. The first two columns are self explanatory and columns 3 and 5 are based on whether the top tax rate on households is less than 5 percent (“Low Rate”) or more than 8 percent (“Class Warfare”).

Column 4, needless to say, is for states where the top tax rate in between 5-8 percent.

The good news is that the above table is better than the one I created in 2018. Thanks to tax competition between states, there have been some improvements in tax policy.

I recently wrote about Louisiana’s shift in the right direction.

Now we have some good news from the Tarheel state. The Wall Street Journal opined today about a new tax reform in North Carolina.

The deal phases out the state’s 2.5% corporate income tax between 2025 and 2031. …The deal also cuts the state’s flat 5.25% personal income tax rate

in stages to 3.99% by July 1, 2027. …North Carolina ranks tenth on the Tax Foundation’s 2021 state business tax climate index, and these reforms will make it even more competitive. …North Carolina has an unreserved cash balance of $8.55 billion, and legislators are wisely returning some of it to taxpayers.

What’s especially noteworthy is that North Carolina has been moving in the right direction for almost 10 years.

P.S. Arizona almost moved from column 3 to column 5, but that big decline was averted.

P.P.S. There are efforts in Mississippi and Nebraska to get rid of state income taxes.

P.P.P.S. Kansas tried for a big improvement a few years ago, but ultimately settled for a modest improvement.

[…] That approach is paying big dividends. Spending restraint means there is now a big budget surplus, which is enabling a discussion of how to reduce property taxes (Texas has no income tax). […]

[…] That approach is paying big dividends. Spending restraint means there is now a big budget surplus, which is enabling a discussion of how to reduce property taxes (Texas has no income tax). […]

[…] Ranking State Income Taxes […]

[…] That approach is paying big dividends. Spending restraint means there is now a big budget surplus, which is enabling a discussion of how to reduce property taxes (Texas has no income tax). […]

[…] That approach is paying big dividends. Spending restraint means there is now a big budget surplus, which is enabling a discussion of how to reduce property taxes (Texas has no income tax). […]

[…] That approach is paying big dividends. Spending restraint means there is now a big budget surplus, which is enabling a discussion of how to reduce property taxes (Texas has no income tax). […]

[…] the top income tax rate in the United States can vary substantially depending on […]

[…] the top income tax rate in the United States can vary substantially depending on […]

[…] there are more than 40 states that are not part of this hate-and-envy cartel. Including a bunch of states with no income taxes and others with flat […]

[…] there were other tax cuts as well, along with some much-needed spending […]

[…] there were other tax cuts as well, along with some much-needed spending […]

[…] want to see some states move not just to Column 2 in my ranking of state tax policy. I want them to be in Column […]

[…] want to see some states move not just to Column 2 in my ranking of state tax policy. I want them to be in Column […]

[…] What’s the one thing they all have in common? No state income tax. […]

[…] What’s the one thing they all have in common? No state income tax. […]

[…] I prefer the states with no income taxes, but low-rate flat taxes are the next best approach. […]

[…] Nope. Citadel is going to Florida, a state famous for having no income tax. […]

[…] we’re approaching 25 states and a few other states have moved in the right direction (reducing so-called progressive tax […]

[…] we’re approaching 25 states and a few other states have moved in the right direction (reducing so-called progressive tax […]

[…] Nope. Citadel is going to Florida, a state famous for having no income tax. […]

[…] Nope. Citadel is going to Florida, a state famous for having no income tax. […]

[…] Notice, by the way, that Texas and Nevada have no income tax and Arizona has a low-rate flat tax. […]

[…] Notice, by the way, that Texas and Nevada have no income tax and Arizona has a low-rate flat tax. […]

[…] I prefer the states with no income taxes, but low-rate flat taxes are the next best approach. […]

[…] I prefer the states with no income taxes, but low-rate flat taxes are the next best approach. […]

[…] I also think it’s worth noting that all the best states have no income tax. […]

[…] P.S. Adopting a flat tax is progress, but the ultimate goal should be abolishing the state income tax. […]

[…] that month, I updated my five-column table showing which states have the best and worst tax […]

[…] that month, I updated my five-column table showing which states have the best and worst tax […]

[…] showed last year how that legislation moved Iowa up one level in a ranking of state income […]

[…] reflexively drawn to Table 7. Kudos to Florida, Tennessee, New Hampshire, and South Dakota (the absence of a state income tax really helps). And I’m surprised to see Massachusetts in the top 10 (it helps to a have a […]

[…] while you contemplate those questions, remember that California is already very unfriendly to taxpayers, ranking #48according to the Tax Foundation and ranking #49 according to the Fraser […]

[…] while you contemplate those questions, remember that California is already very unfriendly to taxpayers, ranking #48 according to the Tax Foundation and ranking #49 according to the Fraser […]

An adjunct table could list income taxes on retired state or military workers. For instance, Alabama, New York, and Pennsylvania don’t tax government pensions. (There are probably more.)

[…] Dan Mitchell, Ranking State Income Taxes: […]

[…] American states rank in terms of economic liberty. Unsurprisingly, a bunch of jurisdictions with no income tax are at the top of the list and California and New York are at the […]

[…] my column yesterday about state tax systems, I specifically noted that North Carolina has been making big […]

[…] Ranking State Income Taxes […]

[…] how American states rank in terms of economic liberty. Unsurprisingly, a bunch of jurisdictions with no income tax are at the top of the list and California and New York are at the […]

What a bout a flat sales tax? I think it would reward savings, and stimulate growth.

Comparing states personal income tax rates is interesting, but it misses a big part of the picture.For instance, Colorado’s flat personal income tax rate has been going down, but they state has been more than offsetting these reductions by imposing new and increased fees.

What would be more interesting is comparing states by per capita spending or spending as a percentage of state GDP.

[…] « Ranking State Income Taxes […]

The Democrats in the Washington legislature have been trying to get a state income tax for years but so far have been stymied by the state constitution which strictly forbids it. They made some headway this year by slipping in a tax (they called it “insurance”) on W-2 workers for long term care even though many workers will have pay while ineligible to collect the very limited benefits.

Excellent as always. Can you do something similar for a state’s total tax burden? In Seattle, the sales tax is 10.5% (local and federal) and the combined property tax is unbelievable.